Professional Documents

Culture Documents

Pooja Patra Corporate Governance Assignment

Uploaded by

raj vardhan agarwal0 ratings0% found this document useful (0 votes)

24 views5 pagesOriginal Title

Pooja Patra corporate governance assignment

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

24 views5 pagesPooja Patra Corporate Governance Assignment

Uploaded by

raj vardhan agarwalCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 5

Pooja Rani Patra

BBA llb sem 9

A90821517033

Corporate governance assignment

Functions of a Promoter:

The Promoter Performs the following main functions:

1. To conceive an idea of forming a company and explore its possibilities

2. To conduct the necessary negotiation for the purchase of business in case it is intended to

purchase as existing business. In this context, the help of experts may be taken, if

considered necessary.

3. To collect the requisite number of persons (i.e. seven in case of a public company and

two in case of a private company) who can sign the ‘Memorandum of Association’ and

‘Articles of Association’ of the company and also agree to act as the first directors of the

company.

4. To decide about the following:

(i) The name of the Company

(ii) The location of its registered office,

(iii) The amount and form of its share capital,

(iv) The brokers or underwriters for capital issue, if necessary

(v) The bankers,

(vi) The auditors,

(vii) The legal advisers.

5. To get the Memorandum of Association (M/A) and Articles of Association (A/A) drafted

and printed.

6. To make preliminary contracts with vendors, underwriters, etc.

7. To make arrangement for the preparation of prospectus, its filing, advertisement and issue

of capital.

8. To arrange for the registration of company and obtain the certificate of incorporation.

9. To defray preliminary expenses.

10. To arrange the minimum subscription.

Legal Position of a Promoter:

The promoter is neither a trustee nor an agent of the company because there is no company yet in

existence. The correct way to describe his legal position is that he stands in a fiduciary position

towards the company about to be formed.

Lord Cairns has correctly stated the position of promoter in Erlanger V. New Semberero

Phophate Co. “The promoters of a company stand undoubtedly in a fiduciary position. They have

in their hands the creation and moulding of the company. They have the power of defining how

and when and in what shape and under what supervision, it shall start into existence and begin to

act as a trading corporation.”

From the fiduciary position of promoters, the two important results follow:

(1) A promoter cannot be allowed to make any secret profits. If it is found that in any

particular transaction of the company, he has obtained a secret profit for himself, he will

be bound to refund the same to the company.

(2) The promoter is not allowed to derive a profit from the sale of his own property to the

company unless all material facts are disclosed. If he contracts to sell his own property to

the company without making a full disclosure, the company may either repudiate/rescind

the sale or affirm the contract and recover the profit made out of it by the promoter.

A promoter who wishes to sell his own property to the company must make a full disclosure of

his interest.

The disclosure may be made:

(i) To an independent Board of Directors, or

(ii) In the articles of association of the company, or

(iii) In the prospectus, or

(iv) To the existing and intended shareholders directly.

If the promoter fails to discharge the obligation demanded of his fiduciary position the company

may rescind the contract or may in the alternative choose to take advantage of the contract and

sue the promoter for damages for breach of his duty to the company.

Secret profits on the sale of property can be recovered from a promoter only when the property

was bought and sold to the company while he was acting as a promoter.

Rights of Promoter:

The rights of promoters are enumerated as follows:

1. Right of indemnity:

Where more than one person act as the promoters of the company, one promoter can claim

against another promoter for the compensation and damages paid by him. Promoters are

severally and jointly liable for any untrue statement given in the prospectus and for the secret

profits.

2. Right to receive the legitimate preliminary expenses:

A promoter is entitled to receive the legitimate preliminary expenses which he has incurred in

the process of formation of the company such as cost of advertisement, fee of solicitor and

surveyors. The right to receive the preliminary expenses is not a contractual right. It depends

upon the discretion of the directors of the company. The claim for expenses should be supported

by vouchers.

3. Right to receive the remuneration:

A promoter has no right against the company for his remuneration unless there is a contract to

that effect. In some cases, articles of the company provide for the directors paying a specified

amount to promoters for their services but this does not give the promoters any contractual right

to sue the company. This is simply an authority vested in the directors of the company.

However, the promoters are usually the directors, so that in practice the promoters will receive

their remuneration.

The remuneration may be paid in any of the following ways:

(i) A commission may be paid to the promoter on the purchase price of the business or

property taken over by the company throughhim.

(ii) The promoters may be granted by the company a lumpsum amount.

