Professional Documents

Culture Documents

Visit For Exam Resources: Guide Sixth Edition

Uploaded by

Neeraj ShuklaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Visit For Exam Resources: Guide Sixth Edition

Uploaded by

Neeraj ShuklaCopyright:

Available Formats

Visit www.pm-prepcast.

com for Exam Resources Page |1

Copyright © 2009-2018 by OSP International LLC. All rights reserved. Version 6.00. Use with PMBOK® Guide Sixth Edition

About this Guide

The Project Management Professional (PMP)® Certification designation will set you apart from other project managers

and we thank you for purchasing our PMP® Exam Formula Study Guide™ to help you achieve this milestone. We are

certain that it will be the most beneficial tool you use while studying the formulas you need to know. We wish you all the

best for your PMP Exam!

This guide contains the following four sections:

• Essential PMP Exam Formulas - The formulas you need to know for the PMP Exam.

• Formula Elaboration - These formulas require a little more explanation

• Values to Remember - A selection of important values to study in preparation for the PMP Exam.

• Acronyms - The list of acronyms used throughout this guide as well as on the PMP Exam.

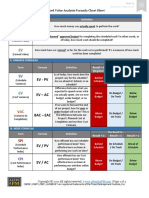

The Formula Table Explained

On the following pages you will find the essential formulas that you will need to know and apply in order to pass the PMP

Exam. The formulas are listed in a table with three columns. For each entry we explain the concept, list the formula(s),

and explain how to interpret the result of the calculation. For example:

Concept Formula Result Interpretation

The first column contains the “concept” behind the We list the actual formula in the second The formula won’t do you much good if

formula. Instead of just giving you the formula “CV = column. For some concepts, multiple you cannot explain what the result is or

EV - AC” we want to make sure that you understand formulas are needed so we list them all. means. That is why we include an

what the formula is trying to achieve. The best way When helpful, we also add examples for interpretation in the third column. PMP

to do that is by explaining its concept. better understanding. questions may require interpretation.

Example: Example: Example:

Cost Variance (CV) CV = EV - AC Negative = over budget = over planned

Provides cost performance of the project. Helps cost

determine if the project is proceeding as planned.

Zero = on budget = on planned cost

Positive = under budget = under

planned cost

Exponentiation

Several formulas needed on the PMP Exam require exponentiation. The exponent is usually shown as a superscript to the

right of the base. For instance: 34. This exponentiation can be read as 3 raised to the 4th power or as 3 raised to the power

of 4. And 34 would be calculated as 3*3*3*3=81.

The superscript notation 34 is convenient in handwriting but can lead to errors when you are in a hurry like on the PMP

Exam. For instance, it is very easy to forget to “raise” the exponent in a formula when you are hurriedly writing it down in

the minutes before you start the exam. So, it could easily happen that the formula PV = FV / (1+r)n gets written down as

PV = FV / (1+r)n. The difference may seem trivial, but the result is disastrous. Therefore, we chose to use an accepted,

alternative way of expressing the exponentiation by using the ^ character.

When using this character, 34 is now expressed as 3^4 and PV = FV / (1+r)n is expressed as PV = FV / (1+r)^n. This

removes any margin for visual errors.

Copyright and Disclaimer

PMI, PMP, CAPM, PgMP, PMI-ACP, PMI-SP, PMI-RMP and PMBOK are trademarks of the Project Management Institute, Inc. PMI has

not endorsed and did not participate in the development of this publication. PMI does not sponsor this publication and makes no

warranty, guarantee or representation, expressed or implied as to the accuracy or content. Every attempt has been made by OSP

International LLC to ensure that the information presented in this publication is accurate and can serve as preparation for the PMP

certification exam. However, OSP International LLC accepts no legal responsibility for the content herein. This document should be

used only as a reference and not as a replacement for officially published material. Using the information from this document does not

guarantee that the reader will pass the PMP certification exam. No such guarantees or warranties are implied or expressed by OSP

International LLC.

Visit www.pm-prepcast.com for Exam Resources Page |2

Copyright © 2009-2018 by OSP International LLC. All rights reserved. Version 6.00. Use with PMBOK® Guide Sixth Edition

Essential PMP Exam Formulas

Concept Formula Result Interpretation

Cost Variance (CV) CV = EV - AC Negative = over budget = over planned

Provides cost performance of the project. Helps cost

determine the amount of budget deficit or surplus at

Zero = on budget = on planned cost

a given point in time.

Positive = under budget = under planned

cost

Cost Performance Index (CPI) CPI = EV / AC <1 = over budget = over planned cost.

Measure of cost efficiency on a project. Ratio of The project is getting <$1 for every $1

earned value to actual cost. spent.

1 = on budget = on planned cost. The

project is getting $1 for every $1 spent.

>1 = under budget = under planned cost.

The project is getting >$1 for every $1

spent.

Schedule Variance (SV) SV = EV - PV Negative = behind schedule

Provides schedule performance of the project.

Zero = on schedule

Helps determine if the project work is proceeding as

planned. Positive = ahead of schedule

Schedule Performance Index (SPI) SPI = EV / PV <1 = behind schedule. The project is

Measure of schedule efficiency on a project. Ratio progressing at a slower rate than

of earned value to planned value. Used to originally planned.

determine if a project is behind, on or ahead of

1 = on schedule. The project is

schedule. Can be used to help predict when a

progressing at the originally planned rate.

project will be completed.

