Professional Documents

Culture Documents

19MBA513B Corporate Finance

Uploaded by

Ruchitha PrakashCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

19MBA513B Corporate Finance

Uploaded by

Ruchitha PrakashCopyright:

Available Formats

M.B.A.

(Business Analytics)

Course Specifications: Corporate Finance

Course Title Corporate Finance

Course Code 19MBA513B

Course Type Core Theory Course

Department Management Studies

Faculty Management and Commerce

1. Course Summary

The course deals with formulation and implementation of financial decisions in a company.

Analytical ability of students is honed through concepts in order to increase firm shareholder

value. Students are taught concepts of cash management, inventory management, capital

budgeting and cost of capital. In addition, value-based management and dividend decision will be

discussed. Students are taught to evaluate tradeoff between risk and return. Further, students are

taught tools and techniques to measure asset volatility and performance in the context of a

corporation.

2. Course Size and Credits:

Number of Credits 04

Credit Structure (Lecture: Tutorial: Practical) 4:0:0

Total Hours of Interaction 70

Number of Weeks in a Semester 15

Department Responsible Management Studies

Total Course Marks 100

Pass Criterion As per the Academic Regulations

Attendance Requirement As per the Academic Regulations

3. Course Outcomes (COs)

After the successful completion of this course, the student will be able to:

CO-1. Discuss the essential principles of Financial Management

CO-2. Discuss cost of capital, capital budget, inventory value and working capital

CO-3. Analyse problems and provide solutions pertinent to the financial management

function

CO-4. Analyse financial decisions for value maximization

CO-5. Demonstrate use of financial techniques and tools in financial investment, dividend

distribution and asset management

CO-6. Solve problems related to finding optimum capital structure

4. Course Contents

Unit 1 Indian Financial system and Financial Markets: Salient features of Indian Financial System,

resource mobilization, Channelization of funds, Equity, Debt and Currency markets, markets for

short term financing requirements, financial sector reforms and financial markets, contemporary

issues

Unit 2 Introduction to Financial management: The role of Financial Management, Introduction, The

Faculty of Management and Commerce

M.B.A. (Business Analytics)

goal of a firm, Corporate governance, Organisation of Financial Management function, The Business

Environment, The Tax Environment, The Financial Environment.

Unit 3 Valuation: The Time Value of Money, the valuation of Long-term securities; Bond Valuation,

Preferred stock valuation, Common stock Valuation, Risk and Return; Defining Risk and return,

Risk and return in portfolio context, The Capital –Asset Pricing Model (CAPM), Efficient Financial

Market.

Flow of Funds Statements, Cash Flow forecasting, Cash flow estimates.

Unit 4 Working capital Management: Overview of Working Capital Management, cash and

Marketable Securities Management, Accounting Receivables and Inventory Management, Short –

Term Financing

Unit 5 Investment in Capital Assets: Capital Budgeting and Estimating Cash flows, Capital

Budgeting Techniques

Unit 6 The Cost of Capital, Capital Structure, and Dividend Policy: Required Returns and the Cost

of Capital, Operating and Financial Leverage, Capital Structure Determination, Dividend Policy

Unit 7 Intermediate and Long-Term Financing: The Capital Market, Long-Term Debt, Preferred

Stock, and Common Stock, Term Loans and Leases

Course Map (CO-PO-PSO Map)

Programme Specific Outcomes (PSOs)

PO-1 PO-2 PO-3 PO-4 PO-5 PO-6 PO-7 PO-8 PO-9 PO-10 PO-11 PSO-1 PSO-2 PSO-3 PSO-4

CO-1 3 1 1 1 1 1

CO-2 2 3 1 2

CO-3 3 2 1 1 1

CO-4 1 3 2 1 1 1

CO-5 3 2 1 1 1

CO-6 2 3 1 1 1

5. Course Teaching and Learning Methods

Total Duration

Teaching and Learning Methods Duration in hours

in Hours

Face to Face Lectures 42

Demonstrations

1. Demonstration using Videos 00

00

2. Demonstration using Physical Models / Systems 00

3. Demonstration on a Computer 00

Numeracy

10

1. Solving Numerical Problems 10

Practical Work 00

1. Course Laboratory 00

Faculty of Management and Commerce

M.B.A. (Business Analytics)

2. Computer Laboratory 00

3. Engineering Workshop / Course/Workshop /

00

Kitchen

4. Clinical Laboratory 00

5. Hospital 00

6. Model Studio 00

Others

1. Case Study Presentation 03

2. Guest Lecture 00

3. Industry / Field Visit 00 08

4. Brain Storming Sessions 05

5. Group Discussions 00

6. Discussing Possible Innovations 00

Term Tests, Laboratory Examination/Written Examination, Presentations 10

Total Duration in Hours 70

6. Course Assessment and Reassessment

The details of the components and subcomponents of course assessment are presented in the

Programme Specifications document pertaining to the M.B.A (Business Analytics). The procedure to

determine the final course marks is also presented in the Programme Specifications document.

The evaluation questions are set to measure the attainment of the COs. In either component (CE or

SEE) or subcomponent of CE (SC1, SC2, SC3 or SC4), COs are assessed as illustrated in the following

Table.

Focus of COs on each Component or Subcomponent of Evaluation

Component

Component 1: CE (50% Weightage) 2: SEE (50%

Weightage)

Subcomponent ► SC1 SC2 SC3 SC4

Assignmen Group

Subcomponent Type ► Term Test Term Test

t Task 100 Marks

Maximum Marks ► 25 25 25 25

CO-1 🞫 🞫 🞫 🞫

CO-2 🞫 🞫 🞫 🞫

CO-3 🞫 🞫 🞫

CO-4 🞫 🞫 🞫

CO-5 🞫 🞫

CO-6 🞫 🞫

The details of SC1, SC2, SC3 or SC4 are presented in the Programme Specifications

Document.

The Course Leader assigned to the course, in consultation with the Head of the Department, shall

provide the focus of COs in each component of assessment in the above template at the beginning

of the semester.

Course reassessment policies are presented in the Academic Regulations document.

Faculty of Management and Commerce

M.B.A. (Business Analytics)

7. Achieving COs

The following skills are directly or indirectly imparted to the students in the following teaching

and learning methods:

S. No Curriculum and Capabilities Skills How imparted during the course

1. Knowledge Classroom lectures

2. Understanding Classroom lectures, Self-study

3. Critical Skills Assignment

4. Analytical Skills Assignment

5. Problem Solving Skills Assignment, Examination

6. Practical Skills Assignment

7. Group Work --

8. Self-Learning Self-study

9. Written Communication Skills Assignment, Examination

10. Verbal Communication Skills --

11. Presentation Skills --

12. Behavioral Skills --

13. Information Management Assignment

14. Personal Management --

15. Leadership Skills --

8. Course Resources

a. Essential Reading

1. Class Notes

2. Text Book: Van Horne, James C and Wachowicz, John M (2015)

Fundamentals of Financial Management, 13th edition, Pearson

Education India.

b. Recommended Reading

1. Brealey, R. and Myers, S. (2014) Principles of corporate Finance. 7th edition,

McGraw Hill.

2. Gitman, L. and Zutter, C. (2012) Principles of Managerial Finance. 13th Edition,

Prentice Hall.

3. Keown, A., Martin, J. and Petty, W. (2017) Foundations of Finance.

9th Edition, Pearson Education Limited.

c. Magazines and Journals

1. The Economist

2. CFO magazine

3. eJournal of Management Accounting Research, American Accounting

Association

4. Chartered Secretary, CSA publications

5. Finance India, Review Publishing Company Ltd

Faculty of Management and Commerce

M.B.A. (Business Analytics)

6. Forbes India – Reliance Industries, Monthly

7. Business India - Fortnightly

8. Business Today – Bi-weekly

d. Websites

1. http://www.exinfm.com

2. http://www.quickmba.com/accounting/fin/

3. http://www.economist.com

4. http://www.ft.com

e. Other Electronic Resources

1. Software: MS Excel

9. Course Organization

Course Code 19BFS513B

Course Title Corporate Finance

Course Leader’s Name As per time table

Phone: 080-4536 6666

Course Leader’s Contact Details

E-mail: As per time table

Course Specifications Approval Date 23rd October 2020

Next Course Specifications Review Date May-2022

Faculty of Management and Commerce

You might also like

- Wiley CMAexcel Learning System Exam Review 2015: Part 2, Financial Decision MakingFrom EverandWiley CMAexcel Learning System Exam Review 2015: Part 2, Financial Decision MakingNo ratings yet

- Managerial Accounting Course OverviewDocument6 pagesManagerial Accounting Course OverviewRonnyNo ratings yet

