Professional Documents

Culture Documents

Act Qstns

Uploaded by

Chaerin Lee0 ratings0% found this document useful (0 votes)

11 views2 pagesOriginal Title

act qstns

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views2 pagesAct Qstns

Uploaded by

Chaerin LeeCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

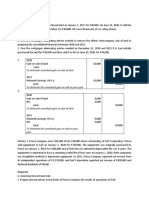

Question 1: Following are the transactions for MR. N’s Books of accounts.

1. Started a business with 100,000 SR cash.

2. Bought furniture for 25,000 Cash.

3. Bought equipments for cash SR 20,000

4. Bought office supplies for SR 5,000 on credit from MR. X

5. Provided services for SR 15,000 Cash

6. Provided services for SR 8,000 on credit to MR. Y

7. Paid cash to Mr. X SR. 4,000

8. Received cash from Mr. Y SR 5000

Requirements: Prepare the accounting equation for Mr. N’s business.

Question 2: Mr. Ahmad has invested 15000 SR cash to start a garments business in Jeddah on 1 st of

January 2013. Following are the business transactions happened over time.

1. Mr. Ahmad paid 2000 SR cash to buy furniture and equipments for his shop on 15 th of

January 2013.

2. All of the garments were purchased on cash for amount 8000 SR.

3. First sales revenue for the shop was 500 SR cash.

4. Mr. Ahmad paid electricity expenses of 200 SR for the shop in cash on 3 rd of February 2013.

5. On 15th of February, MR. Ahmad sold some garments amounting 2000 SR, of which 1000 SR

are given in cash, while rest of money will be received after one month.

6. On 20th of February, MR. Ahmad has taken 2000 SR from the business for his personal use.

Requirements: Prepare the accounting equation for Mr. Ahmad business.

Question 3: Miss Hanouf has started a beauty parlor by investing 50,000 SR cash on 1 st March 2012.

Following are the business transaction for the business.

1. Miss Hanouf has spent 10,000 SR cash for the parlor equipments.

2. Other parlor accessories were purchased for 20,000 on credit.

3. Miss Hanouf has paid the 3000 SR as rent in cash.

4. 3000 SR were earned and paid in cash for bridal make up services.

5. The parlor has provided services on account to some of the customers and wrote 4000 SR as

receivables.

6. Miss Hanouf discussed an expansion project amounting 100,000 SR with her friend Sara.

They might expand the services to other cities in 2015.

7. The entire electricity bills for the month were still due amounting 1500 SR in total.

8. Miss Hanouf received 2000 SR cash in terms of receivables.

Requirements: Prepare the accounting equation for Miss Hanouf business.

Question 4:

1. Abrar has decided to open a computer equipment business which she named Computronics.

On 1st of February 2012 she invested 20,000 SR cash in the business.

2. Abrar has purchased computer equipment’s for SR 10,000 Cash.

3. Abrar has purchased office supplies for her business amounting SR 2000 on account.

4. Abrar received SR 1500 as her first selling income.

5. She placed an ad in the local newspaper which cost her SR 500. Abrar still haven’t paid that

amount.

6. Abrar has sold some equipment for SR 5000 of which she has received SR 2000 in cash while

the rest of money will be paid next month.

7. Abrar paid salaries of SR 3000 for the month of February.

8. She also pays the advertisement bill of SR 500 in cash.

9. Abrar withdraws SR 2000 for her personal use.

10. Abrar received 2000 cash from the customer which were due in transaction 6.

Requirements: Prepare the accounting equation for Abrar’s business.

Question 5: Complete the following table

Assets = Liabilities + Owner’s Equity

90,000 = 50,000 + ?

? = 40,000 + 70,000

94,000 = ? + 53,000

150,000 = 70,000 + ?