>1 = ahead of schedule. The project is

progressing at a faster rate than

originally planned.

Schedule Variance (SV), alternative method SV = ES - AT Negative = behind schedule. The project

Provides schedule performance of the project in earned less than planned

terms of Earned Schedule (ES) and Actual Time

Zero = on schedule. The project earned

(AT).

as planned.

Positive = ahead of schedule. The project

earned more than planned.

Schedule Performance Index (SPI) (Alternative SPI = ES / AT <1 = behind schedule. The project is

Method) progressing at a slower rate than

Measure of schedule efficiency on a project in terms originally planned.

of Earned Schedule (ES) and Actual Time (AT).

1 = on schedule. The project is

progressing at the originally planned rate.

>1 = ahead of schedule. The project is

progressing at a faster rate than

originally planned.

Estimate at Completion (EAC) EAC = BAC / CPI Original budget modified by the cost

Expected final and total cost of a project based on Assumption: use this formula if the performance. The result is a monetary

project performance. Helps determine an estimate current cost performance is expected to value.

of the total costs of a project based on actual costs remain the same for the remainder of

to date. There are several ways to calculate EAC the project.

depending on the current project situation and how

EAC = AC + Bottom-up ETC Actual cost plus a new bottom-up

the actual work is progressing as compared to the

Assumption: use this formula if original estimate for the remaining work. The

budget. Look for keywords in the exam questions to

estimate was fundamentally flawed or result is a monetary value.

determine what assumptions were made.

conditions have changed and

invalidated original estimating

assumptions.

Visit www.pm-prepcast.com for Exam Resources Page |3

Copyright © 2009-2018 by OSP International LLC. All rights reserved. Version 6.00. Use with PMBOK® Guide Sixth Edition

Concept Formula Result Interpretation

EAC = AC + (BAC - EV) Actual cost to date (AC) plus unearned

Assumption: use this formula if current budget (BAC - EV). The result is a

cost variance is not expected to occur monetary value.

again for the remainder of the project,

which means the original budget is still

reliable.

EAC = AC + [(BAC - EV) / (CPI * SPI)] Actual cost to date (AC) plus unearned

Assumption: use this formula if both the budget (BAC - EV) modified by both cost

CPI and SPI influence the remaining performance and schedule performance.

project work. The result is a monetary value.

Estimate to Complete (ETC) ETC = EAC - AC Expected total cost minus actual cost to

Expected cost needed to complete all the remaining Use this formula if no keywords could date. Result is a monetary value that tells

project work. Helps predict what the final cost of the be found. how much more the project will cost.

project will be upon completion. There are many

ways to calculate ETC depending on the

assumptions made. Look for keywords in the exam

questions to determine what assumptions were ETC This is neither a formula nor the result of

made. A new estimate is developed when it is a calculation. It is simply a new bottom

thought that the original estimate was up cost estimate (re-estimate) of the

flawed. remaining project work.

ETC = BAC - EV The value of the unearned project work.

Assumption: use this formula if current The result is a monetary value.

variances are not expected to occur

again for the remainder of the project,

which means the original budget is still

reliable.

ETC = (BAC - EV) / (CPI * SPI) The value of the unearned project work

Assumption: use this formula if both the modified by both cost performance and

CPI and SPI influence the remaining schedule performance. The result is a

project work. monetary value.

ETC = (BAC / CPI) - AC Original budget modified by the cost

Assumption: use this formula if current performance minus the actual cost. The

cost performance is expected to remain result is a monetary value.

the same for the remainder of the

project.

Percent Complete Percent Complete = (EV / BAC) * 100% What is currently completed divided by

How much of the planned budget have been the original budget times 100. The result

completed? is a percentage value.

To-Complete Performance Index (TCPI) Based on BAC: >1 = harder to complete. Project needs

A measure of cost performance that must be TCPI = (BAC - EV) / (BAC - AC) to improve its cost performance to be

achieved on the remaining work to meet a specific completed on target.

management goal (e.g. BAC or EAC). Based on EAC:

1 = same to complete. Same cost

TCPI = (BAC - EV) / (EAC - AC)

efficiency can be maintained to complete

It is the work remaining divided by the funds

the project.

remaining.

<1 = easier to complete. Project is

expected to achieve its cost targets.

Variance at Completion (VAC) VAC = BAC - EAC Result is a monetary value that estimates

Anticipates the difference between the originally how much over or under budget (the

estimated BAC and a newly calculated EAC. In variance) the project will have by its

other words, the cost that was originally planned completion.

minus the cost that is now expected. <0 = over planned budget

=0 = on planned budget

>0 = under planned budget

Visit www.pm-prepcast.com for Exam Resources Page |4

Copyright © 2009-2018 by OSP International LLC. All rights reserved. Version 6.00. Use with PMBOK® Guide Sixth Edition

Concept Formula Result Interpretation

Earned Value (EV) EV = Sum of PV of completed work The result is the EV, a monetary value.

