Professional Documents

Culture Documents

Part 1: Determine The Price of The Bonds Issued On February 1, 2013

Uploaded by

Fred The FishOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Part 1: Determine The Price of The Bonds Issued On February 1, 2013

Uploaded by

Fred The FishCopyright:

Available Formats

Problem 14-5

On February 1, 2013, Cromley Motor Products issued 9% bonds, dated

February 1, with a face amount of $80 million. The bonds mature on

January 31, 2017 (4 years). The market yield for bonds of similar risk

and maturity was 10%. Interest is payable semiannually on July 31,

and January 31. Barnwell Industries acquired $80,000 of the bonds as

a long-term

l i

investment. The

h fiscal

fi l year endd off both

b h firms

fi is

i

December 31.

Part 1: Determine the price of the bonds issued on February 1, 2013.

Cromley: Cash interest paid: 9% x $80,000,000 x 6/12 = $3,600,000

Present value of interest: Table 4, 8 payments @ 5% = 6.46321 x

$3,600,000 = $23,267,556

Present value of $$80 million: Table 2,, 8 periods

p @ 5% = 0.67684 x

$80,000,000 = $54,147,200

Price of bonds: $77,414,756 ($23,267,556 + $54,147,200)

Barnwell purchased 80,000 ÷ 80,000,000 = 0.1% of the bonds.

Therefore, the price paid was 0.1% x $77,414,756 = $77,415

©Dr. Chula King

All Rights Reserved

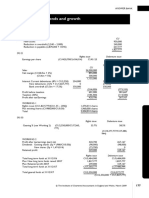

Problem 14-5 (continued)

Part 2: Prepare the amortization schedules that indicates (a) Cromley’s

effective interest expense and (b) Barnwell’s effective interest revenue

for each interest period during the term to maturity.

Cromley Barnwell

Cash

C h Effective

Eff ti Discountt

Di Cash

C h Effective

Eff ti Di

Discountt

Pmt Payment Interest Amortization Balance Pmt Receipt Interest Amortization Balance

77,414,756 77,415

1 3,600,000 3,870,738 270,738 77,685,494 1 3,600 3,871 271 77,686

2 3,600,000 3,884,275 284,275 77,969,769 2 3,600 3,884 284 77,970

3 3,600,000 3,898,488 298,488 78,268,258 3 3,600 3,899 299 78,269

4 3,600,000 3,913,413 313,413 78,581,670 4 3,600 3,913 313 78,581

5 3,600,000 3,929,083 329,084 78,910,754 5 3,600 3,929 330 78,911

6 3,600,000 3,945,538 345,538 79,256,292 6 3,600 3,946 346 79,257

7 3,600,000 3,962,815 362,815 79,619,107 7 3,600 3,963 363 79,620

8 3,600,000 3,980,893 380,893 80,000,000 8 3,600 3,980 380 80,000

©Dr. Chula King

All Rights Reserved

Problem 14-5 (continued)

Part 3: Prepare the journal entries to record (a) the issuance of the bonds

by Cromley and (b) Barnwell’s investment on February 1, 2013.

Cromley:

Cash 77,414,756

Discount on B/P 2,585,244

Bonds Payable 80,000,000

Barnwell:

Investment in Bonds 80,000

Discount on bond investment 2,585

,

Cash 77,415

©Dr. Chula King

All Rights Reserved

Problem 14-5 (continued)

Part 4: Prepare the journal entries by both firms to record all subsequent

events related to the bonds through January 31, 2015.

