Professional Documents

Culture Documents

Matt Crooke Reforming IMS

Uploaded by

M.Hatta Dosen StiepanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Matt Crooke Reforming IMS

Uploaded by

M.Hatta Dosen StiepanCopyright:

Available Formats

Reforming the International

Monetary System:

The Need for a New Framework

•Matt Crooke, Australian Treasury

A summary

• The IMS isn’t broken…

• …but in certain key respects, its evolution hasn’t

kept up with changes in the global economy.

• The IMS comes under pressure from national policy

choices that haven’t been optimally coordinated…

• …and it operates in an environment of seemingly

ever-increasing interconnectedness and complexity.

How can the IMS be encouraged to further

evolve?

• Will fundamental changes in the global economy drive the

IMS to become more multipolar?

• Will governance reforms, boosting IMF resources and tracking

externalities be enough to sustain the IMS’ legitimacy and

support its ongoing evolution?

• Will the market itself deliver more durable solutions than

policymakers might?

• What supporting structures are required?

– mechanisms for dealing with inevitable system

failures and crises

– emergency liquidity arrangements; swap facilities;

regional safety nets; reserve pooling etc.

Role of the G20

• Sustain confidence in the global economy and

financial systems

• Strong, sustainable and balanced growth:

underpins system stability, supports jobs

• Enhancing global governance, policy

coordination and surveillance frameworks

• Driving a stronger commitment by members

to multilateral and national reforms

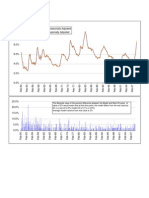

The rise of EMEs

100%

90%

Other advanced economies

80%

EU

70%

60% US

50%

40%

30% Other emerging markets

20%

India

10%

China

0%

Jan-80

Jan-81

Jan-82

Jan-83

Jan-84

Jan-85

Jan-86

Jan-87

Jan-88

Jan-89

Jan-90

Jan-91

Jan-92

Jan-93

Jan-94

Jan-95

Jan-96

Jan-97

Jan-98

Jan-99

Jan-00

Jan-01

Jan-02

Jan-03

Jan-04

Jan-05

Jan-06

Jan-07

Jan-08

Jan-09

Jan-10

Jan-11

Source: International Monetary Fund, April World Economic Outlook database, and IMF World Economic Outlook July 2012 Update.

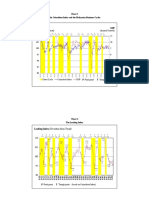

Not keeping pace: IMF quota shares

Current quota shares

(per cent)

United States,

17.670

Other, 40.246

EU, 24.813

Russia, 2.494

Brazil, 1.783 Japan, 6.556

India, 2.442 China, 3.996

Source: International Monetary Fund, pre-2010 quota shares

2010: IMF Quota and Governance

Reform Working Group

• In 2010, Australia and South Africa co-chaired

the G20’s IMF Working Group.

• Laid the groundwork for the 2010 IMF Quota

and Governance Reform endorsed by G20

Leaders at the Seoul Summit.

The 2010 IMF Quota and Governance

Reforms

Elements of agreement

Increase – doubling of quota with a corresponding NAB rollback

Shift in shares – over 6 per cent shift to under-represented members, and

over 6 per cent shift to EMDCs

Quota formula – review to be completed by January 2013 and the 15th

General Review of Quotas to be completed by January 2014

2011: IMS Reform Working Group

• In 2011, the G20 took steps to build a more

stable and resilient IMS

• A key focus was to enhance the capacity for

crisis prevention and response

2012: International Financial

Architecture Working Group

• Co-chaired by Australia and Turkey.

• Four key goals in the first half of 2012:

– Ensure that the IMF has sufficient resources to meet the needs of all

its members;

– Encourage implementation of the 2010 IMF Quota and Governance

Reform and progress on the quota formula review;

– Help strengthen IMF surveillance; and

– Supervise progress on implementation of the G20 Action Plan to

Support the Development of LCBMs.

• IMF governance reform continues to be a priority in the second half of

2012.

• Work has also commenced on the factors affecting infrastructure

investment.