(iii) The promoters may be given fully or partly paid shares in consideration of their

services rendered.

(iv) The promoter may be given a commission at a fixed rate on the shares sold.

(v) The promoter may purchase the business or other property and sell the same to the

company at an inflated price. He must disclose this fact.

(vi) The promoters may take an option to subscribe within a fixed period for a certain

portion of the company’s unissued shares at par.

Whatever be the nature of remuneration, it must be disclosed in the prospectus if paid within the

preceding two years from the date of prospectus.

Duties of Promoter:

The duties of promoters are as follows:

1. To disclose the secret profit:

The promoter should not make any secret profit. If he has made any secret profit, it is his duty to

disclose all the money secretly obtained by way of profit. He is empowered to deduct the

reasonable expenses incurred by him.

2. To disclose all the material facts:

The promoter should disclose all the material facts. If a promoter contracts to sell the company a

property without making a full disclosure, and the property was acquired by him at a time when

he stood in a fiduciary position towards the company, the company may either repudiate the sale

or affirm the contract and recover the profit made out of it by the promoters.

3. The promoter must make good to the company what he has obtained as a trustee:

A promoters stands in fiduciary position towards the company. It is the duty of the promoter to

make good to the company what he has obtained as trustee and not what he may get at any time.

4. Duty to disclose private arrangements:

It is the duty of the promoter to disclose all the private arrangement resulting him profit by the

promotion of the company.

5. Duty of promoter against the future allottees:

When it is said the promoters stand in a fiduciary position towards the company then it does not

mean that they stand in such relation only to the company or to the signatories of memorandums

of company and they will also stand in this relation to the future allottees of the shares.

Liabilities of Promoter:

The liabilities of promoters are given below:

1. Liability to account in profit:

As we have already discussed that promoter stands in a fiduciary position to the company. The

promoter is liable to account to the company for all secret profits made by him without full

disclosure to the company. The company may adopt any one of the following two courses if the

promoter fails to disclose the profit.

(i)The company can sue the promoter for an amount of profit and recover the same with interest.

(ii) The company can rescind the contract and can recover the money paid.

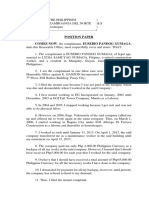

2. Liability for mis-statement in the prospectus:

Section 62(1) holds the promoter liable to pay compensation to every person who subscribes for

any share or debentures on the faith of the prospectus for any loss or damage sustained by reason

of any untrue statement included in it. Sec. on 62 also provides certain grounds on which a

promoter can avoid his liability. Similarly Sec. 63 provides for criminal liability for mis-

statement in the prospectus and a promoter may also become liable under this section.

The promoter may also be imprisoned for a term which may extend to two years or may be

punished with the fine upto Rs. 5,000 for untrue statement in the prospectus. (Sec. 63).

3. Personal liability:

The promoter is personally liable for all contracts made by him on behalf of the company until

the contracts have been discharged or the company takes over the liability of the promoter.

The death of promoter does not relieve him from liabilities.

4. Liability at the time of winding up of the company:

In the course of winding up of the company, on an application made by the official liquidator,

the court may make a promoter liable for misfeasance or breach of trust. (Sec. 543).

Further where fraud has been alleged by the liquidator against a promoter, the court may order

for his public examination. (Sec. 478).

Preliminary Contracts/Pre-Incorporation Contracts Made by the Promoters:

Preliminary contracts are those contracts which are made by the promoters with different parties

on behalf of the company yet to be incorporated. Such contracts are generally entered into by

promoters to acquire some property or right for and on behalf of the company to be formed.

The promoters enter into preliminary contracts, generally as agents or trustees of the company.

Such contracts are not legally binding on the company because two consenting parties are

necessary to a contract whereas the company is nonentity before incorporation.

The company has no legal existence until it is incorporated. It therefore follows:

1. That when, the company is registered, it is not bound by the preliminary contract.

2. That the company when registered cannot ratify the agreement. The company was not a

principal with contractual capacity at the time of contract. A contract can be ratified only

when it is made by an agent for a principal who is in existence and who is competent to

contract at the time when the contract is made.

3. That if the agent undertook any liability under the agreement, he would be personally

liable notwithstanding that he is described in the agreement as an agent and that the

company may have attempted to ratify the agreement.

4. The company cannot enforce the preliminary agreement.

The preliminary contracts made by promoters generally provided that if the company adopts the

agreement the promoter’s liability shall cease and if the company does not adopt the agreement

within a certain time either party may rescind the contract. In such a case promoter’s liability

would cease after the lapse of fixed time.

