Professional Documents

Culture Documents

Economic Viability of Small Scale Shrimp (Penaeus Sri Lanka: Monodon) Farming in The North-Western Province of

Uploaded by

Dilhani PereraOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Economic Viability of Small Scale Shrimp (Penaeus Sri Lanka: Monodon) Farming in The North-Western Province of

Uploaded by

Dilhani PereraCopyright:

Available Formats

unuftp.

is Final Project 2014

ECONOMIC VIABILITY OF SMALL SCALE SHRIMP (Penaeus

monodon) FARMING IN THE NORTH-WESTERN PROVINCE OF

SRI LANKA

Menake Gammanpila

Inland Aquatic Resources and Aquaculture Division (IARAD)

National Aquatic Resources Research and Development Agency (NARA)

Colombo 15, Sri Lanka

menakegammanpila@gmail.com

Supervisor:

Pall Jensson

Reykjavik University, Iceland

pallj@ru.is

ABSTRACT

Shrimp export is the second most valuable export of fish and fishery products of Sri Lanka and

it was 8% of during 2013. Among many commercial aquaculture initiatives so far, shrimp (P.

monodon) farming has been the most lucrative, but the business is subject to high risk and

uncertainties since it started in the mid-1980s. The present study evaluates the profitability and

risks associated with semi intensive small scale shrimp aquaculture practices in the north-

western province of Sri Lanka. Data and information for profitability analysis of the operation

over 10 years were collected from small scale shrimp aquaculture farms in the Puttalam district,

Sri Lanka, during April to August, 2014. Economic analysis revealed that the variable cost per

unit production and break-even production for the black-tiger shrimp through semi-intensive

culture system is 4.4 US$/kg and 2,500 kg respectively. Assuming minimum acceptable rate

of return (MARR) of this study is 15%, the NPV value at the end 10 years was found 33,003

US$ for the total capital invested and 34,993 US$ for the equity. Internal Rate of Return (IRR)

for the total capital investment is 41% and 74% for the equity. At the end of the ten years, sum

of total and net cash flow is 95,176 US$ and 84,093 US$ respectively. Pay-back period for the

capital investment is 3 years and it was two years for the equity. Sensitivity analysis indicated

that profitability was highly sensitive to changes in sales price. When the value of the sales

price falls by 20% or more, the IRR value becomes 13% and is not profitable. The sales price

has frequency of 28% of receiving negative NPV, followed by sales quantity (6%) and variable

cost (5%). Results of present study indicates that investment is highly profitable although the

shrimp farming is most sensitive to changes in sales price.

Key words: Cost-benefit analysis, Economic viability, Profitability, Shrimp farming

This paper should be cited as:

Gammanpila, M. 2015. Economic Viability of small scale shrimp (Penaeus monodon) farming in the north-

western province of Sri Lanka. United Nations University Fisheries Training Programme, Iceland [final

project].http://www.unuftp.is/static/fellows/document/menake14prf.pdf

Gammanpila

TABLE OF CONTENTS

1 INTRODUCTION......................................................................................................................... 5

1.1 Objectives .............................................................................................................................. 6

2 LITERATURE REVIEW............................................................................................................. 7

2.1 Distribution of shrimp (Penaeus monodon) .......................................................................... 7

2.2 Ecology and life history of P. monodon shrimp .................................................................... 7

2.3 Present situation of world shrimp aquaculture ...................................................................... 8

2.4 Overview of the shrimp aquaculture in Sri Lanka ................................................................. 9

2.4.1 Importance of shrimp aquaculture in Sri Lanka ................................................................ 9

2.4.2 Culture facility of shrimp (P. monodon) farming in Sri Lanka ....................................... 10

2.5 The economics of shrimp farming at the farm level ............................................................ 10

3 METHODOLOGY ..................................................................................................................... 12

3.1 Sampling site description..................................................................................................... 12

3.2 Data collection ..................................................................................................................... 12

3.3 Analytical technique ............................................................................................................ 13

3.4 Profitability model of shrimp farming ................................................................................. 13

3.5 Measures of profitability ..................................................................................................... 13

3.5.1 Viability of investments .................................................................................................. 13

3.5.2 Financial ratios ................................................................................................................ 15

3.6 Risk analysis ........................................................................................................................ 15

3.6.1 Sensitivity analysis .......................................................................................................... 16

3.6.2 Scenario analysis ............................................................................................................. 16

3.6.3 Monte Carlo simulation................................................................................................... 16

3.6.4 Qualitative risk analysis .................................................................................................. 16

3.7 Assumptions ........................................................................................................................ 16

3.7.1 Initial investment requirement ........................................................................................ 17

3.7.2 Total cost/Operational cost.............................................................................................. 18

3.7.3 Production Economics of shrimp aquaculture................................................................. 19

3.7.4 Marketing structure and gross revenue ........................................................................... 19

4 RESULTS .................................................................................................................................... 19

4.1 Cash flows analysis ............................................................................................................. 19

4.2 Net Present Value (NPV) in cash flow ................................................................................ 20

4.3 Pay-back period ................................................................................................................... 20

4.4 Internal Rate of Return (IRR) in cash flow ......................................................................... 21

4.5 Break even point and break even price ................................................................................ 21

4.6 Financial ratios .................................................................................................................... 21

4.6.1 Net current ratio .............................................................................................................. 21

4.6.2 Debt service coverage ratio ............................................................................................. 21

4.7 Breakdown of expenses ....................................................................................................... 22

4.8 Risk analysis ........................................................................................................................ 23

4.8.1 Sensitivity analysis .......................................................................................................... 23

4.8.2 Scenario summary ........................................................................................................... 24

4.8.3 Results of Monte Carlo Simulation ................................................................................. 24

4.8.4 Qualitative risk analysis .................................................................................................. 26

5 DISCUSSION .............................................................................................................................. 28

6 CONCLUSION AND RECOMMENDATIONS ...................................................................... 31

ACKNOWLEDGEMENTS ............................................................................................................... 35

LIST OF REFERENCES ................................................................................................................... 36

APPENDIX .......................................................................................................................................... 41

UNU Fisheries Training Programme 2

Gammanpila

LIST OF FIGURES

Figure 1: Life cycle of penaeid shrimp. ..................................................................................... 7

Figure 2: World shrimp aquaculture production by region. ...................................................... 8

Figure 3: Annual shrimp aquaculture production in Sri Lanka ................................................. 9

Figure 4: Variation of export quantity and value of shrimp in Sri Lanka .................................. 9

Figure 5: Major shrimp farming areas in Chilaw - North-western province in Sri Lanka. ..... 12

Figure 6: Total and Net cash flow of the during 10 years of operation of small scale shrimp

farming. ................................................................................................................... 20

Figure 7: Accumulated Net Present Values and payback period of the during 10 years of

operation of shrimp farming. ................................................................................... 20

Figure 8: IRR (Internal Rate of Return) in cash flow. ............................................................. 21

Figure 9: Financial ratios of the small scale shrimp culture in Sri Lanka. .............................. 22

Figure 10: Financial breakdown of small scale shrimp culture in Sri Lanka. ......................... 22

Figure 11: Percentages of major variable cost items in small scale shrimp farming. .............. 23

Figure 12: Impact analysis of different variable in small scale shrimp farming ..................... 23

Figure 13: Output probability distributions of Net Present Value of different variables using

15% discount rate. .................................................................................................. 25

Figure 14: Risk analysis matrix-level of risk in shrimp aquaculture in Sri Lanka. ................. 27

Figure 15: Variations of average farm gate price/kg (>20 g) of shrimp aquaculture in Sri

Lanka...................................................................................................................... 29

Figure 16: Production, cost and revenue of semi-intensive shrimp farming systems in Asian

countries, 1994 ....................................................................................................... 30

