Professional Documents

Culture Documents

Confirmation of Insurance: COC NO. 0149457986

Uploaded by

VANESSAOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Confirmation of Insurance: COC NO. 0149457986

Uploaded by

VANESSACopyright:

Available Formats

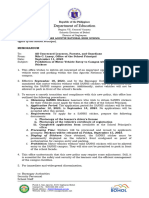

COC NO.

0149457986

CONFIRMATION OF INSURANCE

Name of Assured: Helen Villanueva Quinones

Date of Birth: Apr 17, 1953 Name of Beneficiary: Jasmin Quinones Koh (Child)

Type of Travel: Global Type of Policy: Short Term

Itinerary/Destination: Austria; (All Schengen Countries)

Period of Insurance: May 07, 2018 - Jun 20, 2018 No. of Days: 45 Days

PRODUCT FEATURES & BENEFITS AMOUNT

PERSONAL ACCIDENT

Accidental Death, Dismemberment, and/or Disablement Php 1,000,000.00

Accidental Burial Benefit Php 10,000.00

EMERGENCY MEDICAL TREATMENT (ACCIDENT/SICKNESS)

Local & Asian Travel Php 1,000,000.00

Worldwide Travel Php 2,500,000.00

Follow-up Care Included

Php 1,000.00

Hospital Cash Allowance

Per Day/Max 10 Days per Confinement

PERSONAL LIABILITY Php 1,000,000.00

RECOVERY OF TRAVEL EXPENSES Due to Emergency Situations of Traveller's Immediate Family

Emergency Trip Cancellation Php 50,000.00

Emergency Trip Termination Php 50,000.00

TRAVEL INCONVENIENCE BENEFITS

Loss of Travel Documents Php 20,000.00

Loss of Cash Php 5,000.00

Damage to Laptop Php 5,000.00

Php 50,000.00

Loss of Baggage

Sub-limit of Php 5,000.00 per item

Baggage Delay Php 5,000.00

Php 1,000.00

Strikes and Aircraft Hijacking

Per Day Basis Up to 10 Days Per Occurrence

Php 1,000.00

Flight Delay

Due to Severe Weather, Mechanical Trouble, Airline Strike

TRAVEL ASSISTANCE BENEFITS

Emergency Repatriation Unlimited

Emergency Evacuation Unlimited

Return of Mortal Remains Unlimited

Care for Unattended Minors Unlimited

Compassionate Visit Roundtrip Fare

VALUE-ADDED FEATURES

Car Rental Protection Php 500,000.00

Extends Medical Treatment and Travel Assistance Benefits for accidents

Sports Activities Extension

due to fitness, winter, water and extreme sports

This certificate is governed by the terms and conditions under Travel Master Global with Master Policy No. P0149457, and all claims will be

adjusted in accordance therewith. The insurance will commence from the time the insured leaves his place of work or residence with the intension

of commencing the intended travel as per declared itinerary with Malayan on the date stated above and expiring on the earliest of letters A to D

under commencement and automatic termination of insurance as stated on this COI.

Ref. Policy No: P0149457 Please present this COI when filing a claim.

ATTENTION: Assist America does not replace your medical insurance. All

For emergency assistance and advice while travelling, contact

medical costs should be submitted to your health plan and are subject to the

Assist America's 24/7 emergency assistance number:

policy limits of your health coverage. Assist America provides and pays for the

+ 63 - 2 - 811 - 2521

services it provides. No claims for reibursement will be accepted.

MALAYAN INSURANCE 1 Fri, 20 Apr 18 14:51:39 +0800

SCOPE OF COVERAGE Coverage provided under this section excludes loss of data or software, damage to peripherals or accessories (including but not limited

This policy shall cover the Insured: to screen protector, protective casing, etc.).

- while anywhere outside the Philippines

- while traveling as a fare paying passenger on board any type of conveyance while outside the Philippines Prerequisite to claim settlement is the submission of

- while on board any aircraft, as a fare paying passenger, within the Philippines - proof of purchase, official receipt, certificate of warranty;

- while on travel of at least one hundred (100) miles away from registered place of residence. - deed of assignment (if provided by Insured’s employer);

- repair estimate or certificate of total damage from the dealer or reputable service provider.

