Professional Documents

Culture Documents

Answer

Answer

Uploaded by

Syed Muhammad Kazim RazaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Answer

Answer

Uploaded by

Syed Muhammad Kazim RazaCopyright:

Available Formats

Answer - 1

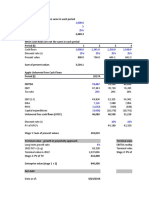

The summary of investment appraisal results are as follows:

Option I Option II

Net present value (Rs. in million) 82 107.41 (W1)

Payback period (years) 3.10 3.83 (W2)

Internal rate of return 10.50% 15.11% (W3)

13.20% 14.30% (W4)

Modified internal rate of return

-

On financial ground, the project to be accepted should be the one with the higher NPV, i.e. Option 2.

NPV shows the absolute amount by which the project is forecast to increase shareholders' wealth and is

theoretically more sound than the IRR and MIRR. However, In this case, both IRR and MIRR back up the NPV.

The discounted payback period shows that Option II is more risky as it takes longer to recover the present value.

WORKINGS

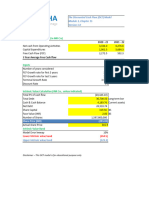

W1: Net present value Year 0 Year 1 Year 2 Year 3 Year 4

Rs. in million

Outside Pak nominal cash flows

(W1.1) (2,252.25) 244.23 308.25 348.35 357.65

Pak nominal cash flows (10%

inflation) - 366.30 423.50 551.03 658.85

Total nominal cash flows (2,252.25) 610.53 731.75 899.38 1,016.50

Discount factor at 13% 1.000 0.885 0.783 0.693 0.613

Present value (2,252.25) 540.32 572.96 623.27 623.11

Net present value 107.41

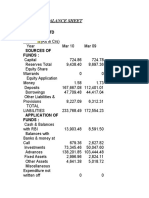

W1.1: Nominal Cash flows in Rupees

Year 0 Year 1 Year 2 Year 3 Year 4

China (Rs. (2,252.25) (1,923) (2,199) (2,454) (2,432)

in million)

UAE (Rs. in - 2,161 2,490 2,773 2,749

million)

Rs. Net (2,252.25) 238 291 319 317

Cashflow at

current

prices

Rs. Net (2,252.25) 244.23 308.25 348.35 357.65

Nominal

Cash flow

at 3%

W2: Discounted Payback Period

Year 0 Year 1 Year 2 Year 3 Year 4

Present value (2,252.25) 540.32 572.96 623.27 623.11

of cash flow

(Rs. in m)

Cumulative (2,252.25) (1,711.93) (1,138.97) ( 515.70) 107.41

discounted

cash flow

Discounted Payback Period = Year before full recovery (3) + Unrecovered cost at start of the year (515.70)

Cashflow during the year (623.11)

Discounted payback period = 3.83 years

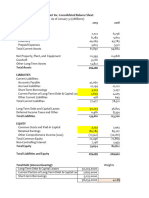

W3 : Internal rate of return

Year 0 Year 1 Year 2 Year 3 Year 4

in million

Nominal cash flows in (2,252.25) 610.53 731.75 899.38 1,016.5

million Rs. 0

Discount factor at 16% 1.000 0.862 0.743 0.641 0.552

Present value (2,252.25) 526.28 543.69 576.50 561.11

Net present value (44.67)

By Interpolation, the IRR is

15.11% P.A

W4 Modified Internal Rate of Return

PV ( Return Phase) (Year 1-4) 2359.66

PV (Investment Phase) (Year 0) 2252.25

Re 13%

MIRR = 14.3%

You might also like

- FM - Assignment 02Document19 pagesFM - Assignment 02SaadNo ratings yet

- DCF TATA PowerDocument2 pagesDCF TATA PowerAman MankotiaNo ratings yet

- Trent Westside DeepakDocument8 pagesTrent Westside DeepakDeepakNo ratings yet

- Statement of Cash Flow: A. Cash Flows From Operating ActivitiesDocument2 pagesStatement of Cash Flow: A. Cash Flows From Operating ActivitiesRtr. Jai NandhikaNo ratings yet

- Annual Financial ResultDocument21 pagesAnnual Financial ResultBTS ARMY FOR LIFENo ratings yet

- Trend Analysis, Horizontal Analysis, Vertical Analysis, Balance Sheet, Income Statement, Ratio AnalysisDocument4 pagesTrend Analysis, Horizontal Analysis, Vertical Analysis, Balance Sheet, Income Statement, Ratio Analysisnaimenim100% (1)

- Quarterly Update: First Half 2014 ResultsDocument4 pagesQuarterly Update: First Half 2014 ResultssapigagahNo ratings yet

