Professional Documents

Culture Documents

Vendor Statutory Compliance Checklist-Karnataka PDF

Vendor Statutory Compliance Checklist-Karnataka PDF

Uploaded by

Vishal ChavanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Vendor Statutory Compliance Checklist-Karnataka PDF

Vendor Statutory Compliance Checklist-Karnataka PDF

Uploaded by

Vishal ChavanCopyright:

Available Formats

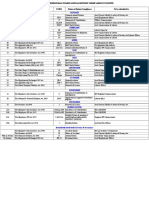

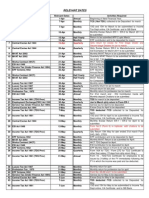

Vendor Compliance Checklist (Returns, registers to be maintained /submitted for Statutory Compliance Audit)-Karnataka State

Sl.No Particulars Remarks

One time document submission under various labour laws

1 Copy of PF Registration Certificate

2 Copy of Esic Registration Certificate

Pls provide the copies attested by Authorised signatory

3 Copy of the P. Tax registration certificate (Form 3 & Form 4)

4 Copy of Karnataka Shops & Commercial Establishment licence

5 Copy of CLRA licence (Form VI) Copy required for our records

The Contract Labour ( Regulation and Abolition) Act, 1970.

1 Register of Workmen employed by the contractor - Form XIII Register to be maintained at principal employer premises

2 Employment Card - Form -XIV

3 Wage slips - Form - XIX

4 Combined Muster roll-cum-Register of Wages- Form T

5 Service Certificate- Form -XV

6 Half Yearly Return by the Contractor- Form XXIV

Karnataka Shops And Commercial Establishments Act, 1961

1 Appointment order Form "Q"

2 Leave with wages register -Form F To be issued to deployed employees

3 Leave with wage book - Form H To be maintained for deployees

4 Annual Return - Form U Acknowledgement to be furnished within 5th February every year

The Karnataka Labour Welfare Fund Act, 1965 & Rules, 1968

1 Karnataka Labour Welfare Fund contribution - Form D Acknowledgement to be furnished within 20th of January every year

2 If any, Unpaid accumulation -Every employer, realizing fines from employees Every Quarter ending

or having unpaid accumulations - Form B 31st March, 30th June,30th September and 31st December

The Payment of Gratuity Act, 1972 &Karnataka Payment of Gratuity Rules , 1973

1 Nomination Form -Form F

2 Notice for Payment of Gratuity -Form L At the time of resignation of deployed employee.

The Equal Remuneration Act, 1976 & Rules, 1976

1 Register of employment -Form D

The Maternity Benefit Act, 1961 & Rules, 1966

1 Form A muster Roll

2 Form D, C, B

3 Medical Bonus -Payment of medical bonus of Rs.2500/- to be paid to

employee, who is expected delivery Proof to be furnished for paying Medical bonus for the eligible employee

The Payment of Bonus Act, 1965 & Rules, 1975

1 Register of computation of allocable surplus- Form-A

2 Register of set on and set off of allocable surplus - Form B

Copy of C & Ack of Form D to be produced

3 Register of Bonus paid to employees -Form C

4 Annual Return - Form D

The Payment of Wages Act, 1936 & Rules, 1963 / The Minimum Wages Act, 1948

&Karnataka Minimum Wages Rules, 1958

1 Register of Deduction

2 Register of Overtime

3 Register of Fines

4 Register of Advance

5 Form I -Under Payment of Wages

The Employees’ State Insurance Act, 1948 & Rules, 1950

1 Copy of ESIC Permanent cards For all deployed employees comes under Esic slab

2 Contribution Remittance - Copy of Esic Challan

3 Register of Employees -Form 6

4 Copy of Half yearly return -Form 5

5 Accident Register - Form 11

6 Self Declaration & Esic contribution statement Self declaration on the company letter head/Contribution statement for deployees

7 Copy of Annual Return -Form 01A

The Employees' Provident Funds and Miscellaneous Provisions Act,1952

1 Copy of Nomination & Declaration Form (Form -2) To be furnished for all deployed employees

2 Contribution Remittance - Copy of EPF Challan

3 PF Monthly Returns (Form 5,10 & 12A)

4 Copy of Annual Return submission Acknowledgement Copy Form 3A & 6A to be furnished for deployed employees (In "6A" names of deployed ees to be

highlighted

5 Self Declaration & EPF contribution statement Self declaration on the company letter head/Contribution statement for deployees

