Professional Documents

Culture Documents

Case Study Assessment (Event 3 of 3) : Criteria

Uploaded by

Fiona AzgardOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case Study Assessment (Event 3 of 3) : Criteria

Uploaded by

Fiona AzgardCopyright:

Available Formats

Case Study Assessment (Event 3 of 3)

Criteria

Unit code, name and release number

BSBFIM501 Manage budgets and financial plans (1)

Qualification/Course code, name and release number

BSB51918 Diploma of Leadership and Management (3)

Student details

Student number

Learner Number: 808434440

USI: 2AYMNHFQAJ

Student name

Muhammad Yasir Kaleem

Assessment Declaration

This assessment is my original work and no part of it has been copied from any other

source except where due acknowledgement is made.

No part of this assessment has been written for me by any other person except

where such collaboration has been authorised by the assessor concerned.

I understand that plagiarism is the presentation of the work, idea or creation of

another person as though it is your own. Plagiarism occurs when the origin of the

material used is not appropriately cited. No part of this assessment is plagiarised.

Student signature and Date

Muhammad Yasir Kaleem 28/07/2020

Document title: BSBFIM501_AE_CS_3of3 Page 1 of 26

Resource ID:TBS_18_005_BSBFIM501_AE_CS_3of3 STUDENT NAME: Muhammad Yasir Kaleem

Version: 20191118

Date created: 10/08/2018

Date modified: 18/11/2019

For queries, please contact:

Technology and business Services SkillsPoint

Building B, Level G, Corner Harris Street and Mary Ann Street, Ultimo NSW 2007

Email: tbsskillspoint@tafensw.edu.au

© 2019 TAFE NSW, Sydney

RTO Provider Number 90003 | CRICOS Provider Code: 00591E

This assessment can be found in the: Learning Bank

The contents in this document is copyright © TAFE NSW 2019, and should not be reproduced without the

permission of the TAFE NSW. Information contained in this document is correct at time of printing: 31 August

2020. For current information, please refer to our website or your teacher as appropriate

Document title: BSBFIM501_AE_CS_3of3 Page 2 of 26

Resource ID:TBS_18_005_BSBFIM501_AE_CS_3of3 STUDENT NAME: Muhammad Yasir Kaleem

Assessment instructions

Table 1 Assessment instructions

Assessment details Instructions

Assessment overview The objective of this assessment is to assess your knowledge and

performance as would be required to undertake financial management

within a work team in an organisation

Assessment Event 3 of 3

number

Instructions for this This is a written assessment and it will be assessing you on your knowledge

assessment of the unit.

This assessment is in three parts:

1. Prepare a report

2. Monitor expenditure and costs

3. Prepare, implement and modify contingency plans

This assessment also contains:

Assessment feedback

Students may discuss the answers with others. However, the responses

Submission instructions

must be individually completed.

On completion of this assessment, you are required to upload it or hand it

to your trainer for marking.

If you study online, you will submit this assessment by uploading it in your

online platform.

Ensure your name is at the bottom of each page of this assessment.

It is important that you keep a copy of all electronic and hardcopy

assessments submitted to TAFE and complete the assessment declaration

when submitting the assessment.

What do I need to do to To achieve a satisfactory result for this assessment all questions must be

achieve a satisfactory answered correctly.

result? This may involve your assessor, allowing you to resubmit some of your

answers. Alternatively, your teacher/assessor may ask you additional

questions to confirm your understanding and knowledge of the topic area.

What do I need to If working off-campus, a computer with internet access to complete

provide? electronically and upload the assessment and/or pen to handwrite your

responses.

Training materials and other research you have completed to refer to while

completing the answers.

A calculator may be used.

What the assessor will Where completed on-campus, a computer with working internet to

Document title: BSBFIM501_AE_CS_3of3 Page 3 of 26

Resource ID:TBS_18_005_BSBFIM501_AE_CS_3of3 STUDENT NAME: Muhammad Yasir Kaleem

provide? complete electronically and upload the assessment.

Due date and time The assessment must be submitted by the due date noted on the Unit

allowed Assessment Guide. If you study online, you can find assessment due

dates/time allowed/venue information on your online platform on the

Assessments page or in your Training plan.

You should allow a minimum of three hours to complete this assessment.

You may need additional time for preparation, research, revision group

work and stakeholder engagement activities to ensure you have responded

to each question satisfactorily.

Supervision This is an unsupervised, out-of-class assessment.

Your assessor may ask for additional evidence to verify the authenticity of

your submission and confirm that the assessment task was completed by

you. This may include oral questioning, comparison with in-class work

samples, or observation.

Assessment feedback, In accordance with the TAFE NSW policy Manage Assessment Appeals, all

review or appeals students have the right to appeal an assessment decision in relation to

how the assessment was conducted and the outcome of the assessment.

Appeals must be lodged within 14 working days of the formal notification

of the result of the assessment.

If you would like to request a review of your results or if you have any

concerns about your results, contact your Teacher or Head Teacher. If

they are unavailable, contact the Student Administration Officer.

Contact your Head Teacher for the assessment appeals procedures at your

college/campus.

Document title: BSBFIM501_AE_CS_3of3 Page 4 of 26

Resource ID:TBS_18_005_BSBFIM501_AE_CS_3of3 STUDENT NAME: Muhammad Yasir Kaleem

Specific task instructions

The instructions and the criteria in the case study below will be used by the assessor to

determine whether you have satisfactorily completed the Case Study Scenario. Use these

instructions and criteria to ensure you demonstrate the required knowledge.

You may be required to upload an electronic version of your responses to certain questions

where you have used software such as MS Excel. If providing a printed copy, you will need to

provide two copies:

1 x final spreadsheet and

1 x final spreadsheet showing your formulas.

Make sure you insert your name and reference the question you are responding to in your

attachments.

To complete this part of the assessment, the student will be required to read the following

Case Study Scenario.

