Professional Documents

Culture Documents

Insurance VS Gambling: 1.risk Creation Vs Risk Reduction

Uploaded by

Rafsun Himel0 ratings0% found this document useful (0 votes)

53 views2 pagesOriginal Title

Insurance VS Gambling

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

53 views2 pagesInsurance VS Gambling: 1.risk Creation Vs Risk Reduction

Uploaded by

Rafsun HimelCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

Insurance VS Gambling

1.Risk creation vs Risk reduction: When we enter into a gambling

engagement, such as buying a lottery ticket or putting money in a slot

machine, we create risk of loss that did not previously exist. In other words,

there was no risk of losing money to gambling until we bought the lottery

ticket or put the money in the slot machine.

Conversely, the risk of financial loss from other causes already exists

whether we purchase insurance or not. For example, my home faces the

same risk of being burned down by a fire whether I buy homeowners

insurance or not. If I do not have homeowners insurance, I am faced with

the possibility of having to pay completely out of my pocket to rebuild my

home in the event of a fire.

2.Valid vs Void Contract: Insurance is a valid contract, on the other hand

gambling is a void contract according to Bangladesh contract act 1872.

3. Socity’s view: People view a gambler as a unreliable person: conversely

People view an insurance holder as a responsible person.

4. Certainty: In case of gambling either loss or gain will happen with each having

50-50 probability. Insurance will cover loss occurred due to uncertain event that

may never happen as well.

5. documentation: Gambling need no formal

Importance of Insurance for

Businesspeople:

1. Security and Safety: It gives a sense of security and safety to the

businessman. It enables him to receive compensation against actual loss.

He can concentrate on his business with a secure feeling that in case of

losses arising from insurable risk, his losses will be compensated.

2. Distribution of risk: Risk in insurance is spread over a number of people

rather being concentrated on a single individual.

3. Normal expected profit: An insured trader can enjoy normal margin of

profit all the time. He is protected from unexpected losses because of

insurance.

4. Easy to get loans: A trader can get bank loans easily if his stock or

property is insured, as insurance provides a sense of security to the lenders.

5. Advantages of Specialization: Businessmen can concentrate on their

business activities without spending more time on safeguarding their

property. The insurance companies, on the other hand, can provide

specialized insurance services.

6. Development of Social Sectors: Insurance funds are available for

economic development particularly for the development of social sectors.

Especially for a developing country like India, insurance funds are an

important source for investing in infrastructure projects (roads, power,

water supply, telecom etc).

7. Social cooperation: The burden of loss is shouldered by so many persons.

Thus, insurance provides a form of social cooperation.

You might also like

- UNIT 1 InsuranceDocument9 pagesUNIT 1 InsuranceHarleenNo ratings yet

- Insurance & Risk Management JUNE 2022Document11 pagesInsurance & Risk Management JUNE 2022Rajni KumariNo ratings yet

- Child Insurance PlanDocument72 pagesChild Insurance PlanAnvesh Pulishetty -BNo ratings yet

- Describe The Concept of InsuranceDocument12 pagesDescribe The Concept of InsuranceIndu GuptaNo ratings yet

- 18BCO32C-U1Document14 pages18BCO32C-U1Vipul TyagiNo ratings yet

- History and Types of Insurance in IndiaDocument72 pagesHistory and Types of Insurance in India6338250% (4)

- INSURANCE LAW IN INDIADocument44 pagesINSURANCE LAW IN INDIAVaibhav AhujaNo ratings yet

- FMS - Unit 6 - Insurance PDFDocument6 pagesFMS - Unit 6 - Insurance PDFHarushika MittalNo ratings yet

- Basics of Business Insurance - NotesDocument41 pagesBasics of Business Insurance - Notesjeganrajraj100% (1)

- Insurance Project 1172407) VarDocument54 pagesInsurance Project 1172407) VarVarinder SinghNo ratings yet

- Open Course (Module 4)Document14 pagesOpen Course (Module 4)Sahil AnsariNo ratings yet

- Insurance BasicsDocument14 pagesInsurance BasicsSahil AnsariNo ratings yet

- Contracts II Assignment AnalysisDocument10 pagesContracts II Assignment AnalysisSAURABH SINGHNo ratings yet

- Banking and InsuranceDocument17 pagesBanking and InsuranceDeepak GhimireNo ratings yet

- Basics of Insurance: Course Instructor: Nusrat FarzanaDocument16 pagesBasics of Insurance: Course Instructor: Nusrat FarzanamjrNo ratings yet

- Importance and Benefits of InsuranceDocument7 pagesImportance and Benefits of InsurancePooja TripathiNo ratings yet

