Professional Documents

Culture Documents

SA 299 Advantages Disadvantages

Uploaded by

Apeksha ChilwalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SA 299 Advantages Disadvantages

Uploaded by

Apeksha ChilwalCopyright:

Available Formats

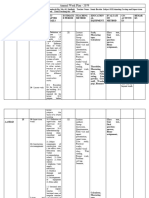

SA 299 Advantages

Disadvantages

Advantage Disadvantage

Expertise Work Load Performance Service Local Firms Healthy Competition Cost Fees being Shared Psychological problem General Superiority Complex Coordination Areas of common concern Liability Responsibility

Pooling and sharing Reduced Better Performance Improved Service To The Client can conduct audit in a better Low where firms of different Uncertainty about the liability Neglected Uncertainty about the liability Lack of clear definition

manner standing are associated in the for the work done, for the work done,

joint audit.

(in terms of development of

specially in case of multi- staff and conducting audit)

national companies

SA 299

SA 299 Specific

Responsibility

points/area in which all the

joint auditors are jointly and

Work Audit Procedures Materiality and Test Check Risk assessment Compliance Procedure Substantive Procedure Audit Documentation Obtaining evidence and severally responsible.

reaching conclusions

"Responsibility of Joint On the other hand, all the

Auditors", joint auditors are jointly and

severally responsible

in respect of audit work

divided among the joint WORK Decision Matters Relevant Statue Audit Report Information and explanation

auditors, each joint auditor is

responsible only for the work

allocated

to him,

which is not divided decisions taken by all the joint matters which are brought to examining that the financial complies with obtaining and evaluating

auditors the notice of the joint auditors statements of the entity comply information and explanation

by any one of them

whether or not he has

the requirements of the

prepared a separate report on

with the disclosure relevant statute from the management

the work performed by him.

and on which requirements of

there is an agreement among the relevant statute.

the joint auditors.

is generally a joint

responsibility of all the

auditors.

You might also like

- Design Thinking for Business Growth: How to Design and Scale Business Models and Business EcosystemsFrom EverandDesign Thinking for Business Growth: How to Design and Scale Business Models and Business EcosystemsNo ratings yet

- CH Dilawar C.VDocument1 pageCH Dilawar C.Vwali mustafaNo ratings yet

- Yearly Workplan of Construction Management-12Document12 pagesYearly Workplan of Construction Management-12nischalbastolaNo ratings yet

- Standards On Auditing 200-299 300-499 500-599 600-699 700-799Document2 pagesStandards On Auditing 200-299 300-499 500-599 600-699 700-799Pali Hill City100% (1)

- ME13Document4 pagesME13Joana Marie SajolNo ratings yet

- Bridggit: Depend Upon Rather ThanDocument4 pagesBridggit: Depend Upon Rather ThanMuhammad Ahmed MirzaNo ratings yet

- 09 Enabling Excellence - ENDocument6 pages09 Enabling Excellence - ENRomnick SaceNo ratings yet

- Comprehansive Process. TamerDocument2 pagesComprehansive Process. TamerMarco IbrahimNo ratings yet

- CQI-12 Coating Master 01.09.2016Document65 pagesCQI-12 Coating Master 01.09.2016Milan PrajapatiNo ratings yet

- ReportDocument8 pagesReportfoxbat1988No ratings yet

- Operations Auditing: - o o - o - o oDocument9 pagesOperations Auditing: - o o - o - o oLORI-LYN GUICONo ratings yet

- Services For MROs - 2019Document30 pagesServices For MROs - 2019bách hàNo ratings yet

- Life Cycle Posters 11x17 - AGILEDocument1 pageLife Cycle Posters 11x17 - AGILEAhmedNo ratings yet

- MarketLine Advantage - Company Report Generator - Master Company Report (Nestle India LTD)Document7 pagesMarketLine Advantage - Company Report Generator - Master Company Report (Nestle India LTD)Abhishek BishtNo ratings yet

- Report 3Document7 pagesReport 3foxbat1988No ratings yet

- Tulip Epicor In-Depth ReportDocument3 pagesTulip Epicor In-Depth ReportMumal BhattacharyaNo ratings yet

- Goitseone Nhlapo Updated CVDocument7 pagesGoitseone Nhlapo Updated CVNokulunga NkosiNo ratings yet

- Ekatm CRMDocument2 pagesEkatm CRMVritti iMediaNo ratings yet

- Different Business ModelDocument2 pagesDifferent Business ModelAjay AravindanNo ratings yet

- Jahanzeeb ALI: About MeDocument1 pageJahanzeeb ALI: About Mehammad.ahmad1854No ratings yet