COMMENCEMENT AND TERMINATION OF COVERAGE

This policy is effective during the policy period specified in the schedule subject to a maximum of ninety (90) days per any one trip or The Company reserves the right to require to surrender the damaged laptop for the sole purpose of examination or inspection which is

travel duration (unless the Company has been informed and the latter accepted). Cover takes effect (except for Coverage C,D and G) not in any way to be misconstrued as an admission of liability. The Insured has the right to be present during said examination or

from the time the Insured leaves his place of work or residence with the intention of commencing the intended travel as per declared inspection and the Company will return the unit to the Insured upon completion of its evaluation.

itinerary with the Company with the date stated in the Schedule and expires on whichever of the following occurs first:

1. the expiry of the policy period specified in the schedule; LOSS of BAGGAGE is subject to the following conditions:

2. the Insured’s return to his/her place of residence or employment, whichever occurs first; The Company will indemnify the Insured for the loss of his checked-in baggage up to the amount stated in the Schedule of Benefits. The

3. the Insured’s travel reaching the 90th day, unless previously declared to the Company and the latter signified its acceptance and an liability of the Company however, will be less any amount recoverable from or paid by the airline company or carrier. Loss must occur (i)

additional premium has been paid. while the baggage is in the possession of a common carrier/airline company and proof of such loss must be obtained in writing from the

4. within five (5) hours after the scheduled time of arrival. common carrier/airline company management and such proof must be provided to the Company, or (ii) as the result of theft of the

baggage from the Insured provided such loss must be reported to the policy having jurisdiction at the place of the loss no more than 24

Please refer to the Coverage A: Accidental Death, Dismemberment &/or Disablement stated in the master policy for the schedule of hours from the incident. Any claim must be accompanied by written documentation from such police.

benefits under Accidental Death, Dismemberment &/or Disablement.

EXCLUSIONS (for Loss of Baggage):

EXCLUSIONS (for Accidental Death, Dismemberment &/or Disablement): 1. Benefits will not be provided for any loss, theft or damage to: animals; documents, identity papers, credit and payment cards, transport

1. loss caused directly or indirectly, wholly or partly, or occasioned by: (1) bacterial infections, disease or sickness; pregnancy or tickets, cash, traveler’s checks, banknotes, travel documents, negotiable instruments, bonds, stocks and securities, jewelry; keys;

miscarriage; congenital anomalies or Acquired Immune Deficiency Syndrome (AIDS); (2) suicide or any attempt thereat (sane or insane), 2. No benefit will be provided for any loss, theft or damage to: skis, bicycles, sailboards, golf clubs, tennis rackets and other sporting

insanity or alcoholism; (3) terrorism, war, invasion, act of foreign enemy, hostilities or warlike operations (whether war be declared or equipment except while checked in as baggage with a registered common carrier;

not), civil war, rebellion, revolution, insurrection, mutiny, military or usurped power, riot, civil commotion, strikes, military or popular 3. This cover will not pay for any loss, theft or damage to: automobiles and automobile equipment, motorcycles, trailers and caravans,

uprising, or the use of a weapon or instrument employing atomic fission or radio-active force, whether in time of peace or war; (4) boats, motors and other means of transport (including accessories); equipment for professional use; musical instruments; objects of art,

landslide or cave-in of mines, earthquake, tidal waves or volcanic eruption; (5) any bodily injury which shall result in Hernia; (6) ionizing precious gemstones, china glasswares, porcelains, antiques, collector’s items, furniture, eye glasses, contact lenses, hearing aids,

radiations or contamination by radioactivity; prosthetic limbs, artificial teeth or dental bridges; perishables and consumables; baggage sent in advance or souvenirs and articles

2. loss while engaging in hunting, mountaineering, winter sports, ice hockey, football, scuba diving, ice or water skiing, yachting, racing of mailed or shipped separately; hired or leased equipment; business goods or samples; data recorded on tapes, cards, disc or otherwise.

any kind, steeple chasing, poloplaying; 4. Benefits will not be provided for any loss resulting in whole or in part from: wear and tear or gradual deterioration; insects or vermin;

3. loss while participating in any brawl, committing a crime, or making an arrest or a raid as an officer of the law; inherent vice or damage; transporting contraband or illegal trade; mysterious disappearance or unaccompanied baggage, losses arising

4. loss while under orders for warlike operations or for restoration of public order; while the insured is serving the Armed Forces of any from personal negligence or unexplainable disappearance; breakage of brittle or fragile articles, cameras, computer (including softwares

country or international authority, whether in peace or war; and accessories), musical instruments, radios and similar property.

5. while operating, learning to operate or serving as a crew member of an aircraft or vessel;

6. loss caused by murder or assault or disappearance; The Insured cannot claim under both benefits of Baggage Delay and Loss of baggage for the same loss.

