Professional Documents

Culture Documents

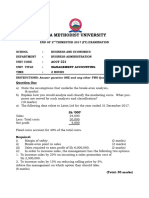

Cost & Managent Accounting Paper 7

Uploaded by

Turyamureeba JuliusCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cost & Managent Accounting Paper 7

Uploaded by

Turyamureeba JuliusCopyright:

Available Formats

THE PUBLIC ACCOUNTANTS EXAMINATIONS BOARD

A Committee of the Council of ICPAU

CPA (U) EXAMINATIONS

LEVEL ONE

COST AND MANAGEMENT ACCOUNTING – PAPER 7

FRIDAY 24 AUGUST, 2018

INSTRUCTIONS TO CANDIDATES:

1. Time allowed: 3 hours 15 minutes.

The first 15 minutes of this examination have been designated for reading

time. You may not start to write your answer during this time.

2. This examination contains Sections A and B.

3. Section A is bound separately from Section B.

4. Attempt all the 20 multiple-choice questions in Section A. Each question

carries 1 mark.

5. Attempt four of the five questions in Section B. Each question carries 20

marks.

6. Write your answer to each question on a fresh page in your answer

booklet.

7. Please, read further instructions on the answer booklet, before attempting

any question.

2018 Public Accountants Examinations Board

Cost and Management Accounting - Paper 7

SECTION B

Attempt four of the five questions in this section

Question 2

(a) (i) Distinguish between management accounting and financial

accounting. (4 marks)

(ii) Explain any two ethical challenges faced by management

accountants.

(2 marks)

(b) Discuss any two merits and two demerits of the following stores

management systems:

(i) Centralised stores. (4 marks)

(ii) Decentralised stores. (4 marks)

(c) Describe how the weighted average cost (WAC) method is used in

inventory valuation.

(2 marks)

(d) Explain any four principles of a good incentive scheme.

(4 marks)

(Total 20 marks)

Question 3

(a) Distinguish between the following costs:

(i) opportunity cost and replacement cost. (2 marks)

(ii) product cost and period cost. (2 marks)

(b) Explain any two merits of an integrated accounting system.

(2 marks)

(c) Fresh Bakery Ltd (FBL) produces and sells delicious cakes and bread at Shs

3,000 and Shs 4,500 per unit respectively. FBL’s standard production cost

card for the month of September 2018 is as follows:

Item Cakes Bread

Shs ‘000’ Shs ’000’

Direct materials per unit 1,000 1,200

Direct labour (Shs 500 per hour) per unit 625 1,250

Variable overheads per unit 500 800

FBL has only 100,000 direct labour hours and expects to sell 30,000 units

of cakes and 30,000 units of bread during the month. Normally FBL incurs

monthly fixed costs of Shs 38,750,000 and does not maintain inventory.

24 August, 2018 Page 2 of 6

Cost and Management Accounting - Paper 7

Required:

Determine, for the month of September 2018, the:

(i) production mix. (10 marks)

(ii) expected net profit. (4 marks)

(Total 20 marks)

Question 4

(a) (i) Describe any four features of process costing. (4 marks)

(ii) Identify two industries that use process costing. (2 marks)

(b) Tubonge Furniture Workshop (TFW) was awarded a contract to supply 150

office chairs and 80 office tables. The following cost data relates to the

contract:

Tables Chairs

Shs ‘000’ Shs ‘000’

Direct labor 20,000 32,000

Direct materials 35,000 68,000

Production overheads are charged at 30% on labour costs and information

relating to other overheads is given below:

Tables Chairs

Budgeted overheads (Shs ‘000’) 6,000 7,500

Budgeted labour hours 2,000 3,000

Actual labour hours 2,000 1,800

The cost of adding special designs was 10% and 20% of the prime costs

for chairs and tables respectively. Selling expenses were Shs 60,000 per

chair and Shs 80,000 per table. TFW prices its products using full cost

plus mark-up and the mark-up on chairs was 5% and tables was 10%.

Required:

Determine the selling price for the chairs and tables.

