Professional Documents

Culture Documents

launchJasperReport 6

Uploaded by

Husen Wahid0 ratings0% found this document useful (0 votes)

22 views1 pageThis document is an Ethiopian tax declaration form for Adonaruk Engineering Plc for the tax period of February 2022. The form shows the company's taxpayer information and declares no taxable sales or turnover tax due. It requires the taxpayer or authorized representative's signature to certify the accuracy of the declaration.

Original Description:

Original Title

launchJasperReport_6

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document is an Ethiopian tax declaration form for Adonaruk Engineering Plc for the tax period of February 2022. The form shows the company's taxpayer information and declares no taxable sales or turnover tax due. It requires the taxpayer or authorized representative's signature to certify the accuracy of the declaration.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

22 views1 pagelaunchJasperReport 6

Uploaded by

Husen WahidThis document is an Ethiopian tax declaration form for Adonaruk Engineering Plc for the tax period of February 2022. The form shows the company's taxpayer information and declares no taxable sales or turnover tax due. It requires the taxpayer or authorized representative's signature to certify the accuracy of the declaration.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

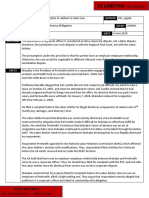

ETHIOPIAN REVENUES AND CUSTOMS

TURNOVER

AUTHORITY

Section 1 - Taxpayer Information

Taxpayer's Name: TIN: Tax Period:

Adonaruk Engineering Plc 0071846759 Feb, 2022

Registration Addresse: Tax Account Number: (Official Use Only)

House No.: NEW 17030430010

Kebele: WOREDA 11 Po.Box: Tax Centre:

Woreda: NO WOREDA-144 Document Number: 1639715930010

Zone/Sub-City: BOLE AA BRANCH EAST

Document Date: 07/04/2022

Region: ADDIS ABABA Ethiopia

Telephone Number: Fax Number:

Submission Number: 14415280010

Submission Date: 07/04/2022

Section 2 - Electronic Tax Declaration

Total Sales subject to 2% turnover Tax 5 0.00

Total Sales subject to 10% turnover Tax 10 0.00

Turnover Tax On Sales subject to 2% Rate (line 5 *2%) 15 0.00

Turnover Tax On Sales subject to !0% Rate (Line 10 *10%) 20 0.00

Total Turnover Tax Payable (Line 15 + Line 20) 25 0.00

Section 3 - Taxpayer Certification

I declare that the above declaration and all information provided here-with is correct and complete. I understand that any misrepresentation

is punishable as per the Tax Law and the Penal Code. Declaration of preparer (other than the taxpayer) is based on all information of

which the preparer has any knowledge.

Printed Taxpayer Name or Authorized Date Company Seal For Official Use Only

Representative

Date of Payment Receipt Number

Signature of Taxpayer or Authorized

Representative

Amount of Payment Check Number

Printed Name of Preparer Date

Cashier's Signature

Signature of Preparer

Page 1 of 1

You might also like

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1From EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1No ratings yet

- Launch Jasper ReportDocument1 pageLaunch Jasper Reportnattyman48No ratings yet

- 37Document1 page37Melat TayeNo ratings yet

- Launch Jasper ReportDocument1 pageLaunch Jasper ReportMekdes AberaNo ratings yet

- Launch Jasper ReportDocument1 pageLaunch Jasper ReportZelalem RegasaNo ratings yet

- New Woreda 13 No Woreda-143 Yeka Addis Ababa EthiopiaDocument1 pageNew Woreda 13 No Woreda-143 Yeka Addis Ababa EthiopiaKalkidan NigussieNo ratings yet

- Launch Jasper ReportDocument1 pageLaunch Jasper ReportZelalem RegasaNo ratings yet

- Pen ReportDocument1 pagePen ReportMirkamotors ethiopiaNo ratings yet

- Launch Jasper ReportDocument1 pageLaunch Jasper Reportalemayehu21tNo ratings yet

- Launch Jasper ReportDocument1 pageLaunch Jasper Reportalemayehu21tNo ratings yet

- Launch Jasper ReportDocument1 pageLaunch Jasper ReportElias Abubeker AhmedNo ratings yet

- DocumentDocument1 pageDocumentDagnachew TsegayeNo ratings yet

- CFHDocument1 pageCFHAbhishek SinghNo ratings yet

- Launch Jasper ReportDocument1 pageLaunch Jasper Reportalemayehu21tNo ratings yet

- 1201 Rental Tax Books of AcctDocument3 pages1201 Rental Tax Books of AcctMaddahayota College100% (1)

- Certificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasDocument4 pagesCertificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas Internasmar corNo ratings yet

- Document PDFDocument2 pagesDocument PDFSamson SeidNo ratings yet

- Income Tax Payment Challan: PSID #: 138414509Document1 pageIncome Tax Payment Challan: PSID #: 138414509naeem1990No ratings yet

- 2307 For EBS Private Individual Percenateg TaxDocument4 pages2307 For EBS Private Individual Percenateg TaxAGrace MercadoNo ratings yet