Once the student has read the information, they are required to complete their written

responses to

Part 1. Prepare a report

Part 2. Monitor expenditure and costs

Part 3. Prepare, implement and modify contingency plans

Once completed the student will need to submit this assessment to the assessor for marking.

Document title: BSBFIM501_AE_CS_3of3 Page 5 of 26

Resource ID:TBS_18_005_BSBFIM501_AE_CS_3of3 STUDENT NAME: Muhammad Yasir Kaleem

Case Study Scenario: Perfect Plants Pty Ltd

Accounting Principles and Government Legislation

Perfect Plants Pty Ltd is a mid-sized wholesale plant nursery based in the western suburbs of

Sydney. As well as their wholesale business they have a small retail operation and

propagation facility where they grow a select number of specialist varieties of orchids. The

following financial statements for 2017/18 tax year have been provided.

Perfect Plants Pty Ltd

Balance Sheet as at 30/6/18

Owner’s Equity $ $

Capital 2,766,000

Add: Net Profit 469,000

3,235,000

Less: Drawings 350,000 2,885,000

Assets

Current Assets

Cash at Bank 200,000

Debtors Control 350,000

Stock Control 550,000 1100,000

Non-Current Assets (Fixed Assets)

Premises 5,000,000

Equipment 1,000,000

Vehicles 750,000 6,750,000

Total Assets 7,850,000

Liabilities

Current Liabilities

Creditors Control 915,000

GST Clearing 50,000 965,000

Non-Current Liabilities

Loan XYZ Bank 4,000,000

Total Liabilities 4,965,000

Net Assets (Assets less Liabilities) 2,885,000

Document title: BSBFIM501_AE_CS_3of3 Page 6 of 26

Resource ID:TBS_18_005_BSBFIM501_AE_CS_3of3 STUDENT NAME: Muhammad Yasir Kaleem

Perfect Plants Pty Ltd

Cash Flow Statement for the year ended 30/6/18

Cash Flows from Operating Activities $

Retail Cash Sales 1,050,000

Receipts from Debtors 4,750,000

Interest Received 10,000

GST Collected 640,000

GST Paid (458,500)

ATO – GST Settlement (171,500)

Payments to Creditors (2,535,000)

Wages & Salaries (1,055,000)

Interest Paid (200,000)

Other Operating Expenses (985,000)

Income Tax Paid (201,000)

Total Cash Flow from Operating Activities 844,000

Cash Flow from Investing Activities

Purchase of Equipment (250,000)

Total Cash Flows from Investing Activities (250,000)

Cash Flow from Financing Activities

Drawings (120,000)

Loan Repayments (350,000)

Total Cash Flows From Financing Activities (470,000)

Net Change in Cash Position 124,000

Opening Bank Balance 76,000

Closing Bank Balance 200,000

Document title: BSBFIM501_AE_CS_3of3 Page 7 of 26

Resource ID:TBS_18_005_BSBFIM501_AE_CS_3of3 STUDENT NAME: Muhammad Yasir Kaleem

Perfect Plants Pty Ltd

Profit and Loss Statement

For the year ended 30/6/18

Revenue $ $

Retail Cash Sales 1,050,000

Wholesale Credit Sales 5,450,000

Interest Received 10,000 6,510,000

Less Cost of Sales

Cost of Goods Sold 3,200,000

Cartage Inward 150,000 3,350,000

Gross Profit 3,160,000

Less Expenses

Wages & Salaries 1,055,000

Interest Paid 200,000

Other Operating Expenses 985,000

Bad Debts 100,000

Depreciation 150,000 2,490,000

Net Profit Before Tax 670,000

Income Tax Expenses 201,000

Net Profit After Tax 469,000

Document title: BSBFIM501_AE_CS_3of3 Page 8 of 26

Resource ID:TBS_18_005_BSBFIM501_AE_CS_3of3 STUDENT NAME: Muhammad Yasir Kaleem

Part 1: Prepare a report

You are the financial manager for Perfect Plants. Use the above information to assist you in

preparing a report to your on the budgets and expenditure of Perfect Plants. You will also be

required to use the ATO website to find some of the answers. Where appropriate, provide

details of where you found your information and any calculations performed.

Your report must include:

1. An evaluation of the accounting method used and whether it is approriate

2. An evaluation of the income tax rate applied

3. The GST implications for Pefect Plants.

4. Record keeping and storing requirements

5. Collection methods of data and information used

6. An analysis of the data and information in point 5 above and the identification,

documentation and recommendations for improvements to existing financial management

processes.

Document title: BSBFIM501_AE_CS_3of3 Page 9 of 26

Resource ID:TBS_18_005_BSBFIM501_AE_CS_3of3 STUDENT NAME: Muhammad Yasir Kaleem

Part 2: Monitor expenditure and costs

You are the Sales Manager for the Wholesale Department at Perfect Plants Pty Ltd. You have

a team of nine sales people and one horticulturalist who assists in the filling of specialist

orders. You have been given the following departmental budget to follow for the 2017/18

financial year.

Wholesale Department Budget 2017/18

Credit Sales Revenue $6,000,000

Cost of Sales ($3,100,000)

Wages ($800,000)

Telephone ($50,000)

Travel ($350,000)

Office Supplies ($75,000)

Bad Debts ($150,000)

Other Operating Expenses ($125,000)

Departmental Profit $1,350,000

Due to the seasonality of your Sales Revenue, Cost of Sales and Travel Expenses are expected

to fluctuate throughout the year. In the first and fourth quarter of the financial year (Winter,

late Autumn and early Spring) you expect a 20% drop from the average. In the second

quarter, heading towards Christmas, you expect an increase of 30% and the third quarter an

increase of 10% from the average.

Question 1

Using the above information, implement a process to monitor actual expenditure and control

of costs by constructing a cyclical quarterly budget of your department using Excel.

Equation functions must be used for all calculations.

