Professional Documents

Culture Documents

Chapter 5

Chapter 5

Uploaded by

Niño Mendoza Mabato0 ratings0% found this document useful (0 votes)

541 views47 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

541 views47 pagesChapter 5

Chapter 5

Uploaded by

Niño Mendoza MabatoCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 47

Chapter 5 — Percentage Tax

CHAPTER 5

PERCENTAGE TAX

Chapter Overview and Objectives

After this chapter, readers are expected to master:

1. The scope of the 3% general percentage tax

2. The list of services specifically subject to percentage tax

3. The various tax rates and exceptions on services specifically subject to

percentage tax

PERCENTAGE TAX

A percentage tax is a national tax measured by a certain percentage of the

gross selling price or gross value in money of goods sold or bartered; or of

the gross receipts or earnings derived by any person engaged in the sale of

services. (CIR vs. Solidbank Corporation, G.R. No. 148191, November 25, 2003)

THE SCOPE OF THE PERCENTAGE TAX

Coverage __[_ Type of % tax Tax rates

1. Services specifically subject | Specific % tax | Various tax rates

to percentage tax

2, Sales of goods or other General % tax 3% percentage

services not exempted tax

2

Se EE ea VAT registered Non-VAT

Type of Percentage Tax taxpayers taxpayers

Specific percentage tax a ¥

General percentage tax x L Ze

Non-VAT taxpayers are those who did not exceed the VAT threshold and

who did not register as VAT taxpayers.

SERVICES SPECIFICALLY SUBJECT TO PERCENTAGE TAX

1. Banks and non-bank financial intermediaries

2. International carriers on their transport of cargoes, excess baggage and

mails only (RA 10378,

3. Common carriers on pete transport of passengers by land and keepers

i of garage

Certain amusement places

149

Chapter 5 — Percentage Tax

5. Brokers in effecting sales of stocks through ' the Bhilippine Story

Exchange and corporations or shareholders on initial public offerings

6. Certain franchise grantees ‘

7. Life insurance companies and agents of. foreign insurance

8. Telephone companies on overseas communication

9. Jai-alai and cockpit operators on winnings

Don’t forget our mnemonic, BICAP FLOW.

ON_BAN! [D__NON-1 K INANCH INTERMEDIARI|

PERFORMING QUASI-BANKING FUNCTIONS

“Banks” refers to entities engaged in the lending of funds obtained in the form

of deposits. (RA 8791, The General Banking Law of 2000) “Banks” includes

commercial banks, savings banks, mortgage banks, development banks rural

banks, stocks and savings associations, branches and agencies of foreign banks

(RA 337, The General Act).

The term also includes cooperative banks, Islamic banks and other banks as

determined by the Monetary Board of the Bangko Sentral ng Pilipinas (BSP) in

the classifications of banks. (RA 8791)

“Non-bank financial intermediaries” refers to persons or entities whose

principal function include the lending, investing or placement of funds 0°

evidences of indebtedness or equity deposited with them, acquired by them ot

omerwise coursed through them, either for their own account or for the accoultt

of others.

This includes all entities regularly engaged inthe lending of funds or purchasif

ex receivables or other obligations with funds obtained from the public throug

tre Ssuance, endorsement or acceptance of debt instruments of any kind fo

oo ven cecount, or through the issuance of certificates, or of repurcha®

dena ments, whether any of these means of obtaining funds from the public

ona regular basis or only occasionally. (Ibid)

one . Quasi-Banking Function?

ae function refers to the borrowing of funds from twenty (20) "

Sse ene lenders at any one time, through the issua™

ce eee piteepance of debt instruments of any kind, other ee

7 WN acco} i fica!

of ‘assignment or similar instruments, wi Sseuated ot eos

ligation {°° PUPOSeS of relending or purchecin ene ee ot ei

obligations ing or purchasing receivables or other sit!

Provided, however,

d, + that commerci . il

Purpose of financing their own needs pany Of these means for the lim!

°

v the needs if their agents or deale™

150

Chapter 5 - Percentage Tax

shall not be considered as performing quasi-banking functions (RR8-2008 and

PD 1739).

Non-bank financial intermediaries performing quasi-banking functions are

commonly referred to as “Quasi-banks.”

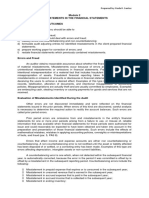

Tax Rates on Bank and Quasi-banks

Source of income or receipt % Tax rate

7. Interest income, commissions and discounts from

lending activities, and income from financial leasing, on

the basis of remaining maturities of instruments from

which the receipts were derived:

a._ Maturity period of five years or less 5%

b._ Maturity period of more than five years 1% |

2 Dividend and equity shares in the net income of

subsidiaries 0%

3. On royalties, rentals of property, real or personal,

profits from exchange and all other items treated as 7%

ross income under Section 32 of the NIRC

4, On net trading gains within the taxable year on for

currency, debt securities, derivatives, and other similar 7™%

financial instruments (RA 9337)

Note:

1. The percentage tax on banks, quasi-banks and other non-bank financial institution

is commonly known as the “grass receipt tax."

2. The BSP usually makes a periodic publication of the list of quasi-banks. Non-bank

financial intermediaries not performing quasi-banking functions are subject to a

separate set of gross receipt tax rates.

Mlustration 1: Basic computation

Orion Bank had the following interest receipts during the month:

Total

Source of income amount

Interest Income from loans maturing within 2 years P 2,500,000

Interest income from loans maturing more than 2years but

within 5 years 1,000,000

Interest income on loans maturing more than 5 years 1,200,000

Processing fees 300,000

| Rent income from foreclosed properties (ROPA) 200,000

Dividends income 50,000

‘The gross receipt tax of the bank shall be computed as follows:

151

Chapter 5 — Percentage Tax

—Taxrates_ __%Tax

Interest on short-term loans:

Upto 2 year loans P 2,500,000

‘an 2 to Syearloans ___1,000,000

al man 2iosy P 3,500,000 5% ©» P 175,000

Interest on long-term loans:

MorethanS year maturity P 1,200,000 1% 12,000

Dividends P 50,000. 0% 0

Other items of gross income:

Processing fees P 300,000

Rent income 20 10

Total P 500,000 7% 35,000

Gross receipt tax

P_222,000

Mlustration 2: Meaning of “On the basis of remaining maturities”

In 2019, East Bank had a 10-year loan with a principal amount of P 1,000,000

which was issued on March 31, 2014.

- The loan pays P20,000 monthly interest

income on the last day of every month.

The applicable gross receipt tax rate for the monthly interest payments on this

Joan in 2014 shall be:

Month Remaining maturity [Applicable tax rate

January 31, 2019 5 years and 2 months 1%

February 28,2019 |" 5 years and 1 month 1%

March 31, 2019 Exactly Syears SH%*

April 30,2019 4 years and 11 months S%*

January Februa 1

Interest income P 20,000 iy March Apri

Gross receipt tax rate ‘ P 20,000 P 20,000 pp 20,000

Gross receipt tax

oe el ae Y

Sa eet

m—200 B00 Fao pouwol

Meaning of “gross income”

‘The items of gross income r

those items of gross inco:

therefore that only those

includible as “gross receij

ferred to in Se,

me subject to reg

items of gross j

Pts” for purpos

ction 32 of the NIRC include on!

ular income tax. It can be argue

nome subject to the regular tax ar?

