Professional Documents

Culture Documents

Asset Revaluation or Impairment: Understanding The Accounting For Fixed Assets in Release 12

Uploaded by

Hamada Asmr AladhamOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Asset Revaluation or Impairment: Understanding The Accounting For Fixed Assets in Release 12

Uploaded by

Hamada Asmr AladhamCopyright:

Available Formats

Asset Revaluation or

Impairment: Understanding

the Accounting for Fixed

Assets in Release 12

an eprentise white paper

tel: 407.591.4950 | toll-free: 1.888.943.5363 | web: www.eprentise.com

Asset Revaluation or Impairment: Understanding the Accounting for Fixed Assets in Release 12

Author: Brian Lewis

www.eprentise.com

© 2018 eprentise, LLC. All rights reserved.

eprentise® is a registered trademark of eprentise, LLC.

FlexField Express and FlexField are registered trademarks of Sage Implementations, LLC.

Oracle, Oracle Applications, and E-Business Suite are registered trademarks of Oracle Corporation.

All other company or product names are used for identification only and may be trademarks of their respective owners.

Copyright © 2018 eprentise, LLC. All rights reserved. www.eprentise.com | Page 2

Asset Revaluation or Impairment: Understanding the Accounting for Fixed Assets in Release 12

Significant changes in financial reporting requirements have transformed the fixed asset accounting

framework of companies. International Financial Reporting Standards (IFRS) require fixed assets to be

initially recorded at cost, but there are two accounting models – the cost model and the revaluation

model. So, what’s the difference, and when should you consider revaluation versus impairment? What

important changes does Release 12 (R12) bring to fixed assets?

IFRS and U.S. GAAP Reporting in Oracle® E-Business Suite

Although it is clear that the Securities and Exchange Commission (SEC) will not be requiring U.S. companies

to use IFRS in the near future, most players in the capital markets tend to agree that it is inevitable that IFRS

will eventually become a more significant part of the U.S. financial reporting environment. This is actually

occurring to an extent as more than 400 global companies based outside the U.S. are being allowed to file

SEC financial reports (10K and 10Q – generally referred to as annual/quarterly financial reports). For overseas

companies that do not file in the U.S. with the SEC, IFRS is becoming the world standard for financial

reporting. For companies that live in multiple capital markets, there may actually be a dual reporting

requirement of both IFRS and U.S. GAAP (Generally Accepted Accounting Principles) financial statements.

With Release 11i and subsequently with Release 12, Oracle® E-Business Suite (EBS) has added functionality

to allow users to live in both the IFRS and U.S. GAAP worlds. The differences between these two reporting

frameworks are extensive; but for the purposes of this white paper, we will focus on fixed assets accounting

within EBS – specifically asset revaluation or impairment.

Under U.S. GAAP, fixed assets are recorded at historic cost and are then depreciated to a disposal or residual

value. If there are certain indicators that the realizable value of the fixed asset has negatively changed, then

the asset is written down and a loss is recorded. This is referred to as impairment.

Under IFRS, financial statement issuers have the option to choose either the cost model (which is in most

respects similar to the U.S. GAAP model) or the revaluation model (for which there is no parallel reporting

under U.S. GAAP). Under the revaluation model, fixed assets may be periodically written up to reflect fair

market value – something that is specifically prohibited under U.S. GAAP and SEC authority.

The balance of this white paper will focus on fixed asset revaluation and impairment under both U.S. GAAP

and IFRS. Prior to diving deeper into this subject, it is useful to run through a list of R12’s new features

relating to fixed assets.

New and Changed Features in Release 12 for Fixed Assets

Oracle® EBS R12 has a number of valuable new features, many of which were made to fixed assets,

including:

• Subledger Accounting (SLA) architecture – Oracle Assets is fully integrated with SLA, allowing for

multiple accounting representations for a single transaction or business event.

• Enhanced mass additions for legacy conversions – Use the mass additions process to convert data

from a previous asset system.

• Automatic preparation of mass additions – Default rules and public Application Programming

Interfaces (APIs) that can be used to complete the preparation of mass addition lines automatically.

• Flexible reporting using XML Publisher – Thirteen customizable new asset reports.

Copyright © 2018 eprentise, LLC. All rights reserved. www.eprentise.com | Page 3

Asset Revaluation or Impairment: Understanding the Accounting for Fixed Assets in Release 12

• Automatic depreciation rollback – Rollback can be executed on select assets as required vs. the entire

asset book, and it is no longer required to be run manually.

