Professional Documents

Culture Documents

Tutorial 4 - A182 Anwers

Uploaded by

Rydia Henry0 ratings0% found this document useful (0 votes)

6 views3 pagesOriginal Title

Tutorial 4_ A182 Anwers

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views3 pagesTutorial 4 - A182 Anwers

Uploaded by

Rydia HenryCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

TUTORIAL 4 ANSWER | A182

Tutorial 4: Topic 6 & 7

Part A

30 MULTIPLE CHOICE QUESTIONS

Q Answer Q Answer Q Answer

1 B 11 C 21 D

2 D 12 C 22 C

3 C 13 C 23 D

4 B 14 B 24 A

5 B 15 A 25 C

6 A 16 A 26 D

7 B 17 D 27 A

8 B 18 C 28 D

9 A 19 C 29 D

10 D 20 A 30 B

Part B

Prob. 6–7

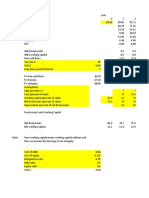

a. Horizontal analysis

2007 2008 Increase/

% change

RM RM decrease

Credit sales 2,185,000 4,945,000 2,760,000 126.32%

Cost of goods sold 1,377,700 3,013,000 1,635,300 118.70%

Gross profit 807,300 1,932,000 1,124,700 139.32%

Sales and administrative 322,000 434,700 112,700 35.00%

expenses

Bad debt 41,400 149,500 108,100 261.11%

Depreciation expense 133,400 478,400 345,000 258.62%

Interest expenses 27,600 441,600 414,000 1500.00%

Profit before tax 282,900 427,800 144,900 51.22%

Tax 85,100 128,800 43,700 51.35%

Profit after tax 197,800 299,000 101,200 51.16%

TUTORIAL 4 ANSWER | A182

b. Ratio analysis

Ratio 2,007 2008

i. Current Assets - Inventories

Quick ratio 2.64 3.13

Current Liabilitie s

ii. Net Profit

Profit margin 9.05% 6.05%

Credit Sales

iii. Net Income + Interest

Rate earned on total asset 18.56% 17.86%

Average Total Asset

iv. Total Liabilities

Debt ratio 0.24 0.58

Total Assets

v. Total owner's equity

Equity ratio 0.76 0.41

Total Asset

vi. Cost of goods sold

Inventory turnover 22.60 9.92

Average inventory

vii. Ratio of net sales to total Net sales

asset Average Total Asset 1.80 1.19

(Assets turnover)

viii. Working capital Current assets – current liabilities 204,700 1,460,500

ix. Current Assets

Current ratio 3.47 4.41

Current Liabilitie s

x. Account receivable Net sales

12.67 6.46

turnover Avg accounts receivable s

TUTORIAL 4 ANSWER | A182

With respect to liquidity position, higher current ratio and quick ratio clearly

indicate slight improvement. Nevertheless, inventory turnover figure has also

tremendously dropped in 2008 that reflect less efficient inventory management.

Similarly, the profit margin has dropped slightly from about 9% to 6%. Account

receivable turn over also does not show improvement with respect to firm’s

ability to collect payments from the customers. Thus, it can be concluded that

the new policy implemented by Tawakal Bhd did not really work well as claimed

by its sales manager.

You might also like

- Unit TestDocument3 pagesUnit TestKetty De GuzmanNo ratings yet

- Mattel - Financial ModelDocument13 pagesMattel - Financial Modelharshwardhan.singh202No ratings yet

- Financial Analysis of Astrazeneca (2014-2015)Document12 pagesFinancial Analysis of Astrazeneca (2014-2015)Hyceinth KumNo ratings yet

- HW 2 - Ch03 P15 Build A Model - HrncarDocument2 pagesHW 2 - Ch03 P15 Build A Model - HrncarsusikralovaNo ratings yet