Australian perspectives on reform

• Reform should be ongoing reflecting key

transitions in the global economy

• Effective multilateral cooperation is essential

• Build on existing strengths of the IMS

• Better reflect global economic realities

• Pragmatic and implementable

• Political will is a key ingredient

• Australia to host G20 in 2014

Reforming the International

Monetary System:

The Need for a New Framework

•Matt Crooke, Australian Treasury

You might also like

- U3 ModelDocument2 pagesU3 Modelkettle1No ratings yet

- USA Eco Indicators Dashboard - Consumer Spending, Confidence & SentimentDocument1 pageUSA Eco Indicators Dashboard - Consumer Spending, Confidence & SentimentWallstreetableNo ratings yet

- OFHEO 3% Trend Dec 2010Document1 pageOFHEO 3% Trend Dec 2010kettle1No ratings yet

- Theories of FX DeterminationDocument52 pagesTheories of FX DeterminationJeisson OchoaNo ratings yet

- By David Harding and Georgia Nakou, Winton Capital ManagementDocument5 pagesBy David Harding and Georgia Nakou, Winton Capital ManagementCoco BungbingNo ratings yet

- Libro Modulo III Capítulo 3 - 9 (Koch y Macdonald)Document185 pagesLibro Modulo III Capítulo 3 - 9 (Koch y Macdonald)Remy Angel Terceros FernandezNo ratings yet

- Risk and Return - : For 9.220, Term 1, 2002/03 02 - Lecture12.ppt Student VersionDocument18 pagesRisk and Return - : For 9.220, Term 1, 2002/03 02 - Lecture12.ppt Student VersionMohammed HammedNo ratings yet

- Risk and Return - : For 9.220, Term 1, 2002/03 02 - Lecture12.ppt Student VersionDocument18 pagesRisk and Return - : For 9.220, Term 1, 2002/03 02 - Lecture12.ppt Student VersionMuhib NoharioNo ratings yet

- Risk and Return - IntroductionDocument18 pagesRisk and Return - IntroductionBNNP Sultra RehabilitasiNo ratings yet

- Jan 2009 Housing OutlookDocument5 pagesJan 2009 Housing Outlookkettle1No ratings yet

- 01 SnyderDocument93 pages01 SnyderSopheak ThapNo ratings yet

- Managing The Financial Crisis: Argentina (2002)Document63 pagesManaging The Financial Crisis: Argentina (2002)ankushishwarNo ratings yet

- Equity Debt Strategy For Mar20Document25 pagesEquity Debt Strategy For Mar20Saad KhanNo ratings yet

- Teaching COIN Lessons to Military StudentsDocument58 pagesTeaching COIN Lessons to Military StudentsArien UberragendNo ratings yet

- Atlanta TieredDocument1 pageAtlanta Tieredkettle1No ratings yet

- SPRING 2020 CAMPUS GUIDEDocument84 pagesSPRING 2020 CAMPUS GUIDENuno LouriselaNo ratings yet

- ML12179A248Document1,039 pagesML12179A248וויסאם חטארNo ratings yet

- US Housing and Mortgage Trends 1110Document8 pagesUS Housing and Mortgage Trends 1110Joe LongNo ratings yet

- Chart 3 The Coincident Index and The Malaysian Business CyclesDocument8 pagesChart 3 The Coincident Index and The Malaysian Business Cyclessmazadamha sulaimanNo ratings yet

- Brazil's Soy Infrastructure:: Improvements and PerspectivesDocument29 pagesBrazil's Soy Infrastructure:: Improvements and PerspectivesMaurício de OliveiraNo ratings yet

- Sovereign Gold Bonds: A Smart Choice For Gold InvestmentsDocument15 pagesSovereign Gold Bonds: A Smart Choice For Gold InvestmentsRaju SharmaNo ratings yet

- Alawadhi Presentation USCDocument27 pagesAlawadhi Presentation USCrajatiaNo ratings yet

- On InflationDocument10 pagesOn Inflationmajor raveendraNo ratings yet

- Control Chart Analysis StatementsDocument1 pageControl Chart Analysis StatementsimNo ratings yet

- JamiesonDocument6 pagesJamiesonAlly Bin AssadNo ratings yet

- Fernando Henrique Cardosoƞs Sociological Theory and PracticeDocument29 pagesFernando Henrique Cardosoƞs Sociological Theory and PracticeCarina L FrancaNo ratings yet

- Equipment efficiency and capacity utilization reportDocument9 pagesEquipment efficiency and capacity utilization reportDhananjay PatilNo ratings yet

- TALLAHASSEE - Florida's Seasonally Adjusted Unemployment Rate in January 2011 Is 11.9 PercentDocument16 pagesTALLAHASSEE - Florida's Seasonally Adjusted Unemployment Rate in January 2011 Is 11.9 PercentMichael AllenNo ratings yet

- Proceso Obtencion de EtanoDocument26 pagesProceso Obtencion de EtanorubenpeNo ratings yet

