Professional Documents

Culture Documents

Solutions:: Problem 3: Exercises 1

Uploaded by

Stephen JohnOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Solutions:: Problem 3: Exercises 1

Uploaded by

Stephen JohnCopyright:

Available Formats

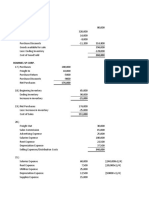

PROBLEM 3: EXERCISES

1. Solutions:

Requirement (a): Reclassification date

The reclassification date is January 1, 20x3.

Requirement (b): Journal entry on reclassification date

Date Interest received Interest income Amortization Present value

Jan. 1, 20x1 1,903,927

Dec. 31, 20x1 200,000 228,471 28,471 1,932,398

Dec. 31, 20x2 200,000 231,888 31,888 1,964,286

Dec. 31, 20x3 200,000 235,714 35,714 2,000,000

Jan. 1, 20x3 Held for trading securities 2,080,000

(2M x 104%)

Investment in bonds at

amortized cost 1,964,286

Gain on reclassification 115,714

2. Solutions:

Requirement (a):

Jan. 1, 20x3 Held for trading securities 20,000

[2M x (104% - 103%)]

Unrealized gain – P/L 20,000

Jan. 1, 20x3 Investment in bonds at amortized cost (2M x 104%)

Held for trading securities 2,080,000

2,080,000

Requirement (b):

Carrying amount (fair value) at date of reclassification 2,080,000

Face amount (2,000,000)

Difference – Premium 80,000

3. Solution:

1/1/x2

FVPL asset 6,000

Unrealized gain – P/L 6,000

Amortized cost asset 226,000

FVPL asset 226,000

4. Solutions:

Scenario (a): Amortized cost to FVPL

Jan. 1, FVPL asset 240,000

20x3 Amortized cost asset 200,000

Gain on reclassification (squeeze) 40,000

Scenario (b): FVPL to Amortized cost

Jan. 1, FVPL asset 40,000

20x3 Unrealized gain – P/L 40,000

Jan. 1, Amortized cost asset 240,000

20x3 FVPL asset 240,000

Scenario (c): Amortized cost to FVOCI (mandatory)

Jan. 1, FVOCI asset 240,000

20x3 Amortized cost asset 200,000

Gain on reclassification – OCI 40,000

Scenario (d): FVOCI (mandatory) to Amortized cost

Jan. 1, FVOCI asset 40,000

20x3 Unrealized gain – OCI 40,000

Jan. 1, Amortized cost asset (squeeze) 190,000

20x3 Unrealized gain – OCI (10K + 40K) 50,000

FVOCI asset(FV on reclassification date) 240,000

Scenario (e): FVPL to FVOCI (mandatory)

Jan. 1, FVPL asset 40,000

20x3 Unrealized gain – P/L 40,000

Jan. 1, FVOCI asset 240,000

20x3 FVPL asset 240,000

Scenario (f): FVOCI (mandatory) to FVPL

Jan. 1, FVOCI asset 40,000

20x3 Unrealized gain – OCI 40,000

Jan. 1, FVPL asset 240,000

20x3 FVOCI asset 240,000

Jan. 1, Unrealized gain – OCI 50,000

20x3 Gain on reclassification – P/L 50,000

5. Solutions:

Dec. 31, Impairment loss – P/L 9,000

20x1 Unrealized loss – OCI 21,000

Investment in bonds – FVOCI 30,000

Dec. 31, Interest receivable 30,000

20x1 Interest income 30,000

You might also like

- Business Combinations (Part 2) : Problem 1: True or FalseDocument12 pagesBusiness Combinations (Part 2) : Problem 1: True or FalseAlexanderJacobVielMartinez100% (3)

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Chap 11Document6 pagesChap 11Shiela DimaculanganNo ratings yet

- Assignment1 BonutanHMDocument4 pagesAssignment1 BonutanHMmaegantrish543No ratings yet

- SHE (Part 2) - OvilloDocument13 pagesSHE (Part 2) - OvilloMaria AngelicaNo ratings yet

- AFA IIP.L III SolutionJune 2016Document4 pagesAFA IIP.L III SolutionJune 2016HossainNo ratings yet

- Problems On Total IncomeDocument12 pagesProblems On Total IncomedipakNo ratings yet

- Tampoa Ae211 Unit 1 Assessment ProblemsDocument12 pagesTampoa Ae211 Unit 1 Assessment ProblemsJahna Kay TampoaNo ratings yet

- Chapter 17 - Depletion of Mineral ResourcesDocument3 pagesChapter 17 - Depletion of Mineral ResourcesXiena50% (2)