(7 marks)

(c) Magala Enterprises Ltd (MEL) produces millet flour and has been using

absorption costing in the previous years. MEL’s board recently resolved to

adopt the marginal costing method that it provides more analysed

information for decision making. The following data was extracted from

MEL’s books of account for the 4th quarter ended 30 June, 2018:

24 August, 2018 Page 3 of 6

Cost and Management Accounting - Paper 7

Details kg

Sales 100,000

Opening inventory 300,000

Closing inventory 400,000

MEL produces a single product based on a normal activity level of 250,000

kg per quarter. During the quarter under review, total direct material

costs amounted to Shs 145 million and Shs 350 million related to direct

labour. Fixed administrative overheads amounted to Shs 20 million while

production overheads were Shs 330 million of which a third were fixed.

MEL sells the flour at Shs 4,500 per kg.

Required:

Prepare, for MEL for the quarter ended 30 June, 2018 a profit statement

using the marginal costing method.

(7 marks)

(Total 20 marks)

Question 5

(a) Explain any two advantages and two disadvantages of standard costing.

(4 marks)

(b) Axel Publishers Ltd (APL) publishes Chika Magazine which is released on a

monthly basis. APL planned to sell all the published copies of the

magazine at Shs 20,000 during the month of July 2018. The following

information relates to the month of July 2018:

Details Budgeted Actual

Copies of magazines 3,000 2,850

Costs Shs ‘000’ Shs ‘000’

Direct materials 21,000 20,640

Direct wages 10,500 9,452

Indirect labour costs (60% variable) 5,500 6,350

Other Overheads (70%fixed) 2,620 2,540

Selling price per copy 20,000 19,600

24 August, 2018 Page 4 of 6

Cost and Management Accounting - Paper 7

Required:

(i) Prepare APL’s flexed budget for the month of July 2018.

(11 marks)

(ii) Compute the sales “price” and “volume” variances.

(5 marks)

(Total 20 marks)

Question 6

(a) Explain the steps involved in the activity-based costing (ABC) system.

(4 marks)

(b) Gomba Farmers Ltd deals in livestock and has three service departments,

i.e. Dips, Feeds and Finance and three production departments i.e.

Breeding, Bull Fattening and Diary. Total overhead costs for the year

ended 30 June, 2018 was as follows:

Production departments Service departments

Breeding Bull Fattening Diary Dips Feeds Finance

Shs ‘000’ Shs ‘000’ Shs ‘000’ Shs ‘000’ Shs ‘000’ Shs ‘000’

25,000 32,000 60,000 15,000 38,000 30,000

Overheads apportionment proposal was as follows:

Feeds Finance Breeding Bull Fattening Diary

Dips 20% 10% 20% 20% 30%

Feeds - 20% 30% 15% 35%

Finance - - 50% 25% 25%

Other information relating to these departments was:

Production departments Service departments

Breeding Bull Diary Dips Feeds Finance

Fattening

No. of cows 100 150 150

No. of stores requisitions

for feeds 15 10 15 10

No. of dip visits 10 70 100 100 20

24 August, 2018 Page 5 of 6

Cost and Management Accounting - Paper 7

Required:

(i) Using the elimination method, apportion service department

overheads to production departments.

(9 marks)

(ii) Using the step method and appropriate bases of apportionment,

apportion service departments to production departments.

(7 marks)

(Total 20 marks)

24 August, 2018 Page 6 of 6

You might also like

- Economic Insights from Input–Output Tables for Asia and the PacificFrom EverandEconomic Insights from Input–Output Tables for Asia and the PacificNo ratings yet

- CPA Cost and Management Accounting Exam PaperDocument6 pagesCPA Cost and Management Accounting Exam PaperTuryamureeba Julius100% (1)

- Management Decision & Control - Paper 11Document8 pagesManagement Decision & Control - Paper 11Jacob Baraka OngengNo ratings yet

- Management Accounting (Acct 321) P2 PT 2ND Trimester 2017Document5 pagesManagement Accounting (Acct 321) P2 PT 2ND Trimester 2017Nodeh Deh SpartaNo ratings yet

- 2016 Mock PDFDocument16 pages2016 Mock PDFNghia Tuan NghiaNo ratings yet

- RVU CMA Work Sheet March 2019Document12 pagesRVU CMA Work Sheet March 2019Henok FikaduNo ratings yet

- KABARAK UNIVERSITY ACCT 520 EXAMDocument5 pagesKABARAK UNIVERSITY ACCT 520 EXAMMutai JoseahNo ratings yet

- 2013 June Management Accounting L2 PDFDocument21 pages2013 June Management Accounting L2 PDFDixie CheeloNo ratings yet

