Professional Documents

Culture Documents

Automotive Division Book

Uploaded by

The Overlord GirlCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Automotive Division Book

Uploaded by

The Overlord GirlCopyright:

Available Formats

Automotive Division (ATV) Call

08 October 2019

Peter Schiefer, Division President Automotive

Agenda

1 Automotive division at a glance

2 Contribution by Cypress

3 Electro-mobility

4 Automated Driving

5 Macro-economic situation and short/mid-term outlook

2019-10-08 Copyright © Infineon Technologies AG 2019. All rights reserved. 2

Long-term semi content drivers intact; improved

market position in all addressed product categories

Automotive semiconductor market

Strong drivers for semi content per car 2018 total market size: $37.7bn

electro-mobility automated driving comfort, premium › #1 in power:

market share of 26.2% (+0.2 %-pt)

› #2 in sensors:

market share of 13.4% (+0.5 %-pt)

› #4 in µC:

market share of 9.1% (+0.6 %-pt)

› driven by › near-term › comfort features total market

legislation L1/L2/L2+ trickling down

› all kinds of xEV, › long-term from high- to

NXP 12.0%

including 48 V L3/L4/L5 mid-range

› today China; › need for › user experience Infineon 11.2% +0.4%-pt

tomorrow Europe dependable › lighting Renesas 8.9%

functionalities* › replacement of

(e.g. sensors, hydraulic and TI 8.2%

power supplies, electro-

computing power) mechanical units STM 7.6%

* For more information on “dependable functionalities” please see slide 18. Source: Strategy Analytics, "Automotive Semiconductor Vendor

Market Shares", April 2019

2019-10-08 Copyright © Infineon Technologies AG 2019. All rights reserved. 3

Infineon is outgrowing the automotive semiconductor

market by ~3%-points

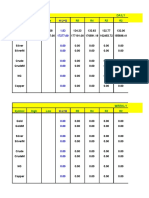

Automotive semi market development* Automotive power semi market development*

[US$

60

bn] 11.2% [US$ bn] 26.2%

25.6%

10.7% 24.8%

10.5%

24%

45

10% 10.2

37.7 10

9.0% 21.4%

21.0%

8.7% 30.2 7.9

7.4

30 27.5

24.0 6.2

21.0 5.0 CAGR(10-18): +9.3% 19%

CAGR(10-18): +7.6%

15

CAGR(10-18): +12.1%

CAGR(10-18): +11.0% 2.7

1.8 2.0

4.2 1.1 1.3

1.8 2.2 2.9 3.2

0 6% 0 14%

2010 2012 2014 2016 2018 2010 2012 2014 2016 2018

Infineon automotive revenue Infineon automotive power revenue

total automotive semiconductor market total automotive power semiconductor market

market share market share

* Infineon automotive revenue as reported to Strategy Analytics incl. revenue from ATV, IPC and PMM. Adjusted to calendar year.

Source: Strategy Analytics, "Automotive Semiconductor Vendor 2018 Market Share", April 2019.

2019-10-08 Copyright © Infineon Technologies AG 2019. All rights reserved. 4

Contribution by Cypress

2019-10-08 Copyright © Infineon Technologies AG 2019. All rights reserved. 5

Infineon and Cypress portfolios complement each

other covering entire range of auto applications

Full coverage of all application fields within automotive Benefits of combination

Body Cluster/ Chassis Powertrain ADAS

Infotainment Creating the #1

auto semi vendor

Connectivity

Complementary MCU

NOR Flash NOR Flash portfolio results in:

› broader customer access

MCU MCU

› cross-selling opportunities

Power Power

Portfolio expansion

Sensors Sensors Sensors through:

› connectivity

Application examples (WiFi, Bluetooth, USB-C)

› HVAC › hybrid cluster › braking › engine › radar › external NOR flash for

› door control › WiFi › steering › transmission › sensor fusion processors in cars

› touch control › domain › inverter

› USB-C

Legend

Infineon Cypress

Low compute power / application complexity High

2019-10-08 Copyright © Infineon Technologies AG 2019. All rights reserved. 6

With the acquisition of Cypress Infineon increases

scale and strengthens its market position

Semiconductor suppliers Automotive semi suppliers Automotive MCU suppliers

2018 market size: $485bn1) 2018 market size: $37.7bn2) 2018 market size: $8.7bn2)

Samsung $74.6bn + 13.4%* #1 NXP

Intel NXP 12.0% Renesas

SK Hynix

11.2% #2

+ 15.1%* #3

Micron

Renesas 8.9%

Broadcom Texas Instr.

Qualcomm Texas Instr.

9.1% #4

Texas Instr. STM

Microchip

+ $11.6bn* #8 Bosch

Toshiba 6.0% #6

ON Semi

nVidia STM

STM Rohm

Toshiba

$9.1bn #11 ADI

NXP nVidia

Toshiba

Western Digital ADI

Microchip

MediaTek

Micron Qualcomm

$2.5bn #32 2.2% #13 Melexis

* pro forma figure; rounded.

