Professional Documents

Culture Documents

European Data Centre Marketview Q3 2017

Uploaded by

andyCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

European Data Centre Marketview Q3 2017

Uploaded by

andyCopyright:

Available Formats

MARKETVIEW

Europe Data Centres, Q3 2017

Continued strong demand is

driving record investment

4.0% 10.8% 10.2%

Figure 1: Europe Colocation Supply, Take-up and Year-End Projection as at Q3 2017

1,400 180

Projected Supply

Supply 160

1,200

Take-up

Forecast Take-up 140

1,000

120

800 100

Supply MW

Take-up MW

600 80

60

400

40

200

20

0 0

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

Q3

Source: CBRE Research, Q3 2017

Q U A R TERL Y R E V I E W Q 3 S N A P S H OT

Q3 2017 CBRE Research © 2017 | CBRE Limited 1

M A R K E T V I E W EUROPE DATA CENTRES

S U P P L Y & A V A I L AB I L I TY T A K E -UP & D E M A ND

Figure 2: Europe Colocation Take-up as at Q3 2017

180

160

140

120

MW

100

80

60

40

20

0

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

Q3-Q4 projection Paris London Frankfurt Amsterdam

Source: CBRE Research, Q3 2017

Q3 2017 CBRE Research © 2017 | CBRE Limited 2

M A R K E T V I E W EUROPE DATA CENTRES

I N V E S TMEN T

Figure 3: Global Data Centre M&A Investment 2011 – H1 2017

20

18

16

14

12

$ Billion

10

8

6

4

2

0

2011 2012 2013 2014 2015 2016 2017 H1

Source: CBRE Research, Q3 2017

Q3 2017 CBRE Research © 2017 | CBRE Limited 3

M A R K E T V I E W EUROPE DATA CENTRES

M A R K ET A B S OR PTI ON

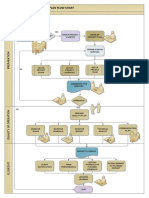

Figure 4: Market Absorption Based on Average Take-up of Previous 5 Years

Source: CBRE Research, Q3 2017

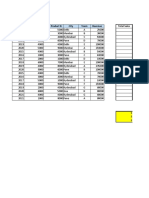

Figure 5: Key Colocation Statistics – year on year comparison (MW)

Take-up Take-up

Supply Availability

(quarterly) (year to date)