- (Filed) Akari Lighting 0605 Payment Form For Itr Fy 2020Document1 page(Filed) Akari Lighting 0605 Payment Form For Itr Fy 2020Gareth TiuNo ratings yet

- 2307 BirDocument3 pages2307 BirPFMPC SecretaryNo ratings yet

- Deliverable Acceptance FormDocument1 pageDeliverable Acceptance FormRyan LincayNo ratings yet

- Document PDFDocument2 pagesDocument PDFSamson SeidNo ratings yet

- 2307 Thedeleons Co LTDDocument2 pages2307 Thedeleons Co LTDRACHEL DAMALERIONo ratings yet

- Income Tax Payment Challan: PSID #: 171709428Document1 pageIncome Tax Payment Challan: PSID #: 171709428fast fbrNo ratings yet

- Certificate of Collection or Deduction of Tax: (See Rule 42 of Income Tax Ordinance 2001) : Withholding AgentDocument9 pagesCertificate of Collection or Deduction of Tax: (See Rule 42 of Income Tax Ordinance 2001) : Withholding Agentnaeem1990No ratings yet

- LA0122001372967Document1 pageLA0122001372967bidda samuelNo ratings yet

- Income Tax Payment Challan: PSID #: 138637167Document1 pageIncome Tax Payment Challan: PSID #: 138637167naeem1990No ratings yet

- Income Tax Payment Challan: PSID #: 42079719Document1 pageIncome Tax Payment Challan: PSID #: 42079719gandapur khanNo ratings yet

- Income Tax Payment Challan: PSID #: 47684385Document1 pageIncome Tax Payment Challan: PSID #: 47684385gandapur khanNo ratings yet

- Certificate of Collection or Deduction of Tax: (See Rule 42 of Income Tax Ordinance 2001) : Withholding AgentDocument1 pageCertificate of Collection or Deduction of Tax: (See Rule 42 of Income Tax Ordinance 2001) : Withholding AgentM Naveed SultanNo ratings yet

- 2307 WestmontDocument2 pages2307 WestmontMarie FranciscoNo ratings yet

- Income Tax Payment Challan: PSID #: 42125287Document1 pageIncome Tax Payment Challan: PSID #: 42125287Muhammad Qaisar LatifNo ratings yet

- PIN CertificateDocument1 pagePIN CertificatemillyNo ratings yet

- 2307 - CTT Synergy - CorporationDocument2 pages2307 - CTT Synergy - CorporationRACHEL DAMALERIONo ratings yet

- PC Square2307Document3 pagesPC Square2307SirManny ReyesNo ratings yet

- Document PDFDocument2 pagesDocument PDFSamson SeidNo ratings yet

- Income Tax Payment Challan: PSID #: 138638394Document1 pageIncome Tax Payment Challan: PSID #: 138638394naeem1990No ratings yet

- GH DepotDocument12 pagesGH DepotNormelita S. Dela CruzNo ratings yet

- Bir Form 2307g JNJ Online ShopDocument5 pagesBir Form 2307g JNJ Online ShopReagan RodriguezNo ratings yet

- Bir Form 2307 SampleDocument3 pagesBir Form 2307 SampleEliza Cortez Castro50% (2)

- BIR Form No. 0605Document1 pageBIR Form No. 0605KC AtinonNo ratings yet

- Income Tax Payment Challan: PSID #: 138458893Document1 pageIncome Tax Payment Challan: PSID #: 138458893naeem1990No ratings yet

- 2307 Jan 2018 ENCS v3Document4 pages2307 Jan 2018 ENCS v3Jasmin Sheryl Fortin-CastroNo ratings yet

- PMR 2307Document1 pagePMR 2307Rheddy RaymundoNo ratings yet

- Tax Credit Certificate On Supplies: For General Tax Questions Call Our Toll Free 0800117000 or Log Onto URA Web PortalDocument1 pageTax Credit Certificate On Supplies: For General Tax Questions Call Our Toll Free 0800117000 or Log Onto URA Web Portalmawamajid2No ratings yet

- 2307Document2 pages2307Nephy Bersales Taberara67% (3)

- Certificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasDocument2 pagesCertificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasAurora Pelagio VallejosNo ratings yet

- It 000143553567 2022 00Document1 pageIt 000143553567 2022 00danishahmed2126No ratings yet

- BIR Form No. 0605Document1 pageBIR Form No. 0605rhea CabillanNo ratings yet

- Aminabad Road, Near Grand Palace Marriage Hall, Tehsil & District, Sialkot Sialkot Qamar ZamanDocument1 pageAminabad Road, Near Grand Palace Marriage Hall, Tehsil & District, Sialkot Sialkot Qamar ZamanSalman LatifNo ratings yet

- Income Tax Payment Challan: PSID #: 138384574Document1 pageIncome Tax Payment Challan: PSID #: 138384574naeem1990No ratings yet

- It 000134579920 2022 00 PDFDocument1 pageIt 000134579920 2022 00 PDFMuhammad AslamNo ratings yet

