Professional Documents

Culture Documents

AbacusShortTakes 09212022

Uploaded by

ignaciomannyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AbacusShortTakes 09212022

Uploaded by

ignaciomannyCopyright:

Available Formats

Wednesday, September 21, 2022

*0

TODAY’S TOPICS

IN FOCUS MPI has been in a tight range over the past 18 months and is likely to remain

_____________

there in the next few months. Keep exposure low but a large dip should be

taken as an opportunity to buy or accumulate.

MPI We assert that inflation is likely to peak soon and that a potential 50 bps rate

P3.64, -2.15% hike tomorrow may be a bit too much.

We partly agree with the PSE CEO that local equities have been

underperforming because of the weak peso. Odds are that the PSEi will

continue to underperform against its peers.

If US policymakers' policy statement is in line with traders' hawkish views,

then a relief rally for US equities is likely and local stocks may follow suit

Heavy fines and increased regulation may be in order for SGP, but it seems

highly unlikely that SGP will be completely stripped of its control over NGCP

or that the latter's franchise is revoked.

: MPI

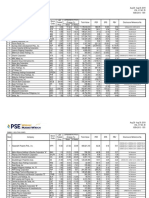

MPI has been in a tight range over the past 18 months. Over this period, the stock

has closed 88% of all trading days between Php3.50 and Php4.00, a range of just

50 centavos or ~14%. If we move the upper bound to Php4.10, the range would still

be quite narrow at ~17%, and the percentage would go to 98%. It is the only member

of the PSEi that has been as range bound as this over the same period. Even San

Miguel, which is hardly traded and has no analyst coverage on Bloomberg, has been

more volatile.

Wednesday, September 21, 2022

PAGE 1

Wednesday, September 21, 2022

Up or down? In technical analysis, a very long and tight consolidation, such as the

IN FOCUS one we have pointed out with MPI, is often followed by a very large move. The

_____________ ments for both. For

the bear case, it must be pointed out that management has already already spent

Php8.2B to repurchase 2.15 billion shares since October of last year and yet the

MPI stock price has actually fallen since the start of the buyback program. What will

P3.64, -2.15%

MER MPI appears to be immune to good news. For example, H1 results were solid and

P301.0, -0.73%

core profit was ahead of consensus but it gave the price no spark. Meralco, its

biggest holding by far, rallied 43% from August 2021 to March 2022. This added

reacted. Our third concern is that foreign interest appears to have waned with the

number of shares held under PCD Nominee (non-Filipino) falling by about 1.5 billion

rate will be reduced significantly, possibly by January. The impact on the bottom

line of MPI is going to be substantial.

Bull case. We already laid out our bullish case in early August but the key points that

bear repeating or expounding on are the following. Metro Pacific, with a market cap

of Php106B, is already trading at a discount to the value of its stake in MER

(Php161B). The former, therefore, is a cheaper way to get exposure to the latter, with

the other businesses thrown in for free. And speaking of cheap, its current forward

P/E of 7x is the lowest in at least 10 years (except for the March 2020 trough) and

is among the least among holding firms. MPI also has one of the biggest gaps

between its share price and consensus price target (currently near 60%) among

index members

domestic vehicular traffic is already above pre-pandemic levels and with four

projects set for completion until the end of next year, its bottom line is set for rapid

growth through 2024. And if MPTC goes public next year, this value can be

unlocked for MPI shareholders.

What it all means. We believe the stock will continue to trade sideways over the

next few months. Downside will be protected by its low valuation and the remaining

Php1.8B

limited by the bearish factors mentioned above. MPI may finally make a major move

some time in 2023. The scenario we have in mind is that its share price will dip below

Wednesday, September 21, 2022

PAGE 2

Wednesday, September 21, 2022

Php3.50 if we are

IN FOCUS this breakdown is likely to be short-lived as we expect management to re-up the

_____________

So we reiterate our recommendation to keep exposure low for the time being but a

large dip should be taken as an opportunity to buy or accumulate.

MPI

P3.64, -2.15%

SIGNIFICANT DIGITS

MER

P301.0, -0.73%

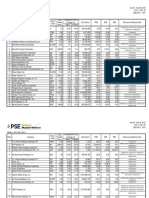

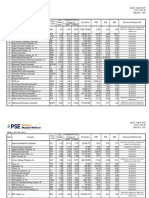

7.1%: Last Monday, we asserted that Philippine inflation will peak in Q4 even if MoM

inflation remains at +0.4%, which was the rate in August. The table below shows

Inflation

why we think so. The columns represent the projected CPI for each month until June

23 under different MoM inflation scenarios. Our view is that +0.4% per month is the

maximum given that actual MoM inflation has already slowed from 0.9% in June to

0.8% in July and 0.4% in August. With fuel prices continuing to fall, the impact of

will peak at 7.1% in October and will be under 6.0% by April. Then obviously, CPI

shall decelerate faster as we move to the left of the columns. Of course MoM

inflation is highly unlikely to plateau or stay at any level; it will fluctuate. This

exercise, however, is meant to show that near term inflation is likely to peak soon

and that a potential 50 basis point hike tomorrow may be a bit too much.