? = 35,000 + 29,000

78,000 = ? + 43,000

You might also like

- Q No.1 Use Following Title of Accounts To Complete Journal Entries of Given TransactionsDocument5 pagesQ No.1 Use Following Title of Accounts To Complete Journal Entries of Given TransactionsNoorNo ratings yet

- General Journal Practice QuestionsDocument7 pagesGeneral Journal Practice QuestionsTahira Batool100% (1)

- Chapter One Test ExercisesDocument2 pagesChapter One Test Exerciseskaahiye cadeNo ratings yet

- Journal-Ledger transactions and accounting equation problemsDocument9 pagesJournal-Ledger transactions and accounting equation problemsanushka100% (1)

- Accounting Equation and General JournalDocument3 pagesAccounting Equation and General JournalWaqar AhmadNo ratings yet

- Tutorial 05Document3 pagesTutorial 05Janidu KavishkaNo ratings yet

- Assignment No. 01 FAPDocument4 pagesAssignment No. 01 FAPUmar FaridNo ratings yet

- Exercises On Accounting EquationDocument4 pagesExercises On Accounting EquationNeelu AggrawalNo ratings yet

- Ca F Chapter 2 CompletelyDocument14 pagesCa F Chapter 2 CompletelyG. DhanyaNo ratings yet

- Management Accounting Assignment 1Document3 pagesManagement Accounting Assignment 1saurabhma23.pumbaNo ratings yet

- Q No.1 Use Following Title of Accounts To Complete Journal Entries of Given TransactionsDocument6 pagesQ No.1 Use Following Title of Accounts To Complete Journal Entries of Given TransactionsMuhammad Haris100% (1)

- Class Exercise Session 1,2Document7 pagesClass Exercise Session 1,2sheheryar50% (4)

- Accounting EquationDocument2 pagesAccounting Equationsyed ali raza kazmi100% (1)

- Accounting Bs 1st New Practice QuestionsDocument14 pagesAccounting Bs 1st New Practice QuestionsJahanzaib ButtNo ratings yet

- Accounting equation problems and solutionsDocument2 pagesAccounting equation problems and solutionsSenthil ArasuNo ratings yet

- Latihan Formatif Accounting Equation 2Document2 pagesLatihan Formatif Accounting Equation 2Muhammad AzamNo ratings yet

- Fundamentals of Financial Accounting: Question No. 1Document1 pageFundamentals of Financial Accounting: Question No. 1Hashim MughalNo ratings yet

- Assignment 1Document2 pagesAssignment 1Zafeer AhmedNo ratings yet

- Accouting Equation HandoutDocument5 pagesAccouting Equation HandoutALI ZAFAR� LIAQAT UnknownNo ratings yet

- Assignment 1Document3 pagesAssignment 1Syed Muhammad Abdullah ShahNo ratings yet

- UntitledDocument2 pagesUntitledGeorgeNo ratings yet

- Assignment On JournalDocument4 pagesAssignment On JournalNIKHIL GUPTANo ratings yet

- General JournalDocument5 pagesGeneral Journalmuhammad.16032.acNo ratings yet

- Problem 1Document14 pagesProblem 1SyedNo ratings yet

- Assignment No-3Document9 pagesAssignment No-3Ronit gawade100% (1)

- Accounting Ex3.0Document3 pagesAccounting Ex3.0Kanishka Singh RaghuvanshiNo ratings yet

- Accounting Equation Problems and SolutionDocument7 pagesAccounting Equation Problems and SolutionNilrose EscartinNo ratings yet

- Problem Set 1 UpdatedDocument2 pagesProblem Set 1 UpdatedRubab MirzaNo ratings yet

- JournalDocument2 pagesJournallulughoshNo ratings yet

- Assignment For Bibs 1 Year Students by Ca Mohit AryaDocument3 pagesAssignment For Bibs 1 Year Students by Ca Mohit Aryamohitarya011No ratings yet

- Journalese The Following Transaction. Time Allowed: 40 Minutes Marks: 20Document1 pageJournalese The Following Transaction. Time Allowed: 40 Minutes Marks: 20murtaza5500No ratings yet