© Of the percentage tax.

152

Chapter 5 — Percentage Tax

Under current jurisprudence, however, the term “gross income” of banks

was held to include those items of gross income subject to final tax. (C/R vs.

Bank of Commerce, GR No. 14936) Furthermore, it was also held that the

amount of gross income to be included in gross receipts for purposes of the

gross receipt tax shall be the amount of the income, gross of the final income

tax (CIR vs. Bank of the Philippine Islands, GR No. 147375).

Mlustration

The United Kalinga Unibank received a total of P8,000,000 interest income from

short-term deposits with other banks during the month. The interest was net of

the 20% final income tax.

Pursuant to the aforementioned Supreme Court rulings, the gross receipt tax of

United Kalinga on the interest income from deposit shall be computed as:

Gross receipts (P8,000,000/80%) P 10,000,000

Multiply by: Th

Gross receipt tax P_700,000

Note:

1. The P8,000,000 net receipt is only 80% of the actual gross receipt. Hence, it is

grossed up by dividing it with 80%.

2. The applicable percentage tax rate is 79% not the 5% tax rate since the interest is

earned from deposits not from loans.

Net trading gains within the taxable year on foreign currencies, debts,

securities, derivatives and other financial instruments

The tax clearly applies to the annual net gains from this category. According

to RR4-2009, the figure to be reported in the monthly percentage tax return

shall be the cumulative total of the net trading gain/loss since the start of

the taxable year less the figures already reflected in the previous months of

the taxable year.

Net trading loss sustained from this category shall be deductible only to the

gains from trading on the same category. The net trading loss shall not be

deductible to other categories of receipts: If the bank has a cumulative net

loss at the end of the year, the same cannot be carried over as deduction

against trading gains in the following year.

Mustration 1

Abank had the following income respectively in April 2016 and May 2016:

April May

Interestine “gin Toans |__P.100,000 | _P 100,000

Rental ne om shoe 50,000 | 50,000

Net trading (Toss) gain (10,000) 20,000

153

Chapter 5 - Percentage Tax

‘The percentage tax shall be computed as follows:

For the month of April ~

Gross receipt tax on interest ~ short term (P100,000 x 5%) P oan

Gross receipt tax on rent (P50,000 x 7%) 500

Net trading loss

Gross receipt tax P__8,500

Note: The loss cannot be offset against other items of gross receipts.

For the month of May -

Gross receipt tax on interest - short-term (P100,000 x 5%) P 5,000

Gross receipt tax on rent (P50,000 x 7%)

3,500

Net trading gain (P20,000 gain - P10,000 loss) x 7% —_200

Gross receipt tax P9200

Note: The taxable amount of the gain is the cumulative net gain to date.

Mlustration 2

Abank had the following data:

December 2015 | January 2016

Net trading gains (loss) (P 10,000) P 20,000

The gross receipt tax in December 2015 shall be nil since there is a loss. The gross

Tereipt tax on the net trading gain for January 2016 shall be P1,400, computed 5

20,000 x 7%. The annual net trading loss in 2015 cannot be deducted in 2016.

Note that the treatment specified by the regulation may result in the

Payment of monthly gross receipt tax even if there is an annual net trading

loss at the end of the year. The regulation is silent on such issue.

However, since the law taxes the ani

it is unders|

net gain, i tandable th:

nual net gain rather than the monthly

such condition is reco

at any monthly gross receipt tax paid unde"

verable by the taxpayer, Hee

Exemption from the gross receipt tax

© Bross receipt tax impo:

rene ese Posed on banks does no

d by the Bangko Sentral ng

t apply to the income

transactions undertaken in Pursuit of its legally

Pilipines (BSP) from i

RRNo. 8.2008) mandated functions. (Se

154

Chapter 5 — Percentage Tax

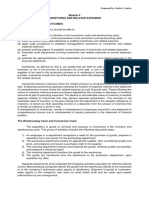

TAX ON OTHER FINANCIAL INTERMEDIARIES WITHOUT QUASI-BANKING

FUNCTIONS

Source of income or receipt % Tax rate

1, Interest income, commissions and discounts from

lending activities, income from financial leasing, on the

basis of remaining maturities of instruments from

which the receipts were derived:

c._ Maturity period is five years or less. 5%

d._ Maturity period is more than five years 1%

2. From all other items treated as gross income under the

NIRC 5%

Examples of non-bank financial intermediaries without quasi-banking

functions include:

a. Pawnshops (RR10-2004, October 18, 2004 and RA 9238)

b. Money changers

Common Rules for Banks, Quasi-banks and Other Financial Institutions

1. Accounting rules

2. Finance lease and operating leases

3. Pre-termination of instruments

Accounting rules

Under RR4-2009, the basis of the calculation of gross receipts shall be the

generally accepted accounting principles (GAAP) prescribed by the:

a. Bangko Sentral ng Pilipinas - for banks and quasi-banks

b. Securities and Exchange Commission for other non-bank financial

intermediaries

Both agencies prescribe the Philippine Financial Reporting Standards

(PERS) based upon International Accounting Standards (IAS) as GAAP. (See

Securities Regulation Code Rule 68 and BSP Circular No. 494 Sept. 20, 2005)

Finance and operating leases

A finance lease (also known as direct financing lease) is a sale of property

whereby the seller earns only interest income on the arrangement. An

operating lease is not a sale and does not transfer ownership over the leased

property.

The taxable gross receipt on finance leases shall consists only of interest

income excluding collections of principal. In operating leases, gross receipt

shall include the gross rentals received.

155

Chapter 5 - Percentage Tax

ive it thod for finance leases

1: The effective interest method f

RIM anaes Corporation imports sass from ea and sel 7

d i , ” ‘achine

rred financing scheme. On February 1 1

Hat ae of P257,710 for P300,000, payable in monthly installment

100,000 starting March 1, 2019.The loan earns 8% effective interest,

‘The P42,290 excess of the contract price over the cost (P300,000 - P257,710),

an interest income to be recognized as income in pursuant to the ffecty,

interest method under GAAP:

Beginning Interest Principal Ending

Date ___ Balance. _Income Collection Reduction

Feb.1,2019 P 257,710 -

- - P 257,710

Mar.1,2019 257,710 P 20,617 P 100,000 79,383 178,327

Apr. 1, 2019 178,327 14,266 100,000 85,734 92,593

May 1, 2019 92,593 7407 100,000 92,593 0

Note:

1. The interest income is com

2. The principal reduction is

3. The ending balance is com

puted as beginning balance of the loan x interest rate.

computed as collection less interest income.

puted as beginning balance less principal reduction.

The interest income in each month is reported as gross receipt in the mont

realized, not the entire P100,000 monthly collection because it contains recovey

of the principal,

Mlustration 2: Operating lease

ogon Industrial Bank foreclosed a property in March, It leased the property ®

a commercial lessee for a period of 10 years. The lex ox pays P50,000 mont

rental on the property.