- Consolidated Financial Statements (Part 2) : Problem 1: Multiple Choice - TheoryDocument24 pagesConsolidated Financial Statements (Part 2) : Problem 1: Multiple Choice - TheoryKeith Alison ArellanoNo ratings yet

- ProblemDocument30 pagesProblemJenika AtanacioNo ratings yet

- (Chapter 1) Sol Man Intermediate Accounting 2 by Zeus MillanDocument8 pages(Chapter 1) Sol Man Intermediate Accounting 2 by Zeus MillanJonathan Villazon Rosales67% (3)

- CL Ka and SolutionsDocument4 pagesCL Ka and SolutionsInvisible CionNo ratings yet

- 2076 - Varias, Aizel Ann B - Module 2Document20 pages2076 - Varias, Aizel Ann B - Module 2Aizel Ann VariasNo ratings yet

- IAS 28 Sol. Man.Document27 pagesIAS 28 Sol. Man.asher phoenixNo ratings yet

- Quiz On Pension, Equity Investments - Answer KeyDocument3 pagesQuiz On Pension, Equity Investments - Answer KeyAlthea RubinNo ratings yet

- CHAPTER 12 - RR REVENUES From Contracts With Customers: Jan 02, 20x5Document13 pagesCHAPTER 12 - RR REVENUES From Contracts With Customers: Jan 02, 20x5Jane DizonNo ratings yet

- Chapter 6 ADVAC (Excel +Document43 pagesChapter 6 ADVAC (Excel +Christine Jane RamosNo ratings yet

- Solutions:: I. In-Transit ItemDocument6 pagesSolutions:: I. In-Transit ItemMary EdsylleNo ratings yet

- Chapter 6: Consolidated Financial Statements (Part 3) : Compilation of ReportsDocument43 pagesChapter 6: Consolidated Financial Statements (Part 3) : Compilation of ReportsKriz TanNo ratings yet

- Sol. Man. - Chapter 5 - Corporate Liquidation Reorganization - 2020 EditionDocument22 pagesSol. Man. - Chapter 5 - Corporate Liquidation Reorganization - 2020 Editiondianel villarico100% (1)

- Sol. Man. - Chapter 7 - Notes (Part 1)Document13 pagesSol. Man. - Chapter 7 - Notes (Part 1)natalie clyde matesNo ratings yet

- Rulona, Kerby Gail P. Bsa-3A Problem 6 1. BDocument12 pagesRulona, Kerby Gail P. Bsa-3A Problem 6 1. BCassandra KarolinaNo ratings yet

- Answer-Key-Chapter-5-BC DeJesusDocument15 pagesAnswer-Key-Chapter-5-BC DeJesusMerel Rose FloresNo ratings yet

- Chapter-14 Intermediate AccountingDocument26 pagesChapter-14 Intermediate AccountingDanica Mae GenaviaNo ratings yet

- Sol. Man. - Chapter 13 - Share Based Payments (Part 2) - 2021Document14 pagesSol. Man. - Chapter 13 - Share Based Payments (Part 2) - 2021Crystal Rose TenerifeNo ratings yet

- Answers - Chapter 1 - Current LiabilitiesDocument5 pagesAnswers - Chapter 1 - Current LiabilitiesLhica EsterasNo ratings yet

- Sol. Man. - Chapter 11 - Investments - Additional ConceptsDocument10 pagesSol. Man. - Chapter 11 - Investments - Additional ConceptsKaisser Niel Mari FormentoNo ratings yet

- Chapters 5-6 Classroom Discussion Answer KeyDocument12 pagesChapters 5-6 Classroom Discussion Answer KeyJeeramel TorresNo ratings yet

- Notes (Part 1) : Accounting Policies, Changes in Estimates and ErrorsDocument13 pagesNotes (Part 1) : Accounting Policies, Changes in Estimates and ErrorsPaula Bautista100% (2)

- Chapter 11 Equity InvestmentDocument3 pagesChapter 11 Equity InvestmentDorothy JeanneNo ratings yet

- Sol. Man. Chapter 4 Consol. Fs Part 1Document37 pagesSol. Man. Chapter 4 Consol. Fs Part 1itsmenatoy43% (7)

- Intermediate Accounting 2 Millan 221013 124345Document233 pagesIntermediate Accounting 2 Millan 221013 124345Krazy Butterfly100% (1)

- Chapter 17 - Teacher's Manual - Aa Part 2Document24 pagesChapter 17 - Teacher's Manual - Aa Part 2Mydel AvelinoNo ratings yet

