0% found this document useful (0 votes)

116 views17 pagesNifty Options Open Interest Analysis

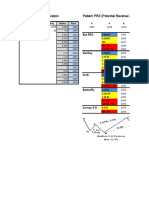

The document analyzes options data and provides an interpretation of market sentiment. It shows call and put open interest, volume, change in open interest and price for different strike prices. The trend is identified as bullish or bearish based on the criteria that if call open interest and price is increasing while put open interest is decreasing, it indicates a bullish or long buildup trend. Conversely, if call open interest and price is decreasing while put open interest is increasing, it indicates a bearish or long liquidation trend. The analysis provides insight into the prevailing market sentiment.

Uploaded by

MOBILE FRIENDCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

116 views17 pagesNifty Options Open Interest Analysis

The document analyzes options data and provides an interpretation of market sentiment. It shows call and put open interest, volume, change in open interest and price for different strike prices. The trend is identified as bullish or bearish based on the criteria that if call open interest and price is increasing while put open interest is decreasing, it indicates a bullish or long buildup trend. Conversely, if call open interest and price is decreasing while put open interest is increasing, it indicates a bearish or long liquidation trend. The analysis provides insight into the prevailing market sentiment.

Uploaded by

MOBILE FRIENDCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd