Professional Documents

Culture Documents

Cgu1 Cgu2: Applicable To Goodwill 320,000 400,000

Uploaded by

Iris DescentOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cgu1 Cgu2: Applicable To Goodwill 320,000 400,000

Uploaded by

Iris DescentCopyright:

Available Formats

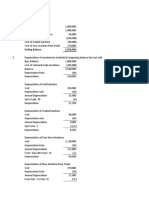

CGU1 CGU2

Carrying value:

Inventories 120,000 150,000

Factory equipment 500,000 750,000

Office equipment 900,000 1,200,000

Building 1,200,000 1,500,000

Goodwill 600,000 400,000

Total 3,320,000 4,000,000

Recoverable amount ( whichever is higher)

Fair value less cost to sell

(excluding cash and receivables) 2,500,000 3,200,000 3,200,000

Value in use

(520,922 x PVF for 10% period of 9) 3,000,000 3,000,000

(446,493 x PVF for 10% period of 11) 2,900,000

Total Impairment loss 320,000 800,000

Applicable to Goodwill 320,000 400,000

Applicable to non-cash assets 400,000

CGU2 Application of Impairment

Carrying value: Before Impairment Loss

Inventories 150,000 - 10,000 140,000 net realizable value is 140k

Factory equipment 750,000 (750/3,450x 390k) - 84,783 665,217

Office equipment 1,200,000 (1200/3,450 x 390k) - 135,652 1,064,348

Building 1,500,000 (1500/3,450 x 390k) - 169,565 1,330,435

Total 3,600,000 - 400,000 3,200,000

CGU2 Application of Impairment

Carrying value: Before Impairment Loss

Inventories 150,000 - 10,000 140,000

Factory equipment 750,000 (750/1,950* x 390k**) - 150,000 600,000

Office equipment 1,200,000 (1200/1,950* x 390k**) - 240,000 960,000

Building 1,500,000 1,500,000 **

Total 3,600,000 - 400,000 3,200,000

** the value of the building retains at 1.5M because the Fair value is still 1.6M, thus not impaired

You might also like

- p2 - Guerrero Ch9Document49 pagesp2 - Guerrero Ch9JerichoPedragosa72% (36)

- Chapter 22 Retained Earnings DividendsDocument39 pagesChapter 22 Retained Earnings DividendstruthNo ratings yet

- Cost of CapitalDocument10 pagesCost of CapitalCharmaine ChuNo ratings yet

- Delegate List - TradeDocument145 pagesDelegate List - TradeFummy Omnipotent67% (3)

- Property, Plant and Equipment Chapter 15Document9 pagesProperty, Plant and Equipment Chapter 15Kiminosunoo Lel100% (3)

- Companies Region Wise TFMDocument39 pagesCompanies Region Wise TFMMeghana VyasNo ratings yet

- Auditing Problem Lease AC42Document28 pagesAuditing Problem Lease AC42Trek Apostol50% (2)

- Waiver of Pre-Emptive RightsDocument5 pagesWaiver of Pre-Emptive RightscamileholicNo ratings yet

- Mystic SportsDocument6 pagesMystic SportsBatista Firangi100% (2)

- Batch 93 FAR First Preboard February 2023 - SolutionDocument5 pagesBatch 93 FAR First Preboard February 2023 - SolutionlorenzNo ratings yet

- Mystic SportsDocument34 pagesMystic SportshelloNo ratings yet

- Bangalore-Chapter: SR - No Name Batch Branch Company City Contact E-MailDocument13 pagesBangalore-Chapter: SR - No Name Batch Branch Company City Contact E-Mailvinaykaamble100% (1)

- Chapter 12 FinalDocument19 pagesChapter 12 FinalMichael Hu100% (1)

- Cost Accounting: Allocation Basis Alpha Beta Gamma TotalDocument6 pagesCost Accounting: Allocation Basis Alpha Beta Gamma TotalShehrozSTNo ratings yet

- Solution To R Haque Associates ProblemDocument8 pagesSolution To R Haque Associates ProblemHasanNo ratings yet

- AccountingDocument4 pagesAccountingFerrNo ratings yet

- A - Mock PSPM Set 2Document6 pagesA - Mock PSPM Set 2IZZAH NUR ATHIRAH BINTI AZLI MoeNo ratings yet

- Chapter 27Document7 pagesChapter 27Shane Ivory ClaudioNo ratings yet

- Sol. Man. - Chapter 15 - Ppe Part 1 - Ia Part 1BDocument5 pagesSol. Man. - Chapter 15 - Ppe Part 1 - Ia Part 1BMahasia MANDIGANNo ratings yet

- AmountDocument3 pagesAmountJudy TotoNo ratings yet

- J. Jarvis Trial Balance As at 31 December 2010Document3 pagesJ. Jarvis Trial Balance As at 31 December 2010Ahmad HaqqyNo ratings yet

- Module 2 Answer Key On Property Plant and EquipmentDocument7 pagesModule 2 Answer Key On Property Plant and EquipmentLoven BoadoNo ratings yet

- Group-8 F2 CCE-2 CMA Cost SheetDocument12 pagesGroup-8 F2 CCE-2 CMA Cost SheetNAMRATANo ratings yet

- Q-3 Aut-16 SOLUTION (Lec#39 HW)Document2 pagesQ-3 Aut-16 SOLUTION (Lec#39 HW)iamneonkingNo ratings yet

- Accounting & Finance Assignment 1 - Updated 1.0Document15 pagesAccounting & Finance Assignment 1 - Updated 1.0lavania100% (1)

- MockDocument6 pagesMockWEI QUAN LEENo ratings yet

- Accounting & Finance Assignment 1 - Updated 2.0Document15 pagesAccounting & Finance Assignment 1 - Updated 2.0lavania0% (1)

- Tutor6 ACCDocument4 pagesTutor6 ACCFood TraditionalNo ratings yet

- Far460 Group Project 1Document3 pagesFar460 Group Project 1NURAMIRA AQILANo ratings yet

- AP-5903 - PPE & IntangiblesDocument8 pagesAP-5903 - PPE & IntangiblesDreiu EsmeleNo ratings yet

- Answer Far270 Feb2021Document8 pagesAnswer Far270 Feb2021Nur Fatin AmirahNo ratings yet

- Property, Plant and Equipment Chapter 15Document9 pagesProperty, Plant and Equipment Chapter 15Kiminosunoo LelNo ratings yet

- Ia3 FinalsDocument4 pagesIa3 FinalsGeraldine MayoNo ratings yet

- Let's Check (ULO J)Document8 pagesLet's Check (ULO J)Kirei MinaNo ratings yet

- Working Notes Profit and Loss Adjustment AccountDocument11 pagesWorking Notes Profit and Loss Adjustment Accountkvrajan6No ratings yet

- Book 1Document12 pagesBook 1Vincent Luigil AlceraNo ratings yet

- A - Mock PSPM Set 1Document5 pagesA - Mock PSPM Set 1IZZAH NUR ATHIRAH BINTI AZLI MoeNo ratings yet

- Project Report On Grocery Shop: Mrs Atsü PhomDocument5 pagesProject Report On Grocery Shop: Mrs Atsü PhomShyamal DuttaNo ratings yet

- Classes 3.a 4.a EXCERCISES From COGS To Planning - September 2022Document9 pagesClasses 3.a 4.a EXCERCISES From COGS To Planning - September 2022Maram PageNo ratings yet

- Tutorial OverheadDocument6 pagesTutorial OverheadImran FarhanNo ratings yet

- IA Activity 6 AssDocument6 pagesIA Activity 6 AssWeStan LegendsNo ratings yet

- Sir Mac Book SolmanDocument10 pagesSir Mac Book SolmanJAY AUBREY PINEDANo ratings yet

- Resource Company Required Debit Credit 2020 Rock and Gravel PropertyDocument10 pagesResource Company Required Debit Credit 2020 Rock and Gravel PropertyAnonnNo ratings yet

- MAS-03 WorksheetDocument32 pagesMAS-03 WorksheetPaupauNo ratings yet

- Cost Accounting 1Document4 pagesCost Accounting 1Rohan RalliNo ratings yet

- Financial Plan OkDocument7 pagesFinancial Plan OkSYED ARSALANNo ratings yet

- ABC - Practice Set Answer and SolutionDocument4 pagesABC - Practice Set Answer and SolutionYvone Ehnnery BumosaoNo ratings yet

- Accounting PrinciplesDocument4 pagesAccounting PrinciplesNazir AhmadNo ratings yet

- Jawaban Soal InventoryDocument4 pagesJawaban Soal InventorywlseptiaraNo ratings yet

- Name: Fe C. Leyros Bsa 2 Acctg TTH 3:00-4:30 PM Solutions: Problem 1Document7 pagesName: Fe C. Leyros Bsa 2 Acctg TTH 3:00-4:30 PM Solutions: Problem 1AlexNo ratings yet

- Auditing ActivityDocument4 pagesAuditing ActivityPrincessNo ratings yet

- Financial Plan (Illustration)Document6 pagesFinancial Plan (Illustration)rana samiNo ratings yet