The PS0,000 monthly

rental shall be included

Purposes of the gross

in the monthly gross receipts

receipt tax. Note that this

rental is purely income.

Pre-termination of loans

ns earn Br pre mination, the maturity period shall be reckoned ‘0 4

and applying the correct aration for Purposes of classifying the trans@“

Mustration

On January 1, 2015, p

Interest pag Paes Decent Payable every December ay wth &

oO .

pases 30,2021, the client pre-

a)

‘ine mh

0% atk loaned P1,000,000 to a client payable with

sali

“erminated the loan by repaying the prin’

156

Chapter 5 — Percentage Tax

The following are the interest income and the gross receipt taxes paid since the

origination of the loan:

Remaining

_—Year___-_ _maturity_ __Interest___ Taxrate © _Amount_

2015 Yyears P 100,000 1% P 1,000

2016 8 years 100,000 1% 1,000

2017 7 years 100,000 1% 1,000

2018 6 years 100,000 1% 1,000

2019 5 years 100,000 5% 5,000

2020 4 years 100,000 5% 5.000

Total P= 14,000

6/30/2021 - P 50,0007? 2

Upon pre-termination in June 30, 2021, the loan shall be reclassified. The

remaining maturities of the loan shall be re-counted up to the date of pre-

termination. The correct gross receipt tax shall be recomputed and adjustment

shall be made:

Remaining

_Year __maturity*_ '__Interest__ Taxrate Amount.

2015 S.5years P 100,000 1% P 1,000

2016 4,5 years 100,000 5% 5,000

2017 3.5 years 100,000 5% 5,000

2018 2.5 years 100,000 5% 5,000

2019 1.5 years 100,000 5% 5,000

2020 <1year 100,000 5% 5,000

2021 None 50,000 5% 2. omy

Total Gross receipt tax P28;

Less: Gross Point tax previously reported and paid 14,000

Gross receipt tax due as recomputed

*Up to June 30, 2021, the date of pre-termination

shall be reflected as a separate line item in

The additi pt tax due

edaitional gross rere gall transactions ofthe month in which the

the Gross Receipt Tax return coverin

re-termination took place. (RR4-2009)

Withholding of Percentage Tax on banks oon

Effective August 1 stk the Bangko Sentral ng Pilipinas (BSP) shall

withhold the percentage tax on banks and non-bank financial institutions on

all its payments to special deposit accounts and reserve liquidity accounts.

(BSP Memorandum No. M-201 4-029)

157

Chapter 5 — Percentage Tax

ER:

i i i in the Philippines shall pay a ta

ional carriers doing business in d I I

Seite 3% of their quarterly gross receipts derived from the

ieanspore of cargoes, baggage, or mails from the Philippines to another

country.

‘There are two types of international carriers:

a. International air carriers

b. International shipping carriers

The term “international carriers” means air or sea carriers owned by foreign

corporations that operate in the Philippines and transport passengers or

cargoes from the Philippines to overseas and vice versa.

The 3% quarterly percentage tax is based on the gross receipts from the

transport of cargoes, excess baggage, or mails regardless of the place where

they are actually billed.

Gross receipts shall include, but shall not be limited to, the total amount of

money or its equivalent representing the contract, freight/cargo fees, mail fees,

deposits applied as payments, advanced payments, and other service charges

and fees actually or constructively received during the taxable quarter from

cargoes and/or mails, originating from the Philippines in a continuous and

uninterrupted flight, irrespective of the place of sale or issue and the place of

payment of the passage documents.

Taxation of gross receipts on flights or voyages

Domestic | International operation

Types of carriers operation Outgoing incomin

| Domestic carrier 12% VAT | 0%VAT | Exempt

International carriers

~ Passengers NZA

7 E i

-__ Goods, mails or cargoes N/A aE oor Fectabt

Illustration

‘The Philippine operations of i

Malaysian Airli ign air carris tas

‘Transport of passengers P

Transport of baggage

Total

cs Outgoing _ __Total__

24,000,000 P 36,000,000 _P 60,000,000

232,000,009

158

247,000,000 P_79,000,000

Chapter 5 — Percentage Tax

20% of the outgoing freights was bill i .

feaghtwas billed inthe Pieie aes © led abroad while 40% of the incoming

‘The percentage tax shall be:

Gross Philippine billings P 11,000,000

Multiply by:

Percentage tax due ETT

Note:

1, Only outbound fares for cargoes, excess baggage or mails are included in the tax

base. The place of actual billing is ignored,

2, The same tax rules apply to international shipping carriers.

The common carrier's tax herein does not apply to off-line international

carriers having a branch/office or sales agent in the Philippines which sells

passage documents for a compensation or commission to cover off-line

fights or voyage of its principal or head office, or for other airlines or sea

carriers covering flights or voyages originating from Philippine ports or off-

line flights or voyages. (RR15-2013) These entities may be subject to VAT.

Note on domestic carriers

Domestic sea or air carriers with international operation are vatable on

their outgoing shipment of passengers, excess baggage, cargoes or mails.

‘They are actually subject to a zero-rated VAT on such shipment.

Table of Comparison: Tax Rules Outgoing flight or voyage

‘Sea or air carriers owned by :

Exempt

Passengers Vatable ip

Cargoes/baggages Vatable [3% percentage tax

oration, firm, or association engaged in

ting passengers or goods or both, by

‘and offering their services to the

A common carrier is any person, Corp

the business of carrying or transpor'

land, water, or air, for compensation,

Public. (Art. 1732, Civil Code)

common carriers include cars for rent or

A s who transport

hire driven by the lessee, transportation contractors, peta a

engers for hire and esti arriers on the! t of

Pa and carriers on their transport

= re and other domestic |: , pf

oS eae of bancas and owners of animal-drawn two

wheeled vehicles,

For purposes of the percentage tax,

159

Chapter 5 — Perce! ntage Tax

i on carriers:

‘The following table summarizes the rules on comm:

Baggage/Mails/Cargoes

sport Passengers

sine me cman

By water or sea vatable Satria

By air vatable

It must be recalled that the term “vatable” mean subject to vat if the

taxpayer is VAT-registered person or a registrable person. Otherwise, the

3% general percentage tax applies.

Under the NIRC, the 3% percentage tax is due quarterly upon the Bross

receipts of common carriers on their transport of passengers by land. This is

called the “common carrier’s tax.” In practice, this quarterly tax is paid in

three monthly payments.

‘The tax base of the quarterly percentage tax is subject to the following

minimum presumptive gross receipts.

