Professional Documents

Culture Documents

AbacusShortTakes 09092022

Uploaded by

ignaciomannyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AbacusShortTakes 09092022

Uploaded by

ignaciomannyCopyright:

Available Formats

Friday, September 9, 2022

*0

TODAY’S TOPICS

IN FOCUS

Contrary to Gov. Medalla s comment, we believe the peso s weakness is also

_____________

due to issues in the domestic economy.

The number of employed Filipinos for July reached 47.4M, a new pandemic

PH Peso high and might be due to some seasonality for the month. Still, we believe that

this supports our view that consumer spending will remain buoyant despite

US Dollar the rise in inflation.

HSBC forecasts that adult Filipinos with net worth of at least $250,000 will

more than triple to 5.0M by 2030. There are some listed firms that will benefit

to some extent but probably the best positioned would be SSI.

Rice prices may be poised to rally after India imposed a 20% levy on most rice

varieties. Inflation might definitely not have peaked yet last month.

a dollar

best. At worst, it ignores clear issues about the economy. We explain below.

Friday, September 9, 2022

PAGE 1

Friday, September 9, 2022

IN FOCUS Two to tango. As the chart above shows, the dollar has been rallying since May of

_____________ last year. The US dollar index (Bloomberg: DXY) is a broad measure of its strength

against a basket of major currencies. We can see that it has risen from 90 to 110 in

about 16 months. A similar, though slightly faster, move was seen from May 2014 to

PH Peso March 2015. In the chart below, we compared how Asian currencies performed

during both periods. Observe that while the peso has depreciated nearly 16% since

US Dollar May 2021, it actually eked out a 0.5% gain in the 16 months ended March 2015. We

can say, therefore, that even an emerging currency like ours can outperform as long

as the fundamentals are there. Specifically, at that time, the Philippines was posting

the longest streak of above trend economic growth in decades, the current account

was in positive territory, the budget deficit was in check and inflation was benign.

Today, each of these factors are moving in the complete opposite direction.

Friday, September 9, 2022

PAGE 2

Friday, September 9, 2022

IN FOCUS Where to next? In our mid-year briefing, we said that our long term prognosis for

_____________ the exchange rate was to eventually breach Php60:$1 and the last couple of months

have strengthened our case. If not for what we believe to be central bank

intervention to smooth out its decline, the Peso might be materially lower than it is

PH Peso now. The near term outlook, on the other hand, is harder to pin down but the main

driver will be the US Fed. If Chairman Powell wants to do his best impression of

US Dollar Volcker then Php58 is likely to be taken out before yearend and what we thought

would take three years or so (> Php60:$1) might happen next year. This is why

markets will again be on tenterhooks as we approach Fed decision day on

September 21 (morning of the 22nd in Manila which will be the rate setting day for

the BSP). There are also other factors that are simultaneously at play including a

weak Chinese economy and a plunging Japanese yen. But again, fundamentals

matter. So if GDP, the current account, the budget deficit and inflation can turn

around, then the expected depreciation for the Peso should be much milder. As it

stands, we can only see reason to be hopeful in the latter two and we are not sure if

this will be enough.

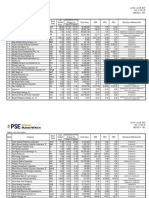

Winners and losers. The chart above shows the companies with the biggest forex gains and

-

losses usually occur when the peso depreciates and firms' US$ debt are restated at the end

of each quarter. When such debts fall due and the exchange rate remains weak, then the

amount to be repaid (in pesos) will be larger. So clients should not dismiss outright such

forex losses.

Friday, September 9, 2022

PAGE 3

Friday, September 9, 2022

IN FOCUS As we can see, a humongous loss for SMC and very large ones for JGS, GLO and CEB

_____________ as well. Globe, however, will soon close deals for half of its towers that will bring in

more than $1.0B and is also conducting an SRO. The proceeds from both can be used

to significantly deleverage its balance sheet. We also want to reiterate that net

PH Peso exporters like miners and electronics manufacturers, but specifically DNL, stand to

gain from a weak peso. Major importers like cement companies, property

US Dollar developers, restaurants and food manufacturers, on the other hand, stand to lose.

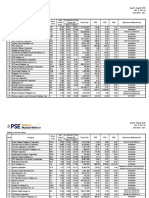

Unemployment SIGNIFICANT DIGITS

Rate

or just before the lockdowns. This series tends to be choppy so we would rather look

at the total number of employed Filipinos. The chart below shows the figure is

47.4M which is a new pandemic high and, again, better compared to the level in

January 2020. We suspect that there is some (or a lot of) seasonality in the data for

July, possibly related to increased employment in agriculture which is usually

lumpy especially during planting season. Still, we believe that this supports our view

that consumer spending will remain buoyant despite the rise in inflation.

