Professional Documents

Culture Documents

Chapter 26: Financial Planning & Strategy

Uploaded by

Mukul KadyanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 26: Financial Planning & Strategy

Uploaded by

Mukul KadyanCopyright:

Available Formats

Chapter 26: Financial Planning & Strategy

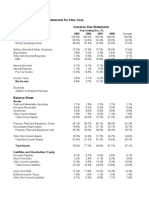

Problem 1

Bajaj Auto Ltd.

% of sales 2001 2000 1999 1998 1997 Average

Net Sales 100.0% 100.0% 100.0% 100.0% 100.0% 100.0%

PBDIT 15.7% 31.5% 30.2% 31.8% 30.4% 27.9%

Depreciation 5.9% 4.7% 4.5% 5.4% 4.5% 5.0%

Interest 0.2% 0.1% 0.2% 0.3% 0.3% 0.2%

Other Income 12.1% 16.5% 12.8% 13.5% 11.3% 13.2%

PBT 9.6% 26.7% 25.6% 26.1% 25.7% 22.7%

Tax Provision 0.9% 6.8% 7.3% 8.5% 9.0% 6.5%

Net Profit 8.7% 19.9% 18.2% 17.6% 16.7% 16.2%

Equity Dividend 2.7% 3.9% 3.2% 3.6% 3.0% 3.3%

Retained Profit 6.0% 16.0% 15.0% 13.9% 13.7% 12.9%

Current Assets 68.2% 76.8% 74.2% 68.5% 51.7% 67.9%

Net Fixed Assets 45.1% 36.1% 31.1% 25.8% 22.9% 32.2%

Other assets 39.7% 63.2% 49.3% 43.3% 37.7% 46.6%

Current Liabilities 48.8% 56.3% 51.6% 47.7% 37.5% 48.4%

Secured Loans 1.9% 3.3% 1.4% 1.0% 0.8% 1.7%

Unsecured Loans 15.1% 12.8% 10.4% 8.7% 7.3% 10.9%

Total Liabilities 153.0% 176.1% 154.6% 137.6% 112.3% 146.7%

Net Worth 87.2% 103.7% 91.2% 80.1% 66.7% 85.8%

2001 2000 1999 1998 1997

Sales growth (historical) -2.1% 4.3% 12.1% 0.2% -

Assumptions: 2006 2005 2004 2003 2002

Sales growth 10.0% 7.5% 5.0% 2.0% 0.0%

Net margin 9%

Equity dividend 3%

Net fixed assets 45%

Current assets 68%

Other assets 45%

Current liabilities 49%

Secured loan 2%

Unsecured loan 15%

Financial Forecasts 2006 2005 2004 2003 2002

Sales 3,828.65 3,480.59 3,237.76 3,083.58 3,023.12

Net profit 333.09 302.81 281.69 268.27 263.01

Equity dividend 114.86 104.42 97.13 92.51 90.69

Retained earnings 218.23 198.39 184.55 175.76 172.32

Net fixed assets 1,722.89 1,566.27 1,456.99 1,387.61 1,360.40

Current assets 2,603.48 2,366.80 2,201.68 2,096.84 2,055.72

Other assets 1,722.89 1,566.27 1,456.99 1,387.61 1,360.40

6,049.27 5,499.34 5,115.66 4,872.06 4,776.53

Net worth 3,585.79 3,367.56 3,169.16 2,984.61 2,808.85

Current liabilities 1,876.04 1,705.49 1,586.50 1,510.96 1,481.33

5,461.83 5,073.05 4,755.67 4,495.57 4,290.18

Funds needed (borrowings) 587.44 426.29 360.00 376.49 486.35

6,049.27 5,499.34 5,115.66 4,872.06 4,776.53

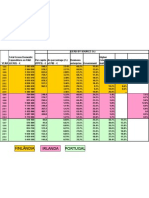

Problem 2

2001 2000 1999 1998 1997 1996 1995 Average Coeff. Var.