You might also like

- Naughty Company LawDocument17 pagesNaughty Company LawMOHAMAMD ZIYA ANSARINo ratings yet

- Meaning of A PromoterDocument7 pagesMeaning of A PromoterUsama ZafarNo ratings yet

- Unit-2 Company LawDocument15 pagesUnit-2 Company LawVishi AwasthiNo ratings yet

- 07 - Company Law - PROMOTERDocument6 pages07 - Company Law - PROMOTERPadmasree HarishNo ratings yet

- Rights and Liabilities of PromotersDocument9 pagesRights and Liabilities of PromotersSyed Huzaifa Ahmed (Larf Nalavale)No ratings yet

- PromoterDocument11 pagesPromoterabdalla mwakutalaNo ratings yet

- Company LawDocument9 pagesCompany LawvramendraNo ratings yet

- Promoters: Farzana Yeasmin MehanazDocument14 pagesPromoters: Farzana Yeasmin MehanazManjare Hassin RaadNo ratings yet

- Duties and remedies of promotersDocument2 pagesDuties and remedies of promotersPriety SinghaniaNo ratings yet

- CL (Promoters)Document7 pagesCL (Promoters)Neha TiwariNo ratings yet

- Company Law 2nd UnitDocument9 pagesCompany Law 2nd Unitmohd sakibNo ratings yet

- Corporate LawDocument13 pagesCorporate LawpushpNo ratings yet

- Module 2 - Company FormationDocument76 pagesModule 2 - Company FormationAryaman BhauwalaNo ratings yet

- Unit 1 - Part 3Document4 pagesUnit 1 - Part 3Ridhima AggarwalNo ratings yet

- Company LawDocument9 pagesCompany LawAyush SemwalNo ratings yet

- Promoter Functions, Rights, Duties and LiabilitiesDocument5 pagesPromoter Functions, Rights, Duties and LiabilitiesAbhinav Palsikar100% (1)

- Promote Company SuccessDocument4 pagesPromote Company SuccessTaiyabaNo ratings yet

- Promoters of A CompanyDocument18 pagesPromoters of A CompanykritiNo ratings yet

- Duties of PromoterDocument2 pagesDuties of Promoterpartha434No ratings yet

- PromotorDocument6 pagesPromotor26amitNo ratings yet

- Unit 5Document12 pagesUnit 5جاين شاكوNo ratings yet

- UnitII (1)Document23 pagesUnitII (1)lakshmi17102004No ratings yet

- Definition of PromoterDocument5 pagesDefinition of PromoterAhmed HaneefNo ratings yet

- Meaning of Misstatement of ProspectusDocument15 pagesMeaning of Misstatement of ProspectusShobha MohandasNo ratings yet

- The role and duties of a promoter in business formationDocument8 pagesThe role and duties of a promoter in business formationAkshay AnandNo ratings yet

- Corporate Law Question BankDocument14 pagesCorporate Law Question BankswapniljainNo ratings yet

- CFDocument23 pagesCFMohit ThakurNo ratings yet

- MIDTERMS - Bus OrgDocument5 pagesMIDTERMS - Bus OrgAxel FontanillaNo ratings yet

- Promoters' Fiduciary Duties & LiabilitiesDocument11 pagesPromoters' Fiduciary Duties & LiabilitiesSaurabh YadavNo ratings yet

- Corporate Law Tutorial QuestionsDocument9 pagesCorporate Law Tutorial QuestionsSooXueJiaNo ratings yet

- Company Law ct1Document7 pagesCompany Law ct1TANISHA ISLAM SHENIZNo ratings yet

- Prepared By: Gargi Jain Kena Shah PGPIBM (2010-2012)Document13 pagesPrepared By: Gargi Jain Kena Shah PGPIBM (2010-2012)kena17No ratings yet

- BBA VI Company Law PromotersDocument54 pagesBBA VI Company Law PromotersIsha aggarwalNo ratings yet

- The Formation of A CompanyDocument17 pagesThe Formation of A Companyshakti ranjan mohantyNo ratings yet

- Promoters Duties and Liabilities of PromotersDocument12 pagesPromoters Duties and Liabilities of PromotersAishwarya B.ANo ratings yet

- Role of PromoterDocument10 pagesRole of PromoterMewish FzNo ratings yet

- Nisha Gupta - Corporate Governance AssignmentDocument5 pagesNisha Gupta - Corporate Governance Assignmentraj vardhan agarwalNo ratings yet

