Professional Documents

Culture Documents

SA 701 Chart 1: Judgement

Uploaded by

Apeksha ChilwalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SA 701 Chart 1: Judgement

Uploaded by

Apeksha ChilwalCopyright:

Available Formats

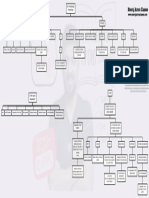

SA 701 Chart 1

Name Meaning of KAM Why? Purpose of KAM

Communicating KAM In Independent Auditor’s Report Matters Communicative Value Additional Information Entity & Areas of significant Engage with Management and

!! !! management judgement TCWG

That in Auditor’s Professional Selected from Matters Provide greater transparency To intended users of FS

Judgement about audit Assist the intended users Intended users will get basis

Communicated to TCWG To assist them

WERE OF MOST To understand the to further engage

SIGNIFICANCE

Matters

Entity Areas of significant With Mgt. and TCWG

In an AOFS management judgement

that WERE OF MOST

SIGNIFICANCE About

In an AOFS Certain matters related to Audited FS Audit that was performed

entity

SA 701 Chart 2

Applicability & Prohibition Objective of Auditor Determining KAM

Applicability Prohibition Determine KAM Communicate KAM Auditor shall determine Factors to be considered while

determining KAMs

Listed entities Auditor decides To Communicate Required by L&R When Auditor disclaims an In A’s Report From Those

KAM in A’s R. opinion on FS 315 Significant Mgt. Judgement Significant events and

!! transaction

Matters communicated with Matters

Unless required by L&R TCWG Areas of Higher assessed Significant Risk areas in the financial

ROMM statements The effect on the audit of

significant events or

transactions that occurred

That require significant auditor

during the period.

attention in performing the

audit that involved significant

management judgment,

In other words matters that

WERE OF MOST including accounting estimates

SIGNIFICANCE in an

AOFS

that have been identified as

having high

estimation uncertainty.

SA 701 Chart 3

Communication

Communicating KAM Description Not a Substitute for Disclosure KAM is not Communicated in Other points related to Communication if NO KAM or

in Financial Statements etc Auditor’s Report communication KAMs to communicated are as

per 705 and 570 only

HOW Language of KAM Section Ref to related disclosure And Summary

disclosure Modified opinion Reporting as per SA 570 Separate opinion on individual Law or regulation prohibits Adverse consequences > Public KAM by Nature KAM by nature shall not be

matters interest benefits described in KAM section auditor shall include a

statement to this effect in a

separate section of the

Auditor shall Shall state that if any Why Matter was considered to How matter was addressed in 3 points

auditor’s report under the

be of the audit When MU Exist Public disclosure Matters giving rise to modified MU

heading “Key Audit

In extremely rare Shall not applicable if entity opinion in accordance with SA Report on these matters in Matters

circumstances, the auditor has publicly disclosed 705 (Revised) accordance with applicable SA’s

determines that information about the matter

Describe Using Under the KAM are those matters Matters were addressed in the in FS Disclosure Why How

context of MOST SIGNIFICANCE Relating to events or conditions of that matter Related to events and condition

Include a ref in KAM section

Adverse consequences > Public

Each Key Audit Matter Using an appropriate sub Heading That in Auditor’s Professional In FS (if any) Considered as KAM Addressed

interest benefits

heading Judgement AOFS and forming an opinion In audit That may cast significant doubt that may cast

about entity’s ability to

continue as a going concern Basis of qualified / adverse MU Related to Going Concern

opinion

“Key Audit Matters”

WERE OF MOST And and therefore determined to be significant doubt on the

SIGNIFICANCE KAM

the auditor does not provide a Entity’s ability to continue as

In an AOFS separate opinion on these GOING CONCERN

matters

in accordance with SA 570

You might also like

- UNVEILING-Analysis of KAM (Final) PDFDocument20 pagesUNVEILING-Analysis of KAM (Final) PDFBmjannah MasturaNo ratings yet

- Audit MCQ Book Nov 22Document12 pagesAudit MCQ Book Nov 223259 ManishaNo ratings yet

- ReconciliationDocument5 pagesReconciliationSankar PaulNo ratings yet

- Webinar ACCA AFA IAPI IAI-What You Need To Know About Implementing KAM - NS Presentation FinalDocument21 pagesWebinar ACCA AFA IAPI IAI-What You Need To Know About Implementing KAM - NS Presentation FinalRiri BariNo ratings yet

- Eon & Son Iso 9001-2015 QMS Implementation Status Summary As at 30.06.2021Document7 pagesEon & Son Iso 9001-2015 QMS Implementation Status Summary As at 30.06.2021john rukorioNo ratings yet

- PROGRAM RELIABILITY IMPROVEMENT IDF UJP IP 2019 Rev2 PDFDocument35 pagesPROGRAM RELIABILITY IMPROVEMENT IDF UJP IP 2019 Rev2 PDFRizqi Priatna100% (1)

- 4.0 ABMS Audit Checklist CommercialDocument3 pages4.0 ABMS Audit Checklist CommercialMöhd JâbïRNo ratings yet

- CA Inter Charts Module 2Document13 pagesCA Inter Charts Module 2Harshit BahetyNo ratings yet

- Topic 2 - Strategic Planning, The Formulation of Long and Short-Term ObjectivesDocument21 pagesTopic 2 - Strategic Planning, The Formulation of Long and Short-Term ObjectivesIbrahim KamaldeenNo ratings yet

- AirIndia AdvtMgrFinance PDFDocument5 pagesAirIndia AdvtMgrFinance PDFFentorNo ratings yet

- SA 700 New Nov 18 Elements of Audit Report (Sections) : Independent Auditor'SDocument1 pageSA 700 New Nov 18 Elements of Audit Report (Sections) : Independent Auditor'SApeksha ChilwalNo ratings yet

- Key Audit Matters Aug 2019Document20 pagesKey Audit Matters Aug 2019ahmed naseerNo ratings yet

- Our Mission..... Your Growth: Team Code: JusticiaDocument28 pagesOur Mission..... Your Growth: Team Code: JusticiaParth KakadeNo ratings yet

- Irt Investor Presentation March 2024 FinalDocument53 pagesIrt Investor Presentation March 2024 FinalSHREYA NAIRNo ratings yet

- Doc 05 - 02 Internal Audit Report Core Financial ControlsDocument14 pagesDoc 05 - 02 Internal Audit Report Core Financial Controlsahmed khoudhiryNo ratings yet

- CRD To CM-21.A - 21.B-001 PDFDocument18 pagesCRD To CM-21.A - 21.B-001 PDFSevin HassanzadehNo ratings yet

- Credit VerificationDocument16 pagesCredit Verificationjack sparowNo ratings yet

- Treasury Cashflow AnalyticsDocument8 pagesTreasury Cashflow AnalyticsTarun TyagiNo ratings yet

- Corporate GovernanceDocument12 pagesCorporate GovernanceDeepanshu SaxenaNo ratings yet

- Treasury RCM 2022-2023Document1 pageTreasury RCM 2022-2023Aman ParchaniNo ratings yet

- Rev Resume PDFDocument2 pagesRev Resume PDFAman MathurNo ratings yet

- 2235 PDFDocument10 pages2235 PDFHarutraNo ratings yet

- Ncontromonitanipatog: InternalDocument7 pagesNcontromonitanipatog: InternalVivek YadavNo ratings yet

- Be Prepared For The Uncleared Margin Rules (UMR) : ContactsDocument4 pagesBe Prepared For The Uncleared Margin Rules (UMR) : ContactsAreeb AbbasNo ratings yet

- Appointed: (A) PQR Having P, Associates Auditors Listed EntityDocument7 pagesAppointed: (A) PQR Having P, Associates Auditors Listed EntityViswasNo ratings yet

- Adobe Scan 22-Jun-2021Document3 pagesAdobe Scan 22-Jun-2021Pavan JvNo ratings yet

- CPA AUD Summary NotesDocument28 pagesCPA AUD Summary Notesgovind raghavanNo ratings yet

- Aman Mathur: Statutory Audits (PSU) Ltd. (Listed On BSE) Performance AreaDocument2 pagesAman Mathur: Statutory Audits (PSU) Ltd. (Listed On BSE) Performance AreaAman MathurNo ratings yet

