Professional Documents

Culture Documents

CourseMarial - 3303dFIBA301 - Advance Corporate Finance

Uploaded by

Govind SinghOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CourseMarial - 3303dFIBA301 - Advance Corporate Finance

Uploaded by

Govind SinghCopyright:

Available Formats

L T P/S SW TOTAL

CREDIT

UNITS

2 0 2 0 3

Course Title: Advanced Corporate Finance

Course Code: FIBA 301

Credit Units: 3

Course Level: UG

Course Objectives:

The basic objective of the course is to:

• Make the students aware of the objectives of a firm and various agency problems issues arising in a firm

• Determine the capital structure and rewarding the shareholders is the basic objective of the course

• Equip students aware of various valuation models used by corporates to value a stock and firm

• Enlighten students with knowledge on tools and defensive strategies used in corporate restructuring

Pre-requisites: Students of finance should be aware of the latest developments in the field of corporate finance. This course will be a step above

Financial Management II where they will learn advanced topics related to corporate restructuring & corporate governance.

Course Learning Outcomes

After successful completion of the course, students will be able to:

• Identify the various agency problems and conflicts in compensation in an organization.

• Understand various capital structure theories and effect of dividend on a stock price.

• Interpret the various valuation concepts.

• Analyze the concept of Corporate Restructuring and its defensive strategies.

• Evaluate the importance of Corporate Governance and ethical practices in implemented in business.

Course Contents/Syllabus:

Weightage (%)

Module I: Introduction 20

Objectives of Corporate finance. Profit and wealth maximization, Agency Problems, Management Compensation &

Measurement.

Module II: Capital Structure Theories and Dividend Decisions 20

Factors affecting Capital Structure decisions, Theory of Capital Structure Decisions, MM Theory, NI, NOI and

traditional theory, Pecking order theory. Importance of dividend decisions, Theories of Dividend Decisions:

Irrelevance theory, optimal dividend decision, relevance theory, Issues in dividend policy:

Bonus Shares, Stock Splits & Buyback of shares.

Module III: Valuation Concepts 20

Concept: Valuation and Principles; Application of valuation models; Valuation Model:

Economic value Added (EVA) and Market value Added (MVA); Concept: Balance Score

Card; Other Methods and measures of financial performance; Concept of Adjusted Present Value.

Module IV: Corporate Restructuring 20

Differential Efficiency & Financial Synergy: Theory of Mergers, Operating Synergy & Pure Diversification: Theory of

mergers, Costs and Benefits of Merger, Evaluation of Merger as a Capital Budgeting Decision, Poison Pills, Turnaround

Strategies, Concept of debt restructuring.

Module V: Recent Trends in Corporate Finance and Business Ethics 20

Applications of Information Technology in Corporate Finance, Zero Based Budgeting Artificial Intelligence, Rolling

Forecasts, Corporate Governance, Ethical practices in marketplace, corporate responsibility, social audit & ethical

investing.

Pedagogy for Course Delivery:

As the basic objective of the course is to equip the students with the understanding of advanced topics of finance. Case studies will be taken up to

illustrate real life situations. We will open the stage for two-way communication and discussion.

List of Professional Skill Development Activities (PSDA):

PSDA 1: Do online study and discuss various management compensation schemes and dividend policies.

PSDA 2: Design a capital structure for any start-up company.

PSDA 3: Prepare a report on CSR practices followed by companies of FMCG/pharmaceutical/automobile industry.

Lab/ Practicals details, if applicable:

List of Experiments:

• Not Applicable

Assessment/ Examination Scheme:

Theory L/T (%) End Term Examination (%)

40% 60%

Continuous Assessment/Internal Assessment End Term

(40 %) Examination

(60%)

Components (Drop down) Class Test Project Case Attendance

(CT) Discussion

Linkage of PSDA with Internal Assessment Component if - PSDA 2 & PSDA 1 - -

any 3

Weightage (%) 5 20 10 5 60

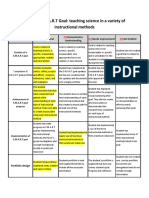

MAPPING CONTINUOUS EVALUATION COMPONENTS/PSDA WITH CLOS

Bloom’s Level > Identify Understand Apply Analyze Evaluate

Course Learning

Outcomes CLO1 CLO2 CLO3 CLO4 CLO5

Assessment type/PSDA

Class Test (CT)

Project (PSDA 1 & 2)

Assignment ✓ ✓ ✓

PSDA 1 ✓ ✓

Text & References:

Text:

• Brealey and Myers (2018), Principles of Corporate Finance, Eighth Edition, Tata McGraw Hill Publishing Company Limited.

