Professional Documents

Culture Documents

Insurance Awareness PDF

Uploaded by

deepakonaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Insurance Awareness PDF

Uploaded by

deepakonaCopyright:

Available Formats

Insurance Awareness Capsule for LIC AAO Mains

S. No Topics Page No.

1. Insurance Definition 2

2. History of Insurance 2

3. History of Insurance in India 2

4. Liberalisation of the Indian Insurance Sector 3

5. Insurance Regulatory Development Authority of India 3

6. Different Types of Insurance 4

7. Principles of Insurance 5

8. Types of Insurance Plans 5

9. Types of Insurance Policies 6

10. The Insurance Ombudsman 8

11. Schemes Related To Insurance 9

12. Insurance Terminologies 10

13. ULIP 15

14. Insurance related acts 16

15. Insurance related committee 17

16. Important Insurance Abbreviations 17

17. Headquarters and Taglines of Insurance Companies 19

Click Here for High Quality Mock Test Series for SBI Clerk Pre 2019 Click Here for High Quality Mock Test Series for SBI PO Pre 2019

Follow us: Telegram , Facebook , Twitter , Instagram 1

Insurance Awareness Capsule for LIC AAO Mains

Insurance

Insurance is a means of protection from financial loss. It is a form of risk management, primarily used to hedge

against the risk of a contingent or uncertain loss. Insurance can also be defined as a co-operative arrangement to

spread the loss caused by a particular risk over a large number of people who are exposed to it, in exchange for a

small sum of money.

In simple terms, insurance is:

A process of passing or transferring the risk of incurring loss by the owner (who cannot bear the risk) of

an asset; to the other party (insurance company) who can bear the risk; in return for a consideration

(premium).

History of Insurance:

The history of insurance is almost as old as the existence of humans. Some of the milestones related to history of

insurance are:

• Over 5000 years back, Chinese traders used insurance as a preventive measure against piracy. The cargo of

each ship used to be distributed among other ships, so that if one ship gets lost or captured by pirates the loss

would only be partial.

• The first written insurance policy was on a Babylonian obelisk monument with the code of King Hammurabi.

The Hammurabi Code was one of the first forms of written laws. The basic insurance gave the Babylonian

traders protection against loss of cargo.

• In 1666, the Great Fire of London destroyed more than 13000 houses. To counter such events in future, Fire

Office, the first fire insurance company was started in 1680.

• Traders in London used to gather at Lloyd’s Coffee House and agree to share losses of goods due to piracy or

the ship sinking due to bad weather or other reasons.

History of Insurance in India:

In India, insurance began formally in the 18th century. The following are some of the early companies who started

operating in India.

1818 - 1st life insurance company – Oriental Life Insurance Company was established in Kolkata

1829 - Madras Equitable was established in Madras (Chennai) Presidency

1850 - 1st non-life insurance company - Triton Insurance Company Limited

1870 - Bombay Mutual was started in Mumbai

1874 - Oriental was started in Mumbai

1896 - Bharat Insurance Company Limited was started in Delhi

1897 - Empire of India was started in Mumbai

The growth of insurance business in India required the enactment of the Insurance Act, 1938

Life Insurance Corporation of India (LIC):

In 1956, the life insurance business in India was nationalised and the Life Insurance Corporation of India

(LIC) was formed on 1st September 1956.

General Insurance Corporation (GIC):

Click Here for High Quality Mock Test Series for SBI Clerk Pre 2019 Click Here for High Quality Mock Test Series for SBI PO Pre 2019

Follow us: Telegram , Facebook , Twitter , Instagram 2

Insurance Awareness Capsule for LIC AAO Mains

In 1973, general insurance business was nationalised in India and the General Insurance Corporation of India

(GIC) and the four subsidiaries; National Insurance Company Limited, The New India Assurance Company Limited,

The Oriental Insurance Company Limited and United India Insurance Company Limited were formed. As part of the

nationalisation process, the funds of all existing companies were merged with the four subsidiaries of the GIC.

Liberalisation of the Indian Insurance Sector:

Insurance in India is governed by the Insurance Act, 1938 as amended from time to time. It lays down the rules

and regulations for the insurance industry. The Insurance Regulatory and Development Authority (IRDA) Act was

enacted in 1999. IRDA is the regulator for insurance business in India.

• In the year 2000, the insurance sector was liberalised and opened up for business to the private sector.

Foreign Direct Investment (FDI) was allowed in insurance upto 26% wherein the foreign players were

allowed to enter into joint ventures with domestic players

• Lot of domestic players joined hands with foreign partners who brought in valuable expertise and capital.

• Opening up of the insurance sector has led to emergence of innovative insurance products and has also

helped in deeper spread of insurance.

• Liberalization brought in the much needed competition and better customer service.

Insurance Regulatory Development Authority of India (IRDAI)

The IRDAI is an independent and autonomous statutory body. The IRDAI was constituted under the

Insurance Regulatory and Development Authority Act which was passed in 1999. The main function of the IRDAI is

to regulate the insurance industry of the country.

For many years the insurance sector of India was protected. The IRDA Act of 1999 allowed the entry of

private companies in the insurance sector. It also allowed for 26% investment by foreign companies. Since 2014 the

FDI limit has been increased to 49% and further opened up the insurance sector.

So the Insurance Regulatory and Development Authority of India has a role to protect the policyholders from

any form of discriminatory practices. They regulate all the insurance companies. All companies have to approach the

IRDAI for registration certificates. And they are responsible for the renewal, modification or cancellation of these

certificates.

Functions and Powers of the IRDAI:

The IRDA Act gives the authority its functions and powers. Section 14 of the Act contains the scope of

powers of the Insurance Regulatory and Development Authority of India to regulate the insurance and reinsurance

industry. Let us take a look at the powers and functions of the IRDAI

The IRDAI has the authority to issue registration certificates to any applicant. The also may re-issue, renew,

cancel or modify these certificates as per their discretion.

• Protection of the policyholders in matters such as assigning of policy, nominating members to the policy,

insurable interest, settlement of claims, and any other such matters

• Make guidelines and provide training for the appropriate code of conduct for insurance agents and

intermediaries

• Also making the code of conduct for loss assessors and surveyors working with the insurance companies.

• They can also conduct investigations and audits of insurance companies, intermediaries, and any other

organizations with a connection to the insurance business

Click Here for High Quality Mock Test Series for SBI Clerk Pre 2019 Click Here for High Quality Mock Test Series for SBI PO Pre 2019

Follow us: Telegram , Facebook , Twitter , Instagram 3

Insurance Awareness Capsule for LIC AAO Mains

• Regulation of rates, terms, and conditions, etc. that the insurers offer their customers in the general insurance

business

• The IRDAI can also dictate the manner in which the insurance companies have to maintain their records and

books of accounts. And how they prepare their final accounts as well.

• They regulate how the insurance companies invest their funds and maintain their margin of solvency

• The adjudication of matters and disputes of any kind involving the insurance companies or intermediaries is

also done by the IRDAI

• There is a Tariff Advisory Committee with relation to the insurance company. The IRDAI regulates its

functions as well.