- DCF Guide ExampleDocument4 pagesDCF Guide ExampleAlexander RiosNo ratings yet

- NDIC Quarterly Volume 37 No 4 2022 Article Financial Condition and Performance of Deposit Money Banks in The Fourth Quarter of 2022Document6 pagesNDIC Quarterly Volume 37 No 4 2022 Article Financial Condition and Performance of Deposit Money Banks in The Fourth Quarter of 2022boombayodeNo ratings yet

- General 4-Year DCF Spreadsheet Valuation Model (Dollars Amount in USD Million)Document2 pagesGeneral 4-Year DCF Spreadsheet Valuation Model (Dollars Amount in USD Million)hoifishNo ratings yet

- Reliance FSA PrachiDocument16 pagesReliance FSA PrachiPrachi SrivastavaNo ratings yet

- Analisis Laporan Keuangan - Prak. ALKDocument2 pagesAnalisis Laporan Keuangan - Prak. ALKAnti HeryantiNo ratings yet

- Performance of Infosys For The Third Quarter Ended December 31Document33 pagesPerformance of Infosys For The Third Quarter Ended December 31ubmba06No ratings yet

- 2021 Con Quarter01 CFDocument2 pages2021 Con Quarter01 CFMohammadNo ratings yet

- LIC Housing Finance LTD: Key Data ' ' ' 'Document4 pagesLIC Housing Finance LTD: Key Data ' ' ' 'Venkata KiranNo ratings yet

- Financial Analysis For NIKEDocument12 pagesFinancial Analysis For NIKEAnny Cloveries GabayanNo ratings yet

- Cash Flow StatementDocument3 pagesCash Flow StatementCreativity life with SmritiNo ratings yet

- Chapter 4Document32 pagesChapter 4sunilNo ratings yet

- Ceylon Investment PLC: A Carson Cumberbatch CompanyDocument11 pagesCeylon Investment PLC: A Carson Cumberbatch CompanygirihellNo ratings yet

- CA2Document22 pagesCA2aryanvaish64No ratings yet

- Topic - Hindustan Copper: Assignment Task No. - 1Document10 pagesTopic - Hindustan Copper: Assignment Task No. - 1syalbossbhanuNo ratings yet

- Eq+ RS /Eq+RS+Dbt K 9.14 Equity Portion 0.62 Debt Portion 0.38Document17 pagesEq+ RS /Eq+RS+Dbt K 9.14 Equity Portion 0.62 Debt Portion 0.38sandipandas2004No ratings yet

- Assignment # 6 Financial RatiosDocument2 pagesAssignment # 6 Financial RatiosAnil VermaNo ratings yet

- B-MGAC203 Long QuizDocument6 pagesB-MGAC203 Long QuizMa. Yelena Italia TalabocNo ratings yet

- Chapter 5 Financial Analysis of JBLDocument12 pagesChapter 5 Financial Analysis of JBLMd. Saiful IslamNo ratings yet

- DCF Guide Example2020Document6 pagesDCF Guide Example2020jam manNo ratings yet

- Cash Flow StatementDocument2 pagesCash Flow StatementVora JeetNo ratings yet

- Long-Term Debt Handout (UPDATED 8-27-22)Document9 pagesLong-Term Debt Handout (UPDATED 8-27-22)Charudatta MundeNo ratings yet

- 08 CTU2022 - Part1 FSDocument5 pages08 CTU2022 - Part1 FSAB12A3 - FRANCISCO JUDDIE G.No ratings yet

- SailashreeChakraborty 13600921093 FM401Document12 pagesSailashreeChakraborty 13600921093 FM401Sailashree ChakrabortyNo ratings yet

- Final Press ReleaseDocument4 pagesFinal Press ReleaseMeghaNo ratings yet

- Taj Nepal Pvt. LTD 76 TaxDocument31 pagesTaj Nepal Pvt. LTD 76 TaxSunny DesharNo ratings yet

- Press Release March 2023Document3 pagesPress Release March 2023Sumiran BansalNo ratings yet

- Fund FlowDocument15 pagesFund FlowArunRamachandranNo ratings yet

- Financial Highlights 2004 PDFDocument1 pageFinancial Highlights 2004 PDFGemielle PadillaNo ratings yet

- Análise HCB 260323Document4 pagesAnálise HCB 260323IlidiomozNo ratings yet

- 2023 q2 Earnings Results PresentationDocument15 pages2023 q2 Earnings Results PresentationZerohedgeNo ratings yet

- Chapter3 AssismentDocument6 pagesChapter3 Assismentchaoyuan tanNo ratings yet

- Project ReportDocument15 pagesProject ReportMichael AdonikarNo ratings yet

- SMChap 006Document22 pagesSMChap 006Anonymous mKjaxpMaLNo ratings yet

- RatioDocument4 pagesRatioMd Junayed IslamNo ratings yet

- Payback Period (In Months)Document4 pagesPayback Period (In Months)Reyy ArbolerasNo ratings yet

