Professional Documents

Culture Documents

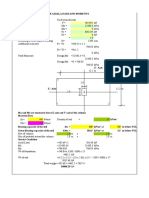

Salary Scale Calculation

Uploaded by

mrprabhu16Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Salary Scale Calculation

Uploaded by

mrprabhu16Copyright:

Available Formats

Option-1

53846

Basic to Total Ratio

1.5384615385 Basic - 65% 35000 (INPUT)

HRA - 20% 10769

CA-15% 8077

Total Salary 53846.00

Salary Scale

Total

Debits Credits Credits Per

Year

Basic Pay (65% of Gross) 35000.00

H.R.A (20% of Gross) 10769.00

C.A (15% of Gross) 8077.00

Medical Reimbursement 2917.00

P.F - 12% of Basic-Self 4200.00 50400.00

P.F - 12% of Basic- Office 4200.00 50400.00

IT 4000.00

Take Home Salary 52563.00 630756.00

Gross Salary 58046.00

Other Benefits:

L.T.A 2917.00 35004.00

Bouns - 1 Month of Salary 53846.00 53846.00

Medical/PA Insurance premi 2500.00 2500.00

Gratuity - 4.8% of Basic 1680.00 20160.00

C.T.C Per Annum 843066.00

C.T.C per Month 70256.00

Option-2

Total Salary 60000 (INPUT)

Basic - 65% 39000

HRA - 20% 12000

CA-15% 9000

Total Salary 60000.00

Salary Scale

Total

Debits Credits Credits Per

Year

Basic Pay (65% of Gross) 39000.00

H.R.A (20% of Gross) 12000.00

C.A (15% of Gross) 9000.00

Medical Reimbursement 3250.00

P.F - 12% of Basic-Self 4680.00 56160.00

P.F - 12% of Basic- Office 4680.00 56160.00

IT 5000.00

Take Home Salary 53570.00 642840.00

Gross Salary 64680.00

Other Benefits:

L.T.A 3250.00 39000.00

Bouns - 1 Month of Salary 60000.00 60000.00

Medical/PA Insurance premiu 2500.00 2500.00

Gratuity - 4.8% of Basic 1872.00 22464.00

C.T.C Per Annum 879124.0

C.T.C per Month 73260.00

You might also like

- Salary Breakup Calculator Excel 1Document2 pagesSalary Breakup Calculator Excel 1Rajinder KumarNo ratings yet

- CTC EstimationDocument3 pagesCTC EstimationVenkata Aneel InugantiNo ratings yet

- CTC Structure FEB20Document2 pagesCTC Structure FEB20Wall Street Forex (WSFx)No ratings yet

- CTC Vs NET LABOUR LAW ADVISORDocument1 pageCTC Vs NET LABOUR LAW ADVISORSiriusNo ratings yet

- Salary breakup calculator excel 2018Document3 pagesSalary breakup calculator excel 2018Babita KumariNo ratings yet

- Leave Salary Calculation For MunicipalityDocument1 pageLeave Salary Calculation For MunicipalityPranab BanerjeeNo ratings yet

- Calculate Salary, EPF and CTC in RM and SGDDocument2 pagesCalculate Salary, EPF and CTC in RM and SGDDarlene ChongNo ratings yet

- Daily costing and efficiency report for IDEPL-6 in October 2016Document74 pagesDaily costing and efficiency report for IDEPL-6 in October 2016Halari MukeshNo ratings yet

- Salary Formation: Basic HRA Allowances Tel. Expense Food All. Spl. All. Monthly Salary PF Bonus LTA Perks Gross SalaryDocument1 pageSalary Formation: Basic HRA Allowances Tel. Expense Food All. Spl. All. Monthly Salary PF Bonus LTA Perks Gross SalaryNikunj SavaniNo ratings yet

- RED-E-SET Cost JustificationDocument2 pagesRED-E-SET Cost JustificationXavier J. Aguilar GarcíaNo ratings yet

