Professional Documents

Culture Documents

Chapter 2

Chapter 2

Uploaded by

Niño Mendoza Mabato0 ratings0% found this document useful (0 votes)

455 views34 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

455 views34 pagesChapter 2

Chapter 2

Uploaded by

Niño Mendoza MabatoCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 34

Chapter 2 — Value Added Tax on Importation

CHAPTER 2

VALUE ADDED TAX ON IMPORTATION

Chapter Overview and Objective:

After this chapter, readers are expected to comprehend:

The concept of importation

The types of consumption tax on importation

‘The list of importations which are exempt consumption

The concept of in “original state” for agricultural or marine food

products

The concept of qualified exemption

‘The scope and applicability of the VAT on importation

The concept of landed cost and Import VAT computation

The concept of technical importation

The treatment of the VAT on importation

PONE

pEnan

IMPORTATION

Importation refers to the purchase of goods or services by Philippine

residents from non-resident sellers.

Types of Consumption Tax on Importation

1. VAT on importation - for the import of goods

2. Final withholding VAT - for the purchase of services from non-residents

Comparison between the Consumption Tax on Importation

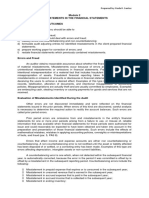

VATonimportation | Final withholding VAT

Object consumption Goods Services

Imposed upon Importers / buyers Foreign service providers

Statutory taxpayer Importers / buyers Resident purchaser of the

service*

Nature Direct consumption tax Indirect business tax

Tax basis Landed cost Contract price

Collecting agency BOC BIR

Timing of payment | Before withdrawal of | After the month of payment

goods

“Individuals engaged in business and corporations

The VAT on importation is payable to the Bureau of Custom and is paid prior

to the withdrawal of the goods from the Customs warehouse. The final

21

Chapter 2-Value Added Tax on Importation

withholding VAT is 12% of the contract price for services rendered by non.

residents. It is remitted to the BIR.

IMPORT OF GOODS

The importation of goods is either:

1. Exempt importation

2. Vatable importation

EXEMPT IMPORTATION

A. Importation of exempt goods

Certain goods considered basic necessities are not subject to the VAT on

importation, such as:

1. Agricultural and marine food products in their original state

2. Fertilizers, seeds, seedlings and fingerlings, fish, prawn, livestock and

poultry feeds, including ingredients used in the manufacture of finished

feeds

3.

Books and any newspaper, magazine, review, or bulletin which appear

at regular intervals with fixed prices for sul

bscription and sale and

which is not devoted Principally to the publication of paid

advertisements

4. Passengers or cargo vessels and aircrafts, including engine, equipment

and spare parts thereof for domestic or international transport

operations

B. Importation by VAT-exempt persons

1. International shipping or air transport operat an

fuel, goods and supplies Perators on their import of

2. Cooperatives of direct farm

including spare parts thereof, to bi

production and or processing of their produce > "4 €X¢lusively in the

3. PEZA locators on their import of ge

ods or services

© Quast-importation

1. Personal and household effects belong;

Philippines returning from abroad and none re jqt®,_ 5

resettle in the Philippines 7

% Professional instruments and implements, wean

animals, and personal household effects beione NS apparel, domestic

Settle in the Philippines, for their own use and oe Pe*S0RS coming go

Sauine Not for sale, barter co

idents of th,

sie .

dent citizens coming to

D. Importation which are exempt under spectal taws

eee ON Internationa,

22

Chapter 2— Value Added Tax on Importation

IMPORTATION OF EXEMPT GOODS

‘The importation of the following exempt goods is not subject to VAT:

A. Basic human food and related goods

1, Agricultural or marine food products in original state

2. Livestock and poultry of a kind generally used as, or yielding or

producing foods for human consumption

3, Breeding stock and genetic materials therefore

B. Books, newspapers and magazines

Passengers or cargo vessels and aircrafts, including engine, equipment

and spare parts

BASIC HUMAN FOOD AND RELATED PRODUCTS

Agricultural or marine food products in original state

Import exemption is limited to agricultural or marine food products in their

original state or those which undergone simple processing. Good that

underwent advanced processing are vatable.

Examples of exempt agricultural or marine food products in original state:

1. Grapes, apples, oranges and other fruits

2. Vegetables, tea, ginseng

3. Rice, corn, coffee beans and other edible farm products

4. Marine foods such as fish and crustaceans

5. Poultry and livestock

6. Milk, eggs, and meat for human consumption

Livestock includes cow, bulls, calves, pigs, sheep, goats and rabbits. Poultry shall

include fowls, ducks, geese and turkey. Marine food shall include fish and

crustaceans such as, but not limited to, eels, trout, lobster, shrimps, prawns,

oysters, mussels and clams (RR16-2005).

To be considered in “original state”, the goods must be in their raw form.

However, those that underwent simple processing are also exempt.

Meaning of simple processing

‘The term simple processing includes:

a. Acts of preparation for the market

b. Acts of preservation, or

c. Acts of packaging including advanced technological means of packaging

Examples of simple acts of preparation:

a. Boiling d. Roasting

b. Broiling e. Stripping,

© Husking f. Grinding

23

Chapter 2 — Value Added Tax on Importation

Examples of simple acts of preservation:

a. Freezing c. Smoking

b. Drying d. Salting

Packaging is not Processing as it does not alter the nature of the products, It

merely involves putting the product in a medium that makes it Convenient

for handling, storage or marketing,

Thus, goods may still be i

using advanced technologi

a. Shrink wrapping in plastics

b. Vacuum packing

¢. Tetra-packing

4. Other similar packaging methods

in their original state ev

en if they are packaged

cal means, such as:

Hence, the following agricultural or marine food products which underwent

Processing are also exempt:

With simple act of | Wit

simple act of |

reparation |___preservation With acts S of packagin

Husked rice Sundried fruits Tetra-packed fresh fruit juice

Corn grits Salted meat Shrink wrapped m,

Raw cane sugar Smoked fish eee

Roasted beans Dried fish

Ordinary salt

Ground meat

Copra

Boiled eggs

Lechon

Frozen meat or fish

Boiled eggs and lechon

Though boiled eggs and lech

methods used (ie. boiling

‘on are said to be cooked in their

lechon are exempt.

Ordinary sen:

or heating) are simple process) 2

ng. Hence by

se, the cooking

oiled eggs and

Raw Sugar means the natural sugar extracted from

mechanical process by pressing the juice; boiled to ctystaly

Separate these crystals, and dried, resulting to eeystalts

content by weight in dry state corres;

degrees and or whose

2015, May 22, 2015)

= Wwarcane through simple

2e; filtered using centrifuge te

n sugar with sucrose

mndiR Of less than 99.59,

includes muscobado. (Rp.

ed brown su,

sponding to a polarimeter

color is 800 ICU or less. Raw sugar i

The importation of the aforementioned agricultural or marine food Products

in their original state is exempt from VAT.

24

Chapter 2 — Value Added Tax on Importation

Processed agricultural or marine food products

Processed agricultural or marine food products pertain to those which have

undergone changes in their chemical compositions or have undergone

complex processing or treatment or are utilizing advanced technologies in

their processing.

Examples of vatable processed agricultural or marine food products:

Refined sugar Canned sardines Flour

Wine or vinegar Butter Marinated milk fish

Vegetable or coconut oil__| Soy

The importation of processed products and those considered not in their

original state shall be subject to VAT on importation.

Use or purpose dictates vatability

Flowers intended as love gifts are vatable since they are not food but

cauliflower, of course, is an exempt human food. Cockfighting chickens are

vatable since they are primarily intended for human amusement. They are

only food when they lose. However, chicken produced for meat or eggs are

VAT-exempt human foods.

Farm or fishery inputs

Marine or agricultural inputs intended for the production of marine or

agricultural food products which are ultimately intended for human

consumption are also VAT-exempt.

‘The importation of farm or fishery inputs such as seeds, seedlings, breeding

stocks and genetic materials are exempt. Likewise, foods of these inputs

such as fertilizers and feeds including ingredients manufacture of finished

feeds are also VAT-exempt.

Products intended as maintenance of crops, livestock or poultry and

supplemental implements of agricultural or inputs such as pesticides,

herbicides, animal medicines, fishing equipment, fishing boats, tractors,

plows, driers, threshers and harvesters are vatable.

Zoo animals, race horse, aquarium fish, fighting cocks and pets are not

intended for human consumption; hence, vatable. Feeds of these non-food

animals called "specialty feeds” is likewise vatable.

Ingredients of feeds for animal food intended for ultimate human

consumption is VAT-exempt but ingredients for the processing of human

food is vatable.

25

Chapter 2 - Value Added Tax on Importation

stration ! i T !

aaa Company imported the following agricultural implements:

Urea Fertilizer P 800,000

Cargil corn seeds 400,000

Pesticides 600,000

Herbicides 800,000

The fertilizer and seeds are exempt, Note that

seedlings and fertilizers. Other farming imple

herbicides are subject to VAT on importation.

exemption is limited to Seeds,

ments such as pesticides and

Rules on VAT taxation of poultry and feeds

Livestock Poultry | Pets

Importation of x x I oA

Importation of feeds for xX X v

Importation of feed X X v

ingredients for

Note: The importation of ingredie

nts for the processi

Of foods for huma nis

vatable because processed human foods are vatable. eae

Examples of vatable non-food agricultural or marin

2 bogs, wood, bamboo, orchid, and similen fore

b. Rubber hem, abaca, tobacco, topical herbs,

crops

© Shelis, corals, and other non-food marine prod

ornaments

Race horses, fighting cocks,

animals generally considered a

'€ products:

St products

Cotton and other non-food

ucts usually used as

aquarium fish, 20,

gnar © animals, and other

BOOKS, NEWSPAPERS, MAGAZINE, R

The VAT exemption on th

upon the necessity of

EVIEW OR BULLETINS

e importation of these goods 'S apparently based

T

education and information Me

ae ‘ Thi i

Constitution requires the state’ to Bive priority to education ae

Patriotism and nationalism, accelerate social 3. BteSS, and promote total

. ‘al

human liberation and development. (See see 1%, Article “i, Phitip on

a il, Phili

Constitution) ilippine

The Philippine Constitution also recognizes the vital Tole of communication

and information in nation-building, (See Sec. 24 Ibi

Conditions for exemption of newspaper, magazine review or bulletin;

1, They must appear at regular intervals with fixed Prices for Subscription.

2. The sale must not be devoted principally to the Publication of paid

advertisements.

26

Chapter 2 — Value Added Tax on Importation

Note that exemption does not extend to other school supplies such as chalk,

board markers, pens, notebook; pad paper and office supplies.

PASSENGER OR CARGO VESSELS AND AIRCRAFTS

The VAT exemption covers the import of passenger or cargo vessels and

aircrafts, including engine, equipment and spare parts thereof for domestic

or international transport operations.

‘The VAT exemption on the import of these items lapsed under RA 9295 but

was reinstated by RA 10378 and was codified under the TRAIN law.

This incentive for VAT-exemption is granted by law in an effort to help the

modernization of the shipping, transport and tourism industry.

To qualify for exemption, the importation must be subject to the

requirements on restriction on vessel importation and mandatory vessel

retirement program of the Marina Industry Authority (MARINA):

- Passenger or cargo vessels - 15 years

= Tankers - 10 years

= High speed passenger crafts - 5 years

Illustration

Total Transport Group has land, sea and air transport operations. To beef up its

operations, it imported 5 units of Daewoo bus, 1 unit of aireraft and 2 cruise

ships.

The importation of the airplane and ships are exempt but the importation of the

buses for land transport is subject to VAT.

Note to readers:

In mastering the consumption taxes, legal sensitivities must be considered. It

is an established principle of law, that items not included are deemed

excluded. Exempt goods must be strictly construed to cover only to those

listed by the law as discussed herein. Other basic necessities such as

medicines, clothing, processed foods, kitchen supplies, school supplies, and

the like are not exempt. A familiarization of the list is imperative.

PT PERSONS

.ct to VAT on importation, The extent of

i

VAT-exempt persons are not su

their exemption varies per exempt persons.

When an exempt importer subsequently sells his exempt importation to a

non-exempt person, the non-exempt buyer shall be subject to VAT on

27

&b

oOoOcr~171—™-—eT

Chapter 2- Value Added Tax on Importation

i i hall constitute a lien on th

i ation. TI e on such importation sh .

Eee ae aaee or liens, irrespective of the possessor of Said

‘oods, a

eae (Sec. 4.107-1(c), RR16-2005).

NIRC:

VAT-Exempt Persons under the

1, International shipping or air transport operators

2. Agricultural cooperatives

3. Ecozone-locators

International shipping or air transport operators

The exemption is limited to the importation of fuel, goods and ‘supplies.

Although these goods or supplies are physically brought into the

Philippines, they are not intended to be consumed herein. They will

ultimately be used in international transport. This consumption is a foreign

consumption rather than domestic consumption,

Mlustration 1

Malaysian Ferries is an international 5

hipping carrier. It imported to the

Philippines fuel and supplies to be used in

its shipping operations.

Note that the fuel, goods, or Supplies will be consumed in the high seas or in

foreign territories outside the country. The importation is not a domestic

consumption but a foreign consumption; hence, itis exempt from VAT.

Mlustration 2

Pinoy Airline imported jet fuel from Ira

the importation is declared for dom

declared for international air transport

iq at a total cost of

estic airline oper;

Operations.

60% of the P50,000,000 importation will be consume j

not for domestic consumption; hence, it is exempt from VAT. 0; i

which will be used domestically will be subject to the VAT on mee portion

PS0,000,000. 40% of

‘ations while 60% is

Mlustration 3

Lufta Airline, an international air carrier,

imported jet fi

40,000,000. It subsequently sold P10,000 ee uel at

a total

000 of these to a Feel mgt

air carrier,

Air, a domestic

Lufea Airline is exempt on its importation of the 10,000,000 worth j

Fee Air Is not an exempt person and that jet fuels are vatable good

be treated as the importer of the P10,000,000 jet fuel and Will be su

ufea Airline fs not required to pass the VAT on its sales of the pay

Agricultural cooperatives

The status of agri-coop as VAT-exempt person is limited

direct farm Inputs, machineries and equipment,

Parts (RA 9337)

to importation of

including their spare

28

Chapter 2 - Value Added Tax on Importation

importation. The tax due on such importation shall Constitute a lien on the

Reais Superior to all charges or liens, irrespective of the possessor Of sai

goods (Sec. 4.107-1(c), RR16-2005).

VAT-Exempt Persons under the NIRC:

1. International shipping or air transport operators

. Agricultural cooperatives

3. Ecozone-locators

International shipping or air transport operators

The exemption is limited to the importation of fuel, goods and supplies.