• Enhanced functionality for the energy industry.

• Retirements and revaluations are now allowed in the period of addition.

The many benefits of these additions include process efficiencies, flexible accounting and reporting and

industry enhancements. From an acquisition or divestiture perspective, legacy system conversions from

disparate standards such as U.S. GAAP and IFRS are specifically addressed.

So how are U.S. GAAP and IFRS the same, and where do they differ when addressing fixed assets?

Comparing IFRS and U.S. GAAP for Business Combinations/Fixed Asset Accounting

The table below summarizes and compares U.S. GAAP and IFRS requirements for fixed assets after an

acquisition.

U.S. GAAP is a conservative rule-based accounting standard that focuses on P & L (profit and loss) financials

for use of owners of the entity (shareholders), while IFRS is more of a principle-based accounting standard

that focuses on the balance sheet primarily for creditors of the entity.

The significant differences in fixed assets between U.S. GAAP and IFRS are in the areas of revaluation,

revaluation surplus and impairment as previously noted, all of which are defined below.

Revaluation of Fixed Assets – Revaluation of a company’s assets takes into account inflation or changes in

fair value since the assets were purchased or acquired. There must be persuasive evidence to revalue. The

change in value is credited to the revaluation surplus (reserve) account. A downward revaluation is

considered impairment.

Revaluation Surplus (Reserve) – The increase in value of fixed assets due to the revaluation of the fixed

assets is credited to revaluation surplus (reserve).

Copyright © 2018 eprentise, LLC. All rights reserved. www.eprentise.com | Page 4

Asset Revaluation or Impairment: Understanding the Accounting for Fixed Assets in Release 12

Impairment of Fixed Assets – Impairment of a fixed asset occurs when the realizable value of an asset, as

shown in the balance sheet, exceeds its actual value (fair value) to the company. When impairment occurs,

the business must decrease its value in the balance sheet and recognize a loss in the income statement.

Cost Model vs. Revaluation Model for Fixed Assets

Cost Model

In the cost model, the fixed assets are carried at their historical cost less accumulated depreciation and

accumulated impairment losses. There is no revaluation or upward adjustment to value due to changing

circumstances. This is similar to the model currently in use by U.S. GAAP.

Example

Acme Ltd. purchased a building worth $200,000 on January 1, 2008. It records the building using the

following journal entry:

The building has a useful life of 20 years, and in this example the company uses straight-line

depreciation. Yearly depreciation is $200,000/20 years, or $10,000. Accumulated depreciation as of

December 31, 2010, is $10,000*3, or $30,000, and the carrying amount is $200,000 minus $30,000, which

equals $170,000.

We see that the building remains at its historical cost and is periodically depreciated with no other upward

adjustment to value. If an asset is subsequently valued down due to impairment, the loss is charged to the

income statement as impairment loss.The building has a useful life of 20 years, and in this example the

company uses straight-line depreciation. Yearly depreciation is $200,000/20 years, or $10,000. Accumulated

depreciation as of December 31, 2010, is $10,000*3, or $30,000, and the carrying amount is $200,000 minus

$30,000, which equals $170,000.

Revaluation Model

In the revaluation model, an asset is initially recorded at cost, but subsequently its carrying amount may be

increased to account for appreciation in value. The difference between the cost model and revaluation

model is that the revaluation model allows both downward and upward adjustment in value of an asset,

while the cost model allows only downward adjustment due to impairment loss. This is the model currently

adopted by IFRS.

Copyright © 2018 eprentise, LLC. All rights reserved. www.eprentise.com | Page 5

Asset Revaluation or Impairment: Understanding the Accounting for Fixed Assets in Release 12

Example

Consider the example of Acme Ltd. used in the cost model. Assume that on December 31, 2010, the

company intends to switch to a revaluation model and carries out a revaluation exercise which estimates

the fair value of the building to be $190,000 (again, at December 31, 2010). The carrying amount at the date

is $170,000 and revalued amount is $190,000, so an upward adjustment of $20,000 is required for the

building account. It is recorded through the following journal entry:

Revaluation Surplus

Upward revaluation is not considered a normal gain and is not recorded on the income statement; rather it

is directly credited to an equity account called revaluation surplus. Revaluation surplus holds all the upward

revaluations of a company’s assets until those assets are disposed.Revaluation Surplus

Depreciation after Revaluation

The depreciation in periods after revaluation is based on the revalued amount. In the case of Acme Ltd.,

depreciation for 2011 was the new carrying amount divided by the remaining useful life, or $190,000/17,

which equals $11,176.

