Professional Documents

Culture Documents

Capital Asset Pricing Model Walmart

Uploaded by

Christopher Kipsang0 ratings0% found this document useful (0 votes)

42 views11 pagesOriginal Title

CAPITAL ASSET PRICING MODEL WALMART

Copyright

© © All Rights Reserved

Available Formats

ODS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as ODS, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

42 views11 pagesCapital Asset Pricing Model Walmart

Uploaded by

Christopher KipsangCopyright:

© All Rights Reserved

Available Formats

Download as ODS, PDF, TXT or read online from Scribd

You are on page 1of 11

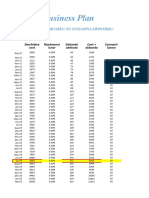

Walmart company limited

Monthly return rates

Walmart Inc. (WMT)

t Date Price(WMT, t) Dividend(WMT, t) R(WMT, t)

28-Feb-15 83.9300

1 31-Mar-15 82.2500 0.4900 -1.4200%

2 30-Apr-15 78.0500 -5.1100%

3 31-May-15 74.2700 0.4900 -4.2200%

4 30-Jun-15 70.9300 -4.5000%

5 31-Jul-15 71.9800 1.4800%

6 31-Aug-15 64.7300 0.4900 -9.3900%

7 30-Sep-15 64.8400 0.1700%

8 31-Oct-15 57.2400 -11.7200%

9 30-Nov-15 58.8400 2.8000%

10 31-Dec-15 61.3000 0.4900 5.0100%

11 31-Jan-16 66.3600 8.2500%

12 29-Feb-16 66.3400 -0.0300%

13 31-Mar-16 68.4900 0.5000 3.9900%

14 30-Apr-16 66.8700 -2.3700%

15 31-May-16 70.7800 0.5000 6.5900%

16 30-Jun-16 73.0200 3.1600%

17 31-Jul-16 72.9700 -0.0700%

18 31-Aug-16 71.4400 0.5000 -1.4100%

19 30-Sep-16 72.1200 0.9500%

20 31-Oct-16 70.0200 -2.9100%

21 30-Nov-16 70.4300 0.5900%

22 31-Dec-16 69.1200 0.5000 -1.1500%

23 31-Jan-17 66.7400 -3.4400%

24 28-Feb-17 70.9300 6.2800%

25 31-Mar-17 72.0800 0.5100 2.3400%

26 30-Apr-17 75.1800 4.3000%

27 31-May-17 78.6000 0.5100 5.2300%

28 30-Jun-17 75.6800 -3.7200%

29 31-Jul-17 79.9900 5.7000%

30 31-Aug-17 78.0700 0.5100 -1.7600%

31 30-Sep-17 78.1400 0.0900%

32 31-Oct-17 87.3100 11.7400%

33 30-Nov-17 97.2300 11.3600%

34 31-Dec-17 98.7500 0.5100 2.0900%

35 31-Jan-18 106.6000 7.9500%

36 28-Feb-18 90.0100 -15.5600%

37 31-Mar-18 88.9700 0.5200 -0.5800%

38 30-Apr-18 88.4600 -0.5700%

39 31-May-18 82.5400 0.5200 -6.1000%

40 30-Jun-18 85.6500 3.7700%

41 31-Jul-18 89.2300 4.1800%

42 31-Aug-18 95.8600 0.5200 8.0100%

43 30-Sep-18 93.9100 -2.0300%

44 31-Oct-18 100.2800 6.7800%

45 30-Nov-18 97.6500 -2.6200%

46 31-Dec-18 93.1500 0.5200 -4.0800%

47 31-Jan-19 95.8300 2.8800%

48 28-Feb-19 98.9900 3.3000%

49 31-Mar-19 97.5300 0.5300 -0.9400%

50 30-Apr-19 102.8400 5.4400%

51 31-May-19 101.4400 0.5300 -0.8500%

52 30-Jun-19 110.4900 8.9200%

53 31-Jul-19 110.3800 -0.1000%

54 31-Aug-19 114.2600 0.5300 4.0000%

55 30-Sep-19 118.6800 3.8700%

56 31-Oct-19 117.2600 -1.2000%

57 30-Nov-19 119.0900 1.5600%

58 31-Dec-19 118.8400 0.5300 0.2400%

59 31-Jan-20 114.4900 -3.6600%

60 29-Feb-20 107.6800 -5.9500%

61 31-Mar-20 113.6200 0.5400 6.0200%

62 30-Apr-20 121.5500 6.9800%

63 31-May-20 124.0600 0.5400 2.5100%

64 30-Jun-20 119.7800 -3.4500%

65 31-Jul-20 129.4000 8.0300%

66 31-Aug-20 138.8500 0.5400 7.7200%

67 30-Sep-20 139.9100 0.7600%

68 31-Oct-20 138.7500 -0.8300%

69 30-Nov-20 152.7900 10.1200%

70 31-Dec-20 144.1500 0.5400 -5.3000%

71 31-Jan-21 140.4900 -2.5400%

Average (R̅): 1.0600%

Standard deviation: 5.2300%

Standard & Poor’s 500 (S&P 500)

Price(S&P 500, t) R(S&P 500, t)