- MT402 R1 Financial Accounting & ManagementDocument4 pagesMT402 R1 Financial Accounting & Managementkirtipandey271No ratings yet

- 38 kq03324 Financial Statements AuditDocument5 pages38 kq03324 Financial Statements Audit26 Đỗ Kim NgọcNo ratings yet

- Managerial Economics Course HandoutDocument3 pagesManagerial Economics Course HandoutADITYA JAMAN VAGHASIANo ratings yet

- FS Audit. Chapter 0Document9 pagesFS Audit. Chapter 0050609212050No ratings yet

- University of The Commonwealth Caribbean School of Business & ManagementDocument13 pagesUniversity of The Commonwealth Caribbean School of Business & ManagementBeyonce SmithNo ratings yet

- AC4056NI - Business Law and EthicsDocument3 pagesAC4056NI - Business Law and EthicsBigendra ShresthaNo ratings yet

- Introduction to Process Engineering (CHE100Document3 pagesIntroduction to Process Engineering (CHE100Linh VoNo ratings yet

- POR Module 1Document36 pagesPOR Module 1Suresh NarayananNo ratings yet

- ACT202 - Management AccountingDocument7 pagesACT202 - Management AccountingSHANILA AHMED KHANNo ratings yet

- Institute of Aeronautical Engineering: Master of Business AdministrationDocument6 pagesInstitute of Aeronautical Engineering: Master of Business AdministrationRammohanreddy RajidiNo ratings yet

- Course OutlineDocument7 pagesCourse Outlinehaziqhussin33No ratings yet

- FAR SYLLABUS FinalDocument13 pagesFAR SYLLABUS FinalUchiha WarrenNo ratings yet

- Master's Syllabus for Marketing ManagementDocument5 pagesMaster's Syllabus for Marketing ManagementAndreeaCNo ratings yet

- Opman 125Document8 pagesOpman 125CIAN CARLO ANDRE TANNo ratings yet

- Course Outline POA Fall 2022Document4 pagesCourse Outline POA Fall 2022Pritam ChakrabortyNo ratings yet

- Applied Portfolio Management Ms UcpDocument4 pagesApplied Portfolio Management Ms UcpSheraz HassanNo ratings yet

- ME-202L Engineering Mechanics Lab GuidelinesDocument35 pagesME-202L Engineering Mechanics Lab GuidelinesRizwan UllahNo ratings yet

- Business and Ethics Outline On WebsiteDocument3 pagesBusiness and Ethics Outline On WebsiteShabana NaveedNo ratings yet

- DCME - 6th Sem SyllabusDocument6 pagesDCME - 6th Sem Syllabusshashi preethamNo ratings yet

- Module Lab Managerial Accounting (MGT)Document36 pagesModule Lab Managerial Accounting (MGT)Elleana YauriNo ratings yet

- Om2 PDFDocument5 pagesOm2 PDFAliNo ratings yet

- Fluid Mechanics Course DescriptionDocument11 pagesFluid Mechanics Course Descriptiondurga sharmaNo ratings yet

- 5.industrial EconomicsDocument11 pages5.industrial Economicsram jrpsNo ratings yet

- 5TH SemDocument19 pages5TH Semskbehera33No ratings yet

- Perform Separation Operations For Purification of Raw Materials and ProductsDocument11 pagesPerform Separation Operations For Purification of Raw Materials and ProductsCliches inNo ratings yet

- CCM 2BBL331 CM Sem III (22-23)Document17 pagesCCM 2BBL331 CM Sem III (22-23)Yogita SinghNo ratings yet

- Higher Canadian Institute Taxation Course ReportDocument8 pagesHigher Canadian Institute Taxation Course ReportShehab HassanNo ratings yet

- MLOM 715 - Purchasing and Sourcing StrategyDocument4 pagesMLOM 715 - Purchasing and Sourcing StrategyDhanabal WiskillNo ratings yet

- BTF Sylallabus 2023 - DraftDocument6 pagesBTF Sylallabus 2023 - DraftNga PhamNo ratings yet

- Syllabus For Bachelor of Technology Chemical EngineeringDocument3 pagesSyllabus For Bachelor of Technology Chemical Engineeringsnow ivoryNo ratings yet

