Professional Documents

Culture Documents

Trans-Pacific Vs CA

Uploaded by

Margie Marj Galban0 ratings0% found this document useful (0 votes)

27 views2 pagesOriginal Title

Trans-pacific vs CA

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

27 views2 pagesTrans-Pacific Vs CA

Uploaded by

Margie Marj GalbanCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

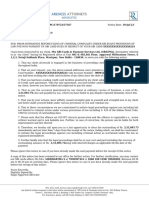

TRANS-PACIFIC INDUSTRIAL SUPPLIES, INC. vs.

The COURT OF APPEALS

G.R. No. 109172 August 19, 1994

FACTS:

Trans-Pacific applied for and was granted several financial accommodations amounting to

P1.3M by Associated Bank. The loans were evidenced and secured by 4 promissory notes, a real

estate mortgage covering three parcels of land and a chattel mortgage over petitioner’s stock and

inventories. Unable to settle its obligation in full, Trans- Pacific requested for, and was granted

by the bank, a restructuring of the remaining indebtedness. To secure the restructured loan, 3

new promissory notes were executed by Trans-Pacific. The mortgaged parcels of land were

substituted by another mortgage covering 2 other parcels of land and a chattel mortgage on

Trans-Pacific’s stock inventory. The released parcels of land were then sold and the proceeds

were turned over to the bank and applied to Trans-Pacific’s restructured loan. Subsequently, the

bank returned the duplicate original copies of the 3 promissory notes to Trans- Pacific with the

word “PAID” stamped thereon.

Despite the return of the notes, Associated Bank demanded from Trans-Pacific payment of the

amount of P492,100.00 representing accrued interest because the promissory notes were

erroneously released. Initially, Trans-Pacific expressed its willingness to pay the amount

demanded by respondent bank but later had a change of heart and instead initiated an action

before the court for specific performance and damages.

ISSUE:

Whether or not Trans- Pacific has indeed paid in full its obligation to respondent bank.

RULING:

Supreme Court found no eversible error committed by the respondent court in disposing of the

appealed decision.

Applying the legal presumption provided by Art. 1271 of the Civil Code, the trial court ruled that

petitioner has fully discharged its obligation by virtue of its possession of the documents

(stamped "PAID") evidencing its indebtedness. Respondent court disagreed and held, among

others, that the documents found in possession of Trans-Pacific are mere duplicates and cannot

be the basis of petitioner's claim that its obligation has been fully paid.

The provision must be construed to mean the original copy of the document evidencing the credit

and not its duplicate. The pronouncement of respondent court is manifestly groundless. It is

undisputed that the documents presented were duplicate originals and are therefore admissible as

evidence. Further, it must be noted that respondent bank itself did not bother to challenge the

authenticity of the duplicate copies submitted by petitioner. A duplicate copy of the original may

be admitted in evidence when the original is in the possession of the party against whom the

evidence is offered, and the latter fails to produce it after reasonable notice, as in the case of

respondent bank. A duplicate copy of the original may be admitted in evidence when the original

is in the possession of the party against whom the evidence is offered, and the latter fails

to produce it after reasonable notice (Sec. 2 [b], Rule 130), as in the case of respondent bank.

The presumption created by the Art. 1271 of the Civil Code is not conclusive but merely prima

facie.

If there be no evidence to the contrary, the presumption stands. Conversely, the presumption

loses its legal efficacy in the face of proof or evidence to the contrary. In the case, SC find

sufficient justification to overthrow the presumption of payment generated by the delivery of the

documents evidencing petitioner’s indebtedness.

You might also like

- People V Tresballes: Petitioners: The People of The Philippines Respondents: PROCOPIO TRESBALLESDocument3 pagesPeople V Tresballes: Petitioners: The People of The Philippines Respondents: PROCOPIO TRESBALLESRica AggabaoNo ratings yet

- Second Division: Willy G. Sia, Appellee, vs. People of The Philippines, AppellantDocument12 pagesSecond Division: Willy G. Sia, Appellee, vs. People of The Philippines, AppellantLianne Rose ParajenoNo ratings yet

- PEOPLE OF THE PHILS V CIOBALDocument1 pagePEOPLE OF THE PHILS V CIOBALMelvin Ikko EspornaNo ratings yet

- Philippine Science High School-Cagayan Valley Campus vs. Pirra Construction Enterprises DigestDocument2 pagesPhilippine Science High School-Cagayan Valley Campus vs. Pirra Construction Enterprises DigestJasielle Leigh UlangkayaNo ratings yet