- eFPS Payment DetailsDocument3 pageseFPS Payment DetailsPoofNo ratings yet

- Sample 2307Document4 pagesSample 2307kaysNo ratings yet

- 0605 2022 BIR Form NoDocument1 page0605 2022 BIR Form NoChristopher AbundoNo ratings yet

- 2024 EdDocument10 pages2024 EdJosé Andrés Concepción TorresNo ratings yet

- Sliop 2023 R12345Document1 pageSliop 2023 R12345Hon Fredrick JowiNo ratings yet

- It 000145640626 2023 11Document1 pageIt 000145640626 2023 11pleasemakemefilerNo ratings yet

- Mechanical Completion FormDocument2 pagesMechanical Completion FormAlvin ArlanzaNo ratings yet

- Constitutional Law Reviewer For FinalsDocument55 pagesConstitutional Law Reviewer For FinalsGodofredo De Leon Sabado100% (1)

- BikanerDocument94 pagesBikanerSaurabh SrivastavaNo ratings yet

- Dispute Recolution and Crisis ManagementDocument12 pagesDispute Recolution and Crisis ManagementVi Marie Pulvera DeLeonNo ratings yet

- Family CourtDocument4 pagesFamily CourtakankshaNo ratings yet

- Leslie Okol Vs Slimmers World International Et. Al. - gr160146 - December 11, 2009Document3 pagesLeslie Okol Vs Slimmers World International Et. Al. - gr160146 - December 11, 2009BerniceAnneAseñas-ElmacoNo ratings yet

- Letter Re SK Mandatory TrainingDocument2 pagesLetter Re SK Mandatory Trainingloveleaf paniquiNo ratings yet

- 21 AGAN Vs PIATCO PDFDocument2 pages21 AGAN Vs PIATCO PDFTon Ton CananeaNo ratings yet

- Case Digests: Topic Author Case Title GR No Tickler Date DoctrineDocument2 pagesCase Digests: Topic Author Case Title GR No Tickler Date DoctrineZachary Philipp LimNo ratings yet

- Ra 11200Document2 pagesRa 11200jha netNo ratings yet

- Conditional Deed of SaleDocument3 pagesConditional Deed of SaleDarkx010No ratings yet

- Oath of Office For Public Officers and Employees and Code of Conduct and Ethical Standards Among Government Officials and EmployeesDocument22 pagesOath of Office For Public Officers and Employees and Code of Conduct and Ethical Standards Among Government Officials and EmployeesAgatha OfrecioNo ratings yet

- Sources of LawDocument4 pagesSources of LawSamuel AmpofoNo ratings yet

- Academic FreedomDocument11 pagesAcademic FreedomMar-Elen Fe Guevara Reñosa100% (1)

- CRISTOBAL BONNEVIE V DecisionDocument4 pagesCRISTOBAL BONNEVIE V DecisionKaiserNo ratings yet

- Comerciante v. People GR No. 205926 July 22, 2015 PDFDocument10 pagesComerciante v. People GR No. 205926 July 22, 2015 PDFAnn MarinNo ratings yet

- BOH - Duty of Care - Draft 09Document24 pagesBOH - Duty of Care - Draft 09BrianOHanlonNo ratings yet

- Burgos V EsperonDocument3 pagesBurgos V EsperonMichelle Joy ItableNo ratings yet

- Bugaring Vs EspanolDocument2 pagesBugaring Vs Espanolkitakattt50% (2)

- Cachero Vs ManilaDocument6 pagesCachero Vs ManilaWEDDANEVER CORNELNo ratings yet

- TranspoDocument5 pagesTranspoGenalyn Española Gantalao DuranoNo ratings yet

- Time CharterDocument23 pagesTime CharterAnkit MauryaNo ratings yet

- Tramat Mercantile V CaDocument1 pageTramat Mercantile V CaJued CisnerosNo ratings yet

- Jimenez Et Al v. Rafanelli & Nahas Management Corporation Et Al - Document No. 5Document11 pagesJimenez Et Al v. Rafanelli & Nahas Management Corporation Et Al - Document No. 5Justia.comNo ratings yet

- Syed Waqas Ali Shah Final PaperDocument4 pagesSyed Waqas Ali Shah Final PaperSyed Ibrahim HassanNo ratings yet

- III Semester Elective Papers Human Resource Management EH-401 Labor Welfare and Employment Laws 100 4 0 0 3Document1 pageIII Semester Elective Papers Human Resource Management EH-401 Labor Welfare and Employment Laws 100 4 0 0 3Sridhar KodaliNo ratings yet

- Labor Law 2 Finals OutlineDocument15 pagesLabor Law 2 Finals OutlineAnika Rose AbisanaNo ratings yet

- Cu31924018926596 PDFDocument824 pagesCu31924018926596 PDFJamie Craig0% (1)

- Work Permits: To Obtain A Work Permit in Norway You Must Have A Concrete Job OfferDocument3 pagesWork Permits: To Obtain A Work Permit in Norway You Must Have A Concrete Job Offerprof_nassarNo ratings yet

- Chapter 17: NCLT & NCLATDocument7 pagesChapter 17: NCLT & NCLATakash ukilNo ratings yet