Amsterdam Q3 2017 240 41 4.7 18.2

Q3 2016 166 25 4.8 9.6

Frankfurt Q3 2017 240 42 13.9 19.8

Q3 2016 199 25 11.5 30.3

London Q3 2017 437 74 7.8 40.8

Q3 2016 384 70 7.0 28.7

Paris Q3 2017 156 27 1.6 6.9

Q3 2016 129 13 1.3 11.0

European Tier 1 Total Q3 2017 1,073 184 28.0 85.7

Q3 2016 879 134 24.7 79.6

Source: CBRE Research, Q3 2017

Q3 2017 CBRE Research © 2017 | CBRE Limited 4

M A R K E T V I E W EUROPE DATA CENTRES

L O N DON Figure 6: London Supply and Take-up 2006-2017 Q3

500 Supply (MW) Take-up (MW) 60

Thousands

450

400 50

350 40

300

250 30

200

150 20

100 10

50

0 0

2015

2006

2007

2008

2009

2010

2011

2012

2013

2014

2016

2017

Source: CBRE Research, Q3 2017

F R A N K F U RT Figure 7: Frankfurt Supply and Take-up 2006-2017 Q3

300 Supply (MW) Take-up (MW) 40

Thousands

250 35

30

200 25

150 20

100 15

10

50 5

0 0

2015

2006

2007

2008

2009

2010

2011

2012

2013

2014

2016

2017

Source: CBRE Research, Q3 2017

Q3 2017 CBRE Research © 2017, CBRE Limited 5

M A R K E T V I E W EUROPE DATA CENTRES

AMSTERDAM Figure 8: Amsterdam Supply and Take-up 2006-2017 Q3

300 Supply (MW) Take-up (MW) 60

Thousands

250 50

200 40

150 30

100 20

50 10

0 0

2015

2006

2007

2008

2009

2010

2011

2012

2013

2014

2016

2017

Source: CBRE Research, Q3 2017

PARIS Figure 9: Paris Supply and Take-up 2006-2017 Q3

180 Supply (MW) Take-up (MW) 25

Thousands

160

140 20

120

100 15

80 10

60

40 5

20

0 0

2015

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

Source: CBRE Research, 2017 Q3

Q3 2017 CBRE Research © 2017, CBRE Limited 6

M A R K E T V I E W EUROPE DATA CENTRES

D E F I N I TI ONS

SUPPLY E U R O PEAN D A T A C E N TRES

SPACE TYPE

A V A I L AB I L I TY

V A C A NC Y R A T E

C O L OC A TI ON T A K E -U P

M A R K ET A B S OR PTION

Q3 2017 CBRE Research © 2017 | CBRE Limited 7

M A R K E T V I E W EUROPE DATA CENTRES

E M E A C O N TAC TS U S C O N TA C T

A S I A C O N TAC T

C B R E D A T A C E N T RE S O L U TI ONS

•

•

•

•

Disclaimer: information contained herein, including projections, has been obtained from sources believed to be reliable. While we do not doubt its accuracy,

we have not verified it and make no guarantee, warranty or representation about it. It is your responsibility to confirm independently its accuracy and

completeness. This information is presented exclusively for use by CBRE clients and professionals and all rights to the material are reserved and cannot be

reproduced without prior written permission of CBRE.

You might also like

- The Basics of Public Budgeting and Financial Management: A Handbook for Academics and PractitionersFrom EverandThe Basics of Public Budgeting and Financial Management: A Handbook for Academics and PractitionersNo ratings yet

- Economies and Consumers Quarterly Data - Historical - Non-Seasonally AdjustedDocument5 pagesEconomies and Consumers Quarterly Data - Historical - Non-Seasonally AdjustedJoseph MateoNo ratings yet

- Business StatisticsDocument5 pagesBusiness StatisticsShubham100% (1)

- An Empirical Study On Factors Affecting Customer Retention in Logistics Service Providers - A Case Study On Abc Logistics (PVT) LimitedDocument24 pagesAn Empirical Study On Factors Affecting Customer Retention in Logistics Service Providers - A Case Study On Abc Logistics (PVT) LimitedAza SamsudeenNo ratings yet

- Brigade Enterprises LimitedDocument36 pagesBrigade Enterprises LimitedAnkur MittalNo ratings yet

- OOIL 2017 Annual Results Presentation PDFDocument29 pagesOOIL 2017 Annual Results Presentation PDFmdorneanuNo ratings yet

- Startup Finance ModelDocument88 pagesStartup Finance ModelAbhishek AggarwalNo ratings yet

- KFH Annual Report 2018 - English PDFDocument162 pagesKFH Annual Report 2018 - English PDFFardheen BanuNo ratings yet

- UShine Implementation PlanDocument4 pagesUShine Implementation PlanwongchingkiNo ratings yet

- Annual Report FY 2018-19Document146 pagesAnnual Report FY 2018-19Javeed GurramkondaNo ratings yet

- Excel - Assignment - 1 (1Document16 pagesExcel - Assignment - 1 (1Ashish ChangediyaNo ratings yet

- Market Capitalisation of Capital Market SegmentsDocument3 pagesMarket Capitalisation of Capital Market Segmentsanjali shilpa kajalNo ratings yet

- PT Hilti - Company Profile - Approval Chemical AnchorDocument18 pagesPT Hilti - Company Profile - Approval Chemical Anchorfalahaskar0% (1)

- HongKong - Industrial - MarketView - Q1 2021Document5 pagesHongKong - Industrial - MarketView - Q1 2021Tu LiangNo ratings yet

- Insead Tech Logistics in SEA 2019Document33 pagesInsead Tech Logistics in SEA 2019Mukul RaghavNo ratings yet

- BCC Sindh Forms 2018-19Document29 pagesBCC Sindh Forms 2018-19Sarmad SamejoNo ratings yet