- NSA 320 (Revised) "Materiality in Planning and Performing An Audit"Document1 pageNSA 320 (Revised) "Materiality in Planning and Performing An Audit"Roshan AddhikariNo ratings yet

- Status of Implementation of Prior Years' Audit RecommendationDocument8 pagesStatus of Implementation of Prior Years' Audit Recommendationsandra bolokNo ratings yet

- Profit Centers vs. Business AreasDocument4 pagesProfit Centers vs. Business Areassneel.bw3636No ratings yet

- Team Assignment 3 - Team 7Document1 pageTeam Assignment 3 - Team 7KiekNo ratings yet

- ISA 800 MindMapDocument1 pageISA 800 MindMapA R AdILNo ratings yet

- AIC General Assembly Report 2023 Draft 2 After 11.25.2023 Meeting3.17pm Sunday RevisionDocument3 pagesAIC General Assembly Report 2023 Draft 2 After 11.25.2023 Meeting3.17pm Sunday RevisionDelia Remerata ElmidoNo ratings yet

- 7.1.1. Consultancy (From Industry)Document8 pages7.1.1. Consultancy (From Industry)Faroza KaziNo ratings yet

- Audit of Insurance CompaniesDocument15 pagesAudit of Insurance CompaniesYoung MetroNo ratings yet

- Long Form Audit ReportDocument10 pagesLong Form Audit Reportchitrank10100% (3)

- 2nd Meeting - Mind Map C. 2 - Introduction To Cost Terms and Cost Purposes - A3 PDFDocument1 page2nd Meeting - Mind Map C. 2 - Introduction To Cost Terms and Cost Purposes - A3 PDFIsna Fauziah Biljannah0% (1)

- 2nd Meeting - Mind Map C. 2 - Introduction To Cost Terms and Cost Purposes - A3 PDFDocument1 page2nd Meeting - Mind Map C. 2 - Introduction To Cost Terms and Cost Purposes - A3 PDFIsna Fauziah BiljannahNo ratings yet

- ClauseDocument12 pagesClausesrirambaskyNo ratings yet

- Amalgamation Mergers PDFDocument57 pagesAmalgamation Mergers PDFshiva karnatiNo ratings yet

- Sa ChartsDocument38 pagesSa ChartsDivya nraoNo ratings yet

- Integrity Dev't. Review of NIA by OmbDocument13 pagesIntegrity Dev't. Review of NIA by OmbPastidjaNo ratings yet

- Sa 570 GCDocument1 pageSa 570 GCLooney ApacheNo ratings yet

- Advisian Business Process - MAINDocument10 pagesAdvisian Business Process - MAINDavid PrastyanNo ratings yet

- Full CMC Template CalibrationDocument31 pagesFull CMC Template CalibrationStudent ForeignNo ratings yet

- Part Iii - Status of Implementation of Prior Years' Audit RecommendationsDocument12 pagesPart Iii - Status of Implementation of Prior Years' Audit RecommendationsAlicia NhsNo ratings yet

- Financial Statement AnalysisDocument10 pagesFinancial Statement AnalysisvvNo ratings yet

- Suchindra IIM Rohtak 2020 PDFDocument19 pagesSuchindra IIM Rohtak 2020 PDFSeema BeheraNo ratings yet

- FI Valuation DeckDocument28 pagesFI Valuation DeckoodidayooNo ratings yet

- Sa Fastrack NotesDocument36 pagesSa Fastrack Noteskunika bachhasNo ratings yet

- Sequel Logistics Private Limited Corporate Office Human Resources & PayrollDocument8 pagesSequel Logistics Private Limited Corporate Office Human Resources & PayrollKhushboo GovaniNo ratings yet

- Bafs Ar2020 enDocument302 pagesBafs Ar2020 enadmn.bbmbuildersNo ratings yet

- AccountsDocument7 pagesAccountsRiddhima DuaNo ratings yet

- Sa520 1529989961017Document11 pagesSa520 1529989961017Apeksha ChilwalNo ratings yet

- Prosedur Mutu: Departemen: Service Nomor SOP: Judul SOP: Prosedur Maintenance Mesin - FlowDocument2 pagesProsedur Mutu: Departemen: Service Nomor SOP: Judul SOP: Prosedur Maintenance Mesin - FlowDominique WNo ratings yet