Role of IRDAI as a Business Facilitator:

One function of the Insurance Regulatory and Development Authority of India is that it also acts as a

business facilitator. It regulates the insurance industry and creates trust and goodwill in the market for these

insurance companies.

The IRDAI is also responsible for the growth and development of the insurance sector. The increasing

participation of foreign companies under the watchful eye of the authority is good for both the insurance sector and

the economy as a whole.

Different Types of Insurance:

Life Insurance

General Insurance

Fire Insurance

Marine Insurance

Miscellaneous

Motor

Liability

Health

Burglary

Life Insurance:

Life insurance deals with covering the lives of human beings. In life insurance, the asset in question is the

‘economic value’ of the person. A person’s earning capacity depends on his skills, knowledge, ability and other

factors. The family, employer and indirectly the users of products created by this asset (human beings) enjoy value

and benefits. A human life is an income generating asset. But this asset can be lost through unexpected, early death

or made non-functional through illnesses or disabilities caused by accidents. Death is certain, but its timing is

uncertain. If death occurs very early in the career, insurance contributes to help those dependent on this asset.

General Insurance:

Non-life insurance or general insurance deals with covering non-human objects like animals, agricultural

crops, goods, factories, cars etc. In some countries nonlife insurance is also known as Property and Casualty

Insurance. Non-life insurance also covers losses through individual behaviours like fraud, burglary, non-fulfilment

of promises (in the case of repayment of mortgage loans) and negligence by professionals in their service. General

insurance policies are mostly for one year and are renewable.

General insurance business is further divided into 3 categories:

Click Here for High Quality Mock Test Series for SBI Clerk Pre 2019 Click Here for High Quality Mock Test Series for SBI PO Pre 2019

Follow us: Telegram , Facebook , Twitter , Instagram 4

Insurance Awareness Capsule for LIC AAO Mains

Fire Insurance

Marine Insurance

Miscellaneous (motor insurance, engineering, liability, burglary, fidelity, health,

personal accident).

Fire insurance deals with all fire related risks and will include damage due to riots, malicious acts, typhoons,

cyclones, earthquakes and consequential expenditures related to these events.

Marine insurance deals with goods being transported by sea, air, rail or road as well as all marine related risks.

Apart from fire insurance and marine insurance all other businesses are included in the miscellaneous class. These

include motor insurance, engineering, liability, burglary, fidelity, health, personal accident etc.

Accidents and illnesses to human beings are covered in health (non-life) insurance in India. But these are covered

in life insurance in many countries. In India accidents and some critical illnesses are covered in life insurance only as

additional cover (riders) along with the main life insurance policy. In India, insurance on life of a person for death by

accident only is treated as non- life insurance.

Principles of Insurance

Utmost Good faith

Insurable Interest

Principle of Indemnity

Principle of Contribution

Principle of Subrogation

Principle of Loss Minimization

Principle of ‘CausaProxima’

Types of Insurance Plans

Endowment Insurance Plan:

Endowment plan is a life insurance policy which provides you with a combination of both i.e. an insurance

cover, as well as savings plan. It is an insurance cum investment plan that offers maturity benefits in addition to

death benefits.

Group Life Insurance Plan:

A Group life insurance plan provides coverage to members of a group that tends to be employees of a

company or members of an organization. Members of the group usually receive insurance at a reduced cost because

the insurer’s risk is spread across a group of policyholders.

Micro Insurance Plan:

Micro Insurance is a mechanism to protect low income people against risk, such as accident, illness, and

natural disasters, in exchange for insurance premium payments tailored to their needs, income and level of risk.

Joint Life Insurance Plan:

Joint Life Insurance plan is a life insurance policy that covers multiple people. Most joint life insurance

policies are permanent policies like whole or universal life insurance that have cash values that earn interest.

Click Here for High Quality Mock Test Series for SBI Clerk Pre 2019 Click Here for High Quality Mock Test Series for SBI PO Pre 2019

Follow us: Telegram , Facebook , Twitter , Instagram 5

Insurance Awareness Capsule for LIC AAO Mains

Single Life Insurance Plan:

A Single Life Insurance Policy covers one person only, and pays out the chosen amount of cover if that

person dies during the length of the policy.

Convertible Insurance Plan:

Policy that allows an insured to cover whole life insurance without having to prove his or her insurability

Pure Endowment Plan:

A Pure Endowment is a type of insurance in which an insurance company agrees to pay the insured a certain

amount of money if the insured is still alive at the end of a specific period of time. There are however no

beneficiaries to a pure endowment means that no benefits will be owed if the insured is not alive by the end of the

endowment period.

Types of Insurance Policies

General Insurance Policy

Life Insurance Policy

General Insurance Policies:

Home Insurance Policies

Renter’s Insurance Policies

Medical or Health Insurance Policies

Pets Insurance Policies

Travel Insurance Policies

Business Insurance Policies

Home Insurance:

As the name suggests, a home insurance policy protect your home and its belongings from the damages

suffered due to manmade or natural disasters. One can obtain cover against the risk of loss to residence and property

therein from fire, theft, earthquake, flood, or other contingencies.

Renter’s Insurance:

Click Here for High Quality Mock Test Series for SBI Clerk Pre 2019 Click Here for High Quality Mock Test Series for SBI PO Pre 2019

Follow us: Telegram , Facebook , Twitter , Instagram 6

Insurance Awareness Capsule for LIC AAO Mains

A Renter’s insurance policy is a group of coverages designed to help protect you and your belongings. A

typical renter’s insurance policy includes liability coverage, protection for your belongings and coverage for

additional expenses, should the home you are renting become temporarily inhabitable.

Health Insurance:

An essential risk mitigating tool, health insurance prevents out-of-pocket expenses while dealing with a

medical emergency. A general health insurance plan is an indemnity plan that pays for hospitalisation expenses up to

the sum insured. While you can avail a standalone health policy, family floater plans provide coverage to all the

members of your family. On the other hand, critical illness plans are fixed-benefit plans which provide a lump sum

upon diagnosis of a critical ailment, taking care of pre- and post-hospitalisation costs. These plans help take care of

astronomical costs associated with the treatment of critical ailments.

Pets Insurance:

Pet Insurance policy is one of the latest insurance schemes introduced in India. This scheme covers

veterinary expenses incurred for the treatment of a pet who has endured an injury or is sick. Some pet insurance

plans also covers death or loss of the pet that is insured.

Travel Insurance:

In case you are travelling abroad, a travel insurance policy protects you against losses suffered due to loss of

baggage, delays in flight and trip cancellation. In some cases, if you are hospitalised while travelling, a travel

insurance may also offer cashless hospitalisation.

Business Insurance:

Business Insurance Policy protects businesses from losses due to events that may occur during the normal

course of business. There are many types of business insurance including coverage for property damage, legal

liability and employee related risks.

Life Insurance Policies:

Term Insurance Policies

Money Back Insurance Policies

Whole Life Policies

Unit Link Investment Policies

Pension Policies

Term Insurance:

It is a form of life cover, it provides coverage for defined period of time, and if the insured expires during the

term of the policy then death benefit is payable to nominee. Term plans are specifically designed to secure your

family needs in case of death or uncertainity. It provides specific amount of coverage for specific period of time.