- Q1 2021 E Commerce ReportDocument6 pagesQ1 2021 E Commerce ReportEstefania HernandezNo ratings yet

- Pacifica Bay Future Resource Analysis: 2014 2015 2016 2017 2018 TotalDocument1 pagePacifica Bay Future Resource Analysis: 2014 2015 2016 2017 2018 TotalNishiki NishioNo ratings yet

- Introduction To Time Series ModelsDocument20 pagesIntroduction To Time Series ModelsManuel Alejandro Sanabria AmayaNo ratings yet

- Indigo Stock Pitch: Nse: Buy at 1046Document21 pagesIndigo Stock Pitch: Nse: Buy at 1046Sourabh ChiprikarNo ratings yet

- Telematics DataDocument19 pagesTelematics DataRenauld SNo ratings yet

- Why Service Robots Boom Worldwide: IFR Press Conference, 11 October 2017 BrusselsDocument25 pagesWhy Service Robots Boom Worldwide: IFR Press Conference, 11 October 2017 BrusselsRishabhNo ratings yet

- Financial AnalysisDocument18 pagesFinancial Analysismaizatul rosniNo ratings yet

- Paint IndustryDocument28 pagesPaint IndustryRAJNI SHRIVASTAVANo ratings yet

- Tata CommunicationsDocument6 pagesTata CommunicationspriyaNo ratings yet

- 2019 q2 Cbre Vietnam Forum - en - HCMDocument78 pages2019 q2 Cbre Vietnam Forum - en - HCMNguyen Quang MinhNo ratings yet

- Choice IntroductionDocument22 pagesChoice IntroductionMonu SinghNo ratings yet

- Book 1Document2 pagesBook 1Blend BerishaNo ratings yet

- ITIDA - Egypt Destination of Choice 2018Document28 pagesITIDA - Egypt Destination of Choice 2018AKNo ratings yet

- Graphical Representation of Nalco Working Capital RatioDocument15 pagesGraphical Representation of Nalco Working Capital RatioAbhijitNo ratings yet

- Analysis NewDocument12 pagesAnalysis NewFairooz AliNo ratings yet

- 19 Investment Economic Cycles and GrowthDocument4 pages19 Investment Economic Cycles and Growthsaywhat133No ratings yet

- Summer Internship Project: On "Working Capital Management of Rastriya Ispat Nigam Limited-Vsp"Document27 pagesSummer Internship Project: On "Working Capital Management of Rastriya Ispat Nigam Limited-Vsp"Avinash GoguNo ratings yet

- Feasibility StudyDocument18 pagesFeasibility StudyJessa BallonNo ratings yet

- Year-End Presentation 2014Document29 pagesYear-End Presentation 2014stefany IINo ratings yet

- #BOLD STOP Marketing PlanDocument50 pages#BOLD STOP Marketing PlanAhmed Alaa100% (1)

- 2017 Budget-Country Presentation FormatDocument59 pages2017 Budget-Country Presentation FormatYhane Hermann BackNo ratings yet

- 2 Charts Show How Much The World Depends On Taiwan For: Revenue RecognitionDocument5 pages2 Charts Show How Much The World Depends On Taiwan For: Revenue RecognitionDuong Trinh MinhNo ratings yet

- AFSA ProjectDocument9 pagesAFSA Projectsunit dasNo ratings yet

- Calzado en España StatistaDocument65 pagesCalzado en España StatistaPaula Calvo ZaragozanoNo ratings yet

- pp16Document30 pagespp16Mark GrahamNo ratings yet

- Client: Taiwan Semiconductor Manufacturing Co., Ltd. (NYSE: TSM / TSE: 2330) Auditor: Deloitte (1) Understanding of The ClientDocument8 pagesClient: Taiwan Semiconductor Manufacturing Co., Ltd. (NYSE: TSM / TSE: 2330) Auditor: Deloitte (1) Understanding of The ClientDuong Trinh MinhNo ratings yet

- Appraisal of Dividend Policy of Navana CNG Limited: Presented by Easmin Ara Eity ID: 2018-2-10-048Document11 pagesAppraisal of Dividend Policy of Navana CNG Limited: Presented by Easmin Ara Eity ID: 2018-2-10-048Movie SenderNo ratings yet

