Professional Documents

Culture Documents

02 Quiz 1 Managerial Acctg

Uploaded by

Ralph Louise PoncianoCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

02 Quiz 1 Managerial Acctg

Uploaded by

Ralph Louise PoncianoCopyright:

Available Formats

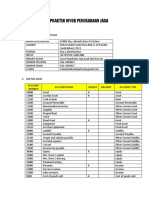

BM1915

NAME: PONCIANO,RALPH LOUISE DATE: SCORE:

QUIZ

I. PROBLEM SOLVING

Answer the following items using the financial statements below. Encircle the letter of the correct

answer. Show your computations. (8 items x 5 points)

ABC Corporation

Comparative Statement of Financial Position

For the Years Ended 201B and 201A (in pesos)

201B 201A

Cash and Cash Equivalents 2,450 2,094

Receivables 1,813 1,611

Inventories 1,324 1,060

Prepaid Expenses 1,709 2,120

Total Current Assets 7,296 6885

Noncurrent Assets 18,500 15,737

Total Assets 25,796 22,622

Current Liabilities 7,230 8,467

Long-Term Liabilities 4,798 3,792

Common Stock 6,568 4,363

Retained Earnings 7,200 6,000

Total Liabilities and Equity 25,796 22,622

ABC Corporation

Income Statement

For the Year Ended 201B (in pesos)

201B

Sales 20,941

Less: Cost of Goods Sold 7,055

Gross Profit 13,886

Less: Operating expenses 7,065

Income from operations 6,821

Less: Interest expense 210

Income before taxes 6,611

Less: Income tax 2,563

Net Income 4,048

1. Which statement best describes ABC’s acid-test ratio for 201B?

a. Greater than 1 c. Less than 1

b. Equal to 1 d. None of the above

2. Inventory turnover (amount rounded)?

a. Six (6) times c. Eight (8) times

b. Seven (7) times d. Cannot be determined

3. Days’ sales in receivables (amounts rounded)?

60.8 or 61 days c. 32 days

a. 28 days d. 34 days

b. 30 days

4. Times-interest-earned ratio? c. 32 times

a. 54.7% d. 34 times

b. 19 times

02 Quiz 1 *Property of STI

Page 1 of 2

BM1915

5. The company has 2,500 shares of common stocks outstanding. What is the earnings-per-share?

a. 1.62 c. 2.63

b. 1.75 d. 2.73

6. Current ratio?

a. 0.99 c. 1.05

b. 1.01 d. 1.09

7. Profit margin?

a. 19.33% c. 59.34%

b. 31.57% d. 66.31%

8. Debt ratio?

a. 46.62% c. 87.36%

b. 53.38% d. Cannot be determined

II. ESSAY (2 items x 5 points)

Read and analyze the items. Write your answer on the space provided.

1. One of the limitations of financial statement analysis is that financial statements are based on

historical costs. What is the danger in focusing solely on the data found in the historical financial

statements?

- I think that the danger focusing solely on the data found in the historical financial statements

is that things change, rules change, competition changes and many issues have emerged.

Just like the others say that “past performance does not necessarily indicative of future

results.”

2. Describe a business that operates where you live and explain how knowing the working capital of

that company would be useful to the management of that company and to outside investors.

- The business of my lolo was selling Hito, in fact he became a secret millionaire because of his

business and he was featured. Working capital is very useful because it has helped him in the

operations to be success as business. Working capital serves as a metric for how efficiently a

company is operating and how financially stable it is in the short-term. It can also help to

improve the company's earnings and profitability

Rubric for Problem Solving:

Performance Indicators Points

Correct accounts and amounts used 3

Computed final amounts are correct/balanced 2

Total 5

Rubric for Essay:

02 Quiz 1 *Property of STI

Page 2 of 2

BM1915

Criteria Performance Indicators Points

Content Provided pieces of evidence, supporting details, and 3

factual scenarios

Organization of ideas Expressed the points in a clear and logical 2

arrangement of ideas in the paragraph

TOTAL 5

02 Quiz 1 *Property of STI

Page 3 of 2

You might also like

- Customers Switching Intentions Behavior in Retail Hypermarket Kingdom of Saudi Arabia: Customers Switching Intentions Behavior in Retail HypermarketFrom EverandCustomers Switching Intentions Behavior in Retail Hypermarket Kingdom of Saudi Arabia: Customers Switching Intentions Behavior in Retail HypermarketNo ratings yet

- Quiz I. Problem Solving: Property of STIDocument2 pagesQuiz I. Problem Solving: Property of STIarisuNo ratings yet

- ABC Corporation Financial AnalysisDocument2 pagesABC Corporation Financial AnalysisRaiza Cartago0% (1)

- ABC Corporation Income Statement For The Year Ended 201B (In Pesos) Vertical Analysis 201B PercentageDocument1 pageABC Corporation Income Statement For The Year Ended 201B (In Pesos) Vertical Analysis 201B PercentageNin JahNo ratings yet

- Multi-Ventures Capital and Management Corp. v. Stalwart Management Services Corp.Document5 pagesMulti-Ventures Capital and Management Corp. v. Stalwart Management Services Corp.Tin DychiocoNo ratings yet

- Dalumpines Case 3Document9 pagesDalumpines Case 3Jessa Mae LabinghisaNo ratings yet

- Accounting 11 Activity 1Document1 pageAccounting 11 Activity 1Ma Trixia Alexandra CuevasNo ratings yet

- Merck's focus on cancer drug KeytrudaDocument2 pagesMerck's focus on cancer drug KeytrudaDaniela AvelinoNo ratings yet

- Oblicon Law 10 Quiz 1Document2 pagesOblicon Law 10 Quiz 1Lovely Joyce JavierNo ratings yet

- Supreme Court Case Digest TaskDocument16 pagesSupreme Court Case Digest TaskShiella Mae BendecioNo ratings yet

- ActivityDocument1 pageActivityCastillo EmmieNo ratings yet

- ObligDocument2 pagesObligKevin PanioNo ratings yet

- Case StudyDocument3 pagesCase Studyshenshen bitaraNo ratings yet

- 05 Activity 1 13 AnswerDocument7 pages05 Activity 1 13 AnswerAllyza RenoballesNo ratings yet

- 09 Activity 1Document2 pages09 Activity 1Maj MarticioNo ratings yet

- 11 Task Performance 2 PDFDocument2 pages11 Task Performance 2 PDFCristopher Rico DelgadoNo ratings yet

- 10 Quiz 1 ARGDocument1 page10 Quiz 1 ARGJessa Mae LabinghisaNo ratings yet

- Stock Spare Engines to Achieve 95% Service LevelDocument1 pageStock Spare Engines to Achieve 95% Service LevelHazel BermudoNo ratings yet

- ABC Corporation Financial Statement Analysis for Year 201B and 201ADocument4 pagesABC Corporation Financial Statement Analysis for Year 201B and 201AarisuNo ratings yet

- 04 TP FinancialDocument4 pages04 TP Financialbless erika lendroNo ratings yet

- TP PDFDocument5 pagesTP PDFAllyza RenoballesNo ratings yet

- Rom Corp Electricity Costs & Machine Hours ReportDocument1 pageRom Corp Electricity Costs & Machine Hours ReportBetchang AquinoNo ratings yet

- Vertical AnalysisDocument1 pageVertical AnalysisKhris Espinili AlgaraNo ratings yet

- Marticio, Joyce Ann M. BSBA-501: 01 Worksheet 1Document3 pagesMarticio, Joyce Ann M. BSBA-501: 01 Worksheet 1Maj MarticioNo ratings yet

- Case Analysis.: Property of STIDocument1 pageCase Analysis.: Property of STILIBREA, Aira Mae C.No ratings yet