Wednesday, September 21, 2022

PAGE 3

Wednesday, September 21, 2022

RANDOM THOUGHTS

IN FOCUS

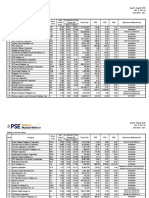

_____________ 1. PSE CEO, Mr. Ramon Monzon, said in an interview with Bloomberg TV that local

equities have been underperforming because of forex volatility (we take this to

mean the peso has been weak). Indeed, if we look at quarterly data from 1988,

PSEi we find that there is a moderate degree of negative correlation (-0.43) between

6,448.00, +0.17% the two variables. That is, when the P:$ exchange rate goes up (depreciation) in

one quarter, the PSE index will tend to go down. This makes sense because a

Exchange Rate sharp depreciation can drive inflation higher and may make foreign investors

think twice about putting money here. Forex, of course is not the only factor.

US Interest This is why the inverse correlation is only moderate. As we mentioned in January,

Rates the index was undergoing a structural de-rating and is currently at our fair value

of 14x forward earnings. The pace of economic and corporate earnings recovery

US Monetary from the pandemic have also been below par. Nevertheless, given our view that

Policy the peso will continue to depreciate, then odds are the PSEi will continue to

underperform against its peers.

SGP

P12.32, -6.81% 2. The yield on 10-year US treasuries touched 3.6% last night, breaking through its

June peak and climbing to its highest since 2011. The US 2-year treasury yield,

on the other hand, is at a 15-year high. Traders, therefore, appear to be bracing

for a very hawkish Fed which will announce its latest policy decision tomorrow

morning (Manila time). As we said previously, Chairman Powell is more

believe there will a dovish surprise. Nevertheless, it is hard to imagine that the

Fed will be even more hawkish than already anticipated or priced in by the

markets. If the policy statement that accompanies the expected 75 basis point

and local stocks may follow suit tomorrow.

3.

have active coverage on the stock. Neither have we closely followed

-day drop of more than 9%. However,

it seems highly unlikely that SGP will be completely stripped of its control over

the government reneges on another major contract with private investors.

Heavy fines and increased regulation may be in order but nothing more drastic.

Wednesday, September 21, 2022

PAGE 4

Wednesday, September 21, 2022

Unit 2904-AEast Tower, Philippine www.mytrade.com.ph asc.research@abacus-sec.com.ph 8667-8900 (63.2) 634-5206

Stock Exchange Centre, Exchange

Road, Ortigas Center, Pasig city 1600

Wednesday, September 21, 2022

PAGE 5

You might also like

- AbacusShortTakes 09092022Document6 pagesAbacusShortTakes 09092022ignaciomannyNo ratings yet

- AbacusShortTakes 09082022Document7 pagesAbacusShortTakes 09082022ignaciomannyNo ratings yet

- Pcomp Up On Gov't Stimulus Programs: Week in ReviewDocument2 pagesPcomp Up On Gov't Stimulus Programs: Week in ReviewJervie GacutanNo ratings yet

- Global Credit Market Outlook 2017Document3 pagesGlobal Credit Market Outlook 2017Đại Phú Trần NăngNo ratings yet

- COL Experts Corner 2019-01-18 Fund Managers AttachmentDocument9 pagesCOL Experts Corner 2019-01-18 Fund Managers AttachmentWa37354No ratings yet

- Gic Weekly 080124Document14 pagesGic Weekly 080124eldime06No ratings yet

- The GIC Weekly: Change in Rates or Rates of Change?Document14 pagesThe GIC Weekly: Change in Rates or Rates of Change?Dylan AdrianNo ratings yet

- Emerging Markets Sovereign Strategy Daily: Implications of The Package On Asset Prices and The CurveDocument6 pagesEmerging Markets Sovereign Strategy Daily: Implications of The Package On Asset Prices and The CurveAlex DiazNo ratings yet

- Economic Outlook Colombia 2Q19Document52 pagesEconomic Outlook Colombia 2Q19eduardo sanchezNo ratings yet

- Top Story:: WED 11 JAN 2023Document9 pagesTop Story:: WED 11 JAN 2023Elcano MirandaNo ratings yet

