Professional Documents

Culture Documents

Course: Financial Accounting & Analysis Internal Assignment Examination

Uploaded by

Jitendra0 ratings0% found this document useful (0 votes)

25 views2 pagesFinancial_Accounting & Analysis_Assignment_Solution

Original Title

Financial_Accounting & Analysis_Assignment_Solution

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFinancial_Accounting & Analysis_Assignment_Solution

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

25 views2 pagesCourse: Financial Accounting & Analysis Internal Assignment Examination

Uploaded by

JitendraFinancial_Accounting & Analysis_Assignment_Solution

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

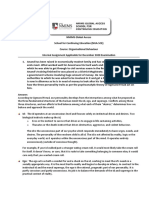

Course: Financial Accounting & Analysis

Internal Assignment Examination

1. Financial accounting information

Answer:

Accounting is the process of identifying, measuring and communicating economic information

to permit informed judgments and decisions by the users of accounts. There are two sub-fields

of Accounting:-

Financial Accounting: It measures the financial performance of an organization using

standard conventions to prepare and distribute financial reports.

Managerial Accounting: It uses both financial and nonfinancial information as a basis

for making decisions within an organization with the purpose of equipping decision

makers to set and evaluate business goals by determining what information they need

to make a particular decision and how to analyze and communicate this information.

Points Financial Accounting Management Accounting

Users of Report External Users Internal Users

Types of Report Financial Statement: Balance Sheet, Internal Reports: Job Cost Sheet,

Income Statement, Cash Flow Production Cost Report, Cost of Goods

Statement etc. Manufactured etc.

Accounting It follows the Generally Accepted It is not bound to follow the Generally

Principles Accounting Principles (GAAP) or Accepted Accounting Principles (GAAP)

International Financial Reporting

Standards (IFRS).

Audit Independent Auditors certifies and There are no independent audits verifying

expresses their opinion on the FS. the information.

Unit of The financial information is usually Besides, monetary units, management

Measurement expressed in monetary terms. This is accounting uses measures such as machine

to help in making comparisons hours, labour hours, product units, etc. for

between different data. the purpose of analysis and decision

making.

Reporting Report is about the company as a Management determines the contents of a

Purpose whole. report and its format. Reports are

prepared only when management believes

the benefit of using the report exceeds the

cost of preparing the report.

Advantages of Financial Accounting

Reveals the financial performance of a business during a period and its financial

position at the end of that period.

Provides relevant information to investors and lenders, both present and

prospective to take appropriate investment and lending decisions

Limitations of Financial Accounting

Provides only historical information about the performance and financial

performance of business. It fails to provide estimates and projections for future

which form the basis of business decisions.

Provides information about matters that can be quantified. Many other items

such as quality of management are important for the success of a business. Since

these items cannot be quantified, these are not reported by Financial Accounting

You might also like

- Financial - Accounting & Analysis - SolutionDocument2 pagesFinancial - Accounting & Analysis - Solutionjitendra kumar vermaNo ratings yet

- Fa Class Notes UplodedDocument252 pagesFa Class Notes UplodedDurvas Karmarkar100% (1)

- Financial AccountingDocument252 pagesFinancial AccountingSonia Dhar100% (1)

- Unit - 1 - Introduction Management AccountingDocument18 pagesUnit - 1 - Introduction Management AccountingKetan GuptaNo ratings yet

- Financial and Managerial AccountingDocument4 pagesFinancial and Managerial Accountingsonam agrawalNo ratings yet

- Adv. Accountancy Paper-2Document17 pagesAdv. Accountancy Paper-2Avadhut PaymalleNo ratings yet

- Management Accounting - Unit1Document15 pagesManagement Accounting - Unit1anil gondNo ratings yet

- Management Accounting (MA)Document114 pagesManagement Accounting (MA)Shivangi Patel100% (1)

- Introduction To Management AccountingDocument12 pagesIntroduction To Management AccountingRODOLFO AUSTRIA JR.No ratings yet

- ch1 Managerial AccDocument4 pagesch1 Managerial AccAsad RehmanNo ratings yet

- Chapter One: Cost Accounting Chapter - IDocument10 pagesChapter One: Cost Accounting Chapter - IlemiNo ratings yet

- Careers in Finanial ManagementDocument62 pagesCareers in Finanial ManagementManoj GuptaNo ratings yet

- Role of Managerial Accounting and Its Direction Toward A Specific FieldDocument4 pagesRole of Managerial Accounting and Its Direction Toward A Specific FieldBududut BurnikNo ratings yet

- Managerial AccountingDocument5 pagesManagerial Accountingjaninemaeserpa14No ratings yet

- Unit 3 Basant Kumar 22gsob2010021 AccountingDocument24 pagesUnit 3 Basant Kumar 22gsob2010021 AccountingRavi guptaNo ratings yet