Cromley

7/31/13 Interest Expense 3,870,738

Discount on B/P 270,738

Cash 3,600,000

12/31/13 Interest Expense (3,884,275 x 5/6) 3,236,896

Discount on B/P (284,275 x 5/6) 236,896

Interest Payable (3,600,000 x 5/6) 3,000,000

1/31/14 I t

Interest

t Expense

E (3,884,275

(3 884 275 x 1/6) 647 379

647,379

Interest Payable 3,000,000

Discount on B/P (284,275 x 1/6) 47,379

Cash 3,600,000

©Dr. Chula King

All Rights Reserved

Problem 14-5 (continued)

Cromley

7/31/14 Interest Expense 3,898,488

Discount on B/P 298,488

Cash 3 600 000

3,600,000

12/31/14 Interest Expense (3,913,413 x 5/6) 3,261,177

Discount on B/P (313,413 x 5/6) 261,177

Interest Payable (3,600,000 x 5/6) 3,000,000

1/31/15 Interest Expense (3,913,413 x 1/6) 652,236

Interest Payable 3,000,000

Discount on B/P (313,413 x 1/6) 52,236

Cash 3,600,000

©Dr. Chula King

All Rights Reserved

Problem 14-5 (continued)

Part 4: Prepare the journal entries by both firms to record all subsequent

events related to the bonds through January 31, 2015.

Barnwell

7/31/13 Cash 3,600

Disc on Bond Invest 271

Interest Revenue 3,871

12/31/13 Interest Receivable (3,600 x 5/6) 3,000

Disc on Bond Invest (284 x 5/6) 237

Interest Revenue (3,884 x 5/6) 3,237

1/31/14 C h

Cash 3 600

3,600

Disc on Bond Invest (284 x 1/6) 47

Interest Receivable 3,000

Interest Revenue (3,884 x 1/6) 647

©Dr. Chula King

All Rights Reserved

Problem 14-5 (continued)

Barnwell

7/31/14 Cash 3,600

Disc on Bond Invest 299

Interest Revenue 3,899

12/31/14 Interest Receivable (3,600 x 5/6) 3,000

Disc on Bond Invest (313 x 5/6) 261

Interest Revenue (3,913 x 5/6) 3,261

1/31/15 Cash 3,600

Disc on Bond Invest (313 x 1/6) 52

Interest Receivable 3,000

Interest Revenue (3,913 x 1/6) 652

©Dr. Chula King

All Rights Reserved

You might also like

- A Investment Platform for Future: Self Help a Self Operating BankingFrom EverandA Investment Platform for Future: Self Help a Self Operating BankingNo ratings yet

- m7 - Note Sample Problems With Solutions Chs 14 and 15Document6 pagesm7 - Note Sample Problems With Solutions Chs 14 and 15Marie Fe GullesNo ratings yet

- Chapter 3 Problem 6 LenzierDocument25 pagesChapter 3 Problem 6 LenzierJohn Lenzier TurtorNo ratings yet

- Chapter 3 Problem 6 LenzierDocument25 pagesChapter 3 Problem 6 LenzierJohn Lenzier TurtorNo ratings yet

- Financial Assets Recognition and MeasurementDocument35 pagesFinancial Assets Recognition and MeasurementC.TangibleNo ratings yet

- Seminar Outline 8Document15 pagesSeminar Outline 8cccqNo ratings yet

- Bonds Payable ConceptsDocument20 pagesBonds Payable ConceptsThalia Rhine AberteNo ratings yet

- Require 1 Require 2: Date Interest PaymentDocument7 pagesRequire 1 Require 2: Date Interest PaymentKiều OanhNo ratings yet

- Sol. Man. - Chapter 3 Bonds Payable & Other ConceptsDocument23 pagesSol. Man. - Chapter 3 Bonds Payable & Other ConceptsMiguel Amihan100% (1)

- Problem 5-31 (Verna Company)Document7 pagesProblem 5-31 (Verna Company)Jannefah Irish SaglayanNo ratings yet

- Debenture 10 Years ExplanationDocument17 pagesDebenture 10 Years Explanationoldtaxi9No ratings yet

- Problem 6: For Classroom Discussion: Requirement (A)Document6 pagesProblem 6: For Classroom Discussion: Requirement (A)Nikky Bless LeonarNo ratings yet

- QuizDocument5 pagesQuizDanna VargasNo ratings yet

- Quiz EiDocument3 pagesQuiz EiJOY LYN REFUGIONo ratings yet

- Phan Tich Tai ChinhDocument16 pagesPhan Tich Tai Chinhbo noloveNo ratings yet

- Name: Michelle J. Sabit Section Code: B6 Date: 02/24/2024Document3 pagesName: Michelle J. Sabit Section Code: B6 Date: 02/24/2024sabit.michelle0903No ratings yet