- Chapter 8. Student Ch08 P 8-15 Build A Model: AssetsDocument2 pagesChapter 8. Student Ch08 P 8-15 Build A Model: Assetsseth litchfield100% (1)

- Homework1 - K32 - Madrazo, JayannDocument5 pagesHomework1 - K32 - Madrazo, JayannJayann Danielle MadrazoNo ratings yet

- Chapter 2Document31 pagesChapter 2MunNo ratings yet

- Financial Analysis Coles GroupDocument5 pagesFinancial Analysis Coles GroupAmmar HassanNo ratings yet

- Chapter 4. Solution To End-of-Chapter Comprehensive/Spreadsheet ProblemDocument3 pagesChapter 4. Solution To End-of-Chapter Comprehensive/Spreadsheet ProblemBen HarrisNo ratings yet

- IFM11 Solution To Ch08 P15 Build A ModelDocument2 pagesIFM11 Solution To Ch08 P15 Build A ModelDiana Soriano50% (2)

- CH 15Document56 pagesCH 15Quỳnh Anh Bùi ThịNo ratings yet

- Gap 2022Document2 pagesGap 2022iroeinrgre9302bNo ratings yet

- BMA 12e SM CH 28 Final PDFDocument13 pagesBMA 12e SM CH 28 Final PDFNikhil ChadhaNo ratings yet

- Answers To Problem Sets: Financial AnalysisDocument13 pagesAnswers To Problem Sets: Financial Analysismandy YiuNo ratings yet

- 02 Quiz 1 Managerial AcctgDocument3 pages02 Quiz 1 Managerial AcctgRalph Louise PoncianoNo ratings yet

- Task 1 AnswerDocument9 pagesTask 1 AnswerSiddhant Aggarwal0% (4)

- Name: Date: Score:: Quiz I. Problem Solving (8 Items X 5 Points)Document2 pagesName: Date: Score:: Quiz I. Problem Solving (8 Items X 5 Points)Raiza Cartago0% (1)

- Solution For FM Extra QuestionsDocument130 pagesSolution For FM Extra Questionsdeepu deepuNo ratings yet

- Ch.17 HW Acc PDFDocument2 pagesCh.17 HW Acc PDFyizhou FengNo ratings yet

- Ratio Analysis ActivityDocument3 pagesRatio Analysis ActivityKarlla ManalastasNo ratings yet

- Front Valuation Page: Un-Levered Firm ValueDocument61 pagesFront Valuation Page: Un-Levered Firm Valueneelakanta srikar100% (1)

- Tutorial 5 Financial Statement Analysis: Accounting and Financial ManagementDocument7 pagesTutorial 5 Financial Statement Analysis: Accounting and Financial ManagementSteven CHONGNo ratings yet

- Solutions To Chapter 17 Financial Statement AnalysisDocument10 pagesSolutions To Chapter 17 Financial Statement Analysishung TranNo ratings yet

- 04 Edu91 FM Practice Sheets FM Solution (Not To Print)Document154 pages04 Edu91 FM Practice Sheets FM Solution (Not To Print)Krutarth VyasNo ratings yet

- Exerciese of Chapter ThreeDocument6 pagesExerciese of Chapter ThreeMohammad Al AkoumNo ratings yet

- Answer Scheme Far 670 - Dec 2018 Part A Answer AnswerDocument4 pagesAnswer Scheme Far 670 - Dec 2018 Part A Answer AnswerDIYANA NABILANo ratings yet

- FIN254 Assignment# 1Document6 pagesFIN254 Assignment# 1Zahidul IslamNo ratings yet

- Clicks Analyst Booklet 2022Document40 pagesClicks Analyst Booklet 2022theedypz82.emNo ratings yet

- Project Problem One: Chapter 3 Problem 15: Aquatic Supplies Co. INCOME STATEMENT ($ Millions) 2017 AssumptionsDocument6 pagesProject Problem One: Chapter 3 Problem 15: Aquatic Supplies Co. INCOME STATEMENT ($ Millions) 2017 AssumptionsShaharyar AsifNo ratings yet

