Professional Documents

Culture Documents

1111, LLLF) : I'ilj) J

Uploaded by

Nguyễn PhongOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1111, LLLF) : I'ilj) J

Uploaded by

Nguyễn PhongCopyright:

Available Formats

Channel Surfing

:

I'ilj)j

II II!

,If II I III j[lilf j I. 1

1111 ',i lll : ::

f] It I 3 !,.S1

J

3i

l

,.

� '"

aPho

�r ) '5ton

i t D 2 D y • n a mISics12

9 � � lftb 9 !

�i 1l '0

10"lfll t " "

y"1SofMe H)(Jet

6tock

lc ourtes

17 !i }6

I i

'� I� Ckart2' ta

One other factor that adds to a confirmatioI;fI'1n�ifs an increase in

volume or the number of trades. We are talking about a substantial

increase, not just a minor one. Greed and panic should be motivating

the market during these times, resulting in a flock of traders scampering

to get in or out. If there is no serious increase in the amount of trades,

then the market is not responding positively to the breakout and may fail

to sustain it and is in danger of fai ling.

These confirmation techniques can be used for practically any type of

breakout trade you are considering. There are a number of patterns where

you can readily apply them, such as with triangle and wedge patterns. But

some breakout trades will require a more aggressive approach by entering

at the break. Of course, these trades will also include more risk, but the

pay-off can be more frequent trades and greater rewards. However, it must

be understood that the breakout trades that we are about to discuss are not

of the same caliper as trading range breakouts. There are usually no

multiple hits against support or resistance and you are not likely to see any

substanti.al increase in volume when they break.

Earlier, we discussed an entry based on the break of a secondary channel

called a rebound entry. The signal required a previous break off ofa larger

channel before a set up was in place. In effect, the two channels acted as a

form of confirmation because of a repeated break. Now we are returning

to this same basic concept, but with a twist.

35

You might also like

- One Note Samba - Glenn OsserDocument34 pagesOne Note Samba - Glenn OsserBidulon100% (1)

- SAP Electronic Bank Statement - Basic Process and Overview - TechloreanDocument6 pagesSAP Electronic Bank Statement - Basic Process and Overview - TechloreaniuriiNo ratings yet

- Bill Evans My Foolish Heart BBDocument7 pagesBill Evans My Foolish Heart BBMichaelJamesChristopherConklinNo ratings yet

- Ey 2022 WCTG WebDocument2,010 pagesEy 2022 WCTG WebPedro J Contreras ContrerasNo ratings yet

- Richard Clayderman - The Piano Solos of Richard Clayderman 2 PDFDocument45 pagesRichard Clayderman - The Piano Solos of Richard Clayderman 2 PDFJesus Hernandez100% (2)

- Adios Muchachos PDFDocument1 pageAdios Muchachos PDFRadanovic ZoranNo ratings yet

- Tarantella PDFDocument10 pagesTarantella PDFDomingos BuenoNo ratings yet

- Ease On Down The Road - BassDocument1 pageEase On Down The Road - BasswburgpnoNo ratings yet

- Highlights of The CREATE LawDocument3 pagesHighlights of The CREATE LawChristine Rufher FajotaNo ratings yet

- Wargames Illustrated #133Document64 pagesWargames Illustrated #133Анатолий Золотухин100% (1)

- COSTE, N. - Estudio #5Document1 pageCOSTE, N. - Estudio #5PepeNo ratings yet

- FreudeDocument33 pagesFreudechrisg1997No ratings yet

- Sta - Ana v. Maliwat Digest G.R. No. L-23023 August 31, 1968Document7 pagesSta - Ana v. Maliwat Digest G.R. No. L-23023 August 31, 1968Emil BautistaNo ratings yet

- EntrepDocument7 pagesEntrepPantz Revibes PastorNo ratings yet

- Jlhi (: Ill) LJDocument1 pageJlhi (: Ill) LJNguyễn PhongNo ratings yet

- Current Investigation Report With PlateDocument8 pagesCurrent Investigation Report With PlateDebaditya ChatterjeeNo ratings yet

