Professional Documents

Culture Documents

The Customs Duty Is Computed As: Dutiable Value X Exchange Rate X Rate of Duty

Uploaded by

francis dungcaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Customs Duty Is Computed As: Dutiable Value X Exchange Rate X Rate of Duty

Uploaded by

francis dungcaCopyright:

Available Formats

The importation of professional instruments and household effects are exempt but the importation of the car is subject to

VAT . Illustration 2

Mr. Kung Fu, a Chinese martial arts master, arrived in the Philippines with an immigration visa. He brought with him the following

which he declared as his personal effects:

10 pieces of brand new iPhone 6 P 150,000 each

10 pieces of brand new IBM laptops P80,000 each

5 desktop computers P40,000 each

1 piece of used laptop P 30,000

1 piece of used iPhone 4S 20,000

1 piece of used calculator 400

Used clothes, apparel and travelling bag 7,000

The used laptop, iPhone 4S, calculator and apparel are apparently personal effects which are past consumptions; hence, these are

exempt from VAT.

The nature and quantity of the iPhone 6, IBM laptops and desktop computers is clearly inconsistent with the concept of personal

effects. These items are unquestionably for domestic consumption; hence. Subject to VAT.

IMPORTATION EXEMPT UNDER SPECIAL LAWS AND TREATIES

Import that are exempted by special laws, treaties and international agreements to which the Philippine government is a signatory is

not subject to the VAP on importation.

THE VAT ON IMPORTATION

Other importation of goods is subject to VAT regardless of whether the:

1. Importer is engaged or not engaged in the trade business.

2. Importer is a VAT or non-VAT business

3. Importation is for business or personal use

4. Non-resident seller is engaged or not engaged to business

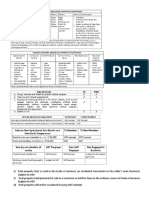

The basis of the VAT on importation

The VAT on importation is computed as 12% of the total landed cost of the importation.

Composition of landed cost:

A. Dutiable value

B. Other in-land costs

1. Custom duty

2. Excise tax, if nay

3. Other in-land costs, such as:

a. Bank charge

b. Brokerage fee

c. Arrastre charge

d. Wharfage due

e. Documentary stamp tax

f. Import processing fees

The dutiable value, also called transaction value, refers to the total value used by the Bureau of Customs in determining customs

duties, such as:

1. Cost of the goods

2. Freight

3. Insurance

4. Other charges and costs to bring goods herein

import

The dutiable vale encompasses all costs incurred in bringing the goods up to the Philippine port and prior t any other in-land costs of

*The customs duty is computed as: Dutiable value x Exchange rate x Rate of Duty

Illustration 1

MRS Trading Corporation imported goods from abroad for domestic Sale. Shown below are the details of the importation.

Peso value of supplier’s invoice P2,000,000

You might also like

- Lesson 3 - VAT On ImportationDocument5 pagesLesson 3 - VAT On ImportationVince TablacNo ratings yet

- Exercises Compiled PDFDocument134 pagesExercises Compiled PDFnena cabañes50% (2)

- Lesson 7Document2 pagesLesson 7Iris Lavigne RojoNo ratings yet

- Tax Booklet 3 Questions & QuizzerDocument30 pagesTax Booklet 3 Questions & QuizzerJLNo ratings yet

- Value Added Tax On ImportationDocument3 pagesValue Added Tax On ImportationAnna CynNo ratings yet

- May 15 2021 Zero Rated SalesDocument12 pagesMay 15 2021 Zero Rated SalesA cNo ratings yet

- Chapter 2 VAT in ImportationDocument51 pagesChapter 2 VAT in ImportationIvy TejadaNo ratings yet

- Tax 56 Activity 2Document2 pagesTax 56 Activity 2Hannah Alvarado BandolaNo ratings yet

- Quiz 1 PrelimDocument2 pagesQuiz 1 PrelimMicaella DanoNo ratings yet

- Income Tax of CorporationsDocument16 pagesIncome Tax of CorporationsLonjin Huang100% (1)

- Value Added Tax On ImportationDocument2 pagesValue Added Tax On ImportationTracy Miranda BognotNo ratings yet