- Financial Management (1) NewDocument15 pagesFinancial Management (1) NewEngineering Rotech PumpsNo ratings yet

- Awasr Oman and Partners SAOC - FS 2020 EnglishDocument42 pagesAwasr Oman and Partners SAOC - FS 2020 Englishabdullahsaleem91No ratings yet

- FE (201312) Paper I - Answer PDFDocument12 pagesFE (201312) Paper I - Answer PDFgaryNo ratings yet

- 13 - Chapter4 - Capital Budgeting - Part2Document9 pages13 - Chapter4 - Capital Budgeting - Part2com01156499073No ratings yet

- AlMeezan AnnualReport2023 MSFDocument9 pagesAlMeezan AnnualReport2023 MSFmrordinaryNo ratings yet

- 5.6 Excel of Financial Statement AnalysisDocument6 pages5.6 Excel of Financial Statement AnalysisTRan TrinhNo ratings yet

- Book 3Document62 pagesBook 3pg23ishika.kumariNo ratings yet

- Financial Statement AnalysisDocument18 pagesFinancial Statement AnalysisShailyn AngcayNo ratings yet

- Minicase 2Document2 pagesMinicase 2TompelGEDE GTNo ratings yet

- Luehrman With ValuesDocument4 pagesLuehrman With ValuesTejdeep ReddyNo ratings yet

- Audited Annual Financial Results-Standalone & Consolidated-31.03.2020-WebsiteDocument11 pagesAudited Annual Financial Results-Standalone & Consolidated-31.03.2020-WebsiteRaj LallNo ratings yet

- Balance Sheet: JK Cement LTDDocument3 pagesBalance Sheet: JK Cement LTDHimanshu SharmaNo ratings yet

- This Statement Should Be Read in Conjunction With The Accompanying NotesDocument6 pagesThis Statement Should Be Read in Conjunction With The Accompanying NotesJoy AcostaNo ratings yet

- With Financials Student Excel Ratio Analysis Case Study I 7022Document17 pagesWith Financials Student Excel Ratio Analysis Case Study I 7022sarahNo ratings yet

- SAPM Assignment: Company: Ashok Leyland Student Name and PRNDocument15 pagesSAPM Assignment: Company: Ashok Leyland Student Name and PRNAkshat JainNo ratings yet

- Assignment 2Document1 pageAssignment 2Sumbal JameelNo ratings yet

- 16453Document2 pages16453fazal nadeemNo ratings yet

- Pac-Sdl: Types of DiscountingDocument5 pagesPac-Sdl: Types of DiscountingSyed Muhammad Kazim RazaNo ratings yet

- 02092035060lecture1 IntroductionPaybackPeriodDocument3 pages02092035060lecture1 IntroductionPaybackPeriodSyed Muhammad Kazim RazaNo ratings yet

- Pac-Sdl: Accounting Rate of Return (ARR)Document4 pagesPac-Sdl: Accounting Rate of Return (ARR)Syed Muhammad Kazim RazaNo ratings yet

- Exploration For and Evaluation of Mineral Resources: Ifrs 6Document12 pagesExploration For and Evaluation of Mineral Resources: Ifrs 6Syed Muhammad Kazim RazaNo ratings yet

- 2018 Winter List of Concepts in CIADocument1 page2018 Winter List of Concepts in CIASyed Muhammad Kazim RazaNo ratings yet

- Business Finance Decision Test # 2: InstructionsDocument2 pagesBusiness Finance Decision Test # 2: InstructionsSyed Muhammad Kazim RazaNo ratings yet

- Business Finance Decision Suggested Solution Test # 2: Answer - 1Document4 pagesBusiness Finance Decision Suggested Solution Test # 2: Answer - 1Syed Muhammad Kazim RazaNo ratings yet

- T 1 S (C I A C 5-7 Icap S) : Option I: Introduce Low Quality Products in The MarketDocument2 pagesT 1 S (C I A C 5-7 Icap S) : Option I: Introduce Low Quality Products in The MarketSyed Muhammad Kazim RazaNo ratings yet

- 5/2 Air Operated, Spring/ Return Valve: Series: 32PDocument2 pages5/2 Air Operated, Spring/ Return Valve: Series: 32PGaurav TripathiNo ratings yet

- Silo - Tips - Employee Welfare in Singareni Collieries Company Limited A StudyDocument125 pagesSilo - Tips - Employee Welfare in Singareni Collieries Company Limited A StudyDivya Darshini SaravananNo ratings yet