- MP 461 - F22 Inventory Working May'21Document116 pagesMP 461 - F22 Inventory Working May'21gaurav kumarNo ratings yet

- JournalEntry-2Document14 pagesJournalEntry-2Dilan Maduranga Fransisku ArachchiNo ratings yet

- CTC - Salary Slip - The Very Basic VersionDocument2 pagesCTC - Salary Slip - The Very Basic VersionAJAY KULKARNI100% (2)

- Incentive Efficiency Target Garment Dye: 15tk 15tk 15 TK 15tk 15tk 15tkDocument4 pagesIncentive Efficiency Target Garment Dye: 15tk 15tk 15 TK 15tk 15tk 15tkMazharul Islam KhondokarNo ratings yet

- Kim's Value Profit and Loss Account Notes Operating Capacity 1 2 3Document10 pagesKim's Value Profit and Loss Account Notes Operating Capacity 1 2 3sulthanhakimNo ratings yet

- Deputy Manager TCTC Cost BreakdownDocument1 pageDeputy Manager TCTC Cost BreakdownRohanNo ratings yet

- Management Accounting AssignmentDocument8 pagesManagement Accounting AssignmentAjay VatsavaiNo ratings yet

- Alpha Drives: Vendor RatingDocument10 pagesAlpha Drives: Vendor Ratingdaniel_sasikumarNo ratings yet

- Press Process Total Defect Monthly TrendDocument4 pagesPress Process Total Defect Monthly TrendNasir IbrahimNo ratings yet

- Pert Chart - Limestone Handling System: Times (In Days)Document1 pagePert Chart - Limestone Handling System: Times (In Days)user_nitsNo ratings yet

- Annex A Project: Excel World Calculation: Waste GenerationDocument4 pagesAnnex A Project: Excel World Calculation: Waste GenerationSameera LakmalNo ratings yet

- FY11 KPI Content Compliance - Amended - 22thAUG10Document2 pagesFY11 KPI Content Compliance - Amended - 22thAUG10Khairul Zahari KhalilNo ratings yet

- Vijay West KRA 22-23Document20 pagesVijay West KRA 22-23rajnibageriaNo ratings yet

- Scop IatfDocument1 pageScop IatfJeevanandhamNo ratings yet

- Qms OBJ 14-15Document19 pagesQms OBJ 14-15Anonymous pKsr5vNo ratings yet

- Excel Advanced Excel For Finance EXERCISEDocument91 pagesExcel Advanced Excel For Finance EXERCISEhaz002No ratings yet

- 2011 HR ScorecardDocument2 pages2011 HR Scorecardluna100280No ratings yet

- KRA FormatDocument1 pageKRA FormatSushil RautNo ratings yet

- Appointment Salary BreakupDocument1 pageAppointment Salary BreakupPhani KumarNo ratings yet

- Pay Slip TemplateDocument1 pagePay Slip TemplateJohn Rheymar TamayoNo ratings yet

- West Bengal Govt Leave Salary CalculationDocument13 pagesWest Bengal Govt Leave Salary CalculationGourab SarkarNo ratings yet

- Quikchex CTC CalculatorDocument8 pagesQuikchex CTC CalculatoriamgodrajeshNo ratings yet

- Build a Budget with this Monthly PlannerDocument7 pagesBuild a Budget with this Monthly Plannerkisan singhNo ratings yet

- Customer Survey Form T2m 2009Document1 pageCustomer Survey Form T2m 2009Peracha EngineeringNo ratings yet

- Annual income of Rs. 948,000 is tax exempt under new slab ratesDocument4 pagesAnnual income of Rs. 948,000 is tax exempt under new slab ratesnaman156No ratings yet

- DMW Organisation Chart 16082019Document1 pageDMW Organisation Chart 16082019Mithelesh KoulNo ratings yet

- Role: Senior Executive - Purchase & Stores Name: ChandrashekarDocument15 pagesRole: Senior Executive - Purchase & Stores Name: Chandrashekarnoorabza69661No ratings yet