- Zero Rated TransactionsDocument4 pagesZero Rated Transactionssad nuNo ratings yet

- Dia Mae A. Generoso - Learning Activity 3Document10 pagesDia Mae A. Generoso - Learning Activity 3Dia Mae Ablao GenerosoNo ratings yet

- Tax2 Quiz2 FinalsDocument11 pagesTax2 Quiz2 Finalsishinoya keishiNo ratings yet

- NEITHER Importation From Abroad, Purchase of Goods From Economic Zones in The PhilDocument2 pagesNEITHER Importation From Abroad, Purchase of Goods From Economic Zones in The PhilLazy LeathNo ratings yet

- Indirect Tax VI SemDocument12 pagesIndirect Tax VI SemrnaganirmitaNo ratings yet

- Template - Post Test - Classification of Taxpayers Other Than IndividualsDocument3 pagesTemplate - Post Test - Classification of Taxpayers Other Than IndividualsAleksander DagreytNo ratings yet

- CHAPTER 1 Part 2Document3 pagesCHAPTER 1 Part 2Marinelle DiazNo ratings yet

- Value Added Tax - : - Output VAT: Zero-Rated SalesDocument23 pagesValue Added Tax - : - Output VAT: Zero-Rated SalesAjey MendiolaNo ratings yet

- M3 Excise Tax Students Copy Revised PDFDocument73 pagesM3 Excise Tax Students Copy Revised PDFTokis SabaNo ratings yet

- VAT ReviewDocument8 pagesVAT ReviewabbyNo ratings yet

- Activity 3-Bustax 1Document4 pagesActivity 3-Bustax 1Nhel AlvaroNo ratings yet

- He May Be Subject To VATDocument6 pagesHe May Be Subject To VATThe makas AbababaNo ratings yet

- Corporate Income Tax - 1Document22 pagesCorporate Income Tax - 1Katrina Vianca DecapiaNo ratings yet

- Transfer and Business Tax Prelim ExamDocument30 pagesTransfer and Business Tax Prelim ExamPASCUA RENALYN M.No ratings yet

- Compilation of ExercisesDocument15 pagesCompilation of ExercisesHazel MoradaNo ratings yet

- AIR - CorporateDocument5 pagesAIR - CorporateRaz JisrylNo ratings yet

- Mid ThúeeDocument4 pagesMid Thúeetuanminhyl56No ratings yet

- Output Vat - Zero-Rated SalesDocument36 pagesOutput Vat - Zero-Rated SalesCoreen Samaniego0% (2)

- Tax On Corp. Sample ProblemsDocument2 pagesTax On Corp. Sample ProblemsWenjunNo ratings yet

- National Income and Related Aggregates: Important FormulaeDocument4 pagesNational Income and Related Aggregates: Important FormulaeRounak BasuNo ratings yet

- Capital Gains TaxDocument38 pagesCapital Gains TaxRenievave TorculasNo ratings yet

- Subject To VAT Subject To VAT 3) Real Property Utilized For Socialized Housing VAT ExemptDocument32 pagesSubject To VAT Subject To VAT 3) Real Property Utilized For Socialized Housing VAT ExemptNikka SanzNo ratings yet

- Activity 2 Final Income TaxDocument1 pageActivity 2 Final Income TaxGileah ZuasolaNo ratings yet

- VAT - OPT Illustrative ExamplesDocument6 pagesVAT - OPT Illustrative ExamplesFerb CruzadaNo ratings yet

- Activity 2 Income Taxation 2 Week, April 13, 2021: Timothy Reiner B. Carta Ňo BSA-191-EDocument5 pagesActivity 2 Income Taxation 2 Week, April 13, 2021: Timothy Reiner B. Carta Ňo BSA-191-EJaried SumbaNo ratings yet

- Chapter 8 Zero Rated SalesDocument39 pagesChapter 8 Zero Rated SalesCathy Marie Angela ArellanoNo ratings yet

- Practical Problems On CustomsDocument13 pagesPractical Problems On Customsnousheen riya67% (3)