- Vonn - FMDocument13 pagesVonn - FMVonn JoviNo ratings yet

- ASE2007 Revised Syllabus - Specimen Paper Answers 2008Document7 pagesASE2007 Revised Syllabus - Specimen Paper Answers 2008WinnieOngNo ratings yet

- PQ3 BondsDocument2 pagesPQ3 BondsElla Mae MagbatoNo ratings yet

- Intermediate Accounting 2 Chapter 3 BondsDocument4 pagesIntermediate Accounting 2 Chapter 3 BondsMARRIETTE JOY ABADNo ratings yet

- IA2 Chapter3 ExercisesDocument4 pagesIA2 Chapter3 Exercisesmarriette joy abadNo ratings yet

- Intermediate Accounting 2 - Notes Payable - Problems October 10, 2020Document11 pagesIntermediate Accounting 2 - Notes Payable - Problems October 10, 2020Sarah GNo ratings yet

- Intermediate Accounting Chapter 3 ProblemsDocument34 pagesIntermediate Accounting Chapter 3 ProblemsPattraniteNo ratings yet

- Homework 1 Suggested SolutionsDocument14 pagesHomework 1 Suggested SolutionsPHI NGUYEN HOANGNo ratings yet

- Sol. Man. - Chapter 3 Bonds Payable Other ConceptsDocument21 pagesSol. Man. - Chapter 3 Bonds Payable Other ConceptsJasmine Nouvel Soriaga Cruz86% (7)

- Solution Chapter 20 Intermediate Accounting ValixDocument5 pagesSolution Chapter 20 Intermediate Accounting Valixnameless0% (1)

- Interest Bearing Note - Periodic Collection (Interest Only) PremiumDocument2 pagesInterest Bearing Note - Periodic Collection (Interest Only) PremiumShannonNo ratings yet

- Prob.2 Classroom Discussion BP OCDocument4 pagesProb.2 Classroom Discussion BP OCWenjunNo ratings yet

- Solution On FranchiseDocument2 pagesSolution On FranchiseAliah CyrilNo ratings yet

- Midterm Exam SolutionDocument3 pagesMidterm Exam SolutionRaj PatelNo ratings yet

- 3.business Plan Divident and Grought ABDocument26 pages3.business Plan Divident and Grought ABmiradvance studyNo ratings yet

- Date Cash Paid Interest Expense Discount Amortized Carrying Amount of BondsDocument10 pagesDate Cash Paid Interest Expense Discount Amortized Carrying Amount of BondsEmmelia Adinda SabatiniNo ratings yet

- Sol. Man. - Chapter 2 Notes PayableDocument10 pagesSol. Man. - Chapter 2 Notes PayableEinez B. CarilloNo ratings yet

- Compound Financial Instrument PDFDocument4 pagesCompound Financial Instrument PDFidontcaree123312100% (1)

- Calculate Market Price and Amortization of Bonds Issued at a DiscountDocument5 pagesCalculate Market Price and Amortization of Bonds Issued at a DiscountKris Hazel RentonNo ratings yet

- 1996 Parent FSDocument15 pages1996 Parent FSNick NangitNo ratings yet

- Plug (Parent) Spark (Subsidary) Lemon (Non Affiliate)Document25 pagesPlug (Parent) Spark (Subsidary) Lemon (Non Affiliate)Pasha HarahapNo ratings yet

- Calculations for bond premium, discount, interest expense and carrying amountDocument9 pagesCalculations for bond premium, discount, interest expense and carrying amountClaire BarbaNo ratings yet

- Agricultural Development Bank Limited: Unaudited Financial Results (Quarterly) ProvisionalDocument3 pagesAgricultural Development Bank Limited: Unaudited Financial Results (Quarterly) ProvisionalaNo ratings yet