2,104.5000

2,067.8900 -1.740%

2,085.5100 0.850%

2,107.3900 1.050%

2,063.1100 -2.100%

2,103.8400 1.970%

1,972.1800 -6.260%

1,920.0300 -2.640%

2,079.3600 8.300%

2,080.4100 0.050%

2,043.9400 -1.750%

1,940.2400 -5.070%

1,932.2300 -0.410%

2,059.7400 6.600%

2,065.3000 0.270%

2,096.9500 1.530%

2,098.8600 0.090%

2,173.6000 3.560%

2,170.9500 -0.120%

2,168.2700 -0.120%

2,126.1500 -1.940%

2,198.8100 3.420%

2,238.8300 1.820%

2,278.8700 1.790%

2,363.6400 3.720%

2,362.7200 -0.040%

2,384.2000 0.910%

2,411.8000 1.160%

2,423.4100 0.480%

2,470.3000 1.930%

2,471.6500 0.050%

2,519.3600 1.930%

2,575.2600 2.220%

2,647.5800 2.810%

2,673.6100 0.980%

2,823.8100 5.620%

2,713.8300 -3.890%

2,640.8700 -2.690%

2,648.0500 0.270%

2,705.2700 2.160%

2,718.3700 0.480%

2,816.2900 3.600%

2,901.5200 3.030%

2,913.9800 0.430%

2,711.7400 -6.940%

2,760.1700 1.790%

2,506.8500 -9.180%

2,704.1000 7.870%

2,784.4900 2.970%

2,834.4000 1.790%

2,945.8300 3.930%

2,752.0600 -6.580%

2,941.7600 6.890%

2,980.3800 1.310%

2,926.4600 -1.810%

2,976.7400 1.720%

3,037.5600 2.040%

3,140.9800 3.400%

3,230.7800 2.860%

3,225.5200 -0.160%

2,954.2200 -8.410%

2,584.5900 -12.510%

2,912.4300 12.680%

3,044.3100 4.530%

3,100.2900 1.840%

3,271.1200 5.510%

3,500.3100 7.010%

3,363.0000 -3.920%

3,269.9600 -2.770%

3,621.6300 10.750%

3,756.0700 3.710%

3,714.2400 -1.110%

0.890%

4.300%

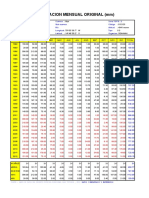

Walmart company

variance and covariance of returns

t Date R(WMT, t) R(S&P 500, t) (R(WMT, t) –

R̅(WMT))2

1 31-Mar-15 -1.4200% -1.7400% 6.1600

2 30-Apr-15 -5.1100% 0.8500% 38.0800

3 31-May-15 -4.2200% 1.0500% 27.8800

4 30-Jun-15 -4.5000% -2.1000% 30.9300

5 31-Jul-15 1.4800% 1.9700% 0.1700

6 31-Aug-15 -9.3900% -6.2600% 109.3300

7 30-Sep-15 0.1700% -2.6400% 0.8000

8 31-Oct-15 -11.7200% 8.3000% 163.4800

9 30-Nov-15 2.8000% 0.0500% 3.0000

10 31-Dec-15 5.0100% -1.7500% 15.5900

11 31-Jan-16 8.2500% -5.0700% 51.6900

12 29-Feb-16 -0.0300% -0.4100% 1.2000

13 31-Mar-16 3.9900% 6.6000% 8.5800

14 30-Apr-16 -2.3700% 0.2700% 11.7600

15 31-May-16 6.5900% 1.5300% 30.5800

16 30-Jun-16 3.1600% 0.0900% 4.4100

17 31-Jul-16 -0.0700% 3.5600% 1.2800