- Quiz 1: Tax 3 Final Period QuizzesDocument10 pagesQuiz 1: Tax 3 Final Period QuizzesJhun bondocNo ratings yet

- Quiz On Percentage Tax and Documentary Stamps TaxDocument4 pagesQuiz On Percentage Tax and Documentary Stamps Taxncllpdll100% (4)

- Consumption Tax On ImportationDocument27 pagesConsumption Tax On ImportationOwncoebdief100% (1)

- Chapter 4 Sources of Income PDFDocument5 pagesChapter 4 Sources of Income PDFkimberly tenebroNo ratings yet

- Chapter 13 Advacc2Document27 pagesChapter 13 Advacc2Anthony Ariel Ramos Depante0% (1)

- Special Tax Rates For Foreign CorporationDocument4 pagesSpecial Tax Rates For Foreign CorporationPaul Anthony AspuriaNo ratings yet

- 12 Value Added Taxes 1Document91 pages12 Value Added Taxes 1Vince ManahanNo ratings yet

- TAX NotesDocument6 pagesTAX Notesadrian carinoNo ratings yet

- The Vat On ImportationDocument2 pagesThe Vat On ImportationQueennie Mae Tadia BilogNo ratings yet

- Fabm 2 Endterm ExaminationDocument4 pagesFabm 2 Endterm Examinationreverewh ouyNo ratings yet

- Note: Your Answer in No. 1 Would Be Whether It Is Subject To Net Income Tax, Final Withholding Tax, or Creditable Withholding TaxDocument1 pageNote: Your Answer in No. 1 Would Be Whether It Is Subject To Net Income Tax, Final Withholding Tax, or Creditable Withholding TaxShane RedoñaNo ratings yet

- Note: Your Answer in No. 1 Would Be Whether It Is Subject To Net Income Tax, Final Withholding Tax, or Creditable Withholding TaxDocument1 pageNote: Your Answer in No. 1 Would Be Whether It Is Subject To Net Income Tax, Final Withholding Tax, or Creditable Withholding TaxShane RedoñaNo ratings yet

- VAT - No. 2Document6 pagesVAT - No. 2Jay-ar Pre0% (1)

- Questions On Customs.Document4 pagesQuestions On Customs.GODBARNo ratings yet

- Chapter 11 Excise TaxDocument10 pagesChapter 11 Excise TaxAmzelle Diego LaspiñasNo ratings yet

- Chapter11 PDFDocument10 pagesChapter11 PDFAmzelle Diego LaspiñasNo ratings yet

- A NonDocument2 pagesA NonAlthea PalmaNo ratings yet

- Income Tax TestbankanssssDocument17 pagesIncome Tax TestbankanssssAirille Carlos67% (3)

- PDF Income Tax TestbankanssssDocument17 pagesPDF Income Tax TestbankanssssMark Emil Barit100% (1)

- How Companies Use: Foreign ExchangeDocument14 pagesHow Companies Use: Foreign Exchangefrancis dungcaNo ratings yet

- Pfandbriefe: Covered Bond Frankfurter HypoDocument1 pagePfandbriefe: Covered Bond Frankfurter Hypofrancis dungcaNo ratings yet

- 3 - Script in MASECODocument15 pages3 - Script in MASECOfrancis dungcaNo ratings yet

- AFAR Quiz 1Document6 pagesAFAR Quiz 1francis dungcaNo ratings yet

- Quiz 1 PPE Part SolutionDocument4 pagesQuiz 1 PPE Part Solutionfrancis dungcaNo ratings yet

- Theoretical Pricing: WAM (22.22% × 300) + (44.44% × 260) + (33.33% × 280) 66.66 + 115.55 + 93.33 275.55 MonthsDocument2 pagesTheoretical Pricing: WAM (22.22% × 300) + (44.44% × 260) + (33.33% × 280) 66.66 + 115.55 + 93.33 275.55 Monthsfrancis dungcaNo ratings yet

- Understanding Collateralized Debt Obligations: Types of CdosDocument1 pageUnderstanding Collateralized Debt Obligations: Types of Cdosfrancis dungcaNo ratings yet