- Accountancy Set-1Document18 pagesAccountancy Set-1VijayNo ratings yet

- Sol. Man. - Chapter 2 Notes PayableDocument12 pagesSol. Man. - Chapter 2 Notes PayableChristine Mae Fernandez Mata100% (1)

- SBR Practice Questions 2019 - QDocument86 pagesSBR Practice Questions 2019 - QALEX TRANNo ratings yet

- Adjusting Entries ExplainedDocument1 pageAdjusting Entries ExplainedJean Dela CruzNo ratings yet

- Reassessment of Lease LiabilityDocument6 pagesReassessment of Lease LiabilityJULIA CHRIS ROMERONo ratings yet

- Notes Payable Chapter 2Document7 pagesNotes Payable Chapter 2Herrah Joyce SalinasNo ratings yet

- United Metal: Initial Outlay (IO) CalculationDocument3 pagesUnited Metal: Initial Outlay (IO) CalculationMarjina Binte Abbas BrishtiNo ratings yet

- Aud Prob Compilation 1Document31 pagesAud Prob Compilation 1Chammy TeyNo ratings yet

- Indikator Tahun 2015 2016 2017 2018Document4 pagesIndikator Tahun 2015 2016 2017 2018buhaenahNo ratings yet

- 72034bos57955 p1 6Document12 pages72034bos57955 p1 6Fs printNo ratings yet

- Chapter 2 Notes PayableDocument11 pagesChapter 2 Notes PayableThalia Rhine AberteNo ratings yet

- Depreciation Methods ExplainedDocument4 pagesDepreciation Methods ExplainedAngel Kaye Nacionales JimenezNo ratings yet

- This Study Resource Was: Assessment Task 3Document5 pagesThis Study Resource Was: Assessment Task 3maria evangelistaNo ratings yet

- Intermediate Accounting Course Investment in Bonds and Shifting to Pharmaceutical StocksDocument4 pagesIntermediate Accounting Course Investment in Bonds and Shifting to Pharmaceutical StocksAntor Podder 1721325No ratings yet

- 9TH Bonds Payable Part IIDocument8 pages9TH Bonds Payable Part IIAnthony DyNo ratings yet

- Ias 32Document3 pagesIas 32Yến Hoàng HảiNo ratings yet

- Noncurrent Liabilities (Part 1) : Problem 23-1: True or FalseDocument10 pagesNoncurrent Liabilities (Part 1) : Problem 23-1: True or FalseMarjorie Zara CustodioNo ratings yet

- Accounts SamplepaperDocument29 pagesAccounts SamplepaperPawni JadhavNo ratings yet

- Financial Accounting & Reporting: Short-Term vs. Long-Term LiabilitiesDocument10 pagesFinancial Accounting & Reporting: Short-Term vs. Long-Term LiabilitiesSourabh GargNo ratings yet

- Audit of bonds payable and convertible bondsDocument4 pagesAudit of bonds payable and convertible bondsspur iousNo ratings yet

- Audit of Long-Term Liabilities - SDocument6 pagesAudit of Long-Term Liabilities - SEva DagusNo ratings yet

- Universitas Diponegoro: Certificate of Student StatusDocument1 pageUniversitas Diponegoro: Certificate of Student StatusFred The FishNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- UVA-C-2200: Breeden Electronics (B) (TN)Document7 pagesUVA-C-2200: Breeden Electronics (B) (TN)Fred The FishNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 20 Questions InternalAudit1 PDFDocument28 pages20 Questions InternalAudit1 PDFtasmaq1No ratings yet

- Internal Audit Strategic Plan 2021-2025Document56 pagesInternal Audit Strategic Plan 2021-2025Fred The Fish100% (1)

- 20 Questions InternalAudit1 PDFDocument28 pages20 Questions InternalAudit1 PDFtasmaq1No ratings yet

- Rainsbury2009 PDFDocument14 pagesRainsbury2009 PDFFred The FishNo ratings yet

- Economics Determinant of Audit IndependenceDocument19 pagesEconomics Determinant of Audit IndependenceFred The FishNo ratings yet

