Professional Documents

Culture Documents

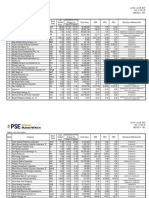

Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV

Uploaded by

ignaciomannyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV

Uploaded by

ignaciomannyCopyright:

Available Formats

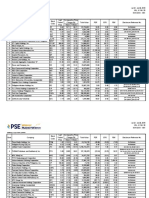

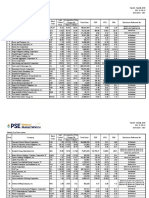

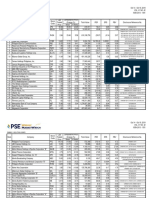

Aug 19 - Aug 23, 2019

VOL. VI NO. 34

ISSN 2013 - 1351

Weekly Top Price Gainers

Last Comparative Price

Stock

Rank Company Traded Change (%) Total Value PER EPS PBV Disclosure Reference No.

Code

Price 1 Week 4 Weeks

1 Kepwealth Property Phils., Inc. KPPI 15.00 84.05 84.05 2,133,240,878 85.66 0.18 7.57 C05852-2019, C05876-2019, C05903-2019

2 Liberty Flour Mills, Inc. LFM 43.50 48.46 (13.00) 13,050 73.29 0.59 2.48 No Disclosure

3 PHINMA Petroleum and Geothermal, Inc. PPG 7.84 46.27 42.81 665,959,950 (31.47) (0.25) 23.17 C05826-2019, C05904-2019

4 Keppel Philippines Holdings, Inc. KPH 5.50 21.68 21.68 502,542 31.37 0.18 0.50 No Disclosure

5 Metro Alliance Holdings & Equities Corporation MAH 1.42 18.33 (5.33) 126,180 56.78 0.03 4.13 CR05432-2019

6 Italpinas Development Corporation IDC 7.90 16.18 19.34 137,219,913 20.23 0.39 4.75 No Disclosure

7 LMG Chemicals Corporation LMG 4.75 14.18 13.10 3,319,980 196.82 0.02 4.98 C05851-2019, C05850-2019

8 Suntrust Home Developers, Inc. SUN 0.91 13.75 10.98 59,312,160 18.66 0.05 4.29 No Disclosure

9 APC Group, Inc. APC 0.59 13.46 13.46 32,490,510 (405.86) (0.001) 25.40 CR05482-2019

10 Jolliville Holdings Corporation JOH 6.20 12.73 (2.97) 18,483 4.69 1.32 0.99 No Disclosure

11 Philippine Racing Club, Inc. PRC 9.20 12.20 11.79 920 7.25 1.27 1.29 No Disclosure

12 Transpacific Broadband Group International, Inc. TBGI 0.350 11.11 (4.11) 8,170,300 87.51 0.004 3.77 No Disclosure

13 Discovery World Corporation DWC 2.27 10.19 10.19 10,460 (10.17) (0.22) 1.27 No Disclosure

14 ATN Holdings, Inc. ATN 1.30 9.24 - 18,913,620 19.14 0.07 2.75 No Disclosure