- Bca Unit Iii Mgt. AcoountingDocument13 pagesBca Unit Iii Mgt. AcoountingGautham SajuNo ratings yet

- Chapter 1Document26 pagesChapter 1Robel HabtamuNo ratings yet

- Maryland International College: Accounting and Finance For ManagersDocument26 pagesMaryland International College: Accounting and Finance For ManagersANTENEH ENDALE DILNESSANo ratings yet

- Management AccountingDocument108 pagesManagement AccountingBATUL ABBAS DEVASWALANo ratings yet

- Business Finance NewDocument7 pagesBusiness Finance NewFarhan Ashraf SaadNo ratings yet

- Cost Accounting Aims To Report, Analyze, and Lead To The Improvement of Internal Cost Controls and EfficiencyDocument23 pagesCost Accounting Aims To Report, Analyze, and Lead To The Improvement of Internal Cost Controls and EfficiencyAmin HoqNo ratings yet

- Fma CH 1 IntroductionDocument32 pagesFma CH 1 IntroductionHabtamuNo ratings yet

- Types of AccountingDocument6 pagesTypes of Accountingkhushnuma20No ratings yet

- Chapetr1-Overview of Cost and Management AccountingDocument12 pagesChapetr1-Overview of Cost and Management AccountingNetsanet BelayNo ratings yet

- L2 Management AccountingDocument23 pagesL2 Management Accountingvidisha sharmaNo ratings yet

- Name Kausar HanifDocument43 pagesName Kausar HanifIqra HanifNo ratings yet

- Management Acc 1Document30 pagesManagement Acc 1AbhishekNo ratings yet

- Maryland International College: Accounting and Finance For ManagersDocument161 pagesMaryland International College: Accounting and Finance For Managershadush Gebreslasie100% (1)

- Financial Accounting Vs Management AccountingDocument2 pagesFinancial Accounting Vs Management AccountingMuhamamd Asfand YarNo ratings yet

- 1 - Intro To CostDocument7 pages1 - Intro To CostALLYSON BURAGANo ratings yet

- Management Accounting Unit No 1st BBA 5th SemesterDocument4 pagesManagement Accounting Unit No 1st BBA 5th SemesterDrVivek SansonNo ratings yet

- Cost AccountingDocument4 pagesCost AccountingAretha Joi Domingo PrezaNo ratings yet

- 1 Management AccountingDocument6 pages1 Management AccountingPercy Joy CruzNo ratings yet

- Financial Accounting VsDocument3 pagesFinancial Accounting VsShubham PatilNo ratings yet

- Financial AccountingDocument4 pagesFinancial AccountingnileshkambleNo ratings yet

- Presentation 001 Management Services Concepts Practices and StandardsDocument33 pagesPresentation 001 Management Services Concepts Practices and StandardsNoe AgubangNo ratings yet

- Cost and Management AccountingDocument51 pagesCost and Management Accountingabhijeet0% (1)

- 01 Fundamentals of Managerial Accounting and Ethical StandardsDocument10 pages01 Fundamentals of Managerial Accounting and Ethical StandardsXtian AmahanNo ratings yet

- 1 Chapter OneDocument36 pages1 Chapter OneMegbaru TesfawNo ratings yet

- ACC-223 SIM Week-1-3 ULOaDocument13 pagesACC-223 SIM Week-1-3 ULOaChara etangNo ratings yet

- Actg35 1Document2 pagesActg35 1api-3744266No ratings yet

- Accounts BDocument13 pagesAccounts Bzabi ullah MohammadiNo ratings yet

- Management AccountingDocument20 pagesManagement AccountingAman ChaudharyNo ratings yet

- Unit - 1: What Is Management Accounting?Document40 pagesUnit - 1: What Is Management Accounting?స్వామియే శరణం అయ్యప్పNo ratings yet

- RA 8293 Intellectual Property LawDocument25 pagesRA 8293 Intellectual Property Lawjohn paolo josonNo ratings yet

- Chapter 1 Management Accounting An OverviewDocument53 pagesChapter 1 Management Accounting An OverviewMs. VelNo ratings yet

- Unit - I Meaning and Nature of Financial AccountingDocument26 pagesUnit - I Meaning and Nature of Financial Accountingaadi1988No ratings yet

- 01 Full CH Cost and Management Accounting Chapter 1 Copy 1Document200 pages01 Full CH Cost and Management Accounting Chapter 1 Copy 1sabit hussenNo ratings yet

- Lec 01 Cost and Management AccDocument53 pagesLec 01 Cost and Management AccMd Shawfiqul IslamNo ratings yet