- Chapter 6 Risk and InsuranceDocument12 pagesChapter 6 Risk and InsuranceArfat AnsariNo ratings yet

- New Microsoft Word DocumentDocument3 pagesNew Microsoft Word DocumentShantam GulatiNo ratings yet

- Banking and Insurance Unit III Study NotesDocument13 pagesBanking and Insurance Unit III Study NotesSekar M KPRCAS-CommerceNo ratings yet

- InsuranceDocument72 pagesInsuranceJigar ShahNo ratings yet

- Pbi Module 4Document25 pagesPbi Module 4SUBHECHHA MOHAPATRANo ratings yet

- Definition of Insurance Insurance PremiumDocument3 pagesDefinition of Insurance Insurance Premiumshefallidhuria7No ratings yet

- Insurance ProvisionDocument8 pagesInsurance ProvisionJake GuataNo ratings yet

- Concept of InsuranceDocument2 pagesConcept of Insurance17-075 Upgna PatelNo ratings yet

- Insurance Fund ManagementDocument108 pagesInsurance Fund Managementsnehachandan91No ratings yet

- Chapter 05 RMIDocument16 pagesChapter 05 RMISudipta BaruaNo ratings yet

- Insurance Is A Means of Protection From Financial Loss. It Is A Form of Risk Management PrimarilyDocument7 pagesInsurance Is A Means of Protection From Financial Loss. It Is A Form of Risk Management PrimarilyPramila ChauhanNo ratings yet

- Insurance Assignmnt Merits and DemeritsDocument8 pagesInsurance Assignmnt Merits and DemeritsDjay SlyNo ratings yet

- Managerial Lookouts On Insurance PrinciplesDocument9 pagesManagerial Lookouts On Insurance PrinciplesDebabrata PriyadarshiNo ratings yet

- Role and Importance of InsuranceDocument2 pagesRole and Importance of InsurancemonuNo ratings yet

- Insurance FundamentalsDocument24 pagesInsurance FundamentalsKarthick KumarNo ratings yet

- Summary Sheet - Insurance Lyst7304Document19 pagesSummary Sheet - Insurance Lyst7304smriti kumariNo ratings yet

- Chapter 1-What Is Insurance?Document20 pagesChapter 1-What Is Insurance?Akshada Chitnis100% (2)

- Understanding Insurance Industry in IndiaDocument51 pagesUnderstanding Insurance Industry in IndiaAnkur SheelNo ratings yet

- Bus Law Insu. PartDocument23 pagesBus Law Insu. PartBona IbrahimNo ratings yet

- Definition of InsuranceDocument11 pagesDefinition of InsurancePuru SharmaNo ratings yet

- INSURANCEDocument11 pagesINSURANCESashNo ratings yet

- Principles of Insurance and Loss Assessment: Unit - 1 Introduction To InsuranceDocument71 pagesPrinciples of Insurance and Loss Assessment: Unit - 1 Introduction To InsuranceVenkat Deepak SarmaNo ratings yet

- Introduction To InsuranceDocument15 pagesIntroduction To InsuranceInza NsaNo ratings yet

- Chapter 4 Legal Principles of Insurance ContractDocument13 pagesChapter 4 Legal Principles of Insurance ContractgozaloiNo ratings yet

- Insurance Act 2010 (Theory) PDFDocument6 pagesInsurance Act 2010 (Theory) PDFCryptic LollNo ratings yet

- Insurance Company ProfileDocument12 pagesInsurance Company ProfileKai MK4No ratings yet

- Insurance 1Document33 pagesInsurance 1Bimsara SomarathnaNo ratings yet

- Apollo MunichDocument52 pagesApollo MunichSumit ManglaniNo ratings yet

- Business Services - Part 3: ObjectivesDocument14 pagesBusiness Services - Part 3: ObjectivesSanta GlenmarkNo ratings yet

- Class - LL.B (HONS.) II SEM. Subject - Insurance Law: Unit I:IntroductionDocument26 pagesClass - LL.B (HONS.) II SEM. Subject - Insurance Law: Unit I:IntroductionVineet ShahNo ratings yet

- Essentials of An Insurance ContractDocument7 pagesEssentials of An Insurance ContractSameer JoshiNo ratings yet

- Law of InsuranceDocument7 pagesLaw of InsuranceJack Dowson100% (1)

- Banking and Insurance ElementsDocument11 pagesBanking and Insurance ElementsNisarg ShahNo ratings yet

- The Characteristics of Insurance ContractsDocument4 pagesThe Characteristics of Insurance Contractsvij_puvva6446No ratings yet

