Professional Documents

Culture Documents

Rob Reck Presentation

Uploaded by

fantasy azerbaijanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Rob Reck Presentation

Uploaded by

fantasy azerbaijanCopyright:

Available Formats

Paddy Power Risk Management

Rob Reck

Principal Analyst

Paddy Power

IAPF Annual Conference: 1 October 2013 www.iapf.ie

Overview

• History of Paddy Power

• Risk Management in bookmaking

• A primer on Modelling Sports

• Beating the Bookie

IAPF Annual Conference: 1 October 2013 www.iapf.ie

History of Paddy Power

Genesis

• 1988 Paddy Power was founded through the merging the shops of 3

Irish bookmakers: John Corcoran, David Power & Kenny O’ Reilly

• Power bookmakers had a 100% clean record as being a reliable payer

in the Irish market and this was the main reason for the name.

• “Paddy” was added to make it more Irish

• Launched with a widely publicised payout limit of £100,000

• They started with an 8% share of the Irish Market

• From this Irish Retail base, through phone, online, mobile

international expansion - Paddy Power has grown to be the world’s

biggest quoted bookmaker

IAPF Annual Conference: 1 October 2013 www.iapf.ie

History of Paddy Power

Building the Company

The Internet Modelling Geographical Expansion

Racing as Major Focus

€5.7bn

Price Change Distribution The Growth of Sports Sports Models & Feeds Recent Technical Leaps: Mobile; HPC; SPE

85% of Turnover in Retail Estate Targets Set on UK & Ireland Automated Risk Management

Run Like a Bookmaker! Sweating In Running

1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

IAPF Annual Conference: 1 October 2013 www.iapf.ie

Before managing Risk

Paddy Power created lots of it!

• Cheltenham 1993 – Champion Bumper

• “If an Irish trained horse wins the Bumper we’ll double the SP”.

“Heist” was the Irish banker of the meeting at 2/1

• Success! Queues snaked out the doors of the shops

• By Luck or by Genius – we escaped a very very large payout

• Heist led up the straight and was beaten into 2nd by half a length.

• Out of sheer necessity the concept for Paddy Power Lucky

Underpants was invented!

IAPF Annual Conference: 1 October 2013 www.iapf.ie

Building the Brand

Using some very big letters

IAPF Annual Conference: 1 October 2013 www.iapf.ie

Building the Brand

With the best team ever!

IAPF Annual Conference: 1 October 2013 www.iapf.ie

Risk Management in Paddy Power

• In 2003 management took a decision to build a Risk

management model based on a financial services skillset

• Bookmaking and Financial services Risk is similar but also

really rather different!

• This led to a trading floor in Paddy Power operated by PhDs,

mathematicians, ex-bankers, actuarial graduates and a whole

host of sports and racing fanatics!

• Staff numbers are over 150 including 40+ ‘Quants’

IAPF Annual Conference: 1 October 2013 www.iapf.ie

It’s Risk Jim ...but not as we know it

• There are no standardised/market pricing models in the industry

• Prices have to be plucked from traders head or derived from an in-

house model

• We don’t have Black-Scholes, duration, basis point sensitivities or

any such

• Sometimes we wish that sport was a simple Brownian motion with

a bit of drift that could be valued in a Risk Neutral world … but

basketball players have other ideas!

• Academia doesn’t help the industry out here either

• Academics have a bet too!

IAPF Annual Conference: 1 October 2013 www.iapf.ie

It’s Risk Jim ...but not as we know it

• Our customers often know more than the market maker – or at

least something that the bookmaker doesn’t

• Asymmetric information is generally not visible to the bookmaker.

We have to listen and react in real time to their view on any

particular market

• Our prices depend both on our models/expertise as well as

‘reading’ what our customers opinions are through their betting

volumes and patterns

• Unfortunately filtering out what your customers know is not as

not as easy as reading the volumes of money

IAPF Annual Conference: 1 October 2013 www.iapf.ie

It’s Risk Jim ...but not as we know it

• Transaction levels mirror those of a decent sized investment bank

• The trade counts are very similar

• The ticket size is a good deal smaller!