- Primavera P6 Manual EditedDocument271 pagesPrimavera P6 Manual EditedCamille GNo ratings yet

- Improving Our Quality Management SystemDocument1 pageImproving Our Quality Management SystemSanjay DhawasNo ratings yet

- Monthly Installment Calculator (New)Document13 pagesMonthly Installment Calculator (New)John SmithNo ratings yet

- Daily construction progress reportDocument2 pagesDaily construction progress reportSyed Adnan AqibNo ratings yet

- Salary / CTC Calculator.Document15 pagesSalary / CTC Calculator.mitalisorthi100% (1)

- Daily Man Machine Report July'20Document6 pagesDaily Man Machine Report July'20ARIFUZZMAN ALVENo ratings yet

- Flow ChartDocument2 pagesFlow Chartshahidul0No ratings yet

- Balance Sheet: Current AssetsDocument32 pagesBalance Sheet: Current AssetsGiri ReddyNo ratings yet

- Ebsm Upgrading Project Daily Report: 30 April 2013 29 April 2013 08.00-22.00Document1 pageEbsm Upgrading Project Daily Report: 30 April 2013 29 April 2013 08.00-22.00ebsmsartNo ratings yet

- HR-L&D-Certification-GoalsDocument3 pagesHR-L&D-Certification-Goalssathish kumarNo ratings yet

- Mangement Review FormatsDocument7 pagesMangement Review FormatsAnkur DhirNo ratings yet

- PT Wijaya Karya Project ScorecardDocument5 pagesPT Wijaya Karya Project ScorecardAlekNo ratings yet

- Hec Wood Ratio Analysis Input Worksheet 2/13/2012Document6 pagesHec Wood Ratio Analysis Input Worksheet 2/13/2012Michael HakimNo ratings yet

- Job Description Form - Hero - E-4-E-5Document4 pagesJob Description Form - Hero - E-4-E-5Dev BhardwajNo ratings yet

- Company Name: Manpower Status Report For Month of June 09Document23 pagesCompany Name: Manpower Status Report For Month of June 09Shrish TiwariNo ratings yet

- 10040-2563 Payment Certificate 01Document8 pages10040-2563 Payment Certificate 01Deepak DevNo ratings yet

- Ship tank capacity and payloadDocument7 pagesShip tank capacity and payloadGita SuryaNo ratings yet

- Skill Matrix DETAILED Know Industrial EngineeringDocument4 pagesSkill Matrix DETAILED Know Industrial EngineeringHatem HusseinNo ratings yet

- Parth S Shah: Education Technical SkillsDocument1 pageParth S Shah: Education Technical SkillsParth ShahNo ratings yet

- Standard Analysis Worksheet: Performance Monitoring For Clinical Documentation Systems Using KPIDocument9 pagesStandard Analysis Worksheet: Performance Monitoring For Clinical Documentation Systems Using KPIislamNo ratings yet

- Copy of PROCESS WISE AUDIT Check SheetDocument18 pagesCopy of PROCESS WISE AUDIT Check SheetDevendra SinghNo ratings yet

- Grading:: Do Not Use A Calculator To Do ANY Calculations! Use Formulas (In Excel) For All Items Marked With An AsteriskDocument2 pagesGrading:: Do Not Use A Calculator To Do ANY Calculations! Use Formulas (In Excel) For All Items Marked With An AsteriskDeep SinghNo ratings yet

- Salary-breakup-TAMAL DEBDocument1 pageSalary-breakup-TAMAL DEBAlika DebNo ratings yet

- Galloping Ellipses CalculationsDocument1 pageGalloping Ellipses Calculationsmrprabhu16No ratings yet

- Fence Post - FDN DeignDocument2 pagesFence Post - FDN Deignmrprabhu16No ratings yet