A measure of completed work expressed in terms of Assumption: use this formula if PV for

the budget authorized for that work. all completed work is given.

EV = % complete * BAC

Assumption: use this formula if PV for

all completed work is not given.

Earned Schedule (ES) The formula for the ES is relatively The ES is a numeric value expressed in

A measure of completed work expressed in terms of complex. Therefore, it is unlikely that the same units as these of the project

the authorized schedule for that work. you will be required to make any ES duration.

calculations on the exam.

Three-Point Estimating (Beta Distribution) Estimate = [Pessimistic + (4 * Most The result is the estimated duration/cost

Three-point estimate for the expected duration (or Likely) + Optimistic] / 6 of a schedule activity expressed as a

cost) of a schedule activity using pessimistic, weighted average.

optimistic and most likely values. This is a This is the preferred formula for the

probabilistic approach, using statistical estimates of PMP Exam unless the use of triangular

durations (or cost) to get a weighted average. Also distribution is explicitly called for.

known as the PERT estimate.

Three-Point Estimating (Triangular Distribution) Estimate = (Pessimistic + Most Likely + The result is the estimated duration/cost

Three-point estimate for the expected duration (or Optimistic) / 3 of a schedule activity expressed as a

cost) of a schedule activity using pessimistic, simple average.

optimistic and most likely values. A probabilistic

approach, using statistical estimates of durations (or

costs) to get a simple average.

Program Evaluation and Review Technique Please see Three-Point Estimating

(PERT) Estimate/Average (Beta Distribution)

PERT Activity Standard Deviation σ = (Pessimistic - Optimistic) / 6 Large standard deviation indicates that

The standard deviation (σ) is a reflection of the the data points are far from the mean; a

uncertainty in the estimates. It is a measure of the small standard deviation indicates that

statistical variability of an activity. If an activity has the data points are clustered closely

different estimates: optimistic, most likely and around the mean. Hence, the larger the

pessimistic, the standard deviation will determine standard deviation, the greater the risk.

the variation in the same units of the

measurements.

PERT Activity Variance Variance = [(Pessimistic - Optimistic) / Unlike expected absolute deviation, the

The variance is a reflection of the uncertainty in the 6] ^ 2 variance of a variable has units that are

estimates expressed in squared units of the the square of the units of the variable

measurements. It is also a measure of the statistical itself. For example, a variable measured

variability of an activity. The difference between in inches will have a variance measured

variance and standard deviation is that the variance in square inches. For this reason,

is in the squared units of the measurements while describing data sets via their standard

the standard deviation is in the same units as the deviation or root mean square deviation

measurements. The standard deviation is not is often preferred over using the

additive and hence cannot be used in mathematical variance.

formulas for studying variations among different

populations; only variance can be used in such

cases.

Activity Duration Duration = EF - ES + 1 Number of days an activity lasts.

Determines how long an activity lasts. There are

two formulas; both will give the same result. Duration = LF - LS + 1

Visit www.pm-prepcast.com for Exam Resources Page |5

Copyright © 2009-2018 by OSP International LLC. All rights reserved. Version 6.00. Use with PMBOK® Guide Sixth Edition

Concept Formula Result Interpretation

Free Float Free Float = ES of Successor Activity - Number of time units (typically days) an

The amount of time a schedule activity can be EF of Present Activity - 1 activity can be delayed without delaying

delayed without delaying the early start date of any the early start of the successor activity.

successor activity or violating a schedule constraint.

Note: If the present activity has more

than one successor activities, then use

the earliest ES of any of the successor

activities.

Total Float Total Float = LS - ES Number of time units (typically days) an

The amount of time a schedule activity can be activity can be delayed without delaying

delayed or extended from its early start date without Total Float = LF - EF the finish date of the project.

delaying the project finish date or violating a

schedule constraint. There are two formulas both

will give the same result.

Early Finish (EF)1 EF = (ES + duration) - 1 The earliest day on which an activity can

Determine when an activity can finish at the earliest. finish.

Early Start (ES)1 ES = (EF of predecessor) + 1 The earliest day on which an activity can

Determine when an activity can start at the earliest. start.

Late Finish (LF)1 LF = (LS of successor) - 1 The latest day on which an activity can

Determine when an activity can finish at the latest. finish.

Late Start (LS)1 LS = (LF - duration) + 1 The latest day on which an activity can

Determine when an activity can start at the latest. start.

Present Value (PV) PV = FV / (1+r)^n The result is the amount of money that

Receiving an amount of money today is more should be invested today (PV) for n

valuable than receiving the same amount of money years at r% interest rate in order to

in the future (e.g., in three years). This formula achieve the desired future value (FV).

calculates how much the future cash flow is valued

The higher the PV the better.

today.

Note: PV in this case should not be confused with

the Planned Value (PV).

Future Value (FV) FV = PV * (1+r)^n The result is the amount of money (FV)

Receiving an amount of money in the future (e.g., in that will be received if a sum of money

three years) is less valuable than receiving the (PV) is invested today for n years at r%

same amount of money today. This formula interest rate.

calculates the future value of an amount invested

today.

