Professional Documents

Culture Documents

Camel Model

Uploaded by

RabinCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Camel Model

Uploaded by

RabinCopyright:

Available Formats

See discussions, stats, and author profiles for this publication at: https://www.researchgate.

net/publication/349252185

A CAMEL MODEL ANALYSIS OF PRIVATE BANKS IN INDIA

Article in EPRA International Journal of Economic and Business Review · July 2017

CITATIONS READS

3 184

2 authors, including:

Bhawna Malhotra

Kurukshetra University

4 PUBLICATIONS 4 CITATIONS

SEE PROFILE

All content following this page was uploaded by Bhawna Malhotra on 17 February 2021.

The user has requested enhancement of the downloaded file.

Volume - 5, Issue- 7, July 2017 IC Value : 56.46 e-ISSN : 2347 - 9671| p- ISSN : 2349 - 0187

EPRA International Journal of Economic and Business Review SJIF Impact Factor(2016) : 6.484

ISI Impact Factor (2013): 1.259(Dubai)

UGC-Approved Journal No: 47335

Research Paper

A CAMEL MODEL ANALYSIS OF

www.eprawisdom.com PRIVATE BANKS IN INDIA

Research Scholar, Department of commerce, Kurukshetra University,

1

Vinod Kumar1

Kurukshetra, Haryana, India

Research Scholar, Department of commerce, Kurukshetra University,

2

Bhawna Malhotra2 Kurukshetra, Haryana, India

ABSTRACT

P erformance evaluation of the banking sector is an effective measure and indicator to

check the soundness of economic activities of an economy. In the present study an

attempt has been made to evaluate the performance & financial soundness of selected Private Banks

in India for the period 2007-2017. CAMEL approach has been used to examine the financial strength

of the selected banks. Composite Rankings, Average, and Covariance has been applied here to reach

conclusion through the comparative and significant analysis of different parameters of CAMEL.

Axis bank is ranked first under the CAMEL analysis followed by ICICI bank. Kotak Mahindra

occupied the third position. The fourth position is occupied by HDFC bank and the last position is

occupied by IndusInd bank amongst all the selected banks.

KEYWORDS: Private Banks, Financial Performance, CAMEL Model.

INTRODUCTION

Banking sector is an important component of 10) has exerted pressure on banks’ profitability and

financial system plays a key role in the economic capital. Private sector banks have seen improvement in

development of countries and it helps in stimulation of asset quality and efficiency parameters, whereas public

Capital formation, innovation and monetization in sector banks have seen declines in both areas (Baru,

addition to facilitation of monetary policy (Said & Tumin, 2010). Sound financial health and performance

2011). Indian banking industry has undergone several evaluation of a bank is significant for the depositors,

changes during the liberalization process. Indian shareholders, employees and the whole economy of a

banking sector has been dominated by public sector country because it determines banks’ capabilities to

banks since 1969 when all major banks were nationalised compete in the sector and has a critical role for the

by the Indian government. However, after liberalisation development of the sector. As a result to this statement,

in government banking policy in the 1990s old and new efforts have been made from time to time, to measure

private sector banks have grown faster and bigger over the financial position of each bank and manage it

the last two decades by using the latest technology, efficiently and effectively (Mohiuddin, 2014). It is of

providing contemporary innovations and monetary great importance to evaluate the overall performance of

tools and techniques. The Indian banking system banks by implementing a regulatory banking supervision

emerged unhurt from the global financial crisis of 2008, framework. One of such measures of supervisory

but the subsequent economic slowdown (barring 2009- information is the CAMEL rating system which was put

www.eprawisdom.com Vol - 5, Issue- 7, July 2017 87

EPRA International Journal of Economic and Business Review| SJIF Impact Factor(2016) : 6.484

into effect firstly in the U.S. in 1979, and now it has been required steps to recover their shortcomings. Ramya

proved to be a useful and efficient tool in response to (2017) analyse the financial performance of State Bank

the financial crisis in 2008 by the U.S. government (Dang, of India for the study period 2012-2016 through the use

2011). of CAMEL approach. It was concluded that there is a

This study is organized as follows: the next need to take necessary steps to improve the position of

section following the introduction discusses the relevant SBI in the context of few parameters i.e., debt-equity,

literature. The third section defines the Objective and operating profit, and non-interest income to total income.

Methodology of the study. In fourth section results and Singh (2017) examined the capital adequacy

analysis are described, and the final section presents performance of private and public sector banks in India

the main conclusions and suggestions. for a period of 2006-2015. The study found that all the

LITERATURE REVIEW banks had sound capital adequacy position except

Mathuva (2009) examined the relationship between Central Bank of India.

