Professional Documents

Culture Documents

WEEKLY TOP MOVERS

Uploaded by

craftersxOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

WEEKLY TOP MOVERS

Uploaded by

craftersxCopyright:

Available Formats

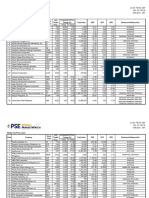

Sep 26 - Sep 30, 2022

VOL. XII NO. 39

ISSN 2013 - 1351

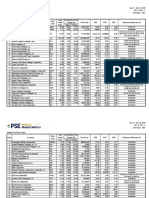

Weekly Top Price Gainers

Last Comparative Price

Stock

Rank Company Traded Change (%) Total Value PER EPS PBV Disclosure Reference No.

Code

Price 1 Week 4 Weeks

1 Manila Jockey Club, Inc. MJC 1.78 40.16 34.85 13,210 (15.47) (0.12) 1.36 No Disclosure

2 Makati Finance Corporation MFIN 3.12 31.09 31.09 3,120 84.87 0.04 1.53 No Disclosure

3 Bogo-Medellin Milling Co., Inc. BMM 74.50 24.17 8.28 6,724 (7.79) (9.57) 3.09 CR06160-2022, CR06183-2022, C07301-2022

4 I-Remit, Inc. I 0.90 23.29 23.29 848,520 (3.65) (0.25) 0.50 No Disclosure

5 MJC Investments Corporation MJIC 1.31 19.09 77.03 9,240 (4.72) (0.28) (3.41) No Disclosure

6 Euro-Med Laboratories Phil., Inc. EURO 0.93 13.41 (8.82) 54,330 22.97 0.04 0.68 No Disclosure

7 Global-Estate Resorts, Inc. GERI 0.96 12.94 5.49 952,400 7.79 0.12 0.35 No Disclosure

8 Berjaya Philippines, Inc. BCOR 7.95 11.03 (0.62) 47,899 35.74 0.22 3.54 No Disclosure

9 Manulife Financial Corporation MFC 991.00 10.11 7.72 19,820 5.08 195.15 0.80 No Disclosure

10 APC Group, Inc. APC 0.196 7.69 (1.01) 688,850 (196.96) (0.001) 9.59 No Disclosure

11 Wilcon Depot, Inc. WLCON 31.95 7.58 7.21 148,993,450 46.65 0.68 7.50 No Disclosure

12 Bright Kindle Resources & Investments Inc. BKR 1.50 6.38 (6.25) 175,000 14.11 0.11 1.98 No Disclosure

13 First Abacus Financial Holdings Corp. FAF 0.67 6.35 1.52 16,750 (10.30) (0.07) 0.76 C07258-2022, C07260-2022, C07270-2022

