Professional Documents

Culture Documents

3 Provincial Accounting Office 2

Uploaded by

Miljane PerdizoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

3 Provincial Accounting Office 2

Uploaded by

Miljane PerdizoCopyright:

Available Formats

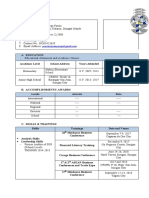

Provincial Accounting Office

MISSION

Maintain accounting records and books of accounts to be able to generate accurate

financial reports/statements of the Province of Surigao del Norte.

Prepare and submit periodic trial balance, balance sheet, statement of income and

expense statement of cash flows etc. Of all funds to the provincial auditors’s office and other

concerned agencies. And provide fair and accurate financial information to users, particularly,

creditors officials and employees, taxpayers, donors, and the public.

Install internal control system on the receipt and disbursement of funds. Thus, ensure the

effective check and balance in the receipt, disposition and utilization of funds and property.

VISION

A highly efficient and effective accounting, payroll and pre-audit office, equipped with

modern technologies, managed by united, responsible and customer friendly staff, maintaining

accounting records and book of accounts and providing transparent reports of the provincial

government financial operation and status.

A user-friendly accounting system conforming to international accounting standards

making it an efficient tool in decision – making.

MANDATE

Install and maintain both accounting and internal audit systems;

Prepare and submit financial statement to the governor and to the sanggunian

panlalawigan;

Appraise the sanggunian panlalawigan and other local government officials on the

financial condition and operation of the province;

Certify obligation of allotment;

Review the propriety and legality of claims including its supporting documents.

Maintain individual ledgers for officials and employees, subsidiary and general ledgers to

which all government transaction shall be posted;

Account for all issued request for obligation and keep reports related thereto;

Exercise such other powers and perform such duties and functions as may be provided by

law or ordinances.

FUNCTIONS

Provincial Accountant’s Office shall take charge of the both accounting and internal audit

services of the province.

To provide the management the basic information and technical data as to the financial

condition and operation of the province which may be needed in attaining its goal and

determining the policies to be adopted to enhance public services.

To stabilize pecuniary affairs of the province by the way of proper accounting for all

receipts and disbursements.

SERVICES

Administrative Support

Preparations of Plans

Management of Personnel Matters

Management of Records

Management of Office Supplies and Properties

Maintenance of Computerized Office System

Payroll and Remittance Preparation

Review of Payroll Requests

Preparation of Payrolls

Indexing of Claims and Salary Deductions to Individual Salary Cards

Preparations of NTC

Preparation of Remittances

Preparation of Replenishment Vouchers

Preparation of Salary Related Certifications

Pre-Auditing

Processing of Disbursement Vouchers and Payrolls

Processing of Liquidation Reports / Report of Disbursements

Controlling of Trust Funds

Preparation of Liquidation Reports of Trust Funds

Accounting and Bookkeeping

Preparation of Journal Entry Vouvhers

Bookkeeping

Taking-up of Liquidation Reports / Reports of Disbursements

Submission of Financial Reports

Preparation of Blank Reconciliation Statement

Submission of Transaction Documents of COA

Preparation/Sending Demand Letters for Cash Advances

You might also like

- Introduction To Government AccountingDocument34 pagesIntroduction To Government AccountingAnnamae Teoxon100% (1)

- Common Practices in Business OrganizationsDocument6 pagesCommon Practices in Business OrganizationssNo ratings yet

- Bank Reconciliation Statement (BRS) Questions PDFDocument11 pagesBank Reconciliation Statement (BRS) Questions PDFAjitesh anandNo ratings yet

- Government Accounting Chapter 4Document34 pagesGovernment Accounting Chapter 4Joan May Peralta100% (2)

- Selena Burke: ResumeDocument3 pagesSelena Burke: ResumeSelena BurkeNo ratings yet

- QuestionDocument45 pagesQuestiondawoodNo ratings yet

- Mastering Bookkeeping: Unveiling the Key to Financial SuccessFrom EverandMastering Bookkeeping: Unveiling the Key to Financial SuccessNo ratings yet