Cost Income Ratio (CIR), Capital Adequacy Ratio (CAR) OBJECTIVE & RESEARCH

and profitability for the period 1998 to 2007. The study METHODOLOGY

found that capital adequacy had differential impact on The main purpose of this paper is an attempt

the profitability of the bank. Mishra et al (2012) to compare the performance of selected Private Banks

analyzed the performance of 12 public and private sector and to investigate the factors that mainly affects the

banks for the period 2000-2011 by using CAMEL financial performance of the selected banks in India.

approach. It was concluded that private sector banks The present study is Descriptive cum exploratory in

were growing at faster pace as compared to public sector nature as it try to obtain information concerning the

banks. Union bank and SBI had displayed low economic current status of the phenomena and to describe “what

soundness. Misra(2013) assessed the performance exists” with respect to variables. Top five private sector

and financial soundness of State Bank Group using banks i.e. HDFC Bank, ICICI Bank, Kotak Mahindra,

CAMEL approach. The study concluded that there is a Axis Bank, IndusInd Bank; as per their market

requirement to improve its position in respect to asset capitalization are selected from the listed banks on BSE.

quality and capital adequacy. Erol (2013) compared This study is purely based on secondary data which is

the performance of Islamic banks against conventional collected from annual reports of selected banks,

banks in Turkey during the period of 2001-2009. The Capitaline data base and Reserve Bank of India, for the

results showed that Islamic banks performed better in time period of Ten years i.e. from year 2006-07 to year

profitability and asset management ratios compared to 2016-17. CAMEL approach has been used to examine

conventional banks but slow in sensitivity to market the financial strength of the selected banks. Certain

risk criterion. Rostami (2015) analyzed the impact of ratios have been calculated under each acronym of

each parameter of CAMELS model on the performance CAMEL and Composite Rankings, Average, and

of Iranian banks. Q-Tobin’s ratio was used as Covariance are applied here to reach conclusion through

performance indicator in this study. It was found that the comparative and significant analysis of different

there was significant relation between each category of parameters of CAMEL.

camel model and Q-Tobin’s ratio as bank’s performance RESULTS AND ANALYSIS

ratio. Majumdar (2016) measured the financial In this section we will analyse the financial

performance of 15 banks in Bangladesh for the period soundness of the selected banks based on the CAMEL

2009-2013. CAMEL model had been used to examine the framework. Only those indicators are selected which

financial soundness of selected banks. Composite are appropriate for the study. The selection of

Ranking, average and ANOVA test had been applied to indicators is based on their analytical significance,

the data. The study concluded that there had been availability of data for compilation, calculation and its

significant difference in the performance of selected relevance for the study. The following table shows the

banks. The study suggested that banks should take selected indicators for the study under each acronym

of CAMEL:-

www.eprawisdom.com Vol - 5, Issue- 7, July 2017 88

e-ISSN : 2347 - 9671, p- ISSN : 2349 - 0187 Vinod Kumar & Bhawna Malhotra

Table1: Calculated ratio under CAMEL model

Capital Adequacy Assets Quality Managerial Earning Liquidity

Efficiency Capabilities

Capital Adequacy Net NPA to Net Return on Return on Assets Cash Deposit Ratio

Ratio Advance Equity(ROE)

Credit Deposit

Capital Adequacy Secured Advance Business Per Net Interest Ratio

Ratio tier 1 to total Advance Employee Margin

Capital Adequacy Term loans to Profit per Operating Profit to Investment

Ratio tier 2 Total Advance Employee Total Assets Deposit Ratio

Return on Net Non-Interest

Worth Income to total

assets

1. CAPITAL ADEQUACY

Capital Adequacy indicates whether the bank the firm that liability could be privileged. If there is any

has enough capital to absorb unexpected losses. It is loss of loans it will be a great risk for banks to meet the

required to maintain depositors’ confidence and demand of their depositors. Therefore, to prevent the

preventing the bank from going bankrupt (Reddy, 2012). bank from failure, it is necessary to maintain a significant

“Meeting statutory minimum capital requirement is the level of capital adequacy (Chen, 2003). As per regulatory

key factor in deciding the capital adequacy, and norms, Indian scheduled commercial banks are required

maintaining an adequate level of capital is a critical to maintain a CAR of 9% while Indian public sector

element” (The United States Uniform Financial banks are emphasized to maintain a CAR of 12%.

