Professional Documents

Culture Documents

Background of The Study

Background of The Study

Uploaded by

Djomar RabangOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Background of The Study

Background of The Study

Uploaded by

Djomar RabangCopyright:

Available Formats

BACKGROUND OF THE STUDY

MY INTERNAL ‘FARMER’S ALMANAC’ warn me that there could be cash flow problems

soon,” said Sarah Clare, the manager of Dinner Bell Hotel (DBH), a Michigan resort. (The Farmer’s

Almanac is a periodical famous for its long‐range weather predictions and astronomical data, as well

as humor, trivia, and personal advice.) Sarah continued: “We need to know now what the likely

situation will be. I think I’d better redo the forecast.” Two months ago (in early January 2011), Sarah

and her financial staff had prepared a cash flow forecast for the period July 2011 to March 2012. July

through early November is the busiest times for the hotel. Summer and fall guests enjoy the

atmosphere of an old‐fashioned resort with large meals, farm animals, a petting zoo, nature walks,

bicycling and hiking trails, fishing, tennis courts, a lake for swimming and boating, and a nine‐hole

golf course. The phrase “dinner bell” dates back about two centuries, when people who lived and

worked on vast tracts of land as ranchers or farmers needed a way to be called to dinner. The hotel

continues that tradition by ringing a bell to announce mealtime. The weather gets too cold by early

November for most outdoor activities, so the hotel built an indoor pool and developed long theme

weekends like classic movies, card tournaments, and supervised child and teen amusements. It is not

unusual for the hotel to run cash deficits during most, if not all, of the months between November

and April, and about break-even in May and June. However, the cash surplus generated during the

peak period, from July through November, is typically sufficient to meet the shortfall. This is what

Sarah had predicted would occur when she had made the cash budget projection for July onward.

STATEMENT OF THE PROBLEM

What are the possible ways to come up to the shortfall?

ALTERNATIVE COURSES OF ACTION

Factoring of receivables if there’s instances receivables occur

Bank borrowings to maintain liquidity of their Total Current Assets

Stretching or deferring of payables must exist for them to look for the working capital and

used it as a part of their financial solutions.

Conclusion

Hence, it ends into cash budgeting method, it seems that in that way almost like a business

cycle which maturity and shortfall always exist. No matter how we try to avoid that we have to

manage it well. We come up to the forecasted sales and manage cash of the company to eliminate

the possibility of losing liquidity. I made it clear that supposing there is shortfall on cash we used to

stretch our payables into the supplier to lessen the cash outflow.

You might also like

- Dinner-Bell-Hotel FinalDocument2 pagesDinner-Bell-Hotel FinalDjomar Rabang100% (2)

- Application Problem Week 2Document3 pagesApplication Problem Week 2Aram BebekianNo ratings yet

- 015-003 TwoFacesAlbertAshwood Final FinalDocument11 pages015-003 TwoFacesAlbertAshwood Final FinalPaolo GodoyNo ratings yet

- Make Your Move: Change the Way You Look At Your Business and Increase Your Bottom LineFrom EverandMake Your Move: Change the Way You Look At Your Business and Increase Your Bottom LineNo ratings yet

- Resorts Customer SatisfactionDocument26 pagesResorts Customer SatisfactionAlyanna ArazaNo ratings yet

- Lit 1 Midterm PDFDocument62 pagesLit 1 Midterm PDFJacob CarniceNo ratings yet

- MICE Guide (Meetings Incentives Conventions Events) Philippines 2013Document18 pagesMICE Guide (Meetings Incentives Conventions Events) Philippines 2013Amy MossNo ratings yet

- Personal Finances: Presented byDocument6 pagesPersonal Finances: Presented byCAMILANo ratings yet

- Essay 1Document7 pagesEssay 1antoNo ratings yet

- Marketing Plan For Ras El BarDocument30 pagesMarketing Plan For Ras El BarYara AzizNo ratings yet

- Discussion Opportunity - Chapter 13Document4 pagesDiscussion Opportunity - Chapter 13Mai El RihanyNo ratings yet

- Aryo Kusumo Rahadyan - V1422009 - UTS - Akuntansi BDocument1 pageAryo Kusumo Rahadyan - V1422009 - UTS - Akuntansi BAryo RahadyanNo ratings yet

- Financial Fluctuations : The Heartbeat of Your Money MattersFrom EverandFinancial Fluctuations : The Heartbeat of Your Money MattersNo ratings yet

- The Secret Language of Money SummaryDocument6 pagesThe Secret Language of Money Summarycoachersland100% (1)

- Thinking Slow When Life's Changing Fast: Financial Planning in Times of TransitionFrom EverandThinking Slow When Life's Changing Fast: Financial Planning in Times of TransitionNo ratings yet

- Perfect Balance: How to Get Ahead Financially and Still Have a LifeFrom EverandPerfect Balance: How to Get Ahead Financially and Still Have a LifeNo ratings yet

- Lesson 2 Planning With Personal Financial Statements 29956Document59 pagesLesson 2 Planning With Personal Financial Statements 29956Antonette HugoNo ratings yet