1) Based on content supplied by IHS Markit, Technology Group, "Annual 2001-2018 Semiconductor Market Share Competitive Landscaping Tool – 2019”, August 2019.

2) Strategy Analytics, “Automotive Semiconductor Vendor 2018 Market Shares", April 2019.

2019-10-08 Copyright © Infineon Technologies AG 2019. All rights reserved. 7

Electro-mobility

2019-10-08 Copyright © Infineon Technologies AG 2019. All rights reserved. 8

xEV growth driven by EU emission regulation;

CO2 reduction of 37.5% by 2030 vs 2021

CO2 emission development and regulations for main regions

200

Japan 2020: US 2020:

125 g CO2/km

CO2 emission values [g/km], normalized to NEDC

122 g CO2/km*

150

No CO2 reduction since 2016!

Necessity for significant improvements

increases continuously!

100

China 2020 : -15%

EU 2021:

117 g CO2/km

95 g CO2/km -37.5%

EU 2025:

81 g CO2/km

50

actual EU 2030:

enacted

CO2 reduction of 37.5% will drive BEV/PHEV 59 g CO2/km

proposed share towards ~40% of all cars sold in EU in 2030!

0

2010 2015 2020 2021 2025 2030

US Japan China EU

* Japan has already met its 2020 statutory target as of 2013

Source: ICCT (www.theicct.org), August 2019

2019-10-08 Copyright © Infineon Technologies AG 2019. All rights reserved. 9

The incremental demand of power semiconductors is

a significant opportunity

2019 average xEV semiconductor content by degree of electrification

48 V / MHEV FHEV / PHEV BEV

$29 $785 $37 $775

$305 $350

$90 $0 $531

$19 $19

$62 $5 $62 $14

$14 $19

$355 $355 $355 $0

xEV Power**

Non PT*

xEV others**

total

$1 $2 $3 $4 $5 $6 $7

xEV µC

xEV Sensors

semi BoM

ICE PT

1 2 3 4 5 6 7 1 2 3 4 5 6 7

xEV Power**

total

xEV Power**

Non PT*

xEV others**

Non PT*

xEV others**

total

xEV µC

xEV µC

xEV Sensors

xEV Sensors

semi BoM

semi BoM

ICE PT

ICE PT

2018 0.3m vehicles 2.9m vehicles 1.7m vehicles

2020 2.3m vehicles 4.8m vehicles 3.2m vehicles

2025 20.6m vehicles 10.5m vehicles 10.2m vehicles

2030 30.0m vehicles 14.1m vehicles 15.8m vehicles

Source: Infineon; IHS Markit, Automotive Group, “Alternative propulsion forecast”, September 2019; Strategy Analytics, "Automotive Semiconductor Content", August 2019.

* Non PT (non powertrain): average semiconductor content in Body, Chassis, Safety & Infotainment application segments.

** "power" includes linear and ASIC; "others" include opto, small signal discrete, memory

2019-10-08 Copyright © Infineon Technologies AG 2019. All rights reserved. 10

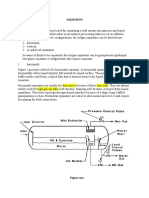

48 V mild hybrid propulsion system offers many

benefits beyond CO2 savings for gasoline and diesel

In addition to CO2 reduction, 48 V improves driving performance,

supports lower emission level and enables better comfort

48 V 12 V

Battery

Management

Motor

E-Catalyst Generator

Heater

48 V 48 V

48 V optional auxiliaries 48 V core architecture

› enables better comfort (heating, suspension) › reduces CO2 between 5% and 15%

› supports emission reduction with electrically › improves driving performance

heated catalyst (e.g. EURO7)

› reduces emission with torque boost (e.g. EURO7)

› reduces CO2 with load electrification

2019-10-08 Copyright © Infineon Technologies AG 2019. All rights reserved. 11

Infineon offers a large product portfolio addressing all

key components for the xEV segment

Infineon product portfolio covers high-voltage as well as 48 V solutions

high-

voltage

Bare die discrete HybridPACK™ EiceDRIVER™ AURIX™ OPTIREG™

IGBTs

48 V

Chip

Bare die OptiMOS™ Driver IC AURIX™ OPTIREG™

Embedding

Power + Driver + µC + Power Supply

2019-10-08 Copyright © Infineon Technologies AG 2019. All rights reserved. 12

Groundbreaking chip embedding technology boosts

system performance of 48 V mild hybrid systems

Technological advantages of chip embedding

› Performance improvement of 48 V systems; up to

60% compared to a traditionally designed system

› Reduction of system complexity and system cost

› Increase of power density, energy efficiency and

reliability

innovative chip embedding technology:

traditionally: MOSFET soldered on the PCB; then wire bonded Infineon OptiMOS™5 integrated within the PCB