• Online Bookmaking is more ‘Amazon’ than ‘AIB’

• Our inventory can amount to circa. half a million different betting

opportunities on offer at any point in time

• Amazon constantly re-prices it’s inventory - Paddy Power re-prices

much of it every second

• Our real time pricing software similar to what most banks would run

overnight.

IAPF Annual Conference: 1 October 2013 www.iapf.ie

It’s Risk Jim ...but not as we know it

• Finally we get a break relative to banking…

• Bookmaking, unlike financial markets, suffers very little from

correlation or contagion effects - all games are independent!

• Great…. but then we don’t get the nights/weekends off to update

our software, run our reports and get some sleep

• Capital Adequacy is replaced by individual event limits

• Event and market limits are set to control spikes in exposure. Pricing

is available to trade on almost all our open positions at all times and

our market position crystalizes within a few short hours

• It’s a beautifully very transparent world to be operating in

IAPF Annual Conference: 1 October 2013 www.iapf.ie

It’s Risk Jim ...but not as we know it

• We’re not paranoid but sometimes everyone is out to get us!

• Time/Rule/Strategy/Equipment changes all cost us money if we

don’t spot them

• We use the same skillsets as banking – but use them in a very

different way.

• We don’t make big bets we just make lots and lots of small ones

• If we are good at our job we can extract a positive margin on a

sequence of unrelated events

• When we make a mistake our customers tell us quickly by dipping

their hand in the till - so we get a chance to learn and ensure it never

happens again!

IAPF Annual Conference: 1 October 2013 www.iapf.ie

When is Margin not really Margin?

• Margin is only really margin if you apply it to the right probability!

• Flick of a fair coin - 50% probability for both Heads & Tails

• Bookmaker offers 9/10 each side

• Bookmaker’s ‘overrround’ = sum(1/(1+odds)) = 105.26%

• Expected profit for bookmaker = 1 – (1+ 9/10) * 50% = 5%

• If the we got it wrong and it’s 60% probability of Heads

• Bookmaker’s ‘overrround’ = sum(1/(1+odds)) = 105.26%

• Expected ‘Heads’ profit = 1 – (1+ 9/10) * 60% = -14%

• Expected ‘Tails’ profit = 1 – (1+ 9/10) * 40% = 24%

IAPF Annual Conference: 1 October 2013 www.iapf.ie

Risk Management - Sports Models

• To ascertain the correct probabilities Paddy Power’s Quants

pricing team is charged with producing pricing models for all

sports

• Racing, Soccer, Tennis, Basketball etc. etc. etc.

• Integrated into an expert systems these models:

• Remove subjectivity from pricing - smoothing achieved margin

• Create scale by increasing quantity of games that can be traded

simultaneously and the quantity of betting propositions within each

of those games

• Sounds easy – but writing and implementing models isn’t trivial and

relies on high performance parallel computing and significant brains!

IAPF Annual Conference: 1 October 2013 www.iapf.ie

Risk Management – Market Models

• Arriving at our own price in only half the battle!

• We can’t be so arrogant to think we always have it right

• Self doubt is very valuable when dealing with asymmetric

information – as is a knowledge of submarines!

• Customers and other market participants betting activity and price

movements contain significant ‘hidden’ information

• Working with the traders Quants have developed a suite of

models and trading tools have been development to monitor,

assimilate and act upon a huge volume of information in real time

IAPF Annual Conference: 1 October 2013 www.iapf.ie

Risk Management – Submarines

• Whether it be popping up when they least expect it to keeping the

head down when keeping the head down is the thing to do:

• Bookmakers have lot to learn from submarines!

• 1968: The search for the USS Scorpion

• “Bayesian Mathematics works!”

• 1970: The search for a Soviet undersea telephone cable connecting

Petropavlovsk to the Russian mainland across the Sea of Okhotsk

• “Mathematics may work – but don’t overcomplicate it”

• There are a lot of ‘undersea’ invisible perils!

• “On the surface of it” …

IAPF Annual Conference: 1 October 2013 www.iapf.ie

A Primer on Modelling Sports

• For very good reasons those who have a decent sports model

don’t tend to share it with the world – they bet it instead!

• Modelling a sport involves blending:

• As much data as you can get your hands on

• Rules of the game

• Models of the psychology of the players/officials

• Models of player fatigue

• Advanced statistical models and distributions

IAPF Annual Conference: 1 October 2013 www.iapf.ie

Modelling Sports– Psychology?

• Imagine tennis match where any two equal players are pitted

against each other

• The win probability of the first set is 50% for each player

• After the first set one player is now ahead

• Are the probabilities for each player for the second set still 50%?

• In a rare piece of published work two TCD academics showed it wasn’t!

• David Jackson/Krizysztof Mosurski (2005) published an article

entitled “Heavy Defeats in Tennis: Psychological Momentum or

Random Effect”

• It turns out – getting walloped in the first two sets significantly impacts

your desire to win (and perhaps your ability to play!)

IAPF Annual Conference: 1 October 2013 www.iapf.ie

Modelling Sports – Soccer

• Soccer, a large component of our turnover, has, on and off,

exercised our modellers’ brains for several years.

• Most modelling of sports begins with a little charting to get a feel

for the game dynamics. For example, in soccer, a chart of goals

against time shows that the game scoring rate evolves throughout

the game – with a notable time varying impact

IAPF Annual Conference: 1 October 2013 www.iapf.ie

Modelling Sports – Soccer

IAPF Annual Conference: 1 October 2013 www.iapf.ie

Sports Models – Soccer

• Scores (in aggregate) appear to increase with time

• An analyses of the results from the same matches shows that

there are also far too many draws for the scoring rates to be

independently distributed

• This is true for most sports! A force, called colloquially in Paddy

Power, “bouncebackability” pulls the teams back together

• The work of Dixon (et al.) proposed that scoring rates in soccer

could be modelled with a time-dependent piecewise constant

poisson distribution of scoring rates

IAPF Annual Conference: 1 October 2013 www.iapf.ie

Modelling Sports – Soccer

• To price more esoteric derivative markets and to stay ahead

of customers and competitors - models have to be

significantly more complex than anything available in the

public domain

• Corners

• Yellow and red cards

• Impact of two-legged and knock-out competitions

• Impact of injury and extra time

• Impact of relative strength of the teams

• Many other, less obvious, effects – right down to crowd attendance!

IAPF Annual Conference: 1 October 2013 www.iapf.ie

Beating the Bookie

• It still can be done but work very hard to make it a somewhat

more difficult with Paddy Power!

• Old School

• Singles vs Multiples

• Short prices

• Spotting mistakes

• Bad E/W – very common (especially multiples)

• Automated Arbitrage

• Plain Hard Work - Become a specialist in a niche sport/market

IAPF Annual Conference: 1 October 2013 www.iapf.ie

The End of the Beginning

(so many)

Questions

IAPF Annual Conference: 1 October 2013 www.iapf.ie

THANK YOU

Rob Reck

IAPF Annual Conference: 1 October 2013 www.iapf.ie

You might also like

- 2023 JulDocument64 pages2023 JulAlex100% (1)

- Apple EvolutionDocument35 pagesApple EvolutionSoso ZayedNo ratings yet

- Tasc 2022 - 03Document64 pagesTasc 2022 - 03Daniel Boureanu100% (2)

- Disposable Diaper Industry 1974: Group 5 Section ADocument11 pagesDisposable Diaper Industry 1974: Group 5 Section AaabfjabfuagfuegbfNo ratings yet

- Brand in Hand: Mobile Marketing at Adidas: Presented byDocument25 pagesBrand in Hand: Mobile Marketing at Adidas: Presented byjazzmaniac23No ratings yet

- Mgt1022-Lean Startup Management: Project Review 3Document25 pagesMgt1022-Lean Startup Management: Project Review 3Keerthi VasanNo ratings yet

- RatioDocument21 pagesRatioahb2009No ratings yet

- MA Flash Report 4-2-09 FinalDocument38 pagesMA Flash Report 4-2-09 Finalelong3102No ratings yet