- DevOps - Maturity Model - 3 - 10 - 14Document24 pagesDevOps - Maturity Model - 3 - 10 - 14Jayaraman RamdasNo ratings yet

- 6 Professional AppointmentsDocument18 pages6 Professional Appointmentsilyas hussainNo ratings yet

- IPMFZ Brochure - v2-2Document2 pagesIPMFZ Brochure - v2-2nashat90No ratings yet

- Chapter 3 Design of Products and ServicesDocument1 pageChapter 3 Design of Products and ServicesAnthony KwoNo ratings yet

- CQI-12 Coating System 11-1-12 Final (1) .Document65 pagesCQI-12 Coating System 11-1-12 Final (1) .Milan PrajapatiNo ratings yet

- Module 3 - Company ObjectivesDocument1 pageModule 3 - Company ObjectivesBaher WilliamNo ratings yet

- Cost Chapter 2Document16 pagesCost Chapter 2Hazel Nicole TiticNo ratings yet

- Lecture # 18 HCI: Goal-Directed Design Methodology Research and Modeling - 1Document2 pagesLecture # 18 HCI: Goal-Directed Design Methodology Research and Modeling - 1harisNo ratings yet

- PFRS15Document17 pagesPFRS15Rheneir MoraNo ratings yet

- Yms Shem P 0810 - (Yms Oms P 31610) - 221216 - 102800Document117 pagesYms Shem P 0810 - (Yms Oms P 31610) - 221216 - 102800vinay kumarNo ratings yet

- Epicor In-Depth ReportDocument3 pagesEpicor In-Depth ReportMumal BhattacharyaNo ratings yet

- 3rd LessonDocument18 pages3rd Lessonhicham haitaneNo ratings yet

- STU Griffin 8e PPT ch02Document17 pagesSTU Griffin 8e PPT ch02Aydrey HumanNo ratings yet

- CAF 08 Chapter 23 MindMapDocument1 pageCAF 08 Chapter 23 MindMapghafoormohsin942No ratings yet

- Equity Research Methodology 031604Document1 pageEquity Research Methodology 031604vardashahid100% (1)

- Tutor ConferenceDocument1 pageTutor ConferencevikkyNo ratings yet

- 10-Tips Maintainable TestsDocument15 pages10-Tips Maintainable TestsAryanNo ratings yet

- Time Sheet: Date Day Time in Time Out Working Hours RemarksDocument6 pagesTime Sheet: Date Day Time in Time Out Working Hours RemarksSales SoftlogiqueNo ratings yet

- Lean Manufacturing: 5S and The Visual WorkplaceDocument76 pagesLean Manufacturing: 5S and The Visual WorkplaceDharmesh patelNo ratings yet

- Emaint: © 2019 - Fluke Reliability Solutions Confidential DocumentDocument12 pagesEmaint: © 2019 - Fluke Reliability Solutions Confidential DocumentSunnyNo ratings yet

- V.R.K. Rubber and Plastics Organizaitonal Knowledge: Internal Sources External SourcesDocument1 pageV.R.K. Rubber and Plastics Organizaitonal Knowledge: Internal Sources External SourcesRamNo ratings yet

- How To Create Barriers To Entry?Document1 pageHow To Create Barriers To Entry?cocoNo ratings yet

- JOB OPENINGS - TCFDocument4 pagesJOB OPENINGS - TCFMaheshNo ratings yet

- TMap NEXT Poster (EN) PDFDocument1 pageTMap NEXT Poster (EN) PDFJose Luis Becerril BurgosNo ratings yet

- Corporate Profile PDFDocument26 pagesCorporate Profile PDFAdeel HassanNo ratings yet

- Quality System Audit Check Sheet (190722)Document21 pagesQuality System Audit Check Sheet (190722)swapon kumar shillNo ratings yet

- Work From AnywhereDocument11 pagesWork From AnywheretaguabsbNo ratings yet

- Cold Applied TapeDocument3 pagesCold Applied TapeKolusu SivakumarNo ratings yet

- Driving Electric Distribution ExcellenceDocument15 pagesDriving Electric Distribution Excellencekashifbutty2kNo ratings yet

- SA 200 300 SeriesDocument9 pagesSA 200 300 SeriesfgbrtbryhtyNo ratings yet

- Gap Analysis Action Plan Energy Isolation Standard (Updated 27.03.2020)Document2 pagesGap Analysis Action Plan Energy Isolation Standard (Updated 27.03.2020)Alaa El-shafei100% (1)

- Perform Substantive Procedures L1Document10 pagesPerform Substantive Procedures L1archanaanuNo ratings yet