Money Back Insurance:

In Money back Insurance plan the insured person gets a percentage of sum assured at regular intervals,

instead of getting the lump sum amount at the end of the term. It is an endowment plan with the benefit of liquidity.

Whole Life Insurance:

Click Here for High Quality Mock Test Series for SBI Clerk Pre 2019 Click Here for High Quality Mock Test Series for SBI PO Pre 2019

Follow us: Telegram , Facebook , Twitter , Instagram 7

Insurance Awareness Capsule for LIC AAO Mains

Whole life Insurance is a contract that provides insurance coverage of the contract holder for his or her entire

life. Upon the inevitable death of the contract holder, the insurance payout is made to contract’s beneficiaries. These

policies also include a savings component, which accumulates a cash value. This cash value is one of the key

elements of whole life insurance.

Unit Link Investment Policy:

Unit Linked Insurance Plan is a market linked product that aggregates the very best of investment and

insurance. It is a plan linked to capital market and offers flexibility to invest in equity or debt funds as per risk

appetite.

Pension Policy:

A pension plan is the retirement amount, which an individual gets from their insurance companies on a

regular basis or in the form of a lump sum.

The Insurance Ombudsman

The Central Government under the powers of the Insurance Act, 1938 made Redressal of Public Grievances

Rules, 1998 by a notification published in the official gazette on November 11, 1998. These rules apply to life and

non- life insurance, for all personal lines of insurance, that is, insurances taken in an individual capacity.

The objective of these rules is to resolve all complaints relating to settlement of claim on the part of the

insurance companies in a cost effective, efficient and impartial manner.

The Ombudsman, by the mutual agreement of the insured and the insurer can act as a mediator and

counsellor within the terms of insurance.

At present there are 17 Insurance Ombudsman in different locations.

The decision of the Ombudsman, whether to accept or reject the complaint is final.

A) Complaint to the Ombudsman

Any complaint made to the Ombudsman should be in writing, signed by the insured or his legal heirs,

addressed to the ombudsman within whose jurisdiction, the insurer has a branch / office, supported by documents, if

any, along with an estimate of the nature and extent of loss to the complainant and the relief sought.

Complaints can be made to the Ombudsman if:

The complainant had made a previous written representation to the insurance company and the insurance

company had:

Rejected the Complaint or

The Complainant had not received any reply within one month after receipt of the complaint by

the insurer

The Complainant is not satisfied with the reply given by the insurer.

The complaint is made within one year from the date of rejection by the insurance company.

The complaint is not pending in any Court or Consumer Forum or in arbitration.

Any dispute about premium paid or payable in terms of insurance policy.

Any partial or total repudiation of claims by the Life insurer, General insurer or the Health insurer.

B) Recommendations by the Ombudsman

Click Here for High Quality Mock Test Series for SBI Clerk Pre 2019 Click Here for High Quality Mock Test Series for SBI PO Pre 2019

Follow us: Telegram , Facebook , Twitter , Instagram 8

Insurance Awareness Capsule for LIC AAO Mains

There are certain protocols / duties that the Ombudsman is expected to follow:

Recommendations should be made within one month of the receipt of such complaint.

The copies should be sent to both the complainant and the insurance company.

Recommendations have to be accepted in writing by the complainant within 15 days of receipt of such

recommendation.

A copy of the acceptance letter by the insured should be sent to the insurer and his written confirmation

sought within 15days of his receiving such acceptance letter.

If the dispute is not settled by intermediation, the Ombudsman will pass award to the insured which he

thinks is fair, and is not more than what is necessary to cover the loss of the insured.

C) Awards by the Ombudsman

The awards by the Ombudsman are governed by the following rules:

The award should not be more than 20 lakh (inclusive of ex-gratia payment and other expenses)

The award should be made within a period of 3 months from the date of receipt of such a complaint, and

the insured should acknowledge the receipt of the award in full as a final settlement within one month of

such award.

The insurer shall comply with the award and send a written intimation to the Ombudsman within 15 days

of the receipt of such acceptance letter.

If the insured does not intimate in writing the acceptance of such award, the insurer may not implement the

award.

Schemes Related To Insurance

Atal Pension Yojana:

Pension Between Rs. 1000 and Rs. 5000 a month.

All individuals between 18 and 40, who will have to contribute till they turn 60.

Pradhan Mantri Suraksha Bima Yojana:

Accidental death and disability cover of Rs 2 lakh

Premium is Rs 12 per year

Anybody who has a savings account in the banks that offer this scheme.

Pradhan Mantri Jeevan Jyoti Bima Yojana :

A pure protection term insurance cover which pays Rs 2 lakh to dependents in the event of the policyholder’s

death.

Premium is Rs 330 a year.

Anybody in the age band of 18- 70 years who has a savings account in a bank that offers this scheme.

Pradhan Mantri Fasal Bima Yojana:

The Maximum Premium payable by the farmers is 2% for all kharif food and oilseeds crops, 1.5% for Rabi

food & Oilseeds and 5% for Annual commercial crops.

Providing financial support to farmers suffering crop loss/ damage arising out of unforeseen events.

Click Here for High Quality Mock Test Series for SBI Clerk Pre 2019 Click Here for High Quality Mock Test Series for SBI PO Pre 2019

Follow us: Telegram , Facebook , Twitter , Instagram 9

Insurance Awareness Capsule for LIC AAO Mains

Employees State Insurance Corporation Scheme:

Wage Limit- Rs 21000

All employees of a covered unit, whose monthly incomes does not exceed Rs 21000 per month are eligible.

Rashtriya Swasthya Bima Yojana:

Hospitalisation cover upto Rs 30000 for a family of five on a floater basis

The beneficiary who is Below Poverty Line is eligible.

Insurance Terminologies

Actuary:

A person with expertise in the fields of economics, statistics and mathematics, who helps in risk assessment

and estimation of premiums etc for an insurance business

Actuarial Science:

Actuarial science is the discipline that applies mathematical and statistical methods to assess risk in

insurance, finance and other industries and professions.

Bancassurance:

Bancassurance means selling insurance product through banks. Banks and insurance company come up in a

partnership wherein the bank sells the tied insurance company’s insurance products to its clients.

Third Party Administrator:

It is an organization that processes insurance claims or certain aspects of employee benefit plans for a

separate entity.

Mortality Charge:

It is the amount charged every year by the insurer to provide the life cover to the policy holder on the life of

life insured. It is also called the cost of insurance.

Maturity date:

Maturity date refers to the date on which the principal and interest associated with a debt security must be

repaid to the holder in its entirely.

Agent:

An Agent is a person who represents an insurance firm and sells insurance policies on its behalf.

Broker:

An Insurance Broker is someone who advises people on their insurance needs and negotiates insurance

contracts on their behalf with insurers in return for a fee or commission.

Annuity:

Click Here for High Quality Mock Test Series for SBI Clerk Pre 2019 Click Here for High Quality Mock Test Series for SBI PO Pre 2019

Follow us: Telegram , Facebook , Twitter , Instagram 10

Insurance Awareness Capsule for LIC AAO Mains

An Annuity is a type of policy issued by insurance company designed to accept and grow funds, and upon

annuitization, create a stream of income or payments. The money you pay in can be either a lump sum or a number

of payments.