- ACC Project 1Document8 pagesACC Project 1Mikaela LensleyNo ratings yet

- Journal Test - 1Document1 pageJournal Test - 1Ana SandeepNo ratings yet

- Accounting exercises on transactionsDocument12 pagesAccounting exercises on transactionsNeelu AggrawalNo ratings yet

- XI State Board bookkeeping practice questionsDocument2 pagesXI State Board bookkeeping practice questionsAlefiya BurhaniNo ratings yet

- Assignment Soution 1Document9 pagesAssignment Soution 1divya kalyaniNo ratings yet

- Exercises On Journalizing (Debit and Credit)Document2 pagesExercises On Journalizing (Debit and Credit)kim100% (4)

- Journal Ledger Trial BalanceDocument8 pagesJournal Ledger Trial BalancejessNo ratings yet

- FA1 Cash BookDocument2 pagesFA1 Cash BookamirNo ratings yet

- AssignmentDocument8 pagesAssignmentSameer SawantNo ratings yet

- # CH-1 - Transaction - AnalysisDocument3 pages# CH-1 - Transaction - AnalysisGetaneh ZewuduNo ratings yet

- Accounting Terms and ConceptsDocument4 pagesAccounting Terms and ConceptsNirajNo ratings yet

- Journalize Following TransactionsDocument13 pagesJournalize Following TransactionsMD SAHIRNo ratings yet

- Chapter 2 Practice ExercisesDocument2 pagesChapter 2 Practice ExercisesSokrit SoeurNo ratings yet

- June 2017 1 5: Problem 5Document2 pagesJune 2017 1 5: Problem 5Roqui M. GonzagaNo ratings yet

- Activity ABMDocument2 pagesActivity ABMRoqui M. GonzagaNo ratings yet

- Accountancy ProjectDocument10 pagesAccountancy ProjectAham GamingNo ratings yet

- 2.-A-Journal & Ledger - QuestionsDocument3 pages2.-A-Journal & Ledger - QuestionsLibrarian 19750% (1)

- E1 Accounting Entries PracticeDocument1 pageE1 Accounting Entries PracticeHuzaifanadeemNo ratings yet

- Accountancy WorksheetDocument5 pagesAccountancy WorksheetAnimesh RajNo ratings yet

- Accounting Equation - Examples of Transactions Affecting Assets, Liabilities, CapitalDocument3 pagesAccounting Equation - Examples of Transactions Affecting Assets, Liabilities, Capitalmaheshbendigeri5945No ratings yet

- Class 11 Accountancy Worksheet - 2023-24Document17 pagesClass 11 Accountancy Worksheet - 2023-24Yashi BhawsarNo ratings yet

- Asm 2670Document3 pagesAsm 2670Pushkar MittalNo ratings yet

- Chapter 8 - Journal and LedgerDocument75 pagesChapter 8 - Journal and LedgerRiya AggarwalNo ratings yet

- Revision WorksheetDocument2 pagesRevision WorksheetRavi UdeshiNo ratings yet

- Questions On Journal Entry For StudentsDocument8 pagesQuestions On Journal Entry For Studentsveraji3735No ratings yet

- Basics of Accounting Question Bank PDDM Term 1Document34 pagesBasics of Accounting Question Bank PDDM Term 1sapitfin0% (1)

- ACCOUNTING PROBLEMS SOLUTIONSDocument31 pagesACCOUNTING PROBLEMS SOLUTIONSJanna GunioNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- MGT 326 AssignmentDocument1 pageMGT 326 AssignmentChaerin LeeNo ratings yet

- MGT 326 AssignmentDocument1 pageMGT 326 AssignmentChaerin LeeNo ratings yet

- Strategic Knowledge Transfer and Its Implications For Competitive AdvantageDocument2 pagesStrategic Knowledge Transfer and Its Implications For Competitive AdvantageChaerin LeeNo ratings yet

- Coursera S.F Executive SummaryDocument2 pagesCoursera S.F Executive SummaryChaerin LeeNo ratings yet