- W05 Research DesignDocument20 pagesW05 Research DesignFred The FishNo ratings yet

- Examining the Effect of Client Fee Dependence on Audit IndependenceDocument9 pagesExamining the Effect of Client Fee Dependence on Audit IndependenceFred The FishNo ratings yet

- CHP 10.Document21 pagesCHP 10.Kurnia Afrilia Erka PNo ratings yet

- Egrove Egrove: 40 Questions and Answers About Audit Reports 40 Questions and Answers About Audit ReportsDocument40 pagesEgrove Egrove: 40 Questions and Answers About Audit Reports 40 Questions and Answers About Audit ReportsFred The FishNo ratings yet

- Case - Breeden (B) - Recomputation of CostsDocument6 pagesCase - Breeden (B) - Recomputation of CostsRaviteja VeluvoluNo ratings yet

- © Dr. Chula King All Rights ReceivedDocument1 page© Dr. Chula King All Rights ReceivedFred The FishNo ratings yet

- How Audit Pricing and Independence Relate to Financial ReportingDocument23 pagesHow Audit Pricing and Independence Relate to Financial ReportingFred The FishNo ratings yet

- How Audit Pricing and Independence Relate to Financial ReportingDocument23 pagesHow Audit Pricing and Independence Relate to Financial ReportingFred The FishNo ratings yet

- Problem 18-8: ©dr. Chula King All Rights ReservedDocument1 pageProblem 18-8: ©dr. Chula King All Rights ReservedFred The FishNo ratings yet

- Journal of International Accounting, Auditing and Taxation: Abdulaziz Alzeban, Nedal SawanDocument11 pagesJournal of International Accounting, Auditing and Taxation: Abdulaziz Alzeban, Nedal SawanFred The FishNo ratings yet

- Threats To Auditor IndependenceDocument28 pagesThreats To Auditor IndependenceFred The FishNo ratings yet

- Rainsbury2009 PDFDocument14 pagesRainsbury2009 PDFFred The FishNo ratings yet

- CH - 4 - Responsibility Centers Expense and RevenueDocument117 pagesCH - 4 - Responsibility Centers Expense and RevenueAj AzisNo ratings yet

- CH 18 Audit of The Acquisition and Payment Cycle PDFDocument13 pagesCH 18 Audit of The Acquisition and Payment Cycle PDFFred The Fish100% (1)

- (Jounal) The Concept of A Scale in Accounting Measurement (Downloaded by Amalia SA - 20170420285)Document13 pages(Jounal) The Concept of A Scale in Accounting Measurement (Downloaded by Amalia SA - 20170420285)ohoosavNo ratings yet

- W05 Research DesignDocument20 pagesW05 Research DesignFred The FishNo ratings yet

- Intermediate Accounting Chapter 10 SolutionsDocument39 pagesIntermediate Accounting Chapter 10 SolutionsNatazia Ibañez0% (4)

- The British Accounting Review: Gerrit Sarens, Ignace de Beelde, Patricia EveraertDocument17 pagesThe British Accounting Review: Gerrit Sarens, Ignace de Beelde, Patricia EveraertFred The FishNo ratings yet

- A Theory of Social Welfare: David StoeszDocument7 pagesA Theory of Social Welfare: David StoeszFred The Fish100% (1)

- Measurement of Variables: Operational Definition and ScalesDocument18 pagesMeasurement of Variables: Operational Definition and ScalesFred The FishNo ratings yet

- Press Release Indian Oil Corporation LTD and Bajaj Allianz General InsuDocument2 pagesPress Release Indian Oil Corporation LTD and Bajaj Allianz General InsuBalasubramaniam RNo ratings yet

- BATA Blackbook AkshitDocument76 pagesBATA Blackbook AkshitKhan YasinNo ratings yet

- Case Ratios and Financial Planning at EaDocument6 pagesCase Ratios and Financial Planning at EaAgus E. SetiyonoNo ratings yet

- Conceptual Framework For Financial ReportingDocument5 pagesConceptual Framework For Financial ReportingRaina OsorioNo ratings yet