Please provide a copy of your excel worksheet and include a reference to the question

number. Alternatively attach a copy of your excel worksheet showing your final budget and a

second copy showing your formulas.

Document title: BSBFIM501_AE_CS_3of3 Page 10 of 26

Resource ID:TBS_18_005_BSBFIM501_AE_CS_3of3 STUDENT NAME: Muhammad Yasir Kaleem

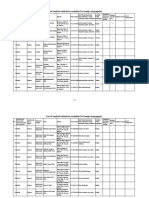

Wholesale Department Budget 2017/18

Annual Q1 Q2 Q3 Q4

Credit Sales Revenue $6,000,000 $1,200,000 $1,950,000 $1,650,000 $1,200,000

Cost of Sales -3100000 -620000 -1007500 -852500 -620000

Wages -800000 -2000000 -200000 -200000 -200000

Telephone -50000 -12500 -12500 -12500 -12500

Travel -350000 -70000 -113750 -96250 -700000

Office Supplies -75000 -18750 -18750 -18750 -18750

Bad Debts -150000 -37500 -37500 -37500 -37500

Other Operating Expenses -125000

-31250 -31250 -31250 -31250

Departmental Profit $1,350,000 $210,000 $528,750 $401,250 $210,000

Question 2

Using the excel spreadsheet you created in question 1, monitor expenditure and costs on a

cyclical basis (in this case quarterly) and update the table to include comparisons of the

budgeted figures for the first quarter to the actual figures. Identify variations and cost

overruns by adding additional columns to calculate variances and show where these variances

are favourable or unfavourable

Please provide a copy of your excel worksheet and include a reference to the question

number. Alternatively attach a copy of your excel worksheet showing your final budget and a

second copy showing your formulas.

Variance

Annual

Q1 Budgeted Actual Variance $ % F/U

Credit Sales Revenue $6,000,000 $1,200,000 $1,125,000 ($75000) 6.25% U

Cost of Sales -3100000 -620000 -581250 $38,750 6.25% F

Wages -200000 -200000 $0 0% F

Telephone -12500 -10000 $2,500 20.00% F

Travel -70000 -74200 6% U

Office Supplies -18750 -15000 $3,750 20.00% F

Bad Debts -37500 -2625 7% U

Other Operating Expenses F

-31250 $0 0%

Departmental Profit $1,350,000 $210,000 $173,125 $36,875 17.5% U

Question 3

From question 2, review the three variations; sales, cost of sales and bad debts, and answer

the following questions.

a. Identify any ‘high priority’ variation in your budgeted figures and explain why do you

think these are of a high priority? Your response should be approximately 50-100

words.

Commissions: as our sales center has the biggest sales comparing to other sales center

we have negotiated the commission with team members will be 2.5% of the sales but

the budget shows only 2 % of the sales. We need to make sure that we will give our

staff the correct commission based on our agreement before.

Document title: BSBFIM501_AE_CS_3of3 Page 11 of 26

Resource ID:TBS_18_005_BSBFIM501_AE_CS_3of3 STUDENT NAME: Muhammad Yasir Kaleem

● Sales: In Q2 the completion of repair and maintenance is already 90%. We are

supposed to get higher sales as sales for Q2 have been estimated to be $1,000,000

when the repair and maintenance reach 90% completion but only $750,000 was

recorded.

Wages: The wages in Q1, Q2, Q3, and Q4 show the same amount. The team members

in our sales center are supposed to get more wages for their hard work and untiring

efforts. It can give them motivation to improve their performance in the near future.

Gross profit: When the commissions, sales and wages fluctuate, the gross profit

fluctuates, so does the gross profit has to follow the changes.

● Store supplies: Sales in the first quarter (Q1), third quarter (Q3), and the fourth quarter

(Q4) are generally 30% less than the second quarter (Q2). It means the supplies in Q2

are supposed to be more than the other quarter but the budget shows that the cost of

goods sold in Q1, Q2, Q3, and Q4 are all the same. It is indicating that there is

something wrong with it and we have to fix it.

b. What are some possible reasons for this variation? Your response should be

approximately 50-100 words.

The 2.5% commission rate is a must for the team members as a reward for their

achievement. That’s why we have to change the percentage in our budget from 2% to

2.5%. Cutting down this rate will not be good for the morale and can have adverse effects

on the overall performance of the team, rendering their efforts not as effective for the

following quarters.

Budget for repairs and maintenance not realistic

considering need.

The budget of the repairs and maintenance in our budget is $50,000 coming down to

$12,500 each quarter but we want at least 90% of the repair and maintenance done in

quarter two. Because Sales in Q2 depend on completion of 90% of repair and maintenance.

There are two ways to make this work. First, we can put more budgets for the repair and

maintenance or we can just split $2500 for Q1 and Q2. So, for the next quarter no more

budget for the repair and maintenance as it is already 90% done and we can continue the

work in the next financial year.

Document title: BSBFIM501_AE_CS_3of3 Page 12 of 26

Resource ID:TBS_18_005_BSBFIM501_AE_CS_3of3 STUDENT NAME: Muhammad Yasir Kaleem

c. What recommendations would you make to bring the budget back under control for

the remaining quarters? Your response should be approximately 50-100 words.

As there are more projections for Sales centre A, there should be more

commissions for sales staffs. Sales center A has the biggest sales compared to

other sales center. We will give them 2.5% commission of the sales to appreciate

their hard work. It is also can motivate the staff in other sales center to improve

their performance and can start a healthy competition of doing better than the

other teams. The wages for Sales Centre A should be adjusted due to high sales

volume. We will put another $10,000 for sales center A.

d. How would you go about implementing these recommendations within your team?

Your response should be approximately 50-100 words.

● Exploring overseas options for manufacturing and new markets unaffected by

domestic downturn i.e. choosing the country with cheap labor to manufacture our

products so that we can decrease our expenses.

● Increasing sales through marketing

Strengthen our advertisement in popular media such us facebook, youtube ,

brochures, and other social media.