Minimum presumptive gross receipts for common carriers and keepers

of garage

Jeepney for hire:

Manila and other cities

Provincial

Public Utility Bus:

Not exceeding 30 passengers 3,600 1,200

Exceeding 30 but not 50 6,000 2,000

Exceeding 50 passengers 7, ;

Bsceeding ager 200 2,400

Manila and other cities

Provincial

Car for hire: 2400

With chauffeur

Without chauffeur 3008 SD

1,800 600

Note: These presumptive

Bross receipts wer ;

compared te i re set by the NIRC ii too low

sn tw sh eka hse cae

Committee Rey 0 Fel as recommended for i senate

conducted befor Ne: 37 (February 11, 2008) since no prepa eension under est

nducted before its implementation, Proper consultation were

160

chapter 5 - Percentage Tax

Ilustration 1

cendong is an operator of five jeepneys and two buses. The monthly receipts of

his vehicles were summarized below:

Passengers _Cargoes__ __Total__

Tricycle P 20,000 - P 20,000

Jeepneys 150,000 P 10,000 160,000

Buses ——200,000 ____40,000 ___240,000

Total P__320,000 P__50,000 P__420,000

‘Assuming Cendong is a VAT-registered business, his monthly percentage tax due

shall be:

Gross receipt P 350,000

Multiply by: 3%

Percentage tax due P__10,500

Note:

1. The P50,000 gross receipts from cargoes shall be subject to VAT.

2. The P20,000 receipts from tricycle is not subject to tax under the NIRC. Itis subject to

the local contractor's tax under the Local Government Code.

Assuming Cendong is a non-VAT-registered business, his monthly percentage tax

due shall be:

Gross receipt P 400,000

Multiply by: ——%

Percentage tax due B_12,000

Note: The P50,000 vatable gross receipts shall be subject to the 396 general percentage

‘ered business. The P350,000 receipts shall

tax rate because Cendong is not a VAT-regists

be subject to the 3% common carrier's tax.

Mlustration 2 ety 3

Mang Bentong is an operator of a taxi and a car for hire in Cebu City. The taxi

reported gross receipts of 26,000 in the month. The car for hire was

indefinitely garaged for repair when its chauffeur bumped it on @ bus. The car

registered only P600 receipts in the same month.

The gross percentage tax shall be computed as:

Actual _Minimum_ _Taxable—

Taxi 726000 P 1.200 P 26,000

Car for hire *s00 _—1.000 —_ 1.000

Gross receipt P 27,000

Multiply by: ____3%

ercentage tax due

161

Chapter 5— Percentage Tax

jes like Uber and Grab Taxi ang

70-2015, transport network compani Jer an¢

Under MG 7°-and cuppliers which are holders of a valid Certieate of Pie

een may be considered as common carriers qualified to the 34

percentage tax.

on carriers are exempt from local taxes. a :

ries receipts of common carriers derived from their incoming ang

outgoing freight shall not be subject to the local taxes under the Loca}

Government Code of 1991 (RA 7160).

tions to the common carriers tax i

ne) that ‘owners of bancas and animal-drawn two-wheeled vehicles are

exempt from the percentage tax. The law is silent regarding pedicabs but

these businesses may qualify as “business for mere subsistence"; hence, these

are also exempt from business tax.

AMUSEMENT TAXES

Proprietor, lessee or operator of the following amusement places shall pay

the following respective tax rates on their quarterly gross receipts:

Places of boxing exhibitions 10%

Places of professional basketball games 15%

Cockpits, cabarets, night or day clubs 18%

Jai-alai and race tracks 30%

Note that other operators of amusement places such as bowling alleys, golf

courses, and billiard halls are vatable. Cinemas and theaters is not subject to

this national amusement tax because it is exclusively subject to local

amusement tax.

Exempt receipts on professional boxing

The gross receipts from professional boxing are exempt from percentage

under the following conditions:

1. World or Oriental Championship

2. 7 least one of the contenders is a Filipino citizen

. The promoter is a Filipino citiz i ich is

ave eae atte citizen or a corporation 60% of which

For the purpose of the amusement tax, gross receipts embrace all receipts

the proprietor, lessee or operator of the amusement places, Said receiP®

include income from television, radio, and motion picture rights, if any:

Person or entity or association conducting any activity subject to the t@*

herein imposed shall be simil

larly liable for said tz i t to suc

portion of the receipts derived by him or it (Sec. 125 MIRC) ae

162

Chapter 5 — Percentage Tax

The tax shall be payable within 20 days after the end of each quarter. The

proprietor, lessee, or operator shall make a true and complete return of the

amount of the gross receipts derived during the preceding quarter and pay

the tax thereon.

Illustration 1: Places of exhibitions

North Dome, Inc. operates a coliseum which caters to various athletic and

artistic competitions or events. During the quarter, North Dome, Inc. reported

receipts from the following events:

Professional non-titled boxing bouts P 200,000

Philippine Championship boxing bouts 300,000

Professional basketball games 400,000

Amateur basketball games 500,000

Concert of various musical artists 400,000

Total receipts 1,800,000

The quarterly percentage taxes will be computed as follows:

Non-titled boxing bout P 200,000

Philippine titled boxing bout ——300,000

Total P 500,000

Multiply by: percentage tax rate 10% P 50,000

Professional basketball games P 400,000

Multiply by: percentage tax rate ___15% saan

Total amusement tax Rouen“

basketball games and concerts are vatable. If

The i amateur "

gross receipts from vese are subject to VAT, Otherwise, these are

North Dome is a VAT taxpayer, th

Subject to the 3% general percentage tax.

Mlustration 2: Cabaret

Jake is an operator of a disco (ca

quarter, it reported the following:

aret) and bowling alleys. During a particular

Cabaret Bowling alleys

p 200,000 P 200,000

oe 800,000 150,000

Sales of foods and beverages

The quarterly percentage tax will be computed as follows:

ca P 200,000

te receipts - cabarets __ 800,000

Sale of food items ce P_ 1,000,000

Total receipts from cabaret business 48

Multiply by: Amusement tax rates > 180,000

‘musement tax

163

Chapter 5 — Percentage Tax

The receipts and sales from the bowling alleys are not specified by the NIRC to by

specifically subject to percentage tax; hence, vatable.

Mlustration 3: Hotel disco a |

avenice Hotel, Inc. operates a hotel with a disco and restaurant. The following |

were its sales and receipts during a particular quarter:

|

Room rentals P 2,000,000 |

Parking rentals 1 one00

Sales from hotel restaurant 200,

Sale of foods and beverages from disco 1,000,000

Gate receipts from disco 200,000 |

The quarterly percentage tax will be computed as follows:

Sale of foods and beverages from disco P 1,000,000

Gate receipts from disco —— 200,000

Total amusement receipts P 1,200,000

Multiply by: Amusement tax rates 18%

Amusement tax 2 216,000

Only the disco operations and all sales or receipts incidental to it is subject to the

amusement tax. The other receipts of La Venice Hotel are vatable.

Illustration 4

Pegasus Sports Complex, a cockpit operated by Mr. Ken Chi, had the following

receipts during the quarter:

Gate receipts P 200,000

“Plasada” (10% tongs on winnings on every “sultada”) 800,000

Sales of foods and drinks (Restaurant operated by Pegasus) 400,000

Rent income from concessionaires

a (other businesses operating in the cockpit) 50,000

‘otal receipts 21,450,000

‘The total percentage tax due of Pegasus Sports Complex shall be:

‘Total amusement receipts

Multiply by: Amusement tax rates ee

Amusement tax Tone

If they do not qualify as business

for mere subsisteni je inside

the cockpits shall be subject to th ice, the concessionaires

'¢ 3% percentage tax or to VAT.