- A.I.M Mgt325 Assignment2Document1 pageA.I.M Mgt325 Assignment2Chaerin LeeNo ratings yet

- A.I.M Mgt325 Assignment2Document1 pageA.I.M Mgt325 Assignment2Chaerin LeeNo ratings yet

- Strategic Knowledge Transfer and Its Implications For Competitive AdvantageDocument2 pagesStrategic Knowledge Transfer and Its Implications For Competitive AdvantageChaerin LeeNo ratings yet

- Coursera S.F Executive SummaryDocument2 pagesCoursera S.F Executive SummaryChaerin LeeNo ratings yet

- MGT 326 AssignmentDocument1 pageMGT 326 AssignmentChaerin LeeNo ratings yet

- A.I.M Mgt325 Assignment2Document1 pageA.I.M Mgt325 Assignment2Chaerin LeeNo ratings yet

- Strategic Knowledge Transfer and Its Implications For Competitive AdvantageDocument2 pagesStrategic Knowledge Transfer and Its Implications For Competitive AdvantageChaerin LeeNo ratings yet

- Management Revision QuestionsDocument27 pagesManagement Revision QuestionsChaerin LeeNo ratings yet

- Coursera S.F Executive SummaryDocument2 pagesCoursera S.F Executive SummaryChaerin LeeNo ratings yet

- Chapter 3 Job Costing: Managerial Accounting, 4e, Global Edition (Braun/Tietz)Document8 pagesChapter 3 Job Costing: Managerial Accounting, 4e, Global Edition (Braun/Tietz)Chaerin LeeNo ratings yet

- Gep Psy Final Project Draft 2Document3 pagesGep Psy Final Project Draft 2Chaerin LeeNo ratings yet

- Chapter 3: Job Costing Practice Questions IIIDocument4 pagesChapter 3: Job Costing Practice Questions IIIChaerin LeeNo ratings yet

- Macroecons ch1 Revision WorksheetDocument4 pagesMacroecons ch1 Revision WorksheetChaerin LeeNo ratings yet

- Assignment 3 - Asthma and Bronchiolitis - Case StudyDocument4 pagesAssignment 3 - Asthma and Bronchiolitis - Case StudyChaerin LeeNo ratings yet

- Assignment MiCROECONOMICSDocument2 pagesAssignment MiCROECONOMICSChaerin LeeNo ratings yet

- Final Project PreCalculus-1Document6 pagesFinal Project PreCalculus-1Chaerin LeeNo ratings yet

- Midterm 2020Document3 pagesMidterm 2020Chaerin LeeNo ratings yet

- Assignment 4 - Cardiovascular DiseaseDocument2 pagesAssignment 4 - Cardiovascular DiseaseChaerin LeeNo ratings yet

- Effects of Procrastination on Students' Grades and Mental HealthDocument2 pagesEffects of Procrastination on Students' Grades and Mental HealthChaerin LeeNo ratings yet

- Causes of Road AccidentsDocument1 pageCauses of Road AccidentsChaerin LeeNo ratings yet

- English Assign CorrectedDocument2 pagesEnglish Assign CorrectedChaerin LeeNo ratings yet

- Case Studies and AnswersDocument2 pagesCase Studies and AnswersChaerin LeeNo ratings yet

- Ghew 181Document1 pageGhew 181Chaerin LeeNo ratings yet

- Smart Car Case StudyDocument1 pageSmart Car Case StudyChaerin LeeNo ratings yet

- Causes and Effects of Early School Dropouts ASSIGNMENTDocument1 pageCauses and Effects of Early School Dropouts ASSIGNMENTChaerin LeeNo ratings yet

- Dutch FarmDocument104 pagesDutch Farmdoc_abdullahNo ratings yet

- Let's Check: To Eliminate Unrealized Gain On Sale of LandDocument4 pagesLet's Check: To Eliminate Unrealized Gain On Sale of Landalmira garciaNo ratings yet