Project Features

› Infineon’s latest 80 V MOSFET technology is applied: OptiMOS™5

› Infineon’s power inlay combines an innovative die attach process with a

specially designed Cu substrate for highest system performance

› Infineon’s power inlay comes fully tested, ready for chip embedding

› Embedded power PCB technology provided by Schweizer: Smart p² Pack®

› New chip embedding technology will be used first in a 48 V starter

generator application by Continental in 2021

2019-10-08 Copyright © Infineon Technologies AG 2019. All rights reserved. 13

Infineon is new partner in Volkswagen’s strategic

supplier network FAST

› FAST (Future Automotive Supply Tracks) was established in 2015

› Today, FAST includes 66 partners

› FAST intensifies cooperation of Volkswagen with its most important

suppliers and partners in central areas of innovation

› Appreciation of Infineon’s competence in electro-mobility and its

contribution to the Volkswagen modular electric drive platform (MEB),

(e.g. power semiconductors, modules)

› The Volkswagen Group has announced that it

intends to launch almost 70 new e-models and

build 22m e-vehicles over the next 10 years

› Most of them will be based on MEB, including

the new ID. family from the Volkswagen brand,

as well as models from Audi, Seat and Škoda

Dr. Helmut Gassel (left), CMO Infineon, and Michael Bäcker, head of

procurement Connectivity, eMobility and Driver Assistance, at the FAST

Nomination in Wolfsburg, Germany, on 10 May 2019

2019-10-08 Copyright © Infineon Technologies AG 2019. All rights reserved. 14

Hyundai has chosen Infineon’s CoolSiC™ products

for their next generation EVs

General CoolSiC™ value contribution to customers

Higher mileage with same battery capacity

› Trench-based SiC devices increase power efficiency

compared to alternative technologies

Easy scalability from IGBT to SiC-based inverters

› HybridPACK™ CoolSiC™ power modules and

EiceDRIVER™ high-voltage drivers allow upgrade from

IGBT to SiC in the same footprint

Additional value for Infineon's customers

Unique automotive quality and reliability levels

High-volume production track record of dedicated electro-

mobility products

2019-10-08 Copyright © Infineon Technologies AG 2019. All rights reserved. 15

Automated Driving

2019-10-08 Copyright © Infineon Technologies AG 2019. All rights reserved. 16

Increased sensor requirements drive the content in

the next five years and beyond

More sensors required for any next level of automation

NCAP 5 Star, AD L2 AD L2+/L3 AD L4/L5

Automatic emergency brake/ forward collision warning

Application* Parking assist Valet parking

Lane keep assist Highway assist Highway and urban chauffeur

Corner MRR/LRR MRR/LRR Imaging

Radar

≥3 ≥6 ≥ 10

# of modules**

New: Corner starting 2020 Corner Surround

Camera

≥1 ≥4 ≥8

# of modules**

Lidar

0 ≤1 ≥1

# of modules**

› Ultrasonic › Ultrasonic › Ultrasonic

Others › Interior camera › Interior camera

› V2X

* Source: VDA (German Association of the Automotive Industry); Society of Automotive Engineers

** market assumption

2019-10-08 Copyright © Infineon Technologies AG 2019. All rights reserved. 17

Vision Zero – AD requires failure-tolerant availability of the

system in the environment, “better than a human”

A failure-tolerant system with high availability relies on dependable key functionalities

Sense Interpret & decide Act

Driver

Dependable Sensors Dependable Computing Dep. Actuators

Camera Braking

inside

Lidar

Secure communication specialized driving

and authentication

sensor domain Transmission

Automated car

Radar processor controller

Steering

Camera

Engine

sensor

Ultrasonic Microphone fusion central

Matrix LED

decision gateway

making

Dependable Power (power supply and power distribution)

2019-10-08 Copyright © Infineon Technologies AG 2019. All rights reserved. 18

ADAS/AD semi growth driven by radar and camera

sensor modules over the next 5 years

Average semiconductor content per car by level of automation at the given years

NCAP 5 Star/AD L2 AD L2+ AD L3 AD L4/L5

L2 vehicles in 2020: ~6m L2+ in 2022: ~1m L3 in 2025: ~1.5m L4/L5 vehicles in 2030: ~4m

L2+ in 2025: ~2.5m $970

$55

$300

$630 $190

$190 $530

High High

$190 $0 Low $230

High

Low

$250

$30 $160 $180 $195

Low

$90 $0 High

$40 Low

L4/L5 (2030)

L2+ (2025)

total BoM

fusion

camera

lidar

sensor

radar

modules

modules

modules

total BoM

total BoM

total BoM

fusion

fusion

camera

camera

sensor

lidar

sensor

lidar

radar

radar

actuators

modules

modules

modules

modules

modules

modules

L2 (2020)

L3 (2025)

Source: Strategy Analytics; Infineon.

BoM contains all type of semiconductors (e.g. radar modules include µC); sensor fusion does not include memory.

BoM are projected figures for the respective time frame. Sense Compute Actuate

2019-10-08 Copyright © Infineon Technologies AG 2019. All rights reserved. 19

Outstanding characteristics make AURIX™ first-

choice microcontroller for ADAS/AD platforms

› AURIX™ family provides leading technology for sensor fusion either as main

fusion computer for L1/L2 or host controller for higher autonomy levels.