Insurable Risk:

A Risk that conforms to the norms and specifications of the insurance policy in such a way that the criterion

for insurance is fulfilled

Lapse:

The policy for which all benefits to the policy holder cease and is terminated due to non-payment of premium

amount on the due date or even after the grace period.

Surrender value:

It is the amount the policy holder will get from the life insurance company if he decides to exit the policy

before maturity.

Maturity claim:

The maturity claim amount is the payment received by the policy holder on paying the premium for the

whole premium paying term and on completion of policy term.

Death claim:

A death claim is a request to grant life insurance benefits due under the policy to the designated beneficiaries

after the death of the insured.

Policy Not in Force:

It means that the policy is paid up and active , so long as you are paying the premium for your life insurance

your policy is considered “in force”. If your policy is lapsed and you die , your insurer will not pay out on your

policy.

Gratuity:

Gratuity is a monetary benefit given by the employer to his employee at the time of retirement. It is a defined

benefit plan where no contributions are made by the employee.

Void and Voidable contract:

A contract will be considered Void when it requires one party to perform an act that is impossible or illegal.

A Voidable contract is a void contract and can be enforced. Usually only one party is bound to the contract terms in

a voidable contract.

Paid up value:

Paid –up value is the reduced amount of sum assured paid by the insurance company, in case the policy

holder discontinues payment of premiums. After payment of three years of premium in traditional life insurance

plans, your policy automatically acquires paid up value.

Terminable Bonus:

Click Here for High Quality Mock Test Series for SBI Clerk Pre 2019 Click Here for High Quality Mock Test Series for SBI PO Pre 2019

Follow us: Telegram , Facebook , Twitter , Instagram 11

Insurance Awareness Capsule for LIC AAO Mains

A Bonus paid on a life insurance policy when the holder reaches a certain age or dies.

Actual Cash Value:

A valuation of the damaged property, i.e. its monetary worth at market value immediately preceding the

occurrence of the loss, is called actual cash value of the property. It gives the estimate of the cost of replacement or

repair of the damaged asset.

Encumbrance:

Encumbrance refer to claims to a property that is under the care , custody and control of another individual.

Liquidity:

Liquidity means how quickly you can get your cash on your hands. In simpler terms, liquidity is to get your

money whenever you need it.

Quick Liquidity Ratio:

It is the total amount of a company’s quick assets divided by the sum of its net liabilities and its reinsurance

liabilities.

Current Liquidity:

Current Liquidity is the total amount of cash and unaffiliated holdings compared with net liabilities and

ceded reinsurance balances payable. Current Liquidity is expressed as a percentage, and is used to determine the

amount of an insurance company’s liabilities that can be covered with liquid assets.

Re insurance:

It is a process whereby one entity (the insurer) takes on all or part of the risk covered under a policy issued

by an insurance company in consideration of a premium payment. In other words, it is a form of an insurance cover

for insurance companies.

Lapse Ratio:

It is the number of policies that are not renewed compared to the number of policies that were active at the

beginning of that same period. The lapse ratio represents the percentage of policies that were not renewed, and thus

have lapsed in coverage.

Impaired Insure:

An Impaired Insurer is an insurance company that is potentially unable to fulfill its policy obligations, and

has been placed under rehabilitation or conservation.

Dividend:

Dividend refers to a reward, cash, or otherwise, that a company gives to its shareholders. Dividends can be

issued in various forms, such as cash payment, stocks or any other form.

Co- insurance:

Type of policy under which the insured must bear a fixed sum of loss in case of a claim

Click Here for High Quality Mock Test Series for SBI Clerk Pre 2019 Click Here for High Quality Mock Test Series for SBI PO Pre 2019

Follow us: Telegram , Facebook , Twitter , Instagram 12

Insurance Awareness Capsule for LIC AAO Mains

Casualty insurance:

Casualty insurance broadly encompasses insurance not directly concerned with life insurance, health

insurance, or property insurance. Casualty insurance is mainly liability coverage of an individual or organization for

negligent acts or omissions.

Retention:

It refers to the amount of money an insured person or business becomes responsible for in the event of a

claim.

Coding Company:

Coding is the process of translating a physician’s documentation about a patient’s medical condition and

health services rendered into medical codes that are then plugged into a claim for processing with an insurance

company.

Declaration:

Part of a property or liability insurance policy that states the name and address of policy- holder , property

insured , its location and description, the policy period, premiums , and supplemental information.

Fortuitous Loss:

Loss occurring by accident or chance, not by anyone’s intention. Insurance policies provide coverage against

losses that occur only on a chance basis, where the insured cannot control the loss, thus the insured should not be

able to burn down his or her own home and collect.

Indemnity:

Indemnity means making compensation payments to one party by the other for the loss occurred.

Insured:

Specifically named individual or firm with whom an insurance contract is made, and whose interests are

protected under the policy. In some cases, more than one entity may be designated as insured.

Insurer:

An insurer refers to the company providing you with financial coverage in the case of unexpected, bad events

covered on your renters or homeowners policy.

Loss Reserve:

Loss Reserve is an estimate of an insurer’s liability from future claims. Loss reserves are typically comprised

of liquid assets, and they allow the insurer to cover claims made against policy that it underwrites.

Pooling:

It is a practice wherein a group of small firms join together to secure better insurance rates and coverage

plans by virtue of their increased buying power as a block.

Premium:

Premium is an amount paid periodically to the insurer by the insured for covering his risk.

Click Here for High Quality Mock Test Series for SBI Clerk Pre 2019 Click Here for High Quality Mock Test Series for SBI PO Pre 2019

Follow us: Telegram , Facebook , Twitter , Instagram 13

Insurance Awareness Capsule for LIC AAO Mains

Umbrella Policy: An Umbrella insurance policy is extra liability insurance coverage that goes beyond the limits of

the insured’s home, auto or watercraft insurance.

Tort:

A Tort is a wrongful action or omission that harms a person or business, prompting the injured party to seek

compensation in civil court.

Waiver:

The surrender of a right or privilege. In life insurance, a provision that sets certain conditions, such as

disablement, which allow coverage to remain in force without payment of premiums.

Insured Peril:

Specific source of loss (such as death, fire, liability) to cover which an insurance policy is issued

Blanket Bond:

It refers to insurance coverage carried by banks and brokerage houses that protects against any losses

incurred by unlawful or dishonest activity on the part of employees. It is also called blanket fidelity bond or fidelity

bond.

Rider:

A Rider is an insurance policy provision that adds benefits to or amends the terms of a basic insurance

policy. Riders provide insured parties with options such as additional coverage , or they may even restrict or limit

coverage.

Free lock Period:

The free lock period is a required period of time in which a new life insurance policy owner can terminate the

policy without penalties such as surrender charges.

Mortality Charge:

It is the amount charged every year by the insurer to provide the life insurance cover to the policyholder on

the life of the life insured.

Assured:

A person who has been insured by some insurance company , or underwriter , against losses or perils

mentioned in the policy of insurance.