Reversal of Revaluation

If a revalued asset is subsequently valued down due to impairment, the loss is first written off against any

balance available in the revaluation surplus. If the loss exceeds the revaluation surplus balance of the same

asset, the difference is charged to the income statement as impairment loss.

Example

Suppose on December 31, 2012, Acme Ltd. revalues the building again to find out that the fair value should

be $160,000. The carrying amount as of December 31, 2012, is $190,000 minus two years depreciation of

$22,352 which amounts to $167,648.

The carrying amount exceeds the fair value by $7,648, so the account balance should be reduced by that

amount. We already have a balance of $20,000 in the revaluation surplus account related to the same

building, so no impairment loss will go to the income statement. The journal entry would be:

Copyright © 2018 eprentise, LLC. All rights reserved. www.eprentise.com | Page 6

Asset Revaluation or Impairment: Understanding the Accounting for Fixed Assets in Release 12

Had the fair value been $140,000, the excess of the carrying amount over fair value would have been

$27,648. In that situation, the following journal entry would have been required:

EBS Considerations for the Revaluation Model

In EBS, you can revalue all categories in a fixed asset book, all assets in a category, or just individual assets.

Revaluing all categories in a book or all assets in a category is considered “Mass Revaluation” – that is, you

can revalue assets en masse. Revaluing individual assets is effected on an asset-by-asset basis.

Regardless of the method used, a prerequisite for performing an asset revaluation is setting up your

revaluation rules and accounts, which is done when you define your depreciation books. If you choose to

allow revaluations, you must specify your revaluation rules – specifically, whether you will allow EBS to

“[r]evalue accumulated depreciation. If you do not revalue accumulated depreciation, Oracle Assets

transfers the accumulated depreciation to the revaluation reserve account.”[i]

Copyright © 2018 eprentise, LLC. All rights reserved. www.eprentise.com | Page 7

Asset Revaluation or Impairment: Understanding the Accounting for Fixed Assets in Release 12

The Mass Revaluation process includes the following steps:

• Create Mass Revaluation Definition

• Preview Revaluation

• Run Revaluation

• Optionally Review Revaluation

Copyright © 2018 eprentise, LLC. All rights reserved. www.eprentise.com | Page 8

Asset Revaluation or Impairment: Understanding the Accounting for Fixed Assets in Release 12

To revalue all assets in a category:

• Navigate to the Mass Revaluations window

• Enter the book for which you want to revalue assets

• Enter a description for the revaluation definition (Important: Note the Mass Transaction Number)

• Specify revaluation rule

• Enter the category you want to revalue

• Enter the revaluation percentage rate to revalue your assets. Enter either a positive or negative number

• Override default revaluation rules if necessary

• Choose Preview (Note: You must preview before EBS will let you proceed)

• If, after previewing, you need to make changes, edit the revaluation rule or percentage

• Find the revaluation definition using the Mass Transaction Number

• Choose Run – Oracle Assets begins a concurrent process to perform the revaluation

• Review the log file after the request completes

To revalue an individual asset:

• Enter the asset number you wish to revalue instead of a category

Revaluation Functionality is Not for Fixed Asset Revaluation Under Purchase Accounting Rules

One area of confusion that has been encountered several times is whether the asset revaluation functionality

of Oracle EBS can be used to revalue assets of an acquired company.

Under Financial Accounting Standard 141(R) and IFRS 3, Business Combinations, companies are required to

revalue their assets to fair value at date of acquisition. This is mandatory for all companies that have to file

annual reports with the SEC or roll-up into an SEC reporting company. For our purposes, this means just

about everyone. The same applies to IFRS reporting companies. It used to be that companies could use

pooling of interest where they could just leave the fixed assets from the acquired company’s books as-is

for cost, accumulated depreciation, and date in-service. This is no longer allowable.