References:

• Damodaran Aswath, Corporate Finance, Second Edition, John Wiley and Sons.

• Quiry, P., Dallocohio, M., YannL E Fur, Antonio Salvi, Corporate Finance: Theory and Practice, Seventh Edition, John Wiley,

and Sons.

• Ross, Westerfield and Jaffe, Corporate Finance, Seventeenth Edition, Tata McGraw Hill.

You might also like

- Rosie Revere Teaching GuideDocument5 pagesRosie Revere Teaching GuideAbrams Books100% (1)

- Prince SopDocument3 pagesPrince Sopvikram toorNo ratings yet

- Fundamentals of EntrepreneurshipDocument6 pagesFundamentals of EntrepreneurshipLoolik SoliNo ratings yet

- Case Laws IBBIDocument21 pagesCase Laws IBBIAbhinjoy PalNo ratings yet

- NAVA - Credit TransactionsDocument79 pagesNAVA - Credit Transactionscarrie navaNo ratings yet

- L T P/S SW/FW Psda Total Credit UnitsDocument5 pagesL T P/S SW/FW Psda Total Credit Unitssajid vermaNo ratings yet

- New SyllabusDocument5 pagesNew SyllabusAditi KediaNo ratings yet

- MGMT 106 Module 1Document24 pagesMGMT 106 Module 1jessNo ratings yet

- Business FinanceDocument5 pagesBusiness FinanceTanmay SinghalNo ratings yet

- Annexure CD - 01': L T P/S SW/FW Psda Total Credit UnitsDocument4 pagesAnnexure CD - 01': L T P/S SW/FW Psda Total Credit UnitsHarsh KumarNo ratings yet

- L T P/S FW No. of Psda Total Credit Units: Weightage (%)Document6 pagesL T P/S FW No. of Psda Total Credit Units: Weightage (%)parth dubeyNo ratings yet

- Scanning of Business Environment For LawyersDocument4 pagesScanning of Business Environment For Lawyersmadhav khanejaNo ratings yet

- Course Title: Financial Management Course Code: FIBA601 Credit Units: 3Document3 pagesCourse Title: Financial Management Course Code: FIBA601 Credit Units: 3Mannat BhallaNo ratings yet

- Fiba Syllabus PDFDocument4 pagesFiba Syllabus PDFShraddha BhardwajNo ratings yet

- Format For Course CurriculumDocument4 pagesFormat For Course CurriculumAgamya GoyalNo ratings yet

- New SyllabusDocument4 pagesNew SyllabusPhototronixNo ratings yet

- Format For Course Curriculum: Annexure CD - 01'Document4 pagesFormat For Course Curriculum: Annexure CD - 01'Divya SoodNo ratings yet

- STRA302 - Business Policy and Strategic ManagementDocument5 pagesSTRA302 - Business Policy and Strategic ManagementAhmad DanielNo ratings yet

- NewSyllabus 235420207940610Document5 pagesNewSyllabus 235420207940610Mistry Of HistoryNo ratings yet

- EconomicsDocument5 pagesEconomicsSupriya SinghalNo ratings yet

- Syllabus of Advanced Corporate AccountingDocument3 pagesSyllabus of Advanced Corporate AccountingDeepanshu MalikNo ratings yet

- Business Stats SyllabusDocument5 pagesBusiness Stats SyllabusHemang LathNo ratings yet

- Aab CD 01Document5 pagesAab CD 01Ankita SharmaNo ratings yet

- Format For Course Curriculum: Course Code: ACCT315 Credit Units: 3 Level: UGDocument4 pagesFormat For Course Curriculum: Course Code: ACCT315 Credit Units: 3 Level: UGLoolik SoliNo ratings yet

- AuditingDocument5 pagesAuditingSakchiNo ratings yet

- Behavioural FinanceDocument4 pagesBehavioural FinanceGeetika RajputNo ratings yet

- Course Title: Credit Units: 3 Credit Course CodeDocument4 pagesCourse Title: Credit Units: 3 Credit Course CodeRX 100No ratings yet

- New SyllabusDocument5 pagesNew SyllabusRaman GoyalNo ratings yet

- Format For Course Curriculum Course Title: Credit Units: 3 Course Code: IB601Document5 pagesFormat For Course Curriculum Course Title: Credit Units: 3 Course Code: IB601Pawan KumarNo ratings yet