Net Present Value (NPV) The formula for the NPV is relatively Positive NPV is good. Negative NPV is

Method for financial evaluation of projects. Also complex. Therefore, it is unlikely that bad. The project with the higher NPV is

described as present value (PV) of all cash inflows you will be required to make any NPV the “better” project.

minus present value of all cash outflows. calculations on the exam.

Discounted Cash Flow (DCF) The formula for the DCF is relatively The project with the higher DCF of net

A valuation method for potential investment that complex. Therefore, it is unlikely that cash flows is the “better” project.

uses future free cash flow projections and discounts you will be required to make any DCF

them (most often using the or weighted average calculations on the exam.

cost of capital (WACC)).

Return on Investment (ROI) Even though the formula for the ROI is The project with the higher ROI is better.

Ratio of money gained or lost on an investment relatively simple, it is unlikely that you

relative to the amount of money invested. The will be required to make any ROI

amount of money gained or lost is often referred to calculations on the exam.

as interest, profit/loss, gain/loss, or net income/loss.

Internal Rate of Return (IRR) The calculations for the IRR is relatively The project with the higher IRR is better.

Interest rate at which the present value of all future complex. Therefore, it is unlikely that

cash flows equals the initial investment. you will be required to make any IRR

calculations on the exam.

1See Formula Elaboration section

Visit www.pm-prepcast.com for Exam Resources Page |6

Copyright © 2009-2018 by OSP International LLC. All rights reserved. Version 6.00. Use with PMBOK® Guide Sixth Edition

Concept Formula Result Interpretation

Payback period Add up the projected cash inflow minus The project with the shorter payback

The time it takes to recover the initial investment by expenses until the result of the period is better.

adding up the future cash inflows until they are calculation is equal to the initial

equal to the initial investment. In plain English: the investment.

time it takes until you are break-even.

Benefit Cost Ratio (BCR) Benefit / Cost BCR < 1 is bad. BCR > 1 is good. The

Ratio that describes the cost versus benefits of a project with the higher BCR is the “better”

project. one.

Cost Benefit Ratio (CBR) Cost / Benefit CBR < 1 is good. CBR > 1 is bad. The

Ratio that describes the benefits versus cost of a project with the lower CBR is the “better”

project. This is simply the reverse of the Benefit one.

Cost Ratio

Opportunity Cost Opportunity Cost = The profit/gain of For the PMP exam the opportunity cost is

Opportunity cost is the benefit foregone by choosing the project not chosen. usually a monetary value: Project B was

one option over an alternative one. Thus, selected over project A, therefore the

opportunity cost is the cost of pursuing one choice opportunity cost is the unrealized profit of

instead of another. project A. Note that NO calculation is

required.

Communication Channels n * (n-1) / 2 Total number of communication channels

The number of all possible communication channels among n people of a group.

on a project.

n-1 Number of communication channels that

one member of the team has with

everyone else on the team. For example,

you have to make this many phone calls

to call everyone else.

Expected Monetary Value (EMV) EMV = Probability * Impact A monetary value that represents the

An estimate that tells how much money (gained or expected gain or loss of an event.

lost) can reasonably be expected by taking

probability of the event into account. For instance: if

it rains, we will lose $200. There is a 25% chance

that it will rain. Therefore, the EMV is: 0.25 * $200 =

$50.

Straight-line Depreciation Depreciation Expense = Asset Cost / The result is either the depreciation

A method that depreciates the same amount (or Useful Life expense (the yearly depreciation amount,

percent) each year by dividing the asset's cost by for example $200) or the depreciation

the number of years it is expected to be in service. Depreciation Expense = (Asset Cost - rate (the yearly depreciation percentage,

The simplest of the depreciation methods. Scrap Value) / Useful Life for example 5%).

If a scrap value is given, then it can also

Depreciation Rate = 100% / Useful Life be factored in by subtracting it.

Double Declining Balance Depreciation Rate = 2 * (100% / Useful The depreciation rate stays the same

A depreciation method that provides for a higher Life) over the years, but the depreciation

depreciation charge in the first year of an asset's life expense gets smaller each year because

and gradually decreasing charges in subsequent Depreciation Expense = Depreciation it is calculated from a smaller book value

years. The method does this by depreciating twice Rate * Book Value at Beginning of Year each year.

the straight-line depreciation rate from an assets

book value at the beginning of the year. Book Value = Book Value at beginning

of year - Depreciation Expense

Average The sum of all the members of the list The result is a number representing the

In mathematics, an average refers to a measure of divided by the number of the members. arithmetic mean of a data set.

the "middle" of a data set. The most common

method is the arithmetic mean. That is why the Average of 2, 3, 7 = (2 + 3 + 7) / 3 = 4

“Average” is sometimes also and simply called the

“Mean”.

Mean See Average

Visit www.pm-prepcast.com for Exam Resources Page |7

Copyright © 2009-2018 by OSP International LLC. All rights reserved. Version 6.00. Use with PMBOK® Guide Sixth Edition

Concept Formula Result Interpretation

Median Arrange the values from lowest value to The result is a number representing the

The middle value that separates the higher half highest value and pick the middle one. median of a data set.

from the lower half of the data set. Example: 5 is the median in 1, 5, 6

If there is an even number of values in

the data set, calculate the mean of the

two middle values. Example: 3 is the

median in 1, 2, 4, 9 because (2 + 4) / 2

=3

Mode Find the value in a data set that occurs The result is a number representing the

The most frequent value in a given data set. most often. Example: 2 is the mode of mode of a data set.

