Professional Documents

Culture Documents

AbacusShortTakes 08312022

Uploaded by

ignaciomannyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AbacusShortTakes 08312022

Uploaded by

ignaciomannyCopyright:

Available Formats

Wednesday, August 31, 2022

*0

TODAY’S TOPICS

IN FOCUS CNVRG is the worst performing index stock, plagued by stalling net income

_____________

and subscriber growth, higher expenses, and uncollected receivables.

Consensus estimates remain too optimistic in our view, and our advice is to

underweight the stock.

CNVRG

P17.96, -3.44% MBT's dividend yield has now risen to 5.67%, well above that of its two

biggest peers. This is another reason to overweight the stock.

Odds of a 75 bps hike from the US Fed have risen significantly, and we believe

BSP Gov Medalla will stick to his guidance of only one or two more hikes of 25

bps. This likely means that the peso will weaken further.

KEEPR plans to buy up to 50% of Williams & Humbert, which we expect to be

positive for the stock.

: CNVRG

Converge is the worst performing index stock YTD (-44%) and is down 60% from

its all-time high. And for many investors, it had one of the most disappointing Q2

results given that it was still considered a growth stock at the start of the year. Net

income in H1 was only 41% of consensus estimates which had already been

financial performance to see if there is any room for optimism.

Wednesday, August 31, 2022

PAGE 1

Wednesday, August 31, 2022

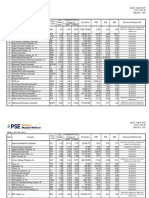

Stalled. Masked by strong revenues and lofty YoY growth figures, CNVRG actually

IN FOCUS started stalling a few quarters ago. As the chart above shows, operating income has

_____________ been practically unchanged for three quarters and even peaked in 3Q21. Net income,

on the other hand, has plateaued for the past four quarters. This is even more

remarkable given that the company got a boost from lower effective corporate tax

CNVRG rates in recent quarters. But it is not just net income that has stalled. Quarterly

P17.96, -3.44% additional subscribers appear to have peaked as well in 3Q21 and net new users in

2Q22 was the lowest since the company went public in 2020. More importantly,

Converge has fallen behind PLDT in terms of subscriber take up over the past twelve

months. Management tried to arrest the decline in new users by waiving upfront

fees late last year. However, this promotion apparently backfired as it attracted low-

quality accounts that caused churn to dramatically increase.

Higher expenses

quarters so this is not the source of weakness in terms of earnings. Operating

margin, on the other hand, averaged 40% in the first nine months of 2021 and

peaked at 43% in 3Q21 but this has since dropped substantially to 34% as of 2Q22.

A chunk of this is due to bad debts (discussed in more detail below) but other

operating expenses also increased to 22% of revenues from only 16% in 3Q21. The

17-Q does not break down opex but we believe that the expansion to Visayas

Wednesday, August 31, 2022

PAGE 2

Wednesday, August 31, 2022

and Mindanao is beginning to eat into margins. Investors can think of this as

IN FOCUS necessary investments for future growth but it remains to be seen if this regional

_____________ expansion will significantly boost subscriber take up. Another drag is from financing

charges. With net debt increasing by Php14.0B YTD, Q2 interest expense jumped to

Php442M, 85% higher QoQ and more than triple YoY.

CNVRG

P17.96, -3.44%

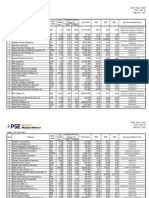

Bad debts. Our biggest concern relates to uncollected receivables. As the chart

above shows, Php2.14B worth of receivables from residential users were more than

90 days past due at the end of June, nearly 150% higher compared to the same

period last year. Corporate accounts were less delinquent but there was also a large

increase YoY in accounts more than 90 days overdue. Looking at it another way,

only 34% of residential accounts were current at end-2Q, a big deterioration from

45% 12 months ago. This may have been partly due to the higher churn in the past

several months but it may foreshadow further increases in bad debt provisions from

Q3 onwards. We expect more pressure because of: a) higher inflation which affects

affordability, b) the return of face to face classes which reduces the need for home

broadband, c) the low ratio of subscribers who are current in their payments, and d)

increased competition. The last is relevant especially when looking at the chart

below. The shrinking market share of CNVRG in terms of wired net adds should be

a red flag for investors.