Base Rate:

The cost of a given unit of insurance for each specific type of auto coverage, such as bodily injury and

property damage liability

Collusion:

An agreement usually secret between two or more persons to defraud or deprive another or others of their

property or rights

Click Here for High Quality Mock Test Series for SBI Clerk Pre 2019 Click Here for High Quality Mock Test Series for SBI PO Pre 2019

Follow us: Telegram , Facebook , Twitter , Instagram 14

Insurance Awareness Capsule for LIC AAO Mains

Deductible:

A deductible is an amount of money subtracted from the value of a loss, which is not covered by insurance.

Grace Period:

It is a defined amount of time after the premium is due in which a policy holder can make a premium

payment without coverage lapsing.

Larceny:

The unlawful taking of a person’s personal property without his consent and with intent to deprive him of

ownership or use. It is a broader term than burglary or robbery, largely synonymous with theft.

ULIP- Unit Linked Insurance Plan

ULIP stands for unit linked insurance plans. ULIP is a combination of insurance and investment. Here

policyholder can pay a premium monthly or annually. A small amount of the premium goes to secure life insurance

and rest of the money is invested just like a mutual fund does. Policyholder goes on investing through the term of the

policy – 5, 10 or 15 years and accumulates the units.

When you make an investment in ULIP, the insurance company invests part of the premium in shares/bonds

etc., and the balance amount is utilized in providing an insurance cover. There are fund managers in the insurance

companies who manage the investments and therefore the investor is spared the hassle of tracking the investments.

ULIPS allow you to switch your portfolio between debt and equity based on your risk appetite as well as

your knowledge of the market’s performance. Benefits like these which offer investors the flexibility of switching is

a huge factor contributing to the popularity of these investment instruments.

Lock in period:

One of the changes brought about by the Insurance Regulatory and Development Authority of India (IRDAI)

in the year 2010 as regards ULIPs, was to increase the lock in a period from 3 years to 5 years. However, insurance

being a long-term product, as an investor you may not really reap the benefits of the policy unless you hold it for the

entire term of the policy which can range from 10 to 15 years.

Types of ULIPs:

ULIPs are categorized based on the following broad parameters:

a. Funds that ULIPs invest in

i. Equity Funds: Where the premium paid is invested in the equity market and thereby is subject to higher

risk.

ii. Balanced funds: Where the premium paid is balanced between the debt and the equity market to minimise

the risk for investors.

iii. Debt Funds: Where the premium is invested in debt instruments which carry a lower risk but in turn also

offer a lower return.

b. End use of Funds

i. Retirement Planning: For those of you who plan to invest for the retirement days while you are still

employed.

ii. Child Education: You can invest with a long-term goal of saving to fund your child’s education or save for

some unforeseen circumstances.

Click Here for High Quality Mock Test Series for SBI Clerk Pre 2019 Click Here for High Quality Mock Test Series for SBI PO Pre 2019

Follow us: Telegram , Facebook , Twitter , Instagram 15

Insurance Awareness Capsule for LIC AAO Mains

iii. Wealth Creation: You can make investments to build a heavy corpus that you can utilize for a future

financial goal.

c. Death benefit to Policy Holders

i. Type I ULIP: This pays higher of the assured sum value or the fund value to the nominee in case of death

of the policyholder.

ii. Type II ULIP: This pays the assured sum value, plus the fund value to the nominee in case of the death of

the policyholder.

Insurance Related Acts

Insurance Act, 1938: The Act applies to the General Insurance Corporation of India and the four Subsidiary

companies subject to exceptions, restrictions and limitations as specified by the Central Government under powers

conferred by Section 35 of the General Insurance Business (Nationalization) Act. The important provisions of the

Act relate, among other things, to registrations, accounts and returns, investments, limitations in expenses of

Management, prohibition of rebates, powers of inves¬tigation, licensing of agents, licensing of surveyors, advance

payment of premium and Tariff Advisory Committee etc.

Marine Insurance Act, 1963: This Act codifies the law relating to Marine Insurance. With a few exceptions this

Act closely follows the UK Marine Insurance Act, 1906.

Motor Vehicles Act, 1939: According to this Act, no motor vehicle can be used in public places unless there is, in

force, in relation to that vehicle, a policy of insurance issued by an authorized insurer.

Motor Vehicles Act, 1988: The Motor Vehicles (Amendment) Act, 1988 has introduced changes which have far-

reaching consequences. The changes also affect Third Party Liability arising out of the use of the Motor Vehicles in

a public place.

Workmen Compensation Act, 1923: The Act provides for the payment of compensation by employers to their

workmen for injury by accident arising out of and in the course of employment.

The Carriage of Goods by Sea Act, 1925: The act specifies the minimum rights, liabilities and immunities of a ship

owner in respect of loss or damage to cargo carried.

The Merchant Shipping Act, 1958: It provides protection to ship owners. The ship owners liability arises up to

certain maximum sums for certain losses, provided the incident giving rise such claims has arisen without the actual

fault or priority of the ship owner, whether the claims relates to loss of life, personal injury, or damage to property

on land or water. It also confers an obligation on the ship owner to send his ship to sea in a sea worthy and safe

condition.

The Inland Steam Vessels Act, 1977: The act is in relation to the insurance of mechanically propelled vessels

against third party risks. It makes the same insurance compulsory for owners or operators of inland vessels to insure

against legal liability for death or bodily injury of third parties or of passengers carried for hire or reward and for

damage to property of third parties. It prescribes the limits of the liability.

Click Here for High Quality Mock Test Series for SBI Clerk Pre 2019 Click Here for High Quality Mock Test Series for SBI PO Pre 2019

Follow us: Telegram , Facebook , Twitter , Instagram 16

Insurance Awareness Capsule for LIC AAO Mains

Public Liability Insurance Act, 1991: It deals with the immediate relief to the persons affected by accidents arising

of hazardous substances. It also deals with that this liability, which is on 'no fault' basis, has to be compulsorily

insured.

Consumer Protection Act, 1986: The objective to pass this act is to provide for better protection of the interests of

consumers and for the settlement of consumers disputes. It is applicable to the buyers of goods and services.

Insurances have been defined as a service, for the purpose of the act. The buyer of insurance is a consumer.