14 Victorias Milling Company, Inc. VMC 2.78 6.11 13.47 81,960 7.75 0.36 0.84 CR06204-2022

15 Arthaland Corporation ALCO 0.53 6.00 (1.85) 73,980 3.80 0.14 0.29 No Disclosure

16 Citystate Savings Bank, Inc. CSB 8.42 5.25 (0.12) 1,684 80.86 0.10 1.09 No Disclosure

17 Sun Life Financial Inc. SLF 2,400.00 4.35 - 1,920,390 8.23 291.57 1.30 C07177-2022

18 Philippine Realty and Holdings Corporation RLT 0.214 3.88 0.94 666,290 9.18 0.02 0.31 No Disclosure

19 Alliance Select Foods International, Inc. FOOD 0.54 3.85 3.85 91,030 (23.08) (0.02) 1.19 No Disclosure

20 Empire East Land Holdings, Inc. ELI 0.199 3.65 2.05 251,250 3.82 0.05 0.11 No Disclosure

21 Philippine Business Bank PBB 7.50 2.74 0.27 791,897 3.66 2.05 0.34 C07154-2022

22 RFM Corporation RFM 3.85 2.67 - 106,810 9.82 0.39 0.98 No Disclosure

23 Crown Asia Chemicals Corporation CROWN 1.35 2.27 0.75 658,510 3.36 0.40 0.50 CR06162-2022, CR06163-2022

24 Rizal Commercial Banking Corporation RCB 21.35 1.91 3.64 6,882,595 5.69 3.75 0.40 C07169-2022, C07170-2022

25 Pryce Corporation PPC 5.40 1.89 (0.92) 567,992 5.92 0.91 0.75 No Disclosure

26 Coal Asia Holdings Incorporated COAL 0.223 1.36 6.19 44,600 (2.31) (0.10) 0.26 No Disclosure

27 Robinsons Land Corporation RLC 16.48 1.23 (13.08) 151,418,384 12.84 1.28 0.68 C07209-2022

28 Centro Escolar University CEU 6.90 1.17 0.58 15,232 16.84 0.41 0.56 CR06178-2022, CR06199-2022

29 Benguet Corporation "B" BCB 5.20 0.97 (6.31) 419,641 2.45 2.13 0.47 CR06221-2022

30 Belle Corporation BEL 1.12 0.90 (2.61) 742,030 18.18 0.06 0.35 No Disclosure

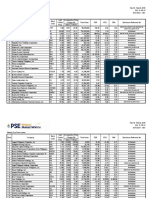

Sep 26 - Sep 30, 2022

VOL. XII NO. 39

ISSN 2013 - 1351

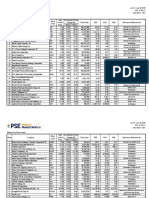

Weekly Top Price Losers

Last Comparative Price

Stock

Rank Company Traded Change (%) Total Value PER EPS PBV Disclosure Reference No.

Code

Price 1 Week 4 Weeks

C07165-2022, C07208-2022,

1 SFA Semicon Philippines Corporation SSP 1.30 (24.86) (11.56) 32,956,580 4.66 0.28 0.39 C07233-2022, C07275-2022

2 Apollo Global Capital, Inc. APL 0.028 (20.00) (31.71) 40,671,200 160.05 0.0002 2.19 No Disclosure

Atlas Consolidated Mining and Development

2 AT 3.28 (20.00) (22.27) 13,331,690 2.50 1.31 0.29 No Disclosure

Corporation

4 Figaro Coffee Group Inc. FCG 0.53 (18.46) (22.06) 33,154,260 7.20 0.07 1.58 No Disclosure

5 Metro Alliance Holdings & Equities Corp. "A" MAH 0.73 (17.98) (13.10) 196,580 (1.36) (0.54) (3.74) No Disclosure

6 Max's Group, Inc. MAXS 4.60 (17.86) (18.44) 3,618,320 30.67 0.15 1.05 No Disclosure

7 Megawide Construction Corporation MWIDE 3.60 (16.86) (32.20) 10,655,650 (17.83) (0.20) 0.44 No Disclosure

8 Vista Land & Lifescapes, Inc. VLL 1.60 (15.34) (22.71) 19,582,010 3.06 0.52 0.18 C07297-2022

9 Philippine Bank of Communications PBC 13.02 (14.34) (16.22) 393,388 3.62 3.60 0.44 C07224-2022

10 Balai ni Fruitas Inc. BALAI 0.60 (14.29) (36.17) 16,984,330 105.02 0.01 5.44 No Disclosure

11 GT Capital Holdings, Inc. GTCAP 415.60 (14.10) (18.51) 630,742,234 7.94 52.36 0.46 C07244-2022

12 International Container Terminal Services, Inc. ICT 156.60 (13.91) (14.43) 2,777,324,057 13.23 11.84 5.90 C07153-2022, CR06148-2022

Converge Information and Communications

13 CNVRG 13.10 (13.47) (26.73) 686,594,250 12.56 1.04 2.57 C07198-2022

Technology Solutions, Inc.