Mlustration 5

Assume that the restaurant in Ilustra

aura ration 4 is operate

anon-VAT taxpayer, ee

dl by Mrs. Tinola Kasado"

164

Chapter 5 — Percentage Tax

Mrs. Kasador shall pay the 3% general percentage tax on the P400,000 receipts.

The same shall not be taxed to Pegasus Sports Complex. The rental which Mrs.

Kasador pays to Pegasus shall be included in Pegasus’ gross receipts which shall

be subject to the 18% amusement tax.

Illegal Cockpits

Persons who are engaged in the same operations such as operators of illegal

“tupada” cockpit are also taxed at 18% of their gross receipts.

T IN_SALE, BAR’ 0 LI RES OF STO ISTED AND

TRADED THROUGH THE ICAL STOCK EXCHANGE OR THR‘

INITIAL PUBLIC OFFERING

Tax on sale, barter or exchange of stocks listed and traded through the

Philippine Stock Exchange (PSE)

The sale, barter or exchange, including block sale, of listed stocks through

the PSE, other than by dealers in securities, is subject to a tax of 60% of 1%

based on gross selling price or gross value in money of the shares of stocks

sold. This percentage tax is commonly known as “stock transaction tax”.

The same shall be paid by the seller or transferor and is to be collected by

the stock broker who effected the sale. The stock broker shall remit the tax

to the BIR within 5 banking days from the date of collection.

Illustration

Orion Securities effected the sale of the following stocks during a trading day:

Type of stocks Owner Selling price Cost

S

Preferred stoc

Client P3,000,000 P 2,900,000

Common stocks Client 2,800,000 3,000,000

Stock options Client 400,000 450,000

Common stocks Orion securities 4,000,000 3,000,000

r

Common stocks Client P 800,000 500,000

Preferred stocks Orion securities 2,000,000 2,100,000

The percentage tax shall be computed from the stocks sold through the P

follows,

eof sto Owne Selling price_

Preferred stocks far P 3,000,000

“Ommon stocks client 2,800,000

tock options ient 400,000

“tal selling price of stocks P__6,200,000

165

Chapter 5 — Percentage Tax

000

Total selling price of stocks P 6200,

Multiply by: 0% x 1%

Stock transaction tax PB 37 200

Note:

i i is ) sold through the PSB, Ty,

: tax applies only on listed stocks (domestic or foreign) :

, na applies without regard to the type of stocks sold. Recall also from Income

Taxation that the term “stock” includes stock options and bones .

Since this is not an income tax, the tax applies without regard to the existence of any

gain or loss on the transaction.

The stock transaction tax does not apply to dealers in securities on their sales o

stocks inventory. The sale of security dealers from the sale of securities whether

through PSE or directly to buyers and their commissions income shall be vatable,

Under RR 16-2012, only the sale of stocks which meets the 10% minimum

public ownership (MPO) in the PSE shall be subject to the stock transaction

tax. However, this rule was rendered useless when the PSE moved to

suspend the trading of stocks which fall below the minimum public float.

Due to this, no listed companies which are below the MPO is traded.

Tax on the Shares of Stock Sold or Exchanged through an Initial Public

Offering (IPO)

The sale, barter, exchange or other disposition through initial public offering

of shares of stocks in a closely held corporation is subject to the following

tax rates based on the gross selling price or gross value in money in

Proportion to the shares sold, bartered or exchanged or otherwise disposed:

Proportion of shares sold, bartered orexchanged | Tax rate

Up to 25% 4%

Over 25% but not over 33 1/3% 2%

Over 33 1/3% 1%

This percentage tax is commonly known as the JPO tax. Note that the IPO tax

applies only to the initial public offering of a closely held corporation.

Meaning of “closely held corporation”

Closely-held corporation means any Corporation at least 50% in the value of

the outstanding capital stock or at least 50% of all classes of stock entitled

directly or indirectly by not more than 20 individuals.

to vote is owned

It must be noted that the

Corporations as defined abi

corporation which is divers:

's owned by more than 20 p

IPO tax applies only to 1PO of closely-held

ove. Be it noted

therefore that the IPO of i

ely owned or those whose 50% of capital sto

eople is not subject to the IPO tax.

166

Chapter 5— Percentage Tax

Determination of the proportion of stocks sold in an IPO

‘The determination of the proportion of stocks sold in an IPO depends upon

the type of offering:

4. Primary offering -unissued shares of the closely held corporation to be

sold in the IPO

2. Secondary offering - issued shares or shares of existing shareholders

who wish to sell their shares in the IPO

Proportion of share offering

Primary offering = Primary shares + outstanding shares after IPO

Secondary offering = Secondary shares + outstanding shares before IPO

Illustration 1

Queen Corporation is owned by the following shareholders:

Mr. Almanac 25,000 shares

Mr. Boar 20,000 shares

Mrs. Cat 40,000 shares

Ms, Donkey 10,000 shares

Mr. Eagle 5,000 shares

Total shares 100,000 shares

Queen Corporation conducted an IPO involving 40,000 unissued shares to be

sold to the public at PS per share. Mr. Boar decided to sell 15,000 of his shares

to the public during the IPO at PS per share.

Proportion of IPO shares ,

a) Primary offer percentage = 40,000/(100,000+40,000) = 28.57%, equivalent

to 2% IPO tax

b) Secondary offer percentage = 15,000/100,000 = 15%, equivalent to 4% 1PO

tax

‘The IPO tax shall be:

Primary offering (40,000 shares x PS x 2%) b__4,000

Secondary offering (15,000 shares x PS x 4%) P_3.000

Tree rer the

issuing corporation, while the 1PO tax of the secondary offering shall be paid by

Mr. Boar, the selling shareholder.

Mustration 2

Assuming further that after the IPO, Queen Corporation conducted another

block sale of 50,000 of its shares for P5 per share, Ms. Donkey also sold her

10,000 shares after the IPO for P6 per share.

167

Chapter 5 — Percentage Tax

ion after the IPO is called a “foy

1 ent sale by Queen Corporation aft E ow,

area This is no longer subject to the IPO tax since the tax apni.

only to the initial listing of closely held corporations.

involvi hares after the listing of Que

the sale of Ms, Donkey involving 10,000 sl : 7

eae the PSE is subject to the usual 60% of 1% stock transaction tax,

Ms, Donkey shall pay a percentage tax of P360 (10,000 x P6 x % x 1%).

Summary of Rules on Sales of Stocks L

Sales made by Before IPO During IPO

Corporate issuer 1PO tax as primary

— No tax offer No tax |

older investor | Capital | IPO tax as secondary Stock |

| Shar

gains tax offering transaction tax

Note: This table ignores documentary stamp taxes on sale or issue of stocks.

TAX ON FRANCHISES

Generally, franchises are vatable. Exceptionally however, there are only two

types of franchises that are specifically subject to percentage taxes under

the NIRC:

|

_ |

Franchise grantees % Tax Rates |

|

1. Radio or television broadcasting companies whose

annual gross receipts do not exceed P10,000,000 3%

2._ Gas and water utilities 2%

The percentage tax on these franchise grantees is referred to as “franchise

tax”.