UNU Fisheries Training Programme 3

Gammanpila

LIST OF TABLES

Table 1: Comparison of past and present impacts. .................................................................. 10

Table 2: Technical/financial information and assumptions used in one farm model of small

scale shrimp farming. ................................................................................................ 17

Table 3: Investment cost for small scale shrimp farming. ....................................................... 18

Table 4: Operational cost (fixed cost and variable cost) for one culture cycle........................ 18

Table 5: Production economic of small scale shrimp farming. ............................................... 19

Table 6: Sale price and quantities produced by one culture cycle ........................................... 19

Table 7: Different scenarios on equipment cost, quantity and sales price on NPV and IRR in

small scale shrimp farming. ...................................................................................... 24

Table 8: Qualitative measures of likelihood and management options. .................................. 27

UNU Fisheries Training Programme 4

Gammanpila

1 INTRODUCTION

Sri Lanka is an island state in the Indian Ocean, south-east of the Indian sub-continent between

latitudes 6-10° N longitudes 80-82° E. The island is approximately 65,610 km2 with a 1,760

km long coastline. The total continental shelf area is around 30,000 km2 with an average width

of approximately 25 km and extending beyond 440 km. Sri Lanka received their sovereign 200

mile Exclusive Economic Zone rights (EEZ) in 1978. The water to land ratio of 3 ha per km2

of land is considered to be one of the highest such ratio in the world (MOFE 2001).

Sri Lanka has a long history of reliance on the sea and coastal areas for nutritional and economic

development and well-being of the people. Today the fisheries and aquaculture sector of Sri

Lanka is a major source of animal protein providing around 70% to the Sri Lankan population

although the current per-capita fish and fishery products consumption level is only at 14.5

kg/year. Sri Lanka’s fisheries sector (including aquaculture) has generated 246 million US$ of

revenue from the growing export market during the year 2013 and it was 2.5% of total export

earnings (MFARD 2014).

The shrimp industry in Sri Lanka has become one of the most important sectors of fisheries

and aquaculture. Among many aquaculture initiatives so far; shrimp farming has been the most

lucrative commercial aquaculture activity and a good attraction for investment over the past

two or three decades. Currently shrimp export is one of major foreign exchange earner in

aquaculture exports of the country earning 19.4 million US$ in 2013 (MFARD 2014).

The shrimp aquaculture industry in Sri Lanka started in the early 1980s when few large

multinational companies and few medium scale entrepreneurs embarked on shrimp industry

(Drengstig, 2013). Although the industry initially emerged in the Batticaloa district on the east

coast, the industry was subsequently established in the north-western province during the 1980s.

The industry grew slowly towards the beginning of 1990 when there were a total of 60 farms

covering an area of 405ha (Siriwardena 1999).

As a result of an attractive package of incentives by the government the shrimp farming grew

rapidly. The north-western coastal belt became the hub of the shrimp farming industry of Sri

Lanka. By the end of 1999, an estimated 1,300 prawn farms covering an area of 4,500 ha and

80 hatcheries with an annual capacity of 750 million post larvae had developed in the area

(FAO 2004).

During this period 30-40 post larvae/m2 were stocked in earthen ponds and produced 8,000-

9,000 kg/ha/year (Drengstig 2013). The industry recorded its peak economic performances in

the year 2000 by earning US$ 69.4 million worth of foreign exchange for the total exported

volume of 4,855 MT. Export of farmed P. monodon accounted for almost 50% of the seafood

export sector (UNEP/GPA 2003). Moreover, shrimp farming has contributed towards the

development of support industries such as agricultural lime outlets/producers, fiberglass

manufacturers, feed outlets, machinery supply and repair facilities, hardware stores and

laboratories, cold-storage, shrimp processing, and export industry networks while providing

many rural livelihoods.

Shrimp farmers in Sri Lanka typically practice brackish-water monoculture of black tiger

prawns (Penaeus monodon). At its blooming period, shrimp farms provided approximately

40,000 employment opportunities. However, that number dropped to approximately 8,000 after

UNU Fisheries Training Programme 5

Gammanpila

disease outbreaks caused a larger number of farmers to abandon their ponds and unemployment

among smallholder shrimp farmers became a reality.

In 2010 there were approximately shrimp 603 farms operating along 120 km of coastline in the

north-western province, a dramatic decline of farming compared to 1999 (Munasinghe et al.

2010). Further, the majority (492) were identified as small scale farms, where the farmer was

actively involved in all activities of his fewer shrimp ponds. Compared to 1999, although the

farming area of during 2010 was 1,404.6 ha, no considerable difference was noted between the

production of 1999 and 2010 (3,820mt and 3,480mt respectively) (MFARD 2014).

However, smallholder farmers face uncertainty and instability, with farmers continuously

entering and leaving the industry. This is mainly because of lack of knowledge on profitable

operations and lack of understanding of the relevant inputs and of their relationships in the

entire production process (Brugère et al. 2007). Many of the studies (Philips 1992, Senarath

and Visvanathan 2001, Munasinghe et al. 2010, Westers 2012, Galappaththi and Berkes 2014)

focused more on the environmental, biological and management aspects rather than paying

critical attention to the financial aspects of the shrimp production in Sri Lanka.

Efficient financial management of aquaculture can make the difference between profits and

losses (Engle and Neira 2005). Therefore, it is essential to know the production costs and its

evolution and to determine the factors that affect farm profitability. That will help farmers to

manage their farms in a cost-effective way.

Such intervention will help to enhance confidence of small scale farmers to stick to shrimp

farming industry. Also careful investigation of the economics of shrimp farming would benefit

both producers and policymakers in designing appropriate policy measures enabling increase

of profitability in aquaculture (Ahmed et al. 2008). For this reason, need to have appropriate

information about things such as production by different culture systems, input costs and

availability, marketing demand, supply and prices making economic decisions on aquaculture

investments.

Though several researchers have looked into the biological and environmental aspects of

shrimp farming in Sri Lanka, very limited attention has been paid to the long term economic

sustainability. Therefore, the purpose of this study is to fill this gap and evaluate production

costs and the profitability (economic viability) of semi intensive small scale shrimp farms.

Further evaluating of farm-level profitability is necessary for implementation of sustainable

shrimp farming practices to convert of abandoned shrimp farms area in the North-western

province, for economic benefits for Sri Lanka.

1.1 Objectives

The purpose of the study was to:

1) Evaluate production costs in order to assess the profitability of semi intensive small

scale shrimp farms in North-western province of Sri Lanka.

2) Assess key risk factors that have significant impacts on farm profitability.

3) Provide recommendation with respect to economics to support the development of

sustainable shrimp farming practices in Sri Lanka.

UNU Fisheries Training Programme 6

Gammanpila

2 LITERATURE REVIEW

2.1 Distribution of shrimp (Penaeus monodon)

Though there are more than 3,000 shrimp species worldwide, only 40 species are in fact

commercially exploited (Whetsone et al. 2002). Shrimp farming is based on a few species,

mainly selected from penaeidae family for their good reproductive and growth potential.

The black tiger shrimp (Penaeus monodon) is the second most cultured shrimp species in the

world, after whiteleg shrimp (Litopenaeus vannamei) (FAO 2010). The P. monodon is naturally

distributed in Indo-Pacific, region including eastern coast of Africa and the Arabian peninsula,

south-east Asia, sea of Japan and northern Australia (Holthuis 1980).

2.2 Ecology and life history of P. monodon shrimp

A marine and lagoon/estuary environment are required to complete the life cycle of black tiger

shrimp (Figure 1). The life cycle of penaeid shrimp is divided into 4 stages, larvae, post-larvae,

juvenile and adult based on morphological, behavioral, feeding and habitat changes.