Friday, September 9, 2022

PAGE 4

Friday, September 9, 2022

IN FOCUS RANDOM THOUGHTS

_____________

1.

something we just noticed. HSBC recently launched a new wealth fund targeting

SSI adult Filipinos with a net worth of at least $250,000. According to management,

P1.58, +1.94% they are forecasting that this group will more than triple from about 1.6M last

year to 5.0 million by 2030 or around 6.2% of the adult population at the time.

Rice Prices We have to do our own estimates but this is consistent with what we have been

saying. That is, slowing population growth and the expanding percentage of

Inflation Filipinos in the working age bracket will fuel a big jump in disposable incomes

over the next decade or two. Obviously, this is good for consumption in general

but if HSBC is correct (they also said adult Filipinos with a net worth of at least

$1 million will quadruple to 400,000 by 2030), then it will be particularly

positive for companies offering high end products and services. There are some

listed firms that will benefit to some extent but probably the best positioned

would be SSI.

2. Rice prices may be poised to rally after India, which accounts for 40% of global

exports, imposed a 20% levy on most rice varieties. This is the third commodity

to have curbs put in place following wheat and sugar. The decision was reached

after the planting area for the staple shrank by 5.6% amid a 25% drop in

exporters association, Thailand and Vietnam (where we get most of our imports)

stand to benefit with prices expected to increase from $350 to $400 per ton.

Rice did not participate in the broad commodities rally earlier this year but is now

outperforming wheat, palm oil and others with a gain of about 20%. Any further

gains, therefore, will swell the cost of our imports and impact inflation. This

could become a bigger problem if, as we expect, domestic rice production falls

short of projections due to the very high cost of fertilizer. Inflation might

definitely not have peaked yet last month.

Friday, September 9, 2022

PAGE 5

Friday, September 9, 2022

Unit 2904-AEast Tower, Philippine www.mytrade.com.ph asc.research@abacus-sec.com.ph 8667-8900 (63.2) 634-5206

Stock Exchange Centre, Exchange

Road, Ortigas Center, Pasig city 1600

Friday, September 9, 2022

PAGE 6

You might also like

- AbacusShortTakes 09212022Document5 pagesAbacusShortTakes 09212022ignaciomannyNo ratings yet

- JPM2019-09 MI - 2020outlook - 112719Document12 pagesJPM2019-09 MI - 2020outlook - 112719RyanNo ratings yet

- Gic Weekly 080124Document14 pagesGic Weekly 080124eldime06No ratings yet

- Rashyu GuyinDocument1 pageRashyu GuyinChandra SegarNo ratings yet

- Mid-Year Investment Outlook For 2023Document14 pagesMid-Year Investment Outlook For 2023ShreyNo ratings yet

- BlackRock What's Ahead in 2011Document12 pagesBlackRock What's Ahead in 2011mm18881No ratings yet

- 2021 Global Market Outlook Full ReportDocument14 pages2021 Global Market Outlook Full ReportFarhan ShariarNo ratings yet

- ARTICLEDocument2 pagesARTICLEMj BollenaNo ratings yet

- The GIC Weekly: Change in Rates or Rates of Change?Document14 pagesThe GIC Weekly: Change in Rates or Rates of Change?Dylan AdrianNo ratings yet

- Ip Newhighs Finalv2Document4 pagesIp Newhighs Finalv2Anonymous Feglbx5No ratings yet

- ECM Quarterly Letter 2Q22Document14 pagesECM Quarterly Letter 2Q22cybereisNo ratings yet

- Trimegah Economics The Point of View 20210113Document7 pagesTrimegah Economics The Point of View 20210113dio dioNo ratings yet

- CIO - Capital MarketDocument9 pagesCIO - Capital MarketThi Phuong Thoa LaNo ratings yet

- Schroders Outlook 2022 Macro Market Outlook FinalDocument24 pagesSchroders Outlook 2022 Macro Market Outlook FinalOkinawan P.SNo ratings yet

- Market Outlook Q1 2010 Sundaram BNP Paribas Asset ManagementDocument8 pagesMarket Outlook Q1 2010 Sundaram BNP Paribas Asset ManagementShwetal BhandariNo ratings yet

- October 2022 Market Strategy Report CtaDocument9 pagesOctober 2022 Market Strategy Report Ctamassimo borrioneNo ratings yet

