Professional Documents

Culture Documents

PA12 - GROUP 3 - PE - CH5: 1. Journalize The Transaction Using A Perpetual Inventory System

Uploaded by

AN HỒ QUÝOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PA12 - GROUP 3 - PE - CH5: 1. Journalize The Transaction Using A Perpetual Inventory System

Uploaded by

AN HỒ QUÝCopyright:

Available Formats

PA12_GROUP 3_PE_CH5

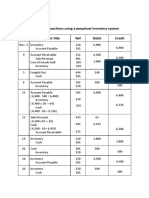

1. Journalize the transaction using a perpetual inventory system.

JOURNAL

J1

Transaction details Ref. Debit Credit

Year

Month Day

Nov 2 Inventory 120 6,900

Account Payable 201 6,900

4 Account Receivable 112 6,500

Sales Revenue 401 6,500

Cost of Goods Sold 505 3,900

Inventory 120 3,900

5 Freight-Out 644 240

Cash 101 240

6 Account Payable 201 500

Inventory 120 500

11 Account Payable 201 6,400

Inventory 120 64

Cash 101 6,336

13 Cash 101 6,435

Sales Discounts 414 65

Account Receivable 112 6,500

14 Inventory 120 3,800

Cash 101 3,800

16 Cash 101 500

Inventory 120 500

18 Inventory 120 4,500

Account Payable 201 4,500

20 Inventory 120 100

Cash 101 100

23 Cash 101 7,400

Sales Revenue 401 7,400

Cost of Goods Sold 505 4,120

Inventory 120 4,120

26 Inventory 120 2,300

Cash 101 2,300

27 Account Payable 201 4,500

Inventory 120 90

Cash 101 4,410

29 Sales Returns and Allowances 412 90

Cash 101 90

Inventory 120 30

Cost of Goods Sold 505 30

30 Accounts Receivable 112 3,700

Sales Revenue 401 3,700

Cost of Goods Sold 505 2,800

Inventory 120 2,800

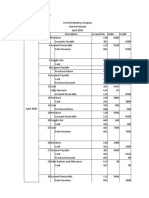

2. Prepare the ledger accounts for the company for the month of November 2022.

Cash No.101

Date Explanation Ref Debit Credit Balance

Nov 1 Owner’s Captial J1 $9,000 $9,000

5 Freight-Out J1 $240 8,760

11 Account Payable J1 6,336 2,424

13 Account Receivable J1 6,435 8,859

14 Inventory J1 3,800 5,059

16 Inventory J1 500 5,559

20 Inventory J1 100 5,459

23 Sales Revenue J1 7,400 12,859

26 Inventory J1 2,300 10.559

27 Account Payable J1 4,410 6,149

29 Sales Returns and Allowances J1 90 $6,059

Account Receivable No.112

Date Explanation Ref Debit Credit Balance

Nov 4 Sales Revenue J1 $6,500 $6,500

13 Cash J1 $6,500 0

Sales Discounts J1

30 Sales Revenue J1 3,700 $3,700

Inventory No.120

Date Explanation Ref Debit Credit Balance

Nov 2 Account Payable J1 $6,900 $6,900

4 Cost of Goods Sold J1 $3,900 3,000

6 Account Payable J1 500 2,500

11 Account Payable J1 64 2,436

14 Cash J1 3,800 6,236

16 Cash J1 500 5,736

18 Account Payable J1 4,500 10,236

20 Cash J1 100 10,336

23 Cost of Goods Sold J1 4,120 6,216

26 Cash J1 2,300 8,516

27 Account Payable J1 90 8,426

29 Cost of Goods Sold J1 30 8,456

30 Cost of Goods Sold J1 2,800 $5,656

Account Payable No.201

Date Explanation Ref Debit Credit Balance

Nov 2 Inventory J1 $6,900 $6,900

6 Inventory J1 $500 6,400

11 Inventory J1 6,400 0

Cash J1

18 Inventory J1 4,500 4,500

27 Inventory J1 4,500 0

Cash

Owner’s Capital No.301

Date Explanation Ref Debit Credit Balance

Nov 1 Cash J1 $9,000 $9,000

Sales Revenue No.401

Date Explanation Ref Debit Credit Balance