VAT registration

Franchise grantees of radio

Note that there is no similar isi

dl Provision for franchise grantees of gas and

tater utilities, Hence, they are subject to percentage wae if they exceed

the P10M gross receipts threshold, — 7

168

Chapter 5— Percentage Tax

illustration 1: Radio franchise grantees

Radio Filipino exceeded the P10,000,000 annual gross receipts last year due to

increase in ads income brought about by the national election. Radio Filipino is

only expected to reach its P6,000,000 average annual receipt this year.

Radio Filipino shall be subject to VAT on all receipts starting this year. Once the

P10M threshold is exceeded, TV or radio broadcasting companies will be

perpetually covered by VAT.

Mlustration 2: Gas utilities

City Gas Corporation, a gas utility, consistently had gross sales exceeding

P10,000,000 every year. During the month, it had a P12,000,000 sales.

City Gas shall be subject to 2% franchise tax on its P 12,000,000 sales.

Illustration 3: Water utilities

Baguio Water District reported a P12,000,000 receipt in a month from water

bills of Baguio City residents.

The receipt of local water districts is subject to the 2% franchise tax not to VAT.

Note also water is a mineral and is not an agricultural food product. Local water

districts are exempt from income tax but not to business tax.

Note that the franchise tax does not apply to water refilling or purification

stations selling bottled mineral water. These are vatable entities on their sales of

water.

Vatable franchises .

a. Electricity - electric generation or transmission and distribution by

electric cooperatives are vatable

b. Telecommunication - Telecom companies are vatable, except on their

receipts from outgoing messages since these are subject to the 10%

overseas communication tax.

«

Transportation - Transport companies are vatable, except receipts of

common carriers by land on their transport of passengers since these

are subject to the 3% common carriers tax.

4. Private franchises

A person, company or corporation (except purely cooperative companies or

associations) doing life insurance business of any sort in the Philippines is

Subject to a tax of 2% on the premiums collected, whether such premium is

Paid in money, notes, credits or any substitute for money.

169

Chapter S — Percentage Tax

A life insurance company is a company which deals with the insurance on

human lives and insurance appertaining thereto or connected therewith,

‘The service likewise includes soliciting group insurance, and health and

accident insurance policies which the company is nevertheless authorizeg

to pursue as part of its business activity. (RMC30-08)

Hence, premiums on health and accident insurance underwritten by life

insurance companies are subject to the premiums tax. However, Premiums

on health and accident insurance underwritten by non-life insurance

policies are vatable.

The following shall not be included in gross receipts of an insurance

company:

a. Premiums refunded within 6 months after payment on account of

rejection of risk or returned for other reasons

b..\Re-insurance premiums

c. Premiums from life insurance of non-residents received from abroad by

branches of domestic corporation, firm or association doing business

outside the Philippines.

d. Excess of premiums on variable contracts in excess of the amounts

necessary to insure the lives of the variable contract owners

Refunded premiums are certainly not receipts, hence, these are properly

excluded from the tax base. Premiums on life-insurance of non-residents

purchased abroad constitute an exempt foreign consumption. Furthermore,

the excess of variable contracts over the life insurance premium represents

investments rather than premiums,

Types of Insurance Business

a. Direct insurance

b. Reinsurers

c. Retrocessionaires

A direct insurance business underwrites insurance policy and negotiates

them to policyholders through insurance agents. To minimize risks, insurelS

cede or assign parts of their insurance premiums to reinsurers who shall

undertake to assume part of the risks, Reinsurers are thus insurers 0!

insurers. Retrocessionaires are insurers of reinsurers,

Upon collection of the premiums by direct insurers, the 2% premium tax for

life insurance policies or VAT for non-life insurance policies applies. Whe"

insurers cede part of these premiums to reinsurers, it should not be taxe

again. Otherwise, double taxation occurs,

170

Chapter 5 — Percentage Tax

Cooperative companies or associations are those conducted by the

members thereof with the money collected from among themselves and

solely for their own protection and not for profit.

Except for crop insurance, non-life insurance is vatable. Non-life insurance

includes surety, fidelity, indemnity, bonding companies, marine, fire and

casualty insurance.

Ilustration 1

Absolute Insurance underwrites both life and non-life insurance policies. The

following were the premiums collected in a month:

—Non-life_

Cash collections P 2,000,000 P 1,500,000

Checks 400,000 600,000

Promissory note 500,000 ___400,000

Total 2,900,000 P 2,500,000

The percentage tax will be computed as:

Cash collections P 2,000,000

Checks 400,000

Promissory notes ——500,000

Total premiums P 2,900,000

Multiply by: percentage tax rates sehen 298

Premiums tax B__ 58,000

Note:

1. Gross receipt includes collections of cash or money substitutes such as check. Only

tress recat life insurance that a promissory note is exceptionally included as part

of gross receipts for the purposes of computing the premium tax:

2. Non-life insurance is vatable, The gross receipts of non-life business do not include

promissory notes.

Mustration 2 .

Phinoy Reinsurance, a domestic reinsurance company, reported the following

premiams and retrocessions to a foreign retrocessionnaire during the month:

Reinsurance premiums P12,000,000

Less: Retroceded premiums = 8.000.000

Retention yen

Commissions from retroceded reinsurance contracts 500,000

Reinsurance premium ts exempt from premiums tax as it is already subjected to

Premium tax on the ceding insurance company. The payment of retrocession

Premium to the foreign insurer is subject to the withholding VAT because this is a

a7.

Chapter 5 — Percentage Tax

purchase of reinsurance service from a non-resident: Insurance commission or,

insurance commission whether life or non-life is vatable.

Mlustration 3 a. | |

Sihra Life Insurance Philippines offers life insurance and variable insurance

products. The following relates to its monthly receipts:

Variable life

—Lifeplans _ ___plans __

Total premiums P 2,000,000 P 8,000,000

Less: Insurance charges 5,000,000

Credits to client account balances P_____- P__ 3,000,000

‘The premiums tax shall be computed as follows:

Life premiums P 2,000,000

Insurance charges on variable life plans —— 5,000,000

Total life insurance premiums P 7,000,000

Multiply by: 2%

Premiums tax

B___140,000

Note: The credits to client account balances constitute client investments.

Taxation of other receipts of life insurance business

1. Renewal or re-insurance fee, re-instatement fee and penalties - these

are considered incidental to or connected to insurance policy contracts

and are akin to premium; hence, subject to the 2%% premiums tax.

2

Management fees, rental income, or other income from unrelated

Services- these are vatable.

3. Investment income

If investment income is realized fro i i

x m the jums

earned, it is exempt. aaa

Note that the premiums which have been the source of the funds

invested had already been subject to 2% Premium tax. (RMC 20-08)

If investment income is realized from the investment of funds obtained

from others, it is considered income from quasi-banking: hence, subject

to the gross receipt tax imposed on non-bank financial intermediaries-

Chapter 5 — Percentage Tax

summary of tax rules on insurance:

Aras Republic of the Philippines

Re-insuran

premium (0%) | Domestic/Resident

life insurers

Foreign

insurers

fe premiums tax

5% percentage tax

Life insurance __| Non-life insurance

Direct premiums _ 2% premiums tax Vatable

Re-insurance premiums Exempt Exempt

Insurance commissions* Vatable Vatable

“covers insurance and reinsurance commissions (RR16-2005)

2% premiums tax shall be eliminated

RA 10001 has a provision that the

this provision was vetoed by

within five years from its effectivity. However,

the president.