18 31-Aug-16 -1.4100% -0.1200% 6.1300

19 30-Sep-16 0.9500% -0.1200% 0.0100

20 31-Oct-16 -2.9100% -1.9400% 15.8100

21 30-Nov-16 0.5900% 3.4200% 0.2300

22 31-Dec-16 -1.1500% 1.8200% 4.9000

23 31-Jan-17 -3.4400% 1.7900% 20.3200

24 28-Feb-17 6.2800% 3.7200% 27.1800

25 31-Mar-17 2.3400% -0.0400% 1.6300

26 30-Apr-17 4.3000% 0.9100% 10.4700

27 31-May-17 5.2300% 1.1600% 17.3300

28 30-Jun-17 -3.7200% 0.4800% 22.8400

29 31-Jul-17 5.7000% 1.9300% 21.4400

30 31-Aug-17 -1.7600% 0.0500% 7.9900

31 30-Sep-17 0.0900% 1.9300% 0.9500

32 31-Oct-17 11.7400% 2.2200% 113.8600

33 30-Nov-17 11.3600% 2.8100% 106.0300

34 31-Dec-17 2.0900% 0.9800% 1.0500

35 31-Jan-18 7.9500% 5.6200% 47.4000

36 28-Feb-18 -15.5600% -3.8900% 276.4700

37 31-Mar-18 -0.5800% -2.6900% 2.7000

38 30-Apr-18 -0.5700% 0.2700% 2.6800

39 31-May-18 -6.1000% 2.1600% 51.4000

40 30-Jun-18 3.7700% 0.4800% 7.3100

41 31-Jul-18 4.1800% 3.6000% 9.7000

42 31-Aug-18 8.0100% 3.0300% 48.2800

43 30-Sep-18 -2.0300% 0.4300% 9.6000

44 31-Oct-18 6.7800% -6.9400% 32.7000

45 30-Nov-18 -2.6200% 1.7900% 13.6000

46 31-Dec-18 -4.0800% -9.1800% 26.4200

47 31-Jan-19 2.8800% 7.8700% 3.2900

48 28-Feb-19 3.3000% 2.9700% 4.9900

49 31-Mar-19 -0.9400% 1.7900% 4.0200

50 30-Apr-19 5.4400% 3.9300% 19.1800

51 31-May-19 -0.8500% -6.5800% 3.6500

52 30-Jun-19 8.9200% 6.8900% 61.7300

53 31-Jul-19 -0.1000% 1.3100% 1.3600

54 31-Aug-19 4.0000% -1.8100% 8.5900

55 30-Sep-19 3.8700% 1.7200% 7.8600

56 31-Oct-19 -1.2000% 2.0400% 5.1100

57 30-Nov-19 1.5600% 3.4000% 0.2500

58 31-Dec-19 0.2400% 2.8600% 0.6900

59 31-Jan-20 -3.6600% -0.1600% 22.3300

60 29-Feb-20 -5.9500% -8.4100% 49.1800

61 31-Mar-20 6.0200% -12.5100% 24.5300

62 30-Apr-20 6.9800% 12.6800% 34.9800

63 31-May-20 2.5100% 4.5300% 2.0900

64 30-Jun-20 -3.4500% 1.8400% 20.3800

65 31-Jul-20 8.0300% 5.5100% 48.5400

66 31-Aug-20 7.7200% 7.0100% 44.3000

67 30-Sep-20 0.7600% -3.9200% 0.0900

68 31-Oct-20 -0.8300% -2.7700% 3.5900

69 30-Nov-20 10.1200% 10.7500% 81.9800

70 31-Dec-20 -5.3000% 3.7100% 40.5300

71 31-Jan-21 -2.5400% -1.1100% 12.9900

Total (Σ): 1,917.6000

(R(S&P 500, t) – (R(WMT, t) –

R̅(S&P 500))2 R̅(WMT)) × (R(S&P

500, t) – R̅(S&P

500))

6.9400 6.5400

0.2600

0.0200 (0.8200)

8.9800 16.6600

1.1700 0.4500

51.1600 74.7900

12.5200 3.1700

54.8100 (94.6600)

0.7100 (1.4600)

7.0100 (10.4600)

35.6200 (42.9100)

1.7100 1.4300

32.5400 16.7100

0.3900 2.1400

0.4100 3.5300

0.6500 (1.6900)

7.1100 (3.0200)

1.0300 2.5200

1.0400 0.1100

8.0500 11.2800

6.3600 (1.2100)

0.8600 (2.0500)

0.8000 (4.0300)

7.9800 14.7300

0.8700 (1.1900)

0.0500

0.0700 1.0900

0.1700 1.9800

1.0800 4.8200

0.7100 2.3800

1.0700 (1.0100)

1.7500 14.1300

3.6600 19.7000

0.0100 0.0900

22.3100 32.5200

22.9400 79.6400

12.8400 5.8800

0.3900 1.0200

1.6000 (9.0800)

0.1700 (1.1100)

7.3300 8.4300

4.5400 14.8100

0.2200 1.4400

61.3900 (44.8000)

0.7900 (3.2900)

101.4500 51.7800

48.6300 12.6400

4.3200 4.6400

0.8100 (1.8000)

9.2200 13.3000

55.8400 14.2800

35.9800 47.1300

0.1700 (0.4900)

7.3100 (7.9200)

0.6800 2.3100

1.3200 (2.6000)

6.3000 1.2500

3.8600 (1.6300)

1.1200 5.0000

86.6000 65.2600

179.7400 (66.4100)

139.0000 69.7300

13.2000 5.2500

0.8900 (4.2600)

21.3000 32.1500

37.3500 40.6800

23.2100 1.4500

13.4100 6.9300

97.2200 89.2700

7.9400 (17.9400)

4.0300 7.2400

1,292.6800 486.7700

Walmart Inc.

Systematic risk (β) estimation

Variance(WMT) $27.3900

Variance(S&P 500) $18.4700

Covariance(WMT, S&P 500) $6.9500

Correlation coefficient(WMT, S&P 500) $0.3100

β(WMT) $0.3800

α(WMT) 0.73%

Walmart Inc.

Expected rate of return

Assumptions

Rate of return on LT Treasury Composite R(F)

Expected rate of return on market portfolio E[R(M)]

Systematic risk (β) of Walmart Inc.’s common stock β(WMT)

Expected rate of return on Walmart Inc.’s common stock E[R(WMT)]

E(RWMT) = RF + βWMT [E(RM) – RF]

= 2.16% + 0.38 [11.73% – 2.16%]

= 5.76%

2.1600%

11.7300%

38.0000%

5.7600%

You might also like

- Secrets of Pivot Boss Trading - Value Areas, VAP, POC, Pivots & CPRDocument10 pagesSecrets of Pivot Boss Trading - Value Areas, VAP, POC, Pivots & CPRmrityunjayNo ratings yet

- Employee Motivation Research ProjectDocument28 pagesEmployee Motivation Research ProjectNidhi MishraNo ratings yet

- Fundamentals of Financial MarketDocument13 pagesFundamentals of Financial MarketOhimai-Uzebu Joshua100% (1)

- Share and Share CapitalDocument63 pagesShare and Share Capitaldolly bhati100% (4)

- Airline Accounting Guideline No. 1Document24 pagesAirline Accounting Guideline No. 1hhap411No ratings yet

- 2022 CFA Level 2 Curriculum Changes Summary (300hours)Document1 page2022 CFA Level 2 Curriculum Changes Summary (300hours)mawais263No ratings yet

- Stock Trak ReportDocument5 pagesStock Trak Reportnhausaue100% (6)