Nov 4 Account Receivable J1 $6,500 $6,500

23 Cash J1 7,400 13,900

30 Accounts Receivable J1 3,700 17,600

Sales Returns and Allowances No.412

Date Explanation Ref Debit Credit Balance

Nov 29 Sales Returns and Allowances J1 $90 $90

Sales Discounts No.414

Date Explanation Ref Debit Credit Balance

Nov 13 Account Receivable J1 $65 $65

Cost of Goods Sold No.505

Date Explanation Ref Debit Credit Balance

Nov 4 Inventory J1 $3,900 $3,900

23 Inventory J1 4,120 8,020

29 Inventory J1 $30 7,990

30 Inventory J1 2,800 $10,790

Freight-Out No.644

Date Explanation Ref Debit Credit Balance

Nov 5 Cash J1 $240 $240

3. Prepare the income statement through gross profit for the month of November

2022.

Markey Department Store

Income Statement

For the Month Ended November 30, 2022

Sales

Sales Revenue $17,600

Less: Sales Returns and Allowances (90)

Sales Discounts (65)

Net sales $17,445

Cost of Goods Sold $10,790

Gross Profit $6,655

Operating Expense

Freight-Out $240

Total Operating Expense $240

Net Income $6,415

You might also like

- Akuntansi, DavidDocument11 pagesAkuntansi, DavidTema Exaudi DaeliNo ratings yet

- Group 1: A) Journalize The Transactions Using A Perpetual Inventory System Date Account Title Ref Debit CreditDocument6 pagesGroup 1: A) Journalize The Transactions Using A Perpetual Inventory System Date Account Title Ref Debit CreditQuỳnh'ss Đắc'ssNo ratings yet

- Tugas Minggu Ke-6 Adifa Shofiya Zulfa 454777Document3 pagesTugas Minggu Ke-6 Adifa Shofiya Zulfa 454777Adifa Shofiya ZulfaNo ratings yet

- AKP2 MarcellinoDwiA 4121911019 5Document3 pagesAKP2 MarcellinoDwiA 4121911019 5Marcellino DwiNo ratings yet

- Sem Plang Merchandising Perpetual Problem With AnswersDocument21 pagesSem Plang Merchandising Perpetual Problem With AnswersJayson Miranda100% (1)

- P5-1A Dan P5-2ADocument6 pagesP5-1A Dan P5-2ASherly Meliana Geraldine100% (1)

- A 4.1 FAR1 AngelineDocument16 pagesA 4.1 FAR1 Angelinelain slngNo ratings yet

- Answer - Quiz No. 7 (B)Document9 pagesAnswer - Quiz No. 7 (B)CPA SangcapNo ratings yet

- Final Exam Part 2 Merch.Document7 pagesFinal Exam Part 2 Merch.Maribel Ticnang100% (1)

- Rosalinda's Boutique Chart of Accounts Assets Current AssetsDocument8 pagesRosalinda's Boutique Chart of Accounts Assets Current AssetsRechelleRuthM.DeiparineNo ratings yet

- Mam Karina Template Periodic 1Document21 pagesMam Karina Template Periodic 1Claudine bea NavarreteNo ratings yet

- Akuntansi Perusahaan Dagang Panorama HijauDocument27 pagesAkuntansi Perusahaan Dagang Panorama Hijausintya saputri100% (1)

- Book 2Document13 pagesBook 2josedvega178No ratings yet

- Journal I ZingDocument8 pagesJournal I ZingKeziah VenturaNo ratings yet

- Sanchez General MerchandisingDocument3 pagesSanchez General MerchandisingRechelle Ramos100% (1)

- Perpetual BowmanDocument19 pagesPerpetual BowmanEric AntonioNo ratings yet

- Perpetual Answer KeyDocument15 pagesPerpetual Answer KeyAngel AmbrosioNo ratings yet

- Magnus ExerciseDocument13 pagesMagnus ExerciseLucas BantilingNo ratings yet

- Cho Cho's - SarayDocument6 pagesCho Cho's - SarayLaiza Cristella SarayNo ratings yet