NTS OF FOREIGN N :

Under Section 124 of the NIRC, fire, marine or miscellaneous insurance

agents authorized under the Insurance Code to procure policies of insurance

on risks located in the Philippines for companies not authorized to transact

business in the Philippines are subject to a tax equal to twice the tax

imposed on life insurance premiums.

RA 10001 reduced the tax on life insurance premium from 5% to 2%.

Therefore, the tax on agents of foreign insurance is 4%now.

Direct insurance from abroad

If property owners obtain insurance directly from abroad without the

Services of an insurance agent, the tax shall be 5% of the premium paid. It

Shall be the duty of the owner to report each transaction to the Insurance

mmissioner and to the Commissioner of Internal Revenue.

Mustration

Mang Pandoy insured his buildings with

Premiums during the month.

a foreign insurer. He paid P150,000

173

Chapter 5 - Percentage Tax

i Insurance Commission ang the

transaction to the :

Marg Pa aad premiums tox (Len P150000 x 5%) t0 the BIR. Tyg

BIR and pay P7,

ion should be subject to the withholding VAT, but the same is specifically

transaction

subjected to percentage tax.

EAS DIS! MESSAGE __O!

E PHILIPPINE:

ORIGINATING FROM THE PHILIPPINES

NVERSATIO)

i ited from the

i e or conversation transmit

Led aT sone ‘elegragti telewriter exchange, wireless and other

eee equipment services is subject to a 10% percentage tax. This

percentage tax is commonly referred to as the “overseas communication tax,

‘The following table summarizes the business tax rules:

Call Origin Call Destination Business tax _|

Philippines Philippines 12% VAT

Abroad Philippines 0% VAT: a

|_Philippines Abroad 10% overseas communication tax

‘*Subject to zero-rating requirements;

fnot met, receipt is exempt.

Mlustration

Quick Telecommunications had the following receipts during the quarter:

{caltOrigin [Cali Destination Amount collected

Philippines Philippines P 20,000,000

Abroad Philippines

~~ beines_|__Abroad | 5,000.00

‘The quarterly overseas communication tax

Gross receipts from outgoing calls

Multiply by:

Percentage tax due

—__10%

P__500,000

Exemptions

{The overseas communication tax shall not app

following:

1. Government - including an iti

instrumentalities ® ae ae

Diplomatic Services ~

governments

International org

Immunities un

News services

shall be computed as:

P_ 5,000,000

ly to the outgoing calls of the

subdivisions

2 embassies and consular

3 anizations ~ those enjoyi

der international agre

ffices of foreig”

ing privileges,

ae and

exemptions a”

‘ements

174

Chapter 5 — Percentage Tax

WINNINGS FROM HORSE R, A

Winnings from race tracks and j

amusement taxes:

alai are subject to the following

Winnings in horse race or jai-alai, in general 10%

Winnings from double, forecast/quinella and trifecta bets 4%

Owners of winning race horses 10%

Note: Types of race winnings

A. Combination bets

Double- a bet to select the winners in two specific races

Daily double ~ a bet to forecast the first winning horse on two consecutive races

Forecast a bet to predict the first and second finisher of a particular race

Exacta or perfecta- a bet to pick the first two finishers in exact order

Quinella~ a bet where at least the first two finishers must be picked in either

order

6. Trifecta - a bet to predict the first three finishers in arace in exact order

ween

B. Straight wagers

1. Win-the selected horse must finish first

2. Place - the selected horse must come first or second

3, Show- the selected horse must come first, second or third

Tax on winnings

The pay-out on combination bets is subject to 49% on the net winnings. The

pay-out on straight wagers (non-combination bets) is taxable at 10%.

The tax shall be deducted from the “dividend” corresponding to each

winning ticket or the “prize” of each winning race horse owner and withheld

by the operator or person in charge of the horse race before paying the

dividends or prizes to the person entitled thereto. The tax shall be paid

within 20 days from the date itis withheld. (Sec. 126, NIRC)

Mlustration 1: Race track operators ;

Gamby Hippodrome operates a race track. It had the following dividends for

winning tickets during an event:

‘Total winnings on straight bets

(costs of winning tickets, P10,000) P 80,000

‘Total winnings in daily double, forecast and quinella

(costs of winning tickets = P600) 40.000

Awinner of trifecta (cost of ticket = P200) 30,000

Prize of the owner of winning horses 100.000

Total prizes, winnings or dividends P_250,000

‘The following tax must have been withheld from these winnings before their

release to the winners:

175

Chapter 5 - Percentage Tax

Net winnings in daily double, forecast and quinella

P 39,400

(P40,000-P600)

Net winning on trifecta (P30,000-P200) pa

Total E

Multiply by: —__ 4% P 2,768

Prize of the winning horse P 100,000

Net winnings on straight bets (P80K - P10K) ____ 70,000

Total P 170,000

Multiply by: 10% 17,000

Total percentage tax on winnings

P__19,768

Note: These taxes on winnings are separate from the 30% amusement tax to be paid by the

race track on its own quarterly gross receipts.

‘The net pay-out of Gamby Hippodrome on the prizes or winnings shall be:

Total prizes, winnings or dividends P 250,000

Less: Percentage tax on winnings 19,768

Net pay-out to winners P__230,232

Illustration 2: Net winnings

Mrs. Petra hit the trifecta with

4 pay-out of P58,000 from her P100 ticket. How

much will she receive from hi

er winning?

Answer: P 58,000 - (P58,000 - P100) x 49% = P55,684

Illustration 3: Operator Of jai-alai

On @ particular event, an operator of jai-alai reported a total receipts of

P1,000,000 from jai-alat bets. There was a total P650,000 total winnings of

‘various picks made by bettors. The ost of winning picks was P50,000.

The jai-alai operator must withhold the fol

lowing tax on the winnings:

Jai-alai winnings

( 650,000 - P 50,000)

le P 600,000

Multiply by: .

4 —__10%

Percentage tax on winnings P___60,000

— ithe P1,000,000 gross receipts shall be subject to the 30% amusement tax for the jai-alal

The percentage tax on winnings is an additional

but is imposed by law on the betting. This

upon the receipts of the ©perator of the

winnings from othe

amusement places or

basketball, billiards, and bowling

amusement tax by nature

in addition to those impos

lai or racetrack. Note thal

activities such as cockpit, boxing

Competitions are not subject to tax.