Net Sales 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 0.0%

Other Income 4.8% 7.3% 7.2% 4.6% 6.2% 6.4% 8.1% 6.4% 18.8%

Total Income 104.8% 107.3% 107.2% 104.6% 106.2% 106.4% 108.1% 106.4% 1.1%

PBDIT 27.2% 35.4% 38.2% 36.9% 37.8% 41.5% 41.9% 37.0% 12.3%

Depreciation 7.7% 9.5% 9.8% 8.5% 8.0% 8.0% 7.2% 8.4% 10.8%

PBIT 19.5% 25.9% 28.3% 28.4% 29.8% 33.5% 34.7% 28.6% 16.3%

Interest 5.9% 7.5% 8.4% 6.4% 3.3% 2.6% 7.2% 5.9% 34.1%

PBT 13.6% 18.4% 19.9% 21.9% 26.5% 30.9% 27.5% 22.7% 24.5%

Tax 0.7% 0.4% 0.3% 0.8% 0.9% 0.0% 0.0% 0.4% 74.5%

PAT 12.9% 17.9% 19.6% 21.1% 25.6% 30.9% 27.5% 22.2% 25.7%

Additional Information

Equity Dividend 2.2% 2.9% 4.0% 4.2% 5.8% 6.5% 5.1% 4.4% 32.8%

Preference Dividend 0.0% 0.3% 0.3% 0.1% 0.0% 0.7% 0.0% 0.2% 110.8%

Corporate Dividend Tax 0.2% 0.3% 0.5% 0.8% 0.0% 0.0% 0.0% 0.3% 106.9%

RELIANCE INDUSTRIES LTD: BALANCE SHEET AS AT 31 MARCH

(%)

2001 2000 1999 1998 1997 1996 1995

CAPITAL & LIABILITIES

Total Shareholders Funds

Equity Share Capital 5.2% 7.9% 10.7% 11.9% 8.9% 10.9% 11.8% 9.6% 23.7%

Preference Capital Paid Up 0.0% 2.2% 2.9% 2.4% 0.0% 4.7% 0.1% 1.8% 94.6%

Reserves & Surplus 67.1% 94.3% 128.6% 138.8% 155.3% 183.6% 173.9% 134.5% 28.9%

72.2% 104.4% 142.3% 153.1% 164.2% 199.2% 185.8% 145.9% 28.4%

Borrowings

Term Loans - Institutions 0.3% 1.2% 0.5% 0.7% 16.7% 9.8% 7.4% 5.2% 111.7%

Term Loans - Banks 0.0% 10.5% 17.6% 2.6% 18.4% 14.4% 4.1% 9.6% 71.9%

Non Convertible Debentures 18.4% 28.2% 41.2% 30.8% 39.0% 42.2% 32.9% 33.2% 23.5%

Working Capital Advances 1.2% 4.8% 3.8% 0.8% 8.3% 14.0% 10.5% 6.2% 73.6%

Other Loans 29.7% 41.3% 59.9% 70.4% 65.5% 31.5% 21.1% 45.6% 39.6%

Total Borrowings 49.6% 86.0% 122.9% 105.4% 147.8% 111.9% 75.9% 99.9% 30.0%

Current Liabilities & Provisions

Creditors 18.9% 22.1% 38.4% 39.5% 46.3% 30.9% 28.9% 32.1% 28.4%

Provisions 4.2% 2.0% 6.3% 6.1% 6.8% 6.7% 5.2% 5.3% 30.1%

Other 1.2% 4.8% 14.0% 7.5% 13.6% 7.7% 2.0% 7.3% 65.0%

Total Current Liabilities 24.3% 28.9% 58.7% 53.1% 66.7% 45.3% 36.1% 44.7% 32.6%

Total Liabilities 146.1% 219.2% 323.8% 311.6% 378.8% 356.5% 297.8% 290.6% 25.9%

ASSETS

Fixed assets

Gross Block 124.0% 181.6% 214.5% 228.1% 212.4% 163.2% 137.3% 180.2% 20.8%

Less: Accum. Depreciation 57.9% 68.8% 77.0% 63.2% 67.7% 50.8% 46.6% 61.7% 16.0%

Net Block 66.1% 112.8% 137.5% 164.9% 144.7% 112.5% 90.7% 118.5% 26.3%

Capital Work in Progress 2.5% 2.5% 39.5% 26.4% 71.9% 106.4% 79.4% 47.0% 79.0%

Total Fixed assets 68.6% 115.3% 177.1% 191.3% 216.6% 218.8% 170.1% 165.4% 30.8%

Investments 32.9% 45.3% 49.4% 54.7% 86.4% 46.3% 51.5% 52.4% 29.2%

Current Assets 44.6% 58.6% 97.4% 65.6% 75.8% 91.3% 76.2% 72.8% 23.3%

Total Assets 146.1% 219.2% 323.8% 311.6% 378.8% 356.5% 297.8% 290.6% 25.9%

Net sales growth 52.6% 54.1% 11.1% 51.7% 22.3% 9.0% -

Forecasts assumptions:

Sales growth 15%

Net profit margin 13%

Equity dividend 2.20%

Corporate dividend tax 0.20%

Fixed assets 69%

Investments 33%

Current assets 45%

Current liabilities 24%

2006 2005 2004 2003 2002

Net sales 41,122.72 35,758.89 31,094.68 27,038.86 23,512.05

Net profit 5,345.95 4,648.66 4,042.31 3,515.05 3,056.57

Equity dividend 904.70 786.70 684.08 594.85 517.27

Corporate dividend tax 82.25 71.52 62.19 54.08 47.02

Retained earnings 4,359.01 3,790.44 3,296.04 2,866.12 2,492.28

2006 2005 2004 2003 2002

Net fixed assets 28,374.68 24,673.63 21,455.33 18,656.81 16,223.31

Investment 13,570.50 11,800.43 10,261.25 8,922.82 7,758.98

Current assets 18,505.22 16,091.50 13,992.61 12,167.49 10,580.42

Total assets 60,450.40 52,565.56 45,709.19 39,747.12 34,562.71

Net worth 31,569.25 27,210.24 23,419.80 20,123.77 17,257.65

Current liabilities 9,869.45 8,582.13 7,462.72 6,489.33 5,642.89

Borrowings (balancing fugure) 19,011.69 16,773.19 14,826.66 13,134.03 11,662.17

Total liabilities 60,450.40 52,565.56 45,709.19 39,747.12 34,562.71

Problem 3

Mason Industry

Net margin 25.0%

Retention ratio 1

Leverage, (1 + D/E) 1.6

Assets/sales 2.79

Sustainable growth 16.7%

Assumptions:

No taxes are paid

No dividends are distributed

Problem 4

Debt ratio 45%

Equity ratio 55%

Payout 60%

Retention 40%

After-tax interest rate 5%

Required growth 20%

Require after-tax ROI 29.8%

You might also like

- United States Census Figures Back to 1630From EverandUnited States Census Figures Back to 1630No ratings yet

- Financial Planning and Strategy Problem 1 Bajaj Auto LTDDocument4 pagesFinancial Planning and Strategy Problem 1 Bajaj Auto LTDMukul KadyanNo ratings yet

- The Unidentified Industries - Residency - CaseDocument4 pagesThe Unidentified Industries - Residency - CaseDBNo ratings yet

- DCF ModelDocument51 pagesDCF Modelhugoe1969No ratings yet

- Data For Ratio DetectiveDocument1 pageData For Ratio DetectiveRoyan Nur HudaNo ratings yet

- Data For Ratio Detective ExerciseDocument1 pageData For Ratio Detective ExercisemaritaputriNo ratings yet

- Purchases / Average Payables Revenue / Average Total AssetsDocument7 pagesPurchases / Average Payables Revenue / Average Total AssetstannuNo ratings yet

- Ratios Tell A StoryDocument3 pagesRatios Tell A StoryJose Arturo Rodriguez AlemanNo ratings yet

- Discounted Cash Flow (DCF) Valuation: This Model Is For Illustrative Purposes Only and Contains No FormulasDocument2 pagesDiscounted Cash Flow (DCF) Valuation: This Model Is For Illustrative Purposes Only and Contains No Formulasrito2005No ratings yet

- Adidas/Reebok Merger: Collin Shaw Kelly Truesdale Michael Rockette Benedikte Schmidt SaravanansadaiyappanDocument27 pagesAdidas/Reebok Merger: Collin Shaw Kelly Truesdale Michael Rockette Benedikte Schmidt SaravanansadaiyappanUdipta DasNo ratings yet

- Gainesboro SolutionDocument7 pagesGainesboro SolutionakashNo ratings yet

- Balance SheetDocument14 pagesBalance SheetIbrahimNo ratings yet

- CH 13 Mod 2 Common Size StatementsDocument2 pagesCH 13 Mod 2 Common Size StatementsAkshat JainNo ratings yet

- Finance Detective - Rizqi Ghani Faturrahman - 29120382 - YP-64BDocument4 pagesFinance Detective - Rizqi Ghani Faturrahman - 29120382 - YP-64BrizqighaniNo ratings yet

- %sales Discount %yoy 18.5% 22.5% 1.8%Document2 pages%sales Discount %yoy 18.5% 22.5% 1.8%Linh NguyenNo ratings yet