› Major OEMs from Europe, Japan, Korea, China, and North America will ramp

production in 2021.

Level 1 Level 2 ≥ Level 2+

Radar Radar Radar

Camera

Camera Camera Fusion

Processor

Ultra-sonic

AURIX™ AURIX™ AURIX™ AURIX™ GPU/CPU

Ultra-sonic Ultra-sonic Lidar

Optional

AURIX™ functionalities AURIX™ functionalities AURIX™ functionalities

› fusion and decision-making › parallel usage to enable › host controller for the data fusion

› safety management scalability with compatibility processor

› security management › safety management › enables ISO 26262 ASIL-D

› security management › emergency response in case of a

› vehicle gateway

GPU/CPU fail

2019-10-08 Copyright © Infineon Technologies AG 2019. All rights reserved. 20

Macro-economic situation and

short-term/mid-term outlook

Light vehicle production forecast to drop in 2019 and

2020; recovery in 2021+ driven by China and RoW

Light vehicle production (y-y growth)

North America (17.0m units in 2018) Europe (22.0m units in 2018) Greater China (26.9m units in 2018)

4.9%

1.1% 1.1% 0.6%

2018 2019 2020 2020-2024 2018 2019 2020 2020-2024 2018 2019 2020 2020-2024

-0.6% -1.8% -2.8%

-1.0% -3.5% -0.4%

-4.1%

-8.8%

Japan / Korea (13.2m units in 2018) RoW (15.2m units in 2018) World (94.2m units in 2018)

6.4%

4.2%

2.2% 2.9%

0.0%

2018 2019 2020 2020-2024 2018 2019 2020 2020-2024 2018 2019 2020 2020-2024

-0.3% -2.9% -0.2% -0.5%

-1.0% -5.1%

-8.9%

Source: IHS Markit, Automotive Group, “Light Vehicle Production Forecast by Region and OEM Brand”, September 2019

2019-10-08 Copyright © Infineon Technologies AG 2019. All rights reserved. 22

Comfort and design will further drive innovation and

growth in ‘classical’ segments

Examples of growing applications in classical segments (market CAGR(19-24))

memory

seat

5.3%

seat

heating

6.5%

› Comfort features drive growth within the

body & infotainment segments

lift gate

7.7%

LED

11.3%

AFS

35.4%

› Lighting is becoming a key element of OEM

brand recognition and design signature

Source: Strategy Analytics, August 2019

2019-10-08 Copyright © Infineon Technologies AG 2019. All rights reserved. 23

Infineon and Nichia to build high-definition micro-LED

matrix solution for adaptive driving beams

Nichia and Infineon develop a Examples of applications

high-definition (HD) light engine

› 16k µLEDs for front light › new driver IC control and project markings on the road

applications diagnose all 16k µLEDs

› resolution ~180x as high as individually

that of comparable solutions › significantly higher energy

› HD light to the entire field efficiency

of view

glare-free high beam

Nichia

µLED

Nichia µ-PLS*

Infineon

control IC

Nichia µ-PLS*

* micro pixelated light source

2019-10-08 Copyright © Infineon Technologies AG 2019. All rights reserved. 24

ATV's long-term growth is driven by xEV, ADAS/AD,

and conceptual changes of the car architecture

Composition of incremental € revenue over five year xEV

planning horizon by application › short-term, growth rate in China

more volatile

› EU target (95 down to 59 g/km CO2)

contributes additional growth

momentum throughout next decade

to meet ADAS/AD

all targets

world- › mid-term, semi content is driven by

wide NCAP and ADAS L1/L2/L2+

› long-term, AD L3/L4/L5 will create

additional structural growth

EU 95 g

Others

› comfort features

› user experience

› lighting

xEV ADAS/AD Others Incremental › replacement of hydraulic and

revenue electro-mechanical units

2019-10-08 Copyright © Infineon Technologies AG 2019. All rights reserved. 25

Dashboard

ATV FY18 revenue by application ATV FY18 revenue by region

Americas

Powertrain

Comfort,

(excl. xEV)

Premium

Japan EMEA

xEV

China

ADAS

Safety APAC

(excl. ADAS) excl.

China

2019-10-08 Copyright © Infineon Technologies AG 2019. All rights reserved. 27

Glossary

AC-DC alternating current - direct current µC microcontroller

AD automated driving MHEV,

mild-hybrid electric vehicle; vehicles using start-stop

ADAS advanced driver assistance system mild-

systems, recuperation, DC-DC conversion, e-motor

hybrid

AEB automatic emergency braking

micro-

vehicles using start-stop systems and limited recuperation

AI artificial intelligence hybrid

BEV battery electric vehicle mild- vehicles using start-stop systems, recuperation, DC-DC

hybrid conversion, e-motor

BoM bill of material

MOSFET metal-oxide silicon field-effect transistor

CPU central processing unit

OBC on-board charger

DC direct current

DC-DC direct current - direct current OEM original equipment manufacturer

ECU electronic control unit PHEV plug-in hybrid electric vehicle

EPS electric power steering PT powertrain

EV electric vehicle RF radio frequency

FHEV full-hybrid electric vehicle RoW rest of world

GaN gallium nitride

Si silicon

GPU graphics processing unit

SiC silicon carbide

HEV mild and full hybrid electric vehicle

SOTA software over-the-air

HSM hardware security module

SW software

HW hardware

ICE internal combustion engine ToF time-of-flight

INV in-vehicle networking V2X vehicle-to-everything communication

lidar light detection and ranging xEV all degrees of vehicle electrification (EV, FHEV, HEV, PHEV)

2019-10-08 Copyright © Infineon Technologies AG 2019. All rights reserved. 28

Disclaimer

Disclaimer

This presentation contains forward-looking statements about the business, financial condition and earnings performance of

the Infineon Group.