- Standard Marginal Costing ImplementationDocument7 pagesStandard Marginal Costing ImplementationadamNo ratings yet

- LABOURDocument5 pagesLABOURAtukwatse PamelaNo ratings yet

- Cost & Management Accounting - Paper 7Document7 pagesCost & Management Accounting - Paper 7Turyamureeba JuliusNo ratings yet

- ACCT 321 - Managerial AccountingDocument5 pagesACCT 321 - Managerial AccountingNodeh Deh SpartaNo ratings yet

- Managerial Accounting (Acct 321 - HTTM 302) 2nd Trimester 2016Document5 pagesManagerial Accounting (Acct 321 - HTTM 302) 2nd Trimester 2016Nodeh Deh SpartaNo ratings yet

- C&M - Model Exam 2023Document7 pagesC&M - Model Exam 2023ahmad.khalif9999No ratings yet

- Cost and Management AccountingDocument6 pagesCost and Management AccountingTIMOREGHNo ratings yet

- Screenshot 2023-02-14 at 9.47.15 AMDocument3 pagesScreenshot 2023-02-14 at 9.47.15 AMPurnima TiwariNo ratings yet

- 7ACCN018W - Exam July 2019 (Internally Moderated)Document8 pages7ACCN018W - Exam July 2019 (Internally Moderated)hazyhazy9977No ratings yet

- 820001-Cost and Management AccountingDocument4 pages820001-Cost and Management AccountingsuchjazzNo ratings yet

- Attempt All Questions: Summer Exam-2009 Performance Measurement Duration: 3 Hrs. Marks-100Document15 pagesAttempt All Questions: Summer Exam-2009 Performance Measurement Duration: 3 Hrs. Marks-100GENIUS1507No ratings yet

- BFC 3227 Cost Accounting 2Document5 pagesBFC 3227 Cost Accounting 2peterkiamaw492No ratings yet

- AD32 Fundamentals of Management Accounting - Pilot Question Paper-1Document3 pagesAD32 Fundamentals of Management Accounting - Pilot Question Paper-1benard owinoNo ratings yet

- Acma Assignment MaterialDocument12 pagesAcma Assignment MaterialHay Jirenyaa100% (8)

- Set: A: Instructions For CandidatesDocument10 pagesSet: A: Instructions For CandidatessaurabhNo ratings yet

- Costing English Question 14.07.2020Document7 pagesCosting English Question 14.07.2020Prathmesh JambhulkarNo ratings yet

- Part 3Document76 pagesPart 3Kofi Asaase100% (1)

- Wef2012 Pilot MAFDocument9 pagesWef2012 Pilot MAFdileepank14No ratings yet

- Cost FM Sample PaperDocument6 pagesCost FM Sample PapercacmacsNo ratings yet

- Extra Exe - MADocument15 pagesExtra Exe - MACassandra LimNo ratings yet

- ACCT 321-Magerial AccountingDocument6 pagesACCT 321-Magerial AccountingNodeh Deh SpartaNo ratings yet

- Group II - June 2010 Cost and Management Accounting: The Figures in The Margin On The Right Side Indicate Full MarksDocument23 pagesGroup II - June 2010 Cost and Management Accounting: The Figures in The Margin On The Right Side Indicate Full MarksMahesh BabuNo ratings yet

- Standard costing analysis and variance calculationDocument16 pagesStandard costing analysis and variance calculationGurveer SNo ratings yet

- 0462Document4 pages0462tinuNo ratings yet

- This Paper Carries Six Questions. 2. Answer Any Four Questions. 3. Each Question Carries 25 Marks. 4. Use of Non-Programmable Calculators Only Is AllowedDocument6 pagesThis Paper Carries Six Questions. 2. Answer Any Four Questions. 3. Each Question Carries 25 Marks. 4. Use of Non-Programmable Calculators Only Is AllowedtawandaNo ratings yet

- CAC2207200808 Management Accounting For BusinessDocument5 pagesCAC2207200808 Management Accounting For BusinessDanielNo ratings yet

- April 2012Document3 pagesApril 2012Derick cheruyotNo ratings yet

- 4 2 Sma 2018Document5 pages4 2 Sma 2018Nawoda SamarasingheNo ratings yet

- M 2012 June PDFDocument21 pagesM 2012 June PDFMoses LukNo ratings yet

- Budgetary Control Test QuestionsDocument4 pagesBudgetary Control Test QuestionsMehul GuptaNo ratings yet