- NBP Funds: Capital Market ReviewDocument1 pageNBP Funds: Capital Market ReviewSufyan SafiNo ratings yet

- Bullish Under The Hood December Policy TakeawaysDocument3 pagesBullish Under The Hood December Policy Takeawaysvishal_lal89No ratings yet

- Westpack JUN 14 Weekly CommentaryDocument7 pagesWestpack JUN 14 Weekly CommentaryMiir ViirNo ratings yet

- March 2021Document15 pagesMarch 2021RajugupatiNo ratings yet

- Trimegah Economics The Point of View 20210113Document7 pagesTrimegah Economics The Point of View 20210113dio dioNo ratings yet

- Indopremier MacroInsight 23 Jun 2023 Unchanged BI Rate Aimed atDocument3 pagesIndopremier MacroInsight 23 Jun 2023 Unchanged BI Rate Aimed atbotoy26No ratings yet

- ME Cio Weekly Letter PDFDocument7 pagesME Cio Weekly Letter PDFHiep KhongNo ratings yet

- AllianzGI Rates Mid Year Outlook 2023 ENG 2023Document14 pagesAllianzGI Rates Mid Year Outlook 2023 ENG 2023Tú Vũ QuangNo ratings yet

- Performance of Debt Markt: An Article ReviewDocument11 pagesPerformance of Debt Markt: An Article ReviewNida SubhaniNo ratings yet

- CMO 12-21-20 Merrill PDFDocument9 pagesCMO 12-21-20 Merrill PDFlwang2013No ratings yet

- UOB Global Economics & Markets Research 2021Document1 pageUOB Global Economics & Markets Research 2021Freddy Daniel NababanNo ratings yet

- Philam Bond Fund, Inc. (PBFI) : Investment Objective CommentaryDocument1 pagePhilam Bond Fund, Inc. (PBFI) : Investment Objective Commentaryapi-25886697No ratings yet

- Monthly Equity Strategy September 2021Document6 pagesMonthly Equity Strategy September 2021Gaurav PatelNo ratings yet

- Rashyu GuyinDocument1 pageRashyu GuyinChandra SegarNo ratings yet

- U.S. Market Update August 12 2011Document6 pagesU.S. Market Update August 12 2011dpbasicNo ratings yet

- State Street Global Advisors Global Market Outlook 2022Document29 pagesState Street Global Advisors Global Market Outlook 2022Email Sampah KucipNo ratings yet

- BIMBSec - Economics - OPR at 4th MPC Meeting 2012 - 20120706Document3 pagesBIMBSec - Economics - OPR at 4th MPC Meeting 2012 - 20120706Bimb SecNo ratings yet

- 2021-09-07-CS Opportunities During The No-Interest PhaseDocument10 pages2021-09-07-CS Opportunities During The No-Interest PhaseIsaac SamsonNo ratings yet

- Global Market Outlook: H2 Outlook: Should I Stay, or ?Document21 pagesGlobal Market Outlook: H2 Outlook: Should I Stay, or ?wesamNo ratings yet

- Analisis de Indicadores para Ver El Momento Como Inversor - 061022Document10 pagesAnalisis de Indicadores para Ver El Momento Como Inversor - 061022Luis Gil - Inspira y AvanzaNo ratings yet

- EquityInvestmentStrategy May2022Document85 pagesEquityInvestmentStrategy May2022varanasidineshNo ratings yet

- ANZ QR Indonesia Policy 19092019Document4 pagesANZ QR Indonesia Policy 19092019Handy HarisNo ratings yet

- JPMorgan Mid-Year-Outlook-2021-UkDocument13 pagesJPMorgan Mid-Year-Outlook-2021-UkfcsamscribdNo ratings yet

- Mid-Year Investment Outlook For 2023Document14 pagesMid-Year Investment Outlook For 2023ShreyNo ratings yet

- Top-10 Macro Trade Ideas (Q2 Update)Document8 pagesTop-10 Macro Trade Ideas (Q2 Update)AdamZawNo ratings yet

- Goldman - China Two Sessions Comment 1 Government Work Report More Dovish Than ExpectedDocument3 pagesGoldman - China Two Sessions Comment 1 Government Work Report More Dovish Than ExpectedZerohedge100% (1)

- SPM Sisop Strategy Sep 2022Document4 pagesSPM Sisop Strategy Sep 2022Ally Bin AssadNo ratings yet

- Empower February 2017Document104 pagesEmpower February 2017Arjun BhatnagarNo ratings yet

- Gondolin Capital LP Investor Letter 2Q22 (Prospective)Document10 pagesGondolin Capital LP Investor Letter 2Q22 (Prospective)Josh WeissNo ratings yet