The young adult shrimp migrate offshore to the ocean environment where they mature, mate

and spawn. Eggs hatch after 12 - 16 hours of fertilization in nauplii larvae. The zoeae larvae,

exist as plankton and feeds on microalgae and then metamorphoses in to mysis larvae after six

days. The mysis larvae metamorphoses to post larvae within another three days which look like

juvenile and adult. They are carried by oceanic currents to estuaries where they obtain

protection and nutrition. They remain within the estuaries until they reach late juvenile/early

adult stage, which is usually a period of 4-5 months. The shrimp migrate into the open ocean

after becoming the early adult stage of development for the remainder of their life.

In aquaculture essential environmental conditions (water salinity, temperature and other water

quality parameters) are provided for each stages of shrimp life cycle. Shrimp hatcheries are

produced post larvae where they are stocked in grow out facility to grown up to a marketable

size.

Figure 1: Life cycle of penaeid shrimp (CSIRO 2011).

UNU Fisheries Training Programme 7

Gammanpila

2.3 Present situation of world shrimp aquaculture

As one of the most important seafood industries, world shrimp farming has undergone an

exponential expansion over the last few decades. In 2012, farmed crustaceans accounted for

9.7 percent (6.4 million tonnes) of food fish aquaculture production by volume but 22.4 percent

(US$30.9 billion) by value. In 2012 shrimp aquaculture accounted for 15% of the total value

of internationally traded fishery products (FAO 2014). During the first half of 2014, the volume

traded in the international shrimp market increased by 5-6% compared with the same time

period in 2013, mostly as a result of import growth to the US and east Asian markets (Globefish

2014).

High profitability and generation of foreign exchange have been a major reason in the global

expansion of shrimp culture, attracting both national and international private companies

(Primavera 1998). In the early 1980s, major improvements in hatchery production and feed

processing allowed rapid advances in shrimp farming techniques, making it possible to produce

dramatically increased yields (Shang et al. 1998). However, in 1991 its production had slowed

down due to viral disease outbreaks in major production countries.

Among the world leading shrimp producing nations, Thailand, Vietnam and Indonesia, are

ranked second, third and fourth respectively after China, the world’s largest (FAO 2014). There

are some important differences in marketing aspects among these leading shrimp-producing

nations. Shrimp production of China is mostly consumed domestically. Most of the shrimp

produced in Thailand, Vietnam and Indonesia, in contrast, is exported to major markets in the

U.S., Japan and the European Union (EU). Thailand is the world’s leading exporter of shrimp.

However, shrimp production practices today are associated with several environmental

degradation, disease out-breaks, excessive use of antibiotics and chemicals and volatility in

prices and quality (GOAL 2013). Lower production of farm shrimp in Asia and Latin America

recorded in 2012-2013 associate with the persistent disease problems, mainly white spot

disease and early mortality syndrome (EMS) (Figure 2).

Figure 2: World shrimp aquaculture production by region (1991-2015). FAO (2013) for

1991-2011; GOAL (2013) for 2012-2015. Note: M. rosenbergii is not included.

UNU Fisheries Training Programme 8

Gammanpila

2.4 Overview of the shrimp aquaculture in Sri Lanka

2.4.1 Importance of shrimp aquaculture in Sri Lanka

Shrimp culture is an attractive business in Sri Lanka. It has identified one of the most successful

growth areas of aquaculture in Sri Lanka. The shrimp aquaculture is emerging as an important

source of foreign exchange in Sri Lanka. In 2013 it produced 4,430 mt and export 1,625 mt of

the value of export is 19.4 million US$ (Figures 3 & 4). The vast majority of cultured shrimp

production comes from north-western province of the country. However, out-breaks of diseases

have caused a major threat to the sustainability of the shrimp industry. The following

production figures clearly show the boom and bust nature of the industry.

5.000

4.500

4.000

Production (Mt)

3.500

3.000

2.500

2.000

1.500

1.000

500

-

1990 1995 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013

Year

Figure 3: Annual shrimp aquaculture production in Sri Lanka (MFARD 2014).

6000 6000

5000 5000

Export value (Rs.Mn)

Export quantity (Mt)

4000 4000

3000 3000

2000 2000

1000 1000

0 0

1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013

Year

Quantity (Mt) Value (Rs.Mn)

Figure 4: Variation of export quantity and value of shrimp in Sri Lanka. Note:

including wild capture shrimp (NAQDA 2014).

UNU Fisheries Training Programme 9

Gammanpila

2.4.2 Culture facility of shrimp (P. monodon) farming in Sri Lanka

The shrimp industry in Sri Lanka can be divided into following components, post-larva

production (hatchery), grow-out (shrimp farming), and shrimp processing. According to

Jayasinghe (1995) all shrimp farms in Sri Lanka are operated at semi-intensive and intensive

scale, based on major economic and technological differences. Major differences between

semi-intensive and intensive levels are in stocking density, aeration systems, farm size,

production and investment. Annual shrimp production (kg/ha) from these systems are, 6,663

for semi-intensive and 7,801 for intensive system in 1995.

A study carried out by Dahdouh-Guebas et al. (2002) before the year 2000 has categorized

three scales of production in Sri Lankan shrimp farming. Based on the classification, the

average farm area criterions for large, medium, and small-scale shrimp farms was larger than

15 hectares, between 2 and 15 hectares, and between 0.5 and 0.7 hectares, respectively. Though

during late1900s there were relatively large scale commercial operations, currently only small-

scale shrimp farms remain in the north western province area (Table 1). There are no

constructions of new farms. Munasinghe et al. (2010) reported that fifty-four percent of

farms of the Puttalam district were less than 1 hectare and 73% of farms were less than 2 ha.

Only large scale farms of > 5 ha represented 9% of farms with the remaining 18% being

between 2 and 5 ha in 2010.

Table 1: Comparison of past and present impacts (Galappaththi 2013).

Characteristics Late 90s to early 2000s Year 2012

Size of the farms Large (>10ha) /medium (2-10ha) Small scale

/small scale (<2ha)

Number of farms 1,500 - 2,000 About 600

Operating time Throughout the year Seasonally (following a crop

calendar system)

Proportion of ponds used All ponds About one-third of the total

number of ponds

Shrimp farm construction Very common Not any more (not needed)

Impact to natural resources (water Relatively high Relatively low

pollution/habitat destruction, etc.)

Semi-intensive operations practice intermediate levels of investment while investors are

generally local residents who often play an active management role in production and profit of

shrimp production system. Farm labor is recruited from members of the family or from the

immediate community nearby.

2.5 The economics of shrimp farming at the farm level

Aquaculture enterprises are usually capital intensive, requiring considerable investment with

an extended payback period. Economic considerations in selection of an appropriate

aquaculture production system include its potential for economic returns, its economic

efficiency and farmer’s access to capital (Green et al. 1995). For most farming businesses,

efficiency is measured in economic terms; that is, the amount of money spent on a farming

activity (including costs of inputs, labor, management, cost for land and capital, etc.) is

compared to the amount earned through the sale of products (Brummett 2007).

Farm profitability is always dependent on management practices and influenced by fluctuation

of market price. Poor management can lead to reduced production and lower profitability even

UNU Fisheries Training Programme 10

Gammanpila

when prices rise. Instability of market prices and income flows pose major hazards to

establishing early profits and ensuring long term viability of the farm. Lack of good

assessments of the industry can cause some producers to struggle to survive under fluctuating

market conditions (Neiland et al. 2001).

Good investment appraisal with sensitivity analysis provides a future values of the most

important factors (farm gate price, feed price etc.) would allow a realistic assessment of

performance of the investment under fluctuating conditions (Griffin 1995). Thus, successful

management of technical and financial measures is a key factor of profitable operations

(Nandlal and Pickering 2004). Production costs data help the farmers in decision making and

in adjusting to changes and determining the price level under which the product cannot be sold

without losses.