- Bolt GradeDocument1 pageBolt Grademrprabhu16No ratings yet

- Pile Cap DesignDocument7 pagesPile Cap Designmrprabhu16No ratings yet

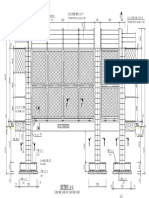

- Detail of Main GateDocument1 pageDetail of Main Gatemrprabhu16No ratings yet

- 1.0 Check For Deflection 1.1 DATADocument2 pages1.0 Check For Deflection 1.1 DATAmrprabhu16No ratings yet

- XXXXX Grid Slab - Admin BuildingDocument3 pagesXXXXX Grid Slab - Admin Buildingmrprabhu16No ratings yet

- Foundation MIX With C30Document1 pageFoundation MIX With C30mrprabhu16No ratings yet

- Wind Load On Wooden PoleDocument1 pageWind Load On Wooden Polemrprabhu16No ratings yet

- Galloping CalculationsDocument1 pageGalloping Calculationsmrprabhu16No ratings yet

- E.Sudharshan: Table and Diagram: Dimension of General Purpose ContainersDocument1 pageE.Sudharshan: Table and Diagram: Dimension of General Purpose Containersmrprabhu16No ratings yet

- GSM Antenna RotationDocument5 pagesGSM Antenna Rotationmrprabhu16No ratings yet

- Culvert Design 2Document8 pagesCulvert Design 2nsiyamNo ratings yet

- Base Plate CircularDocument8 pagesBase Plate Circularmrprabhu16No ratings yet

- Length of Jumper Conductor For Swing Calculation:: 42 DegreesDocument2 pagesLength of Jumper Conductor For Swing Calculation:: 42 Degreesmrprabhu16No ratings yet

- Conductor Spacing Adopte in Different MethodsDocument6 pagesConductor Spacing Adopte in Different Methodsmrprabhu16No ratings yet

- Design of monorail beam for main plantDocument12 pagesDesign of monorail beam for main plantmrprabhu16No ratings yet

- Category 3, Class C: Page 1 of 7Document7 pagesCategory 3, Class C: Page 1 of 7mrprabhu16No ratings yet

- Design of Eccentric Footing Subjected To Axial Force and Moment by LSDDocument12 pagesDesign of Eccentric Footing Subjected To Axial Force and Moment by LSDmrprabhu16No ratings yet

- Septic Tank CapacityDocument1 pageSeptic Tank Capacitymrprabhu16No ratings yet

- Design of SlabsDocument2 pagesDesign of SlabsHaychikkina Bull RockersNo ratings yet

- Wooden Pole FoundationDocument17 pagesWooden Pole Foundationmrprabhu16No ratings yet

- Footing Design - MonopoleDocument5 pagesFooting Design - Monopolemrprabhu16No ratings yet

- Purlin DesignDocument4 pagesPurlin Designmrprabhu16No ratings yet

- HTTP Healthmedicinet Com II 2013 3 PDFDocument246 pagesHTTP Healthmedicinet Com II 2013 3 PDFtuni santeNo ratings yet

- MSDS Crude Oil by Whiting. Rev 2013Document8 pagesMSDS Crude Oil by Whiting. Rev 2013Torero02No ratings yet

- Pva 1Document66 pagesPva 1Rizky AriansyahNo ratings yet

- Call For Papers: Innovations in Glaucoma Surgery: Improving The ResultsDocument1 pageCall For Papers: Innovations in Glaucoma Surgery: Improving The ResultsYulias YoweiNo ratings yet

- Mi̇ndfulness FarkindalikDocument19 pagesMi̇ndfulness FarkindalikBüşra GüçbaşNo ratings yet

- Cultural Competence in Health Care - EditedDocument10 pagesCultural Competence in Health Care - EditedJosphatNo ratings yet

- Teenage Depression Thesis StatementDocument7 pagesTeenage Depression Thesis Statementaimeebrowngilbert100% (2)

- Family Counselling Enhances Environmental Control of Allergic PatientsDocument6 pagesFamily Counselling Enhances Environmental Control of Allergic PatientsNinuk KurniawatiNo ratings yet