- Format For Course Curriculum: Annexure CD - 01'Document4 pagesFormat For Course Curriculum: Annexure CD - 01'anuj sharmaNo ratings yet

- Advanced Corporate Accounting ACCT612Document4 pagesAdvanced Corporate Accounting ACCT612sajid vermaNo ratings yet

- Marketing Theory and PracticesDocument4 pagesMarketing Theory and PracticesSarthak RastogiNo ratings yet

- Service MarketingDocument6 pagesService MarketingShashwat ShuklaNo ratings yet

- New SyllabusDocument6 pagesNew SyllabusMonsters vlogsNo ratings yet

- Strategic Financial ManagementDocument4 pagesStrategic Financial ManagementkaustubhNo ratings yet

- NewSyllabus 0f0f0eda 3b49 4bde 82e7 Ab2494d1be47Document5 pagesNewSyllabus 0f0f0eda 3b49 4bde 82e7 Ab2494d1be47Monsters vlogsNo ratings yet

- New SyllabusDocument5 pagesNew SyllabusHarsh KumarNo ratings yet

- NewSyllabus 1044202081843618Document5 pagesNewSyllabus 1044202081843618Rithika manhasNo ratings yet

- CourseMarial - Cfd36sales and Distribution ManagementDocument5 pagesCourseMarial - Cfd36sales and Distribution ManagementDivyanshi SinghNo ratings yet

- NewSyllabus 1056202071058945Document5 pagesNewSyllabus 1056202071058945divyanshtyagi2005No ratings yet

- AAB CD-01a - Feedback (ECON135)Document5 pagesAAB CD-01a - Feedback (ECON135)Chirag NayakNo ratings yet

- Format For Course Curriculum: Issue ManagementDocument4 pagesFormat For Course Curriculum: Issue Managementparakh malhotraNo ratings yet

- Course Title: Course Code: CSIT660 Credit Units: 3 Level: PGDocument4 pagesCourse Title: Course Code: CSIT660 Credit Units: 3 Level: PGAkash Singh RajputNo ratings yet

- Course Title: Course Code: CSIT660 Credit Units: 3 Level: PGDocument4 pagesCourse Title: Course Code: CSIT660 Credit Units: 3 Level: PGAkash Singh RajputNo ratings yet

- Course Title: Course Code: CSIT660 Credit Units: 3 Level: PGDocument4 pagesCourse Title: Course Code: CSIT660 Credit Units: 3 Level: PGAkash Singh RajputNo ratings yet

- NewSyllabus c26b6f83 0eac 4665 Bdda 2d480c617f7aDocument5 pagesNewSyllabus c26b6f83 0eac 4665 Bdda 2d480c617f7aPragya GoswamiNo ratings yet

- NewSyllabus 18020207773176Document4 pagesNewSyllabus 18020207773176Pawan KumarNo ratings yet

- Micro Finance SyllabusppDocument5 pagesMicro Finance SyllabusppHemang LathNo ratings yet

- Format For Course Curriculum: Annexure CD - 01'Document4 pagesFormat For Course Curriculum: Annexure CD - 01'anuj sharmaNo ratings yet

- SFM PDFDocument3 pagesSFM PDFarpan mukherjeeNo ratings yet

- Management AccountingDocument4 pagesManagement AccountingSakchiNo ratings yet

- Course Title:: AnnexureDocument6 pagesCourse Title:: AnnexureGeetika RajputNo ratings yet

- Corporate Accounting ACCT214Document3 pagesCorporate Accounting ACCT214Loolik SoliNo ratings yet

- Syllabus Wealth ManagementDocument4 pagesSyllabus Wealth Managementsachin choudharyNo ratings yet

- Format For Course Curriculum: L T P SW Psda Total Credit UnitsDocument2 pagesFormat For Course Curriculum: L T P SW Psda Total Credit UnitsTiana KukrejaNo ratings yet

- 163420197929824Document5 pages163420197929824Umang GoelNo ratings yet

- NewSyllabus 1719202071427924Document6 pagesNewSyllabus 1719202071427924Udit chaudharyNo ratings yet

- New SyllabusDocument4 pagesNew SyllabusAdityaNo ratings yet

- Brand MGMT Syllabus ImpDocument6 pagesBrand MGMT Syllabus ImpHemang LathNo ratings yet