1, 2, 2, 3

Visit www.pm-prepcast.com for Exam Resources Page |8

Copyright © 2009-2018 by OSP International LLC. All rights reserved. Version 6.00. Use with PMBOK® Guide Sixth Edition

Formula Elaboration

There are two approaches for calculating ES, EF, LS and LF:

• First approach: calculate the network diagram starting on day 0

• Second approach: calculate the network diagram starting on day 1

In the PMP Exam Formula Study Guide we use the second approach, because when your sponsor tells you that your

project starts on the first day of September, then that is September 1, not September 0. This is also the way that all

modern scheduling tools seem to work. You schedule your project based on a calendar start date and not "on day 0".

That is why there is a slight difference between the calculations: you have to add/subtract 1 from the results in the second

approach.

Of course, this often leads to confusion among the prospective PMP aspirants who ask which formula should they use on

the exam?

We have discussed this with several of our PMP trainer colleagues, and they agree that the Project Management Institute

(PMI)® does not "support" a specific method of calculating a network diagram. (Remember that next to the two options

shown above you could also calculate a network path starting on a specific calendar date in hours instead of days, making

the calculations even more complex).

Both of these calculations will lead to the correct answer. However, in the exam the big difference is that the first approach

(starting on day 0) involves fewer calculations because you don't have to "+1 or -1" each time. So, in order to reduce your

"risk" of doing a calculation wrong and saving time during the exam, you might want to initiate the network diagram with

day 0. However, in "real life" starting with day 1 is more appropriate.

Since PMI is aware of these varying methods, you should not see a question on the exam where only the application of

one or the other leads to the correct answer.

Visit www.pm-prepcast.com for Exam Resources Page |9

Copyright © 2009-2018 by OSP International LLC. All rights reserved. Version 6.00. Use with PMBOK® Guide Sixth Edition

Values to Remember

Description Value Comment

1 sigma 68.27% (68.2689492…) Also: 1 standard deviation

2 sigma 95.45% (95.4499736…) Also: 2 standard deviations

3 sigma 99.73% (99.7300204…) Also: 3 standard deviations

6 sigma 99.99% (99.9999998027…) Also: 6 standard deviations

Note: 99.9999998027… is the so called

“true” 6 sigma value for normal

distribution. The “practical” 6 sigma is

99.999666666…, but 99.99 is sufficient

for the PMP Exam and you do not need to

know these differences.

Control Limits Usually 3 standard deviations above and Control limits reflect the expected

below the mean variation in the data.

Control Specifications Not fixed but defined by the customer Must be looser than the control limits.

Represents the customer’s requirements.

Rough Order of Magnitude estimate -25% to +75% The estimate ranges are not 100%

agreed upon. Some books set the ROM

Preliminary estimate -15% to + 50%

at -25% to +75% others at -50% to

Budget estimate -10% to +25% +100%. See explanation below table for a

Definitive estimate -5% to +10% more detailed discussion.

Final estimate 0%

Float on the critical path 0 days

Pareto’s Law 80/20 For instance: 80% of your problems are

due to 20% of the causes.

Time a PM spends communicating 90% According to Harold Kerzner.

Crashing a project Crash the tasks with the least expensive Only crash activities on the critical path.

crash cost first.

Value of the inventory in a Just in Time 0% (or very close to 0%.)

(JIT) environment

Sunk Cost A cost that has been incurred and cannot Sunk cost is never a factor when making

be reversed. project decisions.

Negative Numbers (100) In the USA the number -100 is the same

-100 as (100). Both indicate “minus one

hundred”.

The Estimate Ranges Disagreement

We often receive questions from students about the fact that they see different numbers for the “Estimate Ranges” when they

compare various training materials. That is true, because there is unfortunately no final authority that defines these ranges.

There is a disagreement both on the names as well as on the actual ranges. Some books set the ROM at -25% to +75% others

at -50% to +100%. This is not surprising because estimate ranges are both application area and industry dependent. Everyone

does it slightly differently in their industry and on their projects. Therefore, it really isn't surprising that you will see different

numbers in different books.

The numbers that we provide in the table above have been successfully used by our students on the exam, so we believe

applying them on the exam is a good approach.

Visit www.pm-prepcast.com for Exam Resources P a g e | 10

Copyright © 2009-2018 by OSP International LLC. All rights reserved. Version 6.00. Use with PMBOK® Guide Sixth Edition

Formula Acronyms

Acronym Term Description

AC Actual Cost Total cost expended and reported during the accomplishment of a project task or project.

This can be labor hours alone; direct costs alone; or all costs, including indirect costs.

AT Actual Time The time in calendar units between the actual start date of the project till the project status

date.

BAC Budget at Completion The sum of all budgets allocated to a project.

BCR Benefit Cost Ratio Ratio that compares benefits to cost

CBR Cost Benefit Ratio Ratio that compares cost to benefit (inversion of BCR)

CPI Cost Performance Cost efficiency rating on a project, expressed as a ratio of EV to AC.

