Professional Documents

Culture Documents

Appendix: Type 2014 2015 % Amount % Dist. Amount % Dist. Inc./ (Dec.)

Uploaded by

Mark Joseph Baja0 ratings0% found this document useful (0 votes)

3 views3 pages1

Original Title

Appendix

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views3 pagesAppendix: Type 2014 2015 % Amount % Dist. Amount % Dist. Inc./ (Dec.)

Uploaded by

Mark Joseph Baja1

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

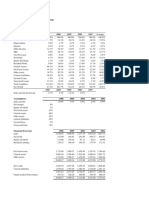

APPENDIX

Table 1. NATIONAL GOVERNMENT REVENUE COLLECTIONS, BY TYPE

CY 2014 - 2015

(In Billion Pesos)

Type 2014 2015P %

Amount % Dist. Amount % Dist. Inc./(Dec.)

NATIONAL GOVERNMENT 1,908.53 100.00% 2,116.91 100.00% 10.92%

REVENUES (I + II)

I. NATIONAL TAX REVENUES 1,718.99 90.07% 1,823.43 86.14% 6.08%

A. Direct Taxes 803.89 42.12% 864.98 40.86% 7.60%

1. Income Taxes 784.76 41.12% 846.20 39.97% 7.83%

a. Corporate income tax 455.10 23.85% 489.76 23.14% 7.62%

(1) Corporate 187.02 9.80% 206.93 9.78% 10.65%

(2) Withholding at source 268.08 14.05% 282.83 13.36% 5.50%

b. Individual income tax 283.59 14.86% 309.21 14.61% 9.03%

(1) Compensation 232.43 12.18% 252.88 11.95% 8.80%

(2) Business 38.68 2.03% 42.59 2.01% 10.11%

i. Withholding at source 23.84 1.25% 26.57 1.26% 11.46%

ii. Individual 14.84 0.78% 16.01 0.76% 7.94%

(3) Capital gains 12.48 0.65% 13.74 0.65% 10.11%

c. Others 46.07 2.41% 47.23 2.23% 2.53%

(1) Bank deposits 12.49 0.65% 14.00 0.66% 12.07%

(2) Treasury bills/bonds 33.58 1.76% 33.23 1.57% -1.02%

2. Transfer Taxes 5.45 0.29% 5.64 0.27% 3.41%

3. Other Direct Taxes 13.69 0.72% 13.14 0.62% -3.97%

a. Motor vehicle tax 11.79 0.62% 11.30 0.53% -4.12%

b. Immigration tax 0.07 0.00% 0.07 0.00% 0.00%

c. Travel tax 1.83 0.10% 1.77 0.08% -3.12%

B. Indirect Taxes 915.09 47.95% 958.45 45.28% 4.74%

1. Excise Taxes 165.74 8.68% 190.14 8.98% 14.72%

a. Domestic trade 135.32 7.09% 158.32 7.48% 17.00%

(1) Alcohol products 37.52 1.97% 42.21 1.99% 12.50%

EO 22 products*

(2) Tobacco 82.34 4.31% 99.50 4.70% 20.85%

(3) Petroleum products 9.42 0.49% 11.89 0.56% 26.21%

(4) Miscellaneous products 2.83 0.15% 2.63 0.12% -7.02%

(5) Mineral products 3.20 0.17% 2.08 0.10% -35.09%

b. Foreign trade 30.43 1.59% 31.82 1.50% 4.58%

2. License and Business Taxes 614.40 32.19% 629.19 29.72% 2.41%

a. VAT 557.91 29.23% 570.20 26.94% 2.20%

(1) Domestic trade 278.79 14.61% 295.50 13.96% 5.99%

(2) Foreign trade 279.11 14.62% 274.70 12.98% -1.58%

236 Guide to Philippine Taxes

Type 2014 2015P %

Amount % Dist. Amount % Dist. Inc./(Dec.)