7. any of the following persons:

1. persons who are under the age of seven (7) years, or over the age of seventy (70) years, or mentally incompetent or physically BAGGAGE DELAY BENEFIT is subject to the following conditions:

impaired; In the event of delay of the Insured’s checked-in baggage, the Company will provide for the essential purchase of necessary clothing and

2. the following persons while performing their duties as such: Acrobats, Asylum Attendants, Aviators, Boilermen, Detectives, Divers, toiletries. The liability of the Company is limited to the amount stated in the Schedule of Benefits and shall be established only after a

Explosive Makers,Firemen, Fishermen, Loggers, Miners, Policemen, Sailors, Sawmill Workers, Secret Service Personnel, Woodworking waiting period of twelve (12) hours after the aircraft’s arrival at its destination and will be less any amount recoverable or paid by the

Machinists, Underground Workers and Window Cleaners, while performing their tasks as such. airline company carrier. In no event will the Company be liable for delay due to detention or confiscation by Customs Authorities.

EXCLUSIONS (for the Baggage Delay Benefit):

EMERGENCY MEDICAL TREATMENT is subject to the following conditions: 1. for claims not declared to a competent person of the airline company as soon as the Insured knows the baggage is late or lost;

If within the policy period, the Insured while on travel incurs reasonable expenses for emergency medical treatment of sickness or 2. for any clothing or toiletries that the Insured purchased more than four days after the actual time of arrival at the airport of destination;

accidental injury occurring during the course of travel, the Company will pay the Insured, up to the limit specified in the policy schedule all 3. when the baggage delay occurs on the return journey to Insured’s normal domicile;

reasonable and customary charges in connection with that emergency medical treatment. Emergency medical treatment, as used in this 4. for purchases made after delivery of Insured’s baggage by the air carrier.

section shall mean treatment by a legally qualified physician or surgeon, confinement within a hospital, employment of a licensed or

graduate nurse, X-ray examination or the use of ambulance. It also covers necessary surgery, physician consultations, diagnostic tests, STRIKES AND AIRCRAFT SKYJACKING is subject to the following conditions:

hospital services and supplies, ambulance and paramedic services; visits to registered physicians and medicines prescribed by them. When the Insured is prevented from reaching his scheduled destination as a result of strike (by airline or airport personnel) or aircraft

The benefits under this Section include any amount advanced under the Hospital Deposits Guarantee (provided by Assist America, Inc.) hijacking, the Company will pay the Insured the amount stated in the schedule for every day of delay. The liability of the Company is up

which the Insured may be required to pay as a result of hospitalization covered under this policy. to a maximum of ten (10) days. Coverage starts following an uninsured grace period of twelve (12) hours. The 12- hour waiting period

shall start immediately after the original estimated time of arrival (ETA) of the aircraft plus any amount of time it was delayed in departing

EXCLUSIONS (for EMERGENCY MEDICAL TREATMENT): from its last point of origin.

1. Congenital conditions of all kinds and hernias unless caused by trauma during the period of insurance.

2. Psychotic, mental or nervous disorders (including any neuroses and their physiological or psychosomatic manifestations). FLIGHT DELAY is subject to the following conditions:

3. Convalescent or rehabilitation care. This policy will reimburse the Insured up to the limit specified in the schedule if the Insured’s flight is delayed for more than twelve (12)

4. Any and all conditions arising from surgical, mechanical or chemical methods of birth control and any and all conditions or treatment hours, for:

pertaining to infertility. 1. any prepaid, unused, non-refundable land or water accommodation

5. Communication and transportation expenses other than medically necessary telecommunications and local ambulance/transportation 2. any reasonable expenses incurred in respect of meals and lodging which were necessarily incurred as a result of the delay and which

services. were not provided by the airline or any other party free of charge;

6. Treatment or service other than on the recommendation of a physician. 3. the cost of transfer to and from the airport.

7. Any sickness or injury due to traveling contrary to doctor’s advice.

8. Pre-existing medical or physical condition(s) or any conditions arising from, or contributed to by such pre-existing medical and physical Only the following causes of delay shall be covered:

conditions. 1. delay caused by any severe weather conditions;

9. Any treatment for sickness or injury on travel arranged primarily for the purpose of obtaining medical treatment. 2. delay due to strike or other job action by employees of the airline on which the Insured is scheduled to travel;

10. Non-emergency treatment, Routine Care/examinations or health check-ups not incidental to the treatment or diagnosis of suspected 3. delay caused by the equipment failure of the aircraft on which the Insured is scheduled to travel.

sickness or injury sustained during the period of insurance. This cover applies to normally scheduled airline flights.

11. Care or treatment for which payment is not required or which is payable by any other insurance or indemnity covering the insured.