- Investments - Chap. 6Document31 pagesInvestments - Chap. 6AndreaNo ratings yet

- Projecting Financials & ValuationsDocument88 pagesProjecting Financials & ValuationsPratik ModyNo ratings yet

- BBA - Study On Gold As A Safer Investment CommodityDocument94 pagesBBA - Study On Gold As A Safer Investment CommoditySANJU GNo ratings yet

- RIC Rates W.E.F 12 01 23Document2 pagesRIC Rates W.E.F 12 01 23Federal Land CommissionNo ratings yet

- Ric Profit Rates 17-06-2021Document4 pagesRic Profit Rates 17-06-2021Mobashir Mehmood KhanNo ratings yet

- Trabajo Listo Carteras ListasDocument49 pagesTrabajo Listo Carteras ListasSantiago SanchezNo ratings yet

- Fecha Ipc Cenda Serie Ene07 100: Indice Var Mensual Var AnualDocument1 pageFecha Ipc Cenda Serie Ene07 100: Indice Var Mensual Var AnualJose JalilNo ratings yet

- Column1 City Bank IFIC Bank Singer Bangladesh Apex Spinning. The Ibn Sina Confidence Cement Meghna CementDocument5 pagesColumn1 City Bank IFIC Bank Singer Bangladesh Apex Spinning. The Ibn Sina Confidence Cement Meghna Cementmuhammad shahid ullahNo ratings yet

- DAILY DATA PBB - PBS Share-3Document21 pagesDAILY DATA PBB - PBS Share-3hariyono nurNo ratings yet

- Business Plan: Va Fi Greu Dar Greu Nu Inseamna Imposibil!Document5 pagesBusiness Plan: Va Fi Greu Dar Greu Nu Inseamna Imposibil!yoNo ratings yet

- Sistema de AguaDocument10 pagesSistema de AguaNANDO 15No ratings yet

- Faisal Bank LTD: Date Indexes Stock % Change in Market % Change in Stock X YDocument3 pagesFaisal Bank LTD: Date Indexes Stock % Change in Market % Change in Stock X Ysumaira_noor287No ratings yet

- Stock ValuesDocument12 pagesStock Values可惜可惜No ratings yet

- 10yr DataDocument21 pages10yr DataNitin TantedNo ratings yet

- Trade PlannerDocument7 pagesTrade PlannerDarwin PachacamaNo ratings yet

- PDF Reduced Mean Yn Dan Reduced Standard Deviation SN N Yn SN N Yn SN N Yn SN CompressDocument20 pagesPDF Reduced Mean Yn Dan Reduced Standard Deviation SN N Yn SN N Yn SN N Yn SN CompressAnisa KamilaNo ratings yet

- Historical Monthly Return Data JCADocument4 pagesHistorical Monthly Return Data JCAJuan Carlos ArveloNo ratings yet

- Data SeriiDocument6 pagesData SeriiAna StanNo ratings yet

- CAL - Sovi Savira Miftah - 29116405Document10 pagesCAL - Sovi Savira Miftah - 29116405afif12No ratings yet

- Demanda de Agua (03 Hectáreas)Document16 pagesDemanda de Agua (03 Hectáreas)JansNo ratings yet

- AFLT3 BetaDocument23 pagesAFLT3 BetaFlathon CardosoNo ratings yet

- 2.4 Prep. HuancavelicaDocument2 pages2.4 Prep. HuancavelicaPercy PalominoNo ratings yet

- Beta CalculationDocument55 pagesBeta CalculationArnav PareekNo ratings yet

- New Microsoft Excel WorksheetDocument6 pagesNew Microsoft Excel WorksheetselvaNo ratings yet

- FinanzasDocument5 pagesFinanzasAngelica ReyNo ratings yet

- Assignment 2 - Jose PosadaDocument9 pagesAssignment 2 - Jose Posadajposada66No ratings yet

- TLKM. Olah Data BaruDocument5 pagesTLKM. Olah Data Barusyahrul oikosNo ratings yet

- Descri TivaDocument6 pagesDescri TivaAriani FotNo ratings yet

- Procter & Gamble Co.: Tasas Mensuales de RetornoDocument7 pagesProcter & Gamble Co.: Tasas Mensuales de RetornoCELESTENo ratings yet