The Karnataka Tax on Professions, Trades, Callings and EmploymentAct,1976

1 Contribution Remittance - Copy of Professional Tax Challan

2 Copy of Professional Tax Annual return

3 PT Contribution statement Contribution statement for deployees

You might also like

- 21st Century Accounting Process 16th EditionDocument23 pages21st Century Accounting Process 16th EditionPaula Anyssa Tobias Berba100% (2)

- Statutory Check List in ExcelDocument160 pagesStatutory Check List in ExcelShweta Singh50% (2)

- All Act Statutory Compliances Xls Download Statutory ComplianceDocument29 pagesAll Act Statutory Compliances Xls Download Statutory ComplianceAditya Mishra100% (1)

- Sample Special Power of Attorney For Settlement of Estate PDFDocument3 pagesSample Special Power of Attorney For Settlement of Estate PDFRizal RamosNo ratings yet

- Compliance Checklist: Sr. No Contract Labour Act RemarksDocument3 pagesCompliance Checklist: Sr. No Contract Labour Act RemarksRAKESH RATHODNo ratings yet

- Statutory Check List 927Document62 pagesStatutory Check List 927Saravana KumarNo ratings yet

- TN ShopsDocument2 pagesTN Shopswanname_joshNo ratings yet

- Forms - Factories Act & Contract Labour ActDocument6 pagesForms - Factories Act & Contract Labour Actrgsr2008No ratings yet

- Checklist of Statuatory ComplianceDocument2 pagesChecklist of Statuatory ComplianceSatyam mishra71% (7)

- ESI & PF CalculationsDocument2 pagesESI & PF Calculationsparavind67% (3)

- Salary Sheet FormatDocument17 pagesSalary Sheet FormatWaqas AhmedNo ratings yet

- Provident Fund Full DetailsDocument5 pagesProvident Fund Full DetailsGaurav VijayNo ratings yet

- Caf 7 Far2 QB PDFDocument262 pagesCaf 7 Far2 QB PDFZahid100% (1)

- PF NotesDocument15 pagesPF NotesAbdul KhadhirNo ratings yet

- Statutory Compliance Checklist.Document3 pagesStatutory Compliance Checklist.jockeyjockey0% (1)

- Acts RegisterDocument3 pagesActs Registersheru006No ratings yet

- Statutory Compliance ChecklistDocument5 pagesStatutory Compliance ChecklistAmit Biswas50% (2)

- Month Wise Checklist For Submission of Various ReturnsDocument3 pagesMonth Wise Checklist For Submission of Various Returnsadith24No ratings yet

- Monthwise Checklist For Submission of Various ReturnsDocument3 pagesMonthwise Checklist For Submission of Various ReturnsBapusaheb GuthaleNo ratings yet

- Statutory Labour Law MaintenanceDocument6 pagesStatutory Labour Law MaintenanceGURMUKH SINGHNo ratings yet

- Statutory Compliance - PF and GratuityDocument11 pagesStatutory Compliance - PF and GratuityHusna SadiyaNo ratings yet

- ESI & PF Brief InformationDocument8 pagesESI & PF Brief InformationPrashant Dhangar0% (1)

- Check List For Auditing Statutory RecordsDocument6 pagesCheck List For Auditing Statutory RecordsShrikant Naik0% (1)

- Labour Law Compliance ChecklistDocument159 pagesLabour Law Compliance ChecklistBharat Joshi100% (1)

- Karnataka S&E ChecklistDocument4 pagesKarnataka S&E Checklistbhavani14No ratings yet

- Anirudh Kumar JainDocument4 pagesAnirudh Kumar JainAnirudh JainNo ratings yet

- TN Shops and Establishments Act FormsDocument3 pagesTN Shops and Establishments Act Formsmanuputhra67% (3)

- Statutory Compliance of All ActsDocument16 pagesStatutory Compliance of All ActsezhilarasanmpNo ratings yet

