Professional Documents

Culture Documents

LTAPolicy 11034 20190107105808

Uploaded by

Ayush JainOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

LTAPolicy 11034 20190107105808

Uploaded by

Ayush JainCopyright:

Available Formats

LTA POLICY

(LEAVE TRAVEL ALLOWANCE)

Guideline: As per the Government guidelines

Contents

1. Objective………………………………………………………………………………………………………….3

2. Applicability……………………………………………………………………………………………………...3

3. Guideline………………………………………………………………………………………………………….3

4. Completion………………………………………………………………………………………………………5

Guideline: As per the Government guidelines

1. Objective

Leave Travel Allowance (LTA) exemption is under section 10(5), payable to staff members as an

allowance during their course of employment with the company.

2. Applicability

This policy is applicable for staff members on rolls of Pine Labs Pvt. Ltd.

3. Guideline

1. The staff member can avail exemption under LTA only in respect of two journeys performed

by him/ her in a block of four calendar year(s). Only one journey will be considered in a calendar

year.

2. For Air Travel – Original air tickets along with original boarding Pass should be submitted

while claiming for LTA. In case of Internet booking – the relevant e-ticket printout can be

submitted with the claim. Eligibility would be limited to Economy Airfare of Airline tickets or the

Proofs submitted. Travel certificate from the Airlines may be submitted, in case of unavailability

of the original boarding pass.

3. For Travel by Train / Bus– Original or Online tickets should be submitted. Eligibility would be

limited to A/C first class train or the proofs submitted. Leave details/ application will be required

for processing the claim.

4. For Travel by Cab – Original bill should be submitted mentioning the place(s) of travel,

distance covered in Kilometers (Trip Sheet) and number of person(s) travelled etc. The bill

should be in the name of the staff member only. Toll gate receipts are also required to be

submitted. In case the same is unavailable, then the Lodge/Hotel Room bills should be

submitted to substantiate the proof of travel. The amount of exemption however will be

restricted to First A.C. fare by rail and as per the shortest route.

5. Tax benefit is applicable on/ for actual fare only. Hotel/Lodge bill, food, sightseeing, local

conveyance (taxi fare for airport/railway station) etc. is not permissible to be claimed and the

travel should be within the country to gain claim eligibility. Travel to foreign country is not

eligible for tax benefit.

6. Exemption is available for farthest place by shortest route when the circular journey is

performed for example travel from Bangalore to Mumbai and Mumbai to Delhi. Hence the

circular journey in such a case will be considered i.e. the travel from Bangalore to Delhi will be

considered.

Guideline: As per the Government guidelines

7. Exemption is available only for Self (i.e. staff member), spouse, children, parents and

dependent brother and sister. Exemption is not available for In-laws or any other member of the

staff member as mentioned in point number ‘8’.

8.Meaning of “family” – For the purpose of section 10(5) “family” in relation to an individual

means—

A. the spouse and children of the individual;

B. the parents, brothers and sisters of the individual who are wholly or mainly dependent on the

staff member.

9. Travel by own vehicle is not eligible as an exemption.

10. If the relatives of the staff member including wife and other family member(s) travel,

without the staff member accompanying them, such a case will not be considered.

11. Leave detail/ application is mandatory to claim Leave Travel Allowance i.e. LTA. The

submission of approved leave and e-mail copy along with Form 12 BB is required to be

submitted. The bills in original should match with the journey/ travel date.

Exemption is subject to the following conditions:

Different Situations Amount of exemption

Amount of economy class air fare of the National

Where the journey is performed by Air. Carrier by the shortest route or the amount

spent, whichever is less

Amount of air-conditioned first class rail fare by

Where journey is performed by Rail.

the shortest or amount spent, whichever is less

Where the places of origin of journey and destination

are connected by rail and journey, is performed by Amount of air-conditioned first class rail fare by

any other mode of transport the shortest or amount spent, whichever is less

Where the places of origin of journey and destination

(or part thereof) are not connected by rail: -

First class or deluxe class fare by the shortest

Where a recognized public transport exists

route or amount spent, whichever is less

Air-conditioned first class rail fare by the shortest

Where no recognized public transport systems exist route (as if journey had been performed by rail)

or the amount actually spent, whichever is less.

12.“Carry-over” concession – If an assesses has not availed travel concession or assistance

during any of the specified four-year block periods on one of the two permitted occasions (or on

both occasions), exemption can be claimed in the first calendar year of the next block (but in

respect of only one journey). This is known as “carry over concession”. In such case, the

exemption so availed will not be counted for the purposes of claiming the future exemptions

allowable in respect of 2 journeys in the subsequent block

Guideline: As per the Government guidelines

4. Completion

All bills for availing LTA should be submitted along with the Form 12 BB and Salary based

reimbursement Form in the salary Reimbursement drop box. The amount on verification would

be disbursed to the staff member as per the re-imbursement cycle payout.