- Rajshri Singh - Corporate Governance AssignmentDocument5 pagesRajshri Singh - Corporate Governance Assignmentraj vardhan agarwalNo ratings yet

- Q1. (Tute 3) Who Is Promoter?: Types of PromotersDocument6 pagesQ1. (Tute 3) Who Is Promoter?: Types of PromotersWinging FlyNo ratings yet

- Claw Ch3 Formation of A CompanyDocument20 pagesClaw Ch3 Formation of A CompanyNeha RohillaNo ratings yet

- Forming a Company EssentialsDocument9 pagesForming a Company EssentialsSASNo ratings yet

- Promotion & Formation of A CompanyDocument41 pagesPromotion & Formation of A Companya_mayani01100% (3)

- Csa Unit 1 SSMRV CollegeDocument16 pagesCsa Unit 1 SSMRV CollegeSHASHANK RAJ RPNo ratings yet

- Law AssignmentDocument12 pagesLaw AssignmentAnusuya JhawarNo ratings yet

- State The Importance of A Prospectus. Discuss The Consequences of Mis-Statement in A Prospectus?Document11 pagesState The Importance of A Prospectus. Discuss The Consequences of Mis-Statement in A Prospectus?Shilpan ShahNo ratings yet

- Samplenewf93d260afad1Document17 pagesSamplenewf93d260afad1anonymous.person10xNo ratings yet

- Formation of A CompanyDocument11 pagesFormation of A CompanyGarv GroverNo ratings yet

- Corporate Governance 17 - 9 - 21Document5 pagesCorporate Governance 17 - 9 - 21raj vardhan agarwalNo ratings yet

- Company LawDocument4 pagesCompany LawShibu ShashankNo ratings yet

- CE Chapter 1Document14 pagesCE Chapter 1nabhayNo ratings yet

- Module II (Autosaved)Document10 pagesModule II (Autosaved)SatyamNo ratings yet

- Formation OF Company: Presented By: Vanisha Assistant Prof. (Commerce & Management)Document15 pagesFormation OF Company: Presented By: Vanisha Assistant Prof. (Commerce & Management)vanishachhabra5008No ratings yet

- Corporate Governance Assignment (Raj Vardhan Agarwal) 17!9!21Document5 pagesCorporate Governance Assignment (Raj Vardhan Agarwal) 17!9!21raj vardhan agarwalNo ratings yet

- Steps To Be Taken To Get Incorporated A Private Limited CompanyDocument7 pagesSteps To Be Taken To Get Incorporated A Private Limited CompanyRajeev SinghNo ratings yet

- Formation and Incorporation of a CompanyDocument28 pagesFormation and Incorporation of a CompanyRISHI CHANDAKNo ratings yet

- Company PromotersDocument13 pagesCompany PromotersMeraNo ratings yet

- Promoter Duties and Liabilities in Corporate LawDocument13 pagesPromoter Duties and Liabilities in Corporate LawJin KnoxvilleNo ratings yet

- Corporate Governance AssignmentDocument5 pagesCorporate Governance Assignmentraj vardhan agarwalNo ratings yet

- Company Law Lesson On Promoters (Autosaved)Document21 pagesCompany Law Lesson On Promoters (Autosaved)William MushongaNo ratings yet

- Accounts Project Assingment 2 (Raj Vardhan Agarwal 1782084)Document6 pagesAccounts Project Assingment 2 (Raj Vardhan Agarwal 1782084)raj vardhan agarwalNo ratings yet

- Accounts Project Assingment 1 (Raj Vardhan Agarwal 1782084)Document8 pagesAccounts Project Assingment 1 (Raj Vardhan Agarwal 1782084)raj vardhan agarwalNo ratings yet

- Change Management ProcessDocument13 pagesChange Management Processraj vardhan agarwalNo ratings yet

- Supreme Court orders Punjab to hand over SYL canal worksDocument2 pagesSupreme Court orders Punjab to hand over SYL canal worksraj vardhan agarwalNo ratings yet

- SC to Determine if Temple Entry Ban on Women Violates ConstitutionDocument13 pagesSC to Determine if Temple Entry Ban on Women Violates Constitutionraj vardhan agarwalNo ratings yet

- RTI 1 Constitutional Law Practice (Raj Vardhan Agarwal)Document1 pageRTI 1 Constitutional Law Practice (Raj Vardhan Agarwal)raj vardhan agarwalNo ratings yet