Institutions Rating System 1997) it shows the ability of

Table 2: Capital Adequacy of selected banks

Kotak IndusInd

Parameters HDFC ICICI Axis Bank

Mahindra Bank

Mean 15.77 16.88 17.63 14.46 13.89

Capital

St. Dev. 1.33 2.40 1.89 1.59 1.47

Adequacy

C. V. 1.78 5.77 3.57 2.53 2.16

Ratio

RANK 3 2 1 4 5

Mean 11.63 12.23 15.25 10.53 10.76

Tier 1 St. Dev. 1.49 1.71 2.41 1.87 2.69

Capital C. V. 2.22 2.93 5.82 3.50 7.22

RANK 3 2 1 5 4

Mean 4.15 4.65 2.38 3.92 3.12

Tier 2 St. Dev. 0.96 1.23 1.34 0.77 1.92

Capital C. V. 0.93 1.52 1.80 0.60 3.69

RANK 2 1 5 3 4

Average 2.66 1.67 1.4 4 4.33

Composite

Rank 3 2 1 4 5

Source: Compiled from annual reports of respective bank

The above table shows that in term of overall 2. ASSET QUALITY

Capital Adequacy Kotak Mahindra has top position The quality of assets is an important parameter

followed by ICICI, HDFC and Axis bank. The lowest to examine the degree of financial strength. The

composite rank represents the good position for the primary objective to measure the assets quality is to

bank. On the other hand, IndusInd bank has the lowest ascertain the composition of non-performing assets

position in comparison to other banks under the study. (NPAs) as a percentage of the total assets.

Capital adequacy highest in case of Kotak Mahindra

bank which is 17.63 and IndusInd bank has 13.89. ICICI

has suffered from highest slandered deviation which

shows more volatility as compare to other bank.

www.eprawisdom.com Vol - 5, Issue- 7, July 2017 89

EPRA International Journal of Economic and Business Review| SJIF Impact Factor(2016) : 6.484

Table 3: Asset Quality of selected banks

Kotak IndusInd

Parameters HDFC ICICI Axis Bank

Mahindra Bank

Mean 0.32 1.50 1.29 0.45 0.82

Net NPA to

St. Dev. 0.14 0.69 0.60 0.15 0.81

Net

C. V. 0.02 0.47 0.36 0.02 0.66

Advance

RANK 1 5 4 2 3

Secured Mean 74.95 80.86 78.85 83.16 89.56

Advance to St. Dev. 2.47 4.65 4.66 3.17 2.46

total C. V. 6.12 21.65 21.68 10.03 6.05

Advance RANK 5 3 4 2 1

Mean 66.47 80.96 78.32 70.21 67.72

Term loans

St. Dev. 8.05 2.62 7.38 1.25 5.61

to Total

C. V. 64.77 6.85 54.50 1.55 31.52

Advance

RANK 5 1 2 3 4

Average 3.67 3 3.33 2.33 2.67

Composite

Rank 5 3 4 1 2

Source: Compiled from annual reports of respective banks

From the Table No. 3, it is witnessed that assets 3. MANAGMENT EFFICIENCY

quality of Axis bank is much better as compare to other Management efficiency is another vital

bank. IndusInd bank got second place in assets quality component of the CAMEL model that ensures the

followed by ICICI, Kotak Mahindra and HDFC survival and growth of a bank. While the other factors

respectively. Net NPA to Net Advance ratio (Lowest of CAMEL model can be quantified easily from current

value provide lowest rank) shows that HDFC (0.32) has financial statements, management quality is a somewhat

the better condition with standard deviation 0.14. Where indefinable and subjective measure, yet one that is

Secured Advance to total Advance depicts that highest crucial for institutional success. The banking sector

value 89.56 obtain by the IndusInd bank and standard reforms reinforce the need to improve productivity of

deviation value is 2.46. Term loans to Total Advance the banks through appropriate measures which aim at

showed that ICICI have highest value (66.47) with reducing the operating cost and improving the

standard deviation 8.05) which is more volatile in profitability of the banks.

comparison to other.

Table 4: Managerial Efficiency of selected banks

Kotak IndusInd

Parameters HDFC ICICI Axis Bank

Mahindra Bank

Mean 18.53 11.45 12.66 18.70 14.50

Return on St. Dev. 1.52 2.25 2.34 1.26 4.55

Equity C. V. 2.31 5.07 5.47 1.58 20.74

RANK 2 5 4 1 3

Mean 72.45 69.09 55.70 122.54 84.50

Business

St. Dev. 21.18 36.80 14.26 14.26 11.28

Per

C. V. 448.64 1354.48 203.33 203.29 127.32

Employee

RANK 3 4 5 1 2

Mean 0.84 18.63 0.72 1.31 0.70

Profit per St. Dev. 0.32 35.15 0.28 0.33 0.28

Employee C. V. 0.10 1235.39 0.08 0.11 0.08

RANK 3 1 4 2 5

Mean 18.49 11.51 12.68 18.71 15.80

Return on St. Dev. 1.57 2.26 2.33 1.27 4.33

Net Worth C. V. 2.48 5.13 5.41 1.61 18.74

RANK 2 5 4 1 3

Average 2.5 3.75 4.25 1.25 3.25

Composite

Rank 2 4 5 1 3

Source: Compiled from annual reports of respective bank

www.eprawisdom.com Vol - 5, Issue- 7, July 2017 90

e-ISSN : 2347 - 9671, p- ISSN : 2349 - 0187 Vinod Kumar & Bhawna Malhotra

Table no 4 depicts that managerial efficiency 4. EARNING QUALITY

of Axis bank is better in comparison to other banks The quality of earnings is crucial criterion that

followed by HDFC, IndusInd bank and ICICI banks determines the ability of a bank to earn consistently.

respectively and Kotak Mahindra got lowest rank. Basically, it determines the profitability of bank and

Return on Equity and business per employee analysis explains its sustainability and growth in earnings in

shows that the Axis banks have highest value with mean future context. Banks depend on their strong earning

18.70 and 122.54 respectively. ICICI bank has highest capability to perform the activities such as funding

Profit per Employee mean value i.e. 18.63 and standard dividends, maintaining adequate capital levels, providing

deviation 35.15. Axis bank shows better position in terms for investment opportunities to for bank for growth,

of Return on Net Worth with mean and standard strategies for engaging in new activities and maintaining

deviation 18.71 and 1.27 respectively. the competitive outlook

Table 5: Earning Quality of selected banks

Kotak IndusInd

Parameters HDFC ICICI Axis Bank

Mahindra Bank

Mean 1.67 1.40 1.52 1.58 1.27

Return on St. Dev. 0.28 0.30 0.38 0.23 0.60

Assets C. V. 0.08 0.09 0.14 0.05 0.36

RANK 1 4 3 2 5

Mean 4.29 2.47 4.68 3.04 2.81

Net

St. Dev. 0.20 0.43 0.48 0.29 0.88

Interest

Margin C. V. 0.04 0.18 0.23 0.08 0.77

RANK 2 5 1 3 4

Operating Mean 3.19 2.59 2.85 2.90 2.32

Profit to St. Dev. 0.09 0.46 0.48 0.36 0.88

Total C. V. 0.01 0.21 0.23 0.13 0.78

Assets RANK 1 4 3 2 5

Non- Mean 1.85 1.97 1.74 2.05 1.95

Interest St. Dev. 0.14 0.25 0.31 0.20 0.44

Income to C. V. 0.02 0.06 0.10 0.04 0.19

total assets RANK 4 2 5 1 3

Average 2 3.75 3 2 4.25

Composite

Rank 1.5 4 3 1.5 5

Source: Compiled from annual reports of respective banks

Table 5 depicts that HDFC and Axis bank has 5. LIQUIDITY

top position in term of earning quality followed by Kotak Liquidity has a significant impact on financial

Mahindra and ICICI bank and lowest position secured soundness and it evaluates the operational performance

by IndusInd bank. Return on Assets is highest in case of a bank. It indicates the capacity of a bank to pay its

of HDFC bank with mean value 1.67 and lowest in short term debts and face unexpected withdrawals of

IndusInd bank with mean value 1.27. Kotak Mahindra depositors. Liquidity shows the ability of an

has highest net interest margin and ICICI has lowest organisation to convert its assets into cash without any

with mean 4.68 and 2.47 respectively. Operating Profit loss. Liquidity of the banks assures the depositors that

to Total Assets shows that HDFC has the highest they can access to their funds whenever need arise and

position and Axis bank got the highest position in term shows the stability and longevity of banks. While too

of Non-Interest Income to total assets with mean value much liquidity has a negative impact on profitability,

3.19 and 2.05 respectively. too little liquidity increases the risk of insolvency.

www.eprawisdom.com Vol - 5, Issue- 7, July 2017 91

EPRA International Journal of Economic and Business Review| SJIF Impact Factor(2016) : 6.484

Table 6: Liquidity Quality of selected banks

Kotak IndusInd

Parameters HDFC ICICI Axis Bank

Mahindra Bank

Mean 8.02 8.57 6.42 6.75 6.47

Cash

St. Dev. 2.54 2.32 1.79 1.06 1.05

Deposit

C. V. 6.43 5.37 3.21 1.13 1.11

Ratio

RANK 2 1 5 3 4

Mean 76.15 97.39 94.76 76.82 79.80

Credit

St. Dev. 6.74 6.38 6.62 8.90 10.40

Deposit

C. V. 45.37 40.74 43.78 79.17 108.26

Ratio

RANK 5 1 2 4 3

Mean 37.77 50.81 51.81 39.97 35.39

Investment

St. Dev. 5.59 8.61 8.55 3.44 2.46

Deposit

C. V. 31.28 74.14 73.14 11.82 6.04

Ratio

RANK 4 2 1 3 5

Average 3.67 1.33 2.67 3.33 4

Composite

Rank 4 1 2 3 5

Source: Compiled from annual reports of respective banks

Above table present that liquidity position of OVERALL RANKING

ICICI bank is much better followed by Kotak Mahindra, The overall ranking of the banks considering

Axis bank, and HDFC respectively. IndusInd bank all the sub criteria rankings under CAMEL analysis

secured the lowest position in term of liquidity. ICICI over the ten years period (2007-2017) is presented in

Bank has strong position in case of in case of cash following Table 1-6. The group rankings of all the banks

deposit ratio and credit deposit ratio. Kotak Mahindra considered for the purpose of study is taken and

has highest average investment deposit ratio i.e. 51.81 averaged out to reach at the overall grand ranking. Axis

with standard deviation 8.55. bank is ranked first under the CAMEL analysis followed

by ICICI. Kotak Mahindra occupied the third position.

The fourth position is occupied by HDFC. The last

position under CAMEL analysis is occupied by

IndusInd bank amongst all the selected banks during

the year 2007-2017.

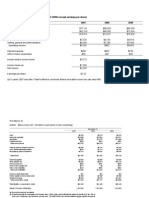

Table 8: Overall ranking of the selected banks based on the CAMELS parameters

Capital Assets Managerial Earning

Bank Liquidity AVERAGE Rank

Adequacy quality efficiency capacity

HDFC 3 5 2 1.5 4 3.1 4

ICICI 2 3 4 4 1 2.8 2

Kotak

1 4 5 3 2 3 3

Mahindra

Axis

4 1 1 1.5 3 2.1 1

Bank

IndusInd

5 2 3 5 5 4 5

Bank

CONCLUSION AND SUGGESTION

By considering all of the parameters of context of Capital Adequacy, Earnings Ability and

CAMEL, it is seen that Axis bank is at the top position Liquidity whereas it perform better in case of capital

as assessed by the CAMEL Model compared to other adequacy. Therefore, IndusInd bank should improve its

banks under the study. Axis bank has strong position in particular weak areas. Therefore, the policy

performance in case of Asset Quality, Management makers of the related lowest ranking banks should take

efficiency and Earnings Ability while it is lag behind in necessary steps and try to find out solution to improve

case of capital adequacy. On the other side, IndusInd their weaknesses by using the findings this study.

bank at the lowest position compared to other banks

under the study due to its poor performance in the

www.eprawisdom.com Vol - 5, Issue- 7, July 2017 92

e-ISSN : 2347 - 9671, p- ISSN : 2349 - 0187 Vinod Kumar & Bhawna Malhotra

REFERENCES

8. Mishra, S. K., & Aspal, P. K. (2012). A camel model

1. Baru, (2014 February 11) Indian banks: Five years after

analysis of state bank group.

global financial crises, Business standard Retrieved from

9. Mohiuddin, G. (2014). Use of CAMEL Model: A Study on

http://www.business-standard.com

Financial Performance of Selected Commercial Banks in

2. Chen, J. (2003). Capital adequacy of Chinese banks:

Bangladesh. Universal journal of accounting and

evaluation and enhancement. Journal of Banking

finance, 2(5), 151-160.

Regulation, 4(4), 320.

10. Ramya, S., Narmadha, N. K. B., Lekha, S., Nandhitha

3. Dang U. (2011). The CAMEL rating system in banking

Bagyam, V. R., & Keerthana, A. (2017). Analysis of financial

supervision: A case study of Arcada. University of Applied

performance of state bank of India using camels

Sciences.

approach. IJAR, 3(2), 449-452.

4. Erol, C., F. Baklaci, H., Aydoðan, B., & Tunç, G. (2014).

11. Reddy, K. S. (2012). Relative Performance of Commercial

Performance comparison of Islamic (participation) banks

Banks in India Using Camel Approach. International

and commercial banks in Turkish banking sector. EuroMed

Journal of Multidisciplinary Research, 2(3), 38-58.

Journal of Business, 9(2), 114-128.

12. Rostami, M. (2015). Determination of CAMELS model on

5. Kumar, M. A., Harsha, G. S., Anand, S., & Dhruva, N. R.

bank’s performance. International journal of

(2012). Analyzing soundness in Indian banking: A CAMEL

multidisciplinary research and development, e-ISSN, 2349-

approach. Research Journal of Management Science,

4182.

ISSN, 2319, 1171.

13. Said, R. M., & Tumin, M. H. (2011). Performance and

6. Majumder, M. T. H., & Rahman, M. M. (2016). A CAMEL

financial ratios of commercial banks in Malaysia and

Model Analysis of Selected Banks in

China. International Review of Business Research

Bangladesh. International Journal of Business and

Papers, 7(2), 157-169.

Technopreneurship, 6(2), 233-266.

14. Singh, J. P., & Seth, M. (2017). An Inclusive Study on

7. Mathuva, D. M. (2009). Capital adequacy,cost income

Capital Adequacy performance of Selected Public Sector

ratio and the performance of commercial banks: The

and Private Sector Banks in India. International Journal

Kenyan Scenario. The International journal of applied

of Multifaceted and Multilingual Studies, 3(10).

economics and Finance, 3(2), 35-47.

www.eprawisdom.com Vol - 5, Issue- 7, July 2017 93

View publication stats

You might also like

- CAMEL Model ReportDocument9 pagesCAMEL Model ReportAbdul Razzak100% (1)

- SYBBA Finance ProjectDocument10 pagesSYBBA Finance ProjectJanki PatilNo ratings yet

- Performance Analysis Using Camel Model-A Study of Select Private BanksDocument10 pagesPerformance Analysis Using Camel Model-A Study of Select Private BanksLIKHITHA RNo ratings yet

- An Analysis of The Performance of Select Public Sector Banks Using Camel ApproachDocument17 pagesAn Analysis of The Performance of Select Public Sector Banks Using Camel Approachmithunraj packiyanathanNo ratings yet

- A Comparative Study On Financial Performance of Public Sector Banks in India: An Analysis On Camel ModelDocument17 pagesA Comparative Study On Financial Performance of Public Sector Banks in India: An Analysis On Camel ModelkishoremeghaniNo ratings yet

- JETIR2302448Document7 pagesJETIR2302448Rupak RoyNo ratings yet

- Vijay Hemant Sonaje and Dr. Shriram S. NerlekarDocument8 pagesVijay Hemant Sonaje and Dr. Shriram S. NerlekarsugeethaNo ratings yet

- Camel Analysis India RankingDocument15 pagesCamel Analysis India RankingManita KunwarNo ratings yet

- Camel Analysis India RankingDocument15 pagesCamel Analysis India RankingAmnaNo ratings yet

- A Synopsis On PEoBDocument8 pagesA Synopsis On PEoBAsit kumar BeheraNo ratings yet

- Financial Performance of Axis Bank and Kotak Mahindra Bank in The Post Reform Era Analysis On CAMEL ModelDocument34 pagesFinancial Performance of Axis Bank and Kotak Mahindra Bank in The Post Reform Era Analysis On CAMEL ModelIjbemrJournalNo ratings yet

- SBI and Associate Bank Performance StudyDocument11 pagesSBI and Associate Bank Performance StudyAnjum Ansh KhanNo ratings yet

- A CAMEL MODEL ANALYSIS OF PUBLIC & PRIVATE SECTOR BANKS IN INDIACamels Rating PDFDocument23 pagesA CAMEL MODEL ANALYSIS OF PUBLIC & PRIVATE SECTOR BANKS IN INDIACamels Rating PDFsambhu_n100% (1)

- Impact of Financial Reforms on Indian Bank PerformanceDocument24 pagesImpact of Financial Reforms on Indian Bank PerformanceShveta VatasNo ratings yet

- Financial Performance of Axis Bank and Kotak Mahindra Bank in The Post Reform Era Analysis On CAMEL ModelDocument35 pagesFinancial Performance of Axis Bank and Kotak Mahindra Bank in The Post Reform Era Analysis On CAMEL Modelkeshyam59No ratings yet

- An Analysis of Public Sector Banks PerfoDocument14 pagesAn Analysis of Public Sector Banks PerfoMurali Balaji M CNo ratings yet

- Bank Performance Analysis Through CAMEL ModelDocument3 pagesBank Performance Analysis Through CAMEL Modeldbkbk902No ratings yet

- A Selective Study Camels Analysis of Indian Private Sector BanksDocument7 pagesA Selective Study Camels Analysis of Indian Private Sector Banksmahesh toshniwalNo ratings yet

- Camel ModelDocument3 pagesCamel ModelGokulapriyan ANo ratings yet

- Financial Performance Analysis of PrivatDocument11 pagesFinancial Performance Analysis of Privatprteek kumarNo ratings yet

- Bank 1 PDFDocument13 pagesBank 1 PDFallauddin nadafNo ratings yet

- Financial Performance of Public Sector Banks in IndiaDocument9 pagesFinancial Performance of Public Sector Banks in IndiaHarshit KashyapNo ratings yet

- Asian Journal of AccountingDocument24 pagesAsian Journal of AccountingDharmendra SinghNo ratings yet

- AJMRMAY2019Document10 pagesAJMRMAY2019Tanmay SarkarNo ratings yet

- A Study On Performance of Private Sector Banks in IndiaDocument14 pagesA Study On Performance of Private Sector Banks in IndiaRekha ShawNo ratings yet

- Theories of ProfitDocument9 pagesTheories of ProfitDeus SindaNo ratings yet

- Use of CAMEL Rating Framework: A Comparative Performance Evaluation of Selected Bangladeshi Private Commercial BanksDocument9 pagesUse of CAMEL Rating Framework: A Comparative Performance Evaluation of Selected Bangladeshi Private Commercial BanksShadabNo ratings yet

- Review of The Literature: Chapter - IIIDocument10 pagesReview of The Literature: Chapter - IIIVįňäý Ğøwđã VįñîNo ratings yet

- Efficiency of Old Private BanksDocument5 pagesEfficiency of Old Private BanksAvneesh BhattNo ratings yet

- India Paper CamelDocument16 pagesIndia Paper Camelmuhammad nawazNo ratings yet

- Synopsys Report CAMEL-MODEL-ANALYSIS-OF-PUBLIC-PRIVATE-SECTOR-BANKS-IN-INDIACamels-rating PDFDocument23 pagesSynopsys Report CAMEL-MODEL-ANALYSIS-OF-PUBLIC-PRIVATE-SECTOR-BANKS-IN-INDIACamels-rating PDFsalmanNo ratings yet

- A Study of Financial Performance Evaluation of Banks in IndiaDocument11 pagesA Study of Financial Performance Evaluation of Banks in IndiaRaghav AryaNo ratings yet

- IJM_11_12_179Document11 pagesIJM_11_12_179Vinayak PadaveNo ratings yet

- Abdc Paper Anubha 2022Document21 pagesAbdc Paper Anubha 2022ANUBHA SRIVASTAVA BUSINESS AND MANAGEMENT (BGR)No ratings yet

- International Journal of Engineering and Management Sciences (IJEMS) Vol. 3. (2018). No. 5Document7 pagesInternational Journal of Engineering and Management Sciences (IJEMS) Vol. 3. (2018). No. 5RabinNo ratings yet

- Earning Quality of Scheduled Commercial Banks in India: Bank-Wise and Sector-Wise AnalysisDocument26 pagesEarning Quality of Scheduled Commercial Banks in India: Bank-Wise and Sector-Wise AnalysisPavithra GowthamNo ratings yet

- Proposal 4Document17 pagesProposal 4SUBHANo ratings yet

- An Analysis of Financial Performance of Public Sector Banks in India Using Camel Rating SystemDocument15 pagesAn Analysis of Financial Performance of Public Sector Banks in India Using Camel Rating SystemTHILAGALAKSHMI M DNo ratings yet

- Measuring Efficiency in Indian Commercial Banks With DEA and Tobit RegressionDocument6 pagesMeasuring Efficiency in Indian Commercial Banks With DEA and Tobit RegressioncharanNo ratings yet

- Effect of Merger On The Performance of Public Sector Banks in IndiaDocument13 pagesEffect of Merger On The Performance of Public Sector Banks in Indiaindex PubNo ratings yet

- A Study of Financial Performance of Public Sector Banks of IndiaDocument4 pagesA Study of Financial Performance of Public Sector Banks of IndiaShruti KashyapNo ratings yet

- India Bank 2018.Document12 pagesIndia Bank 2018.Mihaela TanasievNo ratings yet

- DuPont AnalysisDocument11 pagesDuPont AnalysisShashidhar dNo ratings yet

- A Comparative Study of Financial Permormance of State Bank of India and ICICI BankDocument10 pagesA Comparative Study of Financial Permormance of State Bank of India and ICICI Bankprteek kumarNo ratings yet

- Review of The Literature: Ajit and BangerDocument18 pagesReview of The Literature: Ajit and BangertejasparekhNo ratings yet

- Ajrbf:: Performance Evaluation of Scheduled Commercial Banks in India-A Comparative StudyDocument21 pagesAjrbf:: Performance Evaluation of Scheduled Commercial Banks in India-A Comparative StudyManvi JainNo ratings yet

- CAMELijbt Vol 6 June 2016 4 233-266Document35 pagesCAMELijbt Vol 6 June 2016 4 233-266Sadia R ChowdhuryNo ratings yet

- Chapter: 3 Research MethodologyDocument21 pagesChapter: 3 Research MethodologySamyuktha KNo ratings yet

- DOC-20240407-WA0004.Document50 pagesDOC-20240407-WA0004.pradhanraja05679No ratings yet

- A Comparative Study of Financial Performance of Canara Bank and Union Bank of IndiaDocument8 pagesA Comparative Study of Financial Performance of Canara Bank and Union Bank of IndiaarcherselevatorsNo ratings yet

- A Comparative Study of Financial Performance of Canara Bank and Union Bank of India Dr. Veena K.P. Ms. Pragathi K.MDocument8 pagesA Comparative Study of Financial Performance of Canara Bank and Union Bank of India Dr. Veena K.P. Ms. Pragathi K.MMane DaralNo ratings yet

- A Comparative Study of Financial Performance of Canara Bank and Union Bank of India PDFDocument8 pagesA Comparative Study of Financial Performance of Canara Bank and Union Bank of India PDFPravin RnsNo ratings yet

- SUSMITHADocument30 pagesSUSMITHAmithu mithuNo ratings yet

- Review of Literature on Financial Performance and Efficiency of Indian BanksDocument49 pagesReview of Literature on Financial Performance and Efficiency of Indian BanksSagar TiwariNo ratings yet

- Performance of private sector banks in IndiaDocument14 pagesPerformance of private sector banks in IndiaRekha ShawNo ratings yet

- A Study On Technical Efficiency of Public Sector Banks in IndiaDocument7 pagesA Study On Technical Efficiency of Public Sector Banks in IndiaSharan ChowdaryNo ratings yet

- 2dharmendra S Mistry - Pdfa Comparative Study of The Profitability Performance in TheDocument15 pages2dharmendra S Mistry - Pdfa Comparative Study of The Profitability Performance in ThePsubbu RajNo ratings yet

- Financial Performance Analysis of Syndicate Bank Using Camel ModelDocument11 pagesFinancial Performance Analysis of Syndicate Bank Using Camel ModelGokulapriyan ANo ratings yet

- Performance of Private Banks Before CovidDocument11 pagesPerformance of Private Banks Before CovidAbirami ThevarNo ratings yet

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- CA Casualty Educational ObjectivesDocument40 pagesCA Casualty Educational ObjectiveshasupkNo ratings yet

- Macroeconomics Discussion4Document2 pagesMacroeconomics Discussion4Chia Chia KoayNo ratings yet

- Wohl Cease & DesistDocument35 pagesWohl Cease & DesistTBPInvictus100% (2)

- The Importance of AccountingDocument3 pagesThe Importance of AccountingMathias MikeNo ratings yet

- CBS NewDocument92 pagesCBS NewBen MathewsNo ratings yet

- Lofty Credit Primary TradelinesDocument1 pageLofty Credit Primary Tradelinesmyfaithwalk1343100% (2)

- Private and confidential payslip for Miss V GlibiciucDocument2 pagesPrivate and confidential payslip for Miss V GlibiciucGlibiciuc IlieNo ratings yet

- Excel File of Financial Projection and FundingDocument21 pagesExcel File of Financial Projection and FundingDave John LavariasNo ratings yet

- Insurance License Study GuideDocument3 pagesInsurance License Study GuideKatherine Hsu67% (3)

- A Reformulation: Intel CorporationDocument15 pagesA Reformulation: Intel Corporationmnhasan150No ratings yet

- Nedbank Case StudyDocument14 pagesNedbank Case Studyambuj joshiNo ratings yet

- Chapter 2 The Accounting EquationDocument15 pagesChapter 2 The Accounting EquationDahlia Fernandez Bt Mohd Farid FernandezNo ratings yet

- Panama Private FoundationDocument2 pagesPanama Private FoundationJil JimenezNo ratings yet

- NORKA SPECIAL SCHEME FOR RETURNING EMIGRANTSDocument1 pageNORKA SPECIAL SCHEME FOR RETURNING EMIGRANTSGreatway ServicesNo ratings yet

- Solid Q 50 KW InvoiceDocument1 pageSolid Q 50 KW InvoiceTrisha RawatNo ratings yet

- The Virgin Group: An Innovative Corporate StructureDocument25 pagesThe Virgin Group: An Innovative Corporate Structurerohanag25% (4)

- LandBank - Cash Card FormDocument2 pagesLandBank - Cash Card FormPete Rahon94% (16)

- A Study On The Role and Importance of Treasury Management SystemDocument6 pagesA Study On The Role and Importance of Treasury Management SystemPAVAN KumarNo ratings yet

- Boe Says Uk Was On Brink of Crisis After Market TurmoilDocument42 pagesBoe Says Uk Was On Brink of Crisis After Market TurmoilRo Di Anne EllulNo ratings yet

- Transfer Business Tax SyllabusDocument5 pagesTransfer Business Tax SyllabusamqqndeahdgeNo ratings yet

- Zhang - Wang and Wang China 2012Document36 pagesZhang - Wang and Wang China 2012Karla VenegasNo ratings yet

- Annual Report MERK 2012Document108 pagesAnnual Report MERK 2012StefanyNo ratings yet

- Flash Memory Inc Student Spreadsheet SupplementDocument5 pagesFlash Memory Inc Student Spreadsheet Supplementjamn1979No ratings yet

- Drill Exercises 2Document4 pagesDrill Exercises 2Enerel TumenbayarNo ratings yet

- Risk CalculationDocument6 pagesRisk CalculationvvpvarunNo ratings yet

- Unit Test 5: Answer All Thirty Questions. There Is One Mark Per Question. 1 Who Receives What? Match A-E To 1-5Document6 pagesUnit Test 5: Answer All Thirty Questions. There Is One Mark Per Question. 1 Who Receives What? Match A-E To 1-5gronigan100% (1)

- 6 - General Valuation Concepts and PrinciplesDocument27 pages6 - General Valuation Concepts and PrinciplesKismet100% (7)

- S.Aniker (Apbf2022.35Document28 pagesS.Aniker (Apbf2022.35aniketsuradkar22.imperialNo ratings yet

- Conceptual Framework Accounting Standards: Summary ofDocument5 pagesConceptual Framework Accounting Standards: Summary of버니 모지코No ratings yet