- Globetrot Investment Pitch DeckDocument22 pagesGlobetrot Investment Pitch DeckOpeyemi AdetulaNo ratings yet

- Managing Through The Life CycleDocument34 pagesManaging Through The Life CycleAmit ShrivastavaNo ratings yet

- GBM 5 Globalising Local BrandsDocument25 pagesGBM 5 Globalising Local BrandsAlumni Class of 2019 - (AJ) Sarut KraisuraphongNo ratings yet

- ISJ029Document86 pagesISJ0292imediaNo ratings yet

- Utilization of IP and Need For ValuationDocument15 pagesUtilization of IP and Need For ValuationBrain LeagueNo ratings yet

- Pricing LuxuryDocument15 pagesPricing LuxuryMaeezah MurshedNo ratings yet

- Brand in Hand: Mobile Marketing at Adidas: Presented byDocument24 pagesBrand in Hand: Mobile Marketing at Adidas: Presented bydikku_harshNo ratings yet

- 3 Case Sports ObermeyerDocument56 pages3 Case Sports ObermeyerSinem DüdenNo ratings yet

- Global Financial Markets Infrastructure: Trade ExecutionDocument2 pagesGlobal Financial Markets Infrastructure: Trade ExecutionLmendozaNo ratings yet

- IRage Job Advertisement - Experienced Traders 20190221Document15 pagesIRage Job Advertisement - Experienced Traders 20190221Rajib Ranjan Borah100% (2)

- Business Philosophy: Global or LocalDocument16 pagesBusiness Philosophy: Global or LocalKaushik KgNo ratings yet

- MORNINGSTAR, Jeffrey Vonk - The Power of Moats Within The EUDocument20 pagesMORNINGSTAR, Jeffrey Vonk - The Power of Moats Within The EUtuan nguyenNo ratings yet

- Presentation OMDocument17 pagesPresentation OMTalha Butt1No ratings yet

- Chap 01 Introduction To Investing and ValuationDocument51 pagesChap 01 Introduction To Investing and ValuationhelloNo ratings yet

- The Birth of The Internet Bubble: Netscape IPODocument12 pagesThe Birth of The Internet Bubble: Netscape IPOMridul GreenwoldNo ratings yet

- Eng 2022 CorDocument29 pagesEng 2022 CorJayNo ratings yet

- Fundraising Best Practices: 2020 EditionDocument23 pagesFundraising Best Practices: 2020 EditionFounder InstituteNo ratings yet

- Internship Under CA Final ReportDocument22 pagesInternship Under CA Final ReportChahatNo ratings yet

- Case Study KodakDocument31 pagesCase Study KodakZineb Elouataoui100% (1)

- 08-2015 XYL Investor OverviewDocument30 pages08-2015 XYL Investor Overviewdavidelamo3No ratings yet

- Hockey Varsity TryoutsDocument1 pageHockey Varsity TryoutsPHOEBE CiNo ratings yet

- Presentation Packaging - ROLAND - ARIENSDocument19 pagesPresentation Packaging - ROLAND - ARIENSFlorin StanciuNo ratings yet

- Reviewer in International MarketingDocument9 pagesReviewer in International MarketingBianca Jane GomezNo ratings yet

- AWISCO ARC-Spring 2009Document8 pagesAWISCO ARC-Spring 2009salcabesNo ratings yet

- Apple Case Study AnalysisDocument13 pagesApple Case Study AnalysisKalyan Kumar100% (1)

- Apple Ipad: by Mr. Bakary YabouDocument28 pagesApple Ipad: by Mr. Bakary YabouumerisahfaqNo ratings yet

- Apple CaseDocument11 pagesApple CaseFariyad AnsariNo ratings yet

- SUP 3033 - Network Design and Planning: Submitted To: - SUBMITTED BY: - Nandini Student Id: - C0715691Document10 pagesSUP 3033 - Network Design and Planning: Submitted To: - SUBMITTED BY: - Nandini Student Id: - C0715691wdqwNo ratings yet