Negative net present value (NPV) resulted when a drop in the shrimp price by 15% and the

cost of production raises by 15% simultaneously in semi-intensive farming in west Bengal, east

coast of India (Bhattacharya 2009). The sensitivity analysis indicates that under the uncertain

scenario of international market price traditional shrimp farming system remains more

economically viable than semi-intensive farming. In Philippines (Primavera 1991) finds that if

the price of shrimp decreases by 20%, intensive farming, extensive farming and traditional

farming fail to remain profitable with negative net present value. Only semi-intensive farming

was found to be profitable in that case.

Sathiadhas et al. (2009) reported the break-even point and profitability of aquaculture farming

in India. The results showed that break-even price for black tiger shrimp in semi-intensive and

extensive culture is worked out at US$ 3.35/kg and US$ 2.62/kg, while market sales price is

US$ 7.29 to US$ 8.33/kg. The break-even price of white shrimp culture worked out to

US$ 3.46/kg and US$ 1.8/kg in semi-intensive and improved extensive culture, respectively.

Results of comparison study by Primavera (1993) in three management systems, extensive,

semi intensive and intensive shrimp pond culture in Philippines indicates that effect of price

changes on the profitability is much higher for intensive farms. Break-even price for extensive

(US$ 1.83/kg), semi intensive (US$ 2.72/kg) and intensive (US$ 3.4/kg) in Indonesia suggests

that the market risks of intensive farming are considerably higher.

Production costs per kilogram of shrimp were highest in intensive family and commercial farms

(US$ 2.7) followed by semi-intensive (US$ 2.1) and poly-culture (US$ 1.05) shrimp farming

in China (Cao 2012). Intensive family and commercial farms had similar profits, the highest of

all systems (around US$ 9,500 ha-1 crop-1), while semi-intensive farms obtained about half of

that level of profit. This was due to high yields and better market price of intensive farming.

Gonzalez-Romero et al. (2014) used a bio-economic model to define optimum pond size for

commercial intensive production of the whiteleg shrimp L. vannamei. They concluded that

ponds covering 2 ha are optimal based on maximum NPV (US$ 63,300), 10% interest rate and

IRR (25%).

Though the net present value (NPV) and the internal rate of return (IRR) of ten years farming

of P. vannamei is US$ 232,000 and 15.1%, and thus very profitable, small changes in stocking

density, survival rates and price can result in large losses (Sureshwaran et al. 1994).

UNU Fisheries Training Programme 11

Gammanpila

Valderrama and Engle (2001) was analyzed the profitability of shrimp farming (farm size 10

to over 400 ha) in Honduras under various risk conditions. The effect of risk on profitability

was evaluated through Monte Carlo simulation. In this study feed prices and production were

correlated with other variables such as total seed costs, feed quantity, total full-time labor, total

diesel costs, debt payment, and infrastructure depreciation. Scenario analysis were defined in

order to identify possible differences in management strategies to minimize the impact of

operation failures. The results indicate that risk is more associated with low yields than high

production costs. All farms, regardless of size, need annual shrimp production of more than

450 kg/ha to avoid losses.

3 METHODOLOGY

3.1 Sampling site description

The major source of data for the study was obtained from the three small scale shrimp farms

which are located in around latitudes 7° 31' N, longitudes 79° 48' E Ambakandawila, Chilaw

within the Puttalam district in North-Western province in Sri Lanka (Figure 5).

Figure 5: Major shrimp farming areas in Chilaw - North-Western province in Sri Lanka.

3.2 Data collection

Data were collected over 20 week period from month of April to end of August 2014. Data

collection methods of the study were, a) participant observations of operating activities in farms

b) farmer interview and c) information from farm record keeping books.

For economic analysis, investment cost, production cost and return, data on yield and technical

information of farming was used for clarify production cost and assess the profitability and

feasibility of a shrimp farm investment.

Total initial investment for the present small scale shrimp farming includes cost for land,

building, fencing and equipment. Total production costs are the sum of annual fixed cost and

operational/variable cost. Variable costs are directly related to the scale of farm operations at

UNU Fisheries Training Programme 12

Gammanpila

given time period. Variable costs in production are cost of feed, post larvae, chemicals,

electricity, transport and cost for labor, etc. Fixed costs include cost for license/reports, pond

renovation, salaries of labors and consultants. Further, total production and sales price were

used to calculate gross revenue.

3.3 Analytical technique

In order to assess the profitability of the operation of a shrimp aquaculture farm over 10 years,

a model was developed by using Microsoft Excel. Data from a single farm was used as a base

case for simulation the model. The model simulates the annual activities of a farm including

production, finance, cash flow, capital replacement and depreciation, income taxes, balance

sheet and profitability measures. The model also facilitates a risk analysis. The theoretical

foundation of the profitability model and the formulas are described in the next section.

3.4 Profitability model of shrimp farming

Economic analysis can provide a systematic evaluation of aquaculture operations, which lead

to better management strategies towards economic sustainability. Economic sustainability of

any farming system is examined by its profitability based on cost and benefit analysis. Profit is

defined as the difference between the total revenue and total cost. While profit is the base for

any economic activity, economic analysis provides the basic foundation for decision making.

In aquaculture models different disciplines are used to identify important variables and their

relationships by creating formulas (Cloete 2009). A profitability model is defined as a

simulation model of an initial investment and subsequent operations. Simulation models have

been used to evaluate economic feasibility (Zuniga 2009) and optimize system design and

operations in aquaculture (Leung 1986). Profitability models can also be used as a tool for:

• Assessing the cost factors associated with production

• To assess the effects of changes in investment, operational costs in various farming

systems and market prices on farming profitability and decision making

• Cost-benefit analysis of research and development options

• Providing an economic decision tools for researchers and stakeholders in farming.

3.5 Measures of profitability

3.5.1 Viability of investments

The profitability of investment of small scale shrimp farming will be estimated by measuring

of Net Present Value (NPV), Internal Rate of Return (IRR), Payback period (PBP) and Break-

even point (BEP) (Engle 2010; Bhattacharya 2009). The rate used to calculate the present value

is known as the discount rate (basically opportunity cost of funds plus a risk addition).

Net Present Value (NPV)

Net Present Value is used on discounted cash flows to evaluate capital investment and to give

an indication of the present value of future earnings. Essentially, net present value measures the

total amount of gains and losses a project will produce compared to the amount that could be

earned simply by saving the money in a bank or investing it in some other opportunity that

generates a return equal to the discount rate. Investments with a positive NPV would be

UNU Fisheries Training Programme 13

Gammanpila

accepted; those with a negative NPV rejected, and a zero value makes the investor indifferent.

The NPV value can be calculated by using the formula below (Benninga 2008).

Where, - C0 = Initial investment, Ci = Cash flow, r = Discount rate, T= Planning horizon

Internal Rate of Return (IRR)

The discount rate at which the project has an NPV of zero is called the internal rate of return

or IRR (De Ionno 2006; Benninga 2008; Engle 2010). The IRR represents the maximum rate

of interest that could be paid on all capital invested or the discount rate at which the annual

return becomes zero, or the farm breaks even. In other words, the IRR represents the interest

rate at which capital could be borrowed for the farm, or the interest that could be earned on

capital (opportunity cost) (Siar at al. 2002).

The algorithms available in the Excel software are used for calculating NPV and IRR . These

two measures are calculated for the following cash flow series in model:

1. Total capital invested and cash flow after taxes

2. Equity and free (Net) cash flow

Payback period (PBP)

Payback period is the number of years required to recover the amount of the initial investment

from the net cash flow, resulting from the investment. In other hand it is the time required for

the cumulative NPV to become greater than zero and remain greater than zero over the rest of

the life of the project. The payback period is expressed as number of years, not as a cash amount.