12. Dental care and treatment, except as necessitated by accidental injuries to sound natural teeth occurring during the Period of Please refer to Special Coverage – RENTED CAR PROTECTION stated in the master policy for the schedule of benefits under Rented

Insurance Car Protection

13. Charges in respect for special and private nursing except in the event of a medical evacuation being necessary.

14. Cosmetic surgery, eyeglasses and refraction or hearing aids, and prescriptions therefore except as necessitated by injuries occurring EXCLUSIONS (for Rented Car Protection)

during the Period of Insurance. 1. Theft of the entire vehicle or its accessories or spare parts;

15. The use of any drug (except as medically prescribed but excluding drug addiction) or being under the influence of intoxicating liquor. 2. Any liability, bodily injury or property damage caused by and arising out of the use of the rented car;

FOLLOW UP CARE is subject to the following conditions: 3. The corresponding deductible for each and every accident or occurrence;

This coverage extends to cover medical expenses incurred in the Philippines, or in the place of residence upon return from the Trip for 4. Consequential loss, depreciation, wear and tear, mechanical or electrical breakdowns, failures or breakages;

the treatment of an accident or sickness which is caused by, resulting from, or incurred or contracted during the trip and all expenses 5. Damage to tires unless the car is damaged at the same time;

must be incurred within thirty (30) days from the date the Insured person returns to his or her place of residence in the Philippines. 6. Any malicious damage caused by the Assured, any member of his family or by a person in the Assured’s service;

Admission to the Hospital must be within twelve (12) hours after arrival and must be a continuation of medical attention sought while 7. Whilst the rented car is driven other than by the Authorized Driver named in the Rental Contract or Agreement; and

traveling. 8. Any accident or damage to the rented car whilst being used otherwise than in accordance with what is stated the Rental Contract

Agreement.

Please refer to the EMERGENCY TRIP CANCELLATION stated in the master policy for the schedule of benefits under Emergency Trip

Cancellation. SPORTS COVERAGE is subject to the following conditions:

Only the Benefits under Coverage B-Emergency Medical Treatment shall extend to cover the Assured whilst engaged in winter sports,

EXCLUSIONS (for Emergency Trip Cancellation): scuba diving, trekking and mountain climbing. Provided that the Company shall not pay for the first Ps 2,000 (for Peso Policy) or the first

1. the first Php500.00 of each and every claim per Insured person US$50.00 (for Dollar Policy) for each and every occurrence.

2. arising directly or indirectly as a result of government regulation or act; the failure or default of the travel agent or tour operator or

transport provider to provide any part of the booked journey or service; any unlawful act or criminal proceedings against the Insured or of

any person whom the journey plans depend on; the Insured’s disinclination to travel; the liquidation, bankruptcy or dissolution of he GENERAL EXCLUSIONS

Insured’s company or the Insured’s financial difficulty; the Insured’s failure to notify the travel agent or tour operator or provider of (Applicable to All Sections)

transport or accommodation immediately if is found necessary to cancel or curtail the travel arrangements. This insurance with respect to the above hazards shall not apply to:

3. any claim when at the time of making the travel arrangements the Insured is aware of any circumstances which might cause the 1. loss caused directly or indirectly, wholly or partly by:

journey to be cancelled. 1. bacterial infections or infections caused by parasites, except infections caused by pus-produing micro-organisms (pyrogenic

4. any loss that is covered by any other existing insurance scheme; government program or which will be paid or refunded by a hotel, infections) which shall occur through an accidental cut or wound; (NOTE: GENERAL EXCLUSION a) (1) above does not apply to

airline, travel agent for any other travel and/or accommodation. Coverage B and the additional benefit under Coverage B (Daily Hospital Income on Confinement due to Sickness), provided that it

occurs during the course of travel and is not specifically excluded under EXCLUSIONS SPECIFIC TO COVERAGE B AND ADDITIONAL

Please refer to the EMERGENCY TRIP TERMINATION stated in the master policy for the schedule of benefits under Emergency Trip BENEFIT OF COVERAGE B.

Termination. 2. Medical or surgical treatment (except if necessary by reason of injuries covered by this policy and performed within the period of

insurance);

EXCLUSIONS (for Emergency Trip Termination): 3. Miscarriage or pregnancy;

1. pregnancy and its complications; 4. AIDS or Sexually Transmitted Diseases (STD)

2. illness or disorders of a psychological nature, nervous depressions, mental illness, sexually transmitted diseases, AIDS, HIV infections 2. suicide or attempted suicide (sane or insane);

and AIDS related infections; 3. murder or provoked assault;

3. suicide, attempted suicide, or intentionally self-inflicted injury; 4. loss or injury caused by war, invasion, acts of foreign enemy, hostilities or warlike operations (whether war be declared or not), mutiny,

4. periodic control and observation examinations; strikes, riots, civil commotion, civil war, rebellion, revolution, insurrection, conspiracy, military or usurped power, martial law or state of

5. failure to obtain required vaccinations before departure; siege, seizure, quarantine, or customs regulations or nationalization by or under the order of any government or public or local authority,

6. alcohol or drug abuse; sabotage, terrorism.