- AbacusShortTakes 08232022Document7 pagesAbacusShortTakes 08232022ignaciomannyNo ratings yet

- Indonesia Economic Outlook 2020 1573695401Document14 pagesIndonesia Economic Outlook 2020 1573695401igo badrNo ratings yet

- CIO - Capital MarketDocument9 pagesCIO - Capital MarketThi Phuong Thoa LaNo ratings yet

- Rbi Monetary Policy Review Further Cuts LikelyDocument6 pagesRbi Monetary Policy Review Further Cuts LikelyTaransh ANo ratings yet

- UOB Economic Outlook 2022 - Global Economics & Markets ResearchDocument18 pagesUOB Economic Outlook 2022 - Global Economics & Markets ResearchWagimin SendjajaNo ratings yet

- Economic Outlook ": Empowering The Indonesian Economy For Stronger Recovery"Document23 pagesEconomic Outlook ": Empowering The Indonesian Economy For Stronger Recovery"fadjaradNo ratings yet

- 2021 Global Market Outlook Full ReportDocument14 pages2021 Global Market Outlook Full ReportFarhan ShariarNo ratings yet

- MS JimCaron Transcript 20240102Document7 pagesMS JimCaron Transcript 20240102pj.india1991No ratings yet

- CIO CMO - The Pressure's On Emerging Market Central BanksDocument9 pagesCIO CMO - The Pressure's On Emerging Market Central BanksRCS_CFANo ratings yet

- C O M P A N Y P R O F I L E: Achal Gupta Managing Director & Chief Executive OfficerDocument61 pagesC O M P A N Y P R O F I L E: Achal Gupta Managing Director & Chief Executive OfficervipinkathpalNo ratings yet

- Market Outlook Samvat 2072: Low On Expectations, High On Returns Stock Update Aditya Birla Nuvo Stock Update Oil India Stock Update PTC India Financial ServicesDocument14 pagesMarket Outlook Samvat 2072: Low On Expectations, High On Returns Stock Update Aditya Birla Nuvo Stock Update Oil India Stock Update PTC India Financial ServicesrohitNo ratings yet

- Chaytor Aug26Document3 pagesChaytor Aug26economicburnNo ratings yet

- 2011-06-03 DBS Daily Breakfast SpreadDocument7 pages2011-06-03 DBS Daily Breakfast SpreadkjlaqiNo ratings yet

- BFSI Q2FY22 - Earnings Preview - 08102021 Final (1) (1) - 08-10-2021 - 09Document13 pagesBFSI Q2FY22 - Earnings Preview - 08102021 Final (1) (1) - 08-10-2021 - 09slohariNo ratings yet

- As 120417Document5 pagesAs 120417Anonymous Ht0MIJNo ratings yet

- Pakistan Strategy 2020.Document60 pagesPakistan Strategy 2020.muddasir1980No ratings yet

- Executive Summary: We Are Sri Lanka Rupee Bulls'Document8 pagesExecutive Summary: We Are Sri Lanka Rupee Bulls'Amal SanderatneNo ratings yet

- SVB's Innovation Economy H2 2023 OutlookDocument30 pagesSVB's Innovation Economy H2 2023 OutlookAnonymous XoUqrqyuNo ratings yet

- 2019-7-31 Inaugural EditionDocument6 pages2019-7-31 Inaugural Editionsvejed123No ratings yet

- WEEK 48 - DAILY For December 2, 2010Document2 pagesWEEK 48 - DAILY For December 2, 2010JC CalaycayNo ratings yet

- 2015: Outlook for Stocks, Bonds, Commodities, Currencies and Real EstateFrom Everand2015: Outlook for Stocks, Bonds, Commodities, Currencies and Real EstateNo ratings yet

- LRWC-SEC 17C - Financial Highlights of Q1 2022Document4 pagesLRWC-SEC 17C - Financial Highlights of Q1 2022ignaciomannyNo ratings yet

- Disclosure 2022-09-09 PSE Approval of AREIT Shares Lodgement (SEC-PSE)Document3 pagesDisclosure 2022-09-09 PSE Approval of AREIT Shares Lodgement (SEC-PSE)ignaciomannyNo ratings yet

- Response To PSE Query 07 September 2022Document1 pageResponse To PSE Query 07 September 2022ignaciomannyNo ratings yet

- First Quarterly Report of The Keepers Holdings, Inc. Cy 2022Document73 pagesFirst Quarterly Report of The Keepers Holdings, Inc. Cy 2022ignaciomannyNo ratings yet

- Annual Report of The Keepers Holdings. Inc. For Cy 2021Document201 pagesAnnual Report of The Keepers Holdings. Inc. For Cy 2021ignaciomannyNo ratings yet

- AbacusShortTