Professional Documents

Culture Documents

An Electric Components Manufacturer A Cement Producer A Supermarket Company An Employment Services Company

Uploaded by

audrey gadayOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

An Electric Components Manufacturer A Cement Producer A Supermarket Company An Employment Services Company

Uploaded by

audrey gadayCopyright:

Available Formats

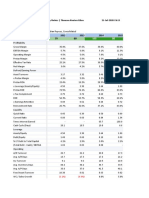

WHO IS WHO ?

The following table provides information on seven major companies. Each of them is representative of an

industry :

an airline company

an electric components manufacturer a cement producer

a supermarket company an employment services company

a food products producer a luxury products manufacturer

1 - Calculate the WCR & the Capital Employed for each,

2 - Calculate the Return on Capital Employed and its two components (op margin % & Asset Rotation)

3 - Find which company is hiden behind each column

All figures are in % of sales All figures areAllinfigures

% of sales

are

Allinfigures

% of sales

are

Allinfigures

% of sales

are

Allinfigures

% of sales

are

Allinfigures

% of sales

are in % of sales

Sales 100% 100% 100% 100% 100% 100%

Cost of sales 81.5 56.6 80.6 34.0 72.8 86.7

Administrative, commercial and other costs 16.1 34.5 15.7 41.3 15.9 5.8

OPERATING PROFIT 2.4 8.9 3.7 24.7 11.3 7.5

Financial revenues 0.1 0.6 0.2 1.7 1.4 0.3

Interest on loans 0.2 2.0 0.4 2.9 2.8 2.8

INCOME BEFORE TAX 2.3 7.5 3.5 23.5 9.9 5.0

Income tax 0.8 2.6 1.2 7.3 2.3 1.4

NET INCOME 1.5 4.9 2.3 16.2 7.6 3.6

(1) after deduction of labor costs : 8.2 17.3 8.3 16.7 20.4 27.0

(2) after deduction of depreciation : 0.6 5.2 2.6 3.8 6.2 7.5

Fixed assets 5.1 82.0 29.4 96.0 109.0 99.0

99.0

Inventory 0.0 8.2 7.9 47.3 11.6 0.9

Trade receivables 19.1 16.3 0.2 20.0 19.6 11.8

Other operating receivables 1.5 0.5 9.5 10.3 5.1 5.1

Cash and cash equivalent 3.0 6.8 2.0 38.3 9.1 5.1

Equity 9.9 53.9 16.6 126.7 83.6 35.7

Financial debts 2.1 32.4 5.0 42.3 36.3 48.3

Other liabilities 4.3 2.5 1.3 16.2 10.2 12.8

Trade payables 3.9 13.6 19.2 11.7 9.9 11.8

Other operating liabilities 8.5 11.4 6.9 15.0 14.4 13.3

Investments in operating assets 0.7 5.3 2.6 3.3 8.8 11.0

Acquisitions 0.2 8.9 5.8 0.3 11.0 0.0

PHILIPS Page 1 Finance for non Financial Managers

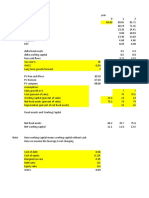

WHO IS WHO ?

MARGINS AND COSTS

IN % OF SALES IN % OF IN % O IN % O IN % O

IN % OF SALES

IN % OF SALES

+ SALES 100.0 100.0 100.0 100.0 100.0 100.0

- Cost of sales 81.5 56.6 80.6 34.0 72.8 86.7

= GROSS MARGIN 18.5 43.4 19.4 66.0 27.2 13.3

- administrative and commercial costs 16.1 34.5 15.7 41.3 15.9 5.8

= OPERATING PROFIT (or EBIT) 2.4 8.9 3.7 24.7 11.3 7.5

+ Depreciation 0.6 5.2 2.6 3.8 6.2 7.5

= EBITDA (Earnings Before Interest & Tax Depreciation

3.0& Amort)

14.1 6.3 28.5 17.5 15.0

+ financial revenues - interests -0.1 -1.4 -0.2 -1.2 -1.4 -2.5

= INCOME BEFORE TAX 2.3 7.5 3.5 23.5 9.9 5.0

- income tax 0.8 2.6 1.2 7.3 2.3 1.4

= NET INCOME 1.5 4.9 2.3 16.2 7.6 3.6

+ Net income 1.5 4.9 2.3 16.2 7.6 3.6

+ Depreciation 0.6 5.2 2.6 3.8 6.2 7.5

= NET CASH FLOW 2.1 10.1 4.9 20.0 13.8 11.1

PHILIPS Page 2 Finance for non Financial Managers

PHILIPS Page 3 Finance for non Financial Managers

You might also like

- Ch05 Solutions, Accounting Principles, 11th EditionDocument96 pagesCh05 Solutions, Accounting Principles, 11th EditionH.R. Robin93% (15)

- Lou Simpson GEICO LettersDocument24 pagesLou Simpson GEICO LettersDaniel TanNo ratings yet

- Gymboree LBO Model ComDocument7 pagesGymboree LBO Model ComrolandsudhofNo ratings yet

- Schaum's Outline of Basic Business Mathematics, 2edFrom EverandSchaum's Outline of Basic Business Mathematics, 2edRating: 5 out of 5 stars5/5 (1)

- Task 3 - DCF ModelDocument10 pagesTask 3 - DCF Modeldavin nathanNo ratings yet

- 115 AS Accounting Theory & Practice Text BookDocument27 pages115 AS Accounting Theory & Practice Text BookRead and Write Publications55% (22)

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionFrom EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionRating: 5 out of 5 stars5/5 (1)

- Gudang Garam (IDX GGRM) Financial Statement Forecasting and Discount Cash Flow (DCF) Valuation ModelDocument2 pagesGudang Garam (IDX GGRM) Financial Statement Forecasting and Discount Cash Flow (DCF) Valuation ModelAndi ErnandaNo ratings yet

- NBA Happy Hour Co - DCF Model - Task 4 - Revised TemplateDocument10 pagesNBA Happy Hour Co - DCF Model - Task 4 - Revised Templateww weNo ratings yet

- Technical Interview WSOmodel2003Document7 pagesTechnical Interview WSOmodel2003Li HuNo ratings yet

- Finance Lease: Demo Teaching PresentationDocument52 pagesFinance Lease: Demo Teaching PresentationFaye Reyes100% (2)

- Einhorn Letter Q3 2019Document5 pagesEinhorn Letter Q3 2019Zerohedge80% (5)

- Nba Advanced - Happy Hour Co - DCF Model v2Document10 pagesNba Advanced - Happy Hour Co - DCF Model v2Siddhant AggarwalNo ratings yet

- Gainesboro SolutionDocument7 pagesGainesboro SolutionakashNo ratings yet

- AirThreads Valuation SolutionDocument20 pagesAirThreads Valuation SolutionBill JoeNo ratings yet

- Maf253 Topic 2 Analysis of Financial Performance - Financial Ratio AnalysisDocument49 pagesMaf253 Topic 2 Analysis of Financial Performance - Financial Ratio AnalysisNUR IMAN SHAHIDAH BINTI SHAHRUL RIZALNo ratings yet

- Case 01a Growing Pains SolutionDocument7 pagesCase 01a Growing Pains SolutionUSD 654No ratings yet

- NBA Happy Hour Co - DCF Model v2Document10 pagesNBA Happy Hour Co - DCF Model v2Siddhant Aggarwal50% (2)

- Economy of Pakistan - Challenges and Prospects (CSS Essay)Document11 pagesEconomy of Pakistan - Challenges and Prospects (CSS Essay)Ihsaan gulzar100% (1)

- Nba Advanced - Happy Hour Co - DCF Model v2Document10 pagesNba Advanced - Happy Hour Co - DCF Model v221BAM045 Sandhiya SNo ratings yet

- Question Bank B 604 F: Working Capital Management UNIT-1-Basic Working Capital & Computation of Working CapitalDocument12 pagesQuestion Bank B 604 F: Working Capital Management UNIT-1-Basic Working Capital & Computation of Working CapitalBhavya Shrivastava100% (3)

- Straight Through Processing for Financial Services: The Complete GuideFrom EverandStraight Through Processing for Financial Services: The Complete GuideNo ratings yet

- Word Note The Body Shop International PLC 2001: An Introduction To Financial ModelingDocument9 pagesWord Note The Body Shop International PLC 2001: An Introduction To Financial Modelingalka murarka100% (2)

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- LEE-CASE Study Case PresentationDocument15 pagesLEE-CASE Study Case Presentationaudrey gaday0% (1)

- Annual Report 201: WS Atkins PLCDocument204 pagesAnnual Report 201: WS Atkins PLCDeden Zaenudin Al-ShiraziNo ratings yet

- Worksheet Akuntansi DahliaDocument4 pagesWorksheet Akuntansi DahliaDahliaNo ratings yet

- An Electric Components ManufacturerDocument3 pagesAn Electric Components Manufactureraudrey gadayNo ratings yet

- Volkswagen Group - Annual Report 2019: Financial Key Performance IndicatorsDocument1 pageVolkswagen Group - Annual Report 2019: Financial Key Performance IndicatorsAshish PatwardhanNo ratings yet

- Financial Analysis OrascomDocument11 pagesFinancial Analysis OrascomMahmoud Elyamany100% (1)

- Practice Exercise - Berger PaintsDocument8 pagesPractice Exercise - Berger PaintsKARIMSETTY DURGA NAGA PRAVALLIKANo ratings yet

- Nyse Cas 2006Document85 pagesNyse Cas 2006gaja babaNo ratings yet

- Financial Planning and Strategy Problem 1 Bajaj Auto LTDDocument4 pagesFinancial Planning and Strategy Problem 1 Bajaj Auto LTDMukul KadyanNo ratings yet

- Werner - Financial Model - Final VersionDocument2 pagesWerner - Financial Model - Final VersionAmit JainNo ratings yet

- Case Study - LÓrealDocument4 pagesCase Study - LÓrealAndrea BrozosNo ratings yet

- Presentation 1Document9 pagesPresentation 1Zubair KhanNo ratings yet

- NFL Annual Report 2019 Compressed PDFDocument130 pagesNFL Annual Report 2019 Compressed PDFZUBAIRNo ratings yet

- DCF ConeDocument37 pagesDCF Conejustinbui85No ratings yet

- DCF Textbook Model ExampleDocument6 pagesDCF Textbook Model ExamplePeterNo ratings yet

- CL EducateDocument7 pagesCL EducateRicha SinghNo ratings yet

- Excel Bodyshop EFDocument18 pagesExcel Bodyshop EFgestion integralNo ratings yet

- STORAENSO RESULTS Key Figures 2018Document11 pagesSTORAENSO RESULTS Key Figures 2018Paula Tapiero MorenoNo ratings yet

- Kovai Medical Center and Hospital Limited BSE 523323 FinancialsDocument39 pagesKovai Medical Center and Hospital Limited BSE 523323 Financialsakumar4uNo ratings yet

- Use 2012 Annual Reports Woolworths Limited Metcash Limited: Pro Forma Financial StatementsDocument3 pagesUse 2012 Annual Reports Woolworths Limited Metcash Limited: Pro Forma Financial StatementsgraceNo ratings yet

- RatioDocument11 pagesRatioAnant BothraNo ratings yet

- 539770228.xls Sources and Uses (2) 1Document5 pages539770228.xls Sources and Uses (2) 1prati gumrNo ratings yet

- BAJAJ AUTO LTD - Quantamental Equity Research ReportDocument1 pageBAJAJ AUTO LTD - Quantamental Equity Research ReportVivek NambiarNo ratings yet

- V F Corporation NYSE VFC FinancialsDocument9 pagesV F Corporation NYSE VFC FinancialsAmalia MegaNo ratings yet

- Annual 20report 202020Document226 pagesAnnual 20report 202020Alexandru DavidNo ratings yet

- Ratio Analysis of Bata IndiaDocument2 pagesRatio Analysis of Bata IndiaSanket BhondageNo ratings yet

- This Spreadsheet Supports STUDENT Analysis of The Case "Guna Fibres, LTD." (UVA-F-1687)Document7 pagesThis Spreadsheet Supports STUDENT Analysis of The Case "Guna Fibres, LTD." (UVA-F-1687)karanNo ratings yet

- Key Performance Indicators Y/E MarchDocument1 pageKey Performance Indicators Y/E Marchretrov androsNo ratings yet

- ANJ AR 2013 - English - Ykds3c20170321164338Document216 pagesANJ AR 2013 - English - Ykds3c20170321164338Ary PandeNo ratings yet

- Atherine S OnfectioneryDocument3 pagesAtherine S OnfectioneryVanshika SinghNo ratings yet

- SPS Sample ReportsDocument61 pagesSPS Sample Reportsphong.parkerdistributorNo ratings yet

- Annual Trading Report: Strictly ConfidentialDocument3 pagesAnnual Trading Report: Strictly ConfidentialMunazza FawadNo ratings yet

- Assignment 5Document2 pagesAssignment 5Amarjeet SinghNo ratings yet

- Ratio Analysis-Overview Ratios:: CaveatsDocument18 pagesRatio Analysis-Overview Ratios:: CaveatsabguyNo ratings yet

- Colgate Ratio Analysis SolvedDocument12 pagesColgate Ratio Analysis Solved2442230910No ratings yet

- Ratio Analysis-Overview Ratios:: CaveatsDocument14 pagesRatio Analysis-Overview Ratios:: CaveatsEng abdifatah saidNo ratings yet

- Max S Group Inc PSE MAXS FinancialsDocument36 pagesMax S Group Inc PSE MAXS FinancialsJasper Andrew AdjaraniNo ratings yet

- Problem1 Section 19.2Document2 pagesProblem1 Section 19.2SANSKAR JAINNo ratings yet

- Financial Modeling Mid-Term ExamDocument17 pagesFinancial Modeling Mid-Term ExamКамиль БайбуринNo ratings yet

- Key Operating Financial DataDocument1 pageKey Operating Financial DataShbxbs dbvdhsNo ratings yet

- Nyse Aan 2001Document32 pagesNyse Aan 2001gaja babaNo ratings yet

- FY2018 (12m) FY2017 (12m) FY2016 (12m) FY2015 (12m) FY2014 (12m) FY2013 (12m) FY2012 (12m)Document1 pageFY2018 (12m) FY2017 (12m) FY2016 (12m) FY2015 (12m) FY2014 (12m) FY2013 (12m) FY2012 (12m)Divyank JyotiNo ratings yet

- Selected Financial Information (Consolidate ($ Millions) )Document2 pagesSelected Financial Information (Consolidate ($ Millions) )KshitishNo ratings yet

- Purchases / Average Payables Revenue / Average Total AssetsDocument7 pagesPurchases / Average Payables Revenue / Average Total AssetstannuNo ratings yet

- Starhub FY21Document20 pagesStarhub FY21SurachaiNo ratings yet

- HUL Training ModelDocument27 pagesHUL Training ModelOMANSHU YADAVNo ratings yet

- Controllership Comprehensive Case ProjectDocument20 pagesControllership Comprehensive Case Projectaudrey gadayNo ratings yet

- Lee Case AssignmentDocument26 pagesLee Case Assignmentaudrey gadayNo ratings yet

- CFS Session 2 Equity FinancingDocument42 pagesCFS Session 2 Equity Financingaudrey gadayNo ratings yet

- CFS Session 1 Choosing The Firm Financial StructureDocument41 pagesCFS Session 1 Choosing The Firm Financial Structureaudrey gadayNo ratings yet

- Wild Wood Case InstructionsDocument2 pagesWild Wood Case Instructionsaudrey gadayNo ratings yet

- Wild Wood Case StudyDocument6 pagesWild Wood Case Studyaudrey gadayNo ratings yet

- Form No. 16A: From ToDocument1 pageForm No. 16A: From ToShail MehtaNo ratings yet

- How Much Growth Can A Firm Afford?: Robert C. HigginsDocument11 pagesHow Much Growth Can A Firm Afford?: Robert C. HigginsFrancisco López-HerreraNo ratings yet

- Salaries and Wages: Salary Is The Compensation UsuallyDocument7 pagesSalaries and Wages: Salary Is The Compensation UsuallyJulius LitaNo ratings yet

- Tata Steel Balance Sheet: AssetsDocument7 pagesTata Steel Balance Sheet: AssetsSahil SawantNo ratings yet

- TS4F01 2 EN Col08Document13 pagesTS4F01 2 EN Col08Kushagra purohitNo ratings yet

- Business Ethics and Corporate Social Responsibility: Confederation of British Industry (CBI)Document18 pagesBusiness Ethics and Corporate Social Responsibility: Confederation of British Industry (CBI)Dime PierrowNo ratings yet

- Illustration: Preparation of Master Budget (Manufacturing Company)Document4 pagesIllustration: Preparation of Master Budget (Manufacturing Company)shimelisNo ratings yet

- 03 27 21Document18 pages03 27 21버니 모지코No ratings yet

- ACCT 2235 - AP 3-1,3,9,11 AnswersDocument7 pagesACCT 2235 - AP 3-1,3,9,11 AnswersAhmad RiazNo ratings yet

- Online Corporate Finance I Practice Exam 1 SolutionDocument14 pagesOnline Corporate Finance I Practice Exam 1 SolutionTien DuongNo ratings yet

- bài tập tổng hợp ônDocument16 pagesbài tập tổng hợp ônHà NguyễnNo ratings yet

- Chapter 10 Liabilities Power PointDocument89 pagesChapter 10 Liabilities Power Pointgisel w100% (1)

- The Role of Managerial Finance: ProfessionalDocument39 pagesThe Role of Managerial Finance: ProfessionalYoong Xuen XuenNo ratings yet

- Break-Even Analysis: Fixed CostsDocument8 pagesBreak-Even Analysis: Fixed CostsDez DLNo ratings yet

- 1.1 Background of Digi Telecommunication Sdn. BHD 2 1.2 Background of Maxis Telecommunication Sdn. BHD 3Document23 pages1.1 Background of Digi Telecommunication Sdn. BHD 2 1.2 Background of Maxis Telecommunication Sdn. BHD 3muazzamNo ratings yet

- Cash Basis & AccrualDocument5 pagesCash Basis & AccrualFerb CruzadaNo ratings yet

- Performa Indemnity BondDocument2 pagesPerforma Indemnity BondNamita Puri0% (1)

- Working Capital Mangement of Reliance IdryDocument365 pagesWorking Capital Mangement of Reliance IdrySonu BhaleraoNo ratings yet

- Payment For Week Ending 10-04-2020Document1 pagePayment For Week Ending 10-04-2020Florin VaetusNo ratings yet

- Bakkafrost Investment Case SummaryDocument9 pagesBakkafrost Investment Case SummaryeboroNo ratings yet

- Palak (Ifs)Document1 pagePalak (Ifs)rpk1812100% (1)