- Sample Size A Rough Guide: Ronán ConroyDocument30 pagesSample Size A Rough Guide: Ronán ConroyNaheedNo ratings yet

- Quality of Work Life With Reference To Vits CollegeDocument62 pagesQuality of Work Life With Reference To Vits CollegeAbhay JainNo ratings yet

- Ambulatory, Acute, Critical Nursing CareDocument18 pagesAmbulatory, Acute, Critical Nursing CareGeeta Thakur100% (1)

- HTM 03-01 Specialised Ventilation For Health Care PremisesDocument134 pagesHTM 03-01 Specialised Ventilation For Health Care PremisesArvish RamseebaluckNo ratings yet

- Quotation For Kitchen Hood Duct & Exhaust System at Basanti & Co.Document4 pagesQuotation For Kitchen Hood Duct & Exhaust System at Basanti & Co.james brahmaneNo ratings yet

- History of Public HealthDocument23 pagesHistory of Public HealthБакытNo ratings yet

- Infertility Caused by Jinn PDFDocument15 pagesInfertility Caused by Jinn PDFKarthik0% (1)

- Research Seminar FinalDocument15 pagesResearch Seminar FinalAmanda ScarletNo ratings yet

- Drug StudyDocument10 pagesDrug Studyjho_No ratings yet

- TASK 8 - Stanbio Glucose Oxidase MethodDocument2 pagesTASK 8 - Stanbio Glucose Oxidase MethodJ Pao Bayro - LacanilaoNo ratings yet

- Candida Ciferrii, A New Fluconazole-Resistant YeastDocument2 pagesCandida Ciferrii, A New Fluconazole-Resistant YeastAndu1991No ratings yet

- Science4 - Q2 - Mod2 - Causes and Treatment of Diseases of The Major Organs - Version3Document50 pagesScience4 - Q2 - Mod2 - Causes and Treatment of Diseases of The Major Organs - Version3Liezel BinsolNo ratings yet

- Parkinson's DiseaseDocument3 pagesParkinson's DiseaseRachelle Ann E. De FelixNo ratings yet

- Toothpaste Industry Overview in India and Rise of Close Up Gel SegmentDocument28 pagesToothpaste Industry Overview in India and Rise of Close Up Gel SegmentDzaky Ulayya100% (1)

- Hubungan Pemberian Obat Terhadap HB, Zat Besi ProteinDocument10 pagesHubungan Pemberian Obat Terhadap HB, Zat Besi ProteinFanny Aulia PratamaNo ratings yet

- PADI RDP TABLE - RDP - Table MetDocument2 pagesPADI RDP TABLE - RDP - Table MetLkjadfljk12393% (14)

- Student's PortfolioDocument6 pagesStudent's PortfolioApril Joy de LimaNo ratings yet

- Lecture 6: What Is The Difference Between 99% Quality & 6Σ Level Of Performance Six Sigma White Belt ProgramDocument12 pagesLecture 6: What Is The Difference Between 99% Quality & 6Σ Level Of Performance Six Sigma White Belt ProgramFaizurNo ratings yet

- Discuss Issues Relating To The Diagnosis and Classification of Schizophrenia. Essay For Unit 4 A Level Psychology AQA A. Typical Essay They Love To Ask Questions On.Document3 pagesDiscuss Issues Relating To The Diagnosis and Classification of Schizophrenia. Essay For Unit 4 A Level Psychology AQA A. Typical Essay They Love To Ask Questions On.moriya1012375% (4)

- Importance of Understanding Stressors Affecting Nurses' SleepDocument22 pagesImportance of Understanding Stressors Affecting Nurses' SleepJehu Rey Obrero CabañesNo ratings yet

- Social Stratification ApproachesDocument12 pagesSocial Stratification ApproachesEdgar PeninsulaNo ratings yet

- Brand Management Lesson 3Document13 pagesBrand Management Lesson 3Jhagantini PalaniveluNo ratings yet