Professional Documents

Culture Documents

Minda Inddustry Swot Analysis

Uploaded by

sattwik narayanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Minda Inddustry Swot Analysis

Uploaded by

sattwik narayanCopyright:

Available Formats

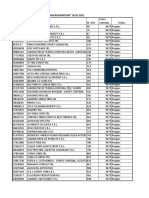

Shareholding Pattern - UNO Minda Ltd.

Promoters 385411394 67.41%

ForeignInstitutions 51444354 9%

NBanksMutualFunds 73130886 12.79%

Others 25296492 4.42%

SWOT Analysis of Minda Corporation

A SWOT analysis examines the strengths, weaknesses, opportunities, and threats that

a firm faces. SWOT Analysis is a tried-and-true tool that enables a company like Minda

Corporation to compare its business and performance to that of its competitors.

It will give us a strategic analysis of its internal and external environment, which is

crucial for understanding the SWOT Analysis of Minda Corporation.

To better understand the SWOT analysis of Minda Corporation, refer to the infographics

below:

Below is an explicit guide to the SWOT analysis of Minda Corporation.

Strengths of Minda Corporation

Minda Corporation, being one of the leading companies in its industry, has several

benefits that help it flourish in the marketplace. These strengths not only help it retain

market share in existing areas but also help it break into new ones.

Famous Brand: A well-known name in India for over 60 years reflects the

amount of trust its customers hold including Audi, BMW, Fiat and many such big

brands.

Global Operations: Minda Corporation has 33 manufacturing facilities and 3

power plants in 7 countries across three continents in India with a presence in

Indonesia, Vietnam, Uzbekistan, U.S.A. and Japan.

Major Distributor: Minda Corporation is one of the major distributors of

Electronic & Mechanical Security Systems, Die Casting, Keyless Solutions,

Starter & Alternator Motors, Telematics, ITS & IoT, Wiring Harnesses,

Components, Instrument Clusters, Sensors, Interior Plastics and new component

are used by some of the major automotive manufacturing companies like Bajaj

Auto, TVS Motor Company, Revolt, Ola Electric.

Offer Many Services: They offer customers a wide range of solutions including

Casting Simulation, Prototyping, Tool Designing & Manufacturing, Assembly, Die

Casting, Shot Blasting, Powder Coating, Core Making & multi-process Foundry

services.

Leading Market Position: Minda Corporation holds the second largest Indian

auto component group position for automotive components. Since its inception

the growth enabled the company to create a new revenue stream and diversify

the economic cycle risk in the markets it serves, propelling Minda Corporation to

the top of the Indian market.

Highly Qualified Workforce: Through training and learning initiatives, Minda

Corporation has been able to develop highly qualified 16,000+ employees. Minda

Corporation devotes significant resources to employee training and development,

resulting in a team that is not just highly competent but also driven to attain

greater success.

Weaknesses of Minda Corporation

Minda Corporation’s weakness is an area where he can improve. Strategy is about

making important decisions, and weaknesses are areas where a company could

improve with the help of a SWOT analysis.

Expenditure on Building Fresh Supply Chain & Logistics Network: AI has

significantly modified the business model in the technology industry and hence,

Minda Corporation has to build a new expensive supply chain network.

Sloping Market Share With Rising Revenues: The electronic industry is

growing faster than the company itself making it challenging to analyze the

trends within the technology sector.

Components Can Get Readily Copied: Minda Corporation’s business model is

the issue to address which can get easily copied by its competitors. The

organisation must develop a platform model that can combine suppliers, vendors,

and end-users to ensure a secure supply chain.

Liabilities: Its total debts and liabilities are more than some of its competitors

(such as Suprajit engineering) as per Money Control’s analysis as of March

2021.

Net Worth: Its net worth from all its sources of funds (share capital, reserves,

preference shares etc) is also less than some of its competitors (such as

Endurance Tech) as per Money Control’s analysis as of March 2021.

Losses: The company faced maximum losses as of March 2020 due to the

pandemic.

Opportunities for Minda Corporation

Opportunities are possible areas for a company to consider to improve results, sales,

and, ultimately, profit. Minda Corporation includes the following opportunities:

Survival: The company has been able to resist the losses caused due to the

pandemic which implies the company has a long way to go in sustaining itself as

a manufacturer.