7. any cancellations resulting from Civil or Foreign war, riots, popular movements, any pre-existing conditions, terrorist acts, any effect of This exclusion shall not be affected by any endorsement, which does not specifically refer to it, in whole or in part.

a source of radioactivity, epidemics, pollution, natural catastrophes and climatic events. 5. nuclear radiation or radioactive contamination;

6. injury sustained while participating in professional athletics or any organized and scheduled amateur physical contact sports;

LOSS OF TRAVEL DOCUMENTS is subject to the following conditions: 7. injury sustained while engaging in mountaineering requiring the use of ropes or guides, skin diving employing the use of compressed

The Company will reimburse the Insured up to the limit specified in the schedule in respect of reasonable additional hotel, travel and cylinders, racing on wheels or horseback, skydiving from a device for aerial navigation, hang gliding (Unless such activities have been

communication expenses necessarily incurred in the country/ies visited in obtaining the replacement of a lost passport or visa. Provided declared to and accepted by the Company, subject to additional premium payment, and affirmed by written endorsement).

that an Insured shall exercise reasonable care for the safety and supervision of the property and that any loss of passport must be 8. Cave-in of mines;

reported to the Police within 24 hours of the discovery. This policy does not cover lost traveller’s checks. 9. Serving as officer or crew of any type of sea vessel; aircraft

LOSS OF CASH

The Company will pay, up to the limit specified in the Policy or Certificate of Insurance, for loss of cash physically carried by the Insured

within the Period of Insurance, and provided that such loss of cash is a direct consequence of accidental injury sustained by the Insured IMPORTANT

and such accidental injury is compensable under this policy. Max of 1 COI per person. All COIs in excess of 1 shall be declared null & void.

No benefit under this section is provided for loss of cash by reason of NOTICE OF CLAIM

- robbery, hold-up, burglary or assault including attempts thereat unless the Insured also sustained physical injury from such acts;

- theft, pickpocketing or unexplained disappearance; Written notice of injury on which claim may be based must be given to the Company within (30)

- Insured’s neglect including but not limited to forgotten place of storage, left unattended, falling off from pocket, wallet or bag, etc.; days after the date of the accident causing the injury. In the event of accidental death,

- drunkenness, intoxication or whilst under the influence of drugs. immediate notice thereof must be given to the Company in any of its branches.

DAMAGE TO LAPTOP

The Company will pay, up to the limit specified in the Policy or Certificate of Insurance, for physical damage to laptop whilst within the For complete Terms and Conditions, please go to:

actual possession of the Insured within the Period of Insurance, provided that http://www.malayan.com/PDFs/Malayan_TravelMaster_Policybooklet.pdf

- the laptop is two (2) years old or newer;

- damage is a direct consequence of accidental injury sustained by the Insured and such accidental injury is compensable under this

policy;

- extent of damage has rendered the laptop irreparable or is beyond economic repair;

No benefit under this section is provided for actual physical damage of the laptop by reason of

- robbery, hold-up, burglary or assault including attempts thereat unless the Insured also sustained physical injury from such acts;

- theft or pickpocketing

- Insured’s neglect such as mishandling, inappropriate packaging or carrying case, falling off from bag, contact with liquid or corrosive

substances, overheating, overcharging, left unattended, etc.;

- damage consequential to drunkenness, intoxication or whilst under the influence of drugs;

- delay, confiscation, detention or examination by customs authorities or other officials;

- seizure of destruction under quarantine or custom regulation;

- wear and tear or gradual deterioration;

- cleaning, repairing or restoring process;

- atmospheric or climatic changes;

- laptop sent in advance or shipped separately from the Insured Person.

MALAYAN INSURANCE 2 Fri, 20 Apr 18 14:51:39 +0800

You might also like

- Annex B-2 RR 11-2018Document1 pageAnnex B-2 RR 11-2018Princess RegalaNo ratings yet

- Claimants' Statement (Coconut Farmers Group Life Insurance) : This Form Is Not For SaleDocument2 pagesClaimants' Statement (Coconut Farmers Group Life Insurance) : This Form Is Not For SaleKhayle Naue100% (2)

- Sample Secretary Certificate - No Intra Corporate ActionDocument2 pagesSample Secretary Certificate - No Intra Corporate ActionCzar Ian AgbayaniNo ratings yet

- Sample Affidavit of GuardianshipDocument1 pageSample Affidavit of GuardianshipAraveug InnavoigNo ratings yet