- S. M. Chenoy, Shahjahanabad A City of Delhi, 1638-1857Document12 pagesS. M. Chenoy, Shahjahanabad A City of Delhi, 1638-1857Vanshika BhardwajNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Bridal Chorus Satb Bagian ADocument1 pageBridal Chorus Satb Bagian Aroy recordingNo ratings yet

- Dec 2019 Jan 2020Document1 pageDec 2019 Jan 2020MBA VCETNo ratings yet

- Ee LLC: - .R Iiill L.:I.If L:-L (',ii:: LaiDocument1 pageEe LLC: - .R Iiill L.:I.If L:-L (',ii:: LaiВсему Миру МирNo ratings yet

- Tugas 1 MatematikaDocument6 pagesTugas 1 MatematikaM Ripal MaimudaNo ratings yet

- Acoustic PA 170080Document1 pageAcoustic PA 170080Sergio MastríacoNo ratings yet

- A Kind of DrumDocument2 pagesA Kind of DrumIstvánKarádiNo ratings yet

- Feb 2019Document1 pageFeb 2019RirinNo ratings yet

- Causeni Iet NR 3 0 PDFDocument20 pagesCauseni Iet NR 3 0 PDFTatiana SolomonNo ratings yet

- NL SLR: Et TTDocument9 pagesNL SLR: Et TTDharmesh ChavdaNo ratings yet

- I.E 17039Document1 pageI.E 17039Yoni Ely Tenorio HerediaNo ratings yet

- Img 20200925 0001 PDFDocument1 pageImg 20200925 0001 PDFChristina TymkoNo ratings yet

- Cover Yamato Cilindrica 1Document169 pagesCover Yamato Cilindrica 1osvaldo perezNo ratings yet

- A Situation Analysis of The Juvenile Justice System in KenyaDocument36 pagesA Situation Analysis of The Juvenile Justice System in KenyaKarenNo ratings yet

- Physical Education PracticalDocument41 pagesPhysical Education PracticalAashvi ShahNo ratings yet

- Passing Thoughts J. YeagerDocument3 pagesPassing Thoughts J. YeagerRosa GoitiaNo ratings yet

- Bukti Transfer - BeckyDocument1 pageBukti Transfer - BeckyyudioperaNo ratings yet

- Du, Du Liegst P. 342Document1 pageDu, Du Liegst P. 342PotomatoNo ratings yet

- Strathmore Bel Pre Special Exception Modification of March 13, 1981Document2 pagesStrathmore Bel Pre Special Exception Modification of March 13, 1981Strathmore Bel PreNo ratings yet

- B9#109 2023Document4 pagesB9#109 2023cherry ann lubidNo ratings yet

- Nili : RT EgDocument5 pagesNili : RT Egjakson_007No ratings yet

- Btruool Assocurrs Lp: ltti郡Document3 pagesBtruool Assocurrs Lp: ltti郡Simon YiuNo ratings yet

- Entrecalles - KycDocument9 pagesEntrecalles - KycCarol OlayaNo ratings yet

- N4 NAT-TEST Certificate of Zaw Ko Ko AungDocument2 pagesN4 NAT-TEST Certificate of Zaw Ko Ko Aungzawko koaungNo ratings yet

- Jingle PEMILU 2019Document4 pagesJingle PEMILU 2019RICHARD A RAMBUNGNo ratings yet

- QuantumV1N1 PDFDocument68 pagesQuantumV1N1 PDFBleg OakNo ratings yet

- I Will Wait For You Iz Filma Šerbučki Kišobrani, Satb - Tomislav UhlikDocument3 pagesI Will Wait For You Iz Filma Šerbučki Kišobrani, Satb - Tomislav UhlikPaja TrosakNo ratings yet

- Tanzmusik PartiturDocument6 pagesTanzmusik Partiturmischka4No ratings yet

- P-. - K R-R - .: - " - .Iir /: 4 Thlrdftoor 5 Four1h S FRFLH LoorDocument4 pagesP-. - K R-R - .: - " - .Iir /: 4 Thlrdftoor 5 Four1h S FRFLH LoorGundi BhattiNo ratings yet