15 PTFC Redevelopment Corporation TFC 53.90 9.11 19.78 900,874 23.88 2.26 5.41 No Disclosure

16 Bogo-Medellin Milling Company, Inc. BMM 109.00 9.00 9.44 19,310 (23.81) (4.58) 3.47 No Disclosure

17 JG Summit Holdings, Inc. JGS 68.80 8.35 3.93 480,321,674 22.61 3.04 1.73 C05820-2019

18 Oriental Petroleum and Minerals Corporation OPMB 0.013 8.33 8.33 106,400 49.94 0.0003 0.55 No Disclosure

19 Manila Broadcasting Company MBC 15.16 8.29 7.37 26,832 62.95 0.24 5.35 No Disclosure

20 Prime Media Holdings, Inc. PRIM 1.36 7.94 (4.23) 3,363,390 (39.24) (0.03) (6.71) No Disclosure

21 Philippine Trust Company PTC 120.00 7.82 4.08 20,102 192.05 0.62 4.81 No Disclosure

22 ATN Holdings, Inc. ATNB 1.31 6.50 (1.50) 2,552,000 19.29 0.07 2.77 No Disclosure

23 First Gen Corporation FGEN 26.55 6.41 (1.30) 167,564,660 7.00 3.79 0.94 C05883-2019

24 Cityland Development Corporation CDC 0.88 6.02 (2.22) 86,590 6.42 0.14 0.52 C05807-2019

25 AgriNurture, Inc. ANI 15.00 5.63 7.14 74,776,348 (401.50) (0.04) 7.44 C05879-2019, C05906-2019

25 Manulife Financial Corporation MFC 750.00 5.63 (5.06) 22,500 6.53 114.79 0.78 No Disclosure

27 Universal Robina Corporation URC 171.00 5.56 - 705,539,772 40.57 4.22 4.73 No Disclosure

28 Manila Mining Corporation MA 0.0096 5.49 31.51 1,120,100 (204.51) (0.00005) 0.85 No Disclosure

C05825-2019, CR05436-2019,

29 Phoenix Petroleum Philippines, Inc. PNX 11.28 5.42 (5.84) 2,577,044 5.76 1.96 0.96 CR05476-2019, CR05470-2019

30 Chelsea Logistics and Infrastructure Holdings Corp. C 7.15 5.30 (5.30) 60,692,271 (24.72) (0.29) 1.02 C05914-2019

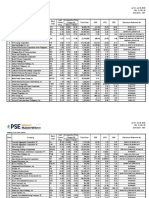

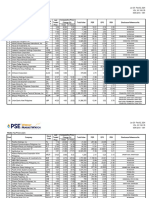

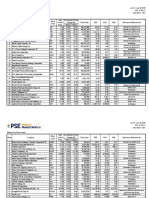

Aug 19 - Aug 23, 2019

VOL. VI NO. 34

ISSN 2013 - 1351

Weekly Top Price Losers

Last Comparative Price

Stock

Rank Company Traded Change (%) Total Value PER EPS PBV Disclosure Reference No.

Code

Price 1 Week 4 Weeks

1 Cirtek Holdings Philippines Corporation TECH 10.40 (13.33) (36.59) 15,276,786 12.98 0.80 0.59 C05832-2019, CR05441-2019