- Public Health EngineeringDocument10 pagesPublic Health EngineeringOmkar DeshpandeNo ratings yet

- Radio Frequency Field - Bioeffects & SafetyDocument37 pagesRadio Frequency Field - Bioeffects & SafetyAmel AntonyNo ratings yet

- Spares Parts Cannibalisation ProcedureDocument3 pagesSpares Parts Cannibalisation ProcedureThang Nguyen Hung100% (1)

- FarkolDocument7 pagesFarkolHasiadin LaodeNo ratings yet

- Candidates applied for Medical Officer post on contract basisDocument11 pagesCandidates applied for Medical Officer post on contract basiszephyrNo ratings yet

- Chap 24 Econ 40Document4 pagesChap 24 Econ 40Racel DelacruzNo ratings yet

- BONDING: Understanding Chemical AttractionsDocument201 pagesBONDING: Understanding Chemical AttractionsKhaled OsmanNo ratings yet

- Water For Injections BP: What Is in This Leaflet?Document2 pagesWater For Injections BP: What Is in This Leaflet?Mohamed OmerNo ratings yet

- NBME 22 OfflineDocument200 pagesNBME 22 OfflineGautham Kanagala86% (14)

- Science Activity Sheet Quarter 4 - MELC 2 Week 2: Uses of WaterDocument13 pagesScience Activity Sheet Quarter 4 - MELC 2 Week 2: Uses of WaterShareinne TeamkNo ratings yet

- Different Surgical Modalities For Management of Postburn FL Exion Contracture of The ElbowDocument6 pagesDifferent Surgical Modalities For Management of Postburn FL Exion Contracture of The ElbowMadhuchandra HirehalliNo ratings yet

- Menu Baru Kopi GandapoeraDocument7 pagesMenu Baru Kopi GandapoeraAlwan AhpNo ratings yet

- Sakshijain75.Final ProDocument46 pagesSakshijain75.Final ProOm AherNo ratings yet

- Order - Judgement Query Coram WiseDocument13 pagesOrder - Judgement Query Coram Wisesatish_CJNo ratings yet

- Old Fashioned Southern Tea CakesDocument2 pagesOld Fashioned Southern Tea CakesDB ScottNo ratings yet

- Rotation: Medical Intensive Care Unit (South Campus) For Interns and ResidentsDocument6 pagesRotation: Medical Intensive Care Unit (South Campus) For Interns and ResidentsHashimIdreesNo ratings yet

- Rational Choice TheoryDocument6 pagesRational Choice TheoryMaria Theresa HerbolingoNo ratings yet

- Sprocket Asa 180Document1 pageSprocket Asa 180jhampolrosalesNo ratings yet

- Amul India Case Study: Product Portfolio and SWOT AnalysisDocument10 pagesAmul India Case Study: Product Portfolio and SWOT AnalysisShruti NagmoteNo ratings yet

- Chemistry Units 8 12Document29 pagesChemistry Units 8 12reg speckNo ratings yet

- Sea Level Rise Threatens Coastal CommunitiesDocument13 pagesSea Level Rise Threatens Coastal CommunitiesGunawan La OdeNo ratings yet

- UM16000 Flame Detector Installation Guide EnglishDocument12 pagesUM16000 Flame Detector Installation Guide Englishmohamed.rescoNo ratings yet

- 311970536Document1 page311970536Codrut RadantaNo ratings yet

- Bibliometric Handbook For Karolinska InstitutetDocument41 pagesBibliometric Handbook For Karolinska InstitutetCamila Araya G100% (1)

- Mcimt NDT Kids at 1Document12 pagesMcimt NDT Kids at 1api-485106673No ratings yet

- CH 2Document20 pagesCH 2Vivek SinghNo ratings yet

- Role of Drugs That Affect Renin Angiotensin SystemDocument22 pagesRole of Drugs That Affect Renin Angiotensin Systemash ashNo ratings yet