It can be used to quickly identify investments with the most immediate cash returns.

Aquaculture investments are preferred with the shortest payback period (Engle 2010) other

factors being equal because of risk considerations.

Break-even point (BEP)

Break-even point is the level of production at which the total cost and total revenue are equal

(Curtis and Howard 1993), hence no profit is made and no losses are incurred. It can also be

defined as the point where the net profit is zero. The selling price, fixed costs or operating costs

will not remain constant resulting in a change in the break-even point. Hence, these should be

calculated on a regular basis to reflect changes in costs and prices and in order to maintain

profitability.

The break-even price can be compared to the cost of production of a single unit of production.

Profit is generated when break-even price is higher than the cost of production. Break-even

production and break-even price offer additional insights in to the overall feasibility of the

farming (Engle and Neira 2005).

Break-even production and breakeven selling price were calculated as follows:

Break-even production = (Fixed cost + Annuity of investment) / (Farm-gate price per unit –

UNU Fisheries Training Programme 14

Gammanpila

Variable cost per unit production)

Break even sales price = Fixed cost per unit production + Variable cost per unit production

3.5.2 Financial ratios

Sustainable farming business requires effective planning and financial management. Financial

ratios are a useful management tool and key indicators of understanding of farm performance.

The most commonly used financial ratios are return on equity, return on investment, net current

ratio and debt service coverage ratio.

Net Current Ratio (NCR)

The net current ratio is a liquidity ratio. A higher current ratio indicates the higher capability

of a farm to pay back immediately its liabilities. The ratio 1.5 is mostly sufficient. The formula

used for calculating current ratio is:

Net Current Ratio: Current assets / Current liabilities

Debt service coverage (DSCR)

Debt service coverage is the ratio of cash available for debt servicing, i.e. to pay annual loan

interest and loan repayments (Engle 2010). It can be used as a useful indicator of financial

strength of the farm. Usually a debt service coverage ratio of 1.5 to 2.0 is considered as

acceptable. If below 1.0 it indicates that there is not enough cash flow to cover loan repayments

and loan interest.

Debt service coverage: (Cash flow after tax) / (Principal repayment + Interest payments)

3.6 Risk analysis

Risk analysis typically seeks to answer four questions:

• What can go wrong?

• How likely is it to go wrong?

• What would be the consequences of its going wrong?

• What can be done to reduce either the likelihood or the consequences of its going

wrong? (Arthur et al. 2004).

All businesses operate in environments loaded with risk. These include environmental,

biological, operational, financial and social risks. Therefore, it is important to evaluate the risks

associated with a business before investing in it (Cloete 2009). In Sri Lanka shrimp aquaculture

is considered a high risk business, as it involves relatively high operational cost and uncertainty

of shrimp survival during the culture period. Risk is associated with the natural variation in

factors affecting profitability over time (Okechi 2004).

Risk analysis provides measures of uncertainty with respect to changes in input variables, such

as variable and fixed cost, initial investment cost, production, sales price and interest rates.

Therefore, it is significant to identify risk early on in the farming and develop an appropriate

risk response plan. There are mainly three techniques used for assessing risks of investments:

UNU Fisheries Training Programme 15

Gammanpila

Sensitivity Analysis, Scenario Analysis and Monte Carlo Simulations (Brigham and Houston

2004).

3.6.1 Sensitivity analysis

Sensitivity analysis is used to see the effect of changes in one input variable (for example fixed

cost, variable cost, equipment cost, production quantity or sales price,) at a time on the

profitability of the production. It also identifies the areas where an improvement in performance

may have a positive impact on economic performance (Losordo and Westerman 1994).

3.6.2 Scenario analysis

The scenario analysis evaluates the impact of changes in input of more than one variable at the

same time looking at for example the optimistic, pessimistic and very pessimistic conditions.

3.6.3 Monte Carlo simulation

Monte Carlo simulation is the most advanced tool for risk assessment. Monte Carlo simulation

techniques were used to generate values for individual cost and quantity parameters based on

the probability distributions. It is used to specify a probability distribution of the outcome as a

function of each of the uncertain input factors. The risk is then the probability of a negative

outcome (negative NPV).

3.6.4 Qualitative risk analysis

The qualitative risk analysis was used to assessment of the impact of the identified risk factors.

The risk matrix ranks probability of risk depending on the impact they could occur and in case

of risk occurring of non-numerical ranges such as low, moderate, high and extreme high.

Probability of occurrence and impact level of a risk matrix was developed in order to better

understand the risk exposure. These include of environmental risks (e.g. severe weather events,

poor water quality), biological risks (disease, lower growth rates, seed quality, predation etc.),

operational risks (equipment failure, sharing of equipment, use of chemicals and supplementary

feed), financial risks (e.g. sales price changes, currency fluctuations, escalating taxes and

interest rates, decreasing market demand, access to credit, increasing production cost) and

social risks (lack of skilled manpower, pouching, competition from other sectors). Information

for analysis were gathered from reports, case studies, news articles, published research,

onsite/field visit and farmers themselves.

3.7 Assumptions

For economic analysis, data on yield, cost and return of farming used for clarify production

cost, assess the profitability and feasibility of an investment. Total production costs included

the sum of annual fixed cost and operational/variable cost. Variable costs are directly related

to the scale of farm operations at given time period. Variable costs in production are cost of

feed, post larvae, chemicals, transport and cost for labor, etc.

The costs and benefits were calculated on per farm basis (6,500 m2) and all the inputs and

output related to current study are based on price at the 2014 and US dollars (US$) exchange

rate is 130 Rs/US$. The financing of the small scale shrimp farm was assumed to be 40% equity

and a loan of 60% of the total investment required, at 11% interest rate, charge and management

UNU Fisheries Training Programme 16

Gammanpila

fee for loans is set at 2% and loan to be paid back over 10 years. Depreciation was calculated

using the straight-line method (equal depreciation costs per annum over the asset’s life).

Depreciation on buildings was assumed to be 4% each year, equipment by 10% and other

investment by 20%. The average accounts receivable from debtors were assumed to be 20% of

revenue and accounts payable for creditors were assumed to be 15% of variable costs.

Dividends to shareholders are expected to be 10% of profit after income tax which is 8%. We

assumed a 15% of discount rate for study (Table 2). Culture period is 4 months and usually two

culture cycles were operated during the year.

Table 2: Technical/financial information and assumptions used in one farm model of

small scale shrimp farming.

Value

Technical Information

Land area (ha) 1.0

Culture pond area (m2) 6,500

Average pond depth (m) 1.0

FCR 1.3

Stocking Density (PL/m2) 21

Survival Rate (%) 63

Culture period (months) 4

Culture cycles/year 2

Initial weight of fingerling stocked (g) 0.01

Initial number of fingerling 140,000

Final harvest weight of individual shrimp (g) 27

Financial information

Loan 60%

Equity 40%

Loan interest 11%

Loan repayments 10 years

Loan Management fees 2%

Assumptions

Dividend 10%*

Debtors (account received) 20%*

Creditors (Account payable) 15%*

Depreciation of buildings 4%*

Depreciation of equipment 10%*

Depreciation of others 20%*

Discounting rate 15%*

Income tax 8%

Planning horizon (years) 10

*Assumed by author

Exchange rate: 1 US$ = 130 Rs.

3.7.1 Initial investment requirement

Shrimp aquaculture businesses require high levels of capital investment. Total initial

investment for the present small scale shrimp farming was 27,000 US$ (farm log book). Of the

total, 17,700 US$ was for purchasing land (1 ha), including already constructed earthen ponds,

because the entire analysis is based on the utilization of an abandoned shrimp farm. There were

three ponds extent in one ha of land area, two ponds were used for farming and other was used

as sedimentation/stock pond. Other investments were 1,600 US$ for permanent building, 3,350

US$ for fencing and 4,350 US$ for equipment (Table 3). The total capital requirement for

initial operation is somewhat higher than total investment and the difference is called working

UNU Fisheries Training Programme 17

Gammanpila

capital. It is the amount of money that necessary to operating the farm until the first sales of

shrimp. The total working capital value for present study was US$ 1,000 (Appendix 2).