- Me Ae CD Ug23Document14 pagesMe Ae CD Ug23AAYUSH ATHAVALENo ratings yet

- SYLLABUS-Cost & Management AccountingDocument3 pagesSYLLABUS-Cost & Management AccountinglakshmiNo ratings yet

- BUSINESS ECONOMICS SYLLABUSDocument5 pagesBUSINESS ECONOMICS SYLLABUSeleonora vinessaNo ratings yet

- OPTIMIZING CHEMICAL PROCESSES (CHE1011Document16 pagesOPTIMIZING CHEMICAL PROCESSES (CHE1011ermiasNo ratings yet

- AF Course Outline Sem 2 201617Document10 pagesAF Course Outline Sem 2 201617Khairul AmirNo ratings yet

- (MBA ACC Major OBE CO) Financial Statement AnalysisDocument7 pages(MBA ACC Major OBE CO) Financial Statement AnalysisMahfuz Ur RahmanNo ratings yet

- Course Outline 2020SS and NotesDocument17 pagesCourse Outline 2020SS and NotesCindy YinNo ratings yet

- MACC7001 Course OutlineDocument5 pagesMACC7001 Course Outline南玖No ratings yet

- Online Consumer Relationship Management SyllabusDocument4 pagesOnline Consumer Relationship Management SyllabusAndreeaCNo ratings yet

- ACC200 33-77 22-23 Winter SiddiqueDocument8 pagesACC200 33-77 22-23 Winter SiddiqueMariamNo ratings yet

- CO-Management Accounting and Control-2022-24Document13 pagesCO-Management Accounting and Control-2022-24GitanshNo ratings yet

- TQM Unit1-Rmk GroupDocument76 pagesTQM Unit1-Rmk GroupKarthi KeyanNo ratings yet

- 614 Course Name: Financial AccountingDocument10 pages614 Course Name: Financial AccountingShiv Shankar ShuklaNo ratings yet

- Jaipuria PGDM Managerial Economics CourseDocument7 pagesJaipuria PGDM Managerial Economics CoursepalakNo ratings yet

- 350FIN Investment AnalysisDocument5 pages350FIN Investment AnalysisNguyen Dac ThichNo ratings yet

- FAR SYLLABUS FinalDocument13 pagesFAR SYLLABUS FinalUchiha WarrenNo ratings yet

- 32civsyllDocument63 pages32civsyllTamil Selvi CIVILNo ratings yet

- ECODocument3 pagesECOVikasNo ratings yet

- BSC 1st Sem CoursesDocument41 pagesBSC 1st Sem CoursesashmitaNo ratings yet

- Module Audit 1 Genap 2021 - 2022Document48 pagesModule Audit 1 Genap 2021 - 2022Catarine TarunaNo ratings yet

- Process Control Lab Manual StudentsDocument87 pagesProcess Control Lab Manual StudentsHadia SAULATNo ratings yet

- PGDM Accounting Fundamentals Course OverviewDocument13 pagesPGDM Accounting Fundamentals Course OverviewAditya SinghNo ratings yet

- Business Accounting SyllabusDocument4 pagesBusiness Accounting Syllabusitsteesha2244No ratings yet

- Business Ethics (MGT503)Document5 pagesBusiness Ethics (MGT503)Kyaw HtutNo ratings yet

- Course OutlineDocument6 pagesCourse OutlinebeenishNo ratings yet

- Python For Finance - 22-24Document11 pagesPython For Finance - 22-24Nitin TantedNo ratings yet

- Software TestingDocument10 pagesSoftware TestingjsspdacsNo ratings yet

- Fybim - Revised SyllabusDocument50 pagesFybim - Revised Syllabusnishchalshetty1323No ratings yet

- Course Code:19BFS507A Investment Banking and Financial ServicesDocument25 pagesCourse Code:19BFS507A Investment Banking and Financial ServicesRuchitha PrakashNo ratings yet

- JMP certificateDocument1 pageJMP certificateRuchitha PrakashNo ratings yet

- Course Code:19BFS507A Investment Banking and Financial ServicesDocument58 pagesCourse Code:19BFS507A Investment Banking and Financial ServicesRuchitha PrakashNo ratings yet

- Ex1. Desai ProblemsDocument18 pagesEx1. Desai ProblemsRuchitha PrakashNo ratings yet

- Investment Banking and Financial Services: Ms. Reshma Reshma - Ms.mc@msruas - Ac.inDocument40 pagesInvestment Banking and Financial Services: Ms. Reshma Reshma - Ms.mc@msruas - Ac.inRuchitha PrakashNo ratings yet