- Introduction FADocument28 pagesIntroduction FAShrestha MohantyNo ratings yet

- Chapter 1Document23 pagesChapter 1Nandini SinhaNo ratings yet

- Updates in Managerial AccountingDocument15 pagesUpdates in Managerial Accountingstudentone50% (2)

- Financial Accounting and Cost AccountingDocument6 pagesFinancial Accounting and Cost AccountingdranilshindeNo ratings yet

- Managerial Accounting Vs Financial AccouDocument11 pagesManagerial Accounting Vs Financial AccouJermaine Joselle FranciscoNo ratings yet

- Notes - Management AccountingDocument54 pagesNotes - Management Accountingbenjoel1209No ratings yet

- FA - ACCA Lecture NotesDocument115 pagesFA - ACCA Lecture NotesmosesmuomeliteNo ratings yet

- Managerial Accounting Is A Branch of Financial Accounting and Serves Essentially The Same Purposes As Financial AccountingDocument4 pagesManagerial Accounting Is A Branch of Financial Accounting and Serves Essentially The Same Purposes As Financial AccountingVronica DayanaNo ratings yet

- Ethical Responsibilities of Management Accountants: 1. CompetenceDocument9 pagesEthical Responsibilities of Management Accountants: 1. Competenceritu paudelNo ratings yet

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- Sigmund Freud TheoryDocument2 pagesSigmund Freud TheoryJitendraNo ratings yet

- Discuss Big Five/OCEAN Answer:: Course: Organisational BehaviourDocument1 pageDiscuss Big Five/OCEAN Answer:: Course: Organisational BehaviourJitendraNo ratings yet

- Perception From Organization Behaviour Point of ViewDocument2 pagesPerception From Organization Behaviour Point of ViewJitendraNo ratings yet

- Explain The Concept of Perception and Factors Affecting Perception in Detail?Document2 pagesExplain The Concept of Perception and Factors Affecting Perception in Detail?JitendraNo ratings yet

- Please Explain Big Five/OCEAN Theory in Detail? Answer:: Assignment: Organisational BehaviourDocument2 pagesPlease Explain Big Five/OCEAN Theory in Detail? Answer:: Assignment: Organisational BehaviourJitendraNo ratings yet

- Organisational Behaviour Assignment SolutionA5Document2 pagesOrganisational Behaviour Assignment SolutionA5JitendraNo ratings yet

- Course: Business Economics Internal Assignment ExaminationDocument2 pagesCourse: Business Economics Internal Assignment ExaminationJitendraNo ratings yet

- Answer:: Course: Business Economics Internal Assignment ExaminationDocument3 pagesAnswer:: Course: Business Economics Internal Assignment ExaminationJitendraNo ratings yet

- Organisational Behaviour Assignment QuestionA1Document13 pagesOrganisational Behaviour Assignment QuestionA1JitendraNo ratings yet

- Business Economics Assignment Q2Document3 pagesBusiness Economics Assignment Q2JitendraNo ratings yet

- Beijing EAP Q3Document1 pageBeijing EAP Q3JitendraNo ratings yet

- Beijing-EAP - Q1Document2 pagesBeijing-EAP - Q1JitendraNo ratings yet

- Beijing EAP Q3Document1 pageBeijing EAP Q3JitendraNo ratings yet

- Q4) How Would You Design A Better Structure and Hence Responsibility and Authority of Project Managers at BEC?Document1 pageQ4) How Would You Design A Better Structure and Hence Responsibility and Authority of Project Managers at BEC?JitendraNo ratings yet

- Beijing EAP Q3Document1 pageBeijing EAP Q3JitendraNo ratings yet

- Gross Domestic Product (GDP) and Gross National Product (GNPDocument3 pagesGross Domestic Product (GDP) and Gross National Product (GNPJitendraNo ratings yet

- Q5) What Future Challenges Would Rapid Growth of BEC in Future Throw Up? How Should It Tackle Them?Document1 pageQ5) What Future Challenges Would Rapid Growth of BEC in Future Throw Up? How Should It Tackle Them?JitendraNo ratings yet

- A. Rewrite These Sentences To Reflect "You" AttitudeDocument1 pageA. Rewrite These Sentences To Reflect "You" AttitudeJitendraNo ratings yet

- Q2) What Caused The Conflict Between The Project Managers and The Other Employees?Document1 pageQ2) What Caused The Conflict Between The Project Managers and The Other Employees?JitendraNo ratings yet

- What Is Accounting Users? Give Details Answer:: Internal AssignmentDocument2 pagesWhat Is Accounting Users? Give Details Answer:: Internal Assignmentjitendra.jgec8525No ratings yet

- What Is Accounting Users? Give Details Answer:: Internal AssignmentDocument2 pagesWhat Is Accounting Users? Give Details Answer:: Internal Assignmentjitendra.jgec8525No ratings yet