- Resignation LetterDocument1 pageResignation Letterduke rellonNo ratings yet

- PNB Deposit Slip FormDocument1 pagePNB Deposit Slip FormJeziel Salazar0% (1)

- Affidavit of AccountabilityDocument1 pageAffidavit of AccountabilityAnonymous YDYoTwwNo ratings yet

- Affidavit of No IncomeDocument1 pageAffidavit of No IncomeDax MonteclarNo ratings yet

- Payment Instruction Form (Pif) : AngelesDocument1 pagePayment Instruction Form (Pif) : AngelesRina la ONo ratings yet

- Affidavit - ThumbmarkDocument1 pageAffidavit - ThumbmarkManuel Joseph FrancoNo ratings yet

- DEED-OF-ABSOLUTE-SALE-OF-A-CAR (Car)Document1 pageDEED-OF-ABSOLUTE-SALE-OF-A-CAR (Car)Manny Sandicho100% (1)

- Letter To RDODocument1 pageLetter To RDOfarizah joy bagundangNo ratings yet

- Customer Request Form (CRF) PDFDocument1 pageCustomer Request Form (CRF) PDFMaurice SalinasNo ratings yet

- HLF111 CertificateEngagement V05Document1 pageHLF111 CertificateEngagement V05julesniko23No ratings yet

- Affidavit of Loss - Policy InsuranceDocument1 pageAffidavit of Loss - Policy InsuranceMa Leizl Jandayan-BernidoNo ratings yet

- RHED Financing Application Form 1Document2 pagesRHED Financing Application Form 1Kenneth InuiNo ratings yet

- RPT Life Basic XDocument9 pagesRPT Life Basic XKhryz CallëjaNo ratings yet

- Authorization to Claim ID CardDocument2 pagesAuthorization to Claim ID CardSandra Mae NavarreteNo ratings yet

- COA employees association membership formDocument1 pageCOA employees association membership formJean Kenneth AlontoNo ratings yet

- Contract to Buy LandDocument2 pagesContract to Buy LandIdonah Lee Grupo CoriticoNo ratings yet

- Videoke Rental Agreement.07.18.2021Document2 pagesVideoke Rental Agreement.07.18.2021Maycee Palencia100% (2)

- HOA Certification Title RegistrationDocument1 pageHOA Certification Title RegistrationembiesNo ratings yet

- Certificate of EmploymentDocument1 pageCertificate of EmploymentAnn SC100% (1)

- DEEDofContribution IndividualDocument3 pagesDEEDofContribution Individualjckgonzales97No ratings yet

- Accountability FormDocument1 pageAccountability FormNina Maniquiz SantosNo ratings yet

- Annex B-2 RR 11-2018Document1 pageAnnex B-2 RR 11-2018Kristine JoyceNo ratings yet

- Liability & Agreement Waiver (TIP-CC-029)Document4 pagesLiability & Agreement Waiver (TIP-CC-029)Ivan Radzll Mendoza MontealegreNo ratings yet

- Katha & Stilts MOA Promote Filipino TourismDocument3 pagesKatha & Stilts MOA Promote Filipino TourismPatricia RodriguezNo ratings yet

- DEED OF SALE OF MOTOR VEHICLE - Mistubishi Lancer GLXDocument1 pageDEED OF SALE OF MOTOR VEHICLE - Mistubishi Lancer GLXSanchez Roman VictorNo ratings yet

- The Difference Between Daily Rate and Monthly Rate EmployeesDocument9 pagesThe Difference Between Daily Rate and Monthly Rate EmployeesJun AspacioNo ratings yet

- Acknowledgement ReceiptDocument1 pageAcknowledgement ReceiptFeEdithOronico100% (1)

- Affidavit of ConsentDocument3 pagesAffidavit of ConsentOtenciano Mautganon100% (1)

- Acknowledment ReceiptDocument1 pageAcknowledment ReceiptLei AdapNo ratings yet

- Shinyu CatalogDocument2 pagesShinyu CatalogCrescendo Solusi TamaNo ratings yet

- China Banking Corporation Bir E-Fps Payment Manual: May 2011 V 6.0Document48 pagesChina Banking Corporation Bir E-Fps Payment Manual: May 2011 V 6.0KyonNo ratings yet

- CenomarDocument2 pagesCenomartoscanini2008100% (1)

- Secretary-Certificate LetterDocument2 pagesSecretary-Certificate Letterteresa bautistaNo ratings yet

- Memorandum - Vehicle StickerDocument4 pagesMemorandum - Vehicle StickerFernan EnadNo ratings yet

- Wage Order No. 18, Regional IIIDocument6 pagesWage Order No. 18, Regional IIIBalboa JapeNo ratings yet