● Reducing wastage

Try to find the way to recycle our wastage to something useable.

● Seeking funding to finance investment put at risk by poor profits.

Investor is another option that can help our sales center with poor profit. The funding

from the investor will give us more budgets for promotion and other expenses that

we help us get access bigger markets.

e. How would these improvements be monitored? Your response should be

approximately 50-100 words.

We will be monitoring the improvements with the help of our Electronic system. Enterprise

resource planning (ERP) system should drive data gathering and analysis related to budget

Document title: BSBFIM501_AE_CS_3of3 Page 13 of 26

Resource ID:TBS_18_005_BSBFIM501_AE_CS_3of3 STUDENT NAME: Muhammad Yasir Kaleem

monitoring. Use of the ERP system allows for real time information to be readily accessible

for encumbrances and other time sensitive information as opposed to reliance on static,

stand-alone reports.

Automation. Budget monitoring data and reports will be integrated into and generated by an

our ERP system to ensure efficient use of staff time and also consistency of information.

Consistency. Off-system analysis will be consistently applied to all aspects of monitoring the

budget improvements and clearly articulated to both staff conducting the analysis and end

users.

Question 4

From your experience you estimate that 75% of Debtors would pay within the first month

from the sale, 16% within the second month, 7% within the third and 2% will be written off as

bad debts.

Your Credit Terms with your suppliers stipulate they must pay within 45 days of purchasing.

Using Excel, complete a quarterly Aged Debtors Budget for your department using the

information above as well as any required information provided in previous sections.

Equation functions must be used for all calculations.

Total Q1 Q2 Q3 Q4

Sales 6,000,000 $1,200,000 $1,950,000 $1,650,000 $1,200,000

Current

30 days 4,500,000

60 days

Bad Debts

Please provide a copy of your excel worksheet and include a reference to the question

number. OR Alternatively attach a copy of your excel worksheet showing your final budget

and a second copy showing your formulas where applicable.

Document title: BSBFIM501_AE_CS_3of3 Page 14 of 26

Resource ID:TBS_18_005_BSBFIM501_AE_CS_3of3 STUDENT NAME: Muhammad Yasir Kaleem

Question 5

The accountant from this enterprise has provided you with the following figures:

Average level of accounts receivable (debtors) $12,500

Credit sales for the year $250,000

Calculate the Debtors Ageing Ratio (Accounts receivable collection period).

Average Accounts Receivables

Debtors Ageing Ratio = ¿ X 365

Annual Sales

12500

X 365 = 18.25

250000

Debtors Ageing Ratio = 18.25

Document title: BSBFIM501_AE_CS_3of3 Page 15 of 26

Resource ID:TBS_18_005_BSBFIM501_AE_CS_3of3 STUDENT NAME: Muhammad Yasir Kaleem

Part 3: Prepare, implement, monitor and modify

contingency plans

Question 1: Preparation of contingency plans

a. Explain the process of preparing contingency plans. Your response should be

approximately 50-100 words.

Contingency Plan

Company name:

Person developing the plan:Sales Centre A Manager

Name: Position Store Manager

Risk identified: Sales fall due to economic downturn

Strategies/activities to minimize By when By whom

the risk

Q2 Sales

General

Restructuring or renegotiating

Manager

wages and team

member

Q3 Production

Manager

Diversification of product range

Q2 Sales

Exploring overseas options for

General

manufacturing and new markets Manager

unaffected by domestic

downturn

Q2 Sales

Increasing sales through

General

marketing Manager

Reducing wastage Q1 Production

Manager

Document title: BSBFIM501_AE_CS_3of3 Page 16 of 26

Resource ID:TBS_18_005_BSBFIM501_AE_CS_3of3 STUDENT NAME: Muhammad Yasir Kaleem

Contingency plan

b. Based on your review of the variations in sales and cost of sales from Part 2 question

3, prepare contingency plans to address the variations in order to maintain financial

objectives. Your response should be approximately 150 -200 words.

Table 2 Preparation of contingency plans

Variation Potential Impact Contingency Plan

Sales Due to the We should prepare to channel our energies into diverse

seasonality of your markets and increase our marketing budget in

Sales Revenue, Cost anticipation of sales slowing down so we can cushion

of Sales and Travel the hit a little. We can ask our sales teams to find new

leads and turn potential clients into loyal clients with

Expenses are

best customer service and prompt and complete

expected to fluctuate product guide.

throughout the year.

In the first and fourth We should also invest in Research and Development

quarter of the and diversify our product range to gain more access to

financial year all kinds of target market.

(Winter, late Autumn

and early Spring) you

expect a 20% drop

from the average.

Cost of sales In the second The costs can be efficiently managed if we streamline

quarter, heading the procedures and improve our projection and

towards Christmas, ordering. By doing this we can secure raw materials at

you expect an cheaper rates, negotiate with clients in time for

Christmas. We can also negotiate our contracts and

increase of 30% and

associations with couriers and delivery partners.

the third quarter an

increase of 10% from

the average.

Document title: BSBFIM501_AE_CS_3of3 Page 17 of 26

Resource ID:TBS_18_005_BSBFIM501_AE_CS_3of3 STUDENT NAME: Muhammad Yasir Kaleem

Question 2. Implementation of contingency plans

a. Explain the process of implementing contingency plans. Your response should be

approximately 50-100 words.

● restructuring or renegotiating wages

the wages based on the sales volume of the sales center

● diversification of product range

● exploring overseas options for manufacturing and new markets unaffected by

domestic downturn

choosing the country with cheap labor to manufacture our product so that we can

decrease our expenses

● increasing sales through marketing

Strengthen our advertisement in popular media such us facebook, youtube ,

brochures, and other social media.

● reducing wastage

Try to find the way to recycle our wastage to something useable.

● Seeking funding to finance investment put at risk by poor profits.

Investor is another option that can help our sales center with poor profit. The funding

from the investor will give us more budgets for promotion and other expenses that we

need to get more customer.