Although these goods or Supplies are physically brought into the

consumption rather than domestic consumption,

Mlustration 1

ym Iraq ata total

the importation is declared for don 2 Sack P50,000,000. 40% of

estic airline operat ; °

Aecared for international ar transport opera Perations while 60% is

50% of the P50,000,000 importation will be consumed i

4 in .

not for domestic consumption; hence it is exempt from vat Ton the gone Ths

Which will be used domestically willbe Subject t0 the VAT on inn My the 40% portion

ion,

Mlustration 3

Lufta Airline, an international air carr ported f

t

40,000,000. it subsequently sold P10,000,000 of these tonsa Ain nal cost of

air carrier, et Air, a domestic

ier, im

ibe Airline is exempt on its importation of the Pg 000,000

000,000 w, ;

fee Air is not an exempt person and that er ‘fuels are vatabje goods itt pie

be treated as the importer of the P10,000,06 Jet fuel and will be subject will

‘ufea Airline is not required to pass the VAT of i sales of the fue, /°°*€4 to Var.

Agricultural cooperatives

‘he status of agri-coop as VAT-exempt Person is limited to importation of

direct farm inputs, machineries and equipment, including thei; Spare

Parts (RA 9337)

28

Chapter 2 — Value Added Tax on Importation

Conditions for exemption:

1, The cooperative must be an agricultural cooperative duly registered and in

good standing with the Cooperative Development Authority (CDA).

2, The importation involves direct farm inputs, machineries, equipment and

their spare parts to be used directly and exclusively in the production or

processing of their produce.

Illustration 1

Abra Farmer's Cooperative imported the following equipment:

Tractors and threshers to be used by the cooperative P_ 2,000,000

Plows and water pumps to be resold to members 3,000,000

Fertilizers and hybrid seeds to be sold by the cooperative 1,000,000

Herbicides and pesticides to be used by the cooperative 500,000

Cars for the use of cooperative directors and officers 2,000,000.

The following table summarizes the tax treatment of the importation:

Tractors and threshers to be used by the cooperative Exempt,

Plows and water pumps to be resold to members Vatable

Fertilizers and hybrid seeds to be sold by the cooperative | _Exempt

Herbicides and pesticides to be used by the cooperative Exempt

Cars for the use of cooperative directors and officers Vatable

Note:

1. The importation of machineries and equipment forthe processing or processing needs of

the cooperative is exempt; hence, tractors and threshers are exempt from VAT on

importation.

‘The importation of fertilizers and seeds is exempt to any importer. The importation of

herbicides and pesticides which are “direct farm inputs’ is exempt to cooperatives. Note

that the importation of farmers of herbicides and pesticides is vatable.

3. Although plows and water pumps qualify as machineries, they are not intended for the

use of the cooperative; hence, these are also vatable,

4, Theears are vatable because they are not direct farm inputs, machineries, or equipment.

Mlustration 2 t

‘Assume that fertilizers and herbicides in the foregoing illustration is

subsequently sold by Abra Farmer's Cooperative to Jon Juan, member farmer.

What is the tax consequence of the sale?

Jon Juan shall be treated as importer and shall be subject to VAT but only to on

vatable goods such as the herbicides. Since the fertilizer is @ VAT-exempt goods,

Jon Juan shall not pay VAT on importation thereon.

Illustration 3

A credit cooperative imported a computer server, from abroad at a cost of

rrally subject to VAT on importation since the

P1,500,000, This importation is gene! I

exemption does not extend to cooperatives which are not engaged in processing or

production,

29

Chapter 2 - Value Added Tax on Importation

Mlustration 4

A mining cooperative imported an ozone generator and an ultraj

ifine Ofe

grinding machine for its gold recovery plant. The importation is generally subject

VAT because the cooperative is not an agricultural cooperative.

Mlustration 5

Arado Coop, a farming cooperative, imported ten tractors and 20 sacks of

hybrid seeds. Arado Coop subsequentl

ly sold four tractors and 5 sacks of hybrid

Seeds to Mr. Laco, a cooperative member,

Mlustration 6

A cooperative imported frozen meat from China, It subsequently sold all of this

to Philippine consumers.

The importation of frozen ‘meat, an exempt goods, is an exempt importation for

any importer. Hence, the sale by the cooperative to the consumers (ie, final

sa yamption) shall not be subject to VAT: Likewise che buyers shall not be subject

to VAT on importation.

Ecozone-locators

Ecozones are designated places of economic activity fo, i

Goods or services for the export market, By legal etion counts of

considered foreign countries and are deemes Outside Customs territ

Thus. the importation of goods into the esenec zones by locators ¥,

Srembt not only from VAT on importation but alse fo customs duties. The

Gemption from VAT covers any goods, supplicy ©” machineries brousne

into the ecozones by locators. es brought

Technical Importation

The rules of VAT on importation apply to tech

consumers in a customs territory fi

nical im,

Tom persons loca

Zones (Sec. 4.107-1, RR 16-2005).

al importation by

ted in Special Economic

Customs territory refers to the

Portion of the Republic

outside of designated special eco

nomic zones (Ecozones).,

“Technical importation" refers to the purchase of non-Ecozone Philippine

residents from Philippine Ecozone-registered enterprises, By legal fiction

ecozones are considered foreign territories. Hence, the puretane from

Economic zones such as but not limited to, Subic-Ecozone, Zambo-Ecozone

and Cagayan-Ecozone is subject to the VAT on importation,

30

of the Philippin

(RR2-2005) ">

Chapter 2— Value Added Tax on Importation

similarly, sales to Ecozones are subject to zero-rated VAT for VAT taxpayers

pecause Ecozones are considered foreign territories. Likewise,sales to

Ecozones are exempt from business tax for non-VAT taxpayers (See Sec. 109

«) and (V), NIRC as amended).

Ilustration 1

Winshield Corporation, a PEZA locator, sold scrap metals to Recycle Industries

Corporation, a customs territory buyer (ie., buyer outside the Ecozone).

Recycle Industries shall pay the VAT on importation directly to the Bureau of

Customs (BOC). Winshield Corporation is not required to impose the VAT on its

sales. However, it must be furnished a copy of the receipt issued by the BOC for the

VAT payment (See BIR Ruling No. DA-031-2007, January 19, 2007).

Mlustration 2

KT, an ecozone locator, imported two machineries for use in the ecozone. It

resold one machinery to S3, a fellow PEZA-locator, and resold the other to T4, a

person outside the zone.

The importation by the locator shall be exempt. The sales to $3 shall not be subject

to business tax since it is deemed a foreign consumption. $3, also an ecozone

locator, shall not likewise be subject to the VAT on importation. However, T4, a

non-locator, shall pay VAT on importation on the machinery it purchased from KT.

QUASI-IMPORTATION

1. Import of personal and household effects belong to residents of

the Philippines returning from abroad or non-resident citizens

coming to resettle in the Philippines

2. Professional instruments and implements, wearing apparel, domestic

animals, and personal household effects belonging to persons coming

to settle in the Philippines, for their own use and not for sale, barter

or exchange

Conditions for exemption:

1. The personal and household effects belong to Philippine residents or

non-residents intending to resettle in the Philippines

2. The goods are exempt from Customs duties

Note that these goods are past consumptions which have been previously

Subjected to consumption tax herein.

The importation of personal or household effects or professional

implements by non-residents intending to resettle in the Philippines is a

foreign consumption not subject to Philippine ‘consumption tax.

31

Chapter 2 - Value Added Tax on Importation

Note that when these were purchased previously, they were already

subjected to consumption. taxes. The VAT on importation applies ty

importations which represent current consumptions of personal, householg

or professional effects. It does not apply to their past consumption.