- Abhishek GuptaDocument3 pagesAbhishek Guptadr_shaikhfaisalNo ratings yet

- ABE Level 4 - Introduction To AccountingDocument410 pagesABE Level 4 - Introduction To AccountingIamThe Boss67% (3)

- Government Accounting ReportDocument48 pagesGovernment Accounting ReportReina Regina S. CamusNo ratings yet

- Removal/Qualifying ExaminationDocument12 pagesRemoval/Qualifying ExaminationMiljane PerdizoNo ratings yet

- Troy Company restructuring costsDocument4 pagesTroy Company restructuring costsMiljane Perdizo67% (3)

- Module For AccountingDocument46 pagesModule For AccountingJhefz KhurtzNo ratings yet

- Audit Programme for Trade PayablesDocument5 pagesAudit Programme for Trade PayablesMiljane PerdizoNo ratings yet

- Audit Programme for Trade PayablesDocument5 pagesAudit Programme for Trade PayablesMiljane PerdizoNo ratings yet

- Reyna ResumeDocument6 pagesReyna ResumeReyna Luz EspesoNo ratings yet

- Introduction to the LGU Accounting OfficeDocument5 pagesIntroduction to the LGU Accounting Office渡辺正平No ratings yet

- The Workplace: Mission StatementDocument8 pagesThe Workplace: Mission StatementLiane DegenerszNo ratings yet

- REVAT HI A/P MARIAPPEN'S Administrative and Accounting ProfileDocument5 pagesREVAT HI A/P MARIAPPEN'S Administrative and Accounting ProfileTNNS ENGINEERINGNo ratings yet

- Resume For Accounts DepartmentDocument5 pagesResume For Accounts DepartmentYubaraj BhattacharyaNo ratings yet

- Job Description of AccountantDocument1 pageJob Description of AccountantJohn WebbNo ratings yet

- CV CMusirike PDFDocument5 pagesCV CMusirike PDFDamulira HakimNo ratings yet

- Copyofellencuevas Ebanksresume 2016Document5 pagesCopyofellencuevas Ebanksresume 2016api-341413699No ratings yet

- ACCA Taxation & FinanceDocument2 pagesACCA Taxation & Financetalent.house1985No ratings yet

- Personal StatementDocument3 pagesPersonal StatementEstherNalubegaNo ratings yet

- Aplication and CVDocument5 pagesAplication and CVGlad MbaleNo ratings yet

- CV Muammar Binudin, DUBAIDocument6 pagesCV Muammar Binudin, DUBAINasir AhmedNo ratings yet

- Himanshu - Draft v0Document2 pagesHimanshu - Draft v0Praddy BrookNo ratings yet

- 407 Misc.-1Document28 pages407 Misc.-1rabababinayshaNo ratings yet

- Revan Zurub-ResumeDocument2 pagesRevan Zurub-Resumesokolov.vsapNo ratings yet

- Resume SabelDocument9 pagesResume SabelMark Anthony AlquizaNo ratings yet

- Voucher Coordinator Job DescriptionDocument3 pagesVoucher Coordinator Job DescriptioniftikharhassanNo ratings yet

- Booking of Expenses To Correct Account HeadDocument2 pagesBooking of Expenses To Correct Account HeadVinay SinghNo ratings yet

- 001 Government AccountingDocument75 pages001 Government AccountingMark Brian Parantar100% (1)

- PalashDocument1 pagePalashkamrul hasanNo ratings yet

- Nature of Government AccountingDocument16 pagesNature of Government AccountingLJ AggabaoNo ratings yet

- County Finance ManualDocument124 pagesCounty Finance ManualchristyNo ratings yet

- Badminton Court ProjectDocument5 pagesBadminton Court ProjectPrince GeraldNo ratings yet

- Senior Accounts/Audit & Taxation Professional: Chetan KhambhaytaDocument3 pagesSenior Accounts/Audit & Taxation Professional: Chetan Khambhaytalala habibiNo ratings yet