14 Basic Energy Corporation BSC 0.295 (13.24) (25.32) 4,091,300 22.62 0.01 0.71 C07280-2022

15 ACE Enexor, Inc. ACEX 11.70 (12.69) (36.69) 9,125,004 (103.92) (0.11) 1,848.07 No Disclosure

16 Haus Talk, Inc. HTI 0.83 (12.63) (14.43) 2,855,800 15.66 0.05 0.65 CR06179-2022

17 Metro Retail Stores Group, Inc. MRSGI 1.18 (12.59) (12.59) 1,602,650 (24.57) (0.05) 0.48 No Disclosure

18 Premiere Horizon Alliance Corporation PHA 0.350 (12.50) (9.09) 7,410,800 (20.69) (0.02) 1.25 No Disclosure

CR06205-2022, CR06206-2022, CR06207-2022,

19 Manila Electric Company MER 263.00 (12.39) (17.30) 524,286,068 11.99 21.94 3.32 CR06209-2022, CR06210-2022, CR06211-2022,

CR06212-2022, CR06213-2022

20 Acesite (Phils.) Hotel Corporation ACE 1.43 (12.27) 2.14 40,770 (9.82) (0.15) 0.26 No Disclosure

21 Central Azucarera de Tarlac, Inc. CAT 10.00 (12.13) (1.57) 59,246 44.41 0.23 0.75 No Disclosure

22 Fruitas Holdings, Inc. FRUIT 0.95 (12.04) (20.17) 8,127,870 361.83 0.003 1.65 No Disclosure

23 Golden MV Holdings, Inc. HVN 519.00 (12.03) (20.70) 4,328,985 210.77 2.46 28.30 No Disclosure

24 Filinvest Land, Inc. FLI 0.76 (11.63) (14.61) 38,984,070 4.92 0.15 0.21 C07250-2022

25 SM Prime Holdings, Inc. SMPH 30.10 (11.60) (17.53) 1,721,489,385 38.25 0.79 2.54 No Disclosure

C07188-2022, C07201-2022,

26 Ayala Corporation AC 616.00 (11.49) (16.64) 989,056,270 12.62 48.79 1.04 C07202-2022, CR06174-2022

27 Manila Bulletin Publishing Corporation MB 0.310 (11.43) (10.14) 150,650 48.04 0.01 0.30 No Disclosure

28 PH Resorts Group Holdings, Inc. PHR 0.78 (11.36) (27.10) 4,113,840 (11.94) (0.07) 1.03 No Disclosure

29 Lepanto Consolidated Mining Company "A" LC 0.102 (11.30) (23.31) 1,531,830 (11.13) (0.01) 1.36 No Disclosure

CR06158-2022, C07237-2022, C07238-2022,

30 ACEN CORPORATION ACEN 5.60 (11.25) (26.70) 581,950,347 50.69 0.11 2.21 CR06187-2022, CR06188-2022, CR06189-2022,

C07265-2022, CR06222-2022, CR06223-2022

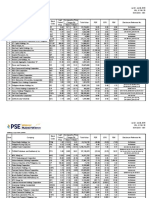

Sep 26 - Sep 30, 2022

VOL. XII NO. 39

ISSN 2013 - 1351

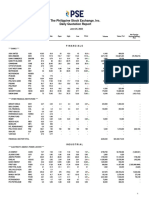

Weekly Market Statistics

(In pesos) September 19 - September 23 September 26 - September 30 Year-to-Date

Total Market Capitalization 15,973,679,593,327.00 15,319,200,177,345.00 15,319,200,177,345.00

Domestic Market Capitalization 12,884,440,691,712.30 11,999,246,928,306.20 11,999,246,928,306.20

Total Value Traded 25,896,405,874.31 39,552,485,192.82 1,331,488,119,286.91

Ave. Daily Value Traded 5,179,281,174.86 9,888,121,298.21 7,158,538,275.74

Foreign Buying 10,186,053,212.81 13,098,667,581.94 538,945,622,553.25

Foreign Selling 12,228,328,635.21 26,673,515,074.74 606,153,079,184.17

Net Foreign Buying/ (Selling) (2,042,275,422.40) (13,574,847,492.80) (67,207,456,630.90)

% of Foreign to Total 43% 50% 43%

Number of Issues (Common shares):