- General Journal: Page Number GJDocument13 pagesGeneral Journal: Page Number GJMTECH ASIANo ratings yet

- Guimbungan, Core Competency Module 1 - Part 3 PDFDocument11 pagesGuimbungan, Core Competency Module 1 - Part 3 PDFSharlyne K. GuimbunganNo ratings yet

- Jawaban pra-UAS No.1Document5 pagesJawaban pra-UAS No.1silvia indahsariNo ratings yet

- C Martin-JournalDocument2 pagesC Martin-JournalGenuine SmileNo ratings yet

- Periodic AriasDocument22 pagesPeriodic AriasEric Antonio0% (1)

- Perpetual Inventory System: 1. Journalizing TransactionsDocument12 pagesPerpetual Inventory System: 1. Journalizing TransactionsCreate UsernaNo ratings yet

- General Journal Page 1 Date Description P/R Debit CreditDocument10 pagesGeneral Journal Page 1 Date Description P/R Debit CreditGonzalo FerrerNo ratings yet

- Case Problem Hanievon MerchandisingDocument20 pagesCase Problem Hanievon MerchandisingPrincessjane Largo100% (1)

- FAR1 1.4BSA CASE2 Igsoc KristaNinaDocument13 pagesFAR1 1.4BSA CASE2 Igsoc KristaNinaKrishta IgsocNo ratings yet

- Perpetual Inventory Method PDFDocument13 pagesPerpetual Inventory Method PDFthegianthony100% (1)

- Inbound 8000560304125008329Document29 pagesInbound 8000560304125008329Jershane MacamNo ratings yet

- Final-Exam-Rogos, Kristine-Bsais-2bDocument26 pagesFinal-Exam-Rogos, Kristine-Bsais-2bSarah MartinNo ratings yet

- Practice Exam - Set ADocument11 pagesPractice Exam - Set ATin PangilinanNo ratings yet

- Perpetual MethodDocument17 pagesPerpetual MethodVictoria Camello100% (1)

- Chapter5 P5 1B Page250Document1 pageChapter5 P5 1B Page250Thanh HằngNo ratings yet

- Practice ActivityDocument23 pagesPractice ActivityLouremie Delos Reyes MalabayabasNo ratings yet

- FAR1 1.4BSA CASE2 Igsoc KristaNina IrabonDocument13 pagesFAR1 1.4BSA CASE2 Igsoc KristaNina IrabonKrishta IgsocNo ratings yet

- Merchadising - Comprehensive Prob. 2 AnswersDocument23 pagesMerchadising - Comprehensive Prob. 2 AnswersMarjorie Jones RubioNo ratings yet

- Problem 1-1Document3 pagesProblem 1-1Frencess Mae MayolaNo ratings yet

- Periodic Inventory MethodDocument13 pagesPeriodic Inventory Methodthegianthony100% (1)

- Perpetual AccountingDocument12 pagesPerpetual AccountingNovelyn Gamboa100% (1)

- General Journal: Description Post Ref Dr. Cr. DateDocument14 pagesGeneral Journal: Description Post Ref Dr. Cr. DateRizki MuhammadNo ratings yet

- Far AssgnDocument5 pagesFar AssgnJustine Aaron LausNo ratings yet

- NC 3 Bookeeping Prcatice SetDocument39 pagesNC 3 Bookeeping Prcatice SetJEFFREY GALANZA71% (7)

- General Journal: Date Account Titles and Explanation Ref Debit CreditDocument3 pagesGeneral Journal: Date Account Titles and Explanation Ref Debit CreditRezekiro IrmNo ratings yet

- MANUEL KATHLEEN TABASA (UP FC1 BSA1 10) ACC102 Activity PeriodicInventorySystemDocument12 pagesMANUEL KATHLEEN TABASA (UP FC1 BSA1 10) ACC102 Activity PeriodicInventorySystemKathleen Tabasa ManuelNo ratings yet

- All JournalsDocument2 pagesAll JournalsNitta SitanggangNo ratings yet

- Chart of AccountsDocument7 pagesChart of AccountsMalou Ang100% (1)