- IFM Session 1 IntroductionDocument47 pagesIFM Session 1 IntroductionRuchitha PrakashNo ratings yet

- International Financial Management Unit 1Document49 pagesInternational Financial Management Unit 1Ruchitha PrakashNo ratings yet

- Course Title: Investment Banking and Financial ServicesDocument13 pagesCourse Title: Investment Banking and Financial ServicesRuchitha PrakashNo ratings yet

- Problems On - Exchange Rate DeterminationDocument19 pagesProblems On - Exchange Rate DeterminationRuchitha PrakashNo ratings yet

- IFM Answers Key 1Document9 pagesIFM Answers Key 1Ruchitha PrakashNo ratings yet

- International Financial ManagementDocument454 pagesInternational Financial ManagementRuchitha PrakashNo ratings yet

- Van Horne Numericals Operating and Financial LeverageDocument9 pagesVan Horne Numericals Operating and Financial LeverageRuchitha PrakashNo ratings yet

- Lesson Plan For International FInanceDocument6 pagesLesson Plan For International FInanceRuchitha PrakashNo ratings yet

- Hedging Currency Risks: at AifsDocument16 pagesHedging Currency Risks: at AifsRuchitha PrakashNo ratings yet

- Assignment QuestionDocument3 pagesAssignment QuestionRuchitha PrakashNo ratings yet

- Assignment Part ADocument18 pagesAssignment Part ARuchitha PrakashNo ratings yet

- International Financial Management Unit 2Document35 pagesInternational Financial Management Unit 2Ruchitha PrakashNo ratings yet

- Van Horne Problems Capital BudgetingDocument10 pagesVan Horne Problems Capital BudgetingRuchitha PrakashNo ratings yet

- Self-Correction Theory and Problem QuestionsDocument7 pagesSelf-Correction Theory and Problem QuestionsRuchitha PrakashNo ratings yet

- Van Horne Problems TVMDocument8 pagesVan Horne Problems TVMRuchitha PrakashNo ratings yet

- Session # 4 Risk and Return - II $Document9 pagesSession # 4 Risk and Return - II $ajayuselessNo ratings yet

- Van Horne Numericals in Working Capital ManagementDocument6 pagesVan Horne Numericals in Working Capital ManagementRuchitha PrakashNo ratings yet

- Van Horne Problems AR and InventoryDocument9 pagesVan Horne Problems AR and InventoryRuchitha PrakashNo ratings yet

- M.B.A International Finance CourseDocument5 pagesM.B.A International Finance CourseRuchitha PrakashNo ratings yet

- Van Horne Numericals in Dividend PolicyDocument12 pagesVan Horne Numericals in Dividend PolicyRuchitha PrakashNo ratings yet

- Van Horne Numericals Capital StructureDocument13 pagesVan Horne Numericals Capital StructureRuchitha PrakashNo ratings yet

- Questions From Chapters For Corporate FinanceDocument1 pageQuestions From Chapters For Corporate FinanceRuchitha PrakashNo ratings yet

- New Microsoft Excel Worksheet NS1Document2 pagesNew Microsoft Excel Worksheet NS1Ruchitha PrakashNo ratings yet

- Van Horne Numericals Cash ManagementDocument5 pagesVan Horne Numericals Cash ManagementRuchitha PrakashNo ratings yet

- M 2 L 3Document7 pagesM 2 L 3Khai HuynhNo ratings yet

- Emailing Complete Business Statistics - Amir D. AczelDocument888 pagesEmailing Complete Business Statistics - Amir D. AczelAnuj KumarNo ratings yet

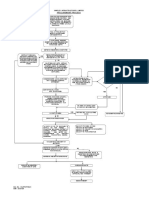

- 27 Flow Chart For Procurement Process Rev1Document1 page27 Flow Chart For Procurement Process Rev1Prasanta ParidaNo ratings yet

- Dynamics of Regulator Functionality: An Assessment of The Legal and Institutional Frameworks of The Nigeria Securities and Exchange CommissionDocument21 pagesDynamics of Regulator Functionality: An Assessment of The Legal and Institutional Frameworks of The Nigeria Securities and Exchange CommissionGabriel AdenyumaNo ratings yet