Index

CV Cost Variance A measure of cost performance on the project, expressed as the difference between earned

value and actual cost.

EAC Estimate at Completion The expected total cost for scheduled activity, a group of activities, or the project when the

work will be completed.

EF Early Finish Early finish of an activity

EMV Expected Monetary This is a statistical technique that calculates the probable financial results of events.

Value

ES Early Start Early start of an activity

ES Earned Schedule A method of deriving time-based performance measure

ETC Estimate to Complete ETC is the expected cost needed to complete all the remaining work for a scheduled activity,

a group of activities, or the project. ETC helps project managers predict what the final cost of

the project will be upon completion.

EV Earned Value EV is the value of completed work expressed in terms of the approved budget assigned to

that work for a scheduled activity or a work breakdown structure component.

FV Future Value Value of money on a given date in the future

IRR Internal Rate of Return A capital budgeting metric used to decide whether an investment should be made. It is an

indicator of the efficiency of an investment.

JIT Just-in-Time An inventory strategy that strives to improve a business's return on investment by reducing

in-process inventory and associated carrying costs.

LF Late Finish Late finish of an activity

LS Late Start Late start of an activity

NPV Net Present Value Standard method for the financial appraisal of long-term projects. Measures the excess or

shortfall of cash flows, in present value (PV) terms, once financing charges are met.

PERT Program Evaluation Method that allows the estimation of the weighted average duration of tasks

and Review Technique

PV Planned Value The authorized budget assigned to the scheduled work to be accomplished for a scheduled

activity or a work breakdown structure component.

PV Present Value Value of money received today instead of in the future.

ROI Return on Investment Ratio of money gained or lost on an investment relative to the amount of money invested

SPI Schedule Performance Ratio of work accomplished versus work planned, for a specified time period. The SPI is an

Index efficiency rating for work accomplishment, comparing work accomplished to what should

have been accomplished. It is a ratio of earned value and planned value. Alternatively, it is

also expressed as a ratio of earned schedule to actual time.

SV Schedule Variance A measure of schedule performance on the project, expressed as the difference between

earned value and planned value. Alternatively, it is also expressed as the difference

between earned schedule and actual time.

Visit www.pm-prepcast.com for Exam Resources P a g e | 11

Copyright © 2009-2018 by OSP International LLC. All rights reserved. Version 6.00. Use with PMBOK® Guide Sixth Edition

TCPI To-Complete The calculated project of cost performance that must be achieved on the remaining work to

Performance Index meet a specific project goal (e.g. BAC or EAC). It is the work remaining divided by the funds

remaining.

VAC Variance at Completion VAC forecasts the difference between the Budget-at-Completion and the expected total

costs to be accrued over the life of the project based on current trends.

Visit www.pm-prepcast.com for Exam Resources P a g e | 12

Copyright © 2009-2018 by OSP International LLC. All rights reserved. Version 6.00. Use with PMBOK® Guide Sixth Edition

You might also like

- The Project Management FrameworkDocument11 pagesThe Project Management FrameworknirmalmthpNo ratings yet

- Formula Study GuideDocument8 pagesFormula Study Guidemusharat_shafiqueNo ratings yet

- Bootcamp - Formules PMPDocument9 pagesBootcamp - Formules PMPMamadou ThioyeNo ratings yet

- EVM #1: EV, PV, AC, BAC, SV, CV, SPI, CPI and All That JazzDocument6 pagesEVM #1: EV, PV, AC, BAC, SV, CV, SPI, CPI and All That Jazzabhishek25No ratings yet

- Earned Value Efficiency Notes Project Controls SeriesDocument2 pagesEarned Value Efficiency Notes Project Controls Seriesdhan singhNo ratings yet

- Evm 1703180224Document4 pagesEvm 1703180224ghv9cxgzjxNo ratings yet

- PGMP Formulae - PMCerty v02Document26 pagesPGMP Formulae - PMCerty v02Srini Reddy100% (2)

- Earned Value CheatSheetDocument1 pageEarned Value CheatSheetZaheeda KhanNo ratings yet

- Earned Value ManagementDocument51 pagesEarned Value Managementمحمود عبدةNo ratings yet

- Earned Value MethodDocument6 pagesEarned Value Methodsudheer80No ratings yet

- PMP FormulasDocument3 pagesPMP Formulaspolters100% (8)

- The Earned Value Analysis MethodDocument6 pagesThe Earned Value Analysis MethodHervé DEBLOCKNo ratings yet

- Praizion Media PMP Exam Student'S Cheat SheetDocument2 pagesPraizion Media PMP Exam Student'S Cheat SheetAbhijeet BhatNo ratings yet

- Earned Value (Calculation Table)Document1 pageEarned Value (Calculation Table)Rounak VijayNo ratings yet

- Earned Value Management: Nabila ArifannisaDocument10 pagesEarned Value Management: Nabila ArifannisaAditya WidiyadiNo ratings yet

- PMP Formula Sheet 2022Document3 pagesPMP Formula Sheet 2022Fabian YslaNo ratings yet

- Earned Value AnalysisDocument54 pagesEarned Value AnalysisNobeenNo ratings yet

- Earned Value Analysis-1Document15 pagesEarned Value Analysis-1Tayyiba ImranNo ratings yet