47 - 184 - 17 34 - 199 - 18 45 - 225 - 4

Gainers - Losers - Unchanged

Weekly Index Performance

Comparative Change (%) YTD Change

Close PER

1 Week 4 Weeks (%)

PSEi 5,741.07 (8.28) (14.22) (19.40) 15.08

All Shares Index 3,107.90 (6.99) (12.42) (18.60) 10.30

Financials Index 1,466.60 (5.38) (9.03) (8.69) 8.74

Industrial Index 8,576.21 (6.16) (13.60) (17.57) 15.27

Holding Firms Index 5,498.89 (9.35) (14.86) (19.22) 13.07

Property Index 2,454.80 (9.36) (17.76) (23.76) 15.37

Services Index 1,503.69 (8.17) (11.13) (24.30) 19.53

Mining and Oil Index 10,455.68 (6.10) (10.20) 8.89 6.47

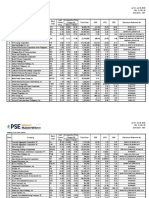

Notes:

- Top price gainers and losers only cover common shares.

- EPS (Earnings per Share) is computed as: Net Income

Outstanding Shares

PER (Price-Earnings Ratio) is computed as: Last Traded Price per Share

Earnings per Share

PBV (Price to Book Value Ratio) is computed as: Company Market Capitalization

Company Stockholders Equity (end of period)

EPS, PER and PBV use four-quarter trailing financial data.

- Total Value in Top

29Gainers and Losers tables refers to total value traded in the regular market.

- The disclosures cover those made from 3:31 pm, Friday of the previous week to 3:30 pm, Friday of the covered week. Information and disclosures made by the companies, as itemized in this report, may be

viewed by clicking on the links above. These may also be viewed in the “Disclosure” page of the company at the PSE website (www.pse.com.ph). To access the disclosure page, enter the stock symbol in the symbol

lookup field located at the upper right portion of the PSE website. The public is encouraged to regularly monitor subsequent developments as may be disclosed by the company in succeeding weeks.

- Current week’s foreign transactions data are subject to amendments allowed until t+2. Previous week’s foreign transactions data have been adjusted accordingly for amendments.

- Domestic Market capitalization excludes the market capitalization of foreign domiciled companies.

The data contained in this file is collated by the Market Data Department of the Philippine Stock Exchange. The PSE does not make any representations or warranties, express or implied, on matters such as, but not limited to, the accuracy, timeliness, completeness, non-infringement, validity, merchantability or fitness for any particular purpose of the information and data herein contained. The PSE assumes no liability and

responsibility for any loss or damage suffered as a consequence of any errors or omissions in this file, or any decision made or action taken in reliance upon information contained herein. This document is for information purposes only, and does not constitute legal, financial or investment advice, nor intended to influence investment decisions. Independent assessment should be undertaken, and advice from a securities professional is

strongly recommended. For inquiries or suggestions on the PSE Weekly MarketWatch, you may call (632) 8876-4888, send a message through fax no. (632) 8876-4553 or email info@pse.com.ph.

You might also like

- WEEKLY PRICE MOVERSDocument3 pagesWEEKLY PRICE MOVERScraftersxNo ratings yet

- wk05 Jan2024mktwatchDocument3 pageswk05 Jan2024mktwatchMacxie Baldonado QuibuyenNo ratings yet

- wk38 Sep2022mktwatchDocument3 pageswk38 Sep2022mktwatchcraftersxNo ratings yet

- Weekly Top Price Gainers and LosersDocument3 pagesWeekly Top Price Gainers and LosersKristian AguilarNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVcraftersxNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Kristian AguilarNo ratings yet

- Weekly Top Price Gainers and LosersDocument3 pagesWeekly Top Price Gainers and LosersKristian AguilarNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVKristian AguilarNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- NLI Securities Limited: Direct Trading AccountDocument12 pagesNLI Securities Limited: Direct Trading AccountSaiful IslamNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- QuarterlyTop50 1Q 2008Document5 pagesQuarterlyTop50 1Q 2008Franz Carla NavarroNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVKristian AguilarNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Kristian AguilarNo ratings yet

- Weekly Philippine stock market price gainers and losersDocument5 pagesWeekly Philippine stock market price gainers and losersignaciomannyNo ratings yet