Illustration 1

Mr. Siman was employed abroad as an OFW. He went abroad taking with him

personal effects such as clothes, pieces of personal jewelry and gadgets

aggregating P300,000 in value. When his contract ended, he returned to the

Philippines bringing with him the same effects which now have an aggregate

value of P280,000,

The importation (i.e., return)

since these are past purchases

Purchased in the Philippines,

of the personal effects will not be subject to VAT

which had been subjected to consumption tax when

Illustration 2

Mlustration 3

Mrs. Kookai Ukay, a Philippine resident,

worth P300,000 from abroad to be sold in

her “Ukay-ukay" s, !

Philippines. She reserved P50,000 of these for her personayusu® exper in the

The entire P300,000 purchase of goods from abroad is @ domestic con fe

subject to the VAT on importation. This rule applies wrttge regard to the aubtion

Af the importation whether for business or for personal no leas

Illustration 4

Mrs. Lovely Bulalo, a non-resident Filipino busing

her business in France. She decommissioned th

esswoman, owns a machine in

; © machine to be transferred to

her business in the Philippines.

Although the machine is a past foreign consumption,

to the Philippines Is subject to VAT because the VAT-

personal, professional or household effects.

the importation Of the same

exemption is limited only ra

32

Cie

Chapter 2— Value Added Tax on Importation

jiustration 5

An international non-profit organization based in Switzerland sent goods

intended as donation to victims of flood in the Philippines. The goods consist of

jarious household effects, grocery goods and rice.

The importation of these donated goods into the Philippines is subject to VAT,

except for the rice - a VAT-exempt goods. These imported donations are exempt

jrom VAT if made in favor of accredited non-profit organization.

Importation of professional instruments and implements, wearing

apparel, domestic animal and personal household effects

Conditions for exemption:

1, The goods belong to persons who come to settle in the Philippines.

2. The goods must accompany the person upon arrival or within 90 days

before or after his/her arrival.

3, There must be evidence to show that the change of residence is bona fide.

4. The importation is not a vehicle, machinery or ‘other equipment used in the

manufacture or merchandise of any kind in commercial quantity-

Ilustration 1

Mr. Marquez, a professional boxer, applied for an application to migrate in the

Philippines and was granted by the Philippine government. He brought his

boxing gears and household effects including his personal car to the Philippines.

The importation of professional instruments and household effects are exempt but

the importation of the car is subject to VAT.

Mlustration 2

ter, arrived in the Philippines with an

Mr. Kung Fu, a Chinese martial arts mas

immigration visa. He brought with him the following which he declared as his

Personal effects:

10 pieces of brand new iPhone 6 P 150,000 each

10 pieces of brand new IBM laptops P 80,000 each

5 desktop computers P-40,000 each

Lpiece of used laptop P-30,000

of used iPhone 4S. 20,000

400

apparel and travelling bag 7,000

The used laptop, iPhone 45, calculator, clothes, and apparel are apparently

Personal effects which are past consumptions; hence, these are exempt from VAT.

iPhone 6, 1BM laptops and desktop computers is

tof personal effects, These items are

hence, subject to VAT.

Th

len eee and quantity of the

gees inconsistent with the concep!

‘estionably for domestic consumption;

33

os

Chapter 2 - Value Added Tax on Importation

Illustration 3 : :

While in Dubai, Mrs. Waca bought a car and numerous pieces of Jewelry 4

her salaries as OFW. She intended to sell the jewelry to her friends an,

townsfolk in the Philippines. When her contract ended,

, Mrs. Waca brought iy

the car and the jewelry to the Philippines.

The importation of the car is vatable since it is not a personal effect. The importeg

Pieces of jewelries are in commercial quantity which makes them clearly no,

personal items; hence, vatable.

IMP\ 10) PT UN) OR.

Import that are exempted by special laws, treaties or international

agreements to which the Philippine government is a signatory is not subject

to the VAT on importation,

THE VAT ON IMPORTATION

Other importation of goods is sub

1. importer is engaged or not e

2. importer isa VAT or non-VA‘

3. importation is for business

4. non-resident seller is enga

ject to VAT regardless of whether the:

ngaged in trade or business

T business

or personal use

ged or not engaged in business

As a consumption tax, the VAT on i

Purpose of the importation and

engaged in business,

Presumption of vatability

Importation is generally subject to VAT unless it can be re

‘ove t

under any of those conditions discussed herein or under a provision ot

special law or treaty. The burden of proof in establishing VA; i

rests upon the importer, ‘6 VAT exemption

Tax basis of the VAT on importation

The VAT on importation is computed as 12% of the total landed cost of the

importation.

Composition of landed cost:

A. Dutiable value

B. Oher in-land costs

1. Custom duty

2. Excise tax, ifany

3, Other in-land costs, such as:

a. Bank charge e. Arrastre charge

b. Brokerage fee f, Wharfage due

c. Arrastre charge g. Documentary stamp tax

d. Wharfage due h. Import processing fees

34

Chapter 2 Value Added Tax on Importation

simply stated, landed costs encompass all costs of importation incurred prior to

the withdrawal of the goods from the warehouse of the Bureau of Customs,

except unofficial or illegal payments made.

The dutiable value, also called transaction value, refers to the total value

used by the Bureau of Customs in determining customs duties, such as:

1. Cost of the goods

2. Freight

3. Insurance

4. Other charges and costs to bring goods herein

‘The dutiable value encompasses all costs incurred in bringing the goods up to

the Philippine port and prior to any other in-land costs of import.

The customs duty is computed as: Dutiable value x Exchange rate x Rate of Duty

Mlustration 1- basic

MRS Trading Corporation imported goods from abroad for domestic sale.

Shown below are the details of the importation:

Peso value of supplier's invoice P 2,000,000

Other costs incurred to bring goods to Philippine port 70,000

Other charges before withdrawal of goods, including

5,000 facilitation fee paid to a fixer 85,000

Customs duties 10%

Freight of goods from BOC warehouse to

MRS warehouse in Makati City 20,000

‘The customs duties shall first be computed as:

Peso value of supplier's invoice P 2,000,000

Other costs to bring goods to the Philippines __ 70,000

Dutiable value P 2,070,000

Rate of duty ——10%

Customs duties b28Z,

‘The VAT on importation shall be computed as:

Dutiable value P 2,070,000

Other official costs paid before withdrawal of goods

from the BOC 80,000

Customs duties ——207,000

Total landed cost P 2,357,000

Multiply by: VAT rate 12%

VAT on importation P_282,840

35

Chapter 2 - Value Added Tax on Importation

2.- comprehensive

ee eae iaeeried a sports car from the US for personal use, Th

following shows details of the charges of the importation:

Purchase price $ 50,000

Insurance in transit 500

Freight __800

Total invoice price $__51.300

Arrastre P 8,500

Bank charge 6,000

Wharfage dues 800

Brokerage fee 90,000

Custom’s documentary stamp 265

Import processing fee 250

Total other charges rE 105,815

The relevant exchange rate per Bureau of Customs Memorandum Circular is

P45:$1. The importation is subject to P683,510 excise tax and 30% tariff rate.

The dutiable value and customs duties shall be computed as:

Purchase price $ 50,000

Insurance in transit 500

Freight —___ 800

Dutiable value in $ $ 51,300

Multiply by: Exchange rate 45.00

Dutiable value in Peso P 2,308,500

Multiply by: Rate of duty 30%

Customs duty 2 692.550

The landed cost and value added tax are computed as:

Dutiable value P 2,308,500

Customs duty 692,550

Excise tax 683,510

Other charges —— 105,815

Landed cost P 3,790,375

Multiply by: VAT rate on import — _ "4294

VAT on importation P___ 454.945

The VAT shall be paid to the Bureau of Customs (BOC) using a form prescribed

by the BOC.