Since under both U.S. GAAP and IFRS there is no such thing as a “merger,” there will always be a company

identified as the acquired. For this company, all fixed assets need to (1) be restated to fair value at date of

acquisition; (2) have the date in service restated to date of acquisition; and (3) have any accumulated

depreciation zeroed out. If a company can support a contention that netting accumulated depreciation

with cost is materially the same as fair value, the acquired company may do that, but the net value has to

be migrated to the original cost field, the accumulated depreciation zeroed, and the date in-service still

reset to date of acquisition. If the company is restating to fair value and cannot use the netting method,

then a number of new fair values must be done for each of the fixed assets.

Oracle Mass Revaluation (OMR) functionality will not work for these types of revaluations for the following

reasons:

1. The date placed in-service must be changed to date of the business combination – OMR does not

support this.

2. OMR mass and category revaluation will not accommodate netting accumulated depreciation or

loading multiple, non-percentage driven fair value restatements.

Copyright © 2018 eprentise, LLC. All rights reserved. www.eprentise.com | Page 9

Asset Revaluation or Impairment: Understanding the Accounting for Fixed Assets in Release 12

3. Individual asset revaluation is impractical for large numbers of assets and also does not accommodate

netting accumulated depreciation or resetting the date placed in service.

For asset revaluations needed as a result of a business combination, using OMR is not a viable option.

Conclusion

Addressing fixed assets in both the U.S. GAAP and IFRS accounting models has become easier in R12. The

flexibility of the accounting rule setup allows requirements in different legislative, geographic or industry

contexts within a single instance. The mass additions and automatic preparation processes can be used to

convert data from legacy systems following an acquisition or consolidation. Additionally, reporting is

flexible with prepopulated or customizable templates.

Use the cost model with accumulated depreciation and accumulated impairment losses for U.S. GAAP

requirements. While IFRS has the flexibility to use either of the accounting models discussed in this white

paper, the revaluation model is most commonly used.

Although the FASB (Financial Accounting Standards Board) and IASB (International Accounting Standards

Board) have made significant progress toward convergence of these models through joint projects, much

work remains. Until or if convergence is achieved – estimated to be in 2015, according to the latest reports

– both accounting models for fixed assets need to be considered during a business combination.

End Notes:

[i] Oracle Library – Revaluing Assets (http://docs.oracle.com/cd/A60725_05/html/comnls/us/fa/revaling.htm)

Curious?

For more information, please call eprentise at 1.888.943.5363 or visit www.eprentise.com.

About eprentise

eprentise provides transformation software products that allow growing companies to make their Oracle® E-Business

Suite (EBS) systems agile enough to support changing business requirements, avoid a reimplementation and lower the

total cost of ownership of enterprise resource planning (ERP). While enabling real-time access to complete, consistent

and correct data across the enterprise, eprentise software is able to consolidate multiple production instances, change

existing configurations such as charts of accounts and calendars, and merge, split or move sets of books, operating

units, legal entities, business groups and inventory organizations.

Copyright © 2018 eprentise, LLC. All rights reserved. www.eprentise.com | Page 10

You might also like

- What is Financial Accounting and BookkeepingFrom EverandWhat is Financial Accounting and BookkeepingRating: 4 out of 5 stars4/5 (10)

- Asset Revaluation or Impairment Understanding The Accounting For Fixed Assets in Release 12 White PaperDocument7 pagesAsset Revaluation or Impairment Understanding The Accounting For Fixed Assets in Release 12 White Papervarachartered283No ratings yet

- What Are Some of The Key Differences Between IFRS and U.S. GAAP?Document3 pagesWhat Are Some of The Key Differences Between IFRS and U.S. GAAP?Anupta PatiNo ratings yet

- Fixed Assets (FINAL)Document13 pagesFixed Assets (FINAL)Salman Saeed100% (1)

- Investment Analysis ProjectDocument6 pagesInvestment Analysis Projectmuhammad ihtishamNo ratings yet

- Home Tasks MBA (2020) - Faisel MohamedDocument5 pagesHome Tasks MBA (2020) - Faisel MohamedFaisel MohamedNo ratings yet

- Irfs and Us GaapDocument7 pagesIrfs and Us Gaapabissi67No ratings yet

- A Case Study of The Cash Flow Statement US GAAP CoDocument7 pagesA Case Study of The Cash Flow Statement US GAAP CoLean ParkNo ratings yet

- Us Gaap and Indian GaapDocument22 pagesUs Gaap and Indian Gaapakram75zaaraNo ratings yet

- International Accounting IssuesDocument16 pagesInternational Accounting IssueschristiananilaomarananNo ratings yet