- The Bodys Defence - MechanismDocument74 pagesThe Bodys Defence - Mechanismagarwaljenish2005No ratings yet

- Ni Oir. MonitoDocument15 pagesNi Oir. MonitoCarlos Alexis Arteaga GómezNo ratings yet

- rt11 Elegant Home With Power Saving, Security, Safety, Remote Controlling and Auto Control of Water Tank MotorDocument3 pagesrt11 Elegant Home With Power Saving, Security, Safety, Remote Controlling and Auto Control of Water Tank MotorMechWindNaniNo ratings yet

- Bassam ArabiDocument2 pagesBassam ArabiBassam OrabiNo ratings yet

- Triple CNC MachineDocument27 pagesTriple CNC MachineLeonardo Nicolas Paez100% (1)

- "Probability": Arun Kumar, Ravindra Gokhale, and Nagarajan KrishnamurthyDocument53 pages"Probability": Arun Kumar, Ravindra Gokhale, and Nagarajan KrishnamurthyNirmal SasidharanNo ratings yet

- IBR IMBUS Datasheet No LogoDocument12 pagesIBR IMBUS Datasheet No Logoenamicul50No ratings yet

- SI-Ethernet ManualDocument198 pagesSI-Ethernet ManualLori WaltonNo ratings yet

- Video Script: Unit 1 Another Country Part 1 Living Abroad Part 2 Adriana: Life in EnglandDocument22 pagesVideo Script: Unit 1 Another Country Part 1 Living Abroad Part 2 Adriana: Life in EnglandZeynep Sulaimankulova100% (2)

- C - Functions: Defining A FunctionDocument3 pagesC - Functions: Defining A Functionamrit323No ratings yet

- Silverado 2005 Wiring DiagramsDocument149 pagesSilverado 2005 Wiring Diagramskurtleyba78% (27)

- AIIMS (MBBS) Solved Question Paper 2010Document34 pagesAIIMS (MBBS) Solved Question Paper 2010cbsestudymaterialsNo ratings yet

- Chapter 4 Capacitance PDFDocument12 pagesChapter 4 Capacitance PDFRessyl Mae PantiloNo ratings yet

- Congenbill94 PyrophylitDocument1 pageCongenbill94 PyrophylitfromantoanNo ratings yet

- Career Resarch Part 2Document4 pagesCareer Resarch Part 2api-478801132No ratings yet

- EIN 3390 Chap 12 Expendable-Mold Cast B Spring - 2012Document51 pagesEIN 3390 Chap 12 Expendable-Mold Cast B Spring - 2012Deepak SharmaNo ratings yet

- Operation and Maintenance Manual: Skum Bladder Tank Type VerticalDocument8 pagesOperation and Maintenance Manual: Skum Bladder Tank Type VerticalSadegh AhmadiNo ratings yet

- The Perception of Bus Rapid Transit: A Passenger Survey From Beijing Southern Axis BRT Line 1Document21 pagesThe Perception of Bus Rapid Transit: A Passenger Survey From Beijing Southern Axis BRT Line 1Edmer FloresNo ratings yet

- Linear ProgrammingDocument48 pagesLinear ProgrammingRana Hanifah Harsari100% (2)

- Fascia Repair DetailsDocument2 pagesFascia Repair DetailsPatricia TicseNo ratings yet

- Structural Design and Strength Analysis of Lifting MachineDocument12 pagesStructural Design and Strength Analysis of Lifting MachineTata OdoyNo ratings yet

- Body Composition Analysis of Animals - A Handbook of Non-Destructive MethodsDocument252 pagesBody Composition Analysis of Animals - A Handbook of Non-Destructive MethodsRogelio Avila100% (1)

- BYW29-50 THRU BYW29-200: Fast Efficient Plastic RectifierDocument2 pagesBYW29-50 THRU BYW29-200: Fast Efficient Plastic Rectifierdj_nickoNo ratings yet

- Knowledge Management On Indian Railways Through Knowledge PortalDocument20 pagesKnowledge Management On Indian Railways Through Knowledge PortalIndian Railways Knowledge PortalNo ratings yet

- A Study On Financial Analysis at Basaveshwar Urban Co-Operative Credit SocietyDocument79 pagesA Study On Financial Analysis at Basaveshwar Urban Co-Operative Credit Society20PMHS005 - Diptasree DebbarmaNo ratings yet

- 01 Gen Prov With GPP OverviewOct2019Document110 pages01 Gen Prov With GPP OverviewOct2019Jay TeeNo ratings yet

- Account StatementDocument2 pagesAccount StatementDebashis MahantaNo ratings yet

- PartnershipsDocument35 pagesPartnershipspavithran selvamNo ratings yet