- Sokkelaret 2017 Engelsk PresentasjonDocument25 pagesSokkelaret 2017 Engelsk PresentasjonHải Thân NgọcNo ratings yet

- Eadr Project On Infosys CompanyDocument5 pagesEadr Project On Infosys CompanyDivyavadan MateNo ratings yet

- Investment Thesis by Prateek LalDocument2 pagesInvestment Thesis by Prateek LalPrateek LalNo ratings yet

- Creating Bar Charts With Single Series of Data: Period SalesDocument8 pagesCreating Bar Charts With Single Series of Data: Period Saleslakshmi PurushothmanNo ratings yet

- EasyJet vs. RyanairDocument22 pagesEasyJet vs. RyanairDiana CostaNo ratings yet

- 2017 Annual Report EN PDFDocument160 pages2017 Annual Report EN PDFYuk SimNo ratings yet

- GDP in Asean, at Current Prrices (Nominal) in Us DollarsDocument3 pagesGDP in Asean, at Current Prrices (Nominal) in Us DollarsMehul AgarwallaNo ratings yet

- Annual Report 2018Document519 pagesAnnual Report 2018MR RockyNo ratings yet

- Demand PlanningDocument31 pagesDemand PlanningRahulRahuNo ratings yet

- Trend of Netflix's Streaming Subscribers Worldwide in Nine Years From 2011-2020Document7 pagesTrend of Netflix's Streaming Subscribers Worldwide in Nine Years From 2011-2020Minh Thu NguyenNo ratings yet

- SaaS Financial Model 3.0 ExcelDocument367 pagesSaaS Financial Model 3.0 Excelმექანიკური ფორთოხალიNo ratings yet

- Business As UsualDocument24 pagesBusiness As UsualRenold DarmasyahNo ratings yet

- AssignmentDocument3 pagesAssignmentLEON JOAQUIN VALDEZNo ratings yet

- Introduction:-: Headquartered - Chennai ValueDocument4 pagesIntroduction:-: Headquartered - Chennai ValueArijit sahaNo ratings yet

- Assets: Director's Letter & Auditor's Notes Flag Major Points Attributed To RiskDocument7 pagesAssets: Director's Letter & Auditor's Notes Flag Major Points Attributed To RiskCH NAIRNo ratings yet

- Chiang Mai Hotel Market Update 2017 03Document4 pagesChiang Mai Hotel Market Update 2017 03Oon KooNo ratings yet

- CEE Budapest City Report Q3 2020Document10 pagesCEE Budapest City Report Q3 2020Iringo NovakNo ratings yet

- Generating FunctionDocument14 pagesGenerating FunctionSrishti UpadhyayNo ratings yet

- Resulticks Credentials Deck 2019 1Document16 pagesResulticks Credentials Deck 2019 1leminhbkNo ratings yet

- Comparative Research On Market Size of Cigarette Brand of ITDocument105 pagesComparative Research On Market Size of Cigarette Brand of ITAbhi SriNo ratings yet

- The Best SharePoint Online Training by Real Time ExpertsDocument15 pagesThe Best SharePoint Online Training by Real Time ExpertsestherNo ratings yet

- Wyndham Worldwide 2011 Competency DictionaryDocument38 pagesWyndham Worldwide 2011 Competency DictionaryNerissa ArvianaNo ratings yet

- Workers Participation in ManagementDocument4 pagesWorkers Participation in Managementbhagathnagar100% (1)

- PP - Master Data-Sap PPDocument16 pagesPP - Master Data-Sap PPratnesh_xpNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Ganesh PrabuNo ratings yet

- CBSE Class 12 Economics Sample Paper (For 2014)Document19 pagesCBSE Class 12 Economics Sample Paper (For 2014)cbsesamplepaperNo ratings yet

- 09.stock - Statement - 31.12.2023 GAJANANDDocument4 pages09.stock - Statement - 31.12.2023 GAJANANDSEENU PATELNo ratings yet