- Doctor's Negligence Leads to Patient's DeathDocument3 pagesDoctor's Negligence Leads to Patient's Deathraj vardhan agarwalNo ratings yet

- WRIT PETITION (Raj Vardhan Agarwal) 1782084Document2 pagesWRIT PETITION (Raj Vardhan Agarwal) 1782084raj vardhan agarwalNo ratings yet

- Raj Vardhan Agarwal (NTCC Report Word File) 6TH SemesterDocument7 pagesRaj Vardhan Agarwal (NTCC Report Word File) 6TH Semesterraj vardhan agarwalNo ratings yet

- Ipr Rough Project MainDocument21 pagesIpr Rough Project Mainraj vardhan agarwalNo ratings yet

- Writ Petition Constitutional Law Practice (Raj Vardhan Agarwal)Document6 pagesWrit Petition Constitutional Law Practice (Raj Vardhan Agarwal)raj vardhan agarwalNo ratings yet

- Topic - Develop BCG Matrix On Unilever ProductsDocument15 pagesTopic - Develop BCG Matrix On Unilever Productsraj vardhan agarwalNo ratings yet

- Article On Tandav Web Series (2) Re - EditedDocument5 pagesArticle On Tandav Web Series (2) Re - Editedraj vardhan agarwalNo ratings yet

- Power of Attorney Project RAJ VARDHAN AGARWALDocument8 pagesPower of Attorney Project RAJ VARDHAN AGARWALraj vardhan agarwalNo ratings yet

- Administrative Law Assignment 7Document4 pagesAdministrative Law Assignment 7raj vardhan agarwalNo ratings yet

- Administrative Law Assignment 6Document5 pagesAdministrative Law Assignment 6raj vardhan agarwalNo ratings yet

- Administrative Law Assignment 8Document6 pagesAdministrative Law Assignment 8raj vardhan agarwalNo ratings yet

- Environmental Studies and Law Assignment 1Document4 pagesEnvironmental Studies and Law Assignment 1raj vardhan agarwalNo ratings yet

- Mergers and Acquisitions Internal ExamDocument3 pagesMergers and Acquisitions Internal Examraj vardhan agarwalNo ratings yet

- Environmental Studies and Law Assignment 2Document4 pagesEnvironmental Studies and Law Assignment 2raj vardhan agarwalNo ratings yet

- Raj Vardhan Agarwal Environmental Studies and Law 2 ProjectDocument12 pagesRaj Vardhan Agarwal Environmental Studies and Law 2 Projectraj vardhan agarwalNo ratings yet

- Raj Vardhan Agarwal Online Research Assignment 4Document4 pagesRaj Vardhan Agarwal Online Research Assignment 4raj vardhan agarwalNo ratings yet

- Viva Transportation Law 8th SemDocument1 pageViva Transportation Law 8th Semraj vardhan agarwalNo ratings yet

- Raj Vardhan Agarwal Online Research Assignment 2Document6 pagesRaj Vardhan Agarwal Online Research Assignment 2raj vardhan agarwalNo ratings yet

- Raj Vardhan Agarwal Online Research Assignment 1Document9 pagesRaj Vardhan Agarwal Online Research Assignment 1raj vardhan agarwalNo ratings yet

- Raj Vardhan Agarwal Online Research Questionnaire ProjectDocument9 pagesRaj Vardhan Agarwal Online Research Questionnaire Projectraj vardhan agarwalNo ratings yet

- Raj Vardhan Agarwal Online Research Assignment 1Document9 pagesRaj Vardhan Agarwal Online Research Assignment 1raj vardhan agarwalNo ratings yet

- Raj Vardhan Agarwal Online Research Assignment 5Document3 pagesRaj Vardhan Agarwal Online Research Assignment 5raj vardhan agarwalNo ratings yet

- Raj Vardhan Agarwal Online Research Assignment 3Document2 pagesRaj Vardhan Agarwal Online Research Assignment 3raj vardhan agarwalNo ratings yet

- M LawDocument4 pagesM Lawrakesh agrawalNo ratings yet

- Case Digest of People Vs Carino 7 SCRA 900Document2 pagesCase Digest of People Vs Carino 7 SCRA 900Lord Jester AguirreNo ratings yet

- CA upholds validity of quitclaim in illegal dismissal caseDocument10 pagesCA upholds validity of quitclaim in illegal dismissal caseKaren Ryl Lozada BritoNo ratings yet