- Civil Law Review 2020: Judicial Declaration of Presumptive DeathDocument1 pageCivil Law Review 2020: Judicial Declaration of Presumptive DeathLoren Bea TulalianNo ratings yet

- RemRev1 CasesDocument4 pagesRemRev1 Cases'Bernan Esguerra Bumatay100% (1)

- People Vs BalatazoDocument7 pagesPeople Vs BalatazoEj AquinoNo ratings yet

- People vs. NerDocument1 pagePeople vs. Nerเจียนคาร์โล การ์เซียNo ratings yet

- Acaac V AzcunaDocument3 pagesAcaac V AzcunaQuengilyn Quintos100% (1)

- People of The Philippines vs. Danny GodoyDocument7 pagesPeople of The Philippines vs. Danny GodoyDales BatoctoyNo ratings yet

- 5 and 10Document4 pages5 and 10ambahomoNo ratings yet

- Salcedo-Ortanez VS CaDocument1 pageSalcedo-Ortanez VS CaJoannah GamboaNo ratings yet

- GMA Network Inc. v. Central CATV, Inc., 18 July 2014Document3 pagesGMA Network Inc. v. Central CATV, Inc., 18 July 2014Caleb Josh PacanaNo ratings yet

- Revised GCTA Manual FormsDocument19 pagesRevised GCTA Manual FormsNakwiNo ratings yet

- Domdom v. SandiganbayanDocument2 pagesDomdom v. SandiganbayanCourtney TirolNo ratings yet

- Taylor v. Uy Tieng Piao, 43 Phil. 873 (1922)Document3 pagesTaylor v. Uy Tieng Piao, 43 Phil. 873 (1922)Fides DamascoNo ratings yet

- People Vs Zenaida Quebral y MATEODocument7 pagesPeople Vs Zenaida Quebral y MATEOSyokoyolanting DondonNo ratings yet

- Ma vs. FernandezDocument3 pagesMa vs. FernandezAli NamlaNo ratings yet

- GR No. 181861Document16 pagesGR No. 181861Dha GoalNo ratings yet

- People V Jose 37 SCRA 450Document38 pagesPeople V Jose 37 SCRA 450Carissa CruzNo ratings yet

- Rudecon MGT Corp V Camacho 437 Scra 202Document4 pagesRudecon MGT Corp V Camacho 437 Scra 202emdi19No ratings yet

- DEVELOPMENT BANK OF THE PHILIPPINES v. TESTONDocument1 pageDEVELOPMENT BANK OF THE PHILIPPINES v. TESTONAlexis Von TeNo ratings yet

- Mactan Cebu Int'l Airport vs. TudtudDocument12 pagesMactan Cebu Int'l Airport vs. TudtudChristian John Dela CruzNo ratings yet

- Custody dispute and infidelity allegations examined in Perkins v PerkinsDocument9 pagesCustody dispute and infidelity allegations examined in Perkins v PerkinsDjøn AmocNo ratings yet

- RA 11222 Simulation of BirthDocument7 pagesRA 11222 Simulation of BirthMegan MateoNo ratings yet

- Cupino V. Pacific RehouseDocument4 pagesCupino V. Pacific RehouseJuris SyebNo ratings yet

- 002 01 Law Philippines - Case Digest - Technol Eight v. NLRC & AmularDocument3 pages002 01 Law Philippines - Case Digest - Technol Eight v. NLRC & AmularRoze JustinNo ratings yet

- Valdez V Dabon PDFDocument2 pagesValdez V Dabon PDFJohn Anthony B. LimNo ratings yet

- Severino Macavinta Jr. vs. People, L-36052Document1 pageSeverino Macavinta Jr. vs. People, L-36052Angelo IsipNo ratings yet

- People v. Camat Miranda v. Arizona: JH Compilation 1Document12 pagesPeople v. Camat Miranda v. Arizona: JH Compilation 1luigi vidaNo ratings yet

- MARIA LACHICA VS. GREGORIO ARANETA: Payment Deadline Dispute in Real Estate ContractDocument9 pagesMARIA LACHICA VS. GREGORIO ARANETA: Payment Deadline Dispute in Real Estate ContractRobert Jayson UyNo ratings yet

- Respondent. G.R. No. 159593, October 12, 2006 Chico-Nazario, JDocument2 pagesRespondent. G.R. No. 159593, October 12, 2006 Chico-Nazario, JChard FaustinoNo ratings yet

- Montefalcon V Vasquez DigestDocument1 pageMontefalcon V Vasquez DigestJermone MuaripNo ratings yet