Wednesday, August 31, 2022

PAGE 3

Wednesday, August 31, 2022

IN FOCUS

_____________

CNVRG

P17.96, -3.44%

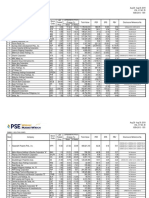

Downgrades. Looking back, we highlighted the same issues mentioned above just

after the company listed. We said the pandemic had pulled forward a lot of the

demand for home broadband and that net adds will slow down significantly. We also

mentioned that Converge was pushing into income groups that have lower capacity

to pay, increasing the likelihood of bad debts. Lastly, we warned that PLDT and even

Globe were not pushovers in this space and that competition was likely to heat up.

It took longer than we expected but our predictions are finally coming true. This is

being reflected in earnings downgrades for 2022 (-10.3% in six months) and 2023

(-11.7%). Consensus estimates remain too optimistic, in our view, and further

adjustments are necessary. The median profit forecast for this year, for example, is

still at Php9.2B whereas 1H22 annualized is only Php7.9B. For 2023, the consensus

is at Php11.6B which implies growth of +26% despite the fact, as shown above, that

earnings have been flat for four straight quarters. Our advice, therefore, is to

underweight CNVRG.

Wednesday, August 31, 2022

PAGE 4

Wednesday, August 31, 2022

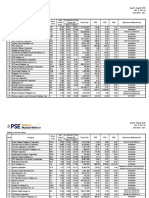

SIGNIFICANT DIGITS

IN FOCUS

_____________ -month yield has now risen

to 5.67%. This is the second highest among the nine universal banks we follow and

well above that of its two biggest peers. We believe the high yield was made possible

MBT by the b

P53.45, 0.00% latter may not sound relevant but it differentiates MBT from most of its peers

because it protects the bank from a potential surge in bad loans (i.e. possibly from

Monetary the effects of high inflation) that could eat into profits and capital. In any case, this

Policy is another reason why clients should overweight the stock.

Exchange Rates

RANDOM THOUGHTS

1.

than most people thought it would be. It should be very clear now that taming

inflation will come at the cost of economic growth and equity prices. One of the

few winners in this scenario is the US dollar. Odds for a 75 basis point hike from

the Fed next month have risen significantly and there is even talk that the

terminal rate could be as high as 5.0%. This is likely to pose problems for central

bankers in emerging markets, including the BSP. Even after increasing the RRP

Wednesday, August 31, 2022

PAGE 5

Wednesday, August 31, 2022

rate by a total of 125 basis points, the peso has appreciated by a mere 0.09%

IN FOCUS and is underperforming both the Indonesian rupiah and Indian rupee despite

_____________ much smaller hikes from these countries' central banks (25 bps and 50 bps since

July 13). Given that Gov. Medalla has flagged only one or two more hikes of 25

bps each until the end of the year, and previously said that surprise monetary

Monetary announcements only work once, we believe that he is going to stick to forward

Policy guidance. This likely means that the peso will weaken further and hit a new low

soon.

Exchange Rates

KEEPR

P1.27, +3.25%

2. KEEPR disclosed yesterday that it plans to buy up to 50% of Williams & Humbert

(W&H). We predicted this potential acquisition back in November (just before the

FOO) and s

brandy which accounts for about 60% of sales. The terms of the acquisition are

subject to the results of the fairness opinion that will be done by Isla Lipana & Co. To

reiterate, we expect this to be positive for KEEPR although the exact value to be

created for shareholders will depend on pricing of the deal. The benefits may also

accrue over a longer time horizon that we initially thought as inflation has surged in

Europe since we made the prediction. In any case, it may take a few more quarters

of strong growth to convince the market that the stock is a bargain at current levels.