- SBMA ID Application FormDocument1 pageSBMA ID Application Formzab04148114No ratings yet

- Application Letter MarinaDocument1 pageApplication Letter MarinaAileen Labastida BarcenasNo ratings yet

- Indemnity Agreement TemplateDocument2 pagesIndemnity Agreement TemplateCynthiaNo ratings yet

- Affidavit of Consent and Support SHDocument1 pageAffidavit of Consent and Support SHmendiguarinNo ratings yet

- Lease Contract for Sari-Sari StoreDocument2 pagesLease Contract for Sari-Sari StoreJilian Kate Alpapara Bustamante100% (1)

- Transaction SlipDocument2 pagesTransaction SlipSIMPLEJG88% (8)

- Contract To SellDocument5 pagesContract To SellMarkJoven LagramaNo ratings yet

- Affidavit of Loss Title ReplacementDocument2 pagesAffidavit of Loss Title ReplacementIza Marie P. Castillo-EspirituNo ratings yet

- Grab Authorisation LetterDocument1 pageGrab Authorisation Letterjoehary zakariaNo ratings yet

- J'NER Cepada Construction Site Inspection AffidavitDocument1 pageJ'NER Cepada Construction Site Inspection AffidavitWam OwnNo ratings yet

- Affidavit Income SourcesDocument6 pagesAffidavit Income SourcesAnonymous VgZb91pL100% (2)

- Affidavit of Loss ID SampleDocument1 pageAffidavit of Loss ID SampleAlexandra Nicole Manigos BaringNo ratings yet

- Income DeclarationDocument1 pageIncome DeclarationPetrovich100% (1)

- WeAccess Enrollment and Maintenance Agreement Form - 2022Document11 pagesWeAccess Enrollment and Maintenance Agreement Form - 2022lailalyn222No ratings yet

- 310019326-Affidavit-Of-Loss-Sim-Card - FLORIBELL F. DUMAODocument1 page310019326-Affidavit-Of-Loss-Sim-Card - FLORIBELL F. DUMAORJ BanquerigoNo ratings yet

- Affidavit of No RentDocument1 pageAffidavit of No RentEnrryson SebastianNo ratings yet

- Deed of Absolute Sale Vehicle: Isuzu Cargo Truck 8PA1-810502F SFW442-6209593 MVT-246 Color: BlueDocument1 pageDeed of Absolute Sale Vehicle: Isuzu Cargo Truck 8PA1-810502F SFW442-6209593 MVT-246 Color: BlueMenchu G. MabanNo ratings yet

- CONDITONAL DEED of SALE Template (With Rent-To-own) FormattedDocument3 pagesCONDITONAL DEED of SALE Template (With Rent-To-own) FormattedRogelio CaratingNo ratings yet

- Mora, Rheneir - Coi Asian 1.5mDocument5 pagesMora, Rheneir - Coi Asian 1.5mRheneir MoraNo ratings yet

- New Travel Master Brochure JAN 2021 COVIDDocument2 pagesNew Travel Master Brochure JAN 2021 COVIDBruno BorisNo ratings yet

- Travel Is Coming Home With Memories, Not Worries.: World Traveller Care TakafulDocument12 pagesTravel Is Coming Home With Memories, Not Worries.: World Traveller Care TakafulAnonymousNo ratings yet

- Philsat Practice Booklet v1Document60 pagesPhilsat Practice Booklet v1Hudson CustodioNo ratings yet

- Philippine Law School Admission Test Practice ItemsDocument18 pagesPhilippine Law School Admission Test Practice ItemsLaser84% (43)

- RecallsDocument8 pagesRecallsVANESSANo ratings yet

- Questionnaires For Professional Drivers License Applicants (Heavy Vehicles) ReviewerDocument22 pagesQuestionnaires For Professional Drivers License Applicants (Heavy Vehicles) ReviewerW MoralesNo ratings yet

- Explosion Box Card PDFDocument5 pagesExplosion Box Card PDFVANESSANo ratings yet

- Criminal Code September-2014 (Draft)Document27 pagesCriminal Code September-2014 (Draft)Charles MJNo ratings yet

- Phil History of LawDocument9 pagesPhil History of LawNicky Jonna Parumog PitallanoNo ratings yet

- Revised Penal Code (Title II) PDFDocument12 pagesRevised Penal Code (Title II) PDFisamokerNo ratings yet

- Clinical Chemistry: Key PointsDocument1 pageClinical Chemistry: Key PointsVANESSANo ratings yet

- RBC&WBC AbnormalitiesDocument10 pagesRBC&WBC AbnormalitiesDeomicah SolanoNo ratings yet