These statements are based on assumptions and projections resting upon currently available information and present

estimates. They are subject to a multitude of uncertainties and risks. Actual business development may therefore differ

materially from what has been expected.

Beyond disclosure requirements stipulated by law, Infineon does not undertake any obligation to update forward-looking

statements.

Specific disclaimer for IHS Markit reports, data and information referenced in this document

The IHS Markit reports, data and information referenced herein (the "IHS Markit Materials") are the copyrighted property of

IHS Markit Ltd. and its subsidiaries (“IHS Markit”) and represent data, research, opinions or viewpoints published by IHS

Markit, and are not representations of fact. The IHS Markit Materials speak as of the original publication date thereof and not

as of the date of this document. The information and opinions expressed in the IHS Markit Materials are subject to change

without notice and neither IHS Markit nor, as a consequence, Infineon have any duty or responsibility to update the IHS

Markit Materials or this publication. IHS Markit Materials are delivered on an “as-is” and “as-available” basis. Moreover, while

the IHS Markit Materials reproduced herein are from sources considered reliable, the accuracy and completeness thereof

are not warranted, nor are the opinions and analyses which are based upon it. IHS Markit disclaims any and all warranties,

express or implied, including any warranties of accuracy, non-infringement, merchantability and fitness for a particular

purpose. IHS Markit and the trademarks used in the Data, if any, are trademarks of IHS Markit. Other trademarks appearing

in the IHS Markit Materials are the property of IHS Markit or their respective owners.

2019-10-08 Copyright © Infineon Technologies AG 2019. All rights reserved. 29

Peter Schiefer

Division President Automotive

› since 2016: Division President Automotive

› Sep 2012: Head of Operations, responsible for

Manufacturing, Supply Chain, Purchasing

› Jan 2012: Division President Power Management &

Multimarket

› 2013 – 2016: Member of the Supervisory Board of

Infineon Technologies Austria

› since 2012: Member of the Supervisory Board of

Infineon Technologies Dresden

› since 2018: Member and Vice Chairman of the Board

of Directors of the JV SIAPM (SAIC Infineon

Automotive Power Modules (Shanghai) Co. Ltd.)

› Peter Schiefer was born in Munich, Germany, in

1965. He holds a Diploma in Electrical Engineering

from the University of Applied Sciences in Munich.

› He joined Infineon (Siemens AG until 1999) in 1990.

2019-10-08 Copyright © Infineon Technologies AG 2019. All rights reserved. 30

You might also like

- Analyst Presentation and Factsheet Q1fy21Document25 pagesAnalyst Presentation and Factsheet Q1fy21Va AniNo ratings yet

- Navi Mumbai Airport PlanningDocument82 pagesNavi Mumbai Airport PlanningLasantha SameeraNo ratings yet

- 2016 08 02 Automotive PresentationDocument27 pages2016 08 02 Automotive PresentationJoao SilvaNo ratings yet

- Turkcell Presentation Q123 ENG VfinalDocument18 pagesTurkcell Presentation Q123 ENG Vfinalmahmoud.te.strategyNo ratings yet

- Indian Auto Component Industry Performance Review: 2017-18 Growth and ExportsDocument16 pagesIndian Auto Component Industry Performance Review: 2017-18 Growth and Exportsknlpriya05No ratings yet

- Revenue Strategy: Problem Statement and Solution ProposalDocument69 pagesRevenue Strategy: Problem Statement and Solution Proposalargha48126No ratings yet

- Accenture-Unlocking-Digital-Value-South Africa-Telecoms-Sector PDFDocument26 pagesAccenture-Unlocking-Digital-Value-South Africa-Telecoms-Sector PDFadityaNo ratings yet

- Tsel2020 AR Webversion FINALDocument164 pagesTsel2020 AR Webversion FINALazka zulfa KhairinaNo ratings yet

- Tsel2021 AR Webversion FINALDocument162 pagesTsel2021 AR Webversion FINALr dNo ratings yet

- Commentary: Composite Indices SubsectorsDocument6 pagesCommentary: Composite Indices SubsectorsCalvin YeohNo ratings yet

- S&P 500 Earnings Dashboard - Dec. 6Document11 pagesS&P 500 Earnings Dashboard - Dec. 6Anonymous V7Ozz1wnNo ratings yet