- Chap 017 AccDocument47 pagesChap 017 Acckaren_park1No ratings yet

- IFRS Standards OverviewDocument12 pagesIFRS Standards OverviewJeneef JoshuaNo ratings yet

- PWC - Ifrs Conversion Property Plant EquipmentDocument7 pagesPWC - Ifrs Conversion Property Plant EquipmentVikas AroraNo ratings yet

- A Case Study of The Cash Flow Statement INDASUS GAAP CoDocument7 pagesA Case Study of The Cash Flow Statement INDASUS GAAP CoVittalDass143 VittalNo ratings yet

- 1A An Overview of Financial StatementsDocument6 pages1A An Overview of Financial StatementsKevin ChengNo ratings yet

- AtementsDocument6 pagesAtementsralph ravasNo ratings yet

- Financial Statements - IntroductionDocument75 pagesFinancial Statements - Introductiontopeq100% (6)

- GAAP vs IFRS: Key Accounting DifferencesDocument6 pagesGAAP vs IFRS: Key Accounting DifferencesShawn WeldieNo ratings yet

- GAAP/IFRS Accounting DifferencesDocument7 pagesGAAP/IFRS Accounting DifferencesAlexander BoshraNo ratings yet

- Thesis Ias 16Document4 pagesThesis Ias 16aflobjhcbakaiu100% (2)

- Securities and Exchange Commission Division of Corporation Finance Washington, D.C. 20549 Attention: Mr. William Thompson Branch Chief Re: Sempra EnergyDocument9 pagesSecurities and Exchange Commission Division of Corporation Finance Washington, D.C. 20549 Attention: Mr. William Thompson Branch Chief Re: Sempra EnergyJared KimaniNo ratings yet

- APC311 CompletedDocument7 pagesAPC311 CompletedShahrukh Abdul GhaffarNo ratings yet

- Solution Manual For Modern Advanced Accounting in Canada 9th Edition Darrell Herauf Murray HiltonDocument37 pagesSolution Manual For Modern Advanced Accounting in Canada 9th Edition Darrell Herauf Murray Hiltonlivre.beseta7f696% (26)

- Gaap VS IfrsDocument2 pagesGaap VS IfrsPrasannaNo ratings yet

- Dual Model Accounting Impacts Latin America Infrastructure AnalysisDocument2 pagesDual Model Accounting Impacts Latin America Infrastructure AnalysisEhud No-bloombergNo ratings yet

- FALL 2020: Course Title: Financial Statement Analysis Course Code: FIN4233Document4 pagesFALL 2020: Course Title: Financial Statement Analysis Course Code: FIN4233ھاشم عمران واھلہNo ratings yet

- Gaap VS IfrsDocument4 pagesGaap VS IfrsPrasannaNo ratings yet

- Solution Manual For Modern Advanced Accounting in Canada 9th Edition Darrell Herauf Murray HiltonDocument35 pagesSolution Manual For Modern Advanced Accounting in Canada 9th Edition Darrell Herauf Murray Hiltoncravingcoarctdbw6wNo ratings yet

- Financial Ratios2Document72 pagesFinancial Ratios2Junel Alapa100% (1)

- Generally Accepted Accounting PrinciplesDocument4 pagesGenerally Accepted Accounting PrinciplesNikhat SultanaNo ratings yet

- MUCLecture 2022 51643431Document15 pagesMUCLecture 2022 51643431gold.2000.dzNo ratings yet

- Comparison of IFRS and U.S GAAP in Relation To Intangible AssetsDocument6 pagesComparison of IFRS and U.S GAAP in Relation To Intangible AssetsVimal SoniNo ratings yet

- A Guide To Understanding Balance SheetsDocument6 pagesA Guide To Understanding Balance SheetsslOwpOke13No ratings yet

- IFRS 16 Impact On Valuations v2 PDFDocument52 pagesIFRS 16 Impact On Valuations v2 PDFLeenin DominguezNo ratings yet

- GAAPDocument2 pagesGAAPMunaf KhanNo ratings yet

- Summary 1 60Document73 pagesSummary 1 60Karen Joy Jacinto Ello100% (1)

- Fa4e SM Ch01Document21 pagesFa4e SM Ch01michaelkwok1100% (1)

- Financial Reporting For Owners' Equity: Revsine/Collins/Johnson/Mittelstaedt: Chapter 15Document15 pagesFinancial Reporting For Owners' Equity: Revsine/Collins/Johnson/Mittelstaedt: Chapter 15Thalia SandersNo ratings yet