- Jadwal Bulan Oktober001Document4 pagesJadwal Bulan Oktober001lapas pohuwatoNo ratings yet

- tlunne Ilrd V,: DT Lu Litilqat IltDocument4 pagestlunne Ilrd V,: DT Lu Litilqat IltFabiano solizNo ratings yet

- E. Thorlaksson - TonadillaDocument1 pageE. Thorlaksson - Tonadillajoseantonsilva4718No ratings yet

- FL (RLLL !!:I:Tr..: !rsrysr (.H,:O Tiilrlqor - LaDocument2 pagesFL (RLLL !!:I:Tr..: !rsrysr (.H,:O Tiilrlqor - LaShanto ChowdhuryNo ratings yet

- Math Ch.8.1Document16 pagesMath Ch.8.1elvahung09No ratings yet

- Corporatiol/: H, S-:t-T++haDocument11 pagesCorporatiol/: H, S-:t-T++hagetachew negaNo ratings yet

- Tap TT2 Ahmad Rofi'i 857713464Document4 pagesTap TT2 Ahmad Rofi'i 857713464isninaNo ratings yet

- I - /lé ',, 41 T' I I) - '), Ÿ5 It - Ùntqorisoiâ T+L?LDocument6 pagesI - /lé ',, 41 T' I I) - '), Ÿ5 It - Ùntqorisoiâ T+L?Lmethode algerainNo ratings yet

- Img 20230907 0001Document1 pageImg 20230907 0001leatherkingbangladeshNo ratings yet

- Gjly:Lg (Yllg JT) T - J: A:R Rza:LzzaDocument7 pagesGjly:Lg (Yllg JT) T - J: A:R Rza:LzzaYPI IRSYADUL ABROR ASSALAMNo ratings yet

- Consolidated Mark SheetDocument1 pageConsolidated Mark SheetMuruganandamGanesanNo ratings yet

- Los PescaoresDocument5 pagesLos PescaoreshoweqkNo ratings yet

- 1JD..u..a: Information Technology UniversityDocument1 page1JD..u..a: Information Technology Universitytalha khalidNo ratings yet

- Electrical Load AnalysisDocument14 pagesElectrical Load AnalysisTECH2982No ratings yet

- Juk MH-380 382Document28 pagesJuk MH-380 382RHoskaNo ratings yet

- قراءات محاسبية مرحلة اولىDocument131 pagesقراءات محاسبية مرحلة اولىntnt0875No ratings yet

- MSDS Sabun Cuci TanganDocument2 pagesMSDS Sabun Cuci TanganLiliana RahmadewiNo ratings yet

- Ij This ' - ".-,lu,,.,.i: Memeor'I/Nqum Is of Technology ItsDocument4 pagesIj This ' - ".-,lu,,.,.i: Memeor'I/Nqum Is of Technology ItsSonamNo ratings yet

- Ell R F-M: Th. PortDocument1 pageEll R F-M: Th. PortNguyễn PhongNo ratings yet

- 036Document1 page036Nguyễn PhongNo ratings yet

- TH Pric of Stori: To ToDocument1 pageTH Pric of Stori: To ToNguyễn PhongNo ratings yet

- 061Document1 page061Nguyễn PhongNo ratings yet

- 062Document1 page062Nguyễn PhongNo ratings yet

- The Internally Motivated 'I'l'3der Part 1Document1 pageThe Internally Motivated 'I'l'3der Part 1Nguyễn PhongNo ratings yet

- Uh Yllu .-LL ND Tlwu Ih' LFH Oulln Oilll'R: Olulion 1 L I LL) /I LNP ' Gli DLLL'L Linn HipDocument1 pageUh Yllu .-LL ND Tlwu Ih' LFH Oulln Oilll'R: Olulion 1 L I LL) /I LNP ' Gli DLLL'L Linn HipNguyễn PhongNo ratings yet