Table 3: Investment cost for small scale shrimp farming.

Investment Cost (US$)

Total Cost (US$)

Investment for land + ponds 17,700

Buildings 1,600

Fencing 3,350

Cost of equipment

Refrigerator 465

Generator 921

Water pump 500

Paddle wheel 2,464

Total 27,000

3.7.2 Total cost/Operational cost

Operating costs are the expenses which are related to the operation of a farm, including fixed

cost and variable cost (Table 4). The variable cost for the single culture cycle of operation was

US$ 10,264 for production of 2,350 kg per culture cycle or US$ 4.37 per/kg of shrimp. There

were two culture cycles per year, so variable cost per year is estimated as US$ 20,528 and total

production per year was 4,700 kg. Fixed cost is estimated at US$ 2,536 per single culture cycle

and US$ 5,012 per year. The total cost of operations for one year period is valued at US$ 25,540.

Table 4: Operational cost (fixed cost and variable cost) for one culture cycle

Total/Operational cost (US$) for one culture cycle

Number of units Unit cost (US$) Total cost(US$)

Fixed Cost

License/reports (Year) 3 20 60

Labor charges (2×4 months) 8 155 1,240

Consultant fees (per month) 4 154 616

Pond renovation 2 310 620

Total Fixed Cost 2,536

Variable Cost

Post Larvae 140,000 0.01 969

Feed:

Commercial feed 2,850 1.73 4,931

Supplementary feed 480 1.4 672

Electricity 9,150 0.12 1,102

Chemicals

Lime 4000 0.08 338.46

Dolomite 7000 0.19 1346.15

Other 315.39

Transport cost (fingerlings) 40

Fuel 200

Harvesting charges 300

Other (telephone, etc…) 50

Total Variable Cost 10,264

TOTAL COST 12,800

UNU Fisheries Training Programme 18

Gammanpila

3.7.3 Production Economics of shrimp aquaculture

Total production for the 6,500 m2 water area was 2,350 kg of shrimp after one production cycle

which is 4 month of culture period (Table 5). There are two production cycles per year, total

annual shrimp production at this rate was 4,700 kg or 7,230 kg/ha/year. The stocking density

is 21 post-larvae per m2, average survival rate was 63 percent, while initial average weight of

post larvae 0.01 g and end of the culture cycle, average size of the harvested shrimp was around

27.0 g. Feed conversation ratio (FCR) was 1.3.

Table 5: Production economic of small scale shrimp farming.

Month Average weight (g) Number of shrimp Total weight (kg) Survival rate (%)

0 0.01 140,000 1.4 100

1 4.5 112,000 504 80

2 13.6 98,000 1,333 70

3 19 90,000 1,710 64

4 26.6 88,200 2,350 63

3.7.4 Marketing structure and gross revenue

The range of sales price for the marketing varies with size of shrimps being produced by the

farm. There are also differences in the markets supplied, domestic versus export. The gross

revenue for one culture cycle was calculated by multiplying the total amount of production

(2,350 kg) by its sales price (US$ 8.31) (Table 6). Gross revenue of net profit was calculated

as the difference between gross revenue from shrimp sale and total cost of production including

fixed cost and variable costs, depreciation, taxes, etc.).

Table 6: Sale price and quantities produced by one culture cycle

Number of units (kg) Sales price (US$) Gross revenue (US$)

Total production 2,350 8.31 19,528

4 RESULTS

4.1 Cash flows analysis

Figure 6 shows the total and net cash flow during ten year period of small scale shrimp farming.

Because of the high initial investment cost, both total and net cash flow are negative during the

first year of study. Nevertheless, in the remaining years, both total and net cash flow are

positive and continues on trend throughout the ten years planning horizon. In 2014, equity

value in the cash flow series is US$ 11,200, which is 40% of total financing in shrimp farm

operation. At the end of the ten years, the sum over the 10 years of the total and net cash flow

is US$ 95,176 and US$ 84,093 respectively (Appendix 8).

UNU Fisheries Training Programme 19

Gammanpila

15.000

10.000

5.000

0

2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024

-5.000

US$

-10.000 Year

-15.000

-20.000 Total Cash Flow & Capital

Net Cash Flow & Equity

-25.000

-30.000

Figure 6: Total and Net cash flow of the during 10 years of operation of small scale shrimp

farming.

4.2 Net Present Value (NPV) in cash flow

The assessment of economic viability is done by calculating the viability measures like Net

Present Value (NPV) and Internal Rate of Return (IRR). Assuming that the discounting rate

(MARR) of this study is 15%, the Net Present Value (NPV) at the end 10 years was found to

be US$ 33,003 for the total capital invested and US$ 34,993 for the equity. Based on Figure 7

it was observed that the first three years the accumulated NPV of total cash flow is negative.

4.3 Pay-back period

According to the Figure 7, the pay-back period for total capital investment is 3 years. It means

that this venture needs three years to recover the original investment. The higher NPV value

and relatively short pay-back period in present study indicates that investment is highly

profitable.

40.000

30.000

20.000

10.000

US$

0

2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024

10.000

Year

20.000

30.000

40.000

NPV Total Cash Flow 15% NPV Net Cash Flow 15%

Figure 7: Accumulated Net Present Values and payback period of the during 10 years of

operation of shrimp farming.

UNU Fisheries Training Programme 20

Gammanpila

4.4 Internal Rate of Return (IRR) in cash flow

Internal Rate of Return for the total capital investment is 41% and 74% for the equity in the

present study. The IRR is higher than the 15% MARR for present study, indicating that

investment is attractive and profitable (Figure 8).

80%

70%

60%

Percentage

50%

40%

30%

20%

10%

0%

2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024

Year

IRR Total Cash Flow IRR Net Cash Flow

Figure 8: IRR (Internal Rate of Return) in cash flow.

4.5 Break even point and break even price

Variable cost per unit production is US$ 4.37/kg and annuity of the investment is US$

4,754/year. Based on annual fixed cost (US$ 5,012) the break-even production and breack-

even price for the black tiger shrimp in semi intensive system is 2,479 kg per year and US$

6.45 respectively.

4.6 Financial ratios

In following includes the results of financial rations based on calculation of the initial setup

values.

4.6.1 Net current ratio

Net current ratio is above one which indicates that current assets are greater than current

liabilities. At the beginning of the farming the assets values are 2.4 times the liabilities values,

at the end of the ten year it was 13.6 times the liabilities values. It indicates the higher capability

of a farm to pay back immediate its liabilities (Figure 9).

4.6.2 Debt service coverage ratio

A debit service coverage ratio of greater than one indicates that farm has enough cash to pay

interest and repayments loans. (Figure 9). In the first year it was 4.7 and end of the ten year 6.1

value indicates that high financial strength of the farm.

UNU Fisheries Training Programme 21

Gammanpila

16

14 Net Current Ratio: (Current

asset/Current liability)

12 Debt Service Coverage: (Cash flow

10 after tax/Interest-LMF+repayment)

Accepatable Minimum

Ratio

0

2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024

Year

Figure 9: Financial ratios of the small scale shrimp culture in Sri Lanka.

4.7 Breakdown of expenses

Breakdown of expenses show that out of the total operational cost nearly 68% of expenses are

variable cost followed by fixed cost which are 17% of total cost (Figure 10). Feed cost represent

55% or more than a half of the variable costs, and it was 44% of total operational cost. Feed

cost must be considered as most important items for the variable cost in semi-intensive systems

followed by 19% and 11% of chemicals and electricity cost respectively (Figure 11).