- Securitization: Subprime Mortgage CrisisDocument1 pageSecuritization: Subprime Mortgage Crisisfrancis dungcaNo ratings yet

- 41Document1 page41francis dungcaNo ratings yet

- History: Advantages and DisadvantagesDocument1 pageHistory: Advantages and Disadvantagesfrancis dungcaNo ratings yet

- Recording and Mortgage Electronic Registration SystemsDocument2 pagesRecording and Mortgage Electronic Registration Systemsfrancis dungcaNo ratings yet

- A Brief History of Cdos: More About Creating CdosDocument1 pageA Brief History of Cdos: More About Creating Cdosfrancis dungcaNo ratings yet

- Bonds: Pass-Through Securities Are Issued by A Trust and Allocate The Cash Flows From TheDocument2 pagesBonds: Pass-Through Securities Are Issued by A Trust and Allocate The Cash Flows From Thefrancis dungcaNo ratings yet

- Secondary Mortgage Market: Government-Sponsored Enterprise Fannie Mae Freddie Mac Ginnie MaeDocument1 pageSecondary Mortgage Market: Government-Sponsored Enterprise Fannie Mae Freddie Mac Ginnie Maefrancis dungcaNo ratings yet

- Government Agencies and InstrumentalitiesDocument1 pageGovernment Agencies and Instrumentalitiesfrancis dungcaNo ratings yet

- Basis of Business Tax Per Type of ActivitiesDocument1 pageBasis of Business Tax Per Type of Activitiesfrancis dungcaNo ratings yet

- Importation Refers To The Purchase of Goods or Services by The Philippine Residents From Non-Resident SellersDocument1 pageImportation Refers To The Purchase of Goods or Services by The Philippine Residents From Non-Resident Sellersfrancis dungcaNo ratings yet

- The Importation of The Ingredients For The Processing of Foods For Human Consumption Is Vatable Because Processed Human Foods Are VatableDocument1 pageThe Importation of The Ingredients For The Processing of Foods For Human Consumption Is Vatable Because Processed Human Foods Are Vatablefrancis dungcaNo ratings yet

- 2Document1 page2francis dungcaNo ratings yet

- 18Document1 page18francis dungcaNo ratings yet

- Illustration 1Document1 pageIllustration 1francis dungcaNo ratings yet

- The Importation Is Not A Vehicle, Machinery or The Equipment Used in The Manufacture of Merchandise of Any Kind in Commercial QuantityDocument1 pageThe Importation Is Not A Vehicle, Machinery or The Equipment Used in The Manufacture of Merchandise of Any Kind in Commercial Quantityfrancis dungcaNo ratings yet

- Determine Taxpayer Registration Type. B. If Taxpayer Is non-VAT Registered, Pay The 3% General Percentage Tax Then Determine The Magnitude of 12-Month Vatable Sales at The End of Every MonthDocument1 pageDetermine Taxpayer Registration Type. B. If Taxpayer Is non-VAT Registered, Pay The 3% General Percentage Tax Then Determine The Magnitude of 12-Month Vatable Sales at The End of Every Monthfrancis dungcaNo ratings yet

- Examples of Persons Considered Engaged in BusinessDocument1 pageExamples of Persons Considered Engaged in Businessfrancis dungcaNo ratings yet

- Types of Business TaxpayersDocument1 pageTypes of Business Taxpayersfrancis dungcaNo ratings yet

- The Importation of Processed Products and Those Considered Not in Their Original State Shall Be Subject To VAT On ImportationDocument1 pageThe Importation of Processed Products and Those Considered Not in Their Original State Shall Be Subject To VAT On Importationfrancis dungcaNo ratings yet

- Illustration 2: Mr. Ysmael's Practice P 800,000 PDocument1 pageIllustration 2: Mr. Ysmael's Practice P 800,000 Pfrancis dungcaNo ratings yet

- Services and Is Imposable Only When The Seller Is A BusinessDocument1 pageServices and Is Imposable Only When The Seller Is A Businessfrancis dungcaNo ratings yet

- 3Document1 page3francis dungcaNo ratings yet

- Specifications: PartsDocument1 pageSpecifications: PartsReza RezaNo ratings yet