- 268,800 Rommel SP CorpDocument10 pages268,800 Rommel SP CorpnovyNo ratings yet

- SOLMAN CHAPTER 14 INVESTMENTS IN ASSOCIATES - IA PART 1B - 2020edDocument27 pagesSOLMAN CHAPTER 14 INVESTMENTS IN ASSOCIATES - IA PART 1B - 2020edMeeka CalimagNo ratings yet

- Chapter 6 Employee Benefits 2Document16 pagesChapter 6 Employee Benefits 2Thalia Rhine AberteNo ratings yet

- Quizzes - Chapter 15 - Accounting For CorporationsDocument6 pagesQuizzes - Chapter 15 - Accounting For CorporationsAmie Jane Miranda100% (3)

- Sol. Man. Chapter 18 Govt Grants Ia Part 1BDocument6 pagesSol. Man. Chapter 18 Govt Grants Ia Part 1BChrismae Monteverde Santos100% (1)

- Intermediate Accounting 1 Second Grading Examination Key AnswersDocument12 pagesIntermediate Accounting 1 Second Grading Examination Key AnswersAbegail Joy De GuzmanNo ratings yet

- Accounting PoliciesDocument10 pagesAccounting PoliciesHohohoNo ratings yet

- Corporate Liquidation & Reorganization: Problem 1: True or FalseDocument20 pagesCorporate Liquidation & Reorganization: Problem 1: True or FalseRicalyn Bugarin0% (2)

- Intermediate Accounting 3 - Chap 10-12 Answer KeyDocument7 pagesIntermediate Accounting 3 - Chap 10-12 Answer KeyKrisselyn ReigneNo ratings yet

- Sol. Man. Chapter 6 Employee Benefits Part 2 2021Document24 pagesSol. Man. Chapter 6 Employee Benefits Part 2 2021Kim HanbinNo ratings yet

- Sol. Man. - Chapter 6 - Employee Benefits (Part 2) - 2021Document24 pagesSol. Man. - Chapter 6 - Employee Benefits (Part 2) - 2021Ventilacion, Jayson M.No ratings yet

- Acc108 Gen 008 p3 Questions and AnswersDocument26 pagesAcc108 Gen 008 p3 Questions and AnswersdgdeguzmanNo ratings yet

- Prime Company Lane Company: RequiredDocument8 pagesPrime Company Lane Company: RequiredSinta AnnisaNo ratings yet

- Notes To Consolidation Immediately After BusComDocument4 pagesNotes To Consolidation Immediately After BusComMelisa DomingoNo ratings yet

- Intermediate Accounting 2 Chapter 4Document2 pagesIntermediate Accounting 2 Chapter 4Miel TaggaoaNo ratings yet

- Employee Benefits (Part 2) : Problem 1: True or FalseDocument21 pagesEmployee Benefits (Part 2) : Problem 1: True or FalseChi Chi100% (1)

- Chapter 4Document36 pagesChapter 4MARRIETTE JOY ABADNo ratings yet

- Non-Profit Organizations: Problem 16-1: Multiple ChoiceDocument7 pagesNon-Profit Organizations: Problem 16-1: Multiple ChoiceKyla Ramos Diamsay100% (1)

- Adv Acc 2 Module 1 Topic 1.1Document4 pagesAdv Acc 2 Module 1 Topic 1.1James CantorneNo ratings yet

- Chapter 16 NPOsDocument8 pagesChapter 16 NPOsElvira AriolaNo ratings yet

- Chapter 18 Govt GrantsDocument6 pagesChapter 18 Govt Grantsrobinady dollaga100% (2)

- 2 Changes in Ownership InterestDocument20 pages2 Changes in Ownership InterestChristine Jane RamosNo ratings yet

- Business PlanDocument1 pageBusiness PlanStephen JohnNo ratings yet

- Payment Means Not Only Delivery of Money But Also The PerformanceDocument11 pagesPayment Means Not Only Delivery of Money But Also The PerformanceStephen JohnNo ratings yet

- Activity 1.6.2Document1 pageActivity 1.6.2Stephen JohnNo ratings yet

- Mangaon Tah Dine-In Resaturant: Misamis UniversityDocument1 pageMangaon Tah Dine-In Resaturant: Misamis UniversityStephen JohnNo ratings yet

- M09 TodaroSmith013934 11 Econ C09Document26 pagesM09 TodaroSmith013934 11 Econ C09Stephen JohnNo ratings yet

- Business PlanDocument9 pagesBusiness PlanStephen John80% (5)