- Weekly Top Price Gainers and LosersDocument3 pagesWeekly Top Price Gainers and LosersKristian AguilarNo ratings yet

- QuarterlyTop50 4Q 2009Document5 pagesQuarterlyTop50 4Q 2009Franz Carla NavarroNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVKristian AguilarNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Nylinad Calubayan EstrellaNo ratings yet

- Attractive Bluechips 12 Jun 2023 1158Document2 pagesAttractive Bluechips 12 Jun 2023 1158spahujNo ratings yet

- Portfolio July 2005Document10 pagesPortfolio July 2005api-3716002No ratings yet

- NYSE 52 Week Highs and LowsDocument58 pagesNYSE 52 Week Highs and LowsmatrixitNo ratings yet

- Daily stock market report for December 15, 2021 with indices, turnover data and top gaining and losing companiesDocument1 pageDaily stock market report for December 15, 2021 with indices, turnover data and top gaining and losing companiesMuhammad Shahid AshrafNo ratings yet

- Nifty 50Document3 pagesNifty 50Arjun BhatnagarNo ratings yet

- Lab 110609Document6 pagesLab 110609Andre SetiawanNo ratings yet

- Shop 75.00 Total: M/S Project Cost & Means of Finance Cost of Project AmountDocument7 pagesShop 75.00 Total: M/S Project Cost & Means of Finance Cost of Project AmountGiri SukumarNo ratings yet

- Shop 75.00 Total: M/S Project Cost & Means of Finance Cost of Project AmountDocument7 pagesShop 75.00 Total: M/S Project Cost & Means of Finance Cost of Project AmountSanjeev MiglaniNo ratings yet

- Shop 75.00 Total: M/S Project Cost & Means of Finance Cost of Project AmountDocument7 pagesShop 75.00 Total: M/S Project Cost & Means of Finance Cost of Project AmountvikramtonseNo ratings yet

- Shop 75.00 Total: M/S Project Cost & Means of Finance Cost of Project AmountDocument7 pagesShop 75.00 Total: M/S Project Cost & Means of Finance Cost of Project AmountNandan UmarjiNo ratings yet

- Fastest growing Australian startupsDocument1 pageFastest growing Australian startupsRomon YangNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- DBH1STMF - Quarterly Portfolio Statement - Jun, 2022Document2 pagesDBH1STMF - Quarterly Portfolio Statement - Jun, 2022Forhad UddinNo ratings yet

- Annexure - 2 (A) - IDocument12 pagesAnnexure - 2 (A) - IUttamJainNo ratings yet

- Bcasvista 20190719Document8 pagesBcasvista 20190719kezia yulinaNo ratings yet

- Multi Carbo Project Report and FinancialsDocument15 pagesMulti Carbo Project Report and FinancialsIT SCNo ratings yet

- NYSE & NASDAQ New 52 Week Highs and Lows - 20220506Document30 pagesNYSE & NASDAQ New 52 Week Highs and Lows - 20220506matrixitNo ratings yet

- Form Kedisiplinan Monitoring DPK Dan Kredit Desember 2022Document2 pagesForm Kedisiplinan Monitoring DPK Dan Kredit Desember 2022Sopyan ArifNo ratings yet

- ACTIVE SET/EQUITY/DIVIDEND HISTORY/5456/Bank of BarodaDocument8 pagesACTIVE SET/EQUITY/DIVIDEND HISTORY/5456/Bank of BarodaAmandeep SinghNo ratings yet

- Closing Rate Summary From:: Flu No: Pageno: 1 125/2020 P.Kse100 Ind: C.Kse100 Ind: Net ChangeDocument12 pagesClosing Rate Summary From:: Flu No: Pageno: 1 125/2020 P.Kse100 Ind: C.Kse100 Ind: Net ChangeUmar Sarfraz KhanNo ratings yet

- CFD - November 6th 2009Document3 pagesCFD - November 6th 2009Andre SetiawanNo ratings yet