b. Other business taxes 56.49 2.96 % 58.99 2.79% 4.43%

(1) Bank/Financial 25.49 1.34% 25.58 1.21% 0.34%

Institutions

(2) Insurance premiums 1.18 0.06% 1.34 0.06% 12.87%

(3) Amusement taxes 0.44 0.02% 0.55 0.03% 25.02%

(4) Other percentage taxes 29.37 1.54% 31.52 1.49% 7.33%

& Franchise tax

3. Import Duties 44.78 2.35% 56.82 2.68% 26.90%

4. Other Indirect Taxes 90.18 4.73% 82.30 3.89% -8.74%

a. Documentary stamp taxes 69.04 3.62% 72.07 3.40% 4.40%

b. Other miscellaneous taxes** 19.88 1.04% 8.73 0.41% -56.09%

c. Forest charges 0.13 0.01% 0.13 0.01% -3.76%

d. Fire code tax 1.13 0.06% 1.37 0.06% 21.26%

II. NATIONAL NON-TAX 189.54 9.93% 293.48 13.86% 54.84%

REVENUES***

Notes:

* Includes collection on tobacco inspection fees.

** Includes Tax Expenditure Fund (TEF) and revenue from administrative measures as

reported by the BOC.

*** Includes grants and Marcos wealth.

Sources of Basic Data: BIR, BOC, BTr

P - Preliminary Data

Table 2. NATIONAL GOVERNMENT TAX REVENUE COLLECTIONS,

BY AGENCY

CY 2014 – 2015

(In Billion Pesos)

Agency 2014 2015P %

Amount % Dist. Amount % Dist. Inc./(Dec.)

TOTAL 1,718.99 100.00% 1,815.48 100.00% 5.61%

Bureau of Internal Revenue 1,334.76 77.65% 1,433.30 78.95% 7.38%

Bureau of Customs 369.28 21.48% 367.53 20.24% -0.47%

Other Offices 14.95 0.87% 14.64 0.81% -2.06%

Sources of Basic Data: BIR, BOC, BTr.

P - Preliminary Data

Guide to Philippine Taxes 237

Table 3. LOCAL GOVERNMENT REVENUE COLLECTIONS, BY SOURCE

CY 2014 - 2015

(In Billion Pesos)

Source 2014 2015P %

Amount % Dist. Amount % Dist. Inc./(Dec.)

LOCAL GOVERNMENT 434.69 100.00% 581.56 100.00% 33.79%

REVENUES (I + II)

I. Local Sources 151.36 34.82% 171.64 29.51% 13.40%

A. Tax Revenue 108.22 24.90% 122.04 20.99% 12.77%

Real Property Tax 45.46 10.46% 48.86 8.40% 7.48%

Tax on Business 55.92 12.87% 65.93 11.34% 17.89%

Other Taxes 6.84 1.57% 7.25 1.25% 6.06%

B. Non-Tax Revenue 43.14 9.92% 49.60 8.53% 14.97%

II. External Sources 283.33 65.18% 409.92 70.49% 44.68%

Of which: Internal 273.38 62.89% 310.51 53.39% 13.58%

Revenue Allotment

Source of Basic Data: Local Government Audit Office Annual Report.

P - Preliminary Data

238 Guide to Philippine Taxes

You might also like

- LuxotticaDocument24 pagesLuxotticaValentina GaviriaNo ratings yet

- Fort St. John 2020 Property Tax ReportDocument5 pagesFort St. John 2020 Property Tax ReportAlaskaHighwayNewsNo ratings yet

- Sales Tax Motor Vehicle Sales/Rental Motor FuelsDocument1 pageSales Tax Motor Vehicle Sales/Rental Motor FuelsThe Dallas Morning NewsNo ratings yet

- Equity Research VRLDocument95 pagesEquity Research VRLshashlearnNo ratings yet

- Rohit Pandey-15E-064 - FSA - EnduranceDocument6 pagesRohit Pandey-15E-064 - FSA - EnduranceROHIT PANDEYNo ratings yet