- Estacion Granja Kayra: Precipitacion Total Mensual en (MM) #AÑO ENE FEB MAR ABR MAY JUNDocument27 pagesEstacion Granja Kayra: Precipitacion Total Mensual en (MM) #AÑO ENE FEB MAR ABR MAY JUNMaritzaCastillaAriasNo ratings yet

- Tiptop RPSDocument2 pagesTiptop RPSNayan YadavNo ratings yet

- EnrgyDocument7 pagesEnrgyMark LownsboroughNo ratings yet

- AMAR3 BetaDocument23 pagesAMAR3 BetaFlathon CardosoNo ratings yet

- Date Open High Low Close Gains Losses Avg Gain Avg Loss RS RSIDocument76 pagesDate Open High Low Close Gains Losses Avg Gain Avg Loss RS RSItanmartinNo ratings yet

- 65 b2203958 Lê Phương Thảo Dbdl3Document15 pages65 b2203958 Lê Phương Thảo Dbdl3lephuongthao19042004No ratings yet

- Fecha S&P 500 LN S&P 500 ABT LN Abt Valor NasvDocument12 pagesFecha S&P 500 LN S&P 500 ABT LN Abt Valor NasvKaren Xiomara Galeano ContrerasNo ratings yet

- Coporate Finance1Document10 pagesCoporate Finance1T TakashiNo ratings yet

- Lab Poa WinterDocument12 pagesLab Poa WinterHanif Cesario AbdullahNo ratings yet

- Regression Curve AdjustedDocument9 pagesRegression Curve AdjustedMarco Antonio Dco Vega RomanNo ratings yet

- 11 Interest Calculation On DepositsDocument3 pages11 Interest Calculation On DepositsAbhishek Kumar SinghNo ratings yet

- Daftar Saham Portofolio Anggota dalam 40 KarakterDocument9 pagesDaftar Saham Portofolio Anggota dalam 40 KarakterANISA GANIFAHNo ratings yet

- P02 18Document248 pagesP02 18priyankaNo ratings yet

- Lupin Ltd. Month Open Price Monthly ReturnDocument12 pagesLupin Ltd. Month Open Price Monthly ReturnDeep NainwaniNo ratings yet

- Analisis Curah HujanDocument3 pagesAnalisis Curah HujanLutfi RagerisNo ratings yet

- AHL Cash Flow to Equity AnalysisDocument25 pagesAHL Cash Flow to Equity AnalysisONASHI DEVNANI BBANo ratings yet

- HDFC Updated Elss Vs PPF 28th Feb 2017Document31 pagesHDFC Updated Elss Vs PPF 28th Feb 2017Mukesh KumarNo ratings yet

- Stock Price Change Over TimeDocument17 pagesStock Price Change Over TimeSubrata Chanda UthpalNo ratings yet

- Assignment2 PortfolioOptimizationDocument310 pagesAssignment2 PortfolioOptimizationsarlagroverNo ratings yet

- Reduced Mean and Reduced Standard Deviation TablesDocument58 pagesReduced Mean and Reduced Standard Deviation TablesRiskiawan ErtantoNo ratings yet

- Analyzing investment targets and returns over timeDocument3 pagesAnalyzing investment targets and returns over timeanto donlotNo ratings yet

- Nuevo Hoja de Cálculo de Microsoft ExcelDocument14 pagesNuevo Hoja de Cálculo de Microsoft ExcelMarcelo SalasNo ratings yet

- DSC RATESDocument2 pagesDSC RATESSami Ur RehmanNo ratings yet

- Menghitung Variance PortofolioDocument11 pagesMenghitung Variance PortofolioSteve MedhurstNo ratings yet

- Atualizacao Monetaria de Debitos JudiciaisDocument29 pagesAtualizacao Monetaria de Debitos JudiciaisFred CastroNo ratings yet

- Turkey CanadaDocument6 pagesTurkey CanadaSimraNo ratings yet

- Varianza y CovarianzaDocument4 pagesVarianza y CovarianzaWendy SequeirosNo ratings yet

- PBA W.E.F 12 04 23Document2 pagesPBA W.E.F 12 04 23Rashid AhmadaniNo ratings yet