- Aqeel Asghar: Senior Financial AccountantDocument4 pagesAqeel Asghar: Senior Financial AccountantM Akhtar MehtabNo ratings yet

- Office of The Chief Controller of Accounts: Eq ( Ys (KK Fu A KD DK DK KzyDocument3 pagesOffice of The Chief Controller of Accounts: Eq ( Ys (KK Fu A KD DK DK KzyRavin ChetalNo ratings yet

- Chithra AjayDocument2 pagesChithra Ajay1053akashNo ratings yet

- Financial Expert Suchendra N. ChandanDocument4 pagesFinancial Expert Suchendra N. ChandanBhavesh PopatNo ratings yet

- Curriculum+Vitae+ Alphonse 3Document4 pagesCurriculum+Vitae+ Alphonse 3Pal D' ColloNo ratings yet

- Kwesiga Ivan CFODocument21 pagesKwesiga Ivan CFOFREDRICK MUSAWONo ratings yet

- Terryann Bodden Revised Resume November 2017Document2 pagesTerryann Bodden Revised Resume November 2017api-341396604No ratings yet

- Accounting, Finance and Auditing ProfessionalDocument3 pagesAccounting, Finance and Auditing ProfessionalmunangomaNo ratings yet

- Looking for Chartered Accountant (CA)Document2 pagesLooking for Chartered Accountant (CA)Supriya NayakNo ratings yet

- XXXXX ResumeDocument3 pagesXXXXX ResumekotisanampudiNo ratings yet

- Nicolas Jack Rikhotso Anthony: Career Summary: 9 YrsDocument6 pagesNicolas Jack Rikhotso Anthony: Career Summary: 9 YrsNicolasNo ratings yet

- Government Accounting Manual Updates PPSAS StandardsDocument22 pagesGovernment Accounting Manual Updates PPSAS StandardsAira TantoyNo ratings yet

- Charles Kibe Magua: Career Profile SummaryDocument3 pagesCharles Kibe Magua: Career Profile SummaryPeter Osundwa KitekiNo ratings yet

- Syed Wajeeh Hasan Zaidi-CVDocument4 pagesSyed Wajeeh Hasan Zaidi-CVmba2135156No ratings yet

- Arif Sukendar: Summary of QualificationsDocument4 pagesArif Sukendar: Summary of QualificationsMANAGER HRDNo ratings yet

- Muhammad Imran Mir 1983 (Updated)Document4 pagesMuhammad Imran Mir 1983 (Updated)MisbhasaeedaNo ratings yet

- NGAS: New Government Accounting SystemDocument56 pagesNGAS: New Government Accounting SystemVenianNo ratings yet

- TANGUB BRGY. AOM - HoyohoyDocument3 pagesTANGUB BRGY. AOM - HoyohoyJess KaNo ratings yet

- 01-LapulapuCity2012 Audit ReportDocument83 pages01-LapulapuCity2012 Audit ReportnelggkramNo ratings yet

- Muzafar Resume Tax SpecialistDocument3 pagesMuzafar Resume Tax Specialistmuzafar.takeyNo ratings yet

- Work Experience Watiga & Co. (S) Pte LTD: IgnatiusDocument3 pagesWork Experience Watiga & Co. (S) Pte LTD: IgnatiusankiosaNo ratings yet

- Pakistani Finance Officer ResumeDocument4 pagesPakistani Finance Officer ResumecdeekyNo ratings yet

- Bonagua: Patrick JohnDocument1 pageBonagua: Patrick JohnRivera T DariNo ratings yet

- DownloadDocument4 pagesDownloadvandana10474No ratings yet

- ResearchDocument16 pagesResearchAngel BenateroNo ratings yet

- Rahul Sharma ResumeDocument5 pagesRahul Sharma ResumeggmdywzbngNo ratings yet

- Job DescriptionsDocument4 pagesJob DescriptionsSaranya Vignesh PerumalNo ratings yet