2 Premiere Horizon Alliance Corporation PHA 0.490 (12.50) (37.97) 32,442,805 (3.49) (0.14) 3.98 No Disclosure

3 Concrete Aggregates Corporation CAB 85.50 (12.04) (8.41) 11,367,186 68.31 1.25 8.18 No Disclosure

4 Easycall Communications Philippines, Inc. ECP 8.22 (11.42) (14.46) 1,389,023 22.57 0.36 6.17 No Disclosure

5 Philweb Corporation WEB 3.05 (10.82) (25.61) 36,767,350 (73.84) (0.04) 102.33 No Disclosure

6 PetroEnergy Resources Corporation PERC 4.20 (10.64) (12.13) 847,660 5.08 0.83 0.50 No Disclosure

7 AbaCore Capital Holdings, Inc. ABA 0.77 (10.47) (25.96) 109,326,840 0.74 1.04 0.30 C05885-2019

8 D.M. Wenceslao & Associates, Incorporated DMW 9.00 (10.00) (11.76) 43,961,586 15.66 0.57 1.64 No Disclosure

9 Megaworld Corporation MEG 4.80 (9.26) (23.20) 1,190,677,930 9.82 0.49 0.92 C05873-2019

10 Zeus Holdings, Inc. ZHI 0.230 (8.00) (17.86) 3,280,460 (890.09) (0.0003) 3,047.49 No Disclosure

CR05480-2019, CR05471-2019, C05912-2019,

11 Vitarich Corporation VITA 1.07 (7.76) (13.71) 41,804,730 (20.52) (0.05) 2.44 CR05488-2019, C05911-2019, C05910-2019

12 Asiabest Group International Inc. ABG 13.26 (7.53) (22.46) 3,091,408 (1,705.92) (0.01) 14.91 No Disclosure

13 Apex Mining Co., Inc. APX 1.25 (7.41) 4.17 38,104,170 39.95 0.03 1.48 No Disclosure

14 Omico Corporation OM 0.455 (7.14) (17.27) 161,200 (37.62) (0.01) 0.68 No Disclosure

15 STI Education Systems Holdings, Inc. STI 0.66 (7.04) (10.81) 4,573,630 17.23 0.04 0.75 No Disclosure

16 Filinvest Land, Inc. FLI 1.59 (7.02) (17.62) 347,929,120 6.18 0.26 0.56 No Disclosure

17 Paxys, Inc. PAX 2.84 (6.58) (2.41) 757,280 218.27 0.01 0.84 No Disclosure

18 Ginebra San Miguel, Inc. GSMI 50.85 (6.35) (13.96) 35,019,061 10.10 5.04 2.22 No Disclosure

19 Euro-Med Laboratories Phil., Inc. EURO 1.63 (6.32) 1.87 67,310 17.78 0.09 1.26 No Disclosure

C05816-2019, C05847-2019,

20 Alliance Global Group, Inc. AGI 12.26 (5.84) (22.41) 780,217,936 7.69 1.59 0.69 C05866-2019, C05896-2019

21 TKC Metals Corporation T 0.97 (5.83) (14.16) 1,802,790 (6.13) (0.16) 1.49 CR05446-2019, CR05472-2019

22 Pepsi-Cola Products Philippines, Inc. PIP 1.81 (5.73) 8.38 169,433,620 569.58 0.003 0.73 No Disclosure

23 Abra Mining and Industrial Corporation AR 0.0017 (5.56) - 2,589,600 (114.34) (0.00001) 0.20 CR05487-2019

24 Asia United Bank Corporation AUB 54.80 (5.52) (6.32) 786,414 7.35 7.45 0.86 No Disclosure

25 Island Information & Technology, Inc. IS 0.107 (5.31) (4.46) 289,190 (605.24) (0.0002) (4.87) No Disclosure

25 Manila Jockey Club, Inc. MJC 3.03 (5.31) (14.65) 572,060 (72.10) (0.04) 1.21 No Disclosure

27 Vantage Equities, Inc. V 1.11 (5.13) (0.89) 365,310 9.61 0.12 0.50 No Disclosure

28 AyalaLand Logistics Holdings Corp. ALLHC 3.54 (5.09) (16.90) 35,233,610 40.41 0.09 2.37 No Disclosure

29 National Reinsurance Corporation of the Philippines NRCP 0.94 (5.05) (18.26) 1,854,020 7.00 0.13 0.39 No Disclosure

30 Philippine Infradev Holdings Inc. IRC 1.33 (5.00) (24.43) 12,486,990 2.72 0.49 1.29 C05828-2019

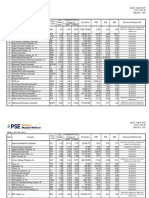

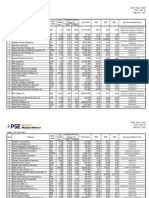

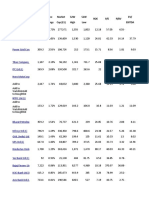

Aug 19 - Aug 23, 2019

VOL. VI NO. 34

ISSN 2013 - 1351

Weekly Market Statistics

(In pesos) August 12 - August 16 August 19 - August 23 Year-to-Date

Total Market Capitalization 16,727,093,643,128.30 16,895,410,146,926.70 16,895,410,146,926.70

Domestic Market Capitalization 14,241,851,952,063.10 14,332,283,997,035.10 14,332,283,997,035.10

Total Value Traded 35,647,995,796.25 30,522,854,326.81 1,194,973,399,624.33

Ave. Daily Value Traded 8,911,998,949.06 7,630,713,581.70 7,611,295,539.01

Foreign Buying 13,478,481,083.86 16,266,756,983.41 661,376,702,831.66

Foreign Selling 18,221,823,301.77 17,775,297,756.50 647,648,260,821.36

Net Foreign Buying/ (Selling) (4,743,342,217.92) (1,508,540,773.09) 13,728,442,010.31