Fixed cost for year - round shrimp farming was US$ 5,012 of which management cost including

labor salaries constitutes about 49% and 25% of consultant fees. License fees, renovation of

pond and canal digging contributed about another 26% of total cost.

Repayments

Financial Costs 5% Paid Divident

4%

3%

Paid Taxes

3%

Fixed Cost

17%

Variable Costs

68%

Figure 10: Financial breakdown of small scale shrimp culture in Sri Lanka.

UNU Fisheries Training Programme 22

Gammanpila

Other

Harvesting charges

Fuel

Expenses

Transport cost

Chemicals/Lime/Dolamite

Electricity

Feed:

Post Larvae

0 10 20 30 40 50 60

Percentage

Figure 11: Percentages of major variable cost items in small scale shrimp farming.

4.8 Risk analysis

In shrimp farming, higher intensity is accumulated with the higher financial risk. In more

intensive systems, the probability of loss are likely to be higher. World Bank (2000) reported

that financial risk in shrimp farming comes from four sources. They are input factors

(availability of brood stock, price of post larvae, water quality, credit, etc.); output factors (sales

price, production supply to the market, etc.); design factors (site selection, etc.) and natural

factors (disease, floods, typhoons, etc.).

4.8.1 Sensitivity analysis

Sensitivity analysis was done for major investment costs including cost of equipment, fixed

and variable cost and further sales quantity and sales price. The results of the impact analysis

showed that the profitability of the small scale shrimp farm production is most sensitive to

variations in the sales price. When the value of the sales price falls by 20% or more, negative

NPV in cash flow is no longer profitable and it might destroy the economic viability of the

shrimp farm (Figure12). Though variation in the cost of equipment and operational cost (fixed

and variable) did not have a significant impact on the farm profitability, variation in variable

cost had more impact on the NPV of equity than cost of equipment and fixed costs (Appendix

9).

140.000

120.000

100.000

80.000

NPV for Equity

60.000

40.000

20.000

0

-50% -40% -30% -20% -10%

-20.000 0% 10% 20% 30% 40% 50%

-40.000

-60.000

-80.000

Deviations

Equipment Sales Quantity Sales Price

Variable cost Fixed cost

Figure 12: Impact analysis of different variable in small scale shrimp farming.

UNU Fisheries Training Programme 23

Gammanpila

4.8.2 Scenario summary

Three variable parameters, i.e. cost of equipment, sales quantity and sales price were used for

scenario analysis. In pessimistic condition, value of equipment cost increased by 30% and sales

quantity decreased by 10%, as well as sales price decreasing by 20% simultaneously, the

farming is no longer profitable. Table 7 shows in resulted negative NPV (-592) and IRR (13%)

which was less than minimum acceptable rate of return (MARR) of 15%.

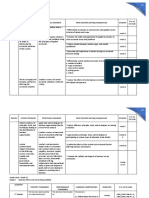

Table 7: Different scenarios on equipment cost, quantity and sales price on NPV and IRR in

small scale shrimp farming.

Sce na rio Summa ry

Cha nging Ce lls:

Equipment 100% 80% 130% 150%

Quantity 100% 110% 90% 80%

Sales Price 100% 120% 80% 70%

R e sult Ce lls:

NPV Equity 34,993 76,026 -592 -18,921

IRR Equity 74% 120% 13% 0%

4.8.3 Results of Monte Carlo Simulation

Figure 13 illustrates the risk that resulted from the Monte Carlo simulation analysis. It shows

the probability of obtaining negative values of NPV assuming uncertainties in sales price, sales

quantity, cost of equipment, variable cost and fixed cost after ten years. In the Monte Carlo

method 100 random points of uniform distributions were generated within the define range

(0.5-1.5 or from 50% lower up to 50% higher values of input parameters), this was used to

represent the five uncertain economic parameters. It should be noted that in the case of say

sales price this range is very wide, so the simulation will show very conservative results.

Among the risk factors studied, the most critical factor affecting economic performance is the

sales price. It has a frequency of 28% of receiving negative NPV, followed by sales quantity

(6%) and variable cost (5%).

UNU Fisheries Training Programme 24

Gammanpila

(a) (b)

12 12

10 10

8 8

Frequency

Frequency

6 6

4 4

2 2

0 0

NPV NPV

(c) (d)

20 12

18

16 10

14

8

Frequency

Frequency

12

10 6

8

6 4

4

2

2

0 0

NPV NPV

(e)

30

25

20

Frequency

15

10

5

0

NPV

Figure 13: Output probability distributions of Net Present Value of different variables

using 15% discount rate. The negative NPV (< 0) are indicate certainty of achieving risk.

(a) Sales price (b) Sales quantity (c) Cost of equipment (d) Variable cost and (e) Fixed

cost.

UNU Fisheries Training Programme 25

Gammanpila

4.8.4 Qualitative risk analysis

Qualitative risk assessment of Figure 14 indicates general risk factors for shrimp aquaculture,

including financial, biological, environmental, operational and social risks. The risks vary in

their spatial extent and in the timing of presence. Some risks factors are always present,

whereas others may only occur at specific times.

A greater number of high potential and extreme risks were associated with disease, low

production and deterioration of water quality. Shrimp farmers in the North-Western province

have dealt with disease problem, which cause lower shrimp yield and result in lower incomes

since the 1990s. Thus, many of the farmers who implemented less sustainable practices may

have left the industry. The increasing of production cost of different variables had significant

financial impact at varying degrees. Government policies including imposing tax incentives,

interest rates and environmental policies likely to change and contribute to risk that are

moderately effect to the financial status of farming.

There is low probability that flood conditions can be expected to in all the farming areas

simultaneously. This situation occurs in general once in 4 to 5 years (UNEP/GPA 2003).

Munasinghe et al. (2010) reported that during the late dry period from August to September,

the salinity levels exceeded 50 ppt which is higher than salinity for optimal shrimp growth in

brackish water around the Puttalam district. Although these natural hazards have not occurred

frequently. They could have a high impact on profitability.

The little cormorant is a troublesome predator excluding carnivorous fish that can grow in

shrimp ponds. Farmers complained that they were robbed of shrimp at night during the later

stage of the crop. It was frequently happening and this could lower and moderately threaten the

viability of its operations respectively.

Likelihood is described as the probability of an event occurring, ranging from rare events to

likely, most likely or frequent events. The qualitative likelihood descriptors used in a risk

assessment is presented in Table 8.

UNU Fisheries Training Programme 26

Gammanpila

Extreme High

Probability of Risk

High

Moderate

Low

Low Moderate High Extreme High

Impact

Disease spread

Biological Decreasing growth rate

Seed stock low quality or limited availability

Predation

Decreasing sales price (<Break even price)

Increasing production cost-equipments

Increasing production cost-feed

Increasing production cost-electricity

Increasing production cost-seed

Financial Increasing production cost-chemicals

Low production quantity

Limited market access

Decreasing market demand (size and quality)

Credit instability

Escalating interest rates/taxes

Limited availability of quality feed

Operational Use of animal products as supplement to feed

Sharing of equipments

Equipment failure

Use of chemicals/Antibiotics

Environmental Deterioration of water source

Natural hazards (flood/drought)

Pouching

Social Lack/loss of skilled labor

Conflicts with other land and resource users

Trade restrictions

Figure 14: Risk analysis matrix-level of risk in shrimp aquaculture in Sri Lanka.

Table 8: Qualitative measures of likelihood and management options.