- Chocolat AnalysisDocument19 pagesChocolat Analysisankitamoney1No ratings yet

- Pidilite Industries Company ValuationDocument39 pagesPidilite Industries Company ValuationKeval ShahNo ratings yet

- COR Press Release December 2021 Final EdDocument3 pagesCOR Press Release December 2021 Final EdReyzell Quiniquini BelmonteNo ratings yet

- CG Ratio-Analysis-UnsolvedDocument15 pagesCG Ratio-Analysis-Unsolvedsumit3902No ratings yet

- Government Finance 2Document7 pagesGovernment Finance 2Yohannes MulugetaNo ratings yet

- UntitledDocument16 pagesUntitledAheli ChakrabortyNo ratings yet

- Book 1Document1 pageBook 1api-324903184No ratings yet

- 1.1 Core Economic Indicators: Indicators FY 02 FY 03 FY 04 FY 05 FY 06Document4 pages1.1 Core Economic Indicators: Indicators FY 02 FY 03 FY 04 FY 05 FY 06Abu AlkhtatNo ratings yet

- Hotel Sector AnalysisDocument39 pagesHotel Sector AnalysisNishant DhakalNo ratings yet

- Pro-Poor Fiscal Policy in CambodiaDocument19 pagesPro-Poor Fiscal Policy in CambodiaLisno SetiawanNo ratings yet

- Williamstown Five-Year Revenue Projection 2010Document1 pageWilliamstown Five-Year Revenue Projection 2010iBerkshires.comNo ratings yet

- ZIMRA Q2 2022 Revenue Performance ReportDocument8 pagesZIMRA Q2 2022 Revenue Performance ReportTatenda MakurumidzeNo ratings yet

- Beginning Balance ReceiptsDocument1 pageBeginning Balance ReceiptspeejayNo ratings yet

- New Jersey Treasury Monthly Revenue Report With Snapshot-FY23MayDocument1 pageNew Jersey Treasury Monthly Revenue Report With Snapshot-FY23MayMichelle Rotuno-JohnsonNo ratings yet

- T Hi Liv S: - Ouc NG e OverDocument9 pagesT Hi Liv S: - Ouc NG e OverRavi AgarwalNo ratings yet

- Country Risk EXDocument6 pagesCountry Risk EXIfechukwu AnunobiNo ratings yet

- Colgate Estados Financieros 2021Document3 pagesColgate Estados Financieros 2021Lluvia RamosNo ratings yet

- FY23 April Revenue Report - NJ Department of The TreasuryDocument1 pageFY23 April Revenue Report - NJ Department of The TreasuryMichelle Rotuno-JohnsonNo ratings yet

- 3.1 Federal Government Revenue Receipts: ReceiptDocument57 pages3.1 Federal Government Revenue Receipts: ReceiptBisma SiddiquiNo ratings yet

- Utah Tax Commission Revenue ReportDocument7 pagesUtah Tax Commission Revenue ReportThe Salt Lake TribuneNo ratings yet

- 1Document1 page1Saray MorenoNo ratings yet

- Dollars and Sales AnalysisDocument5 pagesDollars and Sales AnalysisXimena Isela Villalpando BuenoNo ratings yet

- Ten Years Performance at A GlanceDocument1 pageTen Years Performance at A GlancerahulNo ratings yet

- 04 02 BeginDocument2 pages04 02 BeginnehaNo ratings yet

- HORIZON Analytical Procedure AppendixDocument5 pagesHORIZON Analytical Procedure AppendixWinny PoeNo ratings yet

- SBI Income Statement AnalysisDocument36 pagesSBI Income Statement AnalysisNaman KalraNo ratings yet

- Chapter-4 (English-2023)Document18 pagesChapter-4 (English-2023)Md. Abdur RakibNo ratings yet