- Ias - 2Document2 pagesIas - 2Tajammal HussainNo ratings yet

- Ricardo Dela Cruz Tax and Financial Accounting ResumeDocument2 pagesRicardo Dela Cruz Tax and Financial Accounting ResumeRic Dela CruzNo ratings yet

- Accounting for Financial AssetsDocument4 pagesAccounting for Financial AssetsMiljane PerdizoNo ratings yet

- By Watching The VideoDocument1 pageBy Watching The VideoMiljane PerdizoNo ratings yet

- Chapter 1Document10 pagesChapter 1Miljane PerdizoNo ratings yet

- Book Review of Agile and Lean Concepts For Teaching and Learning Bringing Methodologies From Industry To The ClassroomDocument4 pagesBook Review of Agile and Lean Concepts For Teaching and Learning Bringing Methodologies From Industry To The ClassroomMiljane PerdizoNo ratings yet

- Prepare A Segmented Income Statement That Differentiates Traceable Fixed Costs From Common Fixed Costs and Use It To Make DecisionsDocument6 pagesPrepare A Segmented Income Statement That Differentiates Traceable Fixed Costs From Common Fixed Costs and Use It To Make DecisionsMiljane PerdizoNo ratings yet

- Module Three Our Authentic Freedom Is Bound by Jesus' TeachingsDocument12 pagesModule Three Our Authentic Freedom Is Bound by Jesus' TeachingsMiljane PerdizoNo ratings yet

- Saint Paul University Surigao Intermediate Accounting 1 Final ExamDocument3 pagesSaint Paul University Surigao Intermediate Accounting 1 Final ExamMiljane PerdizoNo ratings yet

- Perdizo, Miljanep.Document1 pagePerdizo, Miljanep.Miljane PerdizoNo ratings yet

- How to Study Effectively and Avoid DistractionsDocument5 pagesHow to Study Effectively and Avoid DistractionsMiljane PerdizoNo ratings yet

- Module Two Our Personhood Is The Key To Christian Moral LifeDocument13 pagesModule Two Our Personhood Is The Key To Christian Moral LifeMiljane PerdizoNo ratings yet

- Pe Ass.Document1 pagePe Ass.Miljane PerdizoNo ratings yet

- Agriculture (IAS 41)Document45 pagesAgriculture (IAS 41)Miljane Perdizo100% (1)

- Accounting for Financial AssetsDocument4 pagesAccounting for Financial AssetsMiljane PerdizoNo ratings yet

- CRSHS Immersion Portfolio RubricDocument2 pagesCRSHS Immersion Portfolio RubricMiljane PerdizoNo ratings yet

- 5 Immersion Schedule and Company Ass.Document1 page5 Immersion Schedule and Company Ass.Miljane PerdizoNo ratings yet

- CRSHS Immersion Portfolio RubricDocument2 pagesCRSHS Immersion Portfolio RubricMiljane PerdizoNo ratings yet

- Sample Tally: Profile of The Participants Variables AGE SEX Strand Emotional Factor IndicatorsDocument4 pagesSample Tally: Profile of The Participants Variables AGE SEX Strand Emotional Factor IndicatorsMiljane PerdizoNo ratings yet

- Answers To Homewtest Randoork 2 Summer 2013Document21 pagesAnswers To Homewtest Randoork 2 Summer 2013Antonio IshoNo ratings yet

- Job Title Number Area of Expertise Industry or FieldDocument1 pageJob Title Number Area of Expertise Industry or FieldMiljane PerdizoNo ratings yet

- Neil Jhun P. Orozco: ObjectivesDocument1 pageNeil Jhun P. Orozco: ObjectivesMiljane PerdizoNo ratings yet

- Main FactorsDocument2 pagesMain FactorsMiljane PerdizoNo ratings yet

- Journal 2Document3 pagesJournal 2Miljane PerdizoNo ratings yet

- 7 About The TraineeDocument2 pages7 About The TraineeMiljane PerdizoNo ratings yet

- Safari - 4 Mar 2020 at 12:33 AMDocument1 pageSafari - 4 Mar 2020 at 12:33 AMMiljane PerdizoNo ratings yet