- A) XYZ Insurance Company Refuse To Pay The Claims Because Mr. Chowdhury GotDocument5 pagesA) XYZ Insurance Company Refuse To Pay The Claims Because Mr. Chowdhury GotKazi Asaduzzman100% (1)

- InsuranceDocument6 pagesInsuranceHarsh SadavartiaNo ratings yet

- New Microsoft Office Word DocumentDocument63 pagesNew Microsoft Office Word DocumentAmin HoqNo ratings yet

- Concept of Insurance & Indian Insurance MarketDocument26 pagesConcept of Insurance & Indian Insurance MarketMADANMOHANREDDYNo ratings yet

- Advantages of Insurance: Security, Risk Spreading, Capital Formation & MoreDocument6 pagesAdvantages of Insurance: Security, Risk Spreading, Capital Formation & MoreSanthosh KumarNo ratings yet

- Mhatre 30Document98 pagesMhatre 30sandeepNo ratings yet

- LIC Study Objectives and MethodologyDocument60 pagesLIC Study Objectives and MethodologypiudiNo ratings yet

- Iom Concept of InsuranceDocument4 pagesIom Concept of Insuranceowuor PeterNo ratings yet

- Security Guard MainGate, 81968 Md. Shahin KadirSecurity GuardDocument1 pageSecurity Guard MainGate, 81968 Md. Shahin KadirSecurity GuardRafsun HimelNo ratings yet

- Security Guard MainGate, 81968 Md. Shahin KadirSecurity GuardDocument1 pageSecurity Guard MainGate, 81968 Md. Shahin KadirSecurity GuardRafsun HimelNo ratings yet

- Security Guard MainGate, 81968 Md. Shahin KadirSecurity GuardDocument1 pageSecurity Guard MainGate, 81968 Md. Shahin KadirSecurity GuardRafsun HimelNo ratings yet

- Security Supervisor. 32457 Md. Shafiqul IslamAssistant Supervisor (Security)Document2 pagesSecurity Supervisor. 32457 Md. Shafiqul IslamAssistant Supervisor (Security)Rafsun HimelNo ratings yet

- Security Supervisor. 32457 Md. Shafiqul IslamAssistant Supervisor (Security)Document2 pagesSecurity Supervisor. 32457 Md. Shafiqul IslamAssistant Supervisor (Security)Rafsun HimelNo ratings yet

- Company's Pool Car GuidelineDocument2 pagesCompany's Pool Car GuidelineRafsun HimelNo ratings yet

- Md. - Abdul - Quddus-Kniting AMDocument2 pagesMd. - Abdul - Quddus-Kniting AMRafsun HimelNo ratings yet

- Accommodation AllowanceDocument6 pagesAccommodation AllowanceRafsun HimelNo ratings yet

- Security Guard MainGate, 81968 Md. Shahin KadirSecurity GuardDocument1 pageSecurity Guard MainGate, 81968 Md. Shahin KadirSecurity GuardRafsun HimelNo ratings yet

- A. Liquid AssetDocument3 pagesA. Liquid AssetRafsun HimelNo ratings yet

- JOB Responsibilities Self-Assessment Questionnaire (JRSA) - Islam Group Ashekur Rahman KhanDocument3 pagesJOB Responsibilities Self-Assessment Questionnaire (JRSA) - Islam Group Ashekur Rahman KhanRafsun HimelNo ratings yet

- Attendance AllowanceDocument3 pagesAttendance AllowanceRafsun HimelNo ratings yet

- Employee Skill InventoryDocument9 pagesEmployee Skill InventoryRafsun HimelNo ratings yet

- Ruknus Jaman-Manager, MaintenanceDocument4 pagesRuknus Jaman-Manager, MaintenanceRafsun HimelNo ratings yet

- Abdullah - Al - Mamun .-3Document2 pagesAbdullah - Al - Mamun .-3Rafsun HimelNo ratings yet

- Relationship Between Bank & Customer: Rights of BankerDocument2 pagesRelationship Between Bank & Customer: Rights of BankerRafsun HimelNo ratings yet

- Mir - Ahammed - Ali-Dyeing ManagerDocument4 pagesMir - Ahammed - Ali-Dyeing ManagerRafsun HimelNo ratings yet

- How Operations As A Competitive Weapon Fits The Operations Management PhilosophyDocument22 pagesHow Operations As A Competitive Weapon Fits The Operations Management PhilosophyRafsun HimelNo ratings yet

- Classwork 04.11.21Document3 pagesClasswork 04.11.21Rafsun HimelNo ratings yet

- Employee Skill InventoryDocument9 pagesEmployee Skill InventoryRafsun HimelNo ratings yet