- Rem Matrix FinalsDocument5 pagesRem Matrix FinalsBoom ManuelNo ratings yet

- PPD 449 Cockfighting Law of 1974Document5 pagesPPD 449 Cockfighting Law of 1974bienvenido.tamondong TamondongNo ratings yet

- Macondary Co. v Commissioner of CustomsDocument4 pagesMacondary Co. v Commissioner of CustomsPipoy AmyNo ratings yet

- My Torts OutlineDocument35 pagesMy Torts OutlineJohnlouisjohnsonNo ratings yet

- Know All Men by These Presents:: Special Power of AttorneyDocument2 pagesKnow All Men by These Presents:: Special Power of AttorneyKaycee Gretz LorescaNo ratings yet

- United States v. Elder, 177 U.S. 104 (1900)Document20 pagesUnited States v. Elder, 177 U.S. 104 (1900)Scribd Government DocsNo ratings yet

- IRLL Week 8 Disciplinary ActionDocument9 pagesIRLL Week 8 Disciplinary ActionahmadNo ratings yet

- Pioneer Texturizing Corp. vs. NLRCDocument23 pagesPioneer Texturizing Corp. vs. NLRCpoiuytrewq9115No ratings yet

- York County Court Oct. 12Document4 pagesYork County Court Oct. 12York Daily Record/Sunday NewsNo ratings yet

- BSP Receivership Authority Without Prior HearingDocument1 pageBSP Receivership Authority Without Prior HearingRoseller SasisNo ratings yet

- NepotismDocument2 pagesNepotismscarlette.ivy.0892No ratings yet

- Affidavit Details College Membership and Online Admission ProcessDocument3 pagesAffidavit Details College Membership and Online Admission ProcessKamlaNehruNo ratings yet

- Letter To SCBA PresidentDocument11 pagesLetter To SCBA PresidentThe Wire100% (1)

- Apaitan CaseDigestDocument3 pagesApaitan CaseDigestStefany ApaitanNo ratings yet

- Balasa V PeopleDocument4 pagesBalasa V PeopleJC AbalosNo ratings yet

- Court overturns drug conviction due to lack of media witnessDocument2 pagesCourt overturns drug conviction due to lack of media witnessAnonymous aDY1FFGNo ratings yet

- Texas Law Manual Web KT v1 S 0614Document160 pagesTexas Law Manual Web KT v1 S 0614Kristin MurphyNo ratings yet

- Charges Upon and Obligations of The Conjugal PartnershipDocument13 pagesCharges Upon and Obligations of The Conjugal PartnershipSheie WiseNo ratings yet

- CNLU HART-FULLER DEBATEDocument19 pagesCNLU HART-FULLER DEBATEShatakshi Sharma100% (1)

- MONGOLIAN RULES FOR COMMISSIONING BUILDING FACILITIES (English Version)Document19 pagesMONGOLIAN RULES FOR COMMISSIONING BUILDING FACILITIES (English Version)SumyaChoiNo ratings yet

- Amnesty ReportDocument69 pagesAmnesty ReportRodger AreolaNo ratings yet

- (DIGEST) (120) Carbonilla vs. Board of Airlines Representatives GR No. 193247 September 14, 2011Document3 pages(DIGEST) (120) Carbonilla vs. Board of Airlines Representatives GR No. 193247 September 14, 2011Mark CruzNo ratings yet

- Case No. 91 of 2013 Pan India Infraprojects Private Limited vs. Board of Control For Cricket in India Appeal No.31 of 2014 Pan India Infra Projects Private Limited vs. CCIDocument2 pagesCase No. 91 of 2013 Pan India Infraprojects Private Limited vs. Board of Control For Cricket in India Appeal No.31 of 2014 Pan India Infra Projects Private Limited vs. CCIVijay KandpalNo ratings yet

- Dacanay Vs PeopleDocument3 pagesDacanay Vs PeopleKarina Katerin BertesNo ratings yet

- International Standby Practices: Institute of International Banking Law & Practice, IncDocument11 pagesInternational Standby Practices: Institute of International Banking Law & Practice, IncTran TungNo ratings yet

- Deed of Tenancey Agreement: BetweenDocument3 pagesDeed of Tenancey Agreement: Betweenriyadh al kamalNo ratings yet

- 6 People vs. AcostaDocument13 pages6 People vs. AcostaJantzenNo ratings yet

- Position Paper Eusebio GumagaDocument3 pagesPosition Paper Eusebio GumagaAlfredSeldaCasipongNo ratings yet