- Implementing Cmmi Practices by Applying Extreme Programing PracticesDocument17 pagesImplementing Cmmi Practices by Applying Extreme Programing PracticesLiat StruvinskyNo ratings yet

- Flexible Smoke Curtains: Mechanical Design For SupercoilDocument22 pagesFlexible Smoke Curtains: Mechanical Design For SupercoilEmmanuel HilarioNo ratings yet

- Case Study Measuring ROI in Interactive SkillsDocument18 pagesCase Study Measuring ROI in Interactive SkillsAbhay KumarNo ratings yet

- Mapping Jurnal InternasionalDocument1 pageMapping Jurnal InternasionalSarjana ManajemenNo ratings yet

- Asian Paints 22-23 - Statutory ReportsDocument59 pagesAsian Paints 22-23 - Statutory Reportsryarpit0No ratings yet

- Select List of Approved Contractors - Performance Monitoring FormDocument4 pagesSelect List of Approved Contractors - Performance Monitoring FormAngga HSE dbn05No ratings yet

- LeanIX An Agile Framework To Implement TOGAF With LeanIX enDocument1 pageLeanIX An Agile Framework To Implement TOGAF With LeanIX enLarry LarsNo ratings yet

- Topic:-DU - J19 - MSC - FN: Correct Answer: - Isozymes (Option ID 861)Document21 pagesTopic:-DU - J19 - MSC - FN: Correct Answer: - Isozymes (Option ID 861)Apeksha ChilwalNo ratings yet

- Paper - 3: Cost Accounting and Financial Management: (A) A Skilled Worker Is Paid A Guaranteed Wage Rate ofDocument21 pagesPaper - 3: Cost Accounting and Financial Management: (A) A Skilled Worker Is Paid A Guaranteed Wage Rate ofApeksha ChilwalNo ratings yet

- 1563325936MA-Linguistics-July 5Document11 pages1563325936MA-Linguistics-July 5Apeksha ChilwalNo ratings yet

- Fa 102Document20 pagesFa 102Apeksha ChilwalNo ratings yet

- PG Prospectus 2017-2018Document27 pagesPG Prospectus 2017-2018Apeksha ChilwalNo ratings yet

- Paper 4 Studycafe - inDocument28 pagesPaper 4 Studycafe - inApeksha ChilwalNo ratings yet

- Part I: Statutory Update: © The Institute of Chartered Accountants of IndiaDocument41 pagesPart I: Statutory Update: © The Institute of Chartered Accountants of IndiaApeksha ChilwalNo ratings yet

- Auditoromermancnc: A, FPQDocument6 pagesAuditoromermancnc: A, FPQApeksha ChilwalNo ratings yet

- Bachelorof Education BEdDocument50 pagesBachelorof Education BEdApeksha ChilwalNo ratings yet

- 1563413817MPhil-PhD-PercussionMusic-July 8Document14 pages1563413817MPhil-PhD-PercussionMusic-July 8Apeksha ChilwalNo ratings yet

- Emailing Adobe Scan 13-Aug-2020Document4 pagesEmailing Adobe Scan 13-Aug-2020Apeksha ChilwalNo ratings yet

- 1563328103MA Psychology July 7Document21 pages1563328103MA Psychology July 7Apeksha ChilwalNo ratings yet

- Paper - 3: Cost Accounting and Financial Management: 2015 (In Lakhs) 2016 (In Lakhs)Document25 pagesPaper - 3: Cost Accounting and Financial Management: 2015 (In Lakhs) 2016 (In Lakhs)Apeksha ChilwalNo ratings yet

- SA 600 - Using The Work of Another AuditorDocument1 pageSA 600 - Using The Work of Another AuditorApeksha ChilwalNo ratings yet

- Emergence of Communist Party in Nationalist MovementDocument5 pagesEmergence of Communist Party in Nationalist MovementApeksha ChilwalNo ratings yet

- SA 700 New Nov 18 Elements of Audit Report (Sections) : Independent Auditor'SDocument1 pageSA 700 New Nov 18 Elements of Audit Report (Sections) : Independent Auditor'SApeksha ChilwalNo ratings yet

- Set CDocument2 pagesSet CApeksha ChilwalNo ratings yet

- SA 701 Chart 1: JudgementDocument3 pagesSA 701 Chart 1: JudgementApeksha ChilwalNo ratings yet

- Du McomDocument18 pagesDu McomApeksha ChilwalNo ratings yet

- 1563327718PhD-FinancialStudies-July 7Document14 pages1563327718PhD-FinancialStudies-July 7Apeksha ChilwalNo ratings yet