Expansion: While the company is going international, it is simultaneously

leaving an everlasting imprint, which implies that the company has the potential

to expand to many locations. Minda Corporation is looking to acquire a

component maker to expand its EV presence by March 2022 and is in

discussions with a few potential targets.

Transport Industry Boom: More and more automotive industries are relying on

external suppliers for vehicle components to save their manufacturing costs

which imply that Minda’s importance won’t decline and would rather increase with

time.

Pandemic: Due to Corona, people are preferring to use their vehicles rather than

public transport for fear of infections which means that the sale of automobiles

(especially electric) would increase with time which would have a positive impact

on the sales of Minda products to automotive manufacturers.

R&D and Tech: If the company starts investing more capital to boost itself and to

be in sync with the latest developments in tech, the company can have a bright

future!

Threats to Minda Corporation

External environmental factors that can harm a Minda Corporation’s growth are known

as threats. Minda Corporation’s threats include the following:

Raw Material Price Volatility: Aluminium and steel are the major raw materials

for the company. Any disruption in the availability or pricing of these raw

materials may have a significant bearing on business profitability.

Global Pandemic Outbreaks: A highly infectious third/fourth wave of COVID-19,

leading to lockdowns or restricted mobility, could impact the business growth of

all auto component manufacturers, due to reduced demand for new vehicles, as

well as lower wear and tear of existing ones.

Strong Rivalry from other Components Providers: There is a lot of

competition in the industry these days. This affects prices, resulting in a drop in

revenue or income for Minda Corporation.

Threat from Local Distributors: Growing strengths of local distributors also

presents a threat in some markets as the competition is paying higher margins to

the local distributors. Also, local distributors like repairing centres and garages

are selling duplicate two-wheeler suspension components in the name of Minda

Corporation which is again another threat for the company.

Country-specific Regulations: Each country has a different set of rules and

regulations regarding the transportation of goods. Some goods have very strict

restrictions in some countries making it difficult to transport them.

This ends our complete SWOT analysis of Minda Corporation. Let us conclude our

learning below.

To Conclude

As we can see, Minda corporation has huge potential owing to its consistent

performance and prestige as an old brand in India. What makes its future picture look a

bit glum is it’s approaching strong and equally good competitors who are running at the

same pace and may cross over Minda’s position if Minda Corporation lags in any of the

aspects, be it upgrading technology, maintaining good financial records along with

relations with clients.

However, the company has outperformed its rival competitors with its incredible

marketing efforts in branding. With the increasing competition and advancement in

technological expertise, digital marketing plays a vital role in boosting traffic, if the

company gets better visibility, sales and revenue will eventually increase.

You might also like

- Bank clearing house rulesDocument40 pagesBank clearing house rulesSathyanarayanaRaoRNo ratings yet

- Statement Nov 2022Document25 pagesStatement Nov 2022Josué SoteloNo ratings yet

- Capra Intra-Day Trading With Market Interals Part I ManualDocument51 pagesCapra Intra-Day Trading With Market Interals Part I ManualVarun Vasurendran100% (1)

- India CIO All Data SalesDocument177 pagesIndia CIO All Data Salesbharat50% (2)

- Sample Protest LetterDocument2 pagesSample Protest LetterLyceum WebinarNo ratings yet

- Case StudyDocument5 pagesCase StudyTrân LêNo ratings yet

- Advertising and Sales Promotion at Bharat Honda, KalaburagiDocument86 pagesAdvertising and Sales Promotion at Bharat Honda, Kalaburagikhsheth0% (1)

- Transition Plan - Plan A and Plan BDocument10 pagesTransition Plan - Plan A and Plan Bapi-631400099No ratings yet

- All You Need To Know About Infrastructure Investment Trusts (Invits)Document14 pagesAll You Need To Know About Infrastructure Investment Trusts (Invits)Arvind JainNo ratings yet

- Policy Schedule DocDocument8 pagesPolicy Schedule Docmohd vasilNo ratings yet

- Annual Report 2021 2022Document312 pagesAnnual Report 2021 2022PRIYA TIWARINo ratings yet