- Activity-Based Cost Management: An Executive's GuideFrom EverandActivity-Based Cost Management: An Executive's GuideRating: 3 out of 5 stars3/5 (1)

- Financial Steering: Valuation, KPI Management and the Interaction with IFRSFrom EverandFinancial Steering: Valuation, KPI Management and the Interaction with IFRSNo ratings yet

- Handbook of Asset and Liability Management: From Models to Optimal Return StrategiesFrom EverandHandbook of Asset and Liability Management: From Models to Optimal Return StrategiesNo ratings yet

- Topic:-DU - J19 - MSC - FN: Correct Answer: - Isozymes (Option ID 861)Document21 pagesTopic:-DU - J19 - MSC - FN: Correct Answer: - Isozymes (Option ID 861)Apeksha ChilwalNo ratings yet

- Paper - 3: Cost Accounting and Financial Management: (A) A Skilled Worker Is Paid A Guaranteed Wage Rate ofDocument21 pagesPaper - 3: Cost Accounting and Financial Management: (A) A Skilled Worker Is Paid A Guaranteed Wage Rate ofApeksha ChilwalNo ratings yet

- 1563325936MA-Linguistics-July 5Document11 pages1563325936MA-Linguistics-July 5Apeksha ChilwalNo ratings yet

- Fa 102Document20 pagesFa 102Apeksha ChilwalNo ratings yet

- PG Prospectus 2017-2018Document27 pagesPG Prospectus 2017-2018Apeksha ChilwalNo ratings yet

- Paper 4 Studycafe - inDocument28 pagesPaper 4 Studycafe - inApeksha ChilwalNo ratings yet

- Part I: Statutory Update: © The Institute of Chartered Accountants of IndiaDocument41 pagesPart I: Statutory Update: © The Institute of Chartered Accountants of IndiaApeksha ChilwalNo ratings yet

- Auditoromermancnc: A, FPQDocument6 pagesAuditoromermancnc: A, FPQApeksha ChilwalNo ratings yet

- Bachelorof Education BEdDocument50 pagesBachelorof Education BEdApeksha ChilwalNo ratings yet

- 1563413817MPhil-PhD-PercussionMusic-July 8Document14 pages1563413817MPhil-PhD-PercussionMusic-July 8Apeksha ChilwalNo ratings yet

- SA 299 Advantages DisadvantagesDocument1 pageSA 299 Advantages DisadvantagesApeksha ChilwalNo ratings yet

- 1563328103MA Psychology July 7Document21 pages1563328103MA Psychology July 7Apeksha ChilwalNo ratings yet

- Paper - 3: Cost Accounting and Financial Management: 2015 (In Lakhs) 2016 (In Lakhs)Document25 pagesPaper - 3: Cost Accounting and Financial Management: 2015 (In Lakhs) 2016 (In Lakhs)Apeksha ChilwalNo ratings yet

- Emailing Adobe Scan 13-Aug-2020Document4 pagesEmailing Adobe Scan 13-Aug-2020Apeksha ChilwalNo ratings yet

- Emergence of Communist Party in Nationalist MovementDocument5 pagesEmergence of Communist Party in Nationalist MovementApeksha ChilwalNo ratings yet

- SA 700 New Nov 18 Elements of Audit Report (Sections) : Independent Auditor'SDocument1 pageSA 700 New Nov 18 Elements of Audit Report (Sections) : Independent Auditor'SApeksha ChilwalNo ratings yet

- Set CDocument2 pagesSet CApeksha ChilwalNo ratings yet

- SA 600 - Using The Work of Another AuditorDocument1 pageSA 600 - Using The Work of Another AuditorApeksha ChilwalNo ratings yet

- Du McomDocument18 pagesDu McomApeksha ChilwalNo ratings yet

- 1563327718PhD-FinancialStudies-July 7Document14 pages1563327718PhD-FinancialStudies-July 7Apeksha ChilwalNo ratings yet

- Edufever: Topic:-DU - J19 - MCOMDocument22 pagesEdufever: Topic:-DU - J19 - MCOMApeksha ChilwalNo ratings yet