- CH 05Document41 pagesCH 05pravyramNo ratings yet

- Infor Ming - Le Install 11 1 AD r18Document114 pagesInfor Ming - Le Install 11 1 AD r18rhutudeva2463No ratings yet

- Export Promotion Capital Goods Scheme PresentationDocument32 pagesExport Promotion Capital Goods Scheme PresentationDakshata SawantNo ratings yet

- Project Management Flowchart 2Document1 pageProject Management Flowchart 2LightNo ratings yet

- Global Marketing UNIQLODocument11 pagesGlobal Marketing UNIQLOM.Maulana Iskandar ZulkarnainNo ratings yet

- Sales TrainingDocument146 pagesSales TrainingdsunteNo ratings yet

- 10 Info SheetDocument6 pages10 Info Sheetdungnv151No ratings yet

- Monetizing VoLTE, RCS and Video IMS MRF and Conferencing SolutionsDocument13 pagesMonetizing VoLTE, RCS and Video IMS MRF and Conferencing SolutionslcardonagNo ratings yet

- SP1 PDFDocument12 pagesSP1 PDFyumyumpuieNo ratings yet

- SNOWTEXDocument29 pagesSNOWTEXMD NayeemNo ratings yet

- Full Download Solution Manual For Horngrens Financial Managerial Accounting 6th Edition PDF Full ChapterDocument36 pagesFull Download Solution Manual For Horngrens Financial Managerial Accounting 6th Edition PDF Full Chaptercrantspremieramxpiz100% (16)

- Case Study Alibaba Versus Tencent APADocument4 pagesCase Study Alibaba Versus Tencent APALeonardo Ferreira da Silva50% (4)

- Ringing A BellDocument31 pagesRinging A Bellnfpsynergy100% (1)

- Dettol - A Complete Product Description and Its ReviewDocument13 pagesDettol - A Complete Product Description and Its ReviewRitesh SrivastavaNo ratings yet

- Supply and Demand ExamplesDocument2 pagesSupply and Demand ExamplesJay R ChivaNo ratings yet

- Name: Jinal M. MistryDocument10 pagesName: Jinal M. MistryjinnymistNo ratings yet

- AA Accounts Course DetailsDocument3 pagesAA Accounts Course DetailsBalaNo ratings yet

- 2Q14 Atlanta Industrial Market ReportDocument4 pages2Q14 Atlanta Industrial Market ReportBea LorinczNo ratings yet

- A Study On Management of Non Performing Assets in District Central Cooperative Bank PDFDocument5 pagesA Study On Management of Non Performing Assets in District Central Cooperative Bank PDFDevikaNo ratings yet

- GW4 - Quantity and InventoryDocument1 pageGW4 - Quantity and InventoryPhương TrầnNo ratings yet

- Waiter Rant: Thanks for the Tip—Confessions of a Cynical WaiterFrom EverandWaiter Rant: Thanks for the Tip—Confessions of a Cynical WaiterRating: 3.5 out of 5 stars3.5/5 (487)

- Dealers of Lightning: Xerox PARC and the Dawn of the Computer AgeFrom EverandDealers of Lightning: Xerox PARC and the Dawn of the Computer AgeRating: 4 out of 5 stars4/5 (88)

- The Intel Trinity: How Robert Noyce, Gordon Moore, and Andy Grove Built the World's Most Important CompanyFrom EverandThe Intel Trinity: How Robert Noyce, Gordon Moore, and Andy Grove Built the World's Most Important CompanyNo ratings yet

- AI Superpowers: China, Silicon Valley, and the New World OrderFrom EverandAI Superpowers: China, Silicon Valley, and the New World OrderRating: 4.5 out of 5 stars4.5/5 (399)

- The United States of Beer: A Freewheeling History of the All-American DrinkFrom EverandThe United States of Beer: A Freewheeling History of the All-American DrinkRating: 4 out of 5 stars4/5 (7)

- Getting Started in Consulting: The Unbeatable Comprehensive Guidebook for First-Time ConsultantsFrom EverandGetting Started in Consulting: The Unbeatable Comprehensive Guidebook for First-Time ConsultantsRating: 4.5 out of 5 stars4.5/5 (10)