- IoT - 2019 Final-ENDocument14 pagesIoT - 2019 Final-ENazwar charis2No ratings yet

- Volumes of SolidsDocument2 pagesVolumes of Solidsessam aliNo ratings yet

- 1st To 28th February - Quiz-Complete-Test Lyst9041Document24 pages1st To 28th February - Quiz-Complete-Test Lyst9041VIBHAKAR SINGHNo ratings yet

- Receipt SummaryDocument1 pageReceipt SummaryKamna VaidNo ratings yet

- T3-FF ModelDocument137 pagesT3-FF ModelKdmfuffad liNo ratings yet

- Week 4 ISWM 2022-BkdDocument9 pagesWeek 4 ISWM 2022-BkdAkanksha YadavNo ratings yet

- LF105 MSDS报告 2018.2.9Document15 pagesLF105 MSDS报告 2018.2.9penguking_113236970No ratings yet

- Ref9 - A Systematic Aproch For PDM Service Design Method and AplicDocument19 pagesRef9 - A Systematic Aproch For PDM Service Design Method and AplicMan HumanNo ratings yet

- E-Commerce IndustryDocument2 pagesE-Commerce Industrydarshita bhuwalkaNo ratings yet

- Manufacturing Milestones of the Industrial RevolutionDocument2 pagesManufacturing Milestones of the Industrial RevolutionOcampo, Paul Angelo A.No ratings yet

- Chrtino DiorDocument31 pagesChrtino Diormanwanimuki12No ratings yet

- CEM Annex E CEM Application FormDocument2 pagesCEM Annex E CEM Application FormJonas MojicaNo ratings yet

- Pidilite Industries' Strategy to Expand Beyond its First Success Brand FevicolDocument2 pagesPidilite Industries' Strategy to Expand Beyond its First Success Brand FevicolNikhil GuptaNo ratings yet

- Banking Current Affairs May 2022Document10 pagesBanking Current Affairs May 2022yazhiniNo ratings yet

- Material Safety Data Sheet: Nitric Acid, 65% MSDSDocument7 pagesMaterial Safety Data Sheet: Nitric Acid, 65% MSDSFikreslasie LemaNo ratings yet

- Cfi PDFDocument1 pageCfi PDFAmit KambojNo ratings yet

- Barringer E4 PPT 05Document44 pagesBarringer E4 PPT 05水TaoNo ratings yet

- JAIIB CAIIB MOCK TESTDocument36 pagesJAIIB CAIIB MOCK TESTrose GuptaNo ratings yet

- (1-14) Study On Individual's Preference About Online Cab Booking ServicesDocument14 pages(1-14) Study On Individual's Preference About Online Cab Booking ServicesKartik RajputNo ratings yet

- Resume - Harshit JainDocument3 pagesResume - Harshit JainAkshay DodiyaNo ratings yet

- Bruker-Revize - 2 - PDFDocument33 pagesBruker-Revize - 2 - PDFEmad BNo ratings yet

- Excel - Module 1 - v2Document113 pagesExcel - Module 1 - v2lauda bhenchodNo ratings yet

- SA - Effective Problem Solving & Decision Making - Semesta Akademi CredentialDocument50 pagesSA - Effective Problem Solving & Decision Making - Semesta Akademi Credentialindah permata suriNo ratings yet

- Cse 434 Name: Bing Hao Computer Networks (2014 Spring) Home PageDocument11 pagesCse 434 Name: Bing Hao Computer Networks (2014 Spring) Home PageTuggNo ratings yet

- City of Reno Staff ReportDocument10 pagesCity of Reno Staff ReportKim BurrowsNo ratings yet

- ASEAN Rubber Testing Laboratories For Rubber VulcanizatesDocument64 pagesASEAN Rubber Testing Laboratories For Rubber Vulcanizateshery siregarNo ratings yet

- Employ 4Document10 pagesEmploy 4Raguwaran SamayyahNo ratings yet

- SouqDocument16 pagesSouqshadow heshamNo ratings yet

- Dela Roca w3 PPST CST Section 6Document4 pagesDela Roca w3 PPST CST Section 6Yhen YhenNo ratings yet