- On Boundary Spanners and Interfirm Embeddedness - 2021 - Journal of PurchasingDocument11 pagesOn Boundary Spanners and Interfirm Embeddedness - 2021 - Journal of PurchasingRoshanNo ratings yet

- Payment Commitment Letter FormatDocument1 pagePayment Commitment Letter FormatScribdTranslationsNo ratings yet

- Principles of Costs and CostingDocument50 pagesPrinciples of Costs and CostingSOOMA OSMANNo ratings yet

- Investment Policy Statement ExampleDocument12 pagesInvestment Policy Statement ExampleCheeseong LimNo ratings yet

- Company Law Assignment of Formation of CompanyDocument43 pagesCompany Law Assignment of Formation of CompanyTayyaba TariqNo ratings yet

- Case StudyDocument5 pagesCase StudyTrân LêNo ratings yet

- Practice Session - PLDocument9 pagesPractice Session - PLDivyansh PandeyNo ratings yet

- McdonaldDocument4 pagesMcdonaldDwi KhonitanNo ratings yet

- Business Plan For EntrepreneurDocument10 pagesBusiness Plan For EntrepreneurMary Joyce Camille ParasNo ratings yet

- Acting Pricey: Some Stocks' Rich Valuations Are Sticky, Irrespective of The Market's Exuberance or TurmoilDocument92 pagesActing Pricey: Some Stocks' Rich Valuations Are Sticky, Irrespective of The Market's Exuberance or TurmoilhariNo ratings yet

- Iii. in Both of The Above Cases, The Capitalist-Industrial Partner Shall Not Share in The Losses in His Capacity As Industrial PartnerDocument4 pagesIii. in Both of The Above Cases, The Capitalist-Industrial Partner Shall Not Share in The Losses in His Capacity As Industrial PartnerEsto, Cassandra Jill SumalbagNo ratings yet

- Fundamentals of Marketing Chapter 5Document6 pagesFundamentals of Marketing Chapter 5Tracy Mason MediaNo ratings yet

- Preventing Enron ScandalDocument1 pagePreventing Enron ScandalChristian Ian LimNo ratings yet

- CBFS-MODULE NO. 3-Globe-Intl TradeDocument4 pagesCBFS-MODULE NO. 3-Globe-Intl TradeDA YenNo ratings yet

- 2023-03-20 Godin, Karen 310072 - Installment Schedule PDFDocument3 pages2023-03-20 Godin, Karen 310072 - Installment Schedule PDFKarenNo ratings yet

- HarvardDocument5 pagesHarvardMahima KumariNo ratings yet

- Financial Report: The Coca Cola Company: Ews/2021-10-27 - Coca - Cola - Reports - Continued - Momentum - and - Strong - 1040 PDFDocument3 pagesFinancial Report: The Coca Cola Company: Ews/2021-10-27 - Coca - Cola - Reports - Continued - Momentum - and - Strong - 1040 PDFDominic MuliNo ratings yet

- To Prosperity: From DEBTDocument112 pagesTo Prosperity: From DEBTمحمد عبدﷲNo ratings yet

- - मुख्यमंत्री सीखो कमाओ योजनाDocument81 pages- मुख्यमंत्री सीखो कमाओ योजनाAmitNo ratings yet

- Inventory ControlDocument26 pagesInventory ControlShweta Dixit100% (1)

- C.MGT Relevant of Chapter 2 STBCDocument12 pagesC.MGT Relevant of Chapter 2 STBCNahum DaichaNo ratings yet

- Best Practices With Lean Principles in Furniture Green ManufacturingDocument10 pagesBest Practices With Lean Principles in Furniture Green ManufacturingJeevanandhamNo ratings yet

- AveDocument3 pagesAveJessaNo ratings yet

- Budget For IPL MatchDocument3 pagesBudget For IPL MatchAbhishekNo ratings yet

- Non-Integrated Cost AccountsDocument20 pagesNon-Integrated Cost Accountsriya thakurNo ratings yet

- Jurnal SCP 1Document9 pagesJurnal SCP 1ayuNo ratings yet