- Development of India's Bond Markets and Market MicrostructureDocument16 pagesDevelopment of India's Bond Markets and Market MicrostructureAmik TandelNo ratings yet

- Florida's April Employment Figures Released: Rick Scott Cynthia R. LorenzoDocument16 pagesFlorida's April Employment Figures Released: Rick Scott Cynthia R. LorenzoMichael AllenNo ratings yet

- Global Hedge Fund Secondary Market IndexDocument1 pageGlobal Hedge Fund Secondary Market IndexZerohedgeNo ratings yet

- Panel OrnamentDocument2 pagesPanel OrnamentMarketing TanajawaNo ratings yet

- HDFC Mutual FundDocument25 pagesHDFC Mutual Fundapi-25886395No ratings yet

- Cercetare Semestrul 2Document39 pagesCercetare Semestrul 2Razvan StanciuNo ratings yet

- GrafikDocument2 pagesGrafikIky SulteraaNo ratings yet

- Tier Index V Delta Dec 2010Document2 pagesTier Index V Delta Dec 2010kettle1No ratings yet

- My LATESTFXForecastsfor JUNE30Document3 pagesMy LATESTFXForecastsfor JUNE30api-26441337No ratings yet

- Lethargic Asset Allocation (LAA) using Growth-Trend (GT) timingDocument15 pagesLethargic Asset Allocation (LAA) using Growth-Trend (GT) timingRicardo GutierrezNo ratings yet

- CIMB-Principal Bond FundDocument2 pagesCIMB-Principal Bond FundAnonymous EA18Sp3Y0No ratings yet

- Pantiliner Findings - U&a 2018-2020Document5 pagesPantiliner Findings - U&a 2018-2020Sứa HeoNo ratings yet

- Rents and Yields Q1-2009Document5 pagesRents and Yields Q1-2009avisitoronscribdNo ratings yet

- GBPINR Strategy: GBP Likely to Strengthen FurtherDocument12 pagesGBPINR Strategy: GBP Likely to Strengthen FurthershivarachappaNo ratings yet

- Site Pt. Duta Alam Sumatera Kecamatan Merapi Barat, Kabupaten Lahat, Provinsi Sumatera SelatanDocument1 pageSite Pt. Duta Alam Sumatera Kecamatan Merapi Barat, Kabupaten Lahat, Provinsi Sumatera SelatandejomarlubNo ratings yet

- Progressing Towards the GoalDocument1 pageProgressing Towards the GoalElangkohNo ratings yet

- Group Leader Development 14-7-2022Document10 pagesGroup Leader Development 14-7-2022Lancar Jaya PrintingNo ratings yet

- Investment Analysis 79: Figure 2.4-9 Relative Performance of Australian Dollar Versus CRB IndexDocument1 pageInvestment Analysis 79: Figure 2.4-9 Relative Performance of Australian Dollar Versus CRB IndexYeimsNo ratings yet

- Retailers see 52% sales drop in August but durables recoveringDocument7 pagesRetailers see 52% sales drop in August but durables recoveringSriniNo ratings yet

- Xact Bear 30-07-2009Document1 pageXact Bear 30-07-2009tome1311100% (2)

- 2013 Topo MapDocument1 page2013 Topo MapAtharva INo ratings yet

- Curva S Presurizadora 25-03-24Document1 pageCurva S Presurizadora 25-03-24cjaraNo ratings yet

- DG Scan PlanDocument1 pageDG Scan PlanAnonymous WnxskULNo ratings yet

- Diversification and The CAPMDocument59 pagesDiversification and The CAPMagrawalrohit_228384No ratings yet

- Progress S-Curve ProcurementDocument1 pageProgress S-Curve ProcurementElangkohNo ratings yet

- Jan 23Document1 pageJan 23Official AulianrNo ratings yet

- Oklahoma Budget Overview: Trends and Outlook, August 2010Document45 pagesOklahoma Budget Overview: Trends and Outlook, August 2010dblattokNo ratings yet

- 2nd Sem... Back 2019Document1 page2nd Sem... Back 2019daffodil82No ratings yet

- MPS 3rd & 4th Quarter Performance IndicatorsDocument1 pageMPS 3rd & 4th Quarter Performance Indicatorsdaffodil82No ratings yet

- Ash Park On Navigating Disruption (Q1 2019 - AIF)Document13 pagesAsh Park On Navigating Disruption (Q1 2019 - AIF)Corry WangNo ratings yet