Recent Committees Related To Insurance

Amitabh Chaudhary Analysis the existing framework of IRDA-linked and non- linked

insurance product regulations

JJ Irani committee Company Law Reforms

Khan Working Group Development of Financial Institutions

Committee

Malegam Committee Reforms in the primary market & Repositioning of UTI

Malhotra Committee Broad Framework of insurance sector

Parekh Committee Infrastructure Refinancing

Dilip C Chakraborty Help in implementing the new risk based capital regime and it will also

Committee enhance protection to policy holders

G.V Ramakrishnan Committee On Disinvestment

Suresh Mathur To review Micro Insurance Framework

Suresh Mathur To review norms related to insurance marketing firms

Important Insurance Abbreviations

ARM Associate in Risk Management

BAP Business Automobile Policy

BOP Business Owner Policy

CIC Certified Insurance Counsellor

DSU Delay in Start Up

NCLT National Company Law Tribunal

NAV Net Asset Value

ULIP Unit Linked Insurance Plan

UHIS Universal Health Insurance Scheme

DOD Date Of Death

EAP Employee Assistance Program

ETB Engaged in Trade or Business

FMU Full Medical Underwriting

GAP Guaranteed Auto Protection

GL General Liability

NDA Non- Disclosure Agreement

EEI Electronic Equipment Insurance

GWP Gross Written Premium

HII Health and Integrated Insurance

HLV Human Life Value

Click Here for High Quality Mock Test Series for SBI Clerk Pre 2019 Click Here for High Quality Mock Test Series for SBI PO Pre 2019

Follow us: Telegram , Facebook , Twitter , Instagram 17

Insurance Awareness Capsule for LIC AAO Mains

LOC Line Of Coverage

MDO Monthly Debit Ordinary

FII Foreign Institutional Investor

SEZ Special Economic Zone

MPL Medical Professional Liability

MPP Minimum Premium Plan

ORFS Operational Risk Financing Securities

PAP Personal Auto Policy

RAM Reverse Annuity Mortgage

SPAP Special Personal Auto Policy

IIB Institute of Insurance Brokers

LIC Life Insurance Corporation of India

TDI Temporary Disability Insurance

TERI Targeted Enterprise Risk Insurance

TPA Third Party Administrator

UL Underwriters Laboratories

YRT Yearly Renewable Term

NSDL National Securities Depository Limited

GBIC Green Bay Insurance Centre

YRCT Yearly Renewable Convertible Term

UMV Uninsured Motor Vehicle

UNL Ultimate Net Loss

UM Uninsured Motorist

UMPD Uninsured Motorist Property Damage

ULC Underwriters Laboratories of Canada

UJF Unsatisfied Judgement Fund

UEP Unearned Premium

TIAA Teachers Insurance and Annuity Association

TDI Trade Disruption Insurance

TDB Temporarily Disability Benefits

SEMCI Single Entry Multiple Carrier Interface

SEC Securities and Exchange Commission

RBC Risk Based Capital

RAA Reinsurance Association of America

PMI Private Mortgage Insurance

PML Probable Maximum Loss

PMF Package Modification Factor

PIP Personal Injury Protection

PICA Professional Insurance Communicators of America

OLR Outstanding Loss Reserves

ORM Operational Risk Management

OCA Outstanding Claims Account

NDI National Disaster Insurance Association

NAUA National Auto Underwriters Association

MPP Managed Premium Plan

MCO Managed Care Organisation

LTA Long Term Agreement

LLC Limited Liability Company

LIRB Liability Insurance Research Bureau

Click Here for High Quality Mock Test Series for SBI Clerk Pre 2019 Click Here for High Quality Mock Test Series for SBI PO Pre 2019

Follow us: Telegram , Facebook , Twitter , Instagram 18

Insurance Awareness Capsule for LIC AAO Mains

LAE Loss Adjustment Expense

IRM Improved Risk Mutual

IIHS Insurance Institute for Highway Safety

HPR Highly Protected Risk

CISR Certified Insurance Service Representative

CIC Certified Insurance Counsellor

DOCC Drive Other Car Coverage

EBIDDA Earnings Before Interest, Dividends, Depreciation and

Amortization

EPLI Employment Practices Liability Insurance

FCAS Fellow of the Casuality Actuarial Society

FCRA Fair Credit Reporting Act

FVD Full Value Declared

GVW Gross Vehicle Weight

HLDI Highway Loss Data Institute

FTCAC Fire, Theft, and Combined Additional Coverage

FIRREA Financial Institutions Reform Recovery and Enforcement Act

NRRA National Risk Retention Association

Headquarters and Taglines of Insurance Companies

Insurance Company Headquarters Taglines/Slogans

Apollo Munich Health Insurance Hyderabad We Know Healthcare

Aviva India Life Insurance Gurugram Kal Par Control

Bajaj Alliance Life Insurance

Company Limited Pune Jiyo Befiqar

Birla Sun Life Insurance Company

Limited Mumbai Your Dreams Our Commitment

Cholamandalam MS General

Insurance Chennai Trust, Transparency and Technology

Total Insurance Solutions / Ek

Future Generali Life Insurance Mumbai Shaagun Zindagi Ke Naam

General Insurance Company Mumbai Aapatkale Rakshisyami

HDFC Standard Life Insurance

Company Limited Mumbai Sar Utha Ke Jiyo

ICICI Lombard General Insurance

Company Limited Mumbai Quick Easy Smart

ICICI Prudential Life Insurance

Company Limited Mumbai Zimmedari ka Humsafar

Click Here for High Quality Mock Test Series for SBI Clerk Pre 2019 Click Here for High Quality Mock Test Series for SBI PO Pre 2019

Follow us: Telegram , Facebook , Twitter , Instagram 19

Insurance Awareness Capsule for LIC AAO Mains

IFFCO Tokio General Insurance Gurugram Muskurate Raho

Kotak Mahindra Old Mutual Life

Insurance Limited Mumbai Faidey ka Insurance

Life Insurance Corporation (LIC)

Limited Mumbai Yogaksheman Vahamyaham

Max Bupa Health Insurance New Delhi Your Health First

Max Life Insurance Company

Limited New Delhi Aapke Sachhee Advisor

National Insurance Company Trusted Since 1906, Thoda Simple

Limited Kolkata Socho

Oriental Insurance Company Prithivi, Agni, Jal, Akash, Sabhi

Limited New Delhi Suraksha Hamare Pass.

PNB Metlife India Insurance

Company Ltd. Mumbai Have You Met Life Today?

Sahara India Life Insurance Co.

Limited Lucknow Chiranjivi Bhava

SBI Life Insurance Company

Limited Mumbai With Us, You Are Sure

Shriram Life Insurance Company

Ltd. Hyderabad Your Partner for Prosperity

Tata AIA Life Insurance Company

Limited Mumbai You Click, We Cover

The New India Assurance India’s Premier General Insurance

Corporation Limited Mumbai Company

United India Insurance Company

Limited Chennai Rest Assured With Us

Click Here for High Quality Mock Test Series for SBI Clerk Pre 2019 Click Here for High Quality Mock Test Series for SBI PO Pre 2019

Follow us: Telegram , Facebook , Twitter , Instagram 20

You might also like

- Final IC 38 - IA - Common - EnglishDocument104 pagesFinal IC 38 - IA - Common - Englishsayali kthalkarNo ratings yet

- Pdfcoffee Insurance Law NotesDocument94 pagesPdfcoffee Insurance Law NotesAnjali DoraNo ratings yet

- Principles & Types of InsuranceDocument6 pagesPrinciples & Types of InsuranceSudhansu Shekhar pandaNo ratings yet

- Sale of Goods Unit.2Document16 pagesSale of Goods Unit.2Sergio RamosNo ratings yet

- Tripple E of DemonetisationDocument19 pagesTripple E of DemonetisationAmeen Uddin Ansari100% (1)

- International Humanitarian Law in The Indian Civilian and Military Justice SystemsDocument16 pagesInternational Humanitarian Law in The Indian Civilian and Military Justice SystemsEswar StarkNo ratings yet