- Kevin Byun's Q1 2010 Denali Investors LetterDocument9 pagesKevin Byun's Q1 2010 Denali Investors LetterThe Manual of IdeasNo ratings yet

- 3 Muskateers VoyagerDocument40 pages3 Muskateers VoyagerNathanNo ratings yet

- Final Case Study The Island View Hotel and ResortDocument8 pagesFinal Case Study The Island View Hotel and ResortSimon LiangNo ratings yet

- Case Study OneDocument2 pagesCase Study Onenikhil yadavNo ratings yet

- Don't Be Too SmartDocument2 pagesDon't Be Too SmartSam PellettieriNo ratings yet

- Grow MoneyDocument81 pagesGrow MoneybeingviswaNo ratings yet

- HRM Opening Case - Seaside HotelDocument2 pagesHRM Opening Case - Seaside Hotelmpunit999No ratings yet

- Life Skills: in This IssueDocument6 pagesLife Skills: in This IssueDebra ForandNo ratings yet

- Types of AccommodationDocument3 pagesTypes of AccommodationYushiuki LanzNo ratings yet

- Lecture 1 Case Study Sea Side HotelDocument2 pagesLecture 1 Case Study Sea Side HotelAnh LeNo ratings yet

- MODULE 2 SVV Personal Cash Flow Statement StudentDocument6 pagesMODULE 2 SVV Personal Cash Flow Statement StudentJessica RosalesNo ratings yet

- 2016 7 IceCap Global Market OutlookDocument21 pages2016 7 IceCap Global Market OutlookZerohedgeNo ratings yet

- Departures From September 2011 - December 2012Document52 pagesDepartures From September 2011 - December 2012Jonas DewitteNo ratings yet

- Newsletter Dec 2009 LFS LTD CP Vol 1 Iss 1Document4 pagesNewsletter Dec 2009 LFS LTD CP Vol 1 Iss 1gmigukNo ratings yet

- Contextualized Learning Material - Ermt AntonioDocument8 pagesContextualized Learning Material - Ermt AntonioFrancis Dubla RafalNo ratings yet

- Business Events News For Mon 11 May 2015 - Port Douglas, Aloft For Sydney, Cathay Pacific Corroboree, Banyan Tree and MoreDocument2 pagesBusiness Events News For Mon 11 May 2015 - Port Douglas, Aloft For Sydney, Cathay Pacific Corroboree, Banyan Tree and MoreBusiness Events NewsNo ratings yet

- Practical Steps To Develop Personal Financial LiteracyDocument12 pagesPractical Steps To Develop Personal Financial Literacyalexander cacho0% (1)

- Business Plan (Like Home Hotel) .FinalDocument10 pagesBusiness Plan (Like Home Hotel) .FinalRonie BagainNo ratings yet

- Credit CreationDocument28 pagesCredit Creationdranita@yahoo.comNo ratings yet

- December Family Connection NewsletterDocument5 pagesDecember Family Connection NewsletterFfsc Fort WorthNo ratings yet

- Business Events News: Fairfax in Events TalksDocument4 pagesBusiness Events News: Fairfax in Events TalksBusiness Events NewsNo ratings yet

- Kumpulan Soal Bhasa InggrisDocument11 pagesKumpulan Soal Bhasa InggrisAnindya GitaNo ratings yet

- Bed and Breakfast InnDocument16 pagesBed and Breakfast InnilocanaNo ratings yet

- Officers Board of DirectorsDocument7 pagesOfficers Board of Directorsjanicewinters7760No ratings yet

- Oper ManDocument38 pagesOper ManDiane UyNo ratings yet

- NAM EbookDocument23 pagesNAM EbookTim LaneNo ratings yet

- QuizDocument46 pagesQuizcyrus navarroNo ratings yet

- Chapter 4Document44 pagesChapter 4JESS M. ARCEONo ratings yet

- Food&Beverage Director or Director of Hospitality or Hotel OperaDocument3 pagesFood&Beverage Director or Director of Hospitality or Hotel Operaapi-121326488No ratings yet

- Money WiseDocument62 pagesMoney Wisejei liNo ratings yet

- Camp Kohelet Camping Site Business PlanDocument21 pagesCamp Kohelet Camping Site Business PlanJohn IgnacioNo ratings yet

- Financial StabilityDocument5 pagesFinancial StabilityyukiNo ratings yet

- 2012 Starwood Proxy Statement & 2011 Annual ReportDocument169 pages2012 Starwood Proxy Statement & 2011 Annual ReportHuy MaiNo ratings yet

- Coping With Stress EssayDocument6 pagesCoping With Stress Essayd3h7qfpr100% (2)

- College Entrance Essay ExampleDocument8 pagesCollege Entrance Essay Exampled3gpmvqw100% (2)

- Annual Teen Film Festival Aug. 20: Residents Gather For Nature Walk and CleanupDocument16 pagesAnnual Teen Film Festival Aug. 20: Residents Gather For Nature Walk and CleanupelauwitNo ratings yet