- Bank AsiaDocument19 pagesBank Asiaতোফায়েল আহমেদNo ratings yet

- PAC All CAF Subjects Mocks With Solutions Regards Saboor AhmadDocument164 pagesPAC All CAF Subjects Mocks With Solutions Regards Saboor AhmadTajammal CheemaNo ratings yet

- Act ch01 l02 EnglishDocument3 pagesAct ch01 l02 EnglishLinds RiveraNo ratings yet

- Umesh Bajaj REPORT1Document63 pagesUmesh Bajaj REPORT1Harapalsinh DarabarNo ratings yet

- m2.2f Diy MCQ Answer KeyDocument6 pagesm2.2f Diy MCQ Answer KeyaapNo ratings yet

- Custom Account Statement TPR 04!10!2019Document3 pagesCustom Account Statement TPR 04!10!2019sudhir kumar sharmaNo ratings yet

- Mobile Banking Adoption and Benefits Towards Customers ServiceDocument6 pagesMobile Banking Adoption and Benefits Towards Customers Servicemanojmis2010No ratings yet

- Simex Intl. Inc. vs. CADocument3 pagesSimex Intl. Inc. vs. CAZen DanielNo ratings yet

- 1557126657969Document10 pages1557126657969Pankaj AkadkarNo ratings yet

- Initial Investment: General Journal Ref Debit Credit Date Account Titles & ExplanationDocument5 pagesInitial Investment: General Journal Ref Debit Credit Date Account Titles & ExplanationG02 BANDELARIA ChristellNo ratings yet

- EUtvt QPZ 3 C183 A 5 SDocument3 pagesEUtvt QPZ 3 C183 A 5 SSyed100% (1)

- Vietnam FSADocument28 pagesVietnam FSAHungreo411No ratings yet

- Chapter 3 Financial Statements and Ratio Analysis: Principles of Managerial Finance, Brief, 7e (Gitman)Document75 pagesChapter 3 Financial Statements and Ratio Analysis: Principles of Managerial Finance, Brief, 7e (Gitman)El jokerNo ratings yet

- Module 6 - Asset-Based ValuationDocument42 pagesModule 6 - Asset-Based Valuationnatalie clyde matesNo ratings yet

- Financial Products To Individuals, Businesses, andDocument2 pagesFinancial Products To Individuals, Businesses, andJane PadillaNo ratings yet

- PPB - Module A Unit 3 Retail Banking, Wholesale Banking.Document17 pagesPPB - Module A Unit 3 Retail Banking, Wholesale Banking.kamalray75_188704880No ratings yet

- 6 Powerful Telephone ScriptsDocument23 pages6 Powerful Telephone ScriptsStephen WilliamsNo ratings yet

- Performance Analysis of Commercial Banks in The Kingdom of Bahrain (2001-2015)Document10 pagesPerformance Analysis of Commercial Banks in The Kingdom of Bahrain (2001-2015)FahimNo ratings yet

- Insurance in Construction Projects CATEGORIES PART IDocument2 pagesInsurance in Construction Projects CATEGORIES PART IAbdul Rahman Sabra100% (2)

- Week - 5 Proof of Cash FinalDocument26 pagesWeek - 5 Proof of Cash FinalChengg JainarNo ratings yet

- Riba in Meezan BankDocument53 pagesRiba in Meezan BankMuhammad ShabbirNo ratings yet

- ExchangerateDocument23 pagesExchangerateAutumn FlowNo ratings yet

- Globetelecominc Financial Statement AnalysisDocument26 pagesGlobetelecominc Financial Statement AnalysisHinata UmazakiNo ratings yet

- Bahria University Bahria University: Allied Bank Limited Allied Bank LimitedDocument1 pageBahria University Bahria University: Allied Bank Limited Allied Bank LimitedHamza Bin TahirNo ratings yet

- Lobrigas Unit3 Topic2 AssessmentDocument6 pagesLobrigas Unit3 Topic2 AssessmentClaudine LobrigasNo ratings yet

- Case 3 - Group 5, Section 2Document8 pagesCase 3 - Group 5, Section 2sd_tataNo ratings yet

- Icici Lombard Mh!49966Document3 pagesIcici Lombard Mh!49966suresh sivadasanNo ratings yet

- 01Document2 pages01Javier AnDres MoRenoNo ratings yet

- Accounting 12 Week 10 & 11Document33 pagesAccounting 12 Week 10 & 11cecilia capiliNo ratings yet

- Debt Recovery Management of SBIDocument12 pagesDebt Recovery Management of SBIDipanjan DasNo ratings yet