- Book 1Document3 pagesBook 1into the unknownNo ratings yet

- TESDA NC III PERPETUAL Ans Key PDFDocument13 pagesTESDA NC III PERPETUAL Ans Key PDFMarvin Bueno91% (11)

- Xyz Company JournalDocument3 pagesXyz Company JournalLearning MaterialsNo ratings yet

- Beginning Balances Debit CreditDocument23 pagesBeginning Balances Debit CreditRaff LesiaaNo ratings yet

- Selam AssignmentDocument6 pagesSelam AssignmentDesalegn BezunehNo ratings yet

- 3RD Activity - ComprehensiveDocument19 pages3RD Activity - ComprehensiveJJ Longno100% (2)

- SEATWORK6Document6 pagesSEATWORK6dumpanonymouslyNo ratings yet

- PerpetualDocument13 pagesPerpetualEcho ClarosNo ratings yet

- Problem 3Document16 pagesProblem 3Jay ann TolentinoNo ratings yet

- Worksheet 2 2nd QuarterDocument5 pagesWorksheet 2 2nd QuarterMaria AngelaNo ratings yet

- Accounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionFrom EverandAccounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionRating: 2.5 out of 5 stars2.5/5 (2)

- PA12 - Group 3 - PE4Document12 pagesPA12 - Group 3 - PE4AN HỒ QUÝNo ratings yet

- PA12 - Group 3 - PE6Document4 pagesPA12 - Group 3 - PE6AN HỒ QUÝNo ratings yet

- PA12 - GROUP 3 - PE - CH3: 1. T-AccountDocument9 pagesPA12 - GROUP 3 - PE - CH3: 1. T-AccountAN HỒ QUÝNo ratings yet

- Exercise 2.1B: PA12 - GROUP 3 - PE - CH2Document5 pagesExercise 2.1B: PA12 - GROUP 3 - PE - CH2AN HỒ QUÝNo ratings yet

- (CB-G8) Case Session 5Document14 pages(CB-G8) Case Session 5AN HỒ QUÝNo ratings yet

- Exercise 1.1A: PA12 - GROUP 3 - PE - CH1Document3 pagesExercise 1.1A: PA12 - GROUP 3 - PE - CH1AN HỒ QUÝNo ratings yet

- (CB-G8) Case Session 3Document13 pages(CB-G8) Case Session 3AN HỒ QUÝNo ratings yet

- (CB-G8) A3 - Part 1 - Project Proposal AssignmentDocument1 page(CB-G8) A3 - Part 1 - Project Proposal AssignmentAN HỒ QUÝNo ratings yet

- (CB-G8) Case Session 4Document15 pages(CB-G8) Case Session 4AN HỒ QUÝNo ratings yet

- How Do Consumers Learn & Adopt Behaviors?: Three Mobile Reimagines HistoryDocument14 pagesHow Do Consumers Learn & Adopt Behaviors?: Three Mobile Reimagines HistoryAN HỒ QUÝNo ratings yet

- (CB-G8) Case Session 8Document15 pages(CB-G8) Case Session 8AN HỒ QUÝNo ratings yet

- Questions: Objective Type Financial InstrumentsDocument4 pagesQuestions: Objective Type Financial InstrumentsZain FatimaNo ratings yet

- ERC AP 1901 InventoriesDocument8 pagesERC AP 1901 Inventoriesjikee11No ratings yet

- Budgeting (Profit Planning) : Professor: John Anthony M. Labay, CPA, MBADocument6 pagesBudgeting (Profit Planning) : Professor: John Anthony M. Labay, CPA, MBAsharielles /No ratings yet

- FAR 4309 Investment in Debt Securities 2Document6 pagesFAR 4309 Investment in Debt Securities 2ATHALIAH LUNA MERCADEJASNo ratings yet

- Chapter 17: Absorption, Variable, and Throughput Costing: Multiple Choice QuestionsDocument28 pagesChapter 17: Absorption, Variable, and Throughput Costing: Multiple Choice QuestionsZee GuillebeauxNo ratings yet