- Problem1 Section 19.2Document2 pagesProblem1 Section 19.2SANSKAR JAINNo ratings yet

- 12 40Document10 pages12 40Gonçalo AlmeidaNo ratings yet

- Revision Excel SheetsDocument9 pagesRevision Excel SheetsPhan Phúc NguyênNo ratings yet

- Research Note On V-GuardDocument2 pagesResearch Note On V-GuardShrey ShahNo ratings yet

- Is Excel Participant Samarth - Simplified v2Document9 pagesIs Excel Participant Samarth - Simplified v2samarth halliNo ratings yet

- Handout - Financial AnalysisDocument18 pagesHandout - Financial Analysisroseberrylacopia18No ratings yet

- Exercises and Answers Chapter 3Document12 pagesExercises and Answers Chapter 3MerleNo ratings yet

- CH 15Document63 pagesCH 15clarysage13100% (1)

- Maybank-Integrated AR 2022 - Corporate-Part 2Document96 pagesMaybank-Integrated AR 2022 - Corporate-Part 2yennielimclNo ratings yet

- Income Based Valuation Unit Exam Answer Key NewDocument6 pagesIncome Based Valuation Unit Exam Answer Key NewAMIKO OHYANo ratings yet

- Group Assignment 2Document2 pagesGroup Assignment 2sebsibeboki01No ratings yet

- Muhammad Luthfi Mahendra - 2001036085 - Tugas 5Document5 pagesMuhammad Luthfi Mahendra - 2001036085 - Tugas 5luthfi mahendraNo ratings yet

- WBSLive Lecture 5 Slides Pres VevoxDocument25 pagesWBSLive Lecture 5 Slides Pres VevoxabhirejanilNo ratings yet

- The Presentation Materials 3Q22Document36 pagesThe Presentation Materials 3Q22ZerohedgeNo ratings yet

- Is Excel Participant - Simplified v2Document10 pagesIs Excel Participant - Simplified v2Aaron Pool0% (2)

- IS Excel Participant (Risit Savani) - Simplified v2Document9 pagesIS Excel Participant (Risit Savani) - Simplified v2risitsavaniNo ratings yet

- Activity Ratio Group-1 AccountingDocument1 pageActivity Ratio Group-1 AccountingLance Miko CondenoNo ratings yet

- Is Excel Participant - Simplified v2Document9 pagesIs Excel Participant - Simplified v2dikshapatil6789No ratings yet

- RatioDocument4 pagesRatioMd Junayed IslamNo ratings yet

- Chapter 12. Tool Kit For Cash Flow Estimation and Risk AnalysisDocument4 pagesChapter 12. Tool Kit For Cash Flow Estimation and Risk AnalysisHerlambang PrayogaNo ratings yet

- 01 - FS AnalysisDocument17 pages01 - FS AnalysisRyzel Borja0% (1)

- 4.EF232.FIM (IL-II) Solution CMA 2023 January ExamDocument6 pages4.EF232.FIM (IL-II) Solution CMA 2023 January ExamnobiNo ratings yet

- Is Excel Participant - Simplified v2Document9 pagesIs Excel Participant - Simplified v2Yash JasaparaNo ratings yet

- UntitledDocument11 pagesUntitledKhang ĐặngNo ratings yet

- Mini Case (Financial Statements)Document12 pagesMini Case (Financial Statements)Melissa López GarzaNo ratings yet

- Week-2-Chapter-3-Financial-Build-A-Mode LDocument7 pagesWeek-2-Chapter-3-Financial-Build-A-Mode LCrusty GirlNo ratings yet

- Creating Winning Event Proposals SecretsDocument16 pagesCreating Winning Event Proposals SecretsAnonymous 5z7ZOpNo ratings yet

- AFD Practice Questions Mock (3399)Document7 pagesAFD Practice Questions Mock (3399)AbhiNo ratings yet