Consequence Probability criteria Effect Measures require

Low Very low, may occur in Low risk Necessary to maintain

exceptional circumstances assurance level

Moderate Likely to occur at some time Moderate financial lost Tolerate, if cost reduction is

acceptable

High High, probably occur in most Significant financial lost Appropriate additional control

circumstances measures are needed

Extreme Expected to occur in most An unacceptable Require immediately action

high circumstances financial loss

UNU Fisheries Training Programme 27

Gammanpila

5 DISCUSSION

Aquaculture is a business. The purpose of a business is to generate profit. Profitability is not

the same as productivity, as it is also subjected to economic factors such as production costs

and market price (Yu et al. 2006). The investors will not only need to practice responsible

aquaculture but also need to make a profit to maintain sustainable aquaculture (Mwangi 2007).

Results of the present study had positive values of NPV, which indicates the economic viability

of shrimp farming. It was also shown that IRR was above a minimum attractive rate of return

(MARR), and debt service coverage ratio was above 1.5 showing that cash flow of the farm

was well above the repayment of loan and its interest. Therefore, the facts above indicate that

small scale shrimp farming in Sri Lanka is a profitable activity. Nevertheless, there is no reason

to conclude that higher mean value of NPV and IRR are accompanied by lower risk. The long

term success of individual farms or industry depends on better management practices. Cao

(2012) ranks the major problems that might significantly affect farm profitability in China. The

top five problems were: disease outbreak, low farm-gate price, poor seed quality, high feed

price and poor water quality.

The ponds size ranging from 0.16-1.0 ha were optimal for efficient management of intensive

cultivation of P. monodon in Thailand and Taiwan (Kongkeo 1997). Monitoring of water

quality and shrimp population and feeding is much easier in small ponds compared to larger

ones. Wind action on small ponds is more effective mixing of water (Brune and Drapcho 1991).

When shrimp prices are low, or pollution or disease problem occur, small scale farmers can

stop their operation for a while, or can reduce stocking density without too much financial

effect. 54% of shrimp farms in Puttalam district were less than 1 hectare and 73% of farms

were less than two ha (Munasinghe et al. 2010). Therefore, small scale farmers get more

advantages on management by using small farming area (<1ha).

Decline in world shrimp price is one of the key issues facing shrimp producers. International

market demand and prices are clearly factors outside the influence of any shrimp producing

country. Funge-Smith and Aeron-Thomas (1995) performed a sensitivity analysis on Thai

shrimp farming and found that shrimp price has the most significant effect on overall

profitability followed by production and feed price. There are 10% reduction in sales price

changing profitability by 73% in his study and it was reduction of NPV by 50% of present

study. Shrimp production was the second most important factor and 10% reduction affecting

profit by 47% and it was 24% of NPV in present study.

Shrimp prices vary with average size and quality differences, fluctuation of exchange rate,

export policies, strength of the economy, consumer preferences (Engle 2010) and supply-

demand interactions in the international market at the moment of harvest (Valderrama and

Engle 2001). The prices fall when world supply expands faster than world demand, and costs

rise as demand for inputs is expanding (Chong 1992). The usual target weight of shrimp is 30g

within 4 month of culture period in Sri Lanka. The production of large (>30 g) head-on healthy

shrimp that are properly handled and processed after harvest has great demand in the world

market. Figure 15 illustrates that variation of farm gate price (Rs) continually increasing last 6

years. It also shows that farm gate price in US$ declined in 2012-2013 due to variation of

exchange rate. According to the history of sales prices during the past 6-7 years, shrimp farmers

have gradually been receiving more favorable sales prices.

UNU Fisheries Training Programme 28

Gammanpila

10,00 1200

1100

8,00 1000

900

800

6,00 700

US$

600

Rs.

4,00 500

400

300

2,00 200

100

0,00 0

2008 2009 2010 2011 2012 2013 2014

Year

Farm gate price (Rs) Farm gate price (US$)

Figure 15: Variations of average farm gate price/kg (>20 g) of shrimp aquaculture in Sri

Lanka (King’s Aqua services Pvt (Ltd), Sri Lanka).

Shang et al. (1998) review the economics of hatchery and grow out of extensive, semi-intensive

and intensive phases of shrimp farming in Asia based on the results of a farm survey conducted

by the Asian Development Bank (ADB) and Network of Aquaculture Centers in Asia-Pacific

(NACA) in 1994-1995. The results can be seen in Figure 16 and Appendix 10. The survey

indicated that production cost per kg was US$ 4.56 in Sri Lanka which is less than the present

value (US$ 6.45) in 2014. It was higher than other Asian countries from China (US$ 2.27),

Vietnam (US$ 3.3), Indonesia (US$ 3.78) and Philippines (US$ 4.0), but lower than Malaysia

(US$ 5.5) and India (US$ 5.96) in 1994. For semi intensive grow out systems Indonesia had

the highest profit (US$ 3.05/kg), followed by Sri Lanka (US$ 3.00/kg), the Philippines (US$

2.54) and Vietnam (US$ 2.29). The relatively high food conversion ratio (1.9) compared to

Indonesia (1.4) is the major factor responsible for higher production cost in Sri Lanka.

Nevertheless Sri Lanka has decreased profit (US$/kg) from US$ 3.0 in 1994 to US$ 1.86 in

2014, while sales price has increased from 7.56 to 8.3 US$/kg (ADB/NACA 1996). Seed is the

second most significant variable cost (19%) in 1994, however it was 9% in the present study.

However cost of chemicals has significantly been increased when compared with in 1994.

Fallowing (Shang et al. 1998) the ponds after each harvest usually reduces the cost of

chemicals.

In 1994 stocking of 29 PL/m2 resulted in a total production of 5,040 kg/ha/year. It was 7,230

kg/ha/year in the present study indicating that small scale farmers are more efficient in the

utilization of inputs. Sri Lanka exhibited a lower profit of US$ 1.14 per kg, due to increases of

production cost during the period of 1994 to 2014. In 1994, Sri Lanka farmers enjoyed

relatively high farm gate prices compared with other Asian countries. While production costs

have continually risen in recent years, the lower export price and reasonable local market price

caused many farmers to sell their harvest to the local market, where they can received an

equivalent price for smaller shrimps (Munasinghe et al. 2010). Applying the resource cost ratio

(RCR) approach to the Asian shrimp farming industry, Shang et al. (1998) indicated that

Thailand, Indonesia and Sri Lanka had a comparative advantage in producing and exporting

shrimp to markets like Japan and/or US countries.

UNU Fisheries Training Programme 29

Gammanpila

6.000 8

7

Production (kg/ha/year)

5.000

6

4.000

5

US$

3.000 4

3

2.000

2

1.000

1

0 0

Indonesia Philippines Malaysia Vietnam India Sri Lanka China

Country

Production (kg/ha/year) Total cost (US$/kg)

Farm gate price (US$) Profit (US$/kg)

Figure 16: Production, cost and revenue of semi-intensive shrimp farming systems in Asian

countries, 1994 (ADB/NACA 1996).

The resent survey by Son et al. (2010) examined the production and economic efficiencies of

eighty black tiger prawn farms in the Mekong delta, Vietnam. He revealed that stocking of 17

PL m2 with a survival rate of 55% resulted in an average yield of 2,470 kg/ha/crop, final

weight of shrimp was 25g, farm gate price 5.7 US$/kg and the net income received was 6,768

US$ ha/crop (US$ 2.3/kg) after 150 culture days. Average production cost amounted to 3.4

US$/kg, and feed, the largest operating cost item accounted for 58% of the production cost.

The total production cost of 3.4 US$/kg is lower than those reported (US$ 6.45/kg) in present

study of Sri Lanka. This lower production cost was resulted due to low labor costs and land

rentals as well as low capital investment in the family-operated prawn farms in Vietnam.

Nevertheless total production (3,615 kg/ha/crop) is higher than compared with relatively

short culture period (120 days) of the present study. The poor weight gains resulted in

lengthening the crop period, increasing costs and further lowering the production and profit