- Chan-A Comparison of Government Accounting and Business AccountingDocument13 pagesChan-A Comparison of Government Accounting and Business AccountingAndy LincolnNo ratings yet

- Financial StatementsDocument6 pagesFinancial StatementsCrissa BernarteNo ratings yet

- ImpairmentDocument5 pagesImpairmentRashleen AroraNo ratings yet

- Balance Sheets: The Basics: Balance Sheet Reporting - Who, When and Where?Document10 pagesBalance Sheets: The Basics: Balance Sheet Reporting - Who, When and Where?Rama KrishnanNo ratings yet

- Solution Manual For Modern Advanced Accounting in Canada 9th Edition Darrell Herauf Murray HiltonDocument37 pagesSolution Manual For Modern Advanced Accounting in Canada 9th Edition Darrell Herauf Murray Hiltonkanttrypilentumn4l71100% (15)

- Financial Reporting & Ratio Analysis GuideDocument36 pagesFinancial Reporting & Ratio Analysis GuideHARVENDRA9022 SINGHNo ratings yet

- IFRS vs GAAP: Top 10 Accounting DifferencesDocument3 pagesIFRS vs GAAP: Top 10 Accounting DifferencesRakesh GuptaNo ratings yet

- 6 - IasDocument25 pages6 - Iasking brothersNo ratings yet

- Week 4. Comparing IFRS To GAAP EssayDocument4 pagesWeek 4. Comparing IFRS To GAAP EssayLindaNo ratings yet

- Harmony of Accounting STDDocument4 pagesHarmony of Accounting STDRavi Thakkar100% (1)

- International Accounting StandardsDocument10 pagesInternational Accounting Standardsgotambahrani2No ratings yet

- Solution Manual For Ethical Obligations and Decision Making in Accounting Text and Cases 2nd Edition by MintzDocument16 pagesSolution Manual For Ethical Obligations and Decision Making in Accounting Text and Cases 2nd Edition by MintzLoriSmithamdt100% (42)

- GAAP General Accepted Accounting PrinciplesDocument10 pagesGAAP General Accepted Accounting PrinciplesAnonymous qbVaMYIIZNo ratings yet

- Basics of Accounting: By: Dr. Bhupendra Singh HadaDocument84 pagesBasics of Accounting: By: Dr. Bhupendra Singh HadaAryanSinghNo ratings yet

- Notes - IFRS vs. GAAPDocument3 pagesNotes - IFRS vs. GAAPbhavanaNo ratings yet

- Enterprise DCF Model: Module-2Document57 pagesEnterprise DCF Model: Module-2DevikaNo ratings yet

- Year 12 Accounting Term 3 Accrual Accounting HandoutDocument18 pagesYear 12 Accounting Term 3 Accrual Accounting HandoutnuhaNo ratings yet

- Interview Related QuestionsDocument8 pagesInterview Related QuestionsAnshita GargNo ratings yet

- Reporting and Analyzing Operating IncomeDocument59 pagesReporting and Analyzing Operating IncomeHazim AbualolaNo ratings yet

- Updates in Financial Reporting StandardsDocument24 pagesUpdates in Financial Reporting Standardsloyd smithNo ratings yet

- IFRSDocument14 pagesIFRSAyaNo ratings yet

- The Enigmatic World of Consciousnes1Document2 pagesThe Enigmatic World of Consciousnes1Hamada Asmr AladhamNo ratings yet

- The Resilient Power of Coral ReefsDocument2 pagesThe Resilient Power of Coral ReefsHamada Asmr AladhamNo ratings yet

- User Duty AssignmentDocument5 pagesUser Duty AssignmentHamada Asmr AladhamNo ratings yet

- The Enigmatic World of Consciousnes1Document2 pagesThe Enigmatic World of Consciousnes1Hamada Asmr AladhamNo ratings yet

- The Enchanting World of MythologyDocument2 pagesThe Enchanting World of MythologyHamada Asmr AladhamNo ratings yet

- Invoice ApprovalDocument54 pagesInvoice ApprovalHamada Asmr AladhamNo ratings yet

- Oracle Cloud Budgetary ControlDocument30 pagesOracle Cloud Budgetary ControljrparidaNo ratings yet