- COMPANY NAME: Kenny Rogers Roasters INDUSTRY: Food Industry NATURE OF BUSINESS: Food Business/Semi Fine Dining Service 1Document3 pagesCOMPANY NAME: Kenny Rogers Roasters INDUSTRY: Food Industry NATURE OF BUSINESS: Food Business/Semi Fine Dining Service 1John Clark RosalesNo ratings yet

- 08 Activity 1 DHL and Shopee PartnershipDocument3 pages08 Activity 1 DHL and Shopee PartnershipKatelyn Mae SungcangNo ratings yet

- BA vs BI: Comparing Business Analytics and Business IntelligenceDocument1 pageBA vs BI: Comparing Business Analytics and Business Intelligencephillip quimenNo ratings yet

- 02 Task Performance 1 - Prelim Exam - PMDocument3 pages02 Task Performance 1 - Prelim Exam - PMJosie Lou RanqueNo ratings yet

- Idea Builder CATILO, AlexisDocument2 pagesIdea Builder CATILO, AlexisPercy Jason BustamanteNo ratings yet

- Jose Miguel Vienes Ms. Maria Felisa Calicdan BSBA 311 14 Quiz 1Document2 pagesJose Miguel Vienes Ms. Maria Felisa Calicdan BSBA 311 14 Quiz 1Miguel VienesNo ratings yet

- Sedano Aizik Dohnavan C 11 Quiz 1 ArgDocument2 pagesSedano Aizik Dohnavan C 11 Quiz 1 ArgJhennifer AlmeroNo ratings yet

- DHL and Shopee Partnership CaseletDocument5 pagesDHL and Shopee Partnership Caseletchristian merreraNo ratings yet

- International Business - BUAD 327 November 6, 2011Document2 pagesInternational Business - BUAD 327 November 6, 2011Miguel VienesNo ratings yet

- Page - 1Document7 pagesPage - 1Collins ManalaysayNo ratings yet

- 03 Seatwork 1 ProjectManagement SenisRachelDocument2 pages03 Seatwork 1 ProjectManagement SenisRachelRachel SenisNo ratings yet

- Clutario 13 Quiz 1Document1 pageClutario 13 Quiz 1Ruiso KitsumonoNo ratings yet

- Sotero 03 Seatwork 1 ProjectDocument3 pagesSotero 03 Seatwork 1 Projectbernadette soteroNo ratings yet

- 01 Performance Task 1Document1 page01 Performance Task 1juan linyaNo ratings yet

- Aguilar, Ilonah Jean B. Bsais J201 Oblicon: I. Elements of An ObligationDocument36 pagesAguilar, Ilonah Jean B. Bsais J201 Oblicon: I. Elements of An ObligationIlonah Bernaldez AguilarNo ratings yet

- Case Analysis. (20 Points: 4 Items X 5 Points)Document2 pagesCase Analysis. (20 Points: 4 Items X 5 Points)Gabriel TantiongcoNo ratings yet

- 09 eLMS ReviewDocument1 page09 eLMS ReviewClaire Aira LumanglasNo ratings yet

- Oblicon 12quiz1 SemillaDocument1 pageOblicon 12quiz1 SemillaJoennel SemillaNo ratings yet

- 03 Task Performance 1 (3) ENVDocument2 pages03 Task Performance 1 (3) ENVRalph Louise PoncianoNo ratings yet

- Task Performance Research Paper Outline I. BackgroundDocument6 pagesTask Performance Research Paper Outline I. BackgroundmichaelabatraloNo ratings yet

- 02 - Task - Performance - 2 EMSDocument4 pages02 - Task - Performance - 2 EMSlalein castilloNo ratings yet

- 02 Activity 2Document1 page02 Activity 2Ralph Louise PoncianoNo ratings yet

- 10 Activity 1Document3 pages10 Activity 1Lyka DollesinNo ratings yet

- Activity 1 - Strategic - ManagementDocument1 pageActivity 1 - Strategic - ManagementLeiann Pongos0% (1)