- Seek Pitch v24Document23 pagesSeek Pitch v24Maria KarlaNo ratings yet

- Orbit RAFI Experience ExpoDocument6 pagesOrbit RAFI Experience Exporico.kenzo86No ratings yet

- International Business: Group MembersDocument19 pagesInternational Business: Group MembersNouman BaigNo ratings yet

- Road Map To SuccessDocument1 pageRoad Map To SuccessLNo ratings yet

- 04 Managing Export IND BusinessDocument54 pages04 Managing Export IND Businessagung bisetioNo ratings yet

- An M&A Update 2006 Software M&A Review and 2007 Outlook: Corum Group LTDDocument32 pagesAn M&A Update 2006 Software M&A Review and 2007 Outlook: Corum Group LTDelong3102No ratings yet

- CBO Oil and Gas White Paper - The Billion US$ Oil Business + 2013 Marginal Fields Sale Special Report + Full Oil Sector ValuationDocument96 pagesCBO Oil and Gas White Paper - The Billion US$ Oil Business + 2013 Marginal Fields Sale Special Report + Full Oil Sector ValuationD. AtanuNo ratings yet

- To Be Earth's Most Customer-Centric Company Where People Can Find and Discover Anything They Want To Buy Online.Document31 pagesTo Be Earth's Most Customer-Centric Company Where People Can Find and Discover Anything They Want To Buy Online.Saywhatt100% (1)

- BCG Matrix PPT of AppleDocument15 pagesBCG Matrix PPT of AppleHEMANSHU JOSHI0% (1)

- Notes FintechDocument10 pagesNotes FintechPALLAVI DASHNo ratings yet

- Bombardier Recreational Products: Ovechkin Communications ConsultingDocument35 pagesBombardier Recreational Products: Ovechkin Communications ConsultingAcky DinnepatiNo ratings yet

- BMW (Final Version)Document18 pagesBMW (Final Version)Nusrat PrantiNo ratings yet

- Wipro Technologies: by D. Siva KumarDocument15 pagesWipro Technologies: by D. Siva KumarNikhil DeshmukhNo ratings yet

- Module 5 - Global SourcingDocument19 pagesModule 5 - Global SourcingArham Kumar JainBD21064No ratings yet

- This Time Is Different - Novel InvestorDocument9 pagesThis Time Is Different - Novel InvestorGSNo ratings yet

- 7investing Special Report 7 Proven Stock StrategiesDocument9 pages7investing Special Report 7 Proven Stock StrategiesshibusabrahamNo ratings yet

- Jazira Capital Corporate Presentation Jan 11Document11 pagesJazira Capital Corporate Presentation Jan 11Mohamed FahmyNo ratings yet

- In 1999 The Economist Reported The Creation of An IndexDocument1 pageIn 1999 The Economist Reported The Creation of An Indextrilocksp SinghNo ratings yet

- Infinox CorporateDocument17 pagesInfinox CorporateRonald FriasNo ratings yet

- International Business Machines Corporation: Performed by Pantea Marcela Group: CON-171Document11 pagesInternational Business Machines Corporation: Performed by Pantea Marcela Group: CON-171MarlenaNo ratings yet

- Strategy - Apple Inc - Project PPT (Recovered)Document16 pagesStrategy - Apple Inc - Project PPT (Recovered)Jayesh GoswamiNo ratings yet

- Philippe Laffont Coatue Presentation 05 09Document20 pagesPhilippe Laffont Coatue Presentation 05 09marketfolly.com100% (3)

- LEAN SERVICE: A Practical Guide for SME Owner / ManagersFrom EverandLEAN SERVICE: A Practical Guide for SME Owner / ManagersRating: 3 out of 5 stars3/5 (2)

- ABB Timers and Controls, Express ProductsDocument89 pagesABB Timers and Controls, Express ProductsElias100% (1)

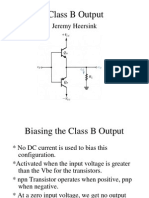

- Class B Output: Jeremy HeersinkDocument10 pagesClass B Output: Jeremy Heersinkdummy1957jNo ratings yet