- 14) People of The Philippines v. QueDocument1 page14) People of The Philippines v. QueDaniela Sandra AgootNo ratings yet

- Ong Chua V. Edward Carr Et AlDocument4 pagesOng Chua V. Edward Carr Et AlrobbyNo ratings yet

- People vs. Pagal G.R. No. 241257 September 29 2020Document34 pagesPeople vs. Pagal G.R. No. 241257 September 29 2020Rikki Marie PajaresNo ratings yet

- Heirs of Paula C. Fabillar, As Represented by Aureo Fabillar vs. Miguel M. Paller, Florentina P. Abayan, and Demetria P. SagalesDocument7 pagesHeirs of Paula C. Fabillar, As Represented by Aureo Fabillar vs. Miguel M. Paller, Florentina P. Abayan, and Demetria P. SagalesWins BanzNo ratings yet

- Philippine National Bank Vs CADocument6 pagesPhilippine National Bank Vs CAHamitaf LatipNo ratings yet

- G.R. No. L-4221Document1 pageG.R. No. L-4221Teresa CardinozaNo ratings yet

- G.R. No. 150394, June 26, 2007: FactsDocument2 pagesG.R. No. 150394, June 26, 2007: FactsAshNo ratings yet

- 403 MENDEZ v SHARI’A COURT RULING ON CUSTODY AWARDDocument2 pages403 MENDEZ v SHARI’A COURT RULING ON CUSTODY AWARDEmmanuel Alejandro YrreverreIiiNo ratings yet

- Custodio - Assignment3 - Modes of DiscoveryDocument12 pagesCustodio - Assignment3 - Modes of DiscoveryJoshua Langit CustodioNo ratings yet

- People V MamantakDocument2 pagesPeople V MamantakanntomarongNo ratings yet

- Legal Ethics Case DigestDocument3 pagesLegal Ethics Case DigestGen GrajoNo ratings yet

- SPL CasesDocument47 pagesSPL Casessheryl bautistaNo ratings yet

- Format of Opinion Writing Letter - FZ PDFDocument2 pagesFormat of Opinion Writing Letter - FZ PDFNiqian GoiNo ratings yet

- People of The Philippines Vs Condemena (1968)Document2 pagesPeople of The Philippines Vs Condemena (1968)Abdulateef SahibuddinNo ratings yet

- British American Tobacco vs. Camacho Tax CaseDocument1 pageBritish American Tobacco vs. Camacho Tax CaseIzzyNo ratings yet

- Oblicon-DBP Vs CADocument16 pagesOblicon-DBP Vs CASuiNo ratings yet

- 59 - People v. RosalesDocument2 pages59 - People v. Rosalesadee0% (1)

- Case DigestDocument5 pagesCase DigestAlexylle Garsula de ConcepcionNo ratings yet

- 8 - GR No.249134-Philippine Rabbit V BumagatDocument2 pages8 - GR No.249134-Philippine Rabbit V BumagatPamela Jane I. Torno0% (1)

- Calilap Vs DBPDocument1 pageCalilap Vs DBPPaula GasparNo ratings yet

- Azcona v. Jamandre, GR L-30597, June 30, 1987 (Per J. Cruz, First Division)Document1 pageAzcona v. Jamandre, GR L-30597, June 30, 1987 (Per J. Cruz, First Division)Maria Isabella MirallesNo ratings yet

- Pagsuyuin vs. IACDocument39 pagesPagsuyuin vs. IACPaul John Santiago TucayNo ratings yet

- People V Robles GR 1777220-AcquitalDocument1 pagePeople V Robles GR 1777220-AcquitalBreth1979No ratings yet

- Case No. 1 Blas Vs Santos G.R. NO. L-14070 MARCH 29, 1961: Page JLADocument5 pagesCase No. 1 Blas Vs Santos G.R. NO. L-14070 MARCH 29, 1961: Page JLAkuraiireen hoNo ratings yet

- Transpacific Industrial Supplies Vs CADocument2 pagesTranspacific Industrial Supplies Vs CAJorela TipanNo ratings yet

- Trans-Pacific Industrial Supplies Inc. vs. CADocument6 pagesTrans-Pacific Industrial Supplies Inc. vs. CAAngelReaNo ratings yet

- Transpacific Vs CADocument7 pagesTranspacific Vs CAJasOn EvangelistaNo ratings yet

- NLRC Ruling on Illegal Dismissal CaseDocument3 pagesNLRC Ruling on Illegal Dismissal CaseMargie Marj GalbanNo ratings yet