- Perencanaan Irigasi - Nur Kholidiah SiagianDocument51 pagesPerencanaan Irigasi - Nur Kholidiah SiagianRian Akbar PratamaNo ratings yet

- ANIM3 BetaDocument23 pagesANIM3 BetaFlathon CardosoNo ratings yet

- Kel 2 - Manivest B - Rekap SahamDocument45 pagesKel 2 - Manivest B - Rekap SahamFradila Ayu NabilaNo ratings yet

- Date Sale RP RP-RP' (RP-RP') 2 Semi Variance IndexDocument3 pagesDate Sale RP RP-RP' (RP-RP') 2 Semi Variance IndexAbdul NaveedNo ratings yet

- 2 Qar Challenge 2 Qar Increment: Date Amount Total Signature Date Amount Total SignatureDocument7 pages2 Qar Challenge 2 Qar Increment: Date Amount Total Signature Date Amount Total SignatureKaren ValdezNo ratings yet

- United States Census Figures Back to 1630From EverandUnited States Census Figures Back to 1630No ratings yet

- Lecture 1 Part 5Document32 pagesLecture 1 Part 5Christopher KipsangNo ratings yet

- ReceiptDocument1 pageReceiptReuben OmondiNo ratings yet

- Academic Session 2022 MAY 2022 Semester: AssignmentDocument6 pagesAcademic Session 2022 MAY 2022 Semester: AssignmentChristopher KipsangNo ratings yet

- Present ValueDocument2 pagesPresent ValueChristopher KipsangNo ratings yet

- Capital Structure TheoryDocument1 pageCapital Structure TheoryChristopher KipsangNo ratings yet

- Sydney ValuationDocument11 pagesSydney ValuationChristopher KipsangNo ratings yet

- Real Estate Development.Document8 pagesReal Estate Development.Christopher KipsangNo ratings yet

- Assignment 3 - Guide To WorkDocument33 pagesAssignment 3 - Guide To WorkChristopher KipsangNo ratings yet

- Wangyanqiu Acc IndivDocument1 pageWangyanqiu Acc IndivChristopher KipsangNo ratings yet

- Research Methodology - EditedDocument2 pagesResearch Methodology - EditedChristopher KipsangNo ratings yet

- Audit Risk MeasurementDocument10 pagesAudit Risk MeasurementChristopher KipsangNo ratings yet

- Sunday Monday Tuesday Wednesday Thursday Friday SaturdayDocument13 pagesSunday Monday Tuesday Wednesday Thursday Friday SaturdayChristopher KipsangNo ratings yet

- Vietnam National University - International School FIN202 Financial Management AssignmentDocument6 pagesVietnam National University - International School FIN202 Financial Management AssignmentChristopher KipsangNo ratings yet

- 要求Document1 page要求Christopher KipsangNo ratings yet

- 10 - Conflict ManagementDocument13 pages10 - Conflict ManagementChristopher KipsangNo ratings yet

- Lecture 11 - Chapter 16 Insolvency and Liquidation: ©2018 John Wiley & Sons Australia LTDDocument62 pagesLecture 11 - Chapter 16 Insolvency and Liquidation: ©2018 John Wiley & Sons Australia LTDChristopher KipsangNo ratings yet

- Assignment/ TugasanDocument6 pagesAssignment/ TugasanChristopher KipsangNo ratings yet

- 10 - Conflict ManagementDocument13 pages10 - Conflict ManagementChristopher KipsangNo ratings yet

- Factors impacting cost of capital for international projectsDocument4 pagesFactors impacting cost of capital for international projectsChristopher KipsangNo ratings yet

- 0f8a532af45f79bfcca789e6ba07955e (1)Document1 page0f8a532af45f79bfcca789e6ba07955e (1)Christopher KipsangNo ratings yet

- Cashbox strategies and preemption clause examinedDocument13 pagesCashbox strategies and preemption clause examinedChristopher KipsangNo ratings yet

- Portfolio Performance Measures GuideDocument12 pagesPortfolio Performance Measures GuideChristopher KipsangNo ratings yet

- Comparison of The RatiosDocument3 pagesComparison of The RatiosChristopher KipsangNo ratings yet