- Applying High-Low Method in Separating Mixed Costs Using MS ExcelDocument6 pagesApplying High-Low Method in Separating Mixed Costs Using MS ExcelMochi MaxNo ratings yet

- Input Output: Flight Promos Flight Tend MonitoringDocument2 pagesInput Output: Flight Promos Flight Tend MonitoringDayanara CuevasNo ratings yet

- Sotero 07PracticeProblems1 InventoryDocument16 pagesSotero 07PracticeProblems1 Inventorybernadette soteroNo ratings yet

- Yangon University of Economics: Third Year SectionDocument5 pagesYangon University of Economics: Third Year SectionThutasoe thomasNo ratings yet

- Case Analysis - 03 Activity 1Document1 pageCase Analysis - 03 Activity 1BeyaNo ratings yet

- 06 Activity 1Document2 pages06 Activity 1Ruiso KitsumonoNo ratings yet

- Two Countries - Great Britain and The United StatesDocument1 pageTwo Countries - Great Britain and The United StatesYan TagleNo ratings yet

- Precious Grace A. Salazar BSA 2.2: Actual BudgetedDocument2 pagesPrecious Grace A. Salazar BSA 2.2: Actual BudgetedDong RoselloNo ratings yet

- The Environmental Impact of iPhonesDocument4 pagesThe Environmental Impact of iPhonesJanine CalditoNo ratings yet

- Case Study Analysis Using MS Word and MS Excel: Laboratory ExerciseDocument3 pagesCase Study Analysis Using MS Word and MS Excel: Laboratory ExerciseAbbegail CalinaoNo ratings yet

- 2nd Quarter TASK PERFORMANCE - FABM2 PDFDocument2 pages2nd Quarter TASK PERFORMANCE - FABM2 PDFMacky EvanchezNo ratings yet

- 02 Activity 1Document1 page02 Activity 1Ralph Louise PoncianoNo ratings yet

- 01 Activity 2Document2 pages01 Activity 2Ralph Louise PoncianoNo ratings yet

- 03 Task Performance 1 (3) ENVDocument2 pages03 Task Performance 1 (3) ENVRalph Louise PoncianoNo ratings yet

- 04 Activity 2 StratDocument3 pages04 Activity 2 StratRalph Louise PoncianoNo ratings yet

- HP's journey to sustainabilityDocument2 pagesHP's journey to sustainabilityRalph Louise PoncianoNo ratings yet

- 02 Assignment HRDocument2 pages02 Assignment HRRalph Louise PoncianoNo ratings yet

- 04 Online Activity 1Document2 pages04 Online Activity 1Ralph Louise PoncianoNo ratings yet

- 04 EnvDocument1 page04 EnvRalph Louise PoncianoNo ratings yet

- 03 Activity 2 (Part 2)Document3 pages03 Activity 2 (Part 2)Ralph Louise PoncianoNo ratings yet

- 02 Activity 1 Strategic PoncianoDocument2 pages02 Activity 1 Strategic PoncianoRalph Louise PoncianoNo ratings yet

- 04 Activity 1 ManagerialDocument3 pages04 Activity 1 ManagerialRalph Louise PoncianoNo ratings yet

- 04 ApplicationDocument15 pages04 ApplicationRalph Louise PoncianoNo ratings yet

- 02 Task Performance 1Document3 pages02 Task Performance 1Ralph Louise PoncianoNo ratings yet

- 02 Activity 2Document1 page02 Activity 2Ralph Louise PoncianoNo ratings yet

- A Financial and Strategic Analysis of AmazonDocument130 pagesA Financial and Strategic Analysis of AmazonRa JaNo ratings yet

- Financial AccountingDocument287 pagesFinancial AccountingMobin Safdar50% (2)

- Understand Financial Reports in 40 CharactersDocument26 pagesUnderstand Financial Reports in 40 CharactersmhikeedelantarNo ratings yet

- Hockey Canada: Financial StatementsDocument21 pagesHockey Canada: Financial StatementsBob MackinNo ratings yet