- 200 - Villafuerte v. CortezDocument1 page200 - Villafuerte v. CortezMargie Marj GalbanNo ratings yet

- 155 - American Home Assurance Co v. NLRCDocument1 page155 - American Home Assurance Co v. NLRCMargie Marj GalbanNo ratings yet

- Atty Violated Ethics in Election CaseDocument1 pageAtty Violated Ethics in Election CaseMargie Marj GalbanNo ratings yet

- 20 - People v. SantocildesDocument1 page20 - People v. SantocildesMargie Marj GalbanNo ratings yet

- Gustilo Vs WyethDocument6 pagesGustilo Vs WyethMargie Marj GalbanNo ratings yet

- Pacific Mills Vs AlonzoDocument2 pagesPacific Mills Vs AlonzoMargie Marj GalbanNo ratings yet

- Pacific Mills Vs AlonzoDocument2 pagesPacific Mills Vs AlonzoMargie Marj GalbanNo ratings yet

- 65 - in Re TagordaDocument1 page65 - in Re TagordaRonnie Garcia Del RosarioNo ratings yet

- Lepanto Vs DumapisDocument6 pagesLepanto Vs DumapisMargie Marj GalbanNo ratings yet

- NLRC Ruling on Illegal Dismissal CaseDocument3 pagesNLRC Ruling on Illegal Dismissal CaseMargie Marj GalbanNo ratings yet

- NLRC Ruling on Worker's DismissalDocument4 pagesNLRC Ruling on Worker's DismissalMargie Marj GalbanNo ratings yet

- FATHER RANHILIO AQUINO Et Al V ATTY EDWIN PASCUADocument1 pageFATHER RANHILIO AQUINO Et Al V ATTY EDWIN PASCUAMargie Marj Galban100% (1)

- Lepanto Vs DumapisDocument6 pagesLepanto Vs DumapisMargie Marj GalbanNo ratings yet

- NLRC Ruling on Worker's DismissalDocument4 pagesNLRC Ruling on Worker's DismissalMargie Marj GalbanNo ratings yet

- Petition For Leave To Resume Practice of Law Benjamin DacanayDocument2 pagesPetition For Leave To Resume Practice of Law Benjamin DacanayMargie Marj GalbanNo ratings yet

- US vs Toribio police power rulingDocument1 pageUS vs Toribio police power rulingMargie Marj GalbanNo ratings yet

- Gustilo Vs WyethDocument6 pagesGustilo Vs WyethMargie Marj GalbanNo ratings yet

- In The Matter of The Disqualification of Bar Examinee Haron MelingDocument2 pagesIn The Matter of The Disqualification of Bar Examinee Haron MelingSheila Rosette100% (1)

- IBP GOVERNOR DISBARMENTDocument3 pagesIBP GOVERNOR DISBARMENTMargie Marj GalbanNo ratings yet

- Cruz V Cabrera Adm. Case No. 5737. October 25, 2004Document1 pageCruz V Cabrera Adm. Case No. 5737. October 25, 2004Margie Marj GalbanNo ratings yet

- SARIO MALINIAS Vs COMELECDocument1 pageSARIO MALINIAS Vs COMELECMargie Marj GalbanNo ratings yet

- Argosino 270 Scra 26Document1 pageArgosino 270 Scra 26Margie Marj GalbanNo ratings yet

- Sario Malinias Vs ComelecDocument1 pageSario Malinias Vs ComelecMargie Marj GalbanNo ratings yet

- COA vs. Province of Cebu: Scholarship grants not chargeable to SEFDocument1 pageCOA vs. Province of Cebu: Scholarship grants not chargeable to SEFMargie Marj GalbanNo ratings yet

- Atty Mejia Reinstated After 15 Years DisbarmentDocument1 pageAtty Mejia Reinstated After 15 Years DisbarmentMargie Marj GalbanNo ratings yet

- AGUIRRE Vs RANADocument2 pagesAGUIRRE Vs RANAMargie Marj GalbanNo ratings yet

- US vs Toribio police power rulingDocument1 pageUS vs Toribio police power rulingMargie Marj GalbanNo ratings yet

- 2 - Gutierrez Vs House of RepDocument1 page2 - Gutierrez Vs House of RepMargie Marj GalbanNo ratings yet

- JJJ Addenbrook Vs Natividad - FULL CASEDocument2 pagesJJJ Addenbrook Vs Natividad - FULL CASEMargie Marj GalbanNo ratings yet