IMPORT OF SERVICES

The purchase of services from non-residents may be:

1. VAT-exempt

2. Subject to specific percentage tax

36

Chapter 2 Value Added Tax on Importation

3. Subject to final withholding VAT

‘The import of services is generally subject to a final withholding VAT, except

when it is exempted or is imposed with a percentage tax.

Nature of the Final Withholding VAT

In principle, domestic consumption by anybody (business or non-business)

of services from abroad should be subject to VAT regardless of the place

(within or without) where the service is rendered.

However, our current tax law views the final withholding VAT as a business

tax. The VAT is deemed imposed upon non-resident service providers. For

this purpose, the law conclusively presumes that the non-resident sellers

are engaged in business even if their sales transactions are merely casual.

Since non-residents cannot be obligated to file tax returns due to territorial

consideration, the resident buyer is obligated to “withhold” the VAT and to

remit the same to the government. Thus, the term “final withholding VAT.”

‘The VAT is deemed passed-on by the non-resident service provider which,

in turn, is withheld by the resident purchaser of the service.

As a withholding tax, the obligation to withhold the VAT technically exists

only ift

1. the service is rendered within the Philippines; and

2, the payor-purchaser of the service is an individual engaged in business

ora corporation

There is no obligation to withhold the VAT if the payor is not-a business,

except for corporate purchasers of service. Moreover, the situs of taxation of

services is determined by the place where the service is rendered and not

the place where the output of the service will be ultimately used. Hence, the

service must be rendered within to be subjected to the withholding tax.

Illustration 1

Eagle Company sought the help of Mr. Putin, a repairman doing business in

‘Australia, to fix its malfunctioning machinery in the Philippines. The contract

price was P1,000,000. Eagle Company shall pay P120,000 (12% x PIM) final

withholding VAT to the BIR.

Query:

1. What if Mr, Putin is not engaged in business in Australia? The contract price

is still subject to the 12% final withholding VAT. Mr, Putin is conclusively

presumed engaged in business.

37

4

Chapter 2 - Value Added Tax on Importation

i -profit institution? The contract price;

if Eagle Company is a non-prot rn * ag

: eueree 12% final withholding VAT. Even non rofit corporation

required to withhold.

”

if i locator? The contra

} What if Eagle Company is an ecozone

subjected to the 12% final withholding VAT because ec

ct price will not,

outside the country (i.e. non-residents) by legal fiction.

‘ozone locators i,

Mlustration 2 ‘

Mr. Wong, a resident travelling sales agents, asked the assistance of Mr. Te;

Chinese national doing business abroad, t

Ba

‘0 help him install a GPS tracking

device in his car for P300,000.

Mr Wong shall pay P36,000 (12% x P300,000) final withholding VAT.

Query:

1

» What if Mr. Teng is not engaged in business in China? The contract rice is

Still subject to the 12% final withholding VAT since he will be presumed

engaged in business,

What if Mr. Wong is not a businessman? The contract price shall not be

Subject to final withholding VAT because withholding tax obligation exists only

Jor individuals engaged in business,

im

is not engaged in business

* Purchase of services from non-

€cozone locators

Non-residents when the individual purchaser

Tesidents by VAT-exempt Persons such as

[P Case the service is rendered by nancre.:

final withholding VAT is not impose et ecozone oe

considered non-residents, The withholding Tequireme tomy ns irae ed

wit mon-residents, Hence, the transact? shall be exesonnct be the final

withholding VAT. (See BIR ITAD Ruling No 311-14 dated Nowe 14

and 316-14 dated November 24 2014) "tated November 4, 20

IMPORT OF SERVICES SPECIFICALLY supy

The only imp

JECT To.

ort of service that is currently subje TERCENTAGE Tax

direct acquisition of insura

on insurance policies dir

ct to a percentage tax is the

nce Cover from abroaa, ne percent eo

*Ctly sourced abroad ig supjct Premium payment

tax. The policyholder sha

bj 9 ‘centage

ll pay the same to the BIR, ere :

38

Chapter 2— Value Added Tax on Importation

VATABLE IMPORT OF SERVICES

All other of import of services is subject to final withholding VAT. The final

withholding VAT is computed as 12% of the contract price. Unlike

withholding income tax, this amount shall not be deducted upon the amount

to be remitted abroad because it is deemed passed-on by the non-resident

service provider and “withheld” by the resident payor-withholding agent.

Examples of vatable import of services:

1. Lease or use of properties or property rights owned by non-residents

2. Services rendered to local insurance companies, with respect to

reinsurance premiums payable to non-residents

3, Other services rendered in the Philippines by non-residents

Mlustration 1

Session Food Corporation is a licensed franchisee of Ronald, Inc, a non-resident

foreign franchisor. During the month, Session is due to pay P800,000 royalties.

The final withholding VAT shall be:

Royalties P 800,000

VAT tax rate —_ 22%

Amount due Ronald, Inc. P__96,000

The amount to be remitted to Ronald, Inc. abroad shall be:

Royalties P 800,000

Less: Final income tax (P800,000 x 30%) ___ 240,000

Amount due Ronald, Inc. P_560,000

Unless agreed that the contract price is VAT-inclusive, the VAT is not deductible

against the gross royalty because the Withholding VAT is not a tax on income.

Remember that that non-resident corporations are subject to 30% final

withholding tax on income.

Illustration 2

Phil Mines imported a customized ozone generator from Chen Company in

China, Before shipment, Phil Mines had the machine customized by Guangzu

Industries in China for P500,000. The generator has a total landed cost of

P1,200,000 on importation. Chen Company installed the generator at Phil

Mine's processing plant in the Philippines for P220,000.

Phil Mines shall pay the following VAT on importation to the BOC:

Import landed cost P. 1,200,000

Multiply by: 12%

VAT on importation P144,000

39

Sy

Chapter 2 — Value Added Tax on Importation

Phil Mines shall likewise pay the following final withholding VAT to the Bir:

Installation service contract price P 220,000

Multiply by: 12%

Final withholding VAT P___26,400

The customization service by Guangzu Industries is not subject to final var

since the service is done abroad. The installation service is subject to final

withholding VAT since it is done within,

Payment of the withholding VAT

Using BIR Form 1600, the withholding VAT is re:

‘mitted monthly on or before

e 10" day of the following month after the wii

for taxes withheld for D,

ithholding was made, except

ecember which shall be filed or paid on or before

January 25 of the following year.

Treatment of the VAT on importa

1,

f tion and the Withholding VAT

If the resident Purchaser is a VAT-registered business, it can claim the

on or withholding VAT as input VAT creditable against

VAT on importati

its output Var.

2. Ifthe resident

is not engaged

merely added to the costs of the

in business, the var on importation is

800ds imported,

40

Chapter 2 — Value Added Tax on Importation

CHAPTER 2: SELF-TEST EXERCISES

Qe

Discussion Questions

ree ene aenre

RPS

What is importation?

Is VAT on importation a business tax? Explain.

What is the nature and scope of the VAT on importation?

Enumerate the list of exempt importations.

What is meant by the phrase “in original state”?

What is landed cost?

Distinguish dutiable value from landed cost.

Discuss technical importation.

Enumerate the current and existing ecozones in the Philippines.

Discuss the final withholding VAT, its scope and nature.

| Discuss the treatment of the VAT on importation and the final withholding

VAT.

True or False 1

1,

z

3.

4,

an

yen

10.