- Entrep Mind Chapter 6Document3 pagesEntrep Mind Chapter 6Yeho ShuaNo ratings yet

- An Overview of Association Rule Mining & Its Application: by Abhinav RaiDocument22 pagesAn Overview of Association Rule Mining & Its Application: by Abhinav RaiBheng AvilaNo ratings yet

- English For Business EassayDocument4 pagesEnglish For Business EassayEma ZulkiffliNo ratings yet

- New Marketing RealitiesDocument16 pagesNew Marketing Realitiesomaik fahimNo ratings yet

- Project Management Processes Methodologies and Economics 2nd Edition Shtub Solutions ManualDocument11 pagesProject Management Processes Methodologies and Economics 2nd Edition Shtub Solutions Manualashleygonzalezcqyxzgwdsa100% (10)

- 6 Mark Grade Boundary:: MarkschemeDocument22 pages6 Mark Grade Boundary:: Markschemeqi huangNo ratings yet

- Demerger of BajajDocument30 pagesDemerger of BajajNikhil100% (1)

- Cooch BeharDocument63 pagesCooch BeharSayantan ChoudhuryNo ratings yet

- E Commerce MLRIT NotesDocument95 pagesE Commerce MLRIT NotesSimran SinghNo ratings yet

- Matrix FAQDocument5 pagesMatrix FAQSafix YazidNo ratings yet

- China Wu Yi QuestionnaireDocument3 pagesChina Wu Yi Questionnairerameez rajaNo ratings yet

- Assignement 1: Exercise 1Document2 pagesAssignement 1: Exercise 1Arbi Chaima100% (1)

- Sticky Branding Work BookDocument38 pagesSticky Branding Work BookChjk PinkNo ratings yet

- Product Costing - COPA (End To End Guide)Document153 pagesProduct Costing - COPA (End To End Guide)rajesh_popatNo ratings yet

- Unit-3: Project SelectionDocument101 pagesUnit-3: Project SelectionMandeep Singh BhatiaNo ratings yet

- Ericsson Oil Gas Solution BriefDocument7 pagesEricsson Oil Gas Solution BriefTanesan WyotNo ratings yet

- Supply Chain Solutions For RanbaxyDocument10 pagesSupply Chain Solutions For RanbaxyMesajalNo ratings yet

- Hansa - 2015.12Document100 pagesHansa - 2015.12Alessandro CastagnaNo ratings yet

- Material Master - ConfigurationDocument57 pagesMaterial Master - ConfigurationRahul Aryan100% (1)

- SCM Group D Ca 1Document32 pagesSCM Group D Ca 1shubo palitNo ratings yet

- Training Design On Expanded Monthly Agricultural and Fisheries Situation Reporting System (EMAFSRS)Document6 pagesTraining Design On Expanded Monthly Agricultural and Fisheries Situation Reporting System (EMAFSRS)Gamel DeanNo ratings yet

- Project Report On-Marketing Strategies of VodafoneDocument109 pagesProject Report On-Marketing Strategies of Vodafoneridhsi61% (23)

- LabRev Cases 1 and NCMBDocument14 pagesLabRev Cases 1 and NCMBLila FowlerNo ratings yet

- CBCS - Macroeconomics - Unit 1 - National Income AccountingDocument37 pagesCBCS - Macroeconomics - Unit 1 - National Income AccountingSouptik MannaNo ratings yet

- Cambridge IGCSE™: Economics 0455/21 May/June 2021Document26 pagesCambridge IGCSE™: Economics 0455/21 May/June 2021Linh HoàngNo ratings yet

- Import Export Manager Interview QuestionsDocument2 pagesImport Export Manager Interview Questionsgoswamimk100% (2)

- Social Innovation AssignmentDocument4 pagesSocial Innovation AssignmentSukriteeNo ratings yet

- Sitrans: Speed SensorsDocument24 pagesSitrans: Speed SensorsJaime ViloriaNo ratings yet

- CIA1 Mentoring Industry AnalysisDocument16 pagesCIA1 Mentoring Industry AnalysisSree Lakshmi DeeviNo ratings yet