Guideline: As per the Government guidelines

You might also like

- Cost Comparison - v2Document3 pagesCost Comparison - v2Ayush JainNo ratings yet

- Cost Comparison - AwokDocument4 pagesCost Comparison - AwokAyush JainNo ratings yet

- Costing v1Document16 pagesCosting v1Ayush JainNo ratings yet

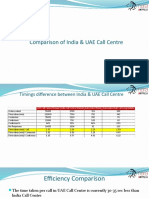

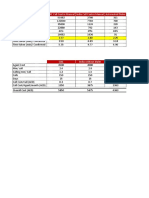

- Call CentreDocument5 pagesCall CentreAyush JainNo ratings yet

- Cost Comparison - v3Document4 pagesCost Comparison - v3Ayush JainNo ratings yet

- Timings Difference Between India & UAE Call CentreDocument3 pagesTimings Difference Between India & UAE Call CentreAyush JainNo ratings yet

- New Microsoft Excel WorksheetDocument3 pagesNew Microsoft Excel WorksheetAyush JainNo ratings yet

- Wrongly Marked by XpertDocument3 pagesWrongly Marked by XpertAyush JainNo ratings yet

- RVP DecDocument106 pagesRVP DecAyush JainNo ratings yet

- RTO JanDocument141 pagesRTO JanAyush JainNo ratings yet

- RVP JanDocument8 pagesRVP JanAyush JainNo ratings yet

- Onboarding of EmployeesDocument9 pagesOnboarding of EmployeesAyush JainNo ratings yet

- RTA Timetable April 2016Document33 pagesRTA Timetable April 2016Ayush JainNo ratings yet

- Solutions of Shakuntala Devi BookDocument5 pagesSolutions of Shakuntala Devi BookAyush Jain100% (3)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- S C in Muay ThaiDocument3 pagesS C in Muay Thaiapi-356589082No ratings yet

- Presumption As To Documents: SECTION 79-90 ADocument22 pagesPresumption As To Documents: SECTION 79-90 ApriyaNo ratings yet

- Semi-Detailed Lesson Plan in English 7Document2 pagesSemi-Detailed Lesson Plan in English 7Ram Duran82% (11)

- Lockwood, T - Design - Thinking PDFDocument3 pagesLockwood, T - Design - Thinking PDFandrehluna0% (2)

- JLPT N1 Vocab ListDocument241 pagesJLPT N1 Vocab ListKennedy GitauNo ratings yet

- As 1386.5-1989 Clean Rooms and Clean Workstations Clean WorkstationsDocument5 pagesAs 1386.5-1989 Clean Rooms and Clean Workstations Clean WorkstationsSAI Global - APACNo ratings yet

- Animal Science - Perfect CowDocument4 pagesAnimal Science - Perfect CowDan ManoleNo ratings yet

- Milk Tea Industry: An Exploratory Study: February 2020Document9 pagesMilk Tea Industry: An Exploratory Study: February 2020NING ANGELNo ratings yet

- Iso 9001 TemplateDocument2 pagesIso 9001 Templatefranckri3010No ratings yet

- Annual Performance Bonus Policy - BALDocument6 pagesAnnual Performance Bonus Policy - BALPankaj KumarNo ratings yet

- Prospectus21 22Document125 pagesProspectus21 22Vishavjeet Singh GarchaNo ratings yet

- Assignment-Ii Hnin Yee Hpwe Emdev.S 16 - Roll 14Document3 pagesAssignment-Ii Hnin Yee Hpwe Emdev.S 16 - Roll 14hnin scarletNo ratings yet

- Formal Observation ReflectionDocument2 pagesFormal Observation Reflectionapi-490271046No ratings yet

- The Impact of Information and Communication Technology On The Performance of Nigerian BanksDocument12 pagesThe Impact of Information and Communication Technology On The Performance of Nigerian BanksTheresa BomabebeNo ratings yet

- 10 Timeless Tips For Giving Effective PresentationsDocument4 pages10 Timeless Tips For Giving Effective Presentationsfer cagsNo ratings yet

- Management: BCCI Is A Key Factor in Creating Such A Persona of Cricket inDocument1 pageManagement: BCCI Is A Key Factor in Creating Such A Persona of Cricket inRAJESH MECHNo ratings yet

- Daily Lesson Plan: No Name Disability AttendanceDocument7 pagesDaily Lesson Plan: No Name Disability AttendanceebellaamayrahaisyahNo ratings yet

- Approaches To Discourse AnalysisDocument16 pagesApproaches To Discourse AnalysisSaadat Hussain Shahji PanjtaniNo ratings yet

- MakerBot in The Classroom PDFDocument146 pagesMakerBot in The Classroom PDFkreatosNo ratings yet

- Midterm Examination: Henri Fayol Identified 5 Functions of Management. According To Fayol (1916), ThisDocument12 pagesMidterm Examination: Henri Fayol Identified 5 Functions of Management. According To Fayol (1916), ThisPatrizzia Ann Rose OcbinaNo ratings yet

- Teaching Innovation Currency in DisciplineDocument5 pagesTeaching Innovation Currency in Disciplineapi-393438096No ratings yet

- Ramirez, Kamille Alein M. - Komunikasyon W8Document2 pagesRamirez, Kamille Alein M. - Komunikasyon W8TcherKamilaNo ratings yet

- Ecocentrism: April 2019Document7 pagesEcocentrism: April 2019Shivam TiwariNo ratings yet

- Method Statement For Excavation and Backfilling WorksDocument2 pagesMethod Statement For Excavation and Backfilling WorksAnonymous wTTx1L86% (22)

- 3 28 19 NtapDocument199 pages3 28 19 Ntapfikri fikriNo ratings yet

- Powers and Limits of The CongressDocument3 pagesPowers and Limits of The Congressm zainNo ratings yet

- Norris Greenhouse Jr. Reasons For Ruling On Motion For Pretrial PublicityDocument11 pagesNorris Greenhouse Jr. Reasons For Ruling On Motion For Pretrial PublicityThe Town TalkNo ratings yet

- Cmbok Desktop Pocket GuideDocument36 pagesCmbok Desktop Pocket Guidemario5681100% (3)

- About LG CompanyDocument52 pagesAbout LG CompanyJonna LynneNo ratings yet

- M-38 Stern Tube SealsDocument246 pagesM-38 Stern Tube SealsMehmet AGAGÜNDÜZNo ratings yet