Wednesday, August 31, 2022

PAGE 6

Wednesday, August 31, 2022

Unit 2904-AEast Tower, Philippine www.mytrade.com.ph asc.research@abacus-sec.com.ph 8667-8900 (63.2) 634-5206

Stock Exchange Centre, Exchange

Road, Ortigas Center, Pasig city 1600

Wednesday, August 31, 2022

PAGE 7

You might also like

- Zaini Zain (BAF2009012) Adv. Fin. Acc Group Assignment (UPDATED)Document23 pagesZaini Zain (BAF2009012) Adv. Fin. Acc Group Assignment (UPDATED)Zaini ZainNo ratings yet

- AbacusShortTakes 08232022Document7 pagesAbacusShortTakes 08232022ignaciomannyNo ratings yet

- Ceb Fs AnalysisDocument12 pagesCeb Fs AnalysisKatrina PaquizNo ratings yet

- Annual Report 2022 Financial Services CompanyDocument206 pagesAnnual Report 2022 Financial Services CompanySunny KumarNo ratings yet

- 03 IAG 1H23 Financial ResultsDocument6 pages03 IAG 1H23 Financial ResultsMarvin SwaminathanNo ratings yet

- Earnings Conference Call: Q2 Fiscal Year 2021Document24 pagesEarnings Conference Call: Q2 Fiscal Year 2021sl7789No ratings yet

- Alibaba Group Holding Limited, Q3 2022 Earnings Call, Feb 24, 2022Document17 pagesAlibaba Group Holding Limited, Q3 2022 Earnings Call, Feb 24, 2022Moiz SaeedNo ratings yet

- Public Bank-1Q22-RA Loan Offloading Progressing Smoothly-MIDF-310522Document5 pagesPublic Bank-1Q22-RA Loan Offloading Progressing Smoothly-MIDF-310522ELF JRNo ratings yet

- Mizuho Securities GPN SQ We Applaud Strong EBITDA COIN More of The Same GPDocument8 pagesMizuho Securities GPN SQ We Applaud Strong EBITDA COIN More of The Same GPoldman lokNo ratings yet

- PJT Partners Inc., Q3 2022 Earnings Call, Oct 25, 2022Document15 pagesPJT Partners Inc., Q3 2022 Earnings Call, Oct 25, 2022Neel DoshiNo ratings yet

- Bajaj Finance q4 Investor Presentation FinalpdfDocument66 pagesBajaj Finance q4 Investor Presentation Finalpdfraj darbarNo ratings yet

- Infosys 140422 MotiDocument10 pagesInfosys 140422 MotiGrace StylesNo ratings yet

- Q2 2022 Earnings PresentationDocument25 pagesQ2 2022 Earnings PresentationIan TorwaldsNo ratings yet

- 4716156162022739schneider Electric Infrastructure Ltd. Q4FY22 - SignedDocument5 pages4716156162022739schneider Electric Infrastructure Ltd. Q4FY22 - SignedbradburywillsNo ratings yet

- 15124-CardinalStone Research 2022 Macro Outlook Consolidating Recovery-ProshareDocument16 pages15124-CardinalStone Research 2022 Macro Outlook Consolidating Recovery-ProshareOladipo OlanyiNo ratings yet

- CIMB Strategy Note 2 Aug 2023 2Q23, Mixed Results, Large Banks AheadDocument10 pagesCIMB Strategy Note 2 Aug 2023 2Q23, Mixed Results, Large Banks Aheadbotoy26No ratings yet

- PVH Financial Analysis - Q1Document7 pagesPVH Financial Analysis - Q1Dulakshi RanadeeraNo ratings yet

- Pra Tinjau SahamDocument8 pagesPra Tinjau SahamADE CHANDRANo ratings yet

- NagaCorp 2022 Interim Results PresentationDocument16 pagesNagaCorp 2022 Interim Results PresentationJonathan ChoiNo ratings yet

- Alliance Bank: ResearchDocument4 pagesAlliance Bank: ResearchZhi_Ming_Cheah_8136No ratings yet

- Adyen Shareholder Letter FY23 H2Document49 pagesAdyen Shareholder Letter FY23 H2Ashutosh DessaiNo ratings yet

- SCMA - The Worst Might Be OverDocument5 pagesSCMA - The Worst Might Be OverBrilliant Indra KNo ratings yet