- PMP Formulas: PMP New Horizon P: +91-938-029-5210 or +1 - 470-504-2231Document3 pagesPMP Formulas: PMP New Horizon P: +91-938-029-5210 or +1 - 470-504-2231hesham farouk86No ratings yet

- PMP Cost Formulas PCDocument1 pagePMP Cost Formulas PCQamar Shahzad SattiNo ratings yet

- Introduction To Earned Value Analysis (EVA) : CSSE 372 Software Project ManagementDocument22 pagesIntroduction To Earned Value Analysis (EVA) : CSSE 372 Software Project Managementmufratul muslimNo ratings yet

- 033 Evm FormulaDocument2 pages033 Evm FormulaArmanbekAlkinNo ratings yet

- EVM Formulas For Exam PDFDocument1 pageEVM Formulas For Exam PDFwfelicescNo ratings yet

- 11 EVA Formula SheetDocument3 pages11 EVA Formula SheetDileep Kumar MotukuriNo ratings yet

- Overview: Earned Value ManagementDocument24 pagesOverview: Earned Value ManagementLei AngeliqueNo ratings yet

- Project Management: Presented by Azhar Ullah AnsariDocument36 pagesProject Management: Presented by Azhar Ullah AnsariZAINI BZNo ratings yet

- Lecture # 6 - Project ControlDocument36 pagesLecture # 6 - Project ControlOwais AhmedNo ratings yet

- Appendix 1 - MN Conference Plan Brief V2.0620Document3 pagesAppendix 1 - MN Conference Plan Brief V2.0620Oscar Perez YaraNo ratings yet

- Demystifying Earned Value ManagementDocument10 pagesDemystifying Earned Value ManagementHeNo ratings yet

- PMP Formulas Cheat SheetDocument3 pagesPMP Formulas Cheat SheetSudhir AcharyaNo ratings yet

- PMP Quick Reference GuideDocument20 pagesPMP Quick Reference Guidevivek100% (2)

- Afcons Evm SlidesDocument41 pagesAfcons Evm SlidesAnonymous xaayU9b9GNo ratings yet

- 25 PMP Formulas To Pass The PMPDocument20 pages25 PMP Formulas To Pass The PMPMarceta BrankicaNo ratings yet

- PMP Formulas: 1. Number of Communication ChannelsDocument5 pagesPMP Formulas: 1. Number of Communication ChannelsramaiahNo ratings yet

- Project Management en AnglaisDocument3 pagesProject Management en Anglaisriedoi675No ratings yet

- Project Cost Management-1Document17 pagesProject Cost Management-1SHAMRAIZKHANNo ratings yet

- Monitoring Project Performance Basics Calculation Comments: EV % Complete PVDocument1 pageMonitoring Project Performance Basics Calculation Comments: EV % Complete PVErin YatesNo ratings yet

- PMP Formulas Week5Document5 pagesPMP Formulas Week5Oscar DoreyNo ratings yet

- Earned Value Analysis Cheat SheetDocument11 pagesEarned Value Analysis Cheat SheetMeeraTharaMaayaNo ratings yet

- Project Management Notes100Document14 pagesProject Management Notes100Kundan SinghNo ratings yet

- Formulas: Duration (Quantity of Work × Productivity Rate) ÷ Number of Resources Used Three-Point Estimating 2Document2 pagesFormulas: Duration (Quantity of Work × Productivity Rate) ÷ Number of Resources Used Three-Point Estimating 2Mukunda AdhikariNo ratings yet

- Earned ValueDocument1 pageEarned ValueDan OakesNo ratings yet

- Calculating Earned ValueDocument2 pagesCalculating Earned ValuebtbowmanNo ratings yet

- Earned Value ManagementDocument7 pagesEarned Value Managementraajmithun3568No ratings yet

- Software Project ManagementDocument12 pagesSoftware Project ManagementHarsh Vardhan SinghNo ratings yet

- Key Concept and Formulas For PMP ExamDocument4 pagesKey Concept and Formulas For PMP ExamaaranganathNo ratings yet

- Evm Quick GuideDocument7 pagesEvm Quick GuideFarid FaridNo ratings yet

- Chapter 2Document5 pagesChapter 2Ashu TuliNo ratings yet

- EVM & Analysis: Information Requirements For The ProjectDocument63 pagesEVM & Analysis: Information Requirements For The ProjectNAEEM SHUJANo ratings yet

- Planning Interview QuestionsDocument6 pagesPlanning Interview Questionsrahul.ril1660No ratings yet

- PMP FormulasDocument4 pagesPMP FormulasNarendra KumarNo ratings yet

- Earned Value Analysis TutorialDocument14 pagesEarned Value Analysis TutorialTom RedwayNo ratings yet

- Monitoring Project Performance With Earned Value Management: Prepared By: Yves Tyrone R. RosalesDocument24 pagesMonitoring Project Performance With Earned Value Management: Prepared By: Yves Tyrone R. Rosalesfrancis pacaigueNo ratings yet

- Aileen's Study Plan - PMP Exam SuccessDocument3 pagesAileen's Study Plan - PMP Exam SuccessRaj KNo ratings yet