- HT I1t'1"l //DL Li T T-Ti Hnilg: - LL - R - SS L'Document1 pageHT I1t'1"l //DL Li T T-Ti Hnilg: - LL - R - SS L'Nguyễn PhongNo ratings yet

- The Price of Holding On To: StoriesDocument1 pageThe Price of Holding On To: StoriesNguyễn PhongNo ratings yet

- ""'1Nm'Wm,: " NI OR L (.//' (" //, II-1"Document1 page""'1Nm'Wm,: " NI OR L (.//' (" //, II-1"Nguyễn PhongNo ratings yet

- Mirl'OI', Mirl'or: If I""k This / While ManagpmentDocument1 pageMirl'OI', Mirl'or: If I""k This / While ManagpmentNguyễn PhongNo ratings yet

- About The Authol': Tarycr E, Wic/Ij"!1Document1 pageAbout The Authol': Tarycr E, Wic/Ij"!1Nguyễn PhongNo ratings yet

- Some Lrarle ... Arrive at The Poil/!. Rlemanding Perf Etion in IheirDocument1 pageSome Lrarle ... Arrive at The Poil/!. Rlemanding Perf Etion in IheirNguyễn PhongNo ratings yet

- Foreword: She Presen!s A Down H .. Ear/!" Easy Lv-Read Co",,,,,,n Sen""Document1 pageForeword: She Presen!s A Down H .. Ear/!" Easy Lv-Read Co",,,,,,n Sen""Nguyễn PhongNo ratings yet

- Pauses Can Provide You With Advance Knowledge Regarding PossibleDocument1 pagePauses Can Provide You With Advance Knowledge Regarding PossibleNguyễn PhongNo ratings yet

- Are Rna,': - E I D Nki Dru Li - LL R I - . orDocument1 pageAre Rna,': - E I D Nki Dru Li - LL R I - . orNguyễn PhongNo ratings yet

- When The Trend Continues After Pausing: Michael 1. ParsonsDocument1 pageWhen The Trend Continues After Pausing: Michael 1. ParsonsNguyễn PhongNo ratings yet

- Michael J. ParsonsDocument1 pageMichael J. ParsonsNguyễn PhongNo ratings yet

- Between Your Entry and The Reversal's Extreme Price. Figure 3-1 Shows How Good of An Entry This Can BeDocument1 pageBetween Your Entry and The Reversal's Extreme Price. Figure 3-1 Shows How Good of An Entry This Can BeNguyễn PhongNo ratings yet

- An Important Early Warning That A Reversal May Fail Can Be Seen in The Price Action Immediately Fol Lowing The Break of The Prior Channel LineDocument1 pageAn Important Early Warning That A Reversal May Fail Can Be Seen in The Price Action Immediately Fol Lowing The Break of The Prior Channel LineNguyễn PhongNo ratings yet

- !" Lillt!: Michael J. ParsonsDocument1 page!" Lillt!: Michael J. ParsonsNguyễn PhongNo ratings yet

- Chapter Three: Kiss of The Channel LineDocument1 pageChapter Three: Kiss of The Channel LineNguyễn PhongNo ratings yet

- Michael 1. Parsons: Changing of The GuardDocument1 pageMichael 1. Parsons: Changing of The GuardNguyễn PhongNo ratings yet

- Michael 1. ParsonsDocument1 pageMichael 1. ParsonsNguyễn PhongNo ratings yet

- L. When A Trend Reverses Direction 2. When The Trend Continues After Pausing 3. Changes in Momentum and Trend ShiftsDocument1 pageL. When A Trend Reverses Direction 2. When The Trend Continues After Pausing 3. Changes in Momentum and Trend ShiftsNguyễn PhongNo ratings yet

- Channel SurfingDocument1 pageChannel SurfingNguyễn PhongNo ratings yet

- Afichael J ParsonsDocument1 pageAfichael J ParsonsNguyễn PhongNo ratings yet

- Trading False Breakouts: Michael 1. ParsonsDocument1 pageTrading False Breakouts: Michael 1. ParsonsNguyễn PhongNo ratings yet