% of Foreign to Total 44% 56% 55%

Number of Issues (Common shares):

74 - 149 - 25 87 - 127 - 32 123 - 128 - 7

Gainers - Losers - Unchanged

Weekly Index Performance

Comparative Change (%) YTD Change

Close PER

1 Week 4 Weeks (%)

PSEi 7,889.41 1.20 (3.60) 5.67 18.15

All Shares Index 4,770.38 0.62 (3.74) 5.59 14.90

Financials Index 1,827.12 2.69 (1.16) 2.66 14.08

Industrial Index 10,997.00 1.41 (4.10) 0.42 16.72

Holding Firms Index 7,772.54 0.59 (2.83) 5.87 16.71

Property Index 4,016.69 (0.50) (7.60) 10.71 18.69

Services Index 1,589.89 1.34 (3.75) 10.20 16.91

Mining and Oil Index 8,074.00 0.28 2.58 (1.54) 14.53

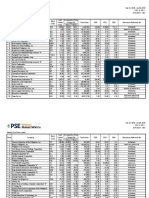

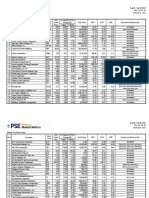

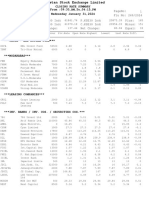

Notes:

- Top price gainers and losers only cover common shares.

- EPS (Earnings per Share) is computed as: Net Income

Outstanding Shares

PER (Price-Earnings Ratio) is computed as: Last Traded Price per Share

Earnings per Share

PBV (Price to Book Value Ratio) is computed as: Company Market Capitalization

Company Stockholders Equity (end of period)

EPS, PER and PBV use four-quarter trailing financial data.

- Total Value in Top Gainers and Losers tables refers to total value traded in the regular market.

- The disclosures cover those made from 3:31 pm, Friday of the previous week to 3:30 pm, Friday of the covered week. Information and disclosures made by the companies, as itemized in this report, may

be viewed by clicking on the links above. These may also be viewed in the “Disclosure” page of the company at the PSE website (www.pse.com.ph). To access the disclosure page, enter the stock symbol in

the symbol lookup field located at the upper right portion of the PSE website. The public is encouraged to regularly monitor subsequent developments as may be disclosed by the company in succeeding

weeks.

- Current week’s foreign transactions data are subject to amendments allowed until t+2. Previous week’s foreign transactions data have been adjusted accordingly for amendments.

- Domestic Market capitalization excludes the market capitalization of foreign domiciled companies.

The data contained in this file is collated by the Corporate Planning & Research Department of the Philippine Stock Exchange. The PSE does not make any representations or warranties, express or implied, on matters such as, but not limited to, the accuracy, timeliness, completeness, non-infringement, validity, merchantability or fitness for any particular purpose of the information and data herein contained. The PSE

assumes no liability and responsibility for any loss or damage suffered as a consequence of any errors or omissions in this file, or any decision made or action taken in reliance upon information contained herein. This document is for information purposes only, and does not constitute legal, financial or investment advice, nor intended to influence investment decisions. Independent assessment should be undertaken, and

advice from a securities professional is strongly recommended. For inquiries or suggestions on the PSE Weekly MarketWatch, you may call (632) 688-7601 to 02, send a message through fax no. (632) 688-8818 or email pirs@pse.com.ph.

You might also like

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVKristian AguilarNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVKristian AguilarNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- Weekly Top Price Gainers and LosersDocument3 pagesWeekly Top Price Gainers and LosersKristian AguilarNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Kristian AguilarNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Kristian AguilarNo ratings yet

- Weekly Top Price Gainers and LosersDocument3 pagesWeekly Top Price Gainers and LosersKristian AguilarNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- wk05 Jan2024mktwatchDocument3 pageswk05 Jan2024mktwatchMacxie Baldonado QuibuyenNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVKristian AguilarNo ratings yet