- Emerson Capital Quarterly Performance - 3Q 2009Document1 pageEmerson Capital Quarterly Performance - 3Q 2009Joseph HarrisonNo ratings yet

- Banco Santander Chile 3Q18 Earnings Report: October 31, 2018Document32 pagesBanco Santander Chile 3Q18 Earnings Report: October 31, 2018manuel querolNo ratings yet

- Software Industry Report: Facts, Trends, M&A & Valuation Metrics Q1 2020Document38 pagesSoftware Industry Report: Facts, Trends, M&A & Valuation Metrics Q1 2020TanbizNo ratings yet

- Electricity Market Design Evolution To Efficiently Integrate Wind and Other Emerging Technologies - ERCOT StyleDocument15 pagesElectricity Market Design Evolution To Efficiently Integrate Wind and Other Emerging Technologies - ERCOT StylePAULO KAJIWARANo ratings yet

- Month-to-Date: Index MTD 3M YTD 12MDocument4 pagesMonth-to-Date: Index MTD 3M YTD 12MEric ReyesNo ratings yet

- FullReport AES2021Document108 pagesFullReport AES2021clement3176No ratings yet

- Banco Santander Chile 2Q18 Earnings Report: July 26, 2018Document27 pagesBanco Santander Chile 2Q18 Earnings Report: July 26, 2018manuel querolNo ratings yet

- Tags Final OnlineDocument13 pagesTags Final OnlineVictor BowmanNo ratings yet

- 3Q09 Business Conference)Document19 pages3Q09 Business Conference)sdey003No ratings yet

- Electronics: September 2009Document17 pagesElectronics: September 2009shreyas2985No ratings yet

- IT Services - Analyst Presentation - Sep15Document15 pagesIT Services - Analyst Presentation - Sep15Nimish NamaNo ratings yet

- KOA (Buy TP NOK10) : Above Auto Market Performance, Improved PMI's, But Lagging Peers. Why?Document23 pagesKOA (Buy TP NOK10) : Above Auto Market Performance, Improved PMI's, But Lagging Peers. Why?jainantoNo ratings yet

- Grameenphone LTD.: C-31531 (652) /96 2 Quarter 2019 Business HighlightsDocument3 pagesGrameenphone LTD.: C-31531 (652) /96 2 Quarter 2019 Business HighlightsTanzir HasanNo ratings yet

- LG Electronics BCG Matrix AnalysisDocument2 pagesLG Electronics BCG Matrix AnalysisKi-Baek KimNo ratings yet

- Africa Day Presentation VDefDocument30 pagesAfrica Day Presentation VDefBernard BiboumNo ratings yet

- Media Sector Industry TrendsDocument42 pagesMedia Sector Industry Trendssanika ponksheNo ratings yet

- Q1 2020-21 Fact Sheet PDFDocument27 pagesQ1 2020-21 Fact Sheet PDFJose CANo ratings yet

- Cloud Computing in BPODocument15 pagesCloud Computing in BPORahul KunwarNo ratings yet

- Quarterly Update - June 2021Document5 pagesQuarterly Update - June 2021Chaitanya Jagarlapudi100% (1)

- Indian Cable MarketDocument6 pagesIndian Cable MarketLokesh KapoorNo ratings yet

- Quarterly Results 2010-11: HCL TechnologiesDocument31 pagesQuarterly Results 2010-11: HCL Technologies13lackhatNo ratings yet

- A Project Proposal From Bangladesh: Strengthening ICT and Telecom Sector in Bangladesh (STIB)Document21 pagesA Project Proposal From Bangladesh: Strengthening ICT and Telecom Sector in Bangladesh (STIB)Rabbir AhmedNo ratings yet

- Acb - HSCDocument10 pagesAcb - HSCSeoNaYoungNo ratings yet

- Everest Group Engineering Services Top 50 2019Document7 pagesEverest Group Engineering Services Top 50 2019Ashish RanjanNo ratings yet

- Gartner ITBudget Sample 2012Document27 pagesGartner ITBudget Sample 2012asd aloNo ratings yet

- Uk Market Ai Feb20Document38 pagesUk Market Ai Feb20pantmukulNo ratings yet

- Quarterly Update Provides Insights Into RW Investment StrategyDocument6 pagesQuarterly Update Provides Insights Into RW Investment StrategyChaitanya JagarlapudiNo ratings yet

- GCA Altium Digital - Media & Internet Monitor Q3 2020Document26 pagesGCA Altium Digital - Media & Internet Monitor Q3 2020John SmithNo ratings yet

- HSL - IT PAck Report - 2021-202108182348354902869Document9 pagesHSL - IT PAck Report - 2021-202108182348354902869SHAIK AHMEDNo ratings yet

- Residence Department Position MarketGroup FrequenciesDocument5 pagesResidence Department Position MarketGroup FrequenciesBeugh RiveraNo ratings yet

- 2020-11-09 Q4 FY20 Investor PresentationDocument76 pages2020-11-09 Q4 FY20 Investor PresentationPOPNo ratings yet