- IS Participant - Simplified v3Document7 pagesIS Participant - Simplified v3luaiNo ratings yet

- Presentation 1Document9 pagesPresentation 1Zubair KhanNo ratings yet

- Social Studies SBA (Final)Document21 pagesSocial Studies SBA (Final)Jada MyersNo ratings yet

- Zahida Perveen: Career Summary: Position / TitleDocument5 pagesZahida Perveen: Career Summary: Position / TitleHASAN EJAZ KAZMINo ratings yet

- 1 - 01-ChapterDocument24 pages1 - 01-ChapterSimran GoelNo ratings yet

- Lump Sum ContractDocument3 pagesLump Sum Contractp9844131No ratings yet

- TQM Chapter-1 IntroductionDocument53 pagesTQM Chapter-1 IntroductionJuliesse TesoreroNo ratings yet

- Will Automation Take Away All Our JobsDocument7 pagesWill Automation Take Away All Our JobsBilal AminNo ratings yet

- Bitumen Prices Wef 16 01 12Document2 pagesBitumen Prices Wef 16 01 12Mahadeva PrasadNo ratings yet

- Eminence Capital & Fincorp Web Page ContentDocument37 pagesEminence Capital & Fincorp Web Page ContentChinmaya DasNo ratings yet

- MSU MBA SylabbusDocument18 pagesMSU MBA SylabbusshivacrazzeNo ratings yet

- Case 5 - Johnnie Walker - Reigniting GrowthDocument6 pagesCase 5 - Johnnie Walker - Reigniting GrowthArah Ibrahim-MacakilingNo ratings yet

- Pro Rata Side LetterDocument1 pagePro Rata Side LetterThirdy BPNo ratings yet

- Deregulation of Petrol PricesDocument16 pagesDeregulation of Petrol PricesKumar AnandNo ratings yet

- Presentation 8-Project AppraisalDocument22 pagesPresentation 8-Project AppraisalafzalNo ratings yet

- Jan ByjusDocument22 pagesJan ByjusPrithvi TejaNo ratings yet

- Pertemuan 2 Visi MisiDocument17 pagesPertemuan 2 Visi MisiGita OktaviantiNo ratings yet

- Globaphobe Vs GlobaphileDocument4 pagesGlobaphobe Vs GlobaphileHiền LưuNo ratings yet

- 高盛IPO全套教程Document53 pages高盛IPO全套教程MaxilNo ratings yet

- Investment BankerDocument2 pagesInvestment BankerFelix OtienoNo ratings yet

- Quality and Performance ExcellenceDocument57 pagesQuality and Performance ExcellenceEmilito Sajol IINo ratings yet

- HBLDocument21 pagesHBLNisar Akbar KhanNo ratings yet

- Annual Report 2020Document256 pagesAnnual Report 2020VYAPAR INDIANo ratings yet

- Introduction To MicroeconomicsDocument43 pagesIntroduction To MicroeconomicsVũ Thùy DươngNo ratings yet

- 4362 Dna2b UgDocument11 pages4362 Dna2b UgSpice MobileNo ratings yet

- Tugas Ke 2 Akm 3Document4 pagesTugas Ke 2 Akm 3RizkiNo ratings yet

- Commercial PolicyDocument21 pagesCommercial PolicyabhiNo ratings yet

- Zara Case: Supply Chain 2015Document16 pagesZara Case: Supply Chain 2015CésarChávezNo ratings yet

- 0520Document3 pages0520RJ Rishabh TyagiNo ratings yet

- Advance Management Accounting Test - 3 Suggested Answers / HintsDocument18 pagesAdvance Management Accounting Test - 3 Suggested Answers / HintsSumit AnandNo ratings yet

- Datamatics Ar 2015Document156 pagesDatamatics Ar 2015ajey_p1270No ratings yet

- The Returns and Risks From InvestingDocument18 pagesThe Returns and Risks From InvestingAli Akand AsifNo ratings yet