- 2021 q2 Earnings Results PresentationDocument17 pages2021 q2 Earnings Results PresentationZerohedgeNo ratings yet

- Bajaj Finance 29072019Document7 pagesBajaj Finance 29072019Pranav VarmaNo ratings yet

- FSA Challenge 1 Group 48Document4 pagesFSA Challenge 1 Group 48francisco.fcarvalho00No ratings yet

- Pinduoduo (PDD US) : Well Positioned For Upcoming RecoveryDocument4 pagesPinduoduo (PDD US) : Well Positioned For Upcoming RecoveryAbhimanyu SinghNo ratings yet

- Indian Bank Investment Note - QIPDocument5 pagesIndian Bank Investment Note - QIPAyushi somaniNo ratings yet

- Citi 2Q23 Press ReleaseDocument12 pagesCiti 2Q23 Press Releasedanielajai614No ratings yet

- Restaurant Brands International: Investment BriefDocument4 pagesRestaurant Brands International: Investment BriefrickescherNo ratings yet

- Half Yearly: Bajaj Finance LimitedDocument6 pagesHalf Yearly: Bajaj Finance LimitedVyasRmNo ratings yet

- Federal Bank LTD.: BUY (Upside 20%)Document8 pagesFederal Bank LTD.: BUY (Upside 20%)darshanmaldeNo ratings yet

- Hampered by Tightening PPKM: Mitra Adiperkasa TBK (MAPI IJ)Document6 pagesHampered by Tightening PPKM: Mitra Adiperkasa TBK (MAPI IJ)Putu Chantika Putri DhammayantiNo ratings yet

- Earnings Conference Call: Q4 Fiscal Year 2021Document25 pagesEarnings Conference Call: Q4 Fiscal Year 2021sl7789No ratings yet

- BLK 3Q22 Earnings ReleaseDocument14 pagesBLK 3Q22 Earnings ReleasefelipeNo ratings yet

- News Release: Profits Up 49% As Activity Increased Across All Business LinesDocument10 pagesNews Release: Profits Up 49% As Activity Increased Across All Business LineskwangzhenxingNo ratings yet

- Gati Q1 Result UpdateDocument7 pagesGati Q1 Result UpdateAryan SharmaNo ratings yet

- 3q 2023 Earnings ReleaseDocument56 pages3q 2023 Earnings ReleaseRonnie KurtzbardNo ratings yet

- Ibh Investor Presentation 0625311001637240357Document54 pagesIbh Investor Presentation 0625311001637240357viratNo ratings yet

- Barclays WMG U.S. Media - DIS - Still Early in The Reset PhaseDocument27 pagesBarclays WMG U.S. Media - DIS - Still Early in The Reset PhaseraymanNo ratings yet

- Rashyu GuyinDocument1 pageRashyu GuyinChandra SegarNo ratings yet

- Confluent Inc. (CFLT) - Cloud Momentum Continues As Growth Accelerates - 3Q21 ResultsDocument9 pagesConfluent Inc. (CFLT) - Cloud Momentum Continues As Growth Accelerates - 3Q21 ResultsShingYiuNo ratings yet

- Berli Jucker PLC (BJC) : Company UpdateDocument3 pagesBerli Jucker PLC (BJC) : Company UpdatePhú TrịnhNo ratings yet

- Analytical Annexures Q2FY23Document24 pagesAnalytical Annexures Q2FY23Kdp03No ratings yet

- Citi 2nd QTR ResultsDocument10 pagesCiti 2nd QTR ResultsTim MooreNo ratings yet

- DNL 1Q21 Earnings Grow 35% Y/y, Ahead of Estimates: D&L Industries, IncDocument9 pagesDNL 1Q21 Earnings Grow 35% Y/y, Ahead of Estimates: D&L Industries, IncJajahinaNo ratings yet

- Enbridge Inc: Investment BriefDocument5 pagesEnbridge Inc: Investment BriefrickescherNo ratings yet

- Dewan Housing Finance Corporation.: Business Background Key DataDocument4 pagesDewan Housing Finance Corporation.: Business Background Key DataKOUSHIKNo ratings yet