- Airport Components GuideDocument5 pagesAirport Components GuideShigeaki TomoikoNo ratings yet

- Summary Notes CPL Module 2Document8 pagesSummary Notes CPL Module 2Kashish Chhabra100% (1)

- Chapter 1 CA Inter Co Act PDFDocument40 pagesChapter 1 CA Inter Co Act PDFNOOB GAMER RELOADEDNo ratings yet

- PUMBA - DSE A - 506 - LDIM - 1.1 Nature and Scope of International Trade Law - PPTDocument34 pagesPUMBA - DSE A - 506 - LDIM - 1.1 Nature and Scope of International Trade Law - PPTTô Mì HakkaNo ratings yet

- 1029 RBI As Watchdog of Indian Economic ScenerioDocument36 pages1029 RBI As Watchdog of Indian Economic ScenerioAnkur GuptaNo ratings yet

- Tactv: Declaration of Distributor Retail Price (Alacarte Channels)Document6 pagesTactv: Declaration of Distributor Retail Price (Alacarte Channels)Kathiravan RNo ratings yet

- Moot Court Brochure LLSDocument41 pagesMoot Court Brochure LLSDIVYANSH SAHU BA LLB (HONOURS)No ratings yet

- Demonetisation JudgmentDocument382 pagesDemonetisation JudgmentShatabdi ChowdhuryNo ratings yet

- Difference Between Partnership and A CompanyDocument9 pagesDifference Between Partnership and A CompanyFazal MuezNo ratings yet

- Trends - Company Law - Term III PDFDocument2 pagesTrends - Company Law - Term III PDFqubrex1No ratings yet

- Roll No-29 Plaintiff MemoDocument23 pagesRoll No-29 Plaintiff MemoatipriyaNo ratings yet

- Module Ii Pil PDFDocument38 pagesModule Ii Pil PDFsweetyNo ratings yet

- Taxguru - In-Vodafone Case AnalysisDocument22 pagesTaxguru - In-Vodafone Case AnalysisGokul RaviNo ratings yet

- Bakeshbhai PDFDocument3 pagesBakeshbhai PDFpij panchayatNo ratings yet

- Unit III Contract of Pledge and PawnDocument16 pagesUnit III Contract of Pledge and PawnHemanta PahariNo ratings yet

- Refugees and Asylum DocumentDocument69 pagesRefugees and Asylum DocumentRAKESH KUMAR BAROINo ratings yet

- OF Insolvency Law Committee On Cross Border Insolvency: OCTOBER, 2018Document70 pagesOF Insolvency Law Committee On Cross Border Insolvency: OCTOBER, 2018Shudhanshu Pratap SinghNo ratings yet

- SFIO Powers and Role in Investigating Corporate FraudDocument12 pagesSFIO Powers and Role in Investigating Corporate FraudAKHAND PRATAP SINGHNo ratings yet

- Court's Inherent Power to Grant InjunctionDocument24 pagesCourt's Inherent Power to Grant InjunctionSaddhviNo ratings yet

- Beneficiaries' Rights to Insurance ProceedsDocument15 pagesBeneficiaries' Rights to Insurance ProceedsVishnu Ameya SunkaraNo ratings yet

- Sem 5 Property Law Sem Ques BankDocument21 pagesSem 5 Property Law Sem Ques BankAditya MenonNo ratings yet

- 19bbl110 RESEARCH PROPOSALDocument7 pages19bbl110 RESEARCH PROPOSALBhumihar Shubham TejasNo ratings yet

- Investment Law MaterialDocument11 pagesInvestment Law MaterialYash VermaNo ratings yet

- Recent trends in India's banking systemDocument5 pagesRecent trends in India's banking systemvishnu priya v 149No ratings yet

- DT Mock Test Paper Solution 1-2Document19 pagesDT Mock Test Paper Solution 1-2Aejaz MohamedNo ratings yet

- 08 Subsidiary RulesDocument52 pages08 Subsidiary RulesMansi BansodNo ratings yet

- On SharesDocument26 pagesOn SharesParth Dahuja100% (1)

- UPES Defendant Ekdum FinalDocument29 pagesUPES Defendant Ekdum FinalSoumya swarup MohantyNo ratings yet

- 001B Admiralty Law Sg2021Document44 pages001B Admiralty Law Sg2021Sam Ram100% (1)

- ORIGIN AND GROWTH OF ENVIRONMENTAL LAW IN INDIA by Furqan AhmadDocument31 pagesORIGIN AND GROWTH OF ENVIRONMENTAL LAW IN INDIA by Furqan AhmadTharun pranavNo ratings yet

- Unit - IV Banking and Insurance Law Study NotesDocument4 pagesUnit - IV Banking and Insurance Law Study NotesSekar M KPRCAS-CommerceNo ratings yet

- Cr.P.C. Sample QuestionsDocument5 pagesCr.P.C. Sample QuestionsvaishnaviNo ratings yet

- GK Krishnan Vs State of TamilnaduDocument6 pagesGK Krishnan Vs State of TamilnaduSidhotam Kumar SinghNo ratings yet

- KES' Shri. Jayantilal H. Patel Law College, Mumbai Versova Beach Clean-Up Drive-Land LawsDocument10 pagesKES' Shri. Jayantilal H. Patel Law College, Mumbai Versova Beach Clean-Up Drive-Land LawsPushkar MahajanNo ratings yet

- 375 of IPC, Consent and Will in EmphasisDocument39 pages375 of IPC, Consent and Will in Emphasis955 Manpreet SinghNo ratings yet

- Drafting of PleadingsDocument83 pagesDrafting of PleadingsSunil Kumar Jha100% (1)

- UntitledDocument107 pagesUntitledRajitha100% (1)

- Bangladesh Labour Rights ResearchDocument29 pagesBangladesh Labour Rights ResearchMd. Hasan Ali JoyNo ratings yet

- IRDA IC-38 (1-5) RefresherDocument20 pagesIRDA IC-38 (1-5) RefresherTechi Kakow100% (1)

- Dicas Pneu BFDocument20 pagesDicas Pneu BFluizNo ratings yet

- SNBP Memorial FormatDocument22 pagesSNBP Memorial FormatzeeshanNo ratings yet

- Adultery, Jopesh Shine Vs UOI.Document18 pagesAdultery, Jopesh Shine Vs UOI.RIMA NAIMNo ratings yet

- Cyber Law Scope and Jurisdictional IssuesDocument21 pagesCyber Law Scope and Jurisdictional IssuesWorkaholicNo ratings yet

- Profile of FAOADocument5 pagesProfile of FAOAqubrex1No ratings yet

- 19-Global Energy v. Adani, SC, 2005Document4 pages19-Global Energy v. Adani, SC, 2005AbhishekNo ratings yet

- Relationship Between State and Its ServantsDocument5 pagesRelationship Between State and Its ServantsJaneNo ratings yet

- Banking&Insurance ProjectDocument21 pagesBanking&Insurance ProjectUrviNo ratings yet

- Special Contracts NotesDocument61 pagesSpecial Contracts NotesSHRAAY BHUSHANNo ratings yet

- Transportation Law Project (Raj Vardhan Agarwal) BBA - LLB (H) 8th SemesterDocument14 pagesTransportation Law Project (Raj Vardhan Agarwal) BBA - LLB (H) 8th Semesterraj vardhan agarwalNo ratings yet

- What is Marine InsuranceDocument9 pagesWhat is Marine InsuranceHaven GarciaNo ratings yet

- Inventive Step For Grnat of PatentDocument7 pagesInventive Step For Grnat of Patentsoki syrti100% (1)

- Blog - Ipleaders.in-Motor Vehicle Act 1988Document16 pagesBlog - Ipleaders.in-Motor Vehicle Act 1988Tushar kalsotraNo ratings yet

- Before The Hon'ble Real Estate Regulatory Authority at Cambala at Satya PradeshDocument12 pagesBefore The Hon'ble Real Estate Regulatory Authority at Cambala at Satya Pradeshsanchit singlaNo ratings yet

- Insurance Awareness PDFDocument20 pagesInsurance Awareness PDFsrutiNo ratings yet

- Notice: Combined Higher Secondary (10+2) Level Examination, 2021Document65 pagesNotice: Combined Higher Secondary (10+2) Level Examination, 2021RaviNo ratings yet

- Temp 19 G 64 VkywkkrbdDocument1 pageTemp 19 G 64 VkywkkrbddeepakonaNo ratings yet

- Q1 - Q5 Carry One Mark Each.: GA - General AptitudeDocument16 pagesQ1 - Q5 Carry One Mark Each.: GA - General AptitudedeepakonaNo ratings yet

- AptitudeDocument5 pagesAptitudeanmolNo ratings yet

- 11 - EH-1 Civil QP FinalDocument4 pages11 - EH-1 Civil QP FinaldeepakonaNo ratings yet

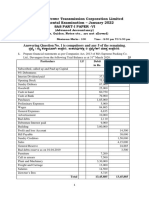

- (Advanced Accountancy) (Books, Guides, Notes Etc., Are Not Allowed)Document8 pages(Advanced Accountancy) (Books, Guides, Notes Etc., Are Not Allowed)deepakonaNo ratings yet

- SAS Part 2 Paper-2 January-2022Document8 pagesSAS Part 2 Paper-2 January-2022deepakonaNo ratings yet

- English Language Practice Set For RBI Assistant MainsDocument15 pagesEnglish Language Practice Set For RBI Assistant MainsdeepakonaNo ratings yet

- GradeupDocument35 pagesGradeupVemu SaiNo ratings yet

- Mark Wolfinger - Rookie's Guide To Options PDFDocument240 pagesMark Wolfinger - Rookie's Guide To Options PDFSusan Fisher100% (1)

- MI - 1 (45) So Pyay Aung Win (Life Insurance)Document3 pagesMI - 1 (45) So Pyay Aung Win (Life Insurance)Dr. SNo ratings yet

- Polita RO07R7YD118720371Document4 pagesPolita RO07R7YD118720371Constantin FilibiuNo ratings yet

- Surya Life InsuranceDocument57 pagesSurya Life InsuranceManastosh KarkiNo ratings yet

- STAR HEALTH - Senior-Citizen-Red-Carpet-BrochureDocument7 pagesSTAR HEALTH - Senior-Citizen-Red-Carpet-BrochureTam AwNo ratings yet

- Chat GPT Banking SystemDocument7 pagesChat GPT Banking SystemSebas GarciaNo ratings yet

- Temporary Auto Identification CardDocument1 pageTemporary Auto Identification Cardcraig litNo ratings yet

- ICICIDocument4 pagesICICIFernandes RudolfNo ratings yet

- Ic38 Mock Test EnglishDocument3 pagesIc38 Mock Test Englishmanish0% (1)

- Insurance Premium and Policy Issuance CasesDocument2 pagesInsurance Premium and Policy Issuance CasesFrancis Louie Allera HumawidNo ratings yet

- Unit 3 - Calculation of PremiumDocument21 pagesUnit 3 - Calculation of PremiumRahul Kumar JainNo ratings yet

- Writing A Good Actuarial ReportDocument65 pagesWriting A Good Actuarial ReportJamie RossNo ratings yet

- Dole Ro8 Checks Issued As of October 28, 2019Document134 pagesDole Ro8 Checks Issued As of October 28, 2019Buah Merah Mix OrmocNo ratings yet

- Insurance Commission Traditional Life Mock Exam 1Document8 pagesInsurance Commission Traditional Life Mock Exam 1Charish DanaoNo ratings yet

- User's Guide to 2005 ISDA Commodity DefinitionsDocument2 pagesUser's Guide to 2005 ISDA Commodity DefinitionsKedar DeshpandeNo ratings yet

- A Study On Perception of Investors Investing in Life InsuranceDocument109 pagesA Study On Perception of Investors Investing in Life InsuranceSujal BedekarNo ratings yet

- Jum'at 28 Juni 2019: Data ASM Sandy F Putra Area PaluDocument11 pagesJum'at 28 Juni 2019: Data ASM Sandy F Putra Area PaluRoy AldNo ratings yet

- InsuranceDocument2 pagesInsuranceАртем ПичугинNo ratings yet

- Week 3 - Lecture NoteDocument47 pagesWeek 3 - Lecture NoteChip choiNo ratings yet

- Excel Function For PracticeDocument17 pagesExcel Function For PracticeMahtab SiddiquiNo ratings yet

- Equity Derivatives Exam Series QuestionsDocument6 pagesEquity Derivatives Exam Series QuestionsManish TandaleNo ratings yet

- 9 Elements of Marine Insurance ContractDocument2 pages9 Elements of Marine Insurance ContractFaheemNo ratings yet

- Mayuresh Patil 9162 Marketing Project ReportDocument78 pagesMayuresh Patil 9162 Marketing Project ReportShreyash ShahNo ratings yet

- Internationalisation - Risk or OpportunityDocument3 pagesInternationalisation - Risk or OpportunityFlorencia SanseauNo ratings yet

- Renewal of Your Optima Restore Floater Two Year Insurance PolicyDocument4 pagesRenewal of Your Optima Restore Floater Two Year Insurance PolicyAngel TalatiNo ratings yet

- Insurance Sany ExcavatorDocument1 pageInsurance Sany ExcavatorIqbal HossainNo ratings yet

- Nothing Seems Impossible: Fixed Entry Age Fixed Entry Age Fixed Entry AgeDocument2 pagesNothing Seems Impossible: Fixed Entry Age Fixed Entry Age Fixed Entry AgeSJ WealthNo ratings yet

- Certified Risk Management Professional (CRMP)Document2 pagesCertified Risk Management Professional (CRMP)taufiqNo ratings yet

- AxiTrader Product Schedule Details Financial ProductsDocument8 pagesAxiTrader Product Schedule Details Financial ProductsSean TanNo ratings yet

- PREMIUM COLLECTION OF PREMIER INSURANCE Front Page DipakDocument1 pagePREMIUM COLLECTION OF PREMIER INSURANCE Front Page Dipakram binod yadavNo ratings yet