- Channel Surfing: A Prior High Is Broken, But The Breakout Fails To HoldDocument1 pageChannel Surfing: A Prior High Is Broken, But The Breakout Fails To HoldNguyễn PhongNo ratings yet

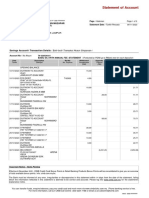

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument3 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balancep4ukumarNo ratings yet

- Malunggaling Churros Business PlanDocument10 pagesMalunggaling Churros Business PlanPrincess Elizabeth ArañezNo ratings yet

- Tax Practice Math Solution PDFDocument1 pageTax Practice Math Solution PDFnurulaminNo ratings yet

- Kaizen Assignment 2Document4 pagesKaizen Assignment 2Walia Raunaq Rajiv PGP 2022-24 BatchNo ratings yet

- Asynch1 - L3 - Understanding Global InequalitiesDocument6 pagesAsynch1 - L3 - Understanding Global InequalitiesVethinaVirayNo ratings yet

- Name: Unsa Soomro Roll no:20S-MSHRM-BS-01 Assigned By: Sir. DR Shah Mohammad KamranDocument12 pagesName: Unsa Soomro Roll no:20S-MSHRM-BS-01 Assigned By: Sir. DR Shah Mohammad Kamranunsa soomro100% (1)

- ALI Top 100 Stockholders As OfSeptember 30, 2020Document13 pagesALI Top 100 Stockholders As OfSeptember 30, 2020Jan Ellard CruzNo ratings yet

- Geopak: Coordinate Measuring Machine Software For Users From Entry-Level To ExpertDocument6 pagesGeopak: Coordinate Measuring Machine Software For Users From Entry-Level To Expertcmm5477No ratings yet

- E - TRADE Confirm Residency StatusDocument4 pagesE - TRADE Confirm Residency Statusjagendra singhNo ratings yet

- AMAZONDocument22 pagesAMAZONASHWINI PATILNo ratings yet

- Risk Management - c1Document33 pagesRisk Management - c1nana hahaNo ratings yet

- Ay 22-23 Dattatri Kadam With Sign & StampDocument13 pagesAy 22-23 Dattatri Kadam With Sign & StampRAJESH DNo ratings yet

- Cfa Level 1 Ethics-Code - Standard Class 6Document21 pagesCfa Level 1 Ethics-Code - Standard Class 6pamilNo ratings yet

- A Case Study of CITIC Investment CorporationDocument5 pagesA Case Study of CITIC Investment Corporationmoni123456No ratings yet

- Statement Cimb NovDocument3 pagesStatement Cimb NovfaqrullhNo ratings yet

- Human Resource ProcuretmentDocument14 pagesHuman Resource Procuretmentjeje jeNo ratings yet

- JD Admin HR-Admin-AssistantDocument1 pageJD Admin HR-Admin-AssistantHoangNo ratings yet

- Chellan Federal-BankDocument1 pageChellan Federal-BankAbhijith. ANo ratings yet

- Hs Entrepreneurship Performance Indicators 3Document20 pagesHs Entrepreneurship Performance Indicators 3api-374581067No ratings yet

- Amazon CaseDocument2 pagesAmazon CaseradhikaNo ratings yet

- Abrasive Jet Machining (AJM) : Unit 3Document54 pagesAbrasive Jet Machining (AJM) : Unit 3Satish SatiNo ratings yet

- Aronium Networking Version: Setup GuideDocument18 pagesAronium Networking Version: Setup Guidefong99No ratings yet

- John Doe v. Brandeis UniversityDocument24 pagesJohn Doe v. Brandeis UniversityReporterJennaNo ratings yet

- Prolongation Cost Claims - The Basic PrinciplesDocument6 pagesProlongation Cost Claims - The Basic PrinciplesMuhammad ZaimmuddinNo ratings yet

- Section 1 PDFDocument299 pagesSection 1 PDFIbrahim KhalifaNo ratings yet