- Tall Trees Excel SpreadsheetsDocument10 pagesTall Trees Excel SpreadsheetsangelovilladoresNo ratings yet

- Valuation: Beta and WACCDocument4 pagesValuation: Beta and WACCnityaNo ratings yet

- Major Economic Indicators of MexicoDocument2 pagesMajor Economic Indicators of MexicomeetwithsanjayNo ratings yet

- Financial Model SolvedDocument29 pagesFinancial Model SolvedSaad KhanNo ratings yet

- Butterfly AnalysisDocument5 pagesButterfly AnalysisChhavi JainNo ratings yet

- Chapter 26: Financial Planning & StrategyDocument3 pagesChapter 26: Financial Planning & StrategyMukul KadyanNo ratings yet

- Walt Disney Financial StatementDocument8 pagesWalt Disney Financial StatementShaReyNo ratings yet

- Sample Excel FileDocument60 pagesSample Excel FileFunny ManNo ratings yet

- Excel 13132110016 Final Paper Individu Fin4BDocument22 pagesExcel 13132110016 Final Paper Individu Fin4BFerian PhungkyNo ratings yet

- Marico Financial Model (Final) (Final-1Document22 pagesMarico Financial Model (Final) (Final-1Jayant JainNo ratings yet

- Maruti Suzuki: Submitted byDocument17 pagesMaruti Suzuki: Submitted byMukesh KumarNo ratings yet

- Bharat Forge Q3 FY22 ResultsDocument7 pagesBharat Forge Q3 FY22 ResultsPratik PatilNo ratings yet

- Ratio Analysis of Colgate PalmoliveDocument19 pagesRatio Analysis of Colgate Palmolivewan nur anisahNo ratings yet

- Apollo Hospitals Enterprise LimitedDocument10 pagesApollo Hospitals Enterprise LimitedHemendra GuptaNo ratings yet

- Eva GlobalDocument7 pagesEva GlobalRodrigo FedaltoNo ratings yet

- Kota Fibres, Ltd. (FIX)Document10 pagesKota Fibres, Ltd. (FIX)Aldo MadonaNo ratings yet

- Colgate Ratio Analysis WSM 2020 SolvedDocument17 pagesColgate Ratio Analysis WSM 2020 Solvedabi habudinNo ratings yet

- Mod1 How Numbers Tells The Story Words (1473)Document3 pagesMod1 How Numbers Tells The Story Words (1473)Pritam Kumar NayakNo ratings yet

- Q4 2020 Revenue PerformanceDocument11 pagesQ4 2020 Revenue PerformanceVoiture GermanNo ratings yet

- Airbus ValoDocument19 pagesAirbus ValobendidisalaheddineNo ratings yet

- Tanzania Revenue Authority Actual Revenue Collections (Quarterly) For 2008/09 by DepartmentsDocument7 pagesTanzania Revenue Authority Actual Revenue Collections (Quarterly) For 2008/09 by DepartmentsLinh LêNo ratings yet

- NationDocument1 pageNationbiawa1100% (2)

- Government of Andhra PradeshDocument13 pagesGovernment of Andhra Pradeshsanthosh kumarNo ratings yet

- KPR Phase_1Document23 pagesKPR Phase_1Satyam1771No ratings yet

- Bottom Up Unlevered BetaDocument12 pagesBottom Up Unlevered BetaUyen HoangNo ratings yet

- Entel 2Q22Document21 pagesEntel 2Q22fioreb12No ratings yet

- 2015 04 Investor Presentation 23 27Document5 pages2015 04 Investor Presentation 23 27Abhimanyu SahniNo ratings yet

- Taxation and Tax Policies in the Middle East: Butterworths Studies in International Political EconomyFrom EverandTaxation and Tax Policies in the Middle East: Butterworths Studies in International Political EconomyRating: 5 out of 5 stars5/5 (1)