- Discuss About Users and Uses of Accounting Information AnswerDocument3 pagesDiscuss About Users and Uses of Accounting Information AnswerJitendraNo ratings yet

- FinanceDocument4 pagesFinancejitendra.jgec8525No ratings yet

- Gross Domestic Product (GDP) and Gross National Product (GNP)Document2 pagesGross Domestic Product (GDP) and Gross National Product (GNP)jitendra.jgec8525No ratings yet

- Senior Project Engineering Manager in Chicago IL Resume Richard PrischingDocument2 pagesSenior Project Engineering Manager in Chicago IL Resume Richard PrischingRichardPrischingNo ratings yet

- Himanshu Singla: EducationDocument3 pagesHimanshu Singla: EducationSahil GargNo ratings yet

- Lesson 5 EBBADocument152 pagesLesson 5 EBBAHuyền LinhNo ratings yet

- The 16 Career ClustersDocument4 pagesThe 16 Career ClusterssanchezromanNo ratings yet

- Completing The Audit: ©2006 Prentice Hall Business Publishing, Auditing 11/e, Arens/Beasley/ElderDocument41 pagesCompleting The Audit: ©2006 Prentice Hall Business Publishing, Auditing 11/e, Arens/Beasley/ElderJohn BryanNo ratings yet

- Running Head: MARKETING PLAN 1Document21 pagesRunning Head: MARKETING PLAN 1Isba RafiqueNo ratings yet

- PM 5-6Document7 pagesPM 5-6Nguyễn UyênNo ratings yet

- Squared-Online BrochureDocument16 pagesSquared-Online BrochureMohsinKhalid0% (1)

- Alphasol International Group Profile: Tel: +251 114 701858 Fax: +251 114 702358 Mobile +251 920745948, EmailDocument16 pagesAlphasol International Group Profile: Tel: +251 114 701858 Fax: +251 114 702358 Mobile +251 920745948, EmailsachinoilNo ratings yet

- Nike Marketing MixDocument9 pagesNike Marketing MixHarshit MaheshwariNo ratings yet

- Oracle Property Management User GuideDocument442 pagesOracle Property Management User GuidemanjucaplNo ratings yet

- CH 07Document99 pagesCH 07baldoewszxc80% (5)

- 1060-2022 PO ATL M.S Bismillah AccessoriesDocument1 page1060-2022 PO ATL M.S Bismillah AccessoriesYounus SheikhNo ratings yet

- Case StudyDocument2 pagesCase StudyCindy Graze EscaleraNo ratings yet

- Project Cutover PlanDocument9 pagesProject Cutover PlanPrashant KumarNo ratings yet

- Methods of Software AcquisitionDocument12 pagesMethods of Software AcquisitionSimranjeet Singh100% (4)

- Study - On GorfersDocument4 pagesStudy - On GorfersrashmiNo ratings yet

- Glenda Lee Resume 2Document2 pagesGlenda Lee Resume 2api-516194049No ratings yet

- Product Management Maturity Model: Tools LeadershipDocument1 pageProduct Management Maturity Model: Tools LeadershipAlexandre NascimentoNo ratings yet

- Public Vs PrivateDocument2 pagesPublic Vs PrivateVishvasniya RatheeNo ratings yet

- SWDocument1 pageSWAnne BustilloNo ratings yet

- Consent Form CTOS V4Document1 pageConsent Form CTOS V4shahila shuhadahNo ratings yet

- Management Accounting: Roll No. Total No. of Pages: 02 Total No. of Questions: 07 - 5)Document2 pagesManagement Accounting: Roll No. Total No. of Pages: 02 Total No. of Questions: 07 - 5)sumanNo ratings yet

- Doors Offer Il BagnoDocument1 pageDoors Offer Il Bagnosellitt ngNo ratings yet

- Unit 5 - Partnership ActDocument28 pagesUnit 5 - Partnership ActNataraj PNo ratings yet

- Acct Statement XX0012 25052023Document5 pagesAcct Statement XX0012 25052023JunoonNo ratings yet

- Swot Analysis PepsiDocument14 pagesSwot Analysis Pepsivmd35sbsbNo ratings yet

- Modern Systems Analysis and Design: Structuring System Process RequirementsDocument45 pagesModern Systems Analysis and Design: Structuring System Process RequirementsBhavikDaveNo ratings yet

- The Cost of Capital: Sources of Capital Component Costs Wacc Adjusting For Flotation Costs Adjusting For RiskDocument37 pagesThe Cost of Capital: Sources of Capital Component Costs Wacc Adjusting For Flotation Costs Adjusting For RiskMohammed MiftahNo ratings yet

- Busman 106 Activity Sheet No. 1Document2 pagesBusman 106 Activity Sheet No. 1melanie jadeNo ratings yet