- 6 Holly Fashion Case StudyDocument3 pages6 Holly Fashion Case StudyCaramalau Mirela-Georgiana0% (1)

- Verticle HorizentalDocument2 pagesVerticle HorizentalMurtaza HassanNo ratings yet

- Equity and Liabilities: Description Mar-21 Mar-20 Mar-19 Mar-18 Mar-17 Share Capital Total ReservesDocument102 pagesEquity and Liabilities: Description Mar-21 Mar-20 Mar-19 Mar-18 Mar-17 Share Capital Total Reservesaditya jainNo ratings yet

- Statement For AAPLDocument1 pageStatement For AAPLEzequiel FriossoNo ratings yet

- FDIC Certificate # 9092 Salin Bank and Trust CompanyDocument31 pagesFDIC Certificate # 9092 Salin Bank and Trust CompanyWaqas Khalid KeenNo ratings yet

- Britannia IndustriesDocument12 pagesBritannia Industriesmundadaharsh1No ratings yet

- Financial Model TemplateDocument30 pagesFinancial Model Templateudoshi_1No ratings yet

- Finance Detective - Ratio AnalysisDocument2 pagesFinance Detective - Ratio AnalysisAndhitiawarman NugrahaNo ratings yet

- Name of The Company Last Financial Year First Projected Year CurrencyDocument15 pagesName of The Company Last Financial Year First Projected Year CurrencygabegwNo ratings yet

- Himatsingka Seida LTD.: Ratio Analysis SheetDocument1 pageHimatsingka Seida LTD.: Ratio Analysis SheetNeetesh DohareNo ratings yet

- Casa Growth Drives Robust Liquidity Position: (RP Billion) Jun-19 Dec-19 Mar-20 Jun-20 Yoy Ytd QoqDocument3 pagesCasa Growth Drives Robust Liquidity Position: (RP Billion) Jun-19 Dec-19 Mar-20 Jun-20 Yoy Ytd QoqErica ZulianaNo ratings yet

- Syndicate 3 - Analisa Ratio IndustriDocument5 pagesSyndicate 3 - Analisa Ratio IndustriMarkus100% (1)

- Amazon DCF: Ticker Implied Share Price Date Current Share PriceDocument4 pagesAmazon DCF: Ticker Implied Share Price Date Current Share PriceFrancesco GliraNo ratings yet

- News Release INDY Result 6M22Document7 pagesNews Release INDY Result 6M22Rama Usaha MandiriNo ratings yet

- Marico Financial Model (Final) (Final-1Document22 pagesMarico Financial Model (Final) (Final-1Jayant JainNo ratings yet

- Mercury Athletic Footwear Case (Work Sheet)Document16 pagesMercury Athletic Footwear Case (Work Sheet)Bharat KoiralaNo ratings yet

- Pakistan State Oil Company Limited (Pso)Document6 pagesPakistan State Oil Company Limited (Pso)Maaz HanifNo ratings yet

- Word Note The Body Shop International PLC 2001: An Introduction To Financial ModelingDocument9 pagesWord Note The Body Shop International PLC 2001: An Introduction To Financial Modelingalka murarka100% (2)

- DCF Trident 2Document20 pagesDCF Trident 2Jayant JainNo ratings yet

- ACC DCF ValuationDocument7 pagesACC DCF ValuationJitesh ThakurNo ratings yet

- GERDBYSOURCEDocument1 pageGERDBYSOURCEapi-3700445No ratings yet

- ITC Financial ModelDocument150 pagesITC Financial ModelKaushik JainNo ratings yet

- Activity 07 CH14Document4 pagesActivity 07 CH14Dandreb SuaybaguioNo ratings yet

- Ratios Tell A StoryDocument2 pagesRatios Tell A StoryJose Arturo Rodriguez AlemanNo ratings yet

- 2 Financial Statements of Bank - For StudentDocument75 pages2 Financial Statements of Bank - For StudenttusedoNo ratings yet

- CG Ratio-Analysis-UnsolvedDocument15 pagesCG Ratio-Analysis-Unsolvedsumit3902No ratings yet

- DCF SBI TemplateDocument7 pagesDCF SBI Templatekeya.bitsembryoNo ratings yet

- Cigniti - Group 3 - BFBVDocument24 pagesCigniti - Group 3 - BFBVpgdm22srijanbNo ratings yet

- Performance Analysis of BATB (2004-2008)Document21 pagesPerformance Analysis of BATB (2004-2008)raihans_dhk3378No ratings yet