- Weekly Top Price Gainers and LosersDocument3 pagesWeekly Top Price Gainers and LosersKristian AguilarNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Philippine stock market price gainers and losersDocument5 pagesWeekly Philippine stock market price gainers and losersignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument4 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- WEEKLY PRICE MOVERSDocument3 pagesWEEKLY PRICE MOVERScraftersxNo ratings yet

- WEEKLY TOP MOVERSDocument3 pagesWEEKLY TOP MOVERScraftersxNo ratings yet

- Weekly Top Price Gainers and Losers in the PhilippinesDocument3 pagesWeekly Top Price Gainers and Losers in the PhilippinesignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVKristian AguilarNo ratings yet

- Weekly Philippine Stock Price Gainers and LosersDocument3 pagesWeekly Philippine Stock Price Gainers and LosersKristian AguilarNo ratings yet

- wk38 Sep2022mktwatchDocument3 pageswk38 Sep2022mktwatchcraftersxNo ratings yet

- QuarterlyTop50 1Q 2008Document5 pagesQuarterlyTop50 1Q 2008Franz Carla NavarroNo ratings yet

- QuarterlyTop50 4Q 2009Document5 pagesQuarterlyTop50 4Q 2009Franz Carla NavarroNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Nylinad Calubayan EstrellaNo ratings yet

- U.S. Dividend Champions: End-Of-Month Update atDocument26 pagesU.S. Dividend Champions: End-Of-Month Update atALFONSO ARREOLANo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVcraftersxNo ratings yet

- Top Story:: MON 14 JUN 2021Document4 pagesTop Story:: MON 14 JUN 2021JajahinaNo ratings yet

- Nifty 50Document3 pagesNifty 50Arjun BhatnagarNo ratings yet

- Top Story:: AEV: JERA Deal Gives AP A Competent Technical Partner, Opens Up Investment Opportunities For The GroupDocument4 pagesTop Story:: AEV: JERA Deal Gives AP A Competent Technical Partner, Opens Up Investment Opportunities For The GroupkristineNo ratings yet

- Lab 110609Document6 pagesLab 110609Andre SetiawanNo ratings yet

- Industry Peer 2016Document13 pagesIndustry Peer 2016cherylmanapolNo ratings yet

- CFD - November 6th 2009Document3 pagesCFD - November 6th 2009Andre SetiawanNo ratings yet

- U S DividendchampionsDocument196 pagesU S DividendchampionsRobert RippeyNo ratings yet

- CFD - October 30th 2009Document3 pagesCFD - October 30th 2009Andre SetiawanNo ratings yet

- Investment GuideDocument2 pagesInvestment Guidegundam busterNo ratings yet

- 2019 11 20 PH D PDFDocument5 pages2019 11 20 PH D PDFJNo ratings yet

- Market Statistics - Friday, October 30 2009: Japan - Nikkei 225Document7 pagesMarket Statistics - Friday, October 30 2009: Japan - Nikkei 225Andre SetiawanNo ratings yet

- CFD - November 5th 2009Document3 pagesCFD - November 5th 2009Andre SetiawanNo ratings yet

- U S DividendChampionsDocument293 pagesU S DividendChampionsmike greeneNo ratings yet

- Kavveri TelecomDocument1 pageKavveri TelecomrohitbhuraNo ratings yet

- CMP Price Market 52W 52W ROE P/E P/BV EV/ Change Cap (CR) High Low Ebitda Ompany Name (M.Cap)Document7 pagesCMP Price Market 52W 52W ROE P/E P/BV EV/ Change Cap (CR) High Low Ebitda Ompany Name (M.Cap)SandeepMalooNo ratings yet

- Investment GuideDocument2 pagesInvestment GuideJustGentleNo ratings yet

- CFD - November 3rd 2009Document3 pagesCFD - November 3rd 2009Andre SetiawanNo ratings yet

- Top Story:: Ubp: Manageable Increase Npls in May Maintain HoldDocument7 pagesTop Story:: Ubp: Manageable Increase Npls in May Maintain HoldJajahinaNo ratings yet

- Top Stories:: FRI 27 AUG 2021Document7 pagesTop Stories:: FRI 27 AUG 2021Elcano MirandaNo ratings yet