- STATUATORY Compliance & LABOUR LAWS - Check List For Auditing Statutory Records & ReturnsDocument5 pagesSTATUATORY Compliance & LABOUR LAWS - Check List For Auditing Statutory Records & ReturnsSatyam mishra83% (6)

- Statutory CompliancesDocument4 pagesStatutory CompliancesPratibha ChopraNo ratings yet

- Statutory Compliances For HRDocument12 pagesStatutory Compliances For HRGaurav Narula83% (65)

- Guidelines On Labour LawsDocument29 pagesGuidelines On Labour LawsSARANYAKRISHNAKUMARNo ratings yet

- Statutory Compliance - Checklist - Labour Law ReporterDocument5 pagesStatutory Compliance - Checklist - Labour Law ReporterMuthu ManikandanNo ratings yet

- PLANTDocument33 pagesPLANTGaurav KapoorNo ratings yet

- Monthwise Statutory Compliance ChecklistDocument9 pagesMonthwise Statutory Compliance ChecklistGaurav2192No ratings yet

- Labour Law Compliance Check ListDocument8 pagesLabour Law Compliance Check ListkaushikNo ratings yet

- Statutory ComplianceDocument16 pagesStatutory ComplianceGovindNo ratings yet

- Statutory Compliances Checklist On Various Labour LawsDocument150 pagesStatutory Compliances Checklist On Various Labour LawsShantanu GanguliNo ratings yet

- Registers To Be Maintained Under Factories ActDocument2 pagesRegisters To Be Maintained Under Factories ActSanjay SinghNo ratings yet

- Form-15 Leave With Wage Register FormatDocument1 pageForm-15 Leave With Wage Register Formatnatrajbaskaran natraj100% (1)

- Comprehensive Compliance Applicable in GodrejDocument19 pagesComprehensive Compliance Applicable in GodrejPashinPatell100% (1)

- Relevant Dates: 15-Apr QuarterlyDocument6 pagesRelevant Dates: 15-Apr Quarterlysanyu1208No ratings yet

- Check List For Statutory Compliance - Deposits, Returns & InformationDocument25 pagesCheck List For Statutory Compliance - Deposits, Returns & InformationHarshivLSharma83% (6)

- Factories Act RegistersDocument2 pagesFactories Act Registerssatyam.pmir678988% (8)

- Auto CTC Salary CalculatorDocument1 pageAuto CTC Salary CalculatorSathvika SaaraNo ratings yet

- Month Wise Compliance ChecklistDocument2 pagesMonth Wise Compliance ChecklistDevrupam SHNo ratings yet

- HR Laws Check ListDocument18 pagesHR Laws Check Listdpak111No ratings yet

- Notice Board Displays As Per Labour LawsDocument5 pagesNotice Board Displays As Per Labour Lawsprakash8767No ratings yet

- Contract Labour Compliance ChecklistDocument9 pagesContract Labour Compliance ChecklistGaurav2192No ratings yet

- Form L Under Maternity Benefit ActDocument1 pageForm L Under Maternity Benefit Acthdpanchal86100% (1)

- Check List of All Labour LawsDocument16 pagesCheck List of All Labour LawsGoutham ShettyNo ratings yet

- PF All Forms in Excel (Challan Monthly Return Annual Return)Document20 pagesPF All Forms in Excel (Challan Monthly Return Annual Return)Pardeep K AggarwalNo ratings yet

- Statutory ComplianceDocument3 pagesStatutory ComplianceAswanth GokaNo ratings yet

- Vendor Labour Compliance Check ListDocument1 pageVendor Labour Compliance Check ListsslajmiNo ratings yet

- Labour Laws - Monthwise Filing of ReturnsDocument6 pagesLabour Laws - Monthwise Filing of ReturnsHarish KGNo ratings yet

- Statutory Compliance DocumentsDocument9 pagesStatutory Compliance DocumentsgauravNo ratings yet

- Profile (I S Channa & Associates)Document6 pagesProfile (I S Channa & Associates)utoNo ratings yet

- Month Wise Checklist For Submission of Various ReturnsDocument3 pagesMonth Wise Checklist For Submission of Various ReturnsKS Jagadish100% (1)

- Labour Laws Compliance-HaryanaDocument7 pagesLabour Laws Compliance-HaryanaAshok Sharma100% (1)