- Timeline IIADocument1 pageTimeline IIAMiljane PerdizoNo ratings yet

- Subhadeep Ghosh CVDocument2 pagesSubhadeep Ghosh CVTabishNo ratings yet

- Accountancy Class XI Chapter 1 IntroductionDocument51 pagesAccountancy Class XI Chapter 1 Introductionaman manderNo ratings yet

- Financial Accounting by PC TulsianDocument16 pagesFinancial Accounting by PC TulsianGeeta Univ0% (1)

- My Food Roller Flour Factory PVT - LTDDocument54 pagesMy Food Roller Flour Factory PVT - LTDSandeep Nair67% (3)

- Accounts Receivable DALDADocument29 pagesAccounts Receivable DALDAAnum ImranNo ratings yet

- Instant Download Essentials of Geology 4th Edition Marshak Test Bank PDF Full ChapterDocument32 pagesInstant Download Essentials of Geology 4th Edition Marshak Test Bank PDF Full Chaptereliasgrinzp100% (8)

- Acc 101Document24 pagesAcc 101Shyam RathiNo ratings yet

- Books of Original Entry Part 3 (Petty Cash Book)Document10 pagesBooks of Original Entry Part 3 (Petty Cash Book)Paula-Kay Thompson100% (1)

- Cash BookDocument3 pagesCash Bookxplora computersNo ratings yet

- Subsidiary Books - DPP 05 - (Aarambh 2024)Document5 pagesSubsidiary Books - DPP 05 - (Aarambh 2024)Shubh KhandelwalNo ratings yet

- Fianancial AccountingDocument298 pagesFianancial Accountingelvis page kamunanwireNo ratings yet

- 30 Ways To Learn English For AccountingDocument7 pages30 Ways To Learn English For AccountingkanahiraNo ratings yet

- 0452 w04 QP 1Document12 pages0452 w04 QP 1MahmozNo ratings yet

- For ACCO 101 - Review of Accounting Concepts and Process (Part 1)Document32 pagesFor ACCO 101 - Review of Accounting Concepts and Process (Part 1)Fionna Rei DeGaliciaNo ratings yet

- Fundamentals of Accounting using SAP B1Document80 pagesFundamentals of Accounting using SAP B1수지No ratings yet

- 2011 VUSSC Intro-AccountingDocument185 pages2011 VUSSC Intro-AccountingGodfreyFrankMwakalingaNo ratings yet

- PAC - Bank Reconciliations and Accounting Concepts TestDocument5 pagesPAC - Bank Reconciliations and Accounting Concepts TestNadir MuhammadNo ratings yet

- Chapter 2 ActivityDocument10 pagesChapter 2 ActivityBELARMINO LOUIE A.No ratings yet

- Marks Weightage of CBSE Class 11 Accountancy Syllabus Term 1Document1 pageMarks Weightage of CBSE Class 11 Accountancy Syllabus Term 1AarushNo ratings yet

- 1082 Muhasibat Aqil E.Document12 pages1082 Muhasibat Aqil E.DanielNo ratings yet

- Bookkeeping NC III Assessment Tool Part 2Document1 pageBookkeeping NC III Assessment Tool Part 2Donalyn BannagaoNo ratings yet

- Alberta Employment and Immigration (Contributors) - Assessing You - The First Step in Career Planning (Formerly The Skills Plus Handbook) PDFDocument64 pagesAlberta Employment and Immigration (Contributors) - Assessing You - The First Step in Career Planning (Formerly The Skills Plus Handbook) PDFcristian chesaNo ratings yet

- Tara-Vel Travel and Tours: Organizational ChartDocument4 pagesTara-Vel Travel and Tours: Organizational ChartArnel IgnacioNo ratings yet

- Scoil Mhuire Clane - Autumn 2011Document40 pagesScoil Mhuire Clane - Autumn 2011gerrymcgowanNo ratings yet

- JNTUA MBA R17 Syllabus PDFDocument52 pagesJNTUA MBA R17 Syllabus PDFthouseef06100% (1)