- Lecture 1Document9 pagesLecture 1Rafsun HimelNo ratings yet

- Employee Skill InventoryDocument9 pagesEmployee Skill InventoryRafsun HimelNo ratings yet

- Process Layout: © 2007 Pearson EducationDocument49 pagesProcess Layout: © 2007 Pearson EducationRafsun HimelNo ratings yet

- How Operations As A Competitive Weapon Fits The Operations Management PhilosophyDocument22 pagesHow Operations As A Competitive Weapon Fits The Operations Management PhilosophyRafsun HimelNo ratings yet

- Process Layout: © 2007 Pearson EducationDocument49 pagesProcess Layout: © 2007 Pearson EducationRafsun HimelNo ratings yet

- Rufus Steele1Document63 pagesRufus Steele1BenjaminMalone100% (1)

- The Animals - The House of The Rising SunDocument2 pagesThe Animals - The House of The Rising Sunjuan sevillaNo ratings yet

- Rule Book v3Document6 pagesRule Book v3Paul FerenceNo ratings yet

- As1 LeadershipDocument19 pagesAs1 LeadershipSandeep BholahNo ratings yet

- Probability Estimation in Poker: A Qualified Success For Unaided JudgmentDocument31 pagesProbability Estimation in Poker: A Qualified Success For Unaided JudgmentDiego GrandonNo ratings yet

- 4th Lecture - Handling Tricky SituationsDocument3 pages4th Lecture - Handling Tricky SituationsKevin fxNo ratings yet

- Compilation of Gambling LawsDocument7 pagesCompilation of Gambling LawsDerlene JoshnaNo ratings yet

- 2020 Kentucky Derby Future (062120)Document1 page2020 Kentucky Derby Future (062120)Matthew Stahl100% (1)

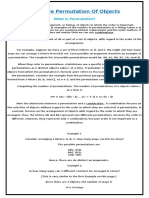

- Practice Questions Probability Class XDocument1 pagePractice Questions Probability Class XMadhuri RaghuNo ratings yet

- Cm1507orp - Resources Manual Tab PDFDocument39 pagesCm1507orp - Resources Manual Tab PDFJackNo ratings yet

- 7TV RulesDocument65 pages7TV RulesСаша Молдавский100% (1)

- Village IdiotDocument19 pagesVillage IdiotFlorischNo ratings yet

- Las Vegas Hotel - OutlookDocument2 pagesLas Vegas Hotel - OutlookkohfordNo ratings yet

- Animal Pack PDFDocument84 pagesAnimal Pack PDFAgnieszka100% (1)

- Gambler's Gambit - Homebrew 5E Gambler ClassDocument12 pagesGambler's Gambit - Homebrew 5E Gambler ClassFish SaviourNo ratings yet

- Card CrawlerDocument2 pagesCard CrawlerJodi FernwehNo ratings yet

- Chicken Man - DNDDocument1 pageChicken Man - DNDYasso GhewNo ratings yet

- Genii-June-06-The Man Who Fooled HoudiniDocument20 pagesGenii-June-06-The Man Who Fooled HoudiniMagicMan100% (1)

- Self-Esteem Bingo CardDocument1 pageSelf-Esteem Bingo CardElla MirandaNo ratings yet

- Screenshot 2021-08-23 at 16.46.06Document1 pageScreenshot 2021-08-23 at 16.46.06amandasibeko098No ratings yet

- LmsDocument2 pagesLmsDerrick Logan AndersonNo ratings yet

- Math Portfolio DocsDocument21 pagesMath Portfolio DocsRussel Andrei BiscoNo ratings yet

- Three Card Poker GuideDocument13 pagesThree Card Poker GuideTafieNo ratings yet

- Report No. 276 LCIDocument73 pagesReport No. 276 LCIKhushi AgarwalNo ratings yet

- Ebooks About Magic - Ed Marlo - Revolutionary Card TechniqueDocument511 pagesEbooks About Magic - Ed Marlo - Revolutionary Card Techniquedurarioz91% (11)

- Superrugby Saturday-Pacific RacingDocument1 pageSuperrugby Saturday-Pacific RacingjoanalcarazNo ratings yet

- Probability ScaleDocument4 pagesProbability ScaleNarjar DungoojNo ratings yet

- Ceng317gc32 Simba JustineDocument6 pagesCeng317gc32 Simba JustineAlexander P. Belka100% (1)

- 3 - Roll A StoryDocument22 pages3 - Roll A Storyapi-426797731No ratings yet

- Mahjong RulesDocument3 pagesMahjong Ruleswrongtree09No ratings yet