- Quick Review Cards For Medical Laboratory Science - Polansky, Valerie DietzDocument619 pagesQuick Review Cards For Medical Laboratory Science - Polansky, Valerie DietzIslam92% (86)

- SGLGB ImplementationDocument47 pagesSGLGB ImplementationDILG Maragondon CaviteNo ratings yet

- W.C. Hicks Appliances: Client Name SKU Item Name Delivery Price Total DueDocument2 pagesW.C. Hicks Appliances: Client Name SKU Item Name Delivery Price Total DueParth PatelNo ratings yet

- MSDS - SYCAMORE Spray PaintDocument6 pagesMSDS - SYCAMORE Spray PaintBatanNo ratings yet

- Tugas Kelompok Pend.b.asing 3Document5 pagesTugas Kelompok Pend.b.asing 3Akun YoutubeNo ratings yet

- Jagirdari SystemDocument10 pagesJagirdari Systemdevang guptaNo ratings yet

- System Integration and Architecture - P2Document24 pagesSystem Integration and Architecture - P2percival fernandezNo ratings yet

- My Little Pony: Friendship Is Magic #14 PreviewDocument10 pagesMy Little Pony: Friendship Is Magic #14 PreviewGraphic Policy100% (3)

- Basic Terms of AccountingDocument24 pagesBasic Terms of AccountingManas Kumar Sahoo100% (1)

- STD 2 ComputerDocument12 pagesSTD 2 ComputertayyabaNo ratings yet

- Improve Your Well-Being With The Wheel Of Life ExerciseDocument2 pagesImprove Your Well-Being With The Wheel Of Life ExerciseLINA PASSIONNo ratings yet

- HI White Paper - Understanding The Effects of Selecting A Pump Performance Test Acceptance GradeDocument17 pagesHI White Paper - Understanding The Effects of Selecting A Pump Performance Test Acceptance Gradeashumishra007No ratings yet

- Advanced Storage - Window Area Dialux - ReportDocument17 pagesAdvanced Storage - Window Area Dialux - ReportAnupamaaNo ratings yet

- Chapter 4 Review QuestionsDocument5 pagesChapter 4 Review Questionschiji chzzzmeowNo ratings yet

- GEC 6 Lesson 12Document19 pagesGEC 6 Lesson 12Annie CabugNo ratings yet

- American Bar Association Standards For Criminal Justice - PrescripDocument14 pagesAmerican Bar Association Standards For Criminal Justice - PrescripWayne LundNo ratings yet

- Home ImplementationDocument7 pagesHome ImplementationiceyrosesNo ratings yet

- CV Raho 2020 PDFDocument5 pagesCV Raho 2020 PDFraholiveiraNo ratings yet

- Marc Mckinney: Current StudentDocument1 pageMarc Mckinney: Current Studentapi-534372004No ratings yet

- AU Small Finance Bank - IC - HDFC Sec-201710030810174398816Document30 pagesAU Small Finance Bank - IC - HDFC Sec-201710030810174398816Anonymous y3hYf50mTNo ratings yet

- ENGINE OVERHAUL 2.6 4cylDocument24 pagesENGINE OVERHAUL 2.6 4cylalbertoNo ratings yet

- RC21 ServiceDocument32 pagesRC21 ServiceMuhammedNo ratings yet

- The Tamil Nadu Municipal General Service Rules, 1970Document13 pagesThe Tamil Nadu Municipal General Service Rules, 1970urbangovernance99100% (1)

- 9AKK102951 ABB Supplier Qualification QuestionnaireDocument6 pages9AKK102951 ABB Supplier Qualification Questionnairesudar1477No ratings yet

- P55-3 Rvge-17 PDFDocument4 pagesP55-3 Rvge-17 PDFMARCONo ratings yet

- Datasheet Floating Roof Tanks Spill Prevention Level Switch SXRLTX A Series1 EnglishDocument4 pagesDatasheet Floating Roof Tanks Spill Prevention Level Switch SXRLTX A Series1 EnglishDylan RamasamyNo ratings yet

- Ultramount Weigh Modules: Service ManualDocument48 pagesUltramount Weigh Modules: Service ManualRicardo Vazquez SalinasNo ratings yet

- Vari-Green Motor: Start Saving NowDocument4 pagesVari-Green Motor: Start Saving NowRandy HawkinsNo ratings yet

- Fund Flow StatementDocument17 pagesFund Flow StatementPrithikaNo ratings yet

- Apple Vs SamsungDocument91 pagesApple Vs SamsungChandan Srivastava50% (2)

- Managing People and OrganisationsDocument50 pagesManaging People and OrganisationsOmkar DesaiNo ratings yet