Document title: BSBFIM501_AE_CS_3of3 Page 18 of 26

Resource ID:TBS_18_005_BSBFIM501_AE_CS_3of3 STUDENT NAME: Muhammad Yasir Kaleem

b. Provide implementation strategies to support your contingency plans in order to

maintain financial objectives. Your response should be approximately 150 -200 words

Table 3 Implementation of contingency plans

Variation Contingency Implementation Strategy

Sales Broadening product We should invest more in R&D and increase our

range, finding different catalogue to attract new customers and keep our usual

markets and focusing on clients engaged. In these testing times, industry is

more than our core squeezed for competition and the only way to stay

products to suit all kind afloat is finding relevance with engaging range of

of clients. Cutting poor products. Finding new varieties, better looking plants,

performers and environmental friendly plants, all of these because of

introducing revolutionary

better R&D, will go a long way.

products.

Also, we can have a look at our partners, contractors

Hold onto loyal clients

and offer them exciting and use third party platforms for direct and indirect

packages to offset the marketing. For example, a building contractor in a new

projected decline in sales. building project should be encouraged to use

greeneries from us for promotion as part of negotiated

marketing.

Cost of sales Cost will be relatively We’ll try to buy in bulk and save as much. Will try to

higher since sales will get discounts as buying in large quantities helps.

sling down.

Will substitute cheaper materials and source them from

low costing areas

Will try to automate the most of the system to rely less

on human factor. It also brings efficiency and accuracy

Document title: BSBFIM501_AE_CS_3of3 Page 19 of 26

Resource ID:TBS_18_005_BSBFIM501_AE_CS_3of3 STUDENT NAME: Muhammad Yasir Kaleem

Question 3: Monitoring of contingency plans

Based on your contingency plans above, you have revised the sales and cost of sales budgets

for Quarters 2 and 3. Implement a process to monitor sales and cost of goods sold of your

department using Excel.

Equation functions must be used for all calculations.

Please provide a copy of your excel worksheet and include a reference to the question

number. Alternatively attach a copy of your excel worksheet showing your final budget and a

second copy showing your formulas.

Quarter 1

Varianc Varianc Varianc

Q1 Budgeted Q1 Actual e$ e% e %F/U

Credit Sales Revenue $1,200,000 $1,125,000 (75,000) 6.25 U

Cost of Sales $620,000 $581,250 38,750 6.25 F

Quarter 2

Varianc Varianc Varianc

Q2 Budgeted Q2 Actual e$ e% e %F/U

Credit Sales Revenue $1,150,000 $1,120, 000 (30,000) 2.61 U

Cost of Sales $590,000 $584,200 5800 0.98 F

Quarter 3

Variance Varianc Varianc

Q3 Budgeted Q3 Actual $ e% e %F/U

(100,000 8.69 U

Credit Sales Revenue

$1,150,000 $1,050,000 )

Cost of Sales $590,000 $600,000 (10,000) (1.69) U

Document title: BSBFIM501_AE_CS_3of3 Page 20 of 26

Resource ID:TBS_18_005_BSBFIM501_AE_CS_3of3 STUDENT NAME: Muhammad Yasir Kaleem

Question 4. Modification of contingency plans

a. Explain the process of monitoring of contingency plans. Your response should be

approximately 50-100 words.

To monitor the status of contingency plan, following directives can be taken into consideration;

Track the progress of activities against the schedule, for example check if planned activities, meetings

and critical milestones are occurring on time

as the schedule changes, provide the updated schedule to relevant stakeholders

Provide timely advice and guidance to the finance team and business areas

Build in quality checks, such as reviews of supporting documentation and working papers at critical

milestones

Maintain contingency plans such as using back-up and/or temporary staff, or reaching prior

agreement with staff to work overtime

Address significant issues promptly, consider their impact and implement corrective action, and

Periodically brief senior management and the audit committee regarding progress against the agreed

timetable.

b. Six months after the implementation of the contingency plan, sales at Perfect Plants

continue to decline. Modify your contingency plan to address the decline and increase

sales. Your response should be approximately 100-200 words.

Table 4 Modification of contingency plans

Contingency plan Modification to the plan

Profit for FY more than 10% less than

Minimize the rust using sprays anti- budgeted

rust, in case of bikes damaged, fix Currently no enforcement of credit

and sell it cheaper terms (customers take too long to pay

Develop strategies to increase sales back impacting on cash flow) Need to be

and training of staff in sales proactive in that regard

techniques Use parts of bikes and salvage as much

Creates policies and procedures and as we can.

Have a review of staff sales training and

enforce that they are followed

more frequent meetings

Stay ahead of credit sales

Document title: BSBFIM501_AE_CS_3of3 Page 21 of 26

Resource ID:TBS_18_005_BSBFIM501_AE_CS_3of3 STUDENT NAME: Muhammad Yasir Kaleem

Assessment Feedback

NOTE: This section must have the assessor signature and student signature to complete the feedback.

Specifc task feedback

Table 3 Assessor feedback

Satisfactory response? Y/N Feedback

Part 1 Prepare a Report that includes :

An evaluation of the accounting method

used and whether it is approriate

An evaluation of the income tax rate

applied

The GST implications for Pefect Plants

Record keeping and storing

requirements

Collection methods of data and

information used

An analysis of the data and information

in point 5 above and the identification,

documentation and recommendations

for improvements to existing financial

management processes

Part 2 Monitor expenditure and costs

Question 1

Using the above information, implement a

process to monitor actual expenditure and control

of costs by constructing a cyclical quarterly

budget of your department using Excel

Part 2 Monitor expenditure and costs

Question 2

Using the excel spreadsheet you created in

question 1, monitor expenditure and costs on a

cyclical basis (in this case quarterly) and update

the table to include comparisons of the budgeted

figures for the first quarter to the actual figures.