- Earned Value Management for the PMP Certification ExamFrom EverandEarned Value Management for the PMP Certification ExamRating: 4.5 out of 5 stars4.5/5 (15)

- Edward Full NotesDocument70 pagesEdward Full NotesNeeraj ShuklaNo ratings yet

- Top Tips To Solve Situational Questions in PMP ExamDocument6 pagesTop Tips To Solve Situational Questions in PMP ExamNeeraj ShuklaNo ratings yet

- Visit For Exam Resources For Disclaimer See PMP® Formula Study GuideDocument2 pagesVisit For Exam Resources For Disclaimer See PMP® Formula Study GuideNeeraj ShuklaNo ratings yet

- PMP - Case Study 1Document8 pagesPMP - Case Study 1Neeraj ShuklaNo ratings yet

- CFA Level1 2017 Mock Exam PDFDocument75 pagesCFA Level1 2017 Mock Exam PDFHéctor GarcíaNo ratings yet

- Profile On The Production of Electric Wires AndLV CablesDocument26 pagesProfile On The Production of Electric Wires AndLV CablesDagim GBZNo ratings yet

- Risk AnalysisDocument26 pagesRisk Analysisashishprk84No ratings yet

- Project Management FormulasDocument7 pagesProject Management FormulasAnand MishraNo ratings yet

- 6 Investment Appraisal: Project ViabilityDocument7 pages6 Investment Appraisal: Project ViabilityLodhi IsmailNo ratings yet

- Evaluatin G Projects: H00141539 - Project Economics and Evaluation 1Document15 pagesEvaluatin G Projects: H00141539 - Project Economics and Evaluation 1Mustafa RokeryaNo ratings yet

- Exercise 8 (11 Jan 2023)Document2 pagesExercise 8 (11 Jan 2023)Teo ShengNo ratings yet

- Corporate Finance Practice Questions MidDocument9 pagesCorporate Finance Practice Questions MidFrasat IqbalNo ratings yet

- Course Outline For MBADocument4 pagesCourse Outline For MBATaklu Marama M. BaatiiNo ratings yet

- JANBI Model Questions - Accounting & Finance For BankersDocument10 pagesJANBI Model Questions - Accounting & Finance For BankersSanjay PradhanNo ratings yet

- Results For Item 2Document26 pagesResults For Item 2Kath LeynesNo ratings yet

- Carded RewriteDocument6 pagesCarded RewriteRyan TeichmannNo ratings yet

- Application of Scenario Analysis in The InvestmentDocument13 pagesApplication of Scenario Analysis in The Investmentharshita bhatronjiNo ratings yet

- A Feasible Business in Nigeria - AgrorafDocument13 pagesA Feasible Business in Nigeria - AgrorafgreatgeniusNo ratings yet

- Acceptance-or-Rejection Decisions: Decisions. Managers Encounter Two (2) Types of Capital-Budgeting DecisionsDocument12 pagesAcceptance-or-Rejection Decisions: Decisions. Managers Encounter Two (2) Types of Capital-Budgeting Decisionsstannis69420No ratings yet

- Project Report On Agri Tourism: Submitted byDocument16 pagesProject Report On Agri Tourism: Submitted bysaumikdebNo ratings yet

- NPV CalculatorDocument3 pagesNPV CalculatorAfrian HindrawijayaNo ratings yet

- SBM (Summary Notes - Alternative)Document172 pagesSBM (Summary Notes - Alternative)Sofia NicoriciNo ratings yet

- Assignment 3 Feb MBA 1Document17 pagesAssignment 3 Feb MBA 1shahzad aliNo ratings yet

- Summary of Article On Capital Budgeting PracticesDocument6 pagesSummary of Article On Capital Budgeting Practicesrahulravi2250% (2)

- Accounting MCQsDocument6 pagesAccounting MCQsNazakat HussainNo ratings yet

- BFD (Past Paper Analysis)Document2 pagesBFD (Past Paper Analysis)Muhammad Ubaid Khosa100% (1)

- Advanced Financial Management: Class 2 Capital Budgeting & Free Cash Flow Professor Janis SkrastinsDocument51 pagesAdvanced Financial Management: Class 2 Capital Budgeting & Free Cash Flow Professor Janis SkrastinsAdam StylesNo ratings yet

- Gas Lift With Nitrogen Injection Generated in SituDocument10 pagesGas Lift With Nitrogen Injection Generated in SitutherockstarsunNo ratings yet

- Exam Chap 13Document59 pagesExam Chap 13oscarv89100% (2)

- Problem Set 3Document3 pagesProblem Set 3Andie BibaresNo ratings yet

- Amortization Equivalent Annual Cost-UploadDocument6 pagesAmortization Equivalent Annual Cost-Uploadniaz kilamNo ratings yet

- The Balance Sheet: Task 1Document12 pagesThe Balance Sheet: Task 1Mahmoud EsmaeilNo ratings yet

- Risk Analysis in Capital BudgetingDocument70 pagesRisk Analysis in Capital BudgetingdhavalshahicNo ratings yet

- Alex MetalDocument40 pagesAlex Metalmuluken walelgnNo ratings yet