Professional Documents

Culture Documents

An Electric Components Manufacturer

Uploaded by

audrey gadayOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

An Electric Components Manufacturer

Uploaded by

audrey gadayCopyright:

Available Formats

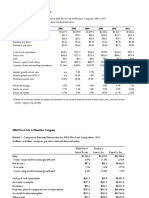

WHO IS WHO ?

The following table provides information on six major companies. Each of them is representative of

an industry :

an airline company

an electric components manufacturer a cement producer

a supermarket company an employment services company

a food products producer a luxury products manufacturer

1 - Find which company is hiden behind each column

2 - Rank them by return on capital employed

3 - What would be the consequences of a 25 % growth for each company ?

All figures are in % of sales All figures are

Allinfigures

% of sales

are

Allinfigures

% of sales

are

Allinfigures

% of sales

are

Allinfigures

% of sales

are

Allinfigures

% of sales

are in % of sales

employmen

luxury supermar airline cement electric

Sales 100% 100% 100% 100% 100% 100%

Cost of sales 81.5 56.6 80.6 34.0 72.8 86.7

Administrative, commercial and other costs 16.1 34.5 15.7 41.3 15.9 5.8

OPERATING PROFIT 2.4 8.9 3.7 24.7 11.3 7.5

Financial revenues 0.1 0.6 0.2 1.7 1.4 0.3

Interest on loans 0.2 2.0 0.4 2.9 2.8 2.8

INCOME BEFORE TAX 2.3 7.5 3.5 23.5 9.9 5.0

Income tax 0.8 2.6 1.2 7.3 2.3 1.4

NET INCOME 1.5 4.9 2.3 16.2 7.6 3.6

(1) after deduction of labor costs : 8.2 17.3 8.3 16.7 20.4 27.0

(2) after deduction of depreciation : 0.6 5.2 2.6 3.8 6.2 7.5

Fixed assets 5.1 82.0 29.4 96.0 109.0 99.0

99.0

Inventory 0.0 8.2 7.9 47.3 11.6 0.9

Trade receivables 19.1 16.3 0.2 20.0 19.6 11.8

Other operating receivables 1.5 0.5 9.5 10.3 5.1 5.1

Cash and cash equivalent 3.0 6.8 2.0 38.3 9.1 5.1

Equity 9.9 53.9 16.6 126.7 83.6 35.7

Financial debts 2.1 32.4 5.0 42.3 36.3 48.3

Other liabilities 4.3 2.5 1.3 16.2 10.2 12.8

PHILIPS Page 1 Finance for non Financial Managers

Trade payables 3.9 13.6 19.2 11.7 9.9 11.8

Other operating liabilities 8.5 11.4 6.9 15.0 14.4 13.3

Investments in operating assets 0.7 5.3 2.6 3.3 8.8 11.0

Acquisitions 0.2 8.9 5.8 0.3 11.0 0.0

WCR 8.2 0.0 -8.5 50.9 12.0 -7.3

Capital employed 13.3 82.0 20.9 146.9 121.0 91.7

IN % OF SALES WHO IS WHO ? WHO IS WHOWHO

IS IS WHO ?IS WHO ?

MARGINS AND COSTS

+ SALES 100.0 100.0 100.0 100.0 100.0 100.0

- Cost of sales 81.5 56.6 80.6 34.0 72.8 86.7

= GROSS MARGIN 18.5 43.4 19.4 66.0 27.2 13.3

- administrative and commercial costs 16.1 34.5 15.7 41.3 15.9 5.8

= OPERATING PROFIT (or EBIT) 2.4 8.9 3.7 24.7 11.3 7.5

+ Depreciation 0.6 5.2 2.6 3.8 6.2 7.5

= EBITDA (Earnings Before Interest & Tax Depreciation

3.0 & Amort)

14.1 6.3 28.5 17.5 15.0

+ financial revenues - interests -0.1 -1.4 -0.2 -1.2 -1.4 -2.5

= INCOME BEFORE TAX 2.3 7.5 3.5 23.5 9.9 5.0

- income tax 1% 3% 1% 7% 2% 1%

= NET INCOME 2.3 7.5 3.5 23.4 9.9 5.0

+ Net income 2.3 7.5 3.5 23.4 9.9 5.0

+ Depreciation 0.6 5.2 2.6 3.8 6.2 7.5

= NET CASH FLOW 2.9 12.7 6.1 27.2 16.1 12.5

NOPAT 2.29% 7.47% 3.49% 23.43% 9.88% 4.99%

Income tax 1% 3% 1% 7% 2% 1%

NOPAT 2.38 8.67 3.66 22.90 11.04 7.40

ROCE 18% 11% 17% 16% 9% 8%

PHILIPS Page 2 Finance for non Financial Managers

PHILIPS Page 3 Finance for non Financial Managers

You might also like

- LEE-CASE Study Case PresentationDocument15 pagesLEE-CASE Study Case Presentationaudrey gaday0% (1)

- MBA104 - Almario - Parco - Online Problem Solving 3 Online Quiz Exam 2Document13 pagesMBA104 - Almario - Parco - Online Problem Solving 3 Online Quiz Exam 2nicolaus copernicusNo ratings yet

- Word Note The Body Shop International PLC 2001: An Introduction To Financial ModelingDocument9 pagesWord Note The Body Shop International PLC 2001: An Introduction To Financial Modelingalka murarka100% (2)

- Nba Advanced - Happy Hour Co - DCF Model v2Document10 pagesNba Advanced - Happy Hour Co - DCF Model v2Siddhant AggarwalNo ratings yet

- Schaum's Outline of Basic Business Mathematics, 2edFrom EverandSchaum's Outline of Basic Business Mathematics, 2edRating: 5 out of 5 stars5/5 (1)

- Cisco System Inc: Economic AnalysisDocument32 pagesCisco System Inc: Economic AnalysisuditmangalNo ratings yet

- ACC51112 - Responsibility Accounting QuizzerDocument12 pagesACC51112 - Responsibility Accounting QuizzerjasNo ratings yet

- Income From Business-ProblemsDocument20 pagesIncome From Business-Problems24.7upskill Lakshmi V100% (1)

- An Electric Components Manufacturer A Cement Producer A Supermarket Company An Employment Services CompanyDocument3 pagesAn Electric Components Manufacturer A Cement Producer A Supermarket Company An Employment Services Companyaudrey gadayNo ratings yet

- Ratio Analysis-Overview Ratios:: CaveatsDocument18 pagesRatio Analysis-Overview Ratios:: CaveatsabguyNo ratings yet

- Analysis IDocument4 pagesAnalysis IBeugh RiveraNo ratings yet

- Lou Simpson GEICO LettersDocument24 pagesLou Simpson GEICO LettersDaniel TanNo ratings yet

- Gudang Garam (IDX GGRM) Financial Statement Forecasting and Discount Cash Flow (DCF) Valuation ModelDocument2 pagesGudang Garam (IDX GGRM) Financial Statement Forecasting and Discount Cash Flow (DCF) Valuation ModelAndi ErnandaNo ratings yet

- Berger Paints Ratio Analysis Summary 2015Document8 pagesBerger Paints Ratio Analysis Summary 2015KARIMSETTY DURGA NAGA PRAVALLIKANo ratings yet

- Nyse Cas 2006Document85 pagesNyse Cas 2006gaja babaNo ratings yet

- VW Group Annual Report 2019 Key Financial IndicatorsDocument1 pageVW Group Annual Report 2019 Key Financial IndicatorsAshish PatwardhanNo ratings yet

- Technical Interview WSOmodel2003Document7 pagesTechnical Interview WSOmodel2003Li HuNo ratings yet

- BAJAJ AUTO LTD QUANTAMENTAL EQUITY RESEARCH REPORTDocument1 pageBAJAJ AUTO LTD QUANTAMENTAL EQUITY RESEARCH REPORTVivek NambiarNo ratings yet

- Ratio Analysis-Overview Ratios:: CaveatsDocument14 pagesRatio Analysis-Overview Ratios:: CaveatsEng abdifatah saidNo ratings yet

- Residence Department Position MarketGroup FrequenciesDocument5 pagesResidence Department Position MarketGroup FrequenciesBeugh RiveraNo ratings yet

- Presentation 1Document9 pagesPresentation 1Zubair KhanNo ratings yet

- DCF ConeDocument37 pagesDCF Conejustinbui85No ratings yet

- Case Study - LÓrealDocument4 pagesCase Study - LÓrealAndrea BrozosNo ratings yet

- 2017 SMIC Lo PDFDocument128 pages2017 SMIC Lo PDFBjay AledonNo ratings yet

- Tyson Foods Inc Class A TSN: Growth Rates (Compound Annual)Document1 pageTyson Foods Inc Class A TSN: Growth Rates (Compound Annual)garikai masawiNo ratings yet

- Annual 20report 202020Document226 pagesAnnual 20report 202020Alexandru DavidNo ratings yet

- KSB - Annual Report 2002 PDFDocument100 pagesKSB - Annual Report 2002 PDFLymeParkNo ratings yet

- Nishat Chunian Group Consists of Three Companies - Nishat Chunian LimitedDocument4 pagesNishat Chunian Group Consists of Three Companies - Nishat Chunian LimitedAleena AshfaqueNo ratings yet

- Terra Repaired FileDocument19 pagesTerra Repaired Fileshahid hassanNo ratings yet

- 1999 Annual ReportDocument72 pages1999 Annual ReportAswinNo ratings yet

- Werner - Financial Model - Final VersionDocument2 pagesWerner - Financial Model - Final VersionAmit JainNo ratings yet

- Competitive Intelligence ReportDocument4 pagesCompetitive Intelligence ReportPham TuyenNo ratings yet

- Anilkumar Sdafm CIA-1Document7 pagesAnilkumar Sdafm CIA-1Varun S UNo ratings yet

- NFL Annual Report 2019 Compressed PDFDocument130 pagesNFL Annual Report 2019 Compressed PDFZUBAIRNo ratings yet

- BLUE STAR LTD - Quantamental Equity Research Report-1Document1 pageBLUE STAR LTD - Quantamental Equity Research Report-1Vivek NambiarNo ratings yet

- MONRY Investment ReportDocument1 pageMONRY Investment Reportjohnny snowNo ratings yet

- Varun Beverages LTD - One Page Profile: Key Finanacial Metrics Share Price - 5YDocument1 pageVarun Beverages LTD - One Page Profile: Key Finanacial Metrics Share Price - 5Yshrikant.colonelNo ratings yet

- Comparison ResultDocument3 pagesComparison ResultSanjhi ParasharNo ratings yet

- Case Study #1: Bigger Isn't Always Better!: Jackelyn Maguillano Hannylen Faye T. Valente Coas Ii-ADocument9 pagesCase Study #1: Bigger Isn't Always Better!: Jackelyn Maguillano Hannylen Faye T. Valente Coas Ii-AHannylen Faye ValenteNo ratings yet

- Nyse Aan 2008Document48 pagesNyse Aan 2008gaja babaNo ratings yet

- Key Performance Indicators Y/E MarchDocument1 pageKey Performance Indicators Y/E Marchretrov androsNo ratings yet

- Faro AR 2008Document76 pagesFaro AR 2008Rudi HasibuanNo ratings yet

- CL EducateDocument7 pagesCL EducateRicha SinghNo ratings yet

- Assignment 5Document2 pagesAssignment 5Amarjeet SinghNo ratings yet

- FIN 3512 Historicals and Projections File To Integrate DFCFDocument17 pagesFIN 3512 Historicals and Projections File To Integrate DFCFgNo ratings yet

- RatioDocument11 pagesRatioAnant BothraNo ratings yet

- Case 01a Growing Pains SolutionDocument7 pagesCase 01a Growing Pains SolutionUSD 654No ratings yet

- Hindustan Unilever LTD.: Distribution of Expenses (%) : Mar 2010 - Mar 2019: Non-Annualised: Rs. MillionDocument2 pagesHindustan Unilever LTD.: Distribution of Expenses (%) : Mar 2010 - Mar 2019: Non-Annualised: Rs. Millionandrew garfieldNo ratings yet

- Financial Planning and Strategy Problem 1 Bajaj Auto LTDDocument4 pagesFinancial Planning and Strategy Problem 1 Bajaj Auto LTDMukul KadyanNo ratings yet

- Excel Model The Body Shop International PLC 2001: An Introduction To Financial ModelingDocument29 pagesExcel Model The Body Shop International PLC 2001: An Introduction To Financial Modelingalka murarka33% (6)

- AP M&A Q1 2017 SnapshotDocument18 pagesAP M&A Q1 2017 SnapshotArchitectPartnersNo ratings yet

- V F Corporation NYSE VFC FinancialsDocument9 pagesV F Corporation NYSE VFC FinancialsAmalia MegaNo ratings yet

- ALLDY Targets Aggressive Store Expansion to Triple Network by 2026Document16 pagesALLDY Targets Aggressive Store Expansion to Triple Network by 2026Isaac SamsonNo ratings yet

- 2001 AnnualreportDocument16 pages2001 AnnualreportMaltesh NaikNo ratings yet

- Key Operating Financial DataDocument1 pageKey Operating Financial DataShbxbs dbvdhsNo ratings yet

- Benchmarking AnalysisDocument9 pagesBenchmarking AnalysisMounaim 123 Hourmat AllahNo ratings yet

- Assignment: 1: Financial Accounting and AnalysisDocument12 pagesAssignment: 1: Financial Accounting and AnalysisFogey RulzNo ratings yet

- Finance 4Document1 pageFinance 4retrov androsNo ratings yet

- Fitbit, Apple, Xiaomi, Garmin, Samsung wearable device market share and growth 2014-2015Document8 pagesFitbit, Apple, Xiaomi, Garmin, Samsung wearable device market share and growth 2014-2015Nexhi DukaNo ratings yet

- Key Indicators: Analysis of EFSA Report FYE 30 June 2014Document16 pagesKey Indicators: Analysis of EFSA Report FYE 30 June 2014mostafaNo ratings yet

- Talwalkars Better Value Fitness Limited BSE 533200 FinancialsDocument36 pagesTalwalkars Better Value Fitness Limited BSE 533200 FinancialsraushanatscribdNo ratings yet

- SPS Sample ReportsDocument61 pagesSPS Sample Reportsphong.parkerdistributorNo ratings yet

- Maruti Suzuki Q1FY19 Investor PresentationDocument14 pagesMaruti Suzuki Q1FY19 Investor PresentationRAHUL GUPTANo ratings yet

- International Business Control, Reporting and Corporate Governance: Global business best practice across cultures, countries and organisationsFrom EverandInternational Business Control, Reporting and Corporate Governance: Global business best practice across cultures, countries and organisationsRating: 5 out of 5 stars5/5 (2)

- Controllership Comprehensive Case ProjectDocument20 pagesControllership Comprehensive Case Projectaudrey gadayNo ratings yet

- Lee - Retailers Case Excel SheetDocument115 pagesLee - Retailers Case Excel Sheetaudrey gadayNo ratings yet

- Lee Case AssignmentDocument26 pagesLee Case Assignmentaudrey gadayNo ratings yet

- Choosing the Firm's Financial StructureDocument41 pagesChoosing the Firm's Financial Structureaudrey gadayNo ratings yet

- Wild Wood Case InstructionsDocument2 pagesWild Wood Case Instructionsaudrey gadayNo ratings yet

- CFS Session 2 Equity FinancingDocument42 pagesCFS Session 2 Equity Financingaudrey gadayNo ratings yet

- Wild Wood Case StudyDocument6 pagesWild Wood Case Studyaudrey gadayNo ratings yet

- Financial Research On Cement IndustryDocument38 pagesFinancial Research On Cement Industryabishek7100% (1)

- ADJUSTING-ENTRIES-PPT-Examples-and-activityDocument14 pagesADJUSTING-ENTRIES-PPT-Examples-and-activitytamorromeo908No ratings yet

- ACCA P2 - Latest Revision NotesDocument198 pagesACCA P2 - Latest Revision NotesFive Fifth100% (1)

- Tugas Manajemen Keuangan PT. Hotel Sahid JayaDocument2 pagesTugas Manajemen Keuangan PT. Hotel Sahid JayaDadra Are PutraNo ratings yet

- New profit sharing ratiosDocument9 pagesNew profit sharing ratiosAman KakkarNo ratings yet

- A Posteriori A Priori Ad HocDocument10 pagesA Posteriori A Priori Ad HocAila Jean PascualNo ratings yet

- Customer Perceptions of Health InsuranceDocument22 pagesCustomer Perceptions of Health Insurancekajal malhotraNo ratings yet

- Quali - ReviewDocument32 pagesQuali - ReviewLA M AENo ratings yet

- STRATEGIC COSTMan QUIZ 3Document5 pagesSTRATEGIC COSTMan QUIZ 3StephannieArreolaNo ratings yet

- SBMC Blank v2 2 PDFDocument1 pageSBMC Blank v2 2 PDFSusan BvochoraNo ratings yet

- Form W-8BEN Certificate of Foreign StatusDocument1 pageForm W-8BEN Certificate of Foreign Statusandres gualterosNo ratings yet

- 06) Theory of Cost PDFDocument79 pages06) Theory of Cost PDFAby Reji ChemmathuNo ratings yet

- Chap - Test - CH4 - Financial Ratio Analysis and Their Implications To ManagementDocument10 pagesChap - Test - CH4 - Financial Ratio Analysis and Their Implications To Managementroyette ladicaNo ratings yet

- Acttg Process QstnsDocument4 pagesActtg Process QstnsMicheleNo ratings yet

- Ranbaxy Annual Report 2013 14 UpdatedDocument180 pagesRanbaxy Annual Report 2013 14 UpdatedAdityaMahajan0% (1)

- MCB Bank Account Types GuideDocument6 pagesMCB Bank Account Types GuideGhulam AbbasNo ratings yet

- Solutions To Chapters 7 and 8 Problem SetsDocument21 pagesSolutions To Chapters 7 and 8 Problem SetsAn Ngoc CồNo ratings yet

- MGT101 Short Notes 1 - 22 - VU Study TricksDocument15 pagesMGT101 Short Notes 1 - 22 - VU Study TricksHRrehmanNo ratings yet

- Dabur Annual ReportDocument199 pagesDabur Annual ReportSusheel MenonNo ratings yet

- Central Exercise Duty ExplainedDocument10 pagesCentral Exercise Duty ExplainedKrishna RajputNo ratings yet

- Chapter 3 Summary of Bussiness Valuation Approaches PDFDocument4 pagesChapter 3 Summary of Bussiness Valuation Approaches PDFAliux CuhzNo ratings yet

- ERelevant Costing and Decision Making ActivityDocument5 pagesERelevant Costing and Decision Making ActivityZee GuillebeauxNo ratings yet

- Solved Nolan Inc Had Taxable Income of 400 000 in 2019 ItsDocument1 pageSolved Nolan Inc Had Taxable Income of 400 000 in 2019 ItsAnbu jaromiaNo ratings yet

- Managerial Accounting The Cornerstone of Business Decision Making 7Th Edition Mowen Solutions Manual Full Chapter PDFDocument63 pagesManagerial Accounting The Cornerstone of Business Decision Making 7Th Edition Mowen Solutions Manual Full Chapter PDFKennethRiosmqoz100% (12)

- Liasse Fiscale VERSION ANGLAISEDocument38 pagesLiasse Fiscale VERSION ANGLAISEDihya DihoNo ratings yet

- Summative Test Accounting Concepts PrinciplesDocument2 pagesSummative Test Accounting Concepts PrinciplesMarlyn LotivioNo ratings yet

- M4 Prac Exer. 2Document10 pagesM4 Prac Exer. 2Jasmine ActaNo ratings yet