- Jee Mains AmanDocument1 pageJee Mains AmanAman BansalNo ratings yet

- Registro de Asistencias Escuela PrimariaDocument1 pageRegistro de Asistencias Escuela PrimariaAve InésNo ratings yet

- GigaBlue 4K Box ManualDocument85 pagesGigaBlue 4K Box ManualWłodzimierz SurdackiNo ratings yet

- Customers' perception of insuranceDocument48 pagesCustomers' perception of insuranceYogendraNo ratings yet

- BS Sample Paper 1 UnsolvedDocument9 pagesBS Sample Paper 1 UnsolvedSeema ShrivastavaNo ratings yet

- Brown and Black Modern Fashion New Arrival NewsletterDocument31 pagesBrown and Black Modern Fashion New Arrival NewsletterkchjahlaNo ratings yet

- Notes:: Computer OrganizationDocument12 pagesNotes:: Computer OrganizationJulia OriasNo ratings yet

- First Announcement COE - 70 - MedanDocument23 pagesFirst Announcement COE - 70 - MedanHeru HermantrieNo ratings yet

- Sandy L. Napocao FinalsDocument7 pagesSandy L. Napocao Finalsjenalyn artetaNo ratings yet

- Corporate Social Responsibility and EmerDocument23 pagesCorporate Social Responsibility and EmerJohn Paul MagbitangNo ratings yet

- Finance Ca2 FinalDocument25 pagesFinance Ca2 Finalmasthan shaikNo ratings yet

- Strategic Analysis of PidiliteDocument20 pagesStrategic Analysis of PidiliteAbhijit DharNo ratings yet

- 812 MarketingDocument12 pages812 MarketingAbhinav SainiNo ratings yet

- IGKV Telephone Directory 2021Document52 pagesIGKV Telephone Directory 2021CIPET KORBA LIVENo ratings yet

- Firm Culture and Leadership as Predictors of Firm PerformanceDocument6 pagesFirm Culture and Leadership as Predictors of Firm Performancechernet kebedeNo ratings yet

- Important Instructions For Candidates (English)Document2 pagesImportant Instructions For Candidates (English)Sumit YadavNo ratings yet

- Needham Bank - A BYOD Case StudyDocument8 pagesNeedham Bank - A BYOD Case StudyMitzi SantosNo ratings yet

- Design, Construction, Modification, Maintenance and Decommissioning of Filling StationsDocument320 pagesDesign, Construction, Modification, Maintenance and Decommissioning of Filling StationsMaurizio BusuNo ratings yet

- Latest Current Affairs 13 October-2022Document8 pagesLatest Current Affairs 13 October-2022Debashish BiswasNo ratings yet

- MZ 2019Document315 pagesMZ 2019muskan singlaNo ratings yet

- Yebhi Group 4 Document AnalysisDocument15 pagesYebhi Group 4 Document AnalysisAnkit BansalNo ratings yet

- 63 BD 111532 Ee 3113 RD Bo AAgenda SEZwDocument39 pages63 BD 111532 Ee 3113 RD Bo AAgenda SEZwGIFT CityNo ratings yet

- Grade 8 Module 7 TLEDocument24 pagesGrade 8 Module 7 TLEAbdul Nasser IsnainNo ratings yet

- Bộ Đề Tự Kiểm Tra 4 Kĩ Năng Tiếng Anh 7 Tập 2Document168 pagesBộ Đề Tự Kiểm Tra 4 Kĩ Năng Tiếng Anh 7 Tập 2Chou ChouNo ratings yet

- Consulting Case Study 101 - An Introduction To Frameworks - Street of WallsDocument14 pagesConsulting Case Study 101 - An Introduction To Frameworks - Street of WallsgtrentinihNo ratings yet

- SDM Project FinalDocument9 pagesSDM Project Finalanon_700727161No ratings yet

- Common Wealth ScamDocument15 pagesCommon Wealth Scamsattwik narayanNo ratings yet

- Ind As 16 - PpeDocument8 pagesInd As 16 - Ppesattwik narayanNo ratings yet

- Technology Indutries Porters Five Factor AnalysisDocument2 pagesTechnology Indutries Porters Five Factor Analysissattwik narayanNo ratings yet