- A-60 WMRDocument2 pagesA-60 WMRMark Joseph BajaNo ratings yet

- A-18 RaofeDocument1 pageA-18 RaofeMark Joseph BajaNo ratings yet

- A-50 RisDocument1 pageA-50 RisMark Joseph BajaNo ratings yet

- A-65 RaafDocument1 pageA-65 RaafMark Joseph BajaNo ratings yet

- A-08 PpelcDocument1 pageA-08 PpelcMark Joseph BajaNo ratings yet

- A 31 RgaudidDocument1 pageA 31 RgaudidMark Joseph BajaNo ratings yet

- Subsidiary Ledger (SL) : InstructionsDocument1 pageSubsidiary Ledger (SL) : InstructionsMark Joseph BajaNo ratings yet

- A-19 RancaiDocument1 pageA-19 RancaiMark Joseph BajaNo ratings yet

- A-11 IlcDocument1 pageA-11 IlcMark Joseph BajaNo ratings yet

- A-37 CDRDocument1 pageA-37 CDRMark Joseph BajaNo ratings yet

- A-02 CRJDocument1 pageA-02 CRJMark Joseph BajaNo ratings yet

- A-53 AreDocument1 pageA-53 AreMark Joseph BajaNo ratings yet

- General Ledger (GL) : InstructionsDocument1 pageGeneral Ledger (GL) : InstructionsMark Joseph BajaNo ratings yet

- A-28 RlardsDocument1 pageA-28 RlardsMark Joseph BajaNo ratings yet

- A-14 RenrepDocument1 pageA-14 RenrepMark Joseph BajaNo ratings yet

- A-16 RaomoDocument1 pageA-16 RaomoMark Joseph BajaNo ratings yet

- A-17 RaopsDocument1 pageA-17 RaopsMark Joseph BajaNo ratings yet

- A-20 RpiDocument1 pageA-20 RpiMark Joseph BajaNo ratings yet

- Itinerary of Travel (It) : InstructionsDocument1 pageItinerary of Travel (It) : InstructionsMark Joseph BajaNo ratings yet

- A-54 RCDDocument1 pageA-54 RCDMark Joseph BajaNo ratings yet

- A-05 CDJDocument1 pageA-05 CDJMark Joseph BajaNo ratings yet

- A-19 RancaiDocument1 pageA-19 RancaiMark Joseph BajaNo ratings yet

- A-10 CiplcDocument1 pageA-10 CiplcMark Joseph BajaNo ratings yet

- A-25 RlarfiDocument1 pageA-25 RlarfiMark Joseph BajaNo ratings yet

- A-55 RciDocument1 pageA-55 RciMark Joseph BajaNo ratings yet

- A-44 PCVDocument2 pagesA-44 PCVMark Joseph BajaNo ratings yet

- A-65 RaafDocument2 pagesA-65 RaafMark Joseph BajaNo ratings yet

- A-35 CRRDocument1 pageA-35 CRRMark Joseph BajaNo ratings yet

- A-22 RpisDocument1 pageA-22 RpisMark Joseph BajaNo ratings yet

- A-60 WMRDocument1 pageA-60 WMRMark Joseph BajaNo ratings yet

- Definition and Importance of Lean ManagementDocument2 pagesDefinition and Importance of Lean Managementprakhar guptaNo ratings yet

- Shree Samarth Tax InvoiceDocument3 pagesShree Samarth Tax InvoicePAVAN YADAVNo ratings yet

- Electrical Engineering Company ProfileDocument16 pagesElectrical Engineering Company ProfileBash GroupNo ratings yet

- BIR Ruling No. 010-02 - 30 Day Period For Filing of Short Period Return by Absorbed CorporationDocument4 pagesBIR Ruling No. 010-02 - 30 Day Period For Filing of Short Period Return by Absorbed Corporationliz kawiNo ratings yet

- Is the US Stock Market in a Bubble? Signs to Watch ForDocument2 pagesIs the US Stock Market in a Bubble? Signs to Watch ForLeslie LammersNo ratings yet