- Save On Repair Shop PrelimDocument3 pagesSave On Repair Shop PrelimDeimos DeezNo ratings yet

- Part II: Discussion QuestionsDocument8 pagesPart II: Discussion Questionssamuel39No ratings yet

- Chapter 2: Asset-Based Valuation Asset-Based ValuationDocument6 pagesChapter 2: Asset-Based Valuation Asset-Based ValuationJoyce Dela CruzNo ratings yet

- Chapter 19 - Corporate Financial ReportingDocument22 pagesChapter 19 - Corporate Financial ReportingTomás de CallaoNo ratings yet

- Question: Landau Company in Early August, Terry Silver, The New MarketDocument4 pagesQuestion: Landau Company in Early August, Terry Silver, The New MarketSebastian StanNo ratings yet

- Case Study - Hill Country Snack Foods Co.Document4 pagesCase Study - Hill Country Snack Foods Co.Saurabh Agarwal0% (1)

- Ratio Alalysis Jersey ProjectDocument64 pagesRatio Alalysis Jersey ProjectAnonymous 22GBLsme1No ratings yet

- Group Accounts - Subsidiaries (CSPLOCI) : Chapter Learning ObjectivesDocument28 pagesGroup Accounts - Subsidiaries (CSPLOCI) : Chapter Learning ObjectivesKeotshepile Esrom MputleNo ratings yet

- Managerial Accounting Fourth Canadian Edition 4Th Edition Full ChapterDocument23 pagesManagerial Accounting Fourth Canadian Edition 4Th Edition Full Chaptergeorge.terrell473100% (20)

- Test Bank For Advanced Financial Accounting 7 e 7th Edition Thomas H Beechy V Umashanker Trivedi Kenneth e MacaulayDocument16 pagesTest Bank For Advanced Financial Accounting 7 e 7th Edition Thomas H Beechy V Umashanker Trivedi Kenneth e MacaulayPearline Teel100% (35)

- p2 Guerrero ch15Document30 pagesp2 Guerrero ch15Clarissa Teodoro100% (1)

- Final Oracle Leasing Solution To IFRS16 ASC842Document74 pagesFinal Oracle Leasing Solution To IFRS16 ASC842Rajendran SureshNo ratings yet

- CH 3 - Intro To Consolidated Fin StatDocument16 pagesCH 3 - Intro To Consolidated Fin StatMutia WardaniNo ratings yet

- Problem 3 Accounts ReceivableDocument11 pagesProblem 3 Accounts ReceivableAngelie Bocala CatalanNo ratings yet

- Accounting For Special Transaction 1Document9 pagesAccounting For Special Transaction 1Timon CarandangNo ratings yet

- Balance Sheet - LifeDocument77 pagesBalance Sheet - LifeYisehak NibereNo ratings yet

- Comparable Companies 3E TemplateDocument22 pagesComparable Companies 3E TemplateLohith Kumar ReddyNo ratings yet

- FABM 2 Module 1 Review of Basic Accounting PDFDocument8 pagesFABM 2 Module 1 Review of Basic Accounting PDFJOHN PAUL LAGAO100% (3)

- Management Advisory Services - FinalDocument8 pagesManagement Advisory Services - FinalFrancis MateosNo ratings yet

- ch04 PDFDocument3 pagesch04 PDFNerissa BanguiNo ratings yet

- SheDocument2 pagesSheRhozeiah LeiahNo ratings yet

- Fabm2121 Fundamentals of Accountancy Business and Management 2Document220 pagesFabm2121 Fundamentals of Accountancy Business and Management 2Jofanie MeridaNo ratings yet

- Income Tax - Corporations Sample Problems: SolutionsDocument12 pagesIncome Tax - Corporations Sample Problems: SolutionsYellow BelleNo ratings yet

- A) Show The Effects of The Above Transactions On The Accounting Equation Using The Following FormatDocument4 pagesA) Show The Effects of The Above Transactions On The Accounting Equation Using The Following FormatMark CalimlimNo ratings yet

- 5 Years Financial HighlightsDocument3 pages5 Years Financial HighlightsMd. Shaikat Alam Joy 1421759030No ratings yet