- Lab 110509Document6 pagesLab 110509Andre SetiawanNo ratings yet

- Closingrates 202431janDocument21 pagesClosingrates 202431janmdcat466No ratings yet

- MFDocument380 pagesMFjayram 8080100% (1)

- February 16-17, 2011 - UpdateDocument2 pagesFebruary 16-17, 2011 - UpdateJC CalaycayNo ratings yet

- Fundcard: Franklin India Smaller Companies FundDocument4 pagesFundcard: Franklin India Smaller Companies FundChiman RaoNo ratings yet

- Lab 110309Document6 pagesLab 110309Andre SetiawanNo ratings yet

- Supervalu's Grocery Business ProfileDocument14 pagesSupervalu's Grocery Business ProfileshaonsterNo ratings yet

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- QUARTERLY REPORT PURSUANT TO SECTION 17 OF THE SECURITIES REGULATION CODEDocument73 pagesQUARTERLY REPORT PURSUANT TO SECTION 17 OF THE SECURITIES REGULATION CODEignaciomannyNo ratings yet

- Annual Report of The Keepers Holdings. Inc. For Cy 2021Document201 pagesAnnual Report of The Keepers Holdings. Inc. For Cy 2021ignaciomannyNo ratings yet

- Disclosure 2022-09-09 PSE Approval of AREIT Shares Lodgement (SEC-PSE)Document3 pagesDisclosure 2022-09-09 PSE Approval of AREIT Shares Lodgement (SEC-PSE)ignaciomannyNo ratings yet

- LRWC-SEC 17C - Financial Highlights of Q1 2022Document4 pagesLRWC-SEC 17C - Financial Highlights of Q1 2022ignaciomannyNo ratings yet

- Response To PSE Query 07 September 2022Document1 pageResponse To PSE Query 07 September 2022ignaciomannyNo ratings yet

- CNVRG Performance PlummetsDocument7 pagesCNVRG Performance PlummetsignaciomannyNo ratings yet

- AbacusShortTakes 09082022Document7 pagesAbacusShortTakes 09082022ignaciomannyNo ratings yet

- Power sector pairs trading: AP favored over FGENDocument6 pagesPower sector pairs trading: AP favored over FGENignaciomannyNo ratings yet

- AbacusShortTakes 08232022Document7 pagesAbacusShortTakes 08232022ignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument4 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- AbacusShortTakes 09212022Document5 pagesAbacusShortTakes 09212022ignaciomannyNo ratings yet

- AbacusShortTakes 09092022Document6 pagesAbacusShortTakes 09092022ignaciomannyNo ratings yet

- Weekly Philippine stock market price gainers and losersDocument5 pagesWeekly Philippine stock market price gainers and losersignaciomannyNo ratings yet

- AbacusShortTakes 10262022Document6 pagesAbacusShortTakes 10262022ignaciomannyNo ratings yet

- Top Gainer 02.18.2017Document3 pagesTop Gainer 02.18.2017ignaciomannyNo ratings yet

- wk26 Jun2019mktwatchDocument3 pageswk26 Jun2019mktwatchignaciomannyNo ratings yet

- REIT Plan - FinalDocument1,701 pagesREIT Plan - FinalChristian John RojoNo ratings yet

- Weekly Top Price Gainers and Losers in the PhilippinesDocument3 pagesWeekly Top Price Gainers and Losers in the PhilippinesignaciomannyNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- wk26 Jun2019mktwatchDocument3 pageswk26 Jun2019mktwatchignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument4 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument4 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- Maths: (Two and A Half Hours)Document6 pagesMaths: (Two and A Half Hours)parthNo ratings yet

- A PESTEL Analysis of The MOngolian Mining INdustryDocument7 pagesA PESTEL Analysis of The MOngolian Mining INdustryJonathan LeeNo ratings yet

- 1989 NY Poultry Farm Business SummaryDocument30 pages1989 NY Poultry Farm Business SummarysuelaNo ratings yet

- Literature Review of HDFCDocument5 pagesLiterature Review of HDFCc5t6h1q5100% (1)