- Dave Rosenberg Gluskin Sheff 01/20/2010Document9 pagesDave Rosenberg Gluskin Sheff 01/20/2010ETFDesk.comNo ratings yet

- 2024 Year-Ahead Outlook: The Last Leg On The Long Road To NormalDocument14 pages2024 Year-Ahead Outlook: The Last Leg On The Long Road To NormaljeanmarcpuechNo ratings yet

- AllianzGI Rates Mid Year Outlook 2023 ENG 2023Document14 pagesAllianzGI Rates Mid Year Outlook 2023 ENG 2023Tú Vũ QuangNo ratings yet

- COL Experts Corner 2019-01-18 Fund Managers AttachmentDocument9 pagesCOL Experts Corner 2019-01-18 Fund Managers AttachmentWa37354No ratings yet

- Insights Weekly A 2020 US Slowdown Near Recession ScenarioDocument9 pagesInsights Weekly A 2020 US Slowdown Near Recession ScenarioHandy HarisNo ratings yet

- Insights Weekly A 2020 US Slowdown Near Recession ScenarioDocument9 pagesInsights Weekly A 2020 US Slowdown Near Recession ScenarioHandy HarisNo ratings yet

- Top Story:: WED 11 JAN 2023Document9 pagesTop Story:: WED 11 JAN 2023Elcano MirandaNo ratings yet

- Blog - The WisdomTree Q2 2022 Economic and Market Outlook in 10 Charts or LessDocument11 pagesBlog - The WisdomTree Q2 2022 Economic and Market Outlook in 10 Charts or LessOwm Close CorporationNo ratings yet

- The Fed Looks Set To Dial Up Its Hawkish Pivot A Notch or Two - NN Investment PartnersDocument6 pagesThe Fed Looks Set To Dial Up Its Hawkish Pivot A Notch or Two - NN Investment PartnersBatsheba EverdeneNo ratings yet

- Monthly Letter - en - 1589563Document14 pagesMonthly Letter - en - 1589563Nikos LeounakisNo ratings yet

- State Street Global Advisors Global Market Outlook 2022Document29 pagesState Street Global Advisors Global Market Outlook 2022Email Sampah KucipNo ratings yet

- GX Global Powers of Retailing 2022Document52 pagesGX Global Powers of Retailing 2022Ngoc Ngan LyNo ratings yet

- Elevated Inflation May Linger, But Earnings Should Drive Equities HigherDocument7 pagesElevated Inflation May Linger, But Earnings Should Drive Equities HigherMaria Virginia MarquinaNo ratings yet

- Saudi Macroeconomic Forecast 2019 - 2023 - SambaDocument23 pagesSaudi Macroeconomic Forecast 2019 - 2023 - SambaTeofilo Gonzalez MarzabalNo ratings yet

- Sellside 121921Document49 pagesSellside 121921jolly soNo ratings yet

- Indian Capital Markets 2020 and Outlook 2021Document21 pagesIndian Capital Markets 2020 and Outlook 2021Sasidhar ThamilNo ratings yet

- Headlines: Thursday, December 7, 2006Document10 pagesHeadlines: Thursday, December 7, 2006Andru VolumNo ratings yet

- 2021-02-04-Flattening Employment Keeps Fed Hostage To Treasury BanksDocument2 pages2021-02-04-Flattening Employment Keeps Fed Hostage To Treasury BanksSant ManukyanNo ratings yet

- Breakfast With Dave 8/9/10Document12 pagesBreakfast With Dave 8/9/10ctringhamNo ratings yet

- Gondolin Capital LP Investor Letter 2Q22 (Prospective)Document10 pagesGondolin Capital LP Investor Letter 2Q22 (Prospective)Josh WeissNo ratings yet

- Volume 2.4 Still Bullish Apr 13 2010Document12 pagesVolume 2.4 Still Bullish Apr 13 2010Denis OuelletNo ratings yet

- Rothschild Growth Equity Update For 2023 1702923530Document21 pagesRothschild Growth Equity Update For 2023 1702923530Saul VillarrealNo ratings yet

- CMO 12-21-20 Merrill PDFDocument9 pagesCMO 12-21-20 Merrill PDFlwang2013No ratings yet

- 2019-7-31 Inaugural EditionDocument6 pages2019-7-31 Inaugural Editionsvejed123No ratings yet

- CMO BofA 09-25-2023 AdaDocument8 pagesCMO BofA 09-25-2023 AdaAlejandroNo ratings yet

- Macro YearAhead ENGDocument14 pagesMacro YearAhead ENGGeraldo MirandaNo ratings yet