- Maruti Suzuki Swot AnalysisDocument2 pagesMaruti Suzuki Swot Analysissattwik narayanNo ratings yet

- - मुख्यमंत्री सीखो कमाओ योजनाDocument81 pages- मुख्यमंत्री सीखो कमाओ योजनाAmitNo ratings yet

- A Study On Responsibility Accounts On StakeholdersDocument6 pagesA Study On Responsibility Accounts On StakeholdersresearchparksNo ratings yet

- Caso 1 - Airbnb in 2020 - Sobreviviendo A La Pandemia OriginalDocument18 pagesCaso 1 - Airbnb in 2020 - Sobreviviendo A La Pandemia OriginalArmando GarzaNo ratings yet

- Chapter 3 Case PartnershipDocument19 pagesChapter 3 Case PartnershipZPadsNo ratings yet

- Masura 1Document108 pagesMasura 1ClaudiuNo ratings yet

- W4 TaxesDocument35 pagesW4 TaxesVanessa LeeNo ratings yet

- C.MGT Relevant of Chapter 2 STBCDocument12 pagesC.MGT Relevant of Chapter 2 STBCNahum DaichaNo ratings yet

- Principles of Costs and CostingDocument50 pagesPrinciples of Costs and CostingSOOMA OSMANNo ratings yet

- Alumni Fee Voucher UpdatedDocument1 pageAlumni Fee Voucher UpdatedHassan KhalidNo ratings yet

- Statement of Cash FlowsDocument33 pagesStatement of Cash Flowslove_abhi_n_22No ratings yet

- Water Bottling AgreementDocument8 pagesWater Bottling AgreementAshish RaiNo ratings yet

- Presented By:-: Diwakar ChaturvediDocument10 pagesPresented By:-: Diwakar ChaturvediDiwakar Chaturvedi100% (2)

- Savings Account & Lockers : Terms & Conditions Apply. Kindly Contact Your Nearest Branch For Latest InformationDocument2 pagesSavings Account & Lockers : Terms & Conditions Apply. Kindly Contact Your Nearest Branch For Latest InformationVipin KumarNo ratings yet

- BUDGETING - Exercises: UnitsDocument2 pagesBUDGETING - Exercises: UnitsLeo Sandy Ambe CuisNo ratings yet

- Case Stdy OPM545 (Boys and Boden)Document15 pagesCase Stdy OPM545 (Boys and Boden)wasab negiNo ratings yet

- Financial Report: The Coca Cola Company: Ews/2021-10-27 - Coca - Cola - Reports - Continued - Momentum - and - Strong - 1040 PDFDocument3 pagesFinancial Report: The Coca Cola Company: Ews/2021-10-27 - Coca - Cola - Reports - Continued - Momentum - and - Strong - 1040 PDFDominic MuliNo ratings yet

- Stock Investing Mastermind - Zebra Learn-85Document2 pagesStock Investing Mastermind - Zebra Learn-85RGNitinDevaNo ratings yet

- CASE STUDY-Walmart VS AmazonDocument3 pagesCASE STUDY-Walmart VS AmazonManasi VermaNo ratings yet

- Part I: Demographic ProfileDocument4 pagesPart I: Demographic ProfileMarie TiffanyNo ratings yet

- Iii. in Both of The Above Cases, The Capitalist-Industrial Partner Shall Not Share in The Losses in His Capacity As Industrial PartnerDocument4 pagesIii. in Both of The Above Cases, The Capitalist-Industrial Partner Shall Not Share in The Losses in His Capacity As Industrial PartnerEsto, Cassandra Jill SumalbagNo ratings yet

- Tax 1 Vthsem Module 1,2, and 3Document97 pagesTax 1 Vthsem Module 1,2, and 3Sahana narayanNo ratings yet

- Chapter One: 1.1. Back Ground of The StudyDocument31 pagesChapter One: 1.1. Back Ground of The StudyBobasa S AhmedNo ratings yet

- Tata Motors OperationsDocument5 pagesTata Motors OperationsbubaimaaNo ratings yet

- AveDocument3 pagesAveJessaNo ratings yet