- To Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryFrom EverandTo Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryRating: 4.5 out of 5 stars4.5/5 (260)

- Summary: Unreasonable Hospitality: The Remarkable Power of Giving People More than They Expect by Will Guidara: Key Takeaways, Summary & Analysis IncludedFrom EverandSummary: Unreasonable Hospitality: The Remarkable Power of Giving People More than They Expect by Will Guidara: Key Takeaways, Summary & Analysis IncludedRating: 2.5 out of 5 stars2.5/5 (5)

- All The Beauty in the World: The Metropolitan Museum of Art and MeFrom EverandAll The Beauty in the World: The Metropolitan Museum of Art and MeRating: 4.5 out of 5 stars4.5/5 (83)

- The War Below: Lithium, Copper, and the Global Battle to Power Our LivesFrom EverandThe War Below: Lithium, Copper, and the Global Battle to Power Our LivesRating: 4.5 out of 5 stars4.5/5 (9)

- The Toyota Way (Second Edition): 14 Management Principles from the World's Greatest ManufacturerFrom EverandThe Toyota Way (Second Edition): 14 Management Principles from the World's Greatest ManufacturerRating: 4 out of 5 stars4/5 (121)

- Vulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomFrom EverandVulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomNo ratings yet

- The Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumFrom EverandThe Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumRating: 3 out of 5 stars3/5 (12)

- All You Need to Know About the Music Business: Eleventh EditionFrom EverandAll You Need to Know About the Music Business: Eleventh EditionNo ratings yet

- How to Make Money Online with OnlyFans Earn More than $10,000 per Month From Zero With the 7 Secret Hacks To Start and Scale Your Digital BusinessFrom EverandHow to Make Money Online with OnlyFans Earn More than $10,000 per Month From Zero With the 7 Secret Hacks To Start and Scale Your Digital BusinessRating: 5 out of 5 stars5/5 (1)

- The Formula: How Rogues, Geniuses, and Speed Freaks Reengineered F1 into the World's Fastest Growing SportFrom EverandThe Formula: How Rogues, Geniuses, and Speed Freaks Reengineered F1 into the World's Fastest Growing SportRating: 4 out of 5 stars4/5 (1)

- Lean Six Sigma: The Ultimate Guide to Lean Six Sigma, Lean Enterprise, and Lean Manufacturing, with Tools Included for Increased Efficiency and Higher Customer SatisfactionFrom EverandLean Six Sigma: The Ultimate Guide to Lean Six Sigma, Lean Enterprise, and Lean Manufacturing, with Tools Included for Increased Efficiency and Higher Customer SatisfactionRating: 5 out of 5 stars5/5 (2)

- Rainmaker: Superagent Hughes Norton and the Money Grab Explosion of Golf from Tiger to LIV and BeyondFrom EverandRainmaker: Superagent Hughes Norton and the Money Grab Explosion of Golf from Tiger to LIV and BeyondRating: 4 out of 5 stars4/5 (1)

- 15 Lies Women Are Told at Work: …And the Truth We Need to SucceedFrom Everand15 Lies Women Are Told at Work: …And the Truth We Need to SucceedNo ratings yet

- INSPIRED: How to Create Tech Products Customers LoveFrom EverandINSPIRED: How to Create Tech Products Customers LoveRating: 5 out of 5 stars5/5 (9)

- Network of Lies: The Epic Saga of Fox News, Donald Trump, and the Battle for American DemocracyFrom EverandNetwork of Lies: The Epic Saga of Fox News, Donald Trump, and the Battle for American DemocracyRating: 4 out of 5 stars4/5 (16)

- How to Make a Killing: Blood, Death and Dollars in American MedicineFrom EverandHow to Make a Killing: Blood, Death and Dollars in American MedicineRating: 5 out of 5 stars5/5 (1)

- Excellence Wins: A No-Nonsense Guide to Becoming the Best in a World of CompromiseFrom EverandExcellence Wins: A No-Nonsense Guide to Becoming the Best in a World of CompromiseRating: 5 out of 5 stars5/5 (79)