- Reliance Communications: Group 8 Presented By: Nichelle Kamath Mitali Mistry Komal Tambade - F65 Mansi Morajkar - F39Document31 pagesReliance Communications: Group 8 Presented By: Nichelle Kamath Mitali Mistry Komal Tambade - F65 Mansi Morajkar - F39sachinborade11997No ratings yet

- Reliance Communications LTD: Key Financial IndicatorsDocument4 pagesReliance Communications LTD: Key Financial IndicatorscomplexnoNo ratings yet

- Engineering & Capital Goods Industry Trends and StatisticsDocument1 pageEngineering & Capital Goods Industry Trends and StatisticsrohitNo ratings yet

- Indonesia Morning CuppaDocument8 pagesIndonesia Morning CuppaPT SKSNo ratings yet

- Economie Numerique 4Document168 pagesEconomie Numerique 4Biggest JunjunNo ratings yet

- 246420231227 m 001Document16 pages246420231227 m 001danny122192No ratings yet

- Digital Transformation From Strategy To ExecutionDocument101 pagesDigital Transformation From Strategy To ExecutionHichem CasbahNo ratings yet

- CTRA Results Presentation 3M21Document49 pagesCTRA Results Presentation 3M21Fadhel FebryansyahNo ratings yet

- Kotak NASDAQ 100 FOF Product PresentationDocument40 pagesKotak NASDAQ 100 FOF Product PresentationJyotirmoy BhattaNo ratings yet

- Automotive Engineering 2025: Five Key ChallengesDocument12 pagesAutomotive Engineering 2025: Five Key ChallengesNissam SidheeqNo ratings yet

- ACMA-Presentation Press-Conference 2020Document16 pagesACMA-Presentation Press-Conference 2020KarthikMeenakshiSundaramNo ratings yet

- Analysis IDocument4 pagesAnalysis IBeugh RiveraNo ratings yet

- Wipro Limited: Investor PresentationDocument22 pagesWipro Limited: Investor PresentationKaveri PandeyNo ratings yet

- Total Assets (Rs. Trillion) : 1 Industry Trends January 2021Document6 pagesTotal Assets (Rs. Trillion) : 1 Industry Trends January 2021atifrazmNo ratings yet

- SECUREDocument26 pagesSECUREsozodaaaNo ratings yet

- Ikhtisar Data Keuangan enDocument8 pagesIkhtisar Data Keuangan enFarisNo ratings yet

- JapanDocument59 pagesJapanThe Overlord GirlNo ratings yet

- National Presentation of JapanDocument7 pagesNational Presentation of JapanThe Overlord GirlNo ratings yet

- Japan and It's ColoniesDocument44 pagesJapan and It's ColoniesThe Overlord GirlNo ratings yet

- The Indian TelegraphDocument1 pageThe Indian TelegraphThe Overlord GirlNo ratings yet

- Latent Profiles Based On Light Physical Activity, Sedentary Behavior, Perceived Body Shape, and Body Mass Index in Patients With Dyslipidemia Influence Their Quality of LifeDocument10 pagesLatent Profiles Based On Light Physical Activity, Sedentary Behavior, Perceived Body Shape, and Body Mass Index in Patients With Dyslipidemia Influence Their Quality of LifeThe Overlord GirlNo ratings yet

- The Residence of The U.S. Ambassador To The Republic of KoreaDocument43 pagesThe Residence of The U.S. Ambassador To The Republic of KoreaThe Overlord GirlNo ratings yet

- Cross-Cultural Ties Between China and KoreaDocument23 pagesCross-Cultural Ties Between China and KoreaThe Overlord GirlNo ratings yet

- Port Schedules of Busan Korea 2019Document15 pagesPort Schedules of Busan Korea 2019The Overlord GirlNo ratings yet

- Pashto AlphabetDocument9 pagesPashto AlphabetThe Overlord Girl100% (1)

- Public Sector SheetDocument41 pagesPublic Sector SheetThe Overlord GirlNo ratings yet

- Persian LanguageDocument19 pagesPersian LanguageThe Overlord Girl0% (1)

- Academic Calendar - Swinburne University, Sarawak, MalaysiaDocument5 pagesAcademic Calendar - Swinburne University, Sarawak, MalaysiaThe Overlord GirlNo ratings yet

- Turkish LanguageDocument23 pagesTurkish LanguageThe Overlord GirlNo ratings yet

- History of Japan-Korea RelationsDocument8 pagesHistory of Japan-Korea RelationsThe Overlord GirlNo ratings yet

- Chagatai Khanate: Tsagadaina Khaanat UlusDocument5 pagesChagatai Khanate: Tsagadaina Khaanat UlusThe Overlord GirlNo ratings yet

- Chagatai LanguageDocument4 pagesChagatai LanguageThe Overlord GirlNo ratings yet

- The History of Ethnic Relationship in MalaysiaDocument19 pagesThe History of Ethnic Relationship in MalaysiaThe Overlord GirlNo ratings yet

- Low Rise Building and Transport Engineering TimetableDocument1 pageLow Rise Building and Transport Engineering TimetableThe Overlord GirlNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Table3000CaracteresChinois PDFDocument125 pagesTable3000CaracteresChinois PDFAngelic PangkarayaNo ratings yet