- 2022.07.24 - DCF Tutorial Answer KeyDocument18 pages2022.07.24 - DCF Tutorial Answer KeySrikanth ReddyNo ratings yet

- Gymboree LBO Model ComDocument7 pagesGymboree LBO Model ComrolandsudhofNo ratings yet

- Use 2012 Annual Reports Woolworths Limited Metcash Limited: Pro Forma Financial StatementsDocument3 pagesUse 2012 Annual Reports Woolworths Limited Metcash Limited: Pro Forma Financial StatementsgraceNo ratings yet

- National DebtDocument9 pagesNational DebtGenelyn Cabudsan MancolNo ratings yet

- Investor Update For December 31, 2016 (Company Update)Document17 pagesInvestor Update For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- 04 02 BeginDocument2 pages04 02 BeginnehaNo ratings yet

- RatioDocument11 pagesRatioAnant BothraNo ratings yet

- CAGR W.R.T First Year: (All Figures in INR Lakhs Unless Stated Otherwise)Document22 pagesCAGR W.R.T First Year: (All Figures in INR Lakhs Unless Stated Otherwise)Garima GulatiNo ratings yet

- News Release INDY Result 3M22Document7 pagesNews Release INDY Result 3M22M Rizky PermanaNo ratings yet

- FMCV PresentationDocument12 pagesFMCV PresentationManmeet SinghNo ratings yet

- Broadcom Financial AnalysisDocument68 pagesBroadcom Financial AnalysisKipley_Pereles_5949No ratings yet

- Industry Median 2018 2017 2016 2015 2014 2013 2012Document10 pagesIndustry Median 2018 2017 2016 2015 2014 2013 2012AnuragNo ratings yet

- 99 FinanceDocument23 pages99 Financeuser111No ratings yet

- Finance Term PaperDocument23 pagesFinance Term PaperTawsiq Asef MahiNo ratings yet

- UST Debt Policy SpreadsheetDocument9 pagesUST Debt Policy Spreadsheetjchodgson0% (2)

- TVS Motor DCF ModelDocument35 pagesTVS Motor DCF ModelPrabhdeep DadyalNo ratings yet

- FM09-CH 18Document5 pagesFM09-CH 18Mukul KadyanNo ratings yet

- FM09-CH 15Document7 pagesFM09-CH 15Mukul Kadyan100% (1)

- FM09-CH 25Document9 pagesFM09-CH 25Mukul KadyanNo ratings yet

- FM09-CH 14Document12 pagesFM09-CH 14Mukul KadyanNo ratings yet

- FM09-CH 16Document12 pagesFM09-CH 16Mukul KadyanNo ratings yet

- FM09-CH 24Document16 pagesFM09-CH 24namitabijweNo ratings yet

- CH 22: Lease, Hire Purchase and Project FinancingDocument7 pagesCH 22: Lease, Hire Purchase and Project FinancingMukul KadyanNo ratings yet