- File 1447Document2 pagesFile 1447Breitbart NewsNo ratings yet

- Chinese Activities in The South China SeaDocument20 pagesChinese Activities in The South China Seaarciblue100% (1)

- Jamia Millia Islamia: PROJECT ON Labour LawDocument25 pagesJamia Millia Islamia: PROJECT ON Labour LawManik Singh KapoorNo ratings yet

- A Reaction Paper of President Noynoy Aquino 2013 State of The Nation Address.Document2 pagesA Reaction Paper of President Noynoy Aquino 2013 State of The Nation Address.Jay Smith100% (2)

- Generate e-Way Bill for inter-city transportation of goodsDocument1 pageGenerate e-Way Bill for inter-city transportation of goodsAkshay TambeNo ratings yet

- SPECPOL Background Guide FinalDocument30 pagesSPECPOL Background Guide FinalJohn GiambalvoNo ratings yet

- 03 The Novikov TelegramDocument12 pages03 The Novikov TelegramErős BreeNo ratings yet

- 2014 Bar Exam QuestionsDocument30 pages2014 Bar Exam QuestionsdetteheartsNo ratings yet

- Case Digest 88Document2 pagesCase Digest 88Johnson Yaplin100% (2)

- Political Law Philippine Supreme Court DecisionsDocument269 pagesPolitical Law Philippine Supreme Court DecisionsChil BelgiraNo ratings yet

- Wesleyan University Phils. v. Wesleyan University Phils. Faculty and Staff Association (Digest)Document2 pagesWesleyan University Phils. v. Wesleyan University Phils. Faculty and Staff Association (Digest)Nelly Louie CasabuenaNo ratings yet

- Bayot v. Sandiganbayan, 128 SCRA 383Document2 pagesBayot v. Sandiganbayan, 128 SCRA 383May Angelica TenezaNo ratings yet

- Missing Persons Act SummaryDocument6 pagesMissing Persons Act SummaryLarona MogapiNo ratings yet

- The Unexpectant FatherDocument2 pagesThe Unexpectant FatherAira AlyssaNo ratings yet

- Why US Invaded Iraq in 2003Document8 pagesWhy US Invaded Iraq in 2003Waseem Abbas AttariNo ratings yet

- UCMJ Article 92Document2 pagesUCMJ Article 92NathanBrownNo ratings yet

- Power of Supreme Court To Transfer Cases Under CRPC, CPC and Constitution of India"Document11 pagesPower of Supreme Court To Transfer Cases Under CRPC, CPC and Constitution of India"a-468951No ratings yet

- Tani-De La Fuente Vs de La Fuente, GR No. 188400, March 8, 2017Document14 pagesTani-De La Fuente Vs de La Fuente, GR No. 188400, March 8, 2017Britt John BallentesNo ratings yet

- FEMA State Preparedness ReportDocument22 pagesFEMA State Preparedness ReportGustavBlitzNo ratings yet

- Special Power of Attorney/Deed of Ratification: - Khalid Moued M Althagafi - Erika Joy L MacasuDocument1 pageSpecial Power of Attorney/Deed of Ratification: - Khalid Moued M Althagafi - Erika Joy L MacasuJerico NaypaNo ratings yet

- MPDFDocument1 pageMPDFPushpendra YadavNo ratings yet

- Commonwealth of PA Americus Curie Lambert 1998Document19 pagesCommonwealth of PA Americus Curie Lambert 1998Stan J. CaterboneNo ratings yet

- United States Court of Appeals, Eleventh CircuitDocument8 pagesUnited States Court of Appeals, Eleventh CircuitScribd Government DocsNo ratings yet

- CrimLaw QuestionsDocument4 pagesCrimLaw QuestionsJamaica Cabildo ManaligodNo ratings yet

- Reinstatement Endorsement LetterDocument4 pagesReinstatement Endorsement LetterARGELINE JOY AMORESNo ratings yet

- Ein Digital ArtDocument2 pagesEin Digital ArtErik ElseaNo ratings yet

- End of America Sample PagesDocument40 pagesEnd of America Sample PagesChelsea Green Publishing100% (2)

- Ali Inam S/O Inam Ullah 50-F-2-Johar Town LHR: Web Generated BillDocument1 pageAli Inam S/O Inam Ullah 50-F-2-Johar Town LHR: Web Generated BillMuhammad Irfan ButtNo ratings yet

- Prohibited Properties: District NameDocument2 pagesProhibited Properties: District NameChandrra NeeliNo ratings yet

- Torres Vs BrennlerDocument6 pagesTorres Vs BrennlerCalCoastNewsNo ratings yet