- Ishrae 365 2009 PDFDocument16 pagesIshrae 365 2009 PDFZeeshan HasanNo ratings yet

- Pearly Co Cleared Funds ForecastDocument8 pagesPearly Co Cleared Funds ForecastPutin Phy0% (1)

- CSC 101-CSC 111 - Introduction To Computer Science - Lecture 1Document23 pagesCSC 101-CSC 111 - Introduction To Computer Science - Lecture 1CODE100% (1)

- Ramial Chipped Wood - A Basic Tool For Regenerating SoilsDocument15 pagesRamial Chipped Wood - A Basic Tool For Regenerating SoilsmrmiscNo ratings yet

- Erowid LSD (Acid) Vault - ImagesDocument2 pagesErowid LSD (Acid) Vault - ImagesAdam BruhNo ratings yet

- Work Permit Renewal Application FormDocument2 pagesWork Permit Renewal Application FormyamojodnabNo ratings yet

- Inside Out or Outside In. Meeting With Couples. Hugh JenkinsDocument24 pagesInside Out or Outside In. Meeting With Couples. Hugh JenkinsRita1976No ratings yet

- Smoke Stratification - Understanding the DynamicsDocument3 pagesSmoke Stratification - Understanding the DynamicsGagan UpadhyayNo ratings yet

- ป 6Document43 pagesป 6MoLo Kanyarat ChenpitaksombatNo ratings yet

- S# Isin CFI Code (As Per New ISO) Security Name Security Symbol Sector Name Security Type StatusDocument25 pagesS# Isin CFI Code (As Per New ISO) Security Name Security Symbol Sector Name Security Type StatusahmedalishNo ratings yet

- Pengaruh Ukuran Potongan Kopra Dalam Proses Pengeringan: Effect of The Copra Cut Size in The Drying ProcessDocument5 pagesPengaruh Ukuran Potongan Kopra Dalam Proses Pengeringan: Effect of The Copra Cut Size in The Drying ProcessAlexia Desi Ratnasari Loi 1841100210No ratings yet

- Aiesha Edward Resume2Document2 pagesAiesha Edward Resume2api-491571342No ratings yet

- SimmonsDocument12 pagesSimmonsGürelBaltalıNo ratings yet

- Derivatives and Risk ManagementDocument17 pagesDerivatives and Risk ManagementDeepak guptaNo ratings yet

- GMP TD Ar FPL 11033Document1 pageGMP TD Ar FPL 11033Sammy NguyenNo ratings yet

- Presley v. Lockwood: Respondent's Trial BriefDocument37 pagesPresley v. Lockwood: Respondent's Trial BriefTony Ortega100% (2)

- Edwards Auto 306 CharacteristicsDocument4 pagesEdwards Auto 306 CharacteristicsJuan Antonio Rubio-LaraNo ratings yet

- Discontinued Tymphany LAT Products LAT500 001 PDFDocument2 pagesDiscontinued Tymphany LAT Products LAT500 001 PDFOgie FermoNo ratings yet

- Biomechinics PDFDocument8 pagesBiomechinics PDFImran KhanNo ratings yet

- Soil Chemistry KeywordsDocument8 pagesSoil Chemistry Keywordssobe64 sNo ratings yet

- UM16000 Flame Detector Installation Guide EnglishDocument12 pagesUM16000 Flame Detector Installation Guide Englishmohamed.rescoNo ratings yet

- Symbol High Low R5 R4 R3 R2: DailyDocument8 pagesSymbol High Low R5 R4 R3 R2: Daily257597 rmp.mech.16No ratings yet

- Separators: Figure OneDocument8 pagesSeparators: Figure OneMohamed Moder100% (1)

- 02 - Purulent Inflammatory DiseaseDocument60 pages02 - Purulent Inflammatory Diseaseshekhawatyuvraj051No ratings yet

- Compabloc Heat Exchangers Cut Downtime at Nynäs RefineryDocument2 pagesCompabloc Heat Exchangers Cut Downtime at Nynäs RefinerylaythNo ratings yet

- Independent Study Report # 1Document75 pagesIndependent Study Report # 1Sunny DubeyNo ratings yet

- CHAPTER 3: Toxic Effects of Drugs: Pharmacology Page 1Document1 pageCHAPTER 3: Toxic Effects of Drugs: Pharmacology Page 1Gabriel GonzagaNo ratings yet

- Nestle Write UpDocument18 pagesNestle Write UpAnjana CarriNo ratings yet

- Testing Automotive/Industrial Composite Materials: Standard Guide ForDocument7 pagesTesting Automotive/Industrial Composite Materials: Standard Guide ForJuanNo ratings yet

- Sulaiman Al Qudaibi Co.: Medium Term (1000 H) Hydrostatic Pressure Survival Test ProcedureDocument8 pagesSulaiman Al Qudaibi Co.: Medium Term (1000 H) Hydrostatic Pressure Survival Test ProcedureNADEEM AHMEDNo ratings yet