- FM09-CH 35Document4 pagesFM09-CH 35lefteris82No ratings yet

- FM09-CH 28Document8 pagesFM09-CH 28Nikhil ChitaliaNo ratings yet

- FM09-CH 27Document6 pagesFM09-CH 27Kritika SwaminathanNo ratings yet

- Chapter 34Document7 pagesChapter 34Mukul KadyanNo ratings yet

- FM09-CH 09Document12 pagesFM09-CH 09Mukul KadyanNo ratings yet

- FM09-CH 07Document9 pagesFM09-CH 07Mukul KadyanNo ratings yet

- FM09-CH 04Document4 pagesFM09-CH 04Mukul KadyanNo ratings yet

- FM09-CH 32 PDFDocument3 pagesFM09-CH 32 PDFNaveen RaiNo ratings yet

- FM09-CH 30Document4 pagesFM09-CH 30Mukul KadyanNo ratings yet

- Chapter 27Document10 pagesChapter 27Mukul KadyanNo ratings yet

- FM09-CH 03 PDFDocument14 pagesFM09-CH 03 PDFGregNo ratings yet

- FM09-CH 08Document9 pagesFM09-CH 08Mukul KadyanNo ratings yet

- Chapter 16Document8 pagesChapter 16Mukul KadyanNo ratings yet

- Chapter 05Document6 pagesChapter 05danbrowndaNo ratings yet

- Chapter 29Document8 pagesChapter 29Mukul KadyanNo ratings yet

- Chapter 07Document8 pagesChapter 07Mukul KadyanNo ratings yet

- FM09-CH 20Document4 pagesFM09-CH 20Naveen RaiNo ratings yet

- FM09-CH 29 PDFDocument2 pagesFM09-CH 29 PDFNaveen RaiNo ratings yet

- FM - Chapter 35Document4 pagesFM - Chapter 35Amit SukhaniNo ratings yet

- FM09-CH 12Document7 pagesFM09-CH 12Mukul KadyanNo ratings yet

- FM09-CH 11Document5 pagesFM09-CH 11Mukul KadyanNo ratings yet

- FM09-CH 05Document4 pagesFM09-CH 05Mukul KadyanNo ratings yet

- Baker McKenzie Doing Business in Thailand Updated As of September 2019Document228 pagesBaker McKenzie Doing Business in Thailand Updated As of September 2019lindsayNo ratings yet

- Tax - AssignmentDocument29 pagesTax - Assignmentjai_thakker7659No ratings yet

- QuoraDocument6 pagesQuoraValleyWag100% (4)

- Notes To FSDocument3 pagesNotes To FSdhez10No ratings yet

- Subprime Mortgage CrisisDocument35 pagesSubprime Mortgage CrisisVineet GuptaNo ratings yet

- Fin 201 Term Paper (Group L)Document33 pagesFin 201 Term Paper (Group L)omarsakib19984No ratings yet

- Private Equity InvestmentsDocument1 pagePrivate Equity InvestmentsbharatNo ratings yet

- Management Financiar (Engleza)Document5 pagesManagement Financiar (Engleza)Alexandra PetrescuNo ratings yet

- Test Bank 3Document1 pageTest Bank 3GabyVionidyaNo ratings yet

- Agri Commodity Reports For The WeekDocument7 pagesAgri Commodity Reports For The WeekDasher_No_1No ratings yet

- What Is Life Insurance ?Document15 pagesWhat Is Life Insurance ?Jagdish SutharNo ratings yet

- HW3 SolDocument13 pagesHW3 SolTowweyBerezNo ratings yet

- Ent300 - Marketing PlanDocument33 pagesEnt300 - Marketing PlanBryan Nicholas50% (2)

- IFRS 9financial InstrumentsDocument33 pagesIFRS 9financial InstrumentsMirzakarimboy AkhmadjonovNo ratings yet

- CH 18: Dividend PolicyDocument55 pagesCH 18: Dividend PolicySaba MalikNo ratings yet

- Provide Answer To All Questions Below: 1. List Three Types of Financial Statement? Income StatementDocument19 pagesProvide Answer To All Questions Below: 1. List Three Types of Financial Statement? Income Statementsamra azadNo ratings yet

- PDICDocument16 pagesPDICBrian Jonathan ParaanNo ratings yet

- Chapter 3 - Cash Flow Analysis - SVDocument26 pagesChapter 3 - Cash Flow Analysis - SVNguyen LienNo ratings yet

- Stock To Watch:: Nifty ChartDocument3 pagesStock To Watch:: Nifty ChartKavitha RavikumarNo ratings yet

- The Tussle Between Adamjee and Mansha GroupDocument4 pagesThe Tussle Between Adamjee and Mansha Groupahsahito12No ratings yet

- Risk Parity PortfoliosDocument11 pagesRisk Parity PortfoliosvettebeatsNo ratings yet

- Fin 9 PDFDocument2 pagesFin 9 PDFChristine AltamarinoNo ratings yet

- Mishkin 6ce TB Ch13Document32 pagesMishkin 6ce TB Ch13JaeDukAndrewSeo50% (2)

- RHB Indonesia 20 JewelsDocument54 pagesRHB Indonesia 20 JewelsBobby RahmantoNo ratings yet

- Snacking Startups 2.0 - CB Insights 2017Document68 pagesSnacking Startups 2.0 - CB Insights 2017jc224100% (1)

- Audit of Financial StatementsDocument4 pagesAudit of Financial StatementsBrit NeyNo ratings yet

- Wil Ar 2015-16Document212 pagesWil Ar 2015-16Kishore JohnNo ratings yet

- No Fail ForexDocument39 pagesNo Fail ForexVincent Sampieri100% (5)

- Mandate For Individuals: To: Danske Bank A/S Trading As Danske Bank ("The Bank")Document3 pagesMandate For Individuals: To: Danske Bank A/S Trading As Danske Bank ("The Bank")EmmaNo ratings yet

- Shil and DasDocument8 pagesShil and Dasbhagaban_fm8098No ratings yet