- AbacusShortTakes 10262022Document6 pagesAbacusShortTakes 10262022ignaciomannyNo ratings yet

- Earnings Update DANGCEM 2021FY 1Document6 pagesEarnings Update DANGCEM 2021FY 1kazeemsheriff8No ratings yet

- Berger Paints Bangladesh Limited-PtdDocument15 pagesBerger Paints Bangladesh Limited-PtdnasirNo ratings yet

- Indusind Bank: MGMT Commentary Suggests A Complete Overhaul AheadDocument8 pagesIndusind Bank: MGMT Commentary Suggests A Complete Overhaul AheadAmit AGRAWALNo ratings yet

- BFSI Q2FY22 - Earnings Preview - 08102021 Final (1) (1) - 08-10-2021 - 09Document13 pagesBFSI Q2FY22 - Earnings Preview - 08102021 Final (1) (1) - 08-10-2021 - 09slohariNo ratings yet

- IR Presentation Q2FY24Document58 pagesIR Presentation Q2FY24Sivasankaran KannanNo ratings yet

- SBI Cards and Payment Services (Sbicard In) : Q1FY21 Result UpdateDocument8 pagesSBI Cards and Payment Services (Sbicard In) : Q1FY21 Result UpdatewhitenagarNo ratings yet

- Tenda 4T23Document33 pagesTenda 4T23Flavya PereiraNo ratings yet

- Ap A2.1Document10 pagesAp A2.1Dat HoangNo ratings yet

- USAA Tax Exempt Long-Term Fund 2Q 2022Document2 pagesUSAA Tax Exempt Long-Term Fund 2Q 2022ag rNo ratings yet

- Clevergroup DigitalmarketingDocument18 pagesClevergroup DigitalmarketingKim HoaNo ratings yet

- Oppday 2022Q1 SCBBDocument40 pagesOppday 2022Q1 SCBBxmen norNo ratings yet

- Consumer Lending Revenues World Summary: Market Values & Financials by CountryFrom EverandConsumer Lending Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- LRWC-SEC 17C - Financial Highlights of Q1 2022Document4 pagesLRWC-SEC 17C - Financial Highlights of Q1 2022ignaciomannyNo ratings yet

- Disclosure 2022-09-09 PSE Approval of AREIT Shares Lodgement (SEC-PSE)Document3 pagesDisclosure 2022-09-09 PSE Approval of AREIT Shares Lodgement (SEC-PSE)ignaciomannyNo ratings yet

- Response To PSE Query 07 September 2022Document1 pageResponse To PSE Query 07 September 2022ignaciomannyNo ratings yet

- First Quarterly Report of The Keepers Holdings, Inc. Cy 2022Document73 pagesFirst Quarterly Report of The Keepers Holdings, Inc. Cy 2022ignaciomannyNo ratings yet

- Annual Report of The Keepers Holdings. Inc. For Cy 2021Document201 pagesAnnual Report of The Keepers Holdings. Inc. For Cy 2021ignaciomannyNo ratings yet

- AbacusShortTakes 09092022Document6 pagesAbacusShortTakes 09092022ignaciomannyNo ratings yet

- REIT Plan - FinalDocument1,701 pagesREIT Plan - FinalChristian John RojoNo ratings yet

- AbacusShortTakes 09212022Document5 pagesAbacusShortTakes 09212022ignaciomannyNo ratings yet

- AbacusShortTakes 10252022Document6 pagesAbacusShortTakes 10252022ignaciomannyNo ratings yet

- AbacusShortTakes 09082022Document7 pagesAbacusShortTakes 09082022ignaciomannyNo ratings yet

- Top Gainer 02.18.2017Document3 pagesTop Gainer 02.18.2017ignaciomannyNo ratings yet

- AbacusShortTakes 10262022Document6 pagesAbacusShortTakes 10262022ignaciomannyNo ratings yet