- Monthly Equity Strategy September 2021Document6 pagesMonthly Equity Strategy September 2021Gaurav PatelNo ratings yet

- Fidelity Annual Outlook 2023Document21 pagesFidelity Annual Outlook 2023Govind GuptaNo ratings yet

- Global Economics: The Year of The CutDocument8 pagesGlobal Economics: The Year of The CutllaryNo ratings yet

- Weekly Trends: The Boc Cuts Rates AgainDocument4 pagesWeekly Trends: The Boc Cuts Rates AgaindpbasicNo ratings yet

- Einhorn Letter Q1 2021Document7 pagesEinhorn Letter Q1 2021Zerohedge100% (4)

- 7 Macro Themes For 2024Document5 pages7 Macro Themes For 2024Sarbartho MukherjeeNo ratings yet

- AbacusShortTakes 08232022Document7 pagesAbacusShortTakes 08232022ignaciomannyNo ratings yet

- US Economy - en - 1346457 PDFDocument4 pagesUS Economy - en - 1346457 PDFChristophe SieberNo ratings yet

- Breakfast With Dave 122410Document11 pagesBreakfast With Dave 122410Evana SchindewolfNo ratings yet

- The Consequences Are ProfoundDocument3 pagesThe Consequences Are ProfoundshamikbhoseNo ratings yet

- Investing in Mexico - en - 1604240Document7 pagesInvesting in Mexico - en - 1604240juanjosesolissNo ratings yet

- Georgia Economic Outlook 2022Document43 pagesGeorgia Economic Outlook 2022Jessie GarciaNo ratings yet

- Debt, Profits, Canada & More .: Nvestment OmpassDocument4 pagesDebt, Profits, Canada & More .: Nvestment OmpassPacifica Partners Capital ManagementNo ratings yet

- Breakfast With Dave - 20101213Document12 pagesBreakfast With Dave - 20101213marketpanicNo ratings yet

- AbacusShortTakes 09082022Document7 pagesAbacusShortTakes 09082022ignaciomannyNo ratings yet

- Week in Pictures 10 17 22 1666106256Document13 pagesWeek in Pictures 10 17 22 1666106256Barry HeNo ratings yet

- LRWC-SEC 17C - Financial Highlights of Q1 2022Document4 pagesLRWC-SEC 17C - Financial Highlights of Q1 2022ignaciomannyNo ratings yet

- Disclosure 2022-09-09 PSE Approval of AREIT Shares Lodgement (SEC-PSE)Document3 pagesDisclosure 2022-09-09 PSE Approval of AREIT Shares Lodgement (SEC-PSE)ignaciomannyNo ratings yet

- Response To PSE Query 07 September 2022Document1 pageResponse To PSE Query 07 September 2022ignaciomannyNo ratings yet

- First Quarterly Report of The Keepers Holdings, Inc. Cy 2022Document73 pagesFirst Quarterly Report of The Keepers Holdings, Inc. Cy 2022ignaciomannyNo ratings yet

- Annual Report of The Keepers Holdings. Inc. For Cy 2021Document201 pagesAnnual Report of The Keepers Holdings. Inc. For Cy 2021ignaciomannyNo ratings yet

- AbacusShortTakes 08232022Document7 pagesAbacusShortTakes 08232022ignaciomannyNo ratings yet

- AbacusShortTakes 08312022Document7 pagesAbacusShortTakes 08312022ignaciomannyNo ratings yet

- REIT Plan - FinalDocument1,701 pagesREIT Plan - FinalChristian John RojoNo ratings yet

- AbacusShortTakes 10252022Document6 pagesAbacusShortTakes 10252022ignaciomannyNo ratings yet

- AbacusShortTakes 09082022Document7 pagesAbacusShortTakes 09082022ignaciomannyNo ratings yet

- Top Gainer 02.18.2017Document3 pagesTop Gainer 02.18.2017ignaciomannyNo ratings yet

- AbacusShortTakes 10262022Document6 pagesAbacusShortTakes 10262022ignaciomannyNo ratings yet

- wk26 Jun2019mktwatchDocument3 pageswk26 Jun2019mktwatchignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument4 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument5 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument4 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- wk26 Jun2019mktwatchDocument3 pageswk26 Jun2019mktwatchignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument4 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Chapter 28 UnemploymentDocument51 pagesChapter 28 UnemploymentNat WutthivongthanakornNo ratings yet

- HRM450.02-Collective Bargaining 1-Group-DDocument7 pagesHRM450.02-Collective Bargaining 1-Group-DNawshinNo ratings yet