- WS-Problems Solved by Quadratic EquationsDocument1 pageWS-Problems Solved by Quadratic EquationsNorul AzimNo ratings yet

- Fuels and Combustion (Unit-Viii) 1. (A) Explain How Fuels Are Classified With Suitable ExamplesDocument15 pagesFuels and Combustion (Unit-Viii) 1. (A) Explain How Fuels Are Classified With Suitable ExamplesengineeringchemistryNo ratings yet

- Zanussi Zou 342 User ManualDocument12 pagesZanussi Zou 342 User Manualadatok2No ratings yet

- Transition Elements Final 1Document44 pagesTransition Elements Final 1Venkatesh MishraNo ratings yet

- Tesis de Pared de BloquesDocument230 pagesTesis de Pared de BloquesRobert FinqNo ratings yet

- Earths InteriorDocument50 pagesEarths InteriorJulius Memeg PanayoNo ratings yet

- BBBBBDocument11 pagesBBBBBAlfredo ErguetaNo ratings yet

- Reduced Complexity Decision Feedback Equalizer For Supporting High Mobility in WimaxDocument5 pagesReduced Complexity Decision Feedback Equalizer For Supporting High Mobility in Wimaxjoy0302No ratings yet

- AnswerDocument51 pagesAnswersamNo ratings yet

- Working With Files and Directories: Chapter 11Document62 pagesWorking With Files and Directories: Chapter 11Abdelahad SatourNo ratings yet

- W12 1321 01 ADocument19 pagesW12 1321 01 ALucy SimmondsNo ratings yet

- Solutions and Solubility 2021Document3 pagesSolutions and Solubility 2021Mauro De LollisNo ratings yet

- Art Appreciation Learning ModulesDocument32 pagesArt Appreciation Learning ModulesJonah ChoiNo ratings yet

- Chap. 49 Modes: 3. Modes On Regular Triangular DrumDocument9 pagesChap. 49 Modes: 3. Modes On Regular Triangular DrumfudogNo ratings yet

- Way4 Manager Menu Editor: Openway Group System Administrator ManualDocument47 pagesWay4 Manager Menu Editor: Openway Group System Administrator ManualEloy Escalona100% (1)

- Oracle Alerts: Mona Lisa SahuDocument35 pagesOracle Alerts: Mona Lisa Sahuanishokm2992No ratings yet

- WPH04 01 Que 20160118Document28 pagesWPH04 01 Que 20160118josekadaNo ratings yet

- When Bad Things Happen To Good MissilesDocument9 pagesWhen Bad Things Happen To Good Missilesmykingboody2156No ratings yet

- ECODRIVE - ошибки и предупрежденияDocument6 pagesECODRIVE - ошибки и предупрежденияАндрей ПетряхинNo ratings yet

- BioavailabilityDocument16 pagesBioavailabilityTyshanna JazzyNicole BariaNo ratings yet

- Datasheet ECM 5158 Interface 4pgv1 A80401 PressDocument4 pagesDatasheet ECM 5158 Interface 4pgv1 A80401 Presslgreilly4No ratings yet

- Age ProblemsDocument4 pagesAge ProblemsBen JNo ratings yet

- UNIT - 3: Fast-Fourier-Transform (FFT) Algorithms: Dr. Manjunatha. PDocument100 pagesUNIT - 3: Fast-Fourier-Transform (FFT) Algorithms: Dr. Manjunatha. PMVRajeshMaliyeckalNo ratings yet

- Tig Mig Plasma OkDocument83 pagesTig Mig Plasma Okspwajeeh50% (2)

- Consideraciones para El Diseño de Una Helice MarinaDocument7 pagesConsideraciones para El Diseño de Una Helice Marinagenesis L. OrtizNo ratings yet

- Certification of eVTOL AircraftDocument19 pagesCertification of eVTOL AircraftrlwersalNo ratings yet

- fronius-informationDocument13 pagesfronius-informationcontactoNo ratings yet

- Flatpack2 IntegratedDocument2 pagesFlatpack2 IntegratedNeil BaillieNo ratings yet