- Lucknow Labour Law Consultancy Check List For The Compliance of Labour LawsDocument2 pagesLucknow Labour Law Consultancy Check List For The Compliance of Labour LawsAnkit Kr MishraNo ratings yet

- Contract Labour Scope of WorkDocument2 pagesContract Labour Scope of WorkJagadeesh GunupuruNo ratings yet

- Statutory ComplianceDocument2 pagesStatutory Compliancemax997No ratings yet

- ComplianceDocument5 pagesComplianceSushanta PadhiNo ratings yet

- Package of Practices of Orange: Krishi Vigyan KendraDocument4 pagesPackage of Practices of Orange: Krishi Vigyan KendramanishdgNo ratings yet

- List of Registered FirmsdripDocument2 pagesList of Registered FirmsdripmanishdgNo ratings yet

- IntercroppingincitrusDocument11 pagesIntercroppingincitrusmanishdgNo ratings yet

- By Budding: Scion/bud Wood Should Be Selected From Diseases Free Healthy Plants and DefoliateDocument2 pagesBy Budding: Scion/bud Wood Should Be Selected From Diseases Free Healthy Plants and DefoliatemanishdgNo ratings yet

- MaDocument3 pagesMamanishdgNo ratings yet

- FdeDocument2 pagesFdemanishdgNo ratings yet

- Padvt 1Document1 pagePadvt 1manishdgNo ratings yet

- Learning From Old Practices and Local Farmers To Improve and Assure Rootstock Quality of Nagpur Mandarin Saplings 1562Document2 pagesLearning From Old Practices and Local Farmers To Improve and Assure Rootstock Quality of Nagpur Mandarin Saplings 1562manishdgNo ratings yet

- BaDocument3 pagesBamanishdgNo ratings yet

- Behavior of AlemowDocument6 pagesBehavior of AlemowmanishdgNo ratings yet

- Ar 232002Document17 pagesAr 232002manishdgNo ratings yet

- Advanced Citriculture in Vidharbha Region of Maharashtra A Case Study of Successful Adoption of TechnologiesDocument6 pagesAdvanced Citriculture in Vidharbha Region of Maharashtra A Case Study of Successful Adoption of TechnologiesmanishdgNo ratings yet

- Karonda A Potentila Fresh Fruit For FutureDocument11 pagesKaronda A Potentila Fresh Fruit For FuturemanishdgNo ratings yet

- Page 1 of 4: Source: Tarla Dalal - Cooking & More - Volume VI - Issue 5Document4 pagesPage 1 of 4: Source: Tarla Dalal - Cooking & More - Volume VI - Issue 5manishdgNo ratings yet

- Enforcement of International Judicial DecisionsDocument189 pagesEnforcement of International Judicial DecisionsmanishdgNo ratings yet

- The Best Kept Secret of Pukhraj: by Alok Jagawat, IndiaDocument4 pagesThe Best Kept Secret of Pukhraj: by Alok Jagawat, Indiamanishdg100% (1)

- Freedom To Bear ArmsDocument129 pagesFreedom To Bear ArmsmanishdgNo ratings yet

- Iran Oil Sanctions PDFDocument95 pagesIran Oil Sanctions PDFmanishdg100% (1)

- Birth India: Rights of The Childbearing WomenDocument2 pagesBirth India: Rights of The Childbearing WomenmanishdgNo ratings yet

- Cesareanbooklet PDFDocument14 pagesCesareanbooklet PDFmanishdgNo ratings yet

- Form No. 1 Certificate of TitleDocument1 pageForm No. 1 Certificate of TitlemanishdgNo ratings yet

- Guidance Text Section4Document28 pagesGuidance Text Section4manishdgNo ratings yet

- 1995: Mah. Viii) Maharashtra Act No. Vill of 1995 (The - Maharashtra Prevention of Defacement of Property Act, 1995.) 1Document3 pages1995: Mah. Viii) Maharashtra Act No. Vill of 1995 (The - Maharashtra Prevention of Defacement of Property Act, 1995.) 1manishdgNo ratings yet