11.

12.

13.

14.

15.

The VAT on importation is a business tax.

The final withholding VAT is a business tax.

The VAT on importation is 12% of the value added on importation.

The VAT on importation is 12% of the receipts from the sale of services

abroad.

Importation is subject to either VAT or percentage tax.

The final withholding VAT is 12% of the contract price of purchased

services from within the Philippines.

The sale of services abroad is subject to 12% final withholding VAT.

‘The VAT on importation is paid to the Bureau of Internal Revenue.

‘The final withholding VAT on services is paid to the Bureau of Internal

Revenue.

The importation of any agricultural or marine products is VAT exempt

‘The importation of professional instruments and implements is exempt

from VAT.

The importation of any product intended for human consumption is VAT-

exempt.

The importation of ingredients which are intended for the manufacture of

goods for human consumption is VAT-exempt.

The importation of professional instruments and implements in commercial

quantities is VAT-exempt.

The importation of equipment,

vessels is VAT-exempt.

machinery and spare parts for marine

‘True or False 2

is

2.

3.

‘ot subject to the VAT on importation.

ture inputs are VAT-exempt.

products is vatable.

Resident foreigners are n

All agricultural or aquacul

‘The sale of processed agricultural

41

os

Chapter 2 - Value Added Tax on Importation

4, The importation of books and newspapers is VAT-exempt.

5. The importation of life-saving equipment is VAT-exempt.

6. The lease of aircrafts or vessels from non-residents is exempt from the fing)

withholding VAT. / i

7. The purchase of services from foreign consultants is exempt from fina,

withholding VAT, : j

8. The importation of fuel, goods, and supplies by international Carriers is

VAT-exempt.

9. The importation of ay

10. The importation of

VAT-exempt.

11. The VAT on importation is payable only by those engaged in business.

12. The final withholding VAT

on importation of services is payable even by

those not engaged in business,

13. The VAT on importation and the final withholdin

Input VAT creditable against Output VAT.

+4. In economic realty, the VAT on importation and the final withholding VAT

are taxes paid by non-resident sellers,

15. Qualified exempt importation is exempt from VAT only if made by an

exempt person.

=

ricultural machineries by farmers is exempt.

agricultural machineries by agricultural cooperatives is

ig VAT can be claimed as

Multiple Choice: Theory - agricultural

or marine food products: Part 1

1. Which is subject to value added tax?

a. Sheep ©. Cut sheep meat

b. Sheep wool 4. All of these

2. Which agricultural product is VAT-exempt on importation?

a. Charcoal ¢. Lumber r

b. Wood .Corn

3.

Which importation is subject to VAT?

a. Importation from abroad

b. Purchase of goods from economic zones in the Philippi

Both AandB nes

d. Neither A nor B

Which is not subject to VAT on importation?

a. Importation of goods for personal use

b. Importation of goods for business use

¢. Purchase of goods from Ecozone entities

d. Purchase of goods from other domestic sellers

5. Which of the following is subject to the VAT on importation when

imported?

a. Books

©. Mushroom

b. Table sugar

d. ordinary salt

42

Chapter 2 - Value Added Tax on Importation

6. Which non-food agricultural product is exempt from VAT on importation?

a. Chicken manure c. Live hogs

b. Eggs d.Cattle

7. Which of the following is not exempt from VAT?

a. Grapes c. Orchids

b. Oranges d. Kiwi fruits

8. Which seedling is vatable?

a. Grafted mango seedlings c. Narra seedlings

b. Pomelo seedlings d. Guava seedlings

9, Which agricultural produce is exempt from VAT?

a. Rubber c.Copra

b. Abaca hemp d. Firewood

10. Which is vatable?

a. Bamboo shoots c. Banana fruits

b. Banana hearts d. Bamboo poles

11. Which is VAT-exempt?

a. Cotton soft wood c. Cotton wool

b. Cotton seeds d. None of these

12. Which is VAT-exempt?

a. Coconut lumber c. Coconut shells

b. Coconut brooms sticks _d. Coconut meat

Which is subject to VAT on importation?

a. Wheat c. Barley

b. Coffee bean d.Cocoa

1,

»

14, Which agricultural product is subject to VAT?

a. Honey c. Sugar cane

b. Rattan cane d. Sugar beets

15, Which is subject to VAT on importation?

a. Cocoon silk c. Furniture

b. Pineapple silk d. All of these

16. Seedlings of this tree are exempt from VAT on importation.

a. Rubber tree c, Palm oil tree

b. Paper tree d. Mahogany tree

43

Chapter 2 - Value Added Tax on Importation

17. Which of the following when imported is subject to VAT?

a. Rubber c. Cacao

b. Com d. Peanuts

18. Which of these seeds is not VAT-exempt?

a. Corn seeds

c. Flower seeds

b. Mustard seeds

d. Cabbage seeds

19. Which of the following feeds is subject to VAT on importation?

a. Formulated horse feeds c. Swine feeds

b. Corn grits 4. Broiler feeds

20. Feeds of the followin,

a. Zoo animals

b. Aquarium fish

animals are considered as specialty feeds, except for

¢ Livestock

d. Fighting cocks

Multiple Choice: Theory - Agricultural or marine food products:

1. Which is VAT-exempt?

Part 2

a. Peacock feathers c. Hamsters

b. Eggs d. Leather

2. Which is vatable on importation?

a. Tealeaves c. Cayenne pepper

b. Tobacco leaves 4. Chinese cabbage

3. Which of these is VAT exempt on importation?

a. Almonds ©. Ginseng roots

b. Blueberries 4. All of these

4.

Which is not exempt from VAT?

a. Sunflower seeds c. Peanuts.

b. Beeswax

d. None of these

Which is not generally considered as pet und

a. Rabbits ¢. Race horses

b. Zoo animals d. Fighting cocks

wa

ler the regulation?

6. Which of these is non-

a. Lovebirds

atable?

©. Goldfish

b. Parrots d. Millefish

7. Which is not a VAT-exempt poultry?

a. Ducks c. Turkeys

b. Geese

d. Game fowl roosters

44

Chapter 2 - Value Added Tax on Importation

8.

10.

L

13.

14.

15.

16.

1

S

x

Which of these animals is vatable when imported?

a. Cows c. Goats

b. Rabbits d. Race horses

Which is a vatable agricultural input?

a. Fertilizers c.Seeds

b. Pesticides d. Seedlings

The following are generally considered as pets which are vatable when

imported except for

a. Janitor fish cc. Catfish

b. Goldfish d. Koi fish

. Which of these is taxable with VAT on importation?

a. Yellowfin tuna c. Blue marlin

b. Pink salmon d. Butterfly fish

Which of the following seafood is considered as vegetable and therefore

VAT-exempt?

a. Kelp c.Sea grapes

b. Sea lettuce ("Green nori”) d. All of these

Which of these is vatable?

a. Seashells c. Squids

b. Octopuses d. Shrimps

Examples of mollusk and shellfish:

A. Crabs B.Oysters C.Lobsters__—_—D. Clams

Which of these is subject to VAT on importation?

a. AandD c.All of these

b.. BandC d. None of these

Which of these agricultural products is not considered as being in its

original state?

a. Kopra c. Refined sugar

b. Muscovado sugar d. Ordinary salt

By revenue regulation, which of the items below is not considered in

original state?

a. Marinated fish c. Frozen meat

b. Dried fish d. Smoked fish

Which product is non-taxable with VAT on importation?