- SAI INTERNET Projections of Profitability, Cash Flow & Balance SheetsDocument8 pagesSAI INTERNET Projections of Profitability, Cash Flow & Balance SheetsAkhil JamadarNo ratings yet

- Weekly Philippine Stock Price Gainers and LosersDocument3 pagesWeekly Philippine Stock Price Gainers and LosersKristian AguilarNo ratings yet

- New 52 Week Highs and LowsDocument4 pagesNew 52 Week Highs and LowsMohammad SiddiquiNo ratings yet

- 1-25 ET 500 Company List 2022Document2 pages1-25 ET 500 Company List 20220000000000000000No ratings yet

- Pricelist 15th DecDocument2 pagesPricelist 15th DecheyzaraNo ratings yet

- MFDocument380 pagesMFjayram 8080100% (1)

- Peer ComparisonDocument1 pagePeer ComparisonRahul DesaiNo ratings yet

- Stocks AC ALI BDO: ValuationsDocument15 pagesStocks AC ALI BDO: ValuationsRicarr ChiongNo ratings yet

- Top Story:: AEV: JERA Deal Gives AP A Competent Technical Partner, Opens Up Investment Opportunities For The GroupDocument4 pagesTop Story:: AEV: JERA Deal Gives AP A Competent Technical Partner, Opens Up Investment Opportunities For The GroupkristineNo ratings yet

- 2019 11 20 PH D PDFDocument5 pages2019 11 20 PH D PDFJNo ratings yet

- Comparison - Ratios - Tyre - DistributionDocument15 pagesComparison - Ratios - Tyre - DistributionParehjuiNo ratings yet

- Closing Rate Summary From:: Flu No: Pageno: 1 001/2021 P.Kse100 Ind: C.Kse100 Ind: Net ChangeDocument12 pagesClosing Rate Summary From:: Flu No: Pageno: 1 001/2021 P.Kse100 Ind: C.Kse100 Ind: Net ChangeMuhammad DawoodNo ratings yet

- Manila Standard Today - Business Daily Stock Review (October 19, 2012)Document1 pageManila Standard Today - Business Daily Stock Review (October 19, 2012)Manila Standard TodayNo ratings yet

- To the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioFrom EverandTo the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioNo ratings yet

- September 29, 2022-EODDocument13 pagesSeptember 29, 2022-EODcraftersxNo ratings yet

- September 29, 2022-EODDocument13 pagesSeptember 29, 2022-EODcraftersxNo ratings yet

- Page01 PSEWeeklyReport2022 wk24Document1 pagePage01 PSEWeeklyReport2022 wk24craftersxNo ratings yet

- September 29, 2022-EODDocument13 pagesSeptember 29, 2022-EODcraftersxNo ratings yet

- Page01 PSEWeeklyReport2022 wk35Document1 pagePage01 PSEWeeklyReport2022 wk35craftersxNo ratings yet

- Page01 PSEWeeklyReport2022 wk24Document1 pagePage01 PSEWeeklyReport2022 wk24craftersxNo ratings yet

- September 29, 2022-EODDocument13 pagesSeptember 29, 2022-EODcraftersxNo ratings yet

- September 29, 2022-EODDocument13 pagesSeptember 29, 2022-EODcraftersxNo ratings yet

- The Philippine Stock Exchange, Inc. Daily Quotation Report: June 24, 2022Document12 pagesThe Philippine Stock Exchange, Inc. Daily Quotation Report: June 24, 2022craftersxNo ratings yet

- 2022.08.22 SEC 23-B Juan Arturo Iluminado C. de CastroDocument5 pages2022.08.22 SEC 23-B Juan Arturo Iluminado C. de CastrocraftersxNo ratings yet

- 2022.08.22 SEC 23-B Juan Arturo Iluminado C. de CastroDocument5 pages2022.08.22 SEC 23-B Juan Arturo Iluminado C. de CastrocraftersxNo ratings yet

- 2022.08.22 SEC 23-B Juan Arturo Iluminado C. de CastroDocument5 pages2022.08.22 SEC 23-B Juan Arturo Iluminado C. de CastrocraftersxNo ratings yet