- Piling Works Tender For NrepDocument10 pagesPiling Works Tender For NrepPratik GuptaNo ratings yet

- Multimodal TransportDocument58 pagesMultimodal TransportAbdurahmanNo ratings yet

- Bedri Managerial Economics ExamDocument3 pagesBedri Managerial Economics ExamBedri M AhmeduNo ratings yet

- Dwnload Full Horngrens Accounting Volume 1 Canadian 10th Edition Nobles Solutions Manual PDFDocument36 pagesDwnload Full Horngrens Accounting Volume 1 Canadian 10th Edition Nobles Solutions Manual PDFduongnujl33q100% (11)

- Employee Cost AnalysisDocument9 pagesEmployee Cost AnalysisGokarakonda SandeepNo ratings yet

- A1073a1073m 6194Document4 pagesA1073a1073m 6194AFQBAVQ2EFCQF31FNo ratings yet

- MR - Economic and Financial Analysis of Planning The Menu in Aqua Caffe and Food RestaurantDocument100 pagesMR - Economic and Financial Analysis of Planning The Menu in Aqua Caffe and Food RestaurantAdhemar C. Rosas (adechoes1112)No ratings yet

- Wa0004.Document16 pagesWa0004.DEBASHISHCHATTERJE78No ratings yet

- Ramos V Peralta DigestDocument1 pageRamos V Peralta DigestJermone MuaripNo ratings yet

- Government and Corporate Social Responsibility (GCSR) Chapter 1: Strategic Public Policy Vision for CSRDocument4 pagesGovernment and Corporate Social Responsibility (GCSR) Chapter 1: Strategic Public Policy Vision for CSRLouelie Jean AlfornonNo ratings yet

- Virtual Office Services OverviewDocument3 pagesVirtual Office Services OverviewSivaraman SNo ratings yet

- CP1 Prelims 27 RetryDocument18 pagesCP1 Prelims 27 RetrySun Tea Seguin0% (2)

- Quiz 1Document8 pagesQuiz 1Lyca Mae Cubangbang67% (3)

- Product Innovation Script. DraftDocument2 pagesProduct Innovation Script. DraftHaidee Ramos EdaNo ratings yet

- Group 1 Kim Jubilee Casencia Flordeliza Nanoy Irish Cayao Erman Dave Sabuya Edrian Carejon Jelyn Paredes Jessica GajetoDocument18 pagesGroup 1 Kim Jubilee Casencia Flordeliza Nanoy Irish Cayao Erman Dave Sabuya Edrian Carejon Jelyn Paredes Jessica GajetoPrincess Di BaykingNo ratings yet

- Stryker Code of ConductDocument2 pagesStryker Code of Conductaditya permadiNo ratings yet

- DGS-2010-001 Design BasisDocument19 pagesDGS-2010-001 Design BasisJose ManjooranNo ratings yet

- Big Data AnalyticsDocument31 pagesBig Data AnalyticsTushar SawantNo ratings yet

- MAS - Runthrough NotesDocument3 pagesMAS - Runthrough NotesMae LaglivaNo ratings yet

- Reflection on Experiences and Organizational Behavior Concepts Learned this SemesterDocument6 pagesReflection on Experiences and Organizational Behavior Concepts Learned this SemesterVaneet SinglaNo ratings yet

- Cultural Difference Management, WalmartDocument6 pagesCultural Difference Management, WalmartMbugua Wa IrunguNo ratings yet

- Describing Companies and JobsDocument9 pagesDescribing Companies and JobsJuan Manuel VillarealNo ratings yet

- Ashwini A. AcharyaDocument10 pagesAshwini A. AcharyaDesh Vikas JournalNo ratings yet

- DM Using UI PathDocument3 pagesDM Using UI PathAnand GuptaNo ratings yet

- 5UOM StudyGuide PDFDocument173 pages5UOM StudyGuide PDFAfia LynchNo ratings yet