- Cases PpeDocument19 pagesCases PpeDavid Harrison PascualNo ratings yet

- Budgeted Statement ExamDocument11 pagesBudgeted Statement ExamNelz KhoNo ratings yet

- Start-Up Capital:: Particulars Taka TakaDocument5 pagesStart-Up Capital:: Particulars Taka TakaSahriar EmonNo ratings yet

- Additional Chapter AssignmentDocument4 pagesAdditional Chapter AssignmentM GualNo ratings yet

- Cost Accounting: 1/4/2010 10:55:09 AM Page 1 of 7Document7 pagesCost Accounting: 1/4/2010 10:55:09 AM Page 1 of 7meelas123No ratings yet

- Category Cost of Asset Accumulated DepreciationDocument10 pagesCategory Cost of Asset Accumulated DepreciationAaliyah ManuelNo ratings yet

- Pre-Final Exam in Audit 2-3Document5 pagesPre-Final Exam in Audit 2-3Shr BnNo ratings yet

- Tutorial4 - Sol - New UpdateDocument13 pagesTutorial4 - Sol - New UpdateHa NguyenNo ratings yet

- Financial Plan (Illustration)Document6 pagesFinancial Plan (Illustration)Syed ArslanNo ratings yet

- M.B.A (2021 Pattern)Document105 pagesM.B.A (2021 Pattern)Mayur HariyaniNo ratings yet

- Working CapitalDocument2 pagesWorking CapitalPayal bhatiaNo ratings yet

- Buscom-Asset AcquisitionDocument7 pagesBuscom-Asset AcquisitionRenelyn DavidNo ratings yet

- Financial Accounting 2022 NeHu Question PaperDocument7 pagesFinancial Accounting 2022 NeHu Question PaperSuraj BoseNo ratings yet

- Template Tuto Group ProjectDocument6 pagesTemplate Tuto Group ProjectNur Athirah Binti MahdirNo ratings yet

- Done by Omar Gamal Tawfik 291800293: There Will Under Applied by 8000 SoDocument7 pagesDone by Omar Gamal Tawfik 291800293: There Will Under Applied by 8000 SoOmar SoussaNo ratings yet

- 268,800 Rommel SP CorpDocument10 pages268,800 Rommel SP CorpnovyNo ratings yet

- British Commercial Computer Digest: Pergamon Computer Data SeriesFrom EverandBritish Commercial Computer Digest: Pergamon Computer Data SeriesNo ratings yet

- Maq Fall00 Charting To The Future PDFDocument8 pagesMaq Fall00 Charting To The Future PDFIris DescentNo ratings yet

- Accounting Information System and Its Role On BusiDocument10 pagesAccounting Information System and Its Role On BusiIris DescentNo ratings yet

- Varthis Columbia 0054D 13224Document100 pagesVarthis Columbia 0054D 13224MARLON MARTINEZNo ratings yet

- Test Bank Management 8th Edition BatemanDocument40 pagesTest Bank Management 8th Edition BatemanIris DescentNo ratings yet

- Reaction Paper: Wha T? Why? How?: Hilkka StotesburyDocument19 pagesReaction Paper: Wha T? Why? How?: Hilkka StotesburyKianJohnCentenoTuricoNo ratings yet

- Students' Perceptions On Studying Accounting Information System CourseDocument9 pagesStudents' Perceptions On Studying Accounting Information System CourseIris DescentNo ratings yet

- AbbreviatedDocument2 pagesAbbreviatedwasiNo ratings yet

- FIN 301 Porter Chapter 10-1-Answer KeyDocument1 pageFIN 301 Porter Chapter 10-1-Answer KeyIris DescentNo ratings yet

- FIN 301 Porter Chapter 10-1-Answer KeyDocument1 pageFIN 301 Porter Chapter 10-1-Answer KeyIris DescentNo ratings yet

- Sim FixDocument15 pagesSim FixAndhiniNo ratings yet

- FM11 CH 09 Test BankDocument15 pagesFM11 CH 09 Test BankFrances Ouano Ponce100% (1)

- Cloud Computing As An Innovation in GIS SDI MethodDocument11 pagesCloud Computing As An Innovation in GIS SDI MethodIris DescentNo ratings yet

- Cloud Computing Awareness and Adoption Among Accounting Practitioners in MalaysiaDocument6 pagesCloud Computing Awareness and Adoption Among Accounting Practitioners in MalaysiaIris DescentNo ratings yet

- Factors That Influence Adoption of Cloud Computing: An Empirical Study of Australian SmesDocument31 pagesFactors That Influence Adoption of Cloud Computing: An Empirical Study of Australian SmesIris DescentNo ratings yet

- Solutions Manual To Accompany An Introduction To Financial MarketsDocument100 pagesSolutions Manual To Accompany An Introduction To Financial MarketsAxel RMNo ratings yet

- Perception Towards Accounting Profession and Parental Influence To Predict Students Career ChoicesDocument4 pagesPerception Towards Accounting Profession and Parental Influence To Predict Students Career ChoicesIris DescentNo ratings yet

- InventoryMgmt - PDF Version 1Document3 pagesInventoryMgmt - PDF Version 1Iris DescentNo ratings yet

- Pi Professional Accountants The Future PDFDocument88 pagesPi Professional Accountants The Future PDFramen pandey100% (1)

- Do Students' Perceptions Matter? A Study of The Effect of Students' Perceptions On Academic PerformanceDocument24 pagesDo Students' Perceptions Matter? A Study of The Effect of Students' Perceptions On Academic PerformanceIris DescentNo ratings yet

- POM DecisionTheoryDocument29 pagesPOM DecisionTheoryAlly CelesteNo ratings yet

- Erpetual vs. Eriodic Ystem: Feature Perpetual System Periodic SystemDocument1 pageErpetual vs. Eriodic Ystem: Feature Perpetual System Periodic SystemIris DescentNo ratings yet

- Fixed-OrderQuantity and Fixed-TimePeriod ExercisesDocument1 pageFixed-OrderQuantity and Fixed-TimePeriod ExercisesIris Descent0% (1)

- Ananlysis Equity Shares of Axis BankDocument17 pagesAnanlysis Equity Shares of Axis BankbluechelseanNo ratings yet

- Idea Vodafone Merger AnalysisDocument7 pagesIdea Vodafone Merger Analysisritesh choudhuryNo ratings yet

- Fiza and Team PresentationDocument18 pagesFiza and Team PresentationMuhammad SaadNo ratings yet

- The State of U.S. Corporate Governance: What's Right and What's Wrong?Document39 pagesThe State of U.S. Corporate Governance: What's Right and What's Wrong?Niaz AliNo ratings yet

- Corporations Canada: Guide To Federal IncorporationDocument60 pagesCorporations Canada: Guide To Federal IncorporationOleksiy KovyrinNo ratings yet

- Corporate Law PracticeDocument183 pagesCorporate Law PracticeEsther Oluwaseyitan SodiyaNo ratings yet

- Corporation Law Syllabus With Assignment of CasesDocument4 pagesCorporation Law Syllabus With Assignment of CasesMarilou AgustinNo ratings yet

- Ch. 1 - Business CombinationDocument40 pagesCh. 1 - Business CombinationKadal BurikNo ratings yet

- Schedule For Analyst Inst MeetDocument20 pagesSchedule For Analyst Inst MeetNeerav Indrajit GadhviNo ratings yet

- Deal Tracker 2015Document23 pagesDeal Tracker 2015kanchanthebest100% (1)

- Notice: Muhammad Junaid Khan 12775Document6 pagesNotice: Muhammad Junaid Khan 12775Junaid KhanNo ratings yet

- The Corporation: I. Chapter OutlineDocument3 pagesThe Corporation: I. Chapter Outlinehung TranNo ratings yet

- Business Combinations Chapter 3 Reverse AcquisitionDocument24 pagesBusiness Combinations Chapter 3 Reverse AcquisitionGia Sarah Barillo BandolaNo ratings yet

- Global M A Activity Latest BCG Perpsective 1569564066Document36 pagesGlobal M A Activity Latest BCG Perpsective 1569564066l0ngj0hnsilv3rNo ratings yet

- Reliance Industries LimitedDocument17 pagesReliance Industries LimitedSourabh GardeNo ratings yet

- Business Studies ProjectDocument10 pagesBusiness Studies Projectabarajitha sureshkumarNo ratings yet

- Bono AptDocument64 pagesBono Aptjosue henry vasquez neyeraNo ratings yet

- The Role of Business in Social and Economic DevelopmentDocument30 pagesThe Role of Business in Social and Economic DevelopmentRealyn Sampang100% (1)

- Tutorial 7Document5 pagesTutorial 7Jian Zhi TehNo ratings yet

- Quiz 1 AnswersDocument6 pagesQuiz 1 AnswersAlyssa CasimiroNo ratings yet

- Data anh ThốngDocument99 pagesData anh ThốngThiện ĐứcNo ratings yet

- ICICI BankDocument32 pagesICICI Bankaditi100% (1)

- Manila Standard Today - Business Daily Stocks Review (May 22, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (May 22, 2013)Manila Standard TodayNo ratings yet

- Company Law Lecture Notes by Ankur MittalDocument48 pagesCompany Law Lecture Notes by Ankur MittalHira Lal TripathiNo ratings yet