- Paper19_Set2 question cma finalDocument5 pagesPaper19_Set2 question cma finalrehaliya15No ratings yet

- Cost and Management Accounting Pass 2019Document3 pagesCost and Management Accounting Pass 2019AditNo ratings yet

- Costing TC9QD18Document6 pagesCosting TC9QD18kalowekamoNo ratings yet

- Practice Questions For Cuac217Document11 pagesPractice Questions For Cuac217Tino MakoniNo ratings yet

- Practice Questions For Cuac217Document11 pagesPractice Questions For Cuac217Tino Makoni100% (1)

- Cost Accounting - 2 2020Document5 pagesCost Accounting - 2 2020Shone Philips ThomasNo ratings yet

- 2014 December Management Accounting L2Document17 pages2014 December Management Accounting L2Dixie CheeloNo ratings yet

- f2---mgmt-accounting-august-2014Document21 pagesf2---mgmt-accounting-august-2014aditya pandianNo ratings yet

- Managerial Accounting and FinanceDocument8 pagesManagerial Accounting and FinanceKiarsNo ratings yet

- Ac 313 Marginal and Absorption CostingDocument4 pagesAc 313 Marginal and Absorption CostingAlex MaugoNo ratings yet

- Q and As-Advanced Management Accounting - June 2010 Dec 2010 and June 2011Document95 pagesQ and As-Advanced Management Accounting - June 2010 Dec 2010 and June 2011Samuel Dwumfour100% (1)

- KL Business Finance May Jun 2017Document2 pagesKL Business Finance May Jun 2017Tanvir PrantoNo ratings yet

- Practical Question For ManagementDocument10 pagesPractical Question For ManagementAbrantie JoeNo ratings yet

- 4 Budget & Budgetary ControlDocument17 pages4 Budget & Budgetary ControlRahul SinghNo ratings yet

- CMA QN November 2017Document7 pagesCMA QN November 2017Goremushandu MungarevaniNo ratings yet

- PGDM Cost & Management Accounting exam questionsDocument3 pagesPGDM Cost & Management Accounting exam questionsAnkita JoshiNo ratings yet

- (WWW - Entrance-Exam - Net) - Mumbai University B.com Sample Paper 1Document4 pages(WWW - Entrance-Exam - Net) - Mumbai University B.com Sample Paper 1mysouldeepNo ratings yet

- ACC 308 2022 ExamDocument15 pagesACC 308 2022 ExamMonowalehippie MangaNo ratings yet

- CPA 1 Financial Accounting-1Document8 pagesCPA 1 Financial Accounting-1LYNETTE NYAKAISIKINo ratings yet

- 2019 7010 3C Cost and Management Accounting PDFDocument6 pages2019 7010 3C Cost and Management Accounting PDFMuabecho FatimatuNo ratings yet

- Management Information May-Jun 2016Document2 pagesManagement Information May-Jun 2016SomeoneNo ratings yet

- Cost Accounting: Level 3Document18 pagesCost Accounting: Level 3Hein Linn KyawNo ratings yet

- JRN Tomato Sauce and Paste Business PlanDocument32 pagesJRN Tomato Sauce and Paste Business PlanTuryamureeba JuliusNo ratings yet

- Introdn To LawDocument1 pageIntrodn To LawTuryamureeba JuliusNo ratings yet

- Introduction To Computerized Accounting: Unit 1Document88 pagesIntroduction To Computerized Accounting: Unit 1Turyamureeba JuliusNo ratings yet

- East African Economy NotesDocument10 pagesEast African Economy NotesTuryamureeba JuliusNo ratings yet

- Julius DissertationDocument54 pagesJulius DissertationTuryamureeba JuliusNo ratings yet

- E BusinessDocument29 pagesE BusinessTuryamureeba JuliusNo ratings yet

- Elements of Taxation Elements of Taxatio PDFDocument24 pagesElements of Taxation Elements of Taxatio PDFTuryamureeba JuliusNo ratings yet

- Financial Management Lecture NoteDocument50 pagesFinancial Management Lecture NoteTuryamureeba JuliusNo ratings yet