a. Fresh cow's milk c. Butter

b. Olive oil d. Parmesan cheese

45

Chapter 2 - Value Added Tax on Importation

i i below is taxable with VAT? 1 ta

* Se Senieeeaed meat _¢,Tetra-packed fresh fruit juice

b. Vacuum-packed vegetables d. Canned fruits

19. Which is not considered as simple processing?

a. Freezing c.Broiling

b. Stripping 4d. Marinating

20. The following advanced technological means of packaging are deemed not

to alter the nature of agricultural marine food products thereby retaining

their original state, Which is the exception?

a. Canning C Plastic shrink wrapping

b. Vacuum-packing d. Tetra-packing

Multiple Choice: Theory - Other exempt importation

1. Which is not exempt from VAT on importation?

a. Importation of books

b. Importation of school supplies

© Importation of magazines

4. Allofthese

2. Which importation is not VAT-exempt?

a. ee i flippant household effects of Tesidents coming to

b. setlepera of tly inthe Pa setold effects of foreigners coming to

© oral a Personal and household effects which are subject to

d. Allofthese

3. The importation o}

subject to VAT when

fYolumeis notin commercial quantity

b- goods accompany the person or ative withi

his/her arrival. “hin 30 days betore or after

importation invol

d. Allofthese

f Professional instrumen i

ie ents and implements may be

Ives vehicles and Machineries,

4. Which importation is exempt from VAT?

a. Importation of books bya school

b. Importation of books bya student

© Importation of books by a bookstore

d. Allof these

46

Chapter 2 — Value Added Tax on Importation

5, The importation of which transport medium is exempt from VAT?

a, Seaorair c.AandB

b. Land d. None

6. Examples of Transport vehicles:

A. Bus B. Cars. C.Vessels D. Aircraft

Which of these is not exempt from VAT when imported?

a CandD c.All of these

b. AandB d. None of these

7. Which importer is exempt from VAT on importation of fuel, goods and

supplies?

a, Domestic carriers

b. International carriers

c. Domestic carriers on their international operations

d. Either BorC

8 Which of the following items is subject to VAT on importation to an

individual who is intending to settle in the Philippines?

a. Vehicles

b. Professional instruments

¢. Household effects

d. Personal effects

9. The importation of fuel, goods and supplies is not exempt from VAT when

used in

a. Domestic operation

b. International shipping operations

c. International transport operations

4. Any of these

10. Which is vatable?

a. Importation of life saving equipment

b. Importation of safety or rescue equipment

c. Importation of spare parts, steel or other metal plates for marine

vessels

d. None of these

11. The importation of vessel or aircraft for domestic operations is

a. vatable.

b. always VAT exempt. poe . Paty

¢. VAT exempt if the importer complies with maximum service life set by

law. i

4. vatable ifthe importer complies with maximum service life set by law.

47

ition

Chapter 2- Value Added Tax on Importa'

rp supplies for domestic shipping o, ait

12. The importation of fuels, goods and supp

” transport operations is

a. vatable. ‘

._ always VAT exempt. / :

° vatableifthe importer is adomestic carrier.

4. VAT-exempt if the importer is a domestic carrier.

13. The importation of farm machineries and equipment is exempt when

imported by :

a amember of a cooperative.

b. trader engaged in business.

© an agricultural cooperative.

d. Aorc

14. Who has the burden of proving exemption from VAT on importation?

a. The government c. The seller

b. The importer-buyer d. Both A and C

15. Which is a qualified exempt importation?

a. Importation bya ‘Cooperative of farm e

b. Importation by a cooperative of, ice

¢. Importation of books

4. Importation of marine food Products

quipment

16. Which is nota qualified exempt importation?

@ Importation of fuels

b. Importation of fuels or

© Importation of cargo v

transport Operations

d. Importation of

17. Which of these is non-vatable?

a Purchase of services from i

a ke i i i

engaged in busines: Oreign service Provider who is not

b. Purchase of goods from a fore,

Ir

business abroad a

¢. Purchase of goo

d. None of these

‘Ce provider who is engaged in

ds from, economic zone enterprises

18. Who shall pay the VAT on i i

importat /AT-exempt entity

a Thecnege ean tMPored amtete gee trien a VATE»

a. The exempt buyer B00ds toa

b. The non-exempt buyer

c. Both Aand B

48

Chapter 2 - Value Added Tax on Importation

d. Neither A nor B

19, Importation is not subject to VAT when

a. made by a VAT-registered business.

b._ made bya non-VAT-registered business.

c. itinvolves exempt goods.

d. coursed through an exempt importer.

20. Which is not included in landed cost?

a. Dutiable value

b. Custom’s duty

c. Excise tax

d. VAT

21. Which is not included in the landed cost?

a. Purchase price

All incidental cost of bringing the goods to the Customs warehouse

c. Taxes other than VAT paid prior to the withdrawal of the goods

d. Cost of transporting the goods from the Customs warehouse to the

importer’s warehouse or residence

Multiple Choice -Problems 1

1. Oceanizers, Inc. purchased the following from abroad:

Sea shells and coral decor P 320,000

Tuna and salmon 120,000

Total B_440,000

What is the amount of taxable importation?

a PO c. P200,000

b. P120,000 4. P320,000

2. Mr. A imported various personal and household effects with a value

aggregating P400,000. P320,000 of these was subjected to a 8% customs

duty by the BOC. What is the VAT on importation?

a PO c. P42,240

b. P 41,472 d. P48,000

3. Abookstore company imported the following items:

Landed cost

Books P 350,000

Professional instruments 200,000

School supplies 350,000

Total B_900,000

49

ion

Chapter 2 - Value Added Tax on Importatio!

i IAT on importation?

Whatis the total V/ rt

b. P6000 4.P108,000

4, Mr.C,a VAT-registered food retailer, imported the following from China:

Landed cost

i P 250,000

Fruits

Vegetables 180,000

Frozen meat 50,000

Marinated milkfish 100,000

Total P_580,000

Compute the VAT on importation,

a ©.P 51,600

b. 12,000 4.P 69,600

5. Alexis Furnitures, a percentage taxpayer, imported the following household

equipment:

Machineries, for business use pides.cost 150,000

Heating system, for home use Py

Total > 250.000

Compute the VAT on importation,

a PO

© P 150,000

b. P27,000 4. P 168,000

6. Danes AgriCorp imported the following:

Seeds

Fertilizers P 400,000

Farming equipment 450000

Herbicides and pesticides “000

Total Eageg ate

Compute the VAT on importation,

a PO ©.P72,000

b. 42,000 4. P 84,000

7. Home Appliance Company imported the following for Personal

use;

Furniture P 600000

Rattan 250,000

Lumber 450,000

50

Chapter 2 - Value Added Tax on Importation

Compute the VAT on importation,

a. 30,000 cP 156,000

b. P72,000 .P 204,000

8. Mr. Huligan imported rice from Vietnam, Details of his importation show

the following:

‘Total invoice value P 1,000,000

Freight and insurance in transit 50,000

BOC and other charges 20,000

Compute the VAT on importation.

a PO ©.P 126,000

b. P120,000 4.P 128,400

9. An agricultural supply dealer imported the following:

Com grits P 200,000

Hog feeds 350,000

Specialty feeds 300,000

Compute the VAT on importation.

a PO ©. P42,000

b. P36,000 d.P 102,000

10. The following data relates to the importation of cigarettes by Mr. Shinto:

Total invoice value P 1,000,000

BOC charges 300,000

Customs duties 200,000

Excise taxes 300,000

Compute the VAT on importation.

a P120,000 ¢.P.180,000

b. P156,000 d.P 216,000

Multiple Choice - Problems 2

1. Don Pepito imported a harvester from the United States with a total cost of

P1,100,000 before Customs duties. The importation is subject to 10%

Customs duties. What is the VAT on importation?

a. P 158,400 c.P. 129,600

b. P 145,200 dP 0

s1

~s

Chapter 2 - Value Added Tax on Importation

2.