- Nepal's 14th Periodic Plan Targets 7.1% GrowthDocument2 pagesNepal's 14th Periodic Plan Targets 7.1% GrowthAvinash HadaNo ratings yet

- Instruments of Trade PolicyDocument14 pagesInstruments of Trade PolicyKatrizia FauniNo ratings yet

- RBI Role Under FEMA ActDocument3 pagesRBI Role Under FEMA ActAYAN AHMEDNo ratings yet

- Abstract - Mukesh Kumar Kella - Session 2Document3 pagesAbstract - Mukesh Kumar Kella - Session 2সাদিক মাহবুব ইসলামNo ratings yet

- Quiz Two: University of Hong Kong CCCH9007 China in The Global EconomyDocument3 pagesQuiz Two: University of Hong Kong CCCH9007 China in The Global EconomyChunming TangNo ratings yet

- Gelo Uge 1Document4 pagesGelo Uge 1Arthur LeywinNo ratings yet

- Present and The Past Behavior of The Garment Industry in Sri LankaDocument7 pagesPresent and The Past Behavior of The Garment Industry in Sri Lankanalaka.sampath100% (1)

- Myanmar - Economic Forecasts - 2017-2020 OutlookDocument8 pagesMyanmar - Economic Forecasts - 2017-2020 OutlookTHAN HANNo ratings yet

- Reflection Papertax Compliance On PayrollDocument1 pageReflection Papertax Compliance On PayrollJoyceNo ratings yet

- Economic Development of IndiaDocument2 pagesEconomic Development of IndiashefuNo ratings yet

- FAQ Basic Accounting ConceptsDocument183 pagesFAQ Basic Accounting ConceptsNowmaster100% (20)

- HBS Richard Vietor 2010Document51 pagesHBS Richard Vietor 2010ZakirNo ratings yet

- Ceiling PriceDocument2 pagesCeiling PricesyahiraazmiNo ratings yet

- ECO415 (Sesi 2 2006)Document5 pagesECO415 (Sesi 2 2006)Dayah FaujanNo ratings yet

- South Korean CaseDocument6 pagesSouth Korean CaseIqbal JoyNo ratings yet

- History of The American Economy With Infotrac 11th Edition Walton Test BankDocument5 pagesHistory of The American Economy With Infotrac 11th Edition Walton Test BankJuanMartinezxpcqj100% (10)

- The Macroeconomic Impact of Remittances in the PhilippinesDocument46 pagesThe Macroeconomic Impact of Remittances in the PhilippinesBrian Jason PonceNo ratings yet

- Industry 4.0 To Drive Economic Growth and Transform Indonesian WorkforceDocument16 pagesIndustry 4.0 To Drive Economic Growth and Transform Indonesian WorkforceAshep100% (1)

- Csc-Roii-Acic and Lddap of Payment For Online TrainingDocument4 pagesCsc-Roii-Acic and Lddap of Payment For Online TrainingJale Ann A. EspañolNo ratings yet

- PESTEL Analysis of Sarosh Rice MillDocument2 pagesPESTEL Analysis of Sarosh Rice MillDhanush ShettyNo ratings yet

- Payslip 4Document1 pagePayslip 4ahmad zakwanNo ratings yet

- Tax Invoice Dwaraka N: Dec, 2021 20/12/2021 906.9 Immediate 1,006.9Document2 pagesTax Invoice Dwaraka N: Dec, 2021 20/12/2021 906.9 Immediate 1,006.9Dwaraka PillaiNo ratings yet

- Overview of Ocean Carriers CaseDocument2 pagesOverview of Ocean Carriers CaseIrakli SaliaNo ratings yet

- Tax Invoice DetailsDocument1 pageTax Invoice DetailsRamakrishna ThommidellaNo ratings yet

- Reading 15 Currency Exchange RatesDocument15 pagesReading 15 Currency Exchange RatesAmineNo ratings yet

- Me 2020 Mercer GCC Covid 19 C&B Response SurveyDocument26 pagesMe 2020 Mercer GCC Covid 19 C&B Response Surveycoolsar25No ratings yet

- Why Banking Reforms Were NecessaryDocument14 pagesWhy Banking Reforms Were Necessarytitiksha jewrajkaNo ratings yet

- Compare and Contrast ESSAYDocument2 pagesCompare and Contrast ESSAYMargarita Gomez CorreaNo ratings yet

- Persistent PPTDocument7 pagesPersistent PPTRahulTiwariNo ratings yet

- Topics On Income TaxationDocument4 pagesTopics On Income TaxationJessa Lopez GarciaNo ratings yet