Identify variations and cost overruns by adding

additional columns to calculate variances and

show where these variances are favourable or

unfavourable

Part 2 Monitor expenditure and costs

Question 3

From question 2, review the three variations;

sales, cost of sales and bad debts, and answer

the following questions.

Identify any ‘high priority’ variation in your

Document title: BSBFIM501_AE_CS_3of3 Page 22 of 26

Resource ID:TBS_18_005_BSBFIM501_AE_CS_3of3 STUDENT NAME: Muhammad Yasir Kaleem

Satisfactory response? Y/N Feedback

budgeted figures and explain why do you

think these are of a high priority?

What are some possible reasons for this

variation?

What recommendations would you make to

bring the budget back under control for the

remaining quarters?

How would you go about implementing these

recommendations within your team?

How would these improvements be

monitored?

Part 3 Prepare, implemet, monitor and modify

contingency plans

Question 1:

a. Explain the process of preparing contingency

plans

b.Based on your review of the variations in

sales and cost of sales from Part 2 question

3, prepare contingency plans to address

the variations in order to maintain financial

objectives

Part 3 Prepare, implemet, monitor and modify

contingency plans

Question 2

a. Explain the process of implementing

contingency plans

b.Provide implementation strategies to support

your contingency plans in order to maintain

financial objectives

Part 3 Prepare, implemet, monitor and modify

contingency plans

Question 3:

Based on your contingency plans above, you

have revised the sales and cost of sales budgets

for Quarters 2 and 3. Implement a process to

monitor sales and cost of goods sold of your

department using Excel.

Equation functions must be used for all

calculations.

Please provide a copy of your excel worksheet

and include a reference to the question number.

Alternatively attach a copy of your excel

worksheet showing your final budget and a

second copy showing your formulas.

Document title: BSBFIM501_AE_CS_3of3 Page 23 of 26

Resource ID:TBS_18_005_BSBFIM501_AE_CS_3of3 STUDENT NAME: Muhammad Yasir Kaleem

Satisfactory response? Y/N Feedback

Part 3 Prepare, implemet, monitor and modify

contingency plans

Question 4.

a. Explain the process of monitoring of

contingency plans

b.Six months after the implementation of the

contingency plan, sales at Perfect Plants

continue to decline. Modify your

contingency plan to address the decline

and increase sales.

Document title: BSBFIM501_AE_CS_3of3 Page 24 of 26

Resource ID:TBS_18_005_BSBFIM501_AE_CS_3of3 STUDENT NAME: Muhammad Yasir Kaleem

Additional evidence for verification of assessment

Additional questions asked by assessor

Assessors may ask additional questions to clarify student understanding. List here any

additional questions that were asked during this assessment event.

Student reponses to additional questions

Record the student responses to any additional questions that were asked during this

assessment event.

Document title: BSBFIM501_AE_CS_3of3 Page 25 of 26

Resource ID:TBS_18_005_BSBFIM501_AE_CS_3of3 STUDENT NAME: Muhammad Yasir Kaleem

Overall Assessment Event Feedback

NOTE: This section must have the assessor signature and student signature to complete the

feedback except if the student submits the assessment online.

Assessment outcome

☐ Satisfactory

☐ Unsatisfactory

Assessor Feedback

☐ Has the Assessment Declaration on page 1 been signed and dated by the student?

☐ Are you assured that the evidence presented for assessment is the student’s own work?

☐ Was the assessment event successfully completed?

☐ If no, was the resubmission/re-assessment successfully completed?

☐ Was reasonable adjustment in place for this assessment event?

If yes, ensure it is detailed on the assessment document.

Comments:

Assessor name, signature and date:

Student acknowledgement of assessment outcome

Would you like to make any comments about this assessment?

Student name, signature and date

NOTE: Make sure you have written your name at the bottom of each page of your

submission before attaching the cover sheet and submitting to your assessor for marking.

Document title: BSBFIM501_AE_CS_3of3 Page 26 of 26

Resource ID:TBS_18_005_BSBFIM501_AE_CS_3of3 STUDENT NAME: Muhammad Yasir Kaleem

You might also like

- Done BSBFIM501 Assessment Tasks Workbook2Document40 pagesDone BSBFIM501 Assessment Tasks Workbook2babluanand100% (2)

- Assesment 2Document8 pagesAssesment 2star trendz0% (1)

- Student Assessment Information GuideDocument8 pagesStudent Assessment Information GuideManpreetNo ratings yet

- Manage Task 3Document5 pagesManage Task 3Umar HassanNo ratings yet

- BSBFIM501 Assessment 1Document15 pagesBSBFIM501 Assessment 1Oh Oh Oh0% (1)

- Assessment Task 1 of 2 Written Questions Assessment Task 1 of 2 Written QuestionsDocument13 pagesAssessment Task 1 of 2 Written Questions Assessment Task 1 of 2 Written QuestionsDiego GreccoNo ratings yet

- BSBFIM501 Manage Budgets and Financial Plans AssignmentDocument11 pagesBSBFIM501 Manage Budgets and Financial Plans AssignmentAryan SinglaNo ratings yet

- Final Result For This Unit: AIC-UP-BSBFIM501-V4.0 Page 1 of 17Document17 pagesFinal Result For This Unit: AIC-UP-BSBFIM501-V4.0 Page 1 of 17Samir BhandariNo ratings yet

- BSBRSK501 ASSESSEMENT Task A Ver 1.3 - 0417 Template LectureDocument35 pagesBSBRSK501 ASSESSEMENT Task A Ver 1.3 - 0417 Template LectureEricKangNo ratings yet

- Manage Personal Work Priorities: BSBWOR501Document10 pagesManage Personal Work Priorities: BSBWOR501Maika de Miguel0% (1)

- BSBCUS501-Task-3-Combined Guidance SKDocument10 pagesBSBCUS501-Task-3-Combined Guidance SKmarceloNo ratings yet