- SMIC - Acquisition of Shares of AIC Group of Companies Holding Corp (August 24, 2022)Document3 pagesSMIC - Acquisition of Shares of AIC Group of Companies Holding Corp (August 24, 2022)craftersxNo ratings yet

- Manila Jockey Club, Inc. - SEC Form 17-Q (2nd QTR 2022) - 23 Aug 2022Document75 pagesManila Jockey Club, Inc. - SEC Form 17-Q (2nd QTR 2022) - 23 Aug 2022craftersxNo ratings yet

- The Philippine Stock Exchange, Inc. Daily Quotation Report: June 24, 2022Document12 pagesThe Philippine Stock Exchange, Inc. Daily Quotation Report: June 24, 2022craftersxNo ratings yet

- The Philippine Stock Exchange, Inc. Daily Quotation Report: June 24, 2022Document12 pagesThe Philippine Stock Exchange, Inc. Daily Quotation Report: June 24, 2022craftersxNo ratings yet

- The Philippine Stock Exchange, Inc. Daily Quotation ReportDocument12 pagesThe Philippine Stock Exchange, Inc. Daily Quotation ReportcraftersxNo ratings yet

- Page01 PSEWeeklyReport2022 wk22Document1 pagePage01 PSEWeeklyReport2022 wk22craftersxNo ratings yet

- Page01 PSEWeeklyReport2022 wk24Document1 pagePage01 PSEWeeklyReport2022 wk24craftersxNo ratings yet

- The Philippine Stock Exchange, Inc. Daily Quotation ReportDocument12 pagesThe Philippine Stock Exchange, Inc. Daily Quotation ReportcraftersxNo ratings yet

- The Philippine Stock Exchange, Inc. Daily Quotation Report: June 24, 2022Document12 pagesThe Philippine Stock Exchange, Inc. Daily Quotation Report: June 24, 2022craftersxNo ratings yet

- The Philippine Stock Exchange, Inc. Daily Quotation Report: June 24, 2022Document12 pagesThe Philippine Stock Exchange, Inc. Daily Quotation Report: June 24, 2022craftersxNo ratings yet

- The Philippine Stock Exchange, Inc. Daily Quotation Report: June 24, 2022Document12 pagesThe Philippine Stock Exchange, Inc. Daily Quotation Report: June 24, 2022craftersxNo ratings yet

- The Philippine Stock Exchange, Inc. Daily Quotation Report: June 24, 2022Document12 pagesThe Philippine Stock Exchange, Inc. Daily Quotation Report: June 24, 2022craftersxNo ratings yet

- The Philippine Stock Exchange, Inc. Daily Quotation Report: June 24, 2022Document12 pagesThe Philippine Stock Exchange, Inc. Daily Quotation Report: June 24, 2022craftersxNo ratings yet

- The Philippine Stock Exchange, Inc. Daily Quotation Report: June 24, 2022Document12 pagesThe Philippine Stock Exchange, Inc. Daily Quotation Report: June 24, 2022craftersxNo ratings yet

- The Philippine Stock Exchange, Inc. Daily Quotation Report: June 24, 2022Document12 pagesThe Philippine Stock Exchange, Inc. Daily Quotation Report: June 24, 2022craftersxNo ratings yet

- Lesson Plan 2 Revised - Morgan LegrandDocument19 pagesLesson Plan 2 Revised - Morgan Legrandapi-540805523No ratings yet

- 41 PDFsam Redis CookbookDocument5 pages41 PDFsam Redis CookbookHữu Hưởng NguyễnNo ratings yet

- Olympic Ayres Magic LyricsDocument1 pageOlympic Ayres Magic Lyricsjackliddy96No ratings yet

- 8.4 Example: Swiss Market Index (SMI) : 188 8 Models of VolatilityDocument3 pages8.4 Example: Swiss Market Index (SMI) : 188 8 Models of VolatilityNickesh ShahNo ratings yet

- Best Home Oxygen Concentrators-Lowest Prices & Fast Shipping (Oxygen Machines) - 2021 - YuwellDocument1 pageBest Home Oxygen Concentrators-Lowest Prices & Fast Shipping (Oxygen Machines) - 2021 - YuwellPelayanan ResusitasiNo ratings yet