- Common Size Analysis and Financial RatiosDocument4 pagesCommon Size Analysis and Financial RatiosLina Levvenia RatanamNo ratings yet

- Assignment 1 AFSDocument14 pagesAssignment 1 AFSSimra SalmanNo ratings yet

- Soal Praktek Myob Perusahaan JasaDocument4 pagesSoal Praktek Myob Perusahaan Jasahani ramadiyantiNo ratings yet

- Investment in AssociateDocument11 pagesInvestment in AssociateElla MontefalcoNo ratings yet

- Assignment 1 محولDocument4 pagesAssignment 1 محولmariam raafatNo ratings yet

- TaxReturn PDFDocument24 pagesTaxReturn PDFga80% (5)

- Assignment 01Document16 pagesAssignment 01Ïñtïsãm Ähmãd100% (1)

- Solution Manual For Accounting For Decision Making and Control 7th Edition by ZimmermanDocument47 pagesSolution Manual For Accounting For Decision Making and Control 7th Edition by ZimmermanPamelaSmithcxdoe100% (75)

- PA-HW Chap3 + 4Document8 pagesPA-HW Chap3 + 4Hà Anh ĐỗNo ratings yet

- Ojt Book ReportDocument15 pagesOjt Book ReportMarjorie SantosNo ratings yet

- Andaz Delhi Accounts Payable ReportDocument32 pagesAndaz Delhi Accounts Payable ReportNeeraj JoshiNo ratings yet

- Retail investment: Addressing timing and pricing issues through SIPsDocument52 pagesRetail investment: Addressing timing and pricing issues through SIPsMauryanNo ratings yet

- Cost Terms, Concepts and Classifications: Chapter TwoDocument270 pagesCost Terms, Concepts and Classifications: Chapter TwoDania Al-ȜbadiNo ratings yet

- Book Assignment Chapter 6: TheoriesDocument18 pagesBook Assignment Chapter 6: TheoriesDeanna GicaleNo ratings yet

- Al in Source Grade 12 For Abm OnlyDocument483 pagesAl in Source Grade 12 For Abm OnlyAxelle PorcelNo ratings yet

- Capital Budgeting John A. DoukasDocument232 pagesCapital Budgeting John A. DoukasĐorđo VosapNo ratings yet

- San Miguel Corporation - Business Life Cycle Analysis ReportDocument2 pagesSan Miguel Corporation - Business Life Cycle Analysis ReportPastel Rose CloudNo ratings yet

- Fundamentals of Corporate Finance Canadian 9th Edition Ross Test BankDocument70 pagesFundamentals of Corporate Finance Canadian 9th Edition Ross Test Bankomicronelegiac8k6st100% (17)

- GE1202 Managing Your Personal Finance: InsuranceDocument41 pagesGE1202 Managing Your Personal Finance: InsuranceAiden LANNo ratings yet

- Fin 413 Sim Weeks 6-7Document66 pagesFin 413 Sim Weeks 6-7Jeson MalinaoNo ratings yet

- Case Study 4 3 Copies ExpressDocument7 pagesCase Study 4 3 Copies Expressamitsemt100% (2)

- Pas 1, Presentation of Financial Statements: Philippine Institute of Certified Public AccountantsDocument38 pagesPas 1, Presentation of Financial Statements: Philippine Institute of Certified Public AccountantsAie GeraldinoNo ratings yet

- How to Calculate Hotel Room Rates with the Hubbart FormulaDocument3 pagesHow to Calculate Hotel Room Rates with the Hubbart FormulaJoseph NtambaraNo ratings yet

- Information Sheet No. 1.3 1Document7 pagesInformation Sheet No. 1.3 1Lav Casal CorpuzNo ratings yet

- Balance Sheet at Beginning of Year: Cash FlowDocument1 pageBalance Sheet at Beginning of Year: Cash FlowluisNo ratings yet

- Steps to consolidate financial statements for PT A and PT BDocument5 pagesSteps to consolidate financial statements for PT A and PT BMega RefiyaniNo ratings yet