- Dfi 302 Mfi Lecture NotesDocument72 pagesDfi 302 Mfi Lecture NotesChristopher KipsangNo ratings yet

- Employee Benefits PlansDocument2 pagesEmployee Benefits PlansChristopher KipsangNo ratings yet

- Portfolio Performance Sharpe RatioDocument4 pagesPortfolio Performance Sharpe RatioChristopher KipsangNo ratings yet

- Portfolio Performance Measures GuideDocument12 pagesPortfolio Performance Measures GuideChristopher KipsangNo ratings yet

- QA UMD Assignment 3 - Apr 2021 CohortDocument6 pagesQA UMD Assignment 3 - Apr 2021 CohortChristopher KipsangNo ratings yet

- Suggested Layout For Motivation ReportDocument3 pagesSuggested Layout For Motivation ReportChristopher KipsangNo ratings yet

- Agency Correspondence: Allianz Life Insurance Malaysia BerhadDocument2 pagesAgency Correspondence: Allianz Life Insurance Malaysia BerhadKt TanNo ratings yet

- Mid Term Test in International MarketingDocument9 pagesMid Term Test in International MarketingTron TrxNo ratings yet

- Alternative Investment Funds: Meaning, Taxation, Regulations & ListDocument7 pagesAlternative Investment Funds: Meaning, Taxation, Regulations & Listsanket karwaNo ratings yet

- Smart Beta Style Box Mtum en UsDocument2 pagesSmart Beta Style Box Mtum en Us5ty5No ratings yet

- Operational Guidelines for Offer to Buy (OTB) Window at BSEDocument38 pagesOperational Guidelines for Offer to Buy (OTB) Window at BSEMaminul IslamNo ratings yet

- Tif 1Document7 pagesTif 1James BurdenNo ratings yet

- 24Document3 pages24Abhishek AgrawalNo ratings yet

- Hedge Fund Strategies and StylesDocument28 pagesHedge Fund Strategies and StylesPriya JagasiaNo ratings yet

- Fed Decision TreeDocument3 pagesFed Decision TreeZerohedgeNo ratings yet

- Contact and career summary for Sandeep LankipalliDocument2 pagesContact and career summary for Sandeep Lankipallirupesh naiduNo ratings yet

- Apple Inc. Financial Statements AnalysisDocument15 pagesApple Inc. Financial Statements AnalysisDOWLA KHANNo ratings yet

- Ratio Analysis of Greenlam Industries vs Stylam IndustriesDocument16 pagesRatio Analysis of Greenlam Industries vs Stylam IndustriesDAGGU SRINIVASA CHAKRAVARTHINo ratings yet

- Marketing Plan - Ruwan LakmalDocument10 pagesMarketing Plan - Ruwan Lakmalsam rosNo ratings yet

- Troy Investor PlanDocument26 pagesTroy Investor PlanSindhu ThomasNo ratings yet

- Afm June 2016 QTDocument13 pagesAfm June 2016 QTBijay AgrawalNo ratings yet

- Fast Track TradingDocument5 pagesFast Track TradingTomasrdNo ratings yet

- DRAFT RED HERRING PROSPECTUS FOR UTI ASSET MANAGEMENT IPODocument393 pagesDRAFT RED HERRING PROSPECTUS FOR UTI ASSET MANAGEMENT IPOSubscriptionNo ratings yet

- The Scenario of Investment in Systematic Investment Plan (SIP) Among The Retail CustomersDocument15 pagesThe Scenario of Investment in Systematic Investment Plan (SIP) Among The Retail CustomerskauvyaNo ratings yet

- BCG MatrixDocument2 pagesBCG MatrixZain AliNo ratings yet

- Financial Decision Making and The Law of One Price: NPV PV PVDocument4 pagesFinancial Decision Making and The Law of One Price: NPV PV PV김진영No ratings yet

- The Implied Volatility of Forward Starting Options: ATM Short-Time Level, Skew and CurvatureDocument21 pagesThe Implied Volatility of Forward Starting Options: ATM Short-Time Level, Skew and CurvatureAnonymous 5mSMeP2jNo ratings yet