- wk26 Jun2019mktwatchDocument3 pageswk26 Jun2019mktwatchignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument4 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument5 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument4 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- wk26 Jun2019mktwatchDocument3 pageswk26 Jun2019mktwatchignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument4 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Mitesh Patel - The Angry Young Man of Options TradingDocument18 pagesMitesh Patel - The Angry Young Man of Options Tradingbarkha rani100% (1)

- Glossary Scanned OcrDocument4 pagesGlossary Scanned OcrJames TanNo ratings yet

- L FinancialinstrumentsDocument38 pagesL FinancialinstrumentsManraj LidharNo ratings yet

- Sap Accounting EntriesDocument9 pagesSap Accounting Entriesswayam100% (1)

- Week 3 Answers To Questions Final DFTDocument10 pagesWeek 3 Answers To Questions Final DFTGabriel Aaron Dionne0% (1)

- Types of LC - Scotia BankDocument20 pagesTypes of LC - Scotia BankgmsangeethNo ratings yet

- General Foods vs. National CoconutDocument1 pageGeneral Foods vs. National CoconutJanlo FevidalNo ratings yet

- Liquefied Natural Gas: Not To Be Confused With orDocument34 pagesLiquefied Natural Gas: Not To Be Confused With orInggitNo ratings yet

- Olympic Inc. Variable Costing Income Statement For Year Ended August 31, 20Document6 pagesOlympic Inc. Variable Costing Income Statement For Year Ended August 31, 20mohitgaba19No ratings yet

- Ten Tips For Leading Companies Out of CrisisDocument6 pagesTen Tips For Leading Companies Out of CrisisPatriciaFutboleraNo ratings yet

- Central University of South Bihar: Assignment of Money and BankingDocument24 pagesCentral University of South Bihar: Assignment of Money and Bankingnirshan rajNo ratings yet

- DB - Chemical DatabookDocument51 pagesDB - Chemical Databooksiput_lembekNo ratings yet

- F5 - IPRO - Mock 1 - QuestionsDocument19 pagesF5 - IPRO - Mock 1 - QuestionsYashna SohawonNo ratings yet

- Denim DemandDocument6 pagesDenim DemandMarketing Expert100% (2)

- TCN Quotation - TCN Vending (16th, March)Document8 pagesTCN Quotation - TCN Vending (16th, March)Gusthavo VidalNo ratings yet

- AIA Doc Synopses by SeriesDocument43 pagesAIA Doc Synopses by Seriesdupree100% (1)

- Economy: Mains Previous Year QuestionsDocument3 pagesEconomy: Mains Previous Year QuestionstavvalakshmiprasoonaNo ratings yet

- A Level Economics NotesDocument41 pagesA Level Economics Notestasleemfca100% (5)

- Review of NY Wrongful Death Expansion BillDocument15 pagesReview of NY Wrongful Death Expansion BillAnonymous 2rsZ7DNo ratings yet

- Corporate Finance MCQsDocument0 pagesCorporate Finance MCQsonlyjaded4655100% (1)

- Financial Management Chapter FourDocument76 pagesFinancial Management Chapter Fourbiko ademNo ratings yet

- No Demand: ServicesDocument2 pagesNo Demand: ServicesJamilaNo ratings yet

- Are Short Sellers Necessary?: MoneyDocument2 pagesAre Short Sellers Necessary?: Moneynestor santamariaNo ratings yet

- FIDIC and Qatar Law - SCL CPD EventDocument28 pagesFIDIC and Qatar Law - SCL CPD EventDilan De Silva100% (1)

- 8 BMCDocument17 pages8 BMCSiddhesh GandhiNo ratings yet

- Mod5Act1 - Distribution To ShareholdersDocument12 pagesMod5Act1 - Distribution To ShareholdersArnelli Marie Asher GregorioNo ratings yet

- International Marketing PlanDocument17 pagesInternational Marketing PlanMac CorleoneNo ratings yet

- Wensha Voucher 3 PDFDocument1 pageWensha Voucher 3 PDFJulia Shane BarriosNo ratings yet

- The Real Power of Real OptionsDocument12 pagesThe Real Power of Real OptionsgoogkiteNo ratings yet

- Portofolio ManagementDocument1 pagePortofolio ManagementfauziyahNo ratings yet