- Oracle ERP Cloud: Budgetary Control and Encumbrance Accounting Implementation GuideDocument73 pagesOracle ERP Cloud: Budgetary Control and Encumbrance Accounting Implementation GuideDock N DenNo ratings yet

- Automatic Bank Statement Import for Cash Management CloudDocument2 pagesAutomatic Bank Statement Import for Cash Management CloudHamada Asmr AladhamNo ratings yet

- Financial Accounting and ReportingDocument34 pagesFinancial Accounting and ReportingMuluk WijayaNo ratings yet

- Balance Forward Billing Setup and Usage GuideDocument8 pagesBalance Forward Billing Setup and Usage GuideHamada Asmr AladhamNo ratings yet

- Balance Forward Billing Setup and Usage GuideDocument8 pagesBalance Forward Billing Setup and Usage GuideHamada Asmr AladhamNo ratings yet

- Complete Financial Management in the CloudDocument8 pagesComplete Financial Management in the CloudHamada Asmr AladhamNo ratings yet

- Implementation Guide - Oracle ERP Cloud Budgetary Control and Encumbrance Accounting Release 13 PDFDocument64 pagesImplementation Guide - Oracle ERP Cloud Budgetary Control and Encumbrance Accounting Release 13 PDFBeatrice Rousselin100% (2)

- Steps For Creating Dial-Up VPNDocument5 pagesSteps For Creating Dial-Up VPNHamada Asmr AladhamNo ratings yet

- IFRS 16 and IAS 36: How Changes in Lease Accounting Will Impact Your Impairment Testing ProcessesDocument4 pagesIFRS 16 and IAS 36: How Changes in Lease Accounting Will Impact Your Impairment Testing ProcessesHamada Asmr Aladham100% (1)

- Transfer Budgets From Oracle Plan and Budget Cloud To Erp Cloud Whitepaper PDFDocument25 pagesTransfer Budgets From Oracle Plan and Budget Cloud To Erp Cloud Whitepaper PDFBeatrice RousselinNo ratings yet

- Fusion Receivables Cloud SmartReceipts Implementation ActivityDocument19 pagesFusion Receivables Cloud SmartReceipts Implementation Activityootydev2000100% (1)

- Complete Financial Management in the CloudDocument8 pagesComplete Financial Management in the CloudHamada Asmr AladhamNo ratings yet

- Chapter 1 Supa My NotesDocument11 pagesChapter 1 Supa My NotesjhouvanNo ratings yet

- Applies To:: How To Import Standard Memo Lines in Receivables Using File Import/Export? (Doc ID 2583282.1)Document1 pageApplies To:: How To Import Standard Memo Lines in Receivables Using File Import/Export? (Doc ID 2583282.1)Hamada Asmr AladhamNo ratings yet

- Recurring Journals in Fusion General LedgerDocument19 pagesRecurring Journals in Fusion General LedgerramanaraoNo ratings yet

- Treasury in The Cloud: Elire Differentiators Service OfferingsDocument1 pageTreasury in The Cloud: Elire Differentiators Service OfferingsHamada Asmr AladhamNo ratings yet

- Fixed Asset Tax AccountingDocument39 pagesFixed Asset Tax AccountingHamada Asmr AladhamNo ratings yet

- Fusion FA SLA PDFDocument43 pagesFusion FA SLA PDFmo7BenzNo ratings yet

- Fusion Allocation ManagerDocument29 pagesFusion Allocation ManagerRahul Jain100% (2)

- Fixed Asset BooksDocument38 pagesFixed Asset BooksnghazalyNo ratings yet

- Fusion Payables White Paper - Modify Proration Method in MPA V 1.0 PDFDocument20 pagesFusion Payables White Paper - Modify Proration Method in MPA V 1.0 PDFMaqbulhusenNo ratings yet

- Fusion Applications White Paper on Intercompany AccountingDocument37 pagesFusion Applications White Paper on Intercompany AccountingPablo Fernández-CastanysNo ratings yet

- Final Examination TT For Cert & Dip - Feb 2023Document3 pagesFinal Examination TT For Cert & Dip - Feb 2023wilfredNo ratings yet

- UK NEQAS Haematology ManualDocument77 pagesUK NEQAS Haematology ManualClínica de Medicina Dentária Drª Fernanda ToméNo ratings yet

- SBA Loan Product MatrixDocument1 pageSBA Loan Product Matrixed_nycNo ratings yet