- Instagram Commerce in The Time of Influenced Purchase Decision - Kirtika ChhetiaDocument2 pagesInstagram Commerce in The Time of Influenced Purchase Decision - Kirtika ChhetiaKirtika ChetiaNo ratings yet

- Notes-Biological AssetsDocument2 pagesNotes-Biological AssetsMary Justine PaquibotNo ratings yet

- MXP 3 M9 F ITSh BNVK7911Document52 pagesMXP 3 M9 F ITSh BNVK7911Noshaba MaqsoodNo ratings yet

- Hilton CH 5 Select SolutionsDocument42 pagesHilton CH 5 Select Solutionsangganteng13No ratings yet

- Pwonlyias Gs 04 Model AnswerDocument37 pagesPwonlyias Gs 04 Model Answerthakursinghkaran8No ratings yet

- Presentation on Puma Brand Life CycleDocument24 pagesPresentation on Puma Brand Life Cyclenicks1988No ratings yet

- Model Final Exam - Total Quality ManagementDocument11 pagesModel Final Exam - Total Quality ManagementEman Essam100% (2)

- INTRO TO INTERNATIONAL TRADEDocument17 pagesINTRO TO INTERNATIONAL TRADEAndy SugiantoNo ratings yet

- RE: POLICY #: A13267806PLA NAME OF INSURED: Ossilien ThimotDocument1 pageRE: POLICY #: A13267806PLA NAME OF INSURED: Ossilien ThimotAndre SenabNo ratings yet

- GRM - Day 1.1Document279 pagesGRM - Day 1.1Tim KraftNo ratings yet

- Application DocsDocument54 pagesApplication Docsthe next miamiNo ratings yet

- 1JSBED597588AU3081Document23 pages1JSBED597588AU3081Sasquarch VeinNo ratings yet

- 3 MienDocument3 pages3 MienNgọc Tú K17No ratings yet

- Partnership Accounting With AnsDocument22 pagesPartnership Accounting With Ansjessica amorosoNo ratings yet

- Paschim Gujarat Vij Co. LTD: PGVCLDocument7 pagesPaschim Gujarat Vij Co. LTD: PGVCLHardikNo ratings yet

- FS Final OutputDocument62 pagesFS Final OutputMariael PinasoNo ratings yet

- International Trade Law: SEMESTER IX - B.A. LL.B. (Hons.) Syllabus (Session: July-December 2022)Document13 pagesInternational Trade Law: SEMESTER IX - B.A. LL.B. (Hons.) Syllabus (Session: July-December 2022)shiviNo ratings yet

- Drill 4 AK FSUU AccountingDocument10 pagesDrill 4 AK FSUU AccountingRobert CastilloNo ratings yet

- (Workshop Practice Series 06) Law Ivan - Measuring and Marking Metals-Argus Books LTD (1985)Document109 pages(Workshop Practice Series 06) Law Ivan - Measuring and Marking Metals-Argus Books LTD (1985)Julian MNo ratings yet

- Intervention Application (Scanned Copy)Document118 pagesIntervention Application (Scanned Copy)Shravani wagheNo ratings yet

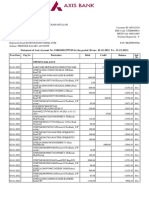

- Statement of Axis Account No:918010022379745 For The Period (From: 01-01-2022 To: 31-12-2022)Document75 pagesStatement of Axis Account No:918010022379745 For The Period (From: 01-01-2022 To: 31-12-2022)Murugesh SalemNo ratings yet

- MEDICI RegTech Executive Summary PDFDocument16 pagesMEDICI RegTech Executive Summary PDFrenukaramaniNo ratings yet

- Using Social Media for Recruitment: Pros, Cons and TrendsDocument47 pagesUsing Social Media for Recruitment: Pros, Cons and TrendsTrusha SharmaNo ratings yet

- Information Security Giovanni PojidaDocument14 pagesInformation Security Giovanni Pojidaapi-279611355No ratings yet

- Project Management FundamentalsDocument25 pagesProject Management FundamentalsAmo Frimpong-Manso100% (1)

- APEDA Exporter Directory in RajasthanDocument21 pagesAPEDA Exporter Directory in RajasthanSandeep BhandariNo ratings yet

- BCA-3rd-Sem-2022-23 (1) - 231123 - 060059Document12 pagesBCA-3rd-Sem-2022-23 (1) - 231123 - 060059satya.bhatia123456No ratings yet