- 02 MortarsDocument2 pages02 MortarsTarun kumar DigarseNo ratings yet

- Athenaze 1 Chapter 7a Jun 18th 2145Document3 pagesAthenaze 1 Chapter 7a Jun 18th 2145maverickpussNo ratings yet

- Class Opening Preparations Status ReportDocument3 pagesClass Opening Preparations Status ReportMaria Theresa Buscato86% (7)

- History and Development of the Foodservice IndustryDocument23 pagesHistory and Development of the Foodservice IndustryMaria Athenna MallariNo ratings yet

- Stellar Structure and EvolutionDocument222 pagesStellar Structure and Evolutionjano71100% (2)

- Staining TechniquesDocument31 pagesStaining TechniquesKhadija JaraNo ratings yet

- Barelwiyah, Barelvi Chapter 1 (Part 2 of 5)Document31 pagesBarelwiyah, Barelvi Chapter 1 (Part 2 of 5)Dawah ChannelNo ratings yet

- Jotrun TDSDocument4 pagesJotrun TDSBiju_PottayilNo ratings yet

- InteliLite AMF20-25Document2 pagesInteliLite AMF20-25albertooliveira100% (2)

- Rotational Equilibrium SimulationDocument3 pagesRotational Equilibrium SimulationCamille ManlongatNo ratings yet

- CBT QuestionsDocument20 pagesCBT Questionsmohammed amjad ali100% (1)

- Soal Kelas 4 IIDocument5 pagesSoal Kelas 4 IIes tougeNo ratings yet

- Akhmatova, Anna - 45 Poems With Requiem PDFDocument79 pagesAkhmatova, Anna - 45 Poems With Requiem PDFAnonymous 6N5Ew3No ratings yet

- True False Survey FinalDocument2 pagesTrue False Survey Finalwayan_agustianaNo ratings yet

- Time Table Semester II 2019-2020Document18 pagesTime Table Semester II 2019-2020Shiv Kumar MeenaNo ratings yet

- Delhi (The Capital of India) : Ebook by Ssac InstituteDocument27 pagesDelhi (The Capital of India) : Ebook by Ssac InstituteAnanjay ChawlaNo ratings yet

- PiXL Knowledge Test ANSWERS - AQA B1 CORE Science - Legacy (2016 and 2017)Document12 pagesPiXL Knowledge Test ANSWERS - AQA B1 CORE Science - Legacy (2016 and 2017)Mrs S BakerNo ratings yet

- Lineapelle: Leather & Non-LeatherDocument16 pagesLineapelle: Leather & Non-LeatherShikha BhartiNo ratings yet

- Siga-Cc1 12-22-2010Document6 pagesSiga-Cc1 12-22-2010Felipe LozanoNo ratings yet

- Service Parts List: 54-26-0005 2551-20 M12™ FUEL™ SURGE™ 1/4" Hex Hydraulic Driver K42ADocument2 pagesService Parts List: 54-26-0005 2551-20 M12™ FUEL™ SURGE™ 1/4" Hex Hydraulic Driver K42AAmjad AlQasrawi100% (1)

- Design ThinkingDocument16 pagesDesign ThinkingbhattanitanNo ratings yet

- Friction, Gravity and Energy TransformationsDocument12 pagesFriction, Gravity and Energy TransformationsDaiserie LlanezaNo ratings yet

- Act 1&2 and SAQ No - LawDocument4 pagesAct 1&2 and SAQ No - LawBududut BurnikNo ratings yet

- Komatsud65ex 16dozerbulldozerservicerepairmanualsn80001andup 200727063646Document26 pagesKomatsud65ex 16dozerbulldozerservicerepairmanualsn80001andup 200727063646juan santa cruzNo ratings yet

- Load Frequency Control of Hydro and Nuclear Power System by PI & GA ControllerDocument6 pagesLoad Frequency Control of Hydro and Nuclear Power System by PI & GA Controllerijsret100% (1)