- Senior 12 Business Finance - Q1 - M2 For PrintingDocument28 pagesSenior 12 Business Finance - Q1 - M2 For PrintingAngelica Paras100% (4)

- Taxation of Discounted Promissory Note from Land SaleDocument3 pagesTaxation of Discounted Promissory Note from Land SaleCzarina CidNo ratings yet

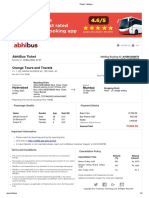

- Abibus RETURN TickDocument2 pagesAbibus RETURN Tickarun13091987No ratings yet

- Ding of Accounting Standards 1-15Document25 pagesDing of Accounting Standards 1-15Moeen MakNo ratings yet

- Bank Loan Interest CalculatorDocument2 pagesBank Loan Interest CalculatorgodabariNo ratings yet

- Van Der Walt, B & T 949 Beacon Street Claremont 0082 5016590876Document2 pagesVan Der Walt, B & T 949 Beacon Street Claremont 0082 5016590876bashNo ratings yet

- Lisa Jardine, CP Snow, Two Culture RevisitedDocument118 pagesLisa Jardine, CP Snow, Two Culture RevisitedJose CornettNo ratings yet

- Incentive PlansDocument21 pagesIncentive Plansnmhrk1118No ratings yet

- Sustainability in BusinessDocument11 pagesSustainability in Businesshakisi6054No ratings yet

- Partnership EssentialsDocument48 pagesPartnership EssentialsMary Pascua Abella100% (1)

- 2017 - Financial Disclosure Statement (Amended - 8/10/2018)Document17 pages2017 - Financial Disclosure Statement (Amended - 8/10/2018)juliabhaberNo ratings yet

- Introduction To Freight BrokeringDocument35 pagesIntroduction To Freight BrokeringAtex9100% (3)

- Ge Healthcare: Strategies For BOP MarketsDocument13 pagesGe Healthcare: Strategies For BOP MarketssairamskNo ratings yet

- Regulatory Board's Guide to Registering Housing ProjectsDocument16 pagesRegulatory Board's Guide to Registering Housing ProjectsLgu SikatunaNo ratings yet

- IAS 7+test ProblemDocument6 pagesIAS 7+test Problemkabir_20004No ratings yet

- The Accounting Equation and The Rules of Debit and CreditDocument9 pagesThe Accounting Equation and The Rules of Debit and CreditJoseph LimbongNo ratings yet

- Sanction LetterDocument3 pagesSanction LetterOnis EnergyNo ratings yet

- Recruitment SampleDocument3 pagesRecruitment SampleNkanyezi MagwazaNo ratings yet

- And J2EE Technologies.: Srinivasulu Boddu Mobile No: +91 9620173938Document4 pagesAnd J2EE Technologies.: Srinivasulu Boddu Mobile No: +91 9620173938raghuramthivariNo ratings yet

- Japan Customs InformationDocument6 pagesJapan Customs InformationJawad HussainNo ratings yet

- Hania Sheikh 1003203014: Rate of Return Dividend/priceDocument8 pagesHania Sheikh 1003203014: Rate of Return Dividend/priceHania SheikhNo ratings yet

- MyLoanCare Loan Against Property Comparison Jammu and Kashmir Bank HDFC BankDocument1 pageMyLoanCare Loan Against Property Comparison Jammu and Kashmir Bank HDFC BankNikita GandotraNo ratings yet

- Claw 12 Company MGTDocument28 pagesClaw 12 Company MGTNeha RohillaNo ratings yet

- CHAPTER 4 DERIVATIONS 7 PGDocument7 pagesCHAPTER 4 DERIVATIONS 7 PGzee abadillaNo ratings yet

- Klarna DealsDatabseExportDataDocument18 pagesKlarna DealsDatabseExportDataGreg AdamsNo ratings yet

- XML and Excel financial ratios made easy with SEO-optimized titlesDocument60 pagesXML and Excel financial ratios made easy with SEO-optimized titlesNikita SharmaNo ratings yet