- Edufever: Topic:-DU - J19 - MCOMDocument22 pagesEdufever: Topic:-DU - J19 - MCOMApeksha ChilwalNo ratings yet

- Static Banking by StudynitiDocument80 pagesStatic Banking by StudynitiSaurabh SinghNo ratings yet

- Choose A Plan - ScribdDocument1 pageChoose A Plan - ScribdUltraJohn95No ratings yet

- Interpretation of StatutesDocument8 pagesInterpretation of StatutesPradeepkumar GadamsettyNo ratings yet

- NY State Official Election ResultsDocument40 pagesNY State Official Election ResultsBloomberg PoliticsNo ratings yet

- AWS Academy Learner Lab Educator GuideDocument12 pagesAWS Academy Learner Lab Educator GuideFiki Fahrudin FahmiNo ratings yet

- IGAINYA LTD Vs NLC& AGDocument15 pagesIGAINYA LTD Vs NLC& AGEdwin ChaungoNo ratings yet

- SDRL Certificate of Conformity: SubseaDocument6 pagesSDRL Certificate of Conformity: SubseaJones Pereira NetoNo ratings yet

- Federal Lawsuit 5 16 CV 00184 RevisedDocument38 pagesFederal Lawsuit 5 16 CV 00184 RevisedPINAC NewsNo ratings yet

- SCIMATHUS UPP INFORMATIONSHEET Eng - 2020Document2 pagesSCIMATHUS UPP INFORMATIONSHEET Eng - 2020bra9tee9tiniNo ratings yet

- SGArrivalCard 110820231101Document12 pagesSGArrivalCard 110820231101GPDI OIKUMENE MANADONo ratings yet

- Audit Program - CashDocument1 pageAudit Program - CashJoseph Pamaong100% (6)

- Bond Acrylic Weldon 42Document2 pagesBond Acrylic Weldon 42Vinaya Almane DattathreyaNo ratings yet

- Ansi B 1.5Document37 pagesAnsi B 1.5Ramana NatesanNo ratings yet

- (DAILY CALLER OBTAINED) - Doe V San Diego Unified SCH Dist Doc. 5 1 Urgent Motion For IPADocument53 pages(DAILY CALLER OBTAINED) - Doe V San Diego Unified SCH Dist Doc. 5 1 Urgent Motion For IPAHenry Rodgers100% (1)

- Taveras Co Decides at The Beginning of 2008 To AdoptDocument1 pageTaveras Co Decides at The Beginning of 2008 To AdoptM Bilal SaleemNo ratings yet

- Claude BalbastreDocument4 pagesClaude BalbastreDiana GhiusNo ratings yet

- AST JSA Excavations.Document3 pagesAST JSA Excavations.md_rehan_2No ratings yet

- Insurance QuestionsDocument5 pagesInsurance QuestionsVijay100% (2)

- Mendoza v. People, 886 SCRA 594Document22 pagesMendoza v. People, 886 SCRA 594EmNo ratings yet

- Ansys Licensing Portal Administrators GuideDocument16 pagesAnsys Licensing Portal Administrators GuidekskskNo ratings yet

- Early Filipino RevoltsDocument49 pagesEarly Filipino RevoltsGionne Carlo GomezNo ratings yet

- List of Firms 01 07 19Document2 pagesList of Firms 01 07 19Umar ArshadNo ratings yet

- D-Visa-Study-Checklist-2021 UpdatedDocument1 pageD-Visa-Study-Checklist-2021 UpdatedSAKA PREMCHANDNo ratings yet

- Wright PDFDocument21 pagesWright PDFmipalosaNo ratings yet

- DBQ USConstitutionDocument10 pagesDBQ USConstitutionselenaespinal792No ratings yet

- MTD 24A46E729 Chipper-Shredder Owner's ManualDocument20 pagesMTD 24A46E729 Chipper-Shredder Owner's ManualcpprioliNo ratings yet

- Resources Mechanical AESSEAL Guides OEMDocument147 pagesResources Mechanical AESSEAL Guides OEMhufuents-1100% (2)

- Saraswat Co-Oprative Bank FINALDocument45 pagesSaraswat Co-Oprative Bank FINALVivek Rabadia100% (1)

- CL-173 Product Sheet - 3T3-L1Document7 pagesCL-173 Product Sheet - 3T3-L1Andreas HaryonoNo ratings yet

- Lya - Benjamin - Politica - Antievreiască - A - Regimului - Antonescu - (1940-1944)Document24 pagesLya - Benjamin - Politica - Antievreiască - A - Regimului - Antonescu - (1940-1944)Paul DumitruNo ratings yet