In the immediately preceding problem, assuming that the im

. . POrtation jg

made by an agricultural cooperative, what is the VAT on importation?

a P 158,400 cP 129,600

b. P 144,000 d.P0

Mr. Smile, a professional practitioner, imported the following:

Calculators and computers for his firm P 900,000

Books 600,000

Total 21,500,000

How much is subject to VAT on importation?

a PO c.P 1,200,000

b. P-900,000 d.P 1,500,000

Mr. Juan Manuel Marquez arrived in the Philippi i immigration

visa. He had with him the following: Peres sith an mmigra

Clothing, shoes, and apparel

g, shoe P 100,000

Professional instruments and implements 150,000

Personal car Y

300,000

Total costs of personal belongings P_s50.000

Compute the total amount subject to VAT on j i

impo

a PO ©.P 300,009. PoTtation.

b. P-200,000 4.P 550,000

Mr. Xhi,

@ non-VAT taxpayer, made the f i

goods: following domestic Purchases of

Purchase of scrap metals fro

m a PEZA-locator

Purchase of machine from a

Pa2

VAT supplier e000

800,000

What is the imposable VAT on importation?

a PO .P96,000

b. P24,000 4.P 120,000

Atlantis Shipping Company imported P

3,000,000 worth

supplies for domestic

of

he company earmarked 60% fuels oad

domestic use while 40% was reserved for its international operations = fF

s.

What is the VAT on importation?

a PO ©.P.216,000

b. P 144,000 dP 360,000

52

Chapter 2- Value Added Tax on Importation

7. Mr. Beer, a VAT-registered trader, imported equipment with a dutiable

value of $40,000 from abroad. The importation was subject to P100,000

BOC charges before 10% customs duties on dutiable value. The exchange

rate to the Peso was P43.00: $1.

Compute the VAT on importation.

a. P218,400 c.P 232,400

b, P227,040 4. P 239,040

8. If an importer paid 15% customs duties in the amount of P24,000 plus

P134,000 charges to the Bureau of Customs, what is the VAT on

importation?

a PO ©. P 35,280

b. P 18,960 .P 38,160

9, Shanum Company had the following data regarding its importation:

Invoice price in US Dollars $12,000

Other costs to bring goods to the Philippines P_ 145,000

BOC charges 100,000

Customs duties is 10% of dutiable value

Peso-Dollar Exchange rate P 42.80: $1

Compute the VAT on importation.

a PO c. P91,032.00

b. P81,643.20 d. P98,935.20

10.

Mr. Dolinger imported various merchandise from abroad. The importation

was invoiced at $ 5,000, Mr. Dolinger also incurred the following costs of

importation:

Insurance P 4,000

Freight 15,000

Wharfage fee 4,000

Arrastre charge 7,000

Brokerage fee 8,000

Facilitation fee 5,000

Mr. Dolinger was also assessed P 24,000 and P 18,000, respectively, for

customs duties and excise tax. The applicable exchange rate was P42.50:$1.

What is the VAT on importation?

a. P 25,500 cc. P35,100

b. P30,540 d.P 35,700

53

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (347)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Module 2 MISSTATEMENTS IN THE FINANCIAL STATEMENTSDocument7 pagesModule 2 MISSTATEMENTS IN THE FINANCIAL STATEMENTSNiño Mendoza MabatoNo ratings yet

- Module 6 INVESTMENT IN FINANCIAL INSTRUMENTS PDFDocument8 pagesModule 6 INVESTMENT IN FINANCIAL INSTRUMENTS PDFNiño Mendoza MabatoNo ratings yet

- Module 1 BASIC CONCEPTS OF FINANCIAL STATEMENT AUDIT PDFDocument8 pagesModule 1 BASIC CONCEPTS OF FINANCIAL STATEMENT AUDIT PDFNiño Mendoza Mabato100% (1)

- Module 5 INVENTORIES AND RELATED EXPENSESDocument4 pagesModule 5 INVENTORIES AND RELATED EXPENSESNiño Mendoza MabatoNo ratings yet

- Module 9 SHAREHOLDERS' EQUITYDocument3 pagesModule 9 SHAREHOLDERS' EQUITYNiño Mendoza MabatoNo ratings yet

- Introduction To Business Taxation: Chapter 3 (Part 1)Document38 pagesIntroduction To Business Taxation: Chapter 3 (Part 1)Niño Mendoza MabatoNo ratings yet

- Lesson 3 Financial Institutions and MarketsDocument3 pagesLesson 3 Financial Institutions and MarketsNiño Mendoza MabatoNo ratings yet

- QUALI Conclusions and Recommendations FormulationDocument6 pagesQUALI Conclusions and Recommendations FormulationNiño Mendoza MabatoNo ratings yet

- Citizen'S Charter: Overseas Workers Welfare AdministrationDocument73 pagesCitizen'S Charter: Overseas Workers Welfare AdministrationNiño Mendoza MabatoNo ratings yet

- Problem and Its BackgroundDocument19 pagesProblem and Its BackgroundNiño Mendoza MabatoNo ratings yet

- Technology and Livelihood EducationDocument16 pagesTechnology and Livelihood EducationNiño Mendoza MabatoNo ratings yet

- Articles of Incorporation of TheDocument15 pagesArticles of Incorporation of TheNiño Mendoza MabatoNo ratings yet

- Manual On Corporate GovernanceDocument86 pagesManual On Corporate GovernanceNiño Mendoza MabatoNo ratings yet

- Qualitative ResearchDocument12 pagesQualitative ResearchNiño Mendoza MabatoNo ratings yet

- Nature and Definition of Research: Scientific ThinkingDocument14 pagesNature and Definition of Research: Scientific ThinkingNiño Mendoza MabatoNo ratings yet

- Chapter 2 HomeworkDocument4 pagesChapter 2 HomeworkNiño Mendoza MabatoNo ratings yet

- Barriers To M-Commerce Adoption in Developing Countries - A Qualitative Study Among The Stakeholders of Bangladesh Mohammed Mizanur RahmanDocument12 pagesBarriers To M-Commerce Adoption in Developing Countries - A Qualitative Study Among The Stakeholders of Bangladesh Mohammed Mizanur RahmanNiño Mendoza MabatoNo ratings yet

- Types of Research According To PurposeDocument7 pagesTypes of Research According To PurposeNiño Mendoza MabatoNo ratings yet

- Shared Value in Practice: TOMS Business Model: September 2013Document8 pagesShared Value in Practice: TOMS Business Model: September 2013Niño Mendoza MabatoNo ratings yet

- 5 C 8 F 600 BF 3450Document11 pages5 C 8 F 600 BF 3450Niño Mendoza MabatoNo ratings yet

- Chapter 1Document20 pagesChapter 1Niño Mendoza MabatoNo ratings yet

- Chapter 5Document47 pagesChapter 5Niño Mendoza MabatoNo ratings yet

- Chapter 4Document51 pagesChapter 4Niño Mendoza MabatoNo ratings yet

- Module 8 LIABILITIESDocument5 pagesModule 8 LIABILITIESNiño Mendoza MabatoNo ratings yet

- Module 4 RECEIVABLES AND RELATED REVENUESDocument5 pagesModule 4 RECEIVABLES AND RELATED REVENUESNiño Mendoza MabatoNo ratings yet