- 060 SkillFront The Lean Six Sigma FrameworkDocument241 pages060 SkillFront The Lean Six Sigma FrameworkSnics Desarrollo HumanoNo ratings yet

- Contract of AgencyDocument2 pagesContract of Agencyjonel sembranaNo ratings yet

- ILAC International College 2019 BrochureDocument32 pagesILAC International College 2019 BrochureLorz CatalinaNo ratings yet

- Bolt May 201592181742354Document103 pagesBolt May 201592181742354Debasish RauloNo ratings yet

- IBS301 International Business Work Plan 2023Document19 pagesIBS301 International Business Work Plan 2023sha ve3No ratings yet

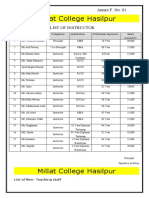

- Millat College Hasilpur: Annex F. No. 01Document3 pagesMillat College Hasilpur: Annex F. No. 01Hashim IjazNo ratings yet

- INB 301 - Chapter 8 - Foreign Direct InvestmentDocument16 pagesINB 301 - Chapter 8 - Foreign Direct InvestmentS.M. YAMINUR RAHMANNo ratings yet

- Process Interaction: Plutofab Engineers Private LimitedDocument1 pageProcess Interaction: Plutofab Engineers Private LimitedRahul MenchNo ratings yet

- Brochure BBA 2024Document12 pagesBrochure BBA 2024emastanciu275xNo ratings yet

- Easy Lunchboxes Social Media Marketing PlanDocument6 pagesEasy Lunchboxes Social Media Marketing PlanKareem NabilNo ratings yet

- Capital BudgetingDocument2 pagesCapital BudgetingAlexis KingNo ratings yet

- NEP Syllabus 1 - 24082023Document117 pagesNEP Syllabus 1 - 24082023tejasshelke629No ratings yet

- 39 Different Types of Candlesticks PatternsDocument47 pages39 Different Types of Candlesticks Patternspritesh.tiwariNo ratings yet

- English Homework #3Document11 pagesEnglish Homework #3Yaremi PereiraNo ratings yet

- Engro-Polymer-Chemicals 2021 ReportDocument197 pagesEngro-Polymer-Chemicals 2021 ReportUmer FarooqNo ratings yet

- Fortinet Specialized Partner NFR KitDocument8 pagesFortinet Specialized Partner NFR KitQualit ConsultingNo ratings yet

- RuPay TrainingDocument4 pagesRuPay TrainingSeldon Pradhan DoraeholicNo ratings yet

- Macroeconomics 9th Edition Mankiw Test BankDocument36 pagesMacroeconomics 9th Edition Mankiw Test Bankgrainnematthew7cr3xy100% (28)

- Project: Restaurant at Thamel Designer: Needle Weave L Architects Job Address: Thamel, KathmanduDocument1 pageProject: Restaurant at Thamel Designer: Needle Weave L Architects Job Address: Thamel, KathmanduKiran BasuNo ratings yet

- The Following Instances Do Not Necessarily Establish A PartnershipDocument4 pagesThe Following Instances Do Not Necessarily Establish A PartnershipGIRLNo ratings yet

- Business Development ServicesDocument10 pagesBusiness Development ServicesHaile SilasieNo ratings yet

- Impact of E-commerce in Indian Economy[1]Document11 pagesImpact of E-commerce in Indian Economy[1]kgourab1184No ratings yet

- The Impact of Sustainability Reporting Quality On The Value Relevance of Corporate Sustainability PerformanceDocument21 pagesThe Impact of Sustainability Reporting Quality On The Value Relevance of Corporate Sustainability PerformanceFarwa KhalidNo ratings yet

- Annexure 'CD - 01' Course Curriculum: Organizational BehaviourDocument7 pagesAnnexure 'CD - 01' Course Curriculum: Organizational BehaviourshikshaNo ratings yet

- How to Write an Order LetterDocument14 pagesHow to Write an Order LettermidhunNo ratings yet

- Chapter 5 SolutionDocument47 pagesChapter 5 SolutionJay-PNo ratings yet

- Statement of Comprehensive IncomeDocument3 pagesStatement of Comprehensive IncomeHaidee Flavier SabidoNo ratings yet

![Impact of E-commerce in Indian Economy[1]](https://imgv2-1-f.scribdassets.com/img/document/720874275/149x198/b0ee1ccfe4/1712504211?v=1)