- SATURDAYDocument20 pagesSATURDAYkristine bandaviaNo ratings yet

- Institute of Management Studies Davv Indore Mba (Financial Administration) Iiird Semester - Fa 303C Insurance and Bank ManagementDocument4 pagesInstitute of Management Studies Davv Indore Mba (Financial Administration) Iiird Semester - Fa 303C Insurance and Bank ManagementjaiNo ratings yet

- Memorandum of Agreement1 2Document6 pagesMemorandum of Agreement1 2Mhel DemabogteNo ratings yet

- Gross Income Regular TaxDocument51 pagesGross Income Regular TaxElizalen MacarilayNo ratings yet

- GP - Consumer Behaviour For Third Party Products at Private BanksDocument75 pagesGP - Consumer Behaviour For Third Party Products at Private Banksjignay100% (4)

- PeopleSoft - Payroll Doc - SatishDocument9 pagesPeopleSoft - Payroll Doc - SatishAnuj SharmaNo ratings yet

- Cat Bonds Demystified: RMS Guide To The Asset ClassDocument12 pagesCat Bonds Demystified: RMS Guide To The Asset ClassRicha TripathiNo ratings yet

- Ratios Report Ambuja CementDocument11 pagesRatios Report Ambuja CementSajal GoyalNo ratings yet

- Vendor Registration FormDocument3 pagesVendor Registration FormSourabh ShrivastavaNo ratings yet

- Capital Structure Analysis of Indian Oil Corporation Limited (IOCL)Document87 pagesCapital Structure Analysis of Indian Oil Corporation Limited (IOCL)MOHITKOLLINo ratings yet

- Charles P. Jones and Gerald R. Jensen, Investments: Analysis and Management, 13 Edition, John Wiley & SonsDocument17 pagesCharles P. Jones and Gerald R. Jensen, Investments: Analysis and Management, 13 Edition, John Wiley & SonsFebri MonikaNo ratings yet

- House Building AdvanceDocument14 pagesHouse Building AdvanceKashifNo ratings yet

- Company Law Assignment 1Document24 pagesCompany Law Assignment 1management1997No ratings yet

- English Form For DB Account Opening Form For StudentsDocument7 pagesEnglish Form For DB Account Opening Form For StudentsFelly M. LogioNo ratings yet

- Week 5 Workshop Solutions - Short-Term Debt MarketsDocument3 pagesWeek 5 Workshop Solutions - Short-Term Debt MarketsMengdi ZhangNo ratings yet

- Chapter 15 Debt and EquityDocument4 pagesChapter 15 Debt and EquityMahmood KarimNo ratings yet

- Registration Form3330389035449Document2 pagesRegistration Form3330389035449MUHAMMAD IQBALNo ratings yet

- Chapter-I: 1.1 Background of The StudyDocument61 pagesChapter-I: 1.1 Background of The StudyPratikshya Karki100% (1)

- Case Digest AssignmentDocument18 pagesCase Digest AssignmentTJ MerinNo ratings yet

- Report 3 Charging of Engineering ServicesDocument4 pagesReport 3 Charging of Engineering Serviceso100% (1)

- DE - Dirk Bliesener - Hengeler MuellerDocument54 pagesDE - Dirk Bliesener - Hengeler MuellerarohiNo ratings yet

- Day 4Document7 pagesDay 4sabrina006No ratings yet

- Jardenil V SalasDocument1 pageJardenil V Salascmv mendozaNo ratings yet

- Jeevan Akshay-VII - 857: Premium ChartDocument2 pagesJeevan Akshay-VII - 857: Premium ChartNarendar KumarNo ratings yet

- MPX x.100 Quarter 2Document1 pageMPX x.100 Quarter 2srinuvoodiNo ratings yet

- Budget 2K19: Made By: 17BCS1907 17BCS1908 17BCS1909 17BCS1910 17BCS1911Document9 pagesBudget 2K19: Made By: 17BCS1907 17BCS1908 17BCS1909 17BCS1910 17BCS1911Sameer KhullarNo ratings yet

- Vetan Deyak Praptra Vittiya Niyam Sangrah, Khand-5, Bhag-1 See Chapter 6 Para-108, Chapter 7 Para-131Document11 pagesVetan Deyak Praptra Vittiya Niyam Sangrah, Khand-5, Bhag-1 See Chapter 6 Para-108, Chapter 7 Para-131Madan ChaturvediNo ratings yet