176

Chapter 5 - Percentage Tax

SUMMARY OF SPECIFIC PERCENTAGE TAXES

Percentage tax Tax rates

Banks and financial Gross receipt tax 5%,1%; 7%

intermediaries

International carriers International carrier's 3%

tax

Common carriers Common carrier’s tax 3%

Amusement places Amusement tax. 10%,15%,18%;30%

Sales of stocks by an Stock transaction tax 60% x 1%

investor

Sale of stocks during an IPO Tax 4%, 2%; 1%

ial public offering (IPO)

Franchise Franchise tax 3%

| Life insurance Premiums tax 2%, 4%; 5%

Overseas calls Overseas

communication tax. 10%

Amusement betting Winnings tax 10%; 4%

WITHHOLDING OF PERCENTAGE TAX AT SOURCE

The sale to government agencies, and instrumentalities including

government-owned and controlled corporation (GOCC) is subject to a

withholding tax of 3% at source.

The government agency, instrumentality or GOCC withholds the 3%

percentage tax and issues to the taxpayer BIR Form 2307. The taxpayer

shall attach BIR Form 2307 in filing his monthly percentage tax return.

The same procedure is employed for withholdings made by the BSP on

gross receipts of banks and quasi-banks on their special deposit accounts or

liquidity reserve accounts.

Mustration 1 .

During the quarter, Mr. Avila, a non-VAT taxpayer, sold various office supplies

toa government agency for P200,000 and to private customers for P80,000.

The government agency shall pay Mr. Avila the following proceeds net of the 3%

final percentage tax.

Sales P 200,000

Less: 3% final withholdin tage tax 6.000

g percentage

Net proceeds to be released to Mr. Avila P__194,000

177

Chapter 5 — Percentage Tax

‘h tage tax payable for the quarter shall be computed and presenteq in

‘The perce

BIR Form 2551Q as follows:

Sales subjected to government withholding

P 200,000

(P194,000/97%)

Sales to private customers = 80,000

Gross sales

Multiply by: 7 oy mT

tage tax due

ess Tan credit (BIR Form 2307) = P200,000 x3% ____6,000

Percentage tax payable

P___2.400

Note: In effect, the sales not subject to withholding is being taxed; hence, P80,000 x 3%,

Mustration 2

Goodyear Corporation, a non-VAT taxpayer paying the 3% percentage tax, had

the following receipts in the quarter:

Taxable sales to government entities

P 150,000

Taxable sales to private entities 60,000

Exempt sales —180,000

Total sales P__390.000

The total creditable percentage tax withheld at source was P4,500.

ue Percentage ‘ax payable for the month to be presented in BIR Form 2551Q

shall be:

Taxable sales to government entities

‘Taxable sales to private entities

Prot 50,000

Total taxable sales non

Multiply by: fn maar

Percentage tax due P 6,300

Less: withheld percentage tax und 4.500

Percentage tax payable UMter BIR Form 2307

see impose TAXABLE SALES OF NON-VAT TAXPAYERS

7 ntage tax i]

registered persons is 30, ;

ct to percentage tax, of non-VAT

Mlustration 1

Diak Restaurant had annus i

ale *

Restaurant generated P200,000 Bross recone PSM. During the month, 2

178

You might also like

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Module 2 MISSTATEMENTS IN THE FINANCIAL STATEMENTSDocument7 pagesModule 2 MISSTATEMENTS IN THE FINANCIAL STATEMENTSNiño Mendoza MabatoNo ratings yet

- Introduction To Business Taxation: Chapter 3 (Part 1)Document38 pagesIntroduction To Business Taxation: Chapter 3 (Part 1)Niño Mendoza MabatoNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Module 6 INVESTMENT IN FINANCIAL INSTRUMENTS PDFDocument8 pagesModule 6 INVESTMENT IN FINANCIAL INSTRUMENTS PDFNiño Mendoza MabatoNo ratings yet

- Module 9 SHAREHOLDERS' EQUITYDocument3 pagesModule 9 SHAREHOLDERS' EQUITYNiño Mendoza MabatoNo ratings yet

- Module 5 INVENTORIES AND RELATED EXPENSESDocument4 pagesModule 5 INVENTORIES AND RELATED EXPENSESNiño Mendoza MabatoNo ratings yet

- Module 1 BASIC CONCEPTS OF FINANCIAL STATEMENT AUDIT PDFDocument8 pagesModule 1 BASIC CONCEPTS OF FINANCIAL STATEMENT AUDIT PDFNiño Mendoza Mabato100% (1)

- Lesson 3 Financial Institutions and MarketsDocument3 pagesLesson 3 Financial Institutions and MarketsNiño Mendoza MabatoNo ratings yet

- Citizen'S Charter: Overseas Workers Welfare AdministrationDocument73 pagesCitizen'S Charter: Overseas Workers Welfare AdministrationNiño Mendoza MabatoNo ratings yet

- Articles of Incorporation of TheDocument15 pagesArticles of Incorporation of TheNiño Mendoza MabatoNo ratings yet

- Problem and Its BackgroundDocument19 pagesProblem and Its BackgroundNiño Mendoza MabatoNo ratings yet

- Nature and Definition of Research: Scientific ThinkingDocument14 pagesNature and Definition of Research: Scientific ThinkingNiño Mendoza MabatoNo ratings yet

- QUALI Conclusions and Recommendations FormulationDocument6 pagesQUALI Conclusions and Recommendations FormulationNiño Mendoza MabatoNo ratings yet

- Technology and Livelihood EducationDocument16 pagesTechnology and Livelihood EducationNiño Mendoza MabatoNo ratings yet

- Manual On Corporate GovernanceDocument86 pagesManual On Corporate GovernanceNiño Mendoza MabatoNo ratings yet

- Qualitative ResearchDocument12 pagesQualitative ResearchNiño Mendoza MabatoNo ratings yet

- Shared Value in Practice: TOMS Business Model: September 2013Document8 pagesShared Value in Practice: TOMS Business Model: September 2013Niño Mendoza MabatoNo ratings yet

- Barriers To M-Commerce Adoption in Developing Countries - A Qualitative Study Among The Stakeholders of Bangladesh Mohammed Mizanur RahmanDocument12 pagesBarriers To M-Commerce Adoption in Developing Countries - A Qualitative Study Among The Stakeholders of Bangladesh Mohammed Mizanur RahmanNiño Mendoza MabatoNo ratings yet

- Chapter 2 HomeworkDocument4 pagesChapter 2 HomeworkNiño Mendoza MabatoNo ratings yet

- Chapter 2Document34 pagesChapter 2Niño Mendoza MabatoNo ratings yet

- Types of Research According To PurposeDocument7 pagesTypes of Research According To PurposeNiño Mendoza MabatoNo ratings yet

- 5 C 8 F 600 BF 3450Document11 pages5 C 8 F 600 BF 3450Niño Mendoza MabatoNo ratings yet

- Chapter 1Document20 pagesChapter 1Niño Mendoza MabatoNo ratings yet

- Chapter 4Document51 pagesChapter 4Niño Mendoza MabatoNo ratings yet

- Module 8 LIABILITIESDocument5 pagesModule 8 LIABILITIESNiño Mendoza MabatoNo ratings yet

- Module 4 RECEIVABLES AND RELATED REVENUESDocument5 pagesModule 4 RECEIVABLES AND RELATED REVENUESNiño Mendoza MabatoNo ratings yet