- Inflation Sample NotesDocument7 pagesInflation Sample NotesNilesh SinghNo ratings yet

- Philippine Development Plan 2017-2022 Overall FrameworkDocument12 pagesPhilippine Development Plan 2017-2022 Overall FrameworkAngelica PagaduanNo ratings yet

- Linking Words Help You To Connect Ideas and Sentences When You Speak or Write EnglishDocument4 pagesLinking Words Help You To Connect Ideas and Sentences When You Speak or Write EnglishANDREEA802100% (1)

- BHR CH 2Document34 pagesBHR CH 2CHINMAYA NAYAKNo ratings yet

- Chapter 1 Risk and Its Treatment: Principles of Risk Management and Insurance, 14e (Rejda)Document17 pagesChapter 1 Risk and Its Treatment: Principles of Risk Management and Insurance, 14e (Rejda)solid9283No ratings yet

- Practical Research 2Document9 pagesPractical Research 2Chia RicablancaNo ratings yet

- Assighnemt Economic Factors in Pak 2022Document6 pagesAssighnemt Economic Factors in Pak 2022Muzamil AshfaqNo ratings yet

- WichitaEast HaRa Neg 04 - KCKCC Round 1Document30 pagesWichitaEast HaRa Neg 04 - KCKCC Round 1EmronNo ratings yet

- Add Climate Havoc To War Crimes: Pentagon's Role in Global CatastropheDocument12 pagesAdd Climate Havoc To War Crimes: Pentagon's Role in Global CatastropheWorkers.orgNo ratings yet

- 1531 Grammar Test 100Document3 pages1531 Grammar Test 100Azamat BozorovichNo ratings yet

- Chapter 1 - Introduction To MacroeconomicsDocument25 pagesChapter 1 - Introduction To MacroeconomicsDaNetNo ratings yet

- ECO202-Practice Test - 15 (CH 15)Document4 pagesECO202-Practice Test - 15 (CH 15)Aly HoudrojNo ratings yet

- Labor Relations and Negotiations MQ1-Midterm ExamDocument5 pagesLabor Relations and Negotiations MQ1-Midterm ExamMelina JaminNo ratings yet

- Macroeconomics: Case Fair OsterDocument22 pagesMacroeconomics: Case Fair OsterTarun Kumar SinghNo ratings yet

- Unemployment: For Payments Paid To Unemployed People, SeeDocument51 pagesUnemployment: For Payments Paid To Unemployed People, SeeAnonymous TdcVx7iNo ratings yet

- Economics Edexcel As Unit 1 Workbook AnswersDocument73 pagesEconomics Edexcel As Unit 1 Workbook AnswersSam catlin100% (3)

- ECON 102: Second Assignment: Part A: The Cost of LivingDocument9 pagesECON 102: Second Assignment: Part A: The Cost of LivingBrian MaruaNo ratings yet

- PDF PPT Mini Project Hipertensi CompressDocument26 pagesPDF PPT Mini Project Hipertensi CompressDavid TampubolonNo ratings yet

- Effects of Underemployment On Job SatisfactionDocument34 pagesEffects of Underemployment On Job Satisfactionmzubair42No ratings yet

- Degrowth Policies That Can Change The Business World 1678930113 PDFDocument45 pagesDegrowth Policies That Can Change The Business World 1678930113 PDFemmanuel_diasNo ratings yet

- Olimpiada EnglezaDocument2 pagesOlimpiada EnglezaRamona Marinuc100% (1)

- Graduate Unemployment and Unemployability in Kenya - IJSST 2 (3) 1-12-LibreDocument12 pagesGraduate Unemployment and Unemployability in Kenya - IJSST 2 (3) 1-12-LibreIan WairuaNo ratings yet

- Sibl 1Document21 pagesSibl 1Masuk HasanNo ratings yet

- ELEN 3018 - Macro Test - 2013 - ADocument1 pageELEN 3018 - Macro Test - 2013 - AsirlordbookwormNo ratings yet

- Liberian Daily Observer 11/20/2013Document24 pagesLiberian Daily Observer 11/20/2013Liberian Daily Observer NewspaperNo ratings yet

- The Data of Macroeconomics Slides PDFDocument43 pagesThe Data of Macroeconomics Slides PDFSpandana AchantaNo ratings yet

- Practice Synthesis ExampleDocument1 pagePractice Synthesis ExampleShayyy JacksonNo ratings yet

- Document Based Questions Exercise On Nazi GermanyDocument6 pagesDocument Based Questions Exercise On Nazi GermanyshahrilmohdshahNo ratings yet