- FNSACC313 AT2 Financial Calculations SanaaDocument4 pagesFNSACC313 AT2 Financial Calculations SanaaOyunsuvd Amgalan100% (1)

- BSBMGT517 Bbqfun NewDocument24 pagesBSBMGT517 Bbqfun NewSukhdeep ChohanNo ratings yet

- Part 3 - Written Questionnaire: 494460245.docxversion 2.0 Nov 2019 1 of 2Document2 pagesPart 3 - Written Questionnaire: 494460245.docxversion 2.0 Nov 2019 1 of 2Stacy ParkerNo ratings yet

- Improve Team Performance Ways To Improve Team Performance: BSBWOR502 14Document2 pagesImprove Team Performance Ways To Improve Team Performance: BSBWOR502 14nattyNo ratings yet

- Assessment 3 - Professional Development Policy and Procedure Project-1Document3 pagesAssessment 3 - Professional Development Policy and Procedure Project-1puja dumreNo ratings yet

- Task 1 Finance ManagementDocument17 pagesTask 1 Finance Managementraj ramukNo ratings yet

- BSBCMM401 Assessment Task 1Document9 pagesBSBCMM401 Assessment Task 1alexNo ratings yet

- BSBINN601-Task 1Document5 pagesBSBINN601-Task 1Ali Butt100% (2)

- 18.11.26 Diploma BSBCRT401 Articulate Present and Debate Ideas Assessments LEGENDSDocument34 pages18.11.26 Diploma BSBCRT401 Articulate Present and Debate Ideas Assessments LEGENDSMichelle SukamtoNo ratings yet

- Assessment Submission Sheet: Final Result For This UnitDocument29 pagesAssessment Submission Sheet: Final Result For This UnitGRACENo ratings yet

- BSBFIM501A Assessment 21042015 1Document10 pagesBSBFIM501A Assessment 21042015 1Anonymous YGpyYSH0% (2)

- BSBWOR501 Manage Personal Work Priorities and Professional Development Assessment Task 2Document12 pagesBSBWOR501 Manage Personal Work Priorities and Professional Development Assessment Task 2ajayNo ratings yet

- Task01: Written Questions: Submission DetailsDocument2 pagesTask01: Written Questions: Submission DetailsXavar XanNo ratings yet

- Bsbfia401 3Document2 pagesBsbfia401 3nattyNo ratings yet

- Task 2 - Bsbcus501Document10 pagesTask 2 - Bsbcus501Phung KimNo ratings yet

- BSBFIM501 Assessment Instructions V1 1219Document10 pagesBSBFIM501 Assessment Instructions V1 1219Lucy RegaladoNo ratings yet

- SUS501 Sustainability Records PDFDocument4 pagesSUS501 Sustainability Records PDFharry100% (1)

- BSBLDR601 Student Assessment TasksDocument19 pagesBSBLDR601 Student Assessment TasksBhanu AUGMENTNo ratings yet

- BSBCUS501 Assessment Task - 1Document4 pagesBSBCUS501 Assessment Task - 1Sylvain Pgl17% (6)

- BSBFIM501Document14 pagesBSBFIM501Sukhdeep ChohanNo ratings yet

- BSBMGT605 Assessment 3Document6 pagesBSBMGT605 Assessment 3KOKOWARA VIANo ratings yet

- BSBWHS501 At3Document5 pagesBSBWHS501 At3Utpann SolutionsNo ratings yet

- BSBWOR502 Assessment - 3Document3 pagesBSBWOR502 Assessment - 3Jaskiran KaurNo ratings yet

- Task 2Document24 pagesTask 2Virender Arya100% (1)

- MGT617Document14 pagesMGT617Youtube Theater100% (2)

- BSBCMM401 - Dolph Summative Assessment Task 2Document5 pagesBSBCMM401 - Dolph Summative Assessment Task 2Carlos Rodriguez0% (1)

- PB0218025 - BSBWHS501 - Sagar - 1Document26 pagesPB0218025 - BSBWHS501 - Sagar - 1Anand Pandey100% (2)

- Student Assessment Tasks: BSBCRT401 Articulate, Present and Debate IdeasDocument9 pagesStudent Assessment Tasks: BSBCRT401 Articulate, Present and Debate IdeasSuhaib AhmedNo ratings yet

- This Study Resource Was: Assessment Task 3 - Written /oral QuestionDocument9 pagesThis Study Resource Was: Assessment Task 3 - Written /oral QuestionRomali KeerthisingheNo ratings yet

- Work Health and Safety Management System Evaluation Report BackgroundDocument3 pagesWork Health and Safety Management System Evaluation Report Backgrounde_dmsaveNo ratings yet

- Declaration: Family Name Given Name(s) Student ID Trainer's Name Class Day/timeDocument7 pagesDeclaration: Family Name Given Name(s) Student ID Trainer's Name Class Day/timestar trendzNo ratings yet

- Briefing Report TemplateDocument2 pagesBriefing Report TemplateMichelle SukamtoNo ratings yet

- Assessment - BSBFIA401Document10 pagesAssessment - BSBFIA401Sabah Khan RajaNo ratings yet

- BSBFIM501 Assessment 2 PDocument3 pagesBSBFIM501 Assessment 2 Psamra azadNo ratings yet

- Before You Begin VII Topic 1: Review Programs, Systems and Processes 1Document20 pagesBefore You Begin VII Topic 1: Review Programs, Systems and Processes 1Vaishali AroraNo ratings yet

- BSBCMM401 Assessment Guide 1Document8 pagesBSBCMM401 Assessment Guide 1Candra WijayaNo ratings yet

- BSBINM601 - Assessment Workbook-Task-2Document23 pagesBSBINM601 - Assessment Workbook-Task-2Nazakat AliNo ratings yet

- BSBSUS501 TaskDocument2 pagesBSBSUS501 TaskHamza Anees0% (1)