- ENTREPRENEURSHIPDocument5 pagesENTREPRENEURSHIPSam SharmaNo ratings yet

- Format For Course Curriculum: Annexure CD - 01'Document4 pagesFormat For Course Curriculum: Annexure CD - 01'Geetansh VarshneyNo ratings yet

- VABusinessValuationpdf 2023 01 25 08 51 39Document2 pagesVABusinessValuationpdf 2023 01 25 08 51 39Rahul PopatNo ratings yet

- Financial Statement Analysis - CODocument4 pagesFinancial Statement Analysis - COHaardik GandhiNo ratings yet

- CPS Fitting Stations by County - 22 - 0817Document33 pagesCPS Fitting Stations by County - 22 - 0817Melissa R.No ratings yet

- Bangladesh PoliceDocument17 pagesBangladesh PoliceCpsMinhazulIslamNo ratings yet

- Instructions For Form 8824Document4 pagesInstructions For Form 8824Abdullah TheNo ratings yet

- LCOE CHILE Ene - 11052401aDocument23 pagesLCOE CHILE Ene - 11052401aLenin AgrinzoneNo ratings yet

- Smart Goals Rubric 2Document2 pagesSmart Goals Rubric 2api-338549230100% (2)

- CSS Practical No. 14. Roll No. 32Document25 pagesCSS Practical No. 14. Roll No. 32CM5I53Umeidhasan ShaikhNo ratings yet

- CCS0006L (Computer Programming 1) : ActivityDocument10 pagesCCS0006L (Computer Programming 1) : ActivityLuis AlcalaNo ratings yet

- Manual de Usuario PLECSIM 4.2Document756 pagesManual de Usuario PLECSIM 4.2juansNo ratings yet

- Practice Questions SheetDocument4 pagesPractice Questions Sheetsaif hasanNo ratings yet

- Crop Insurance Proposal 31.07.2023 (CLN) PCPMD Inputs Rev SCIDocument14 pagesCrop Insurance Proposal 31.07.2023 (CLN) PCPMD Inputs Rev SCIĐỗ ThăngNo ratings yet

- 0x08. C - RecursionDocument13 pages0x08. C - RecursionElyousoufi hakim0% (1)

- LogisticsDocument5 pagesLogisticsHương LýNo ratings yet

- PAL-AT Operating ManualDocument60 pagesPAL-AT Operating ManualArmağan DemirelNo ratings yet

- RidleyBoxManual1 17Document63 pagesRidleyBoxManual1 17Sergio Omar OrlandoNo ratings yet

- Pre Int Work Book Unit 9Document8 pagesPre Int Work Book Unit 9Maria Andreina Diaz SantanaNo ratings yet

- V3 Hyundai Price ListDocument4 pagesV3 Hyundai Price Listdeepu kumarNo ratings yet

- Easa Ad 2022-0026 1Document12 pagesEasa Ad 2022-0026 1Syed BellaryNo ratings yet

- Aegps Manual Fluxpower Hpi Installation enDocument44 pagesAegps Manual Fluxpower Hpi Installation enAbdus SalamNo ratings yet

- Progress Test 3Document7 pagesProgress Test 3Mỹ Dung PntNo ratings yet

- Chapter 6 Game Theory TwoDocument9 pagesChapter 6 Game Theory TwoMextli BarritaNo ratings yet

- Final Results Report: Curative Labs Inc. 3330 New York Ave NE Washington, DC 20002Document1 pageFinal Results Report: Curative Labs Inc. 3330 New York Ave NE Washington, DC 20002Aidan NicholsNo ratings yet

- LSD - Job Description - LogisticsDocument2 pagesLSD - Job Description - LogisticsIjas AslamNo ratings yet

- Conceptual Framework For Financial Reporting: Student - Feedback@sti - EduDocument4 pagesConceptual Framework For Financial Reporting: Student - Feedback@sti - Eduwaeyo girlNo ratings yet

- Ease Us Fix ToolDocument7 pagesEase Us Fix ToolGregorio TironaNo ratings yet

- Datasheet Solis 3.6K 2G US 1phase 20170613Document2 pagesDatasheet Solis 3.6K 2G US 1phase 20170613Jimmy F HernandezNo ratings yet

- Intelligent Traffic Signal Control System Using Embedded SystemDocument11 pagesIntelligent Traffic Signal Control System Using Embedded SystemAlexander DeckerNo ratings yet