- Class 1 Project Management An OverviewDocument31 pagesClass 1 Project Management An OverviewAbdul FasiehNo ratings yet

- Chap 010Document100 pagesChap 010hertzberg 1No ratings yet

- 551 M.F. Jhocson Street, Sampaloc, Manila 1008 Philippines: Subject Code Description Section Schedule Room UnitsDocument1 page551 M.F. Jhocson Street, Sampaloc, Manila 1008 Philippines: Subject Code Description Section Schedule Room UnitsBernadette PalermoNo ratings yet

- Number of Months Number of Brownouts Per Month: Correct!Document6 pagesNumber of Months Number of Brownouts Per Month: Correct!Hey BeshywapNo ratings yet

- Solution For The Problems in High Performance & PMS: NestleDocument31 pagesSolution For The Problems in High Performance & PMS: NestleAdrianus PramudhitaNo ratings yet

- MAITRIDocument36 pagesMAITRIAS VatsalNo ratings yet

- 7 Krishnaveni ArthiDocument14 pages7 Krishnaveni ArthiMahesh K sNo ratings yet

- Altman Z ScoreDocument19 pagesAltman Z ScoreShadab khanNo ratings yet

- It Iia AustraliaDocument4 pagesIt Iia AustraliaAzaria KylaNo ratings yet

- BD VenteDocument525 pagesBD VentebadrNo ratings yet

- APA Database ReportDocument8,796 pagesAPA Database ReportAmishNo ratings yet

- Value Cocreationn Vega-Vazquez2013Document13 pagesValue Cocreationn Vega-Vazquez2013Sonila ShakyaNo ratings yet

- Carta AccountDocument1 pageCarta Accountzhenxian lohNo ratings yet

- Management CommunicationDocument8 pagesManagement CommunicationJohn Carlo DinglasanNo ratings yet

- Plant LayoutDocument5 pagesPlant LayoutSasmita SahooNo ratings yet

- Ba1141 (Dba5026)Document3 pagesBa1141 (Dba5026)gayathri nathNo ratings yet

- FTP2023 Chapter01Document8 pagesFTP2023 Chapter01Rutul ParikhNo ratings yet

- Hubungan K Emosi DG WirausahaDocument23 pagesHubungan K Emosi DG WirausahaDimas MahendraNo ratings yet

- TMW6104 Project Management: Booking SystemDocument10 pagesTMW6104 Project Management: Booking SystemfatihahNo ratings yet

- Business CommunicationDocument11 pagesBusiness CommunicationMohammed BouhjariNo ratings yet

- Web ListDocument30 pagesWeb ListbcmahatoNo ratings yet

- Term Paper On Analysis of Audit Report of Listed Bank in BangladeshDocument33 pagesTerm Paper On Analysis of Audit Report of Listed Bank in BangladeshAbdulAhadNo ratings yet

- Guideline For Practical Training Report - Updated Oct 2021Document7 pagesGuideline For Practical Training Report - Updated Oct 2021Izny KamaliyahNo ratings yet

- Berkowitz Designer BookDocument27 pagesBerkowitz Designer BookNoah BerkowitzNo ratings yet

- Workshop - Customer ServiceDocument12 pagesWorkshop - Customer ServiceCristian Ramirez100% (1)

- Integrative Course Progress Report: Title of Research ProjectDocument1 pageIntegrative Course Progress Report: Title of Research Projectmache dumadNo ratings yet

- Mohammed Zadjali Daleel Petroleum Bi8yna0GyBNOIs6WQF66yDYZhvUNWiaE89ubNukvDocument15 pagesMohammed Zadjali Daleel Petroleum Bi8yna0GyBNOIs6WQF66yDYZhvUNWiaE89ubNukvbaaziz2015No ratings yet

- MF COMPARISON - MidcapDocument3 pagesMF COMPARISON - MidcapRajkumar GNo ratings yet

- Inventory Master Items Attributes Oracle EBS R12Document42 pagesInventory Master Items Attributes Oracle EBS R12arsal6323No ratings yet

- Entrepreneurial CompetenciesDocument16 pagesEntrepreneurial CompetenciesTamanam sharonNo ratings yet