- N601 1Document6 pagesN601 1Arif FaisalNo ratings yet

- Business Plan - Delivers in Regional Area in NSW: Assessment Task 1 Part ADocument17 pagesBusiness Plan - Delivers in Regional Area in NSW: Assessment Task 1 Part Aayu sriikNo ratings yet

- Assesment 01-BSBHRM601Document3 pagesAssesment 01-BSBHRM601Aayush Bhattarai60% (5)

- BSBFIM501 Assessment 3 PDocument2 pagesBSBFIM501 Assessment 3 Psamra azadNo ratings yet

- 4.BSBWHS501-Ensure A Safe WorkplaceDocument28 pages4.BSBWHS501-Ensure A Safe WorkplaceYesi HandaniNo ratings yet

- Bsbadv602 Assessment Tool Task 1 and 2 - V2020 T1 1.2 2Document17 pagesBsbadv602 Assessment Tool Task 1 and 2 - V2020 T1 1.2 2Roshika Khadka0% (1)

- BSBCUS501 4 Complaint Breifing ReportDocument6 pagesBSBCUS501 4 Complaint Breifing ReportSana Rehman100% (2)

- Assessment Task One: Short Answer QuestionsDocument6 pagesAssessment Task One: Short Answer QuestionsCindy HuangNo ratings yet

- Chcprp001 Ae SK 2of3 1Document23 pagesChcprp001 Ae SK 2of3 1Rehab AdelNo ratings yet

- BSBWOR301 AE ProfessionalDocument13 pagesBSBWOR301 AE Professionalsc20600226No ratings yet

- BSBHRM614 AE Project AssessmentDocument33 pagesBSBHRM614 AE Project AssessmentpatrciaNo ratings yet

- Error Codes & Diagram DCF80-100Document247 pagesError Codes & Diagram DCF80-100Dat100% (1)

- List of Medical Institutions Available For Foreign Language(s)Document24 pagesList of Medical Institutions Available For Foreign Language(s)leithNo ratings yet

- IT2840D 3640D Copier Operation ManualDocument516 pagesIT2840D 3640D Copier Operation ManualChristopher CollinsNo ratings yet

- Affidavit of WaiverDocument1 pageAffidavit of Waivergelbert palomarNo ratings yet

- Laser Ignition ReportDocument26 pagesLaser Ignition ReportRaHul100% (2)

- LGC CasesDocument97 pagesLGC CasesJeshe BalsomoNo ratings yet

- 6-GFM Series: Main Applications DimensionsDocument2 pages6-GFM Series: Main Applications Dimensionsleslie azabacheNo ratings yet

- Fruit and Vegetable Wash TdsDocument1 pageFruit and Vegetable Wash TdsEsheshNo ratings yet

- Algebra 1 Vocab CardsDocument15 pagesAlgebra 1 Vocab Cardsjoero51No ratings yet

- Masonry: Department of EducationDocument6 pagesMasonry: Department of EducationFatima AdilNo ratings yet

- MEP Works OverviewDocument14 pagesMEP Works OverviewManoj KumarNo ratings yet

- Stochastic Frontier Analysis of Productive Efficiency in Chinas Forestry IndustryDocument9 pagesStochastic Frontier Analysis of Productive Efficiency in Chinas Forestry Industrynoemie-quinnNo ratings yet

- Casio fx-82MSDocument49 pagesCasio fx-82MSPéter GedeNo ratings yet

- Cambridge International Advanced Subsidiary and Advanced LevelDocument12 pagesCambridge International Advanced Subsidiary and Advanced Levelmehmet mutluNo ratings yet

- Adverse Event Log TemplateDocument2 pagesAdverse Event Log TemplateLore LopezNo ratings yet

- Microwave Engineering MCC121, 7.5hec, 2014: Passive DevicesDocument47 pagesMicrowave Engineering MCC121, 7.5hec, 2014: Passive DevicesBruno AlvimNo ratings yet

- Step by Step Dilr Preparation GuideDocument22 pagesStep by Step Dilr Preparation GuideVishakha TNo ratings yet

- Invoice: Buyer Information Delivery Information Transaction DetailsDocument1 pageInvoice: Buyer Information Delivery Information Transaction DetailsZarida SahdanNo ratings yet

- Technical Report Documentation PageDocument176 pagesTechnical Report Documentation Pagepacotao123No ratings yet

- Low Carb Diabetic RecipesDocument43 pagesLow Carb Diabetic RecipesDayane Sant'AnnaNo ratings yet

- Stanley Diamond Toward A Marxist AnthropologyDocument504 pagesStanley Diamond Toward A Marxist AnthropologyZachNo ratings yet

- Human Behavior in OrganizationDocument85 pagesHuman Behavior in OrganizationNeric Ico Magleo100% (1)

- Trench Infill Catalog Sheet Euro Version PDFDocument3 pagesTrench Infill Catalog Sheet Euro Version PDFricbxavierNo ratings yet

- FAC1502 Bank Reconcilliation NotesDocument22 pagesFAC1502 Bank Reconcilliation NotesMichelle Foord0% (1)

- PMP Cheat SheetDocument9 pagesPMP Cheat SheetzepededudaNo ratings yet

- TIDCP vs. Manalang-DemigilioDocument2 pagesTIDCP vs. Manalang-DemigilioDi ko alam100% (1)

- List of Ambulance Services in Rajahmundry - PythondealsDocument5 pagesList of Ambulance Services in Rajahmundry - PythondealsSRINIVASARAO JONNALANo ratings yet

- DWC Ordering InformationDocument15 pagesDWC Ordering InformationbalaNo ratings yet

- Solve A Second-Order Differential Equation Numerically - MATLAB SimulinkDocument2 pagesSolve A Second-Order Differential Equation Numerically - MATLAB Simulinkmohammedshaiban000No ratings yet

- Jungle Safari Booking Management System: Mini Project ReportDocument19 pagesJungle Safari Booking Management System: Mini Project ReportNIRAV SHAH100% (1)