- El Rinoceronte Alexander Scott ResumenDocument5 pagesEl Rinoceronte Alexander Scott Resumenqwaskmrmd100% (1)

- Tourism in CalambaDocument3 pagesTourism in CalambaJanelle M. JumadiaoNo ratings yet

- Resorts and Great Hotels Magazine 2005 PDFDocument456 pagesResorts and Great Hotels Magazine 2005 PDFBuliga Alexandra ElenaNo ratings yet

- Due DiligenceDocument32 pagesDue DiligenceDjomar RabangNo ratings yet

- Quiz Cap BudDocument1 pageQuiz Cap BudDjomar RabangNo ratings yet

- Org ChartDocument1 pageOrg ChartDjomar RabangNo ratings yet

- Plany LayoutDocument1 pagePlany LayoutDjomar RabangNo ratings yet

- CselDocument26 pagesCselJulian AssangeNo ratings yet

- Stelor Productions v. Silvers, Et Al - Document No. 45Document10 pagesStelor Productions v. Silvers, Et Al - Document No. 45Justia.comNo ratings yet

- Company Law Project PKDocument16 pagesCompany Law Project PKprabhat chaudharyNo ratings yet

- Garcia-Patricio Final PaperDocument25 pagesGarcia-Patricio Final PaperHeinna Alyssa GarciaNo ratings yet

- Advanced Accounting and Reporting 1713 Job Order CostingDocument2 pagesAdvanced Accounting and Reporting 1713 Job Order CostingDon CabasiNo ratings yet

- IMO Conventions 2018Document98 pagesIMO Conventions 2018Sandy NaufalNo ratings yet

- The Impact of Social Isolation and Loneliness in Later LifeDocument15 pagesThe Impact of Social Isolation and Loneliness in Later LifeMauriceNo ratings yet

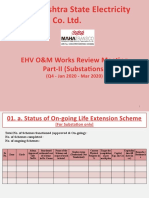

- Part-II-Substations Template - Q4Document19 pagesPart-II-Substations Template - Q4sadegaonkarNo ratings yet

- Beast of RevelationDocument27 pagesBeast of RevelationKoffi François KouadioNo ratings yet

- Lee, H. The Development of The Malta ConstitutionDocument10 pagesLee, H. The Development of The Malta ConstitutionIan MassaNo ratings yet

- PA-205 Term PaperDocument24 pagesPA-205 Term PaperVer SabornidoNo ratings yet

- Film BiografijaDocument13 pagesFilm BiografijaMirko MiricNo ratings yet

- GROUP 13 - Cultural DiversityDocument27 pagesGROUP 13 - Cultural DiversityVENTURA, ANNIE M.No ratings yet

- Housekeeping Services Ncii Self-Learning Module 1: Quarter 3Document9 pagesHousekeeping Services Ncii Self-Learning Module 1: Quarter 3lhenNo ratings yet

- Career Orientation Canvas CareerShiftDocument7 pagesCareer Orientation Canvas CareerShiftGeorgetaBadeaNo ratings yet

- 3rd Sem 1 Sub 1 Project Hydropower Economics Course OutlineDocument2 pages3rd Sem 1 Sub 1 Project Hydropower Economics Course OutlinePujan Amit GurungNo ratings yet

- Iso 17025Document14 pagesIso 17025mynameisrobbyNo ratings yet

- Anu Tandon Resignation As DirectorDocument3 pagesAnu Tandon Resignation As DirectorjaychandonkakhulasaNo ratings yet

- Uranium Mining: Managing Environmental and Health Impacts of Uranium Mining, Nea No. 7062, © IbidDocument5 pagesUranium Mining: Managing Environmental and Health Impacts of Uranium Mining, Nea No. 7062, © IbidVivek rajNo ratings yet

- ManjushriDocument2 pagesManjushrivitralak100% (2)

- International Student GuideDocument16 pagesInternational Student Guidepetrutz.marcuNo ratings yet

- TF WorkDocument11 pagesTF WorkMay Jutamanee LeangvichajalearnNo ratings yet

- M&B Switchgear PVT LTD: Survey No. 211/1, Opp. Sector C & Metalman, Industrial Area, Sanwer Road, IndoreDocument6 pagesM&B Switchgear PVT LTD: Survey No. 211/1, Opp. Sector C & Metalman, Industrial Area, Sanwer Road, Indoreokman17No ratings yet

- EniDocument14 pagesEniParth PanchalNo ratings yet

- LASUED - Undergraduate Bachelor's Degree (Full-Time) - 2023 - 2024 Application FormDocument3 pagesLASUED - Undergraduate Bachelor's Degree (Full-Time) - 2023 - 2024 Application Formadenekan707No ratings yet

- Ramos National High School: Republic of The Philippines Department of EducationDocument7 pagesRamos National High School: Republic of The Philippines Department of EducationGersom FabrosNo ratings yet

- Competitor Analysis NotesDocument11 pagesCompetitor Analysis NotesnoxaNo ratings yet

- Document C - Slave Ship DoctorDocument2 pagesDocument C - Slave Ship DoctorKiera JelleNo ratings yet