- BBM Company Law NotesDocument116 pagesBBM Company Law NotesTuryamureeba JuliusNo ratings yet

- Financial Management Lecture NoteDocument50 pagesFinancial Management Lecture NoteTuryamureeba JuliusNo ratings yet

- Characteristics of a CompanyDocument102 pagesCharacteristics of a CompanyVignesh_Mallya_878675% (4)

- OB NotesDocument56 pagesOB NotesAnkur Nagwan89% (9)

- Research Books PDFDocument118 pagesResearch Books PDFAnonymous 9Yv6n5qvSNo ratings yet

- Auditing Summary NotesDocument23 pagesAuditing Summary NotesTuryamureeba Julius100% (4)

- AcceptDocument2 pagesAcceptTuryamureeba JuliusNo ratings yet

- Elements of Taxation Elements of Taxatio PDFDocument24 pagesElements of Taxation Elements of Taxatio PDFTuryamureeba JuliusNo ratings yet

- CPA Financial Accounting Exam PrepDocument10 pagesCPA Financial Accounting Exam PrepTuryamureeba JuliusNo ratings yet

- Paper 2 Quantitative Techniques PDFDocument12 pagesPaper 2 Quantitative Techniques PDFTuryamureeba JuliusNo ratings yet

- Cost & Managent Accounting Paper 7Document6 pagesCost & Managent Accounting Paper 7Turyamureeba JuliusNo ratings yet

- Cost & Managent Accounting Paper 7Document27 pagesCost & Managent Accounting Paper 7Turyamureeba JuliusNo ratings yet

- Business Law NotesDocument134 pagesBusiness Law NotesNadeem Sharif96% (24)

- Bachelor of Business AdministrationDocument3 pagesBachelor of Business AdministrationTuryamureeba JuliusNo ratings yet

- CPA Financial Accounting Exam PrepDocument10 pagesCPA Financial Accounting Exam PrepTuryamureeba JuliusNo ratings yet

- 02 Chapter 2 Evolution of EntrepreneurshipDocument28 pages02 Chapter 2 Evolution of Entrepreneurshiptj akibNo ratings yet

- Business CommunicationDocument70 pagesBusiness CommunicationJericho PedragosaNo ratings yet

- Quantitative Techniques - Paper 2 PDFDocument11 pagesQuantitative Techniques - Paper 2 PDFTuryamureeba JuliusNo ratings yet

- Cost & Management Accounting - Paper 7Document7 pagesCost & Management Accounting - Paper 7Turyamureeba JuliusNo ratings yet

- ADL 12 Business Laws V4Document26 pagesADL 12 Business Laws V4Aditya BhatNo ratings yet

- Massimo Caputi Prelios - Approvato Prelios Business Plan 2014-2016Document21 pagesMassimo Caputi Prelios - Approvato Prelios Business Plan 2014-2016michelaplatiniNo ratings yet

- Document From Harsh DhankharDocument54 pagesDocument From Harsh DhankharHarsh DhankharNo ratings yet

- 74936bos60526-Cp3 UnlockedDocument70 pages74936bos60526-Cp3 Unlockedhrudaya boysNo ratings yet

- Talent Acquisition.Document13 pagesTalent Acquisition.Smiti Agarwal100% (2)

- SGS CBE Workplace Safety Risk Management A4 en 16 09 LRDocument8 pagesSGS CBE Workplace Safety Risk Management A4 en 16 09 LRnazirkuraNo ratings yet

- Point of View: Subsistence NeedsDocument3 pagesPoint of View: Subsistence NeedsJen AdvientoNo ratings yet

- Marketing Strategies of Bakery Operators BodyDocument13 pagesMarketing Strategies of Bakery Operators BodyVickyNo ratings yet

- Application LetterDocument9 pagesApplication LetterYash MangadangNo ratings yet

- Financial Accounting, 8/e, Chapter 13 ANSWERS TO QUESTIONSDocument36 pagesFinancial Accounting, 8/e, Chapter 13 ANSWERS TO QUESTIONSLazaros KarapouNo ratings yet

- NL-0000325 DocDocument14 pagesNL-0000325 DocAjeya SaxenaNo ratings yet

- Inventories AccountingDocument15 pagesInventories AccountingcociorvanmiriamNo ratings yet

- Olic MM As Is Document (Updated) 21.07.2022Document18 pagesOlic MM As Is Document (Updated) 21.07.2022Janmejaya SahooNo ratings yet

- v3n2p31 39Document9 pagesv3n2p31 39novan kostkaNo ratings yet

- Labor Relations Termination GuideDocument15 pagesLabor Relations Termination GuideOlenFuerteNo ratings yet

- Ccw332 Digital Marketing-syllabus-r 2021Document1 pageCcw332 Digital Marketing-syllabus-r 2021examcell.vvcetNo ratings yet

- Location of Enterprise and Steps in Setting SSIDocument44 pagesLocation of Enterprise and Steps in Setting SSImurugesh_mbahit100% (2)

- Experienced IT Professional with 20 Years of ExperienceDocument3 pagesExperienced IT Professional with 20 Years of ExperienceEvans CorpNo ratings yet

- CVS OTIF Program Webinar-Reporting, Charge Investigation, Disputes - 0Document58 pagesCVS OTIF Program Webinar-Reporting, Charge Investigation, Disputes - 0Elite Cleaning ProductsNo ratings yet

- Chapter 6Document23 pagesChapter 6red8blue8No ratings yet

- Providing Brand New Ambulance ServicesDocument83 pagesProviding Brand New Ambulance Servicesmadhav kumarNo ratings yet

- BSBRSK501 Manage Risk Assessment 2Document5 pagesBSBRSK501 Manage Risk Assessment 2prasannareddy9989No ratings yet

- The Philosophy of An Audit: Relevant, Benchmarks For Presentation and Disclosure"Document5 pagesThe Philosophy of An Audit: Relevant, Benchmarks For Presentation and Disclosure"Aie GeraldinoNo ratings yet

- Indian Contract Act, 1872Document111 pagesIndian Contract Act, 1872bhishamshah70No ratings yet

- 4 - Director Planning and Organisation DevelopmentDocument2 pages4 - Director Planning and Organisation DevelopmentAli Raza ShahNo ratings yet

- EDP Audit MCQsDocument3 pagesEDP Audit MCQsSaria Waqas0% (1)

- Sales and Inventory System THESIS SURVEYS & QUESTIONNAIREDocument5 pagesSales and Inventory System THESIS SURVEYS & QUESTIONNAIREKhristine KateNo ratings yet

- Nielsen - Market Research For PanteneDocument21 pagesNielsen - Market Research For Panteneveerapratapreddy509No ratings yet

- Marketing ReportDocument19 pagesMarketing ReportMike James Rudio AgnesNo ratings yet

- MKT4220 JAN2021 Individual Assessment 30%Document3 pagesMKT4220 JAN2021 Individual Assessment 30%suvendran MorganasundramNo ratings yet

- Business Plan SampleDocument11 pagesBusiness Plan SampleChristian Alejandrino100% (1)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (13)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- STEM Labs for Physical Science, Grades 6 - 8From EverandSTEM Labs for Physical Science, Grades 6 - 8Rating: 3.5 out of 5 stars3.5/5 (6)

- Bookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesFrom EverandBookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesRating: 5 out of 5 stars5/5 (4)

- Lower Secondary Science Workbook: Stage 8From EverandLower Secondary Science Workbook: Stage 8Rating: 5 out of 5 stars5/5 (1)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantFrom EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantRating: 4.5 out of 5 stars4.5/5 (146)

- Ledger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceFrom EverandLedger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceNo ratings yet

- Quantum Physics for Beginners: Simple Illustrated Guide to Discover with Practical Explanations the Paradoxes of the Life and Universe Reconsidering RealityFrom EverandQuantum Physics for Beginners: Simple Illustrated Guide to Discover with Practical Explanations the Paradoxes of the Life and Universe Reconsidering RealityRating: 2 out of 5 stars2/5 (1)

- The One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyFrom EverandThe One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyRating: 4.5 out of 5 stars4.5/5 (37)

- Warren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageFrom EverandWarren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageRating: 4.5 out of 5 stars4.5/5 (109)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Profit First for Therapists: A Simple Framework for Financial FreedomFrom EverandProfit First for Therapists: A Simple Framework for Financial FreedomNo ratings yet

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- A-level Biology Revision: Cheeky Revision ShortcutsFrom EverandA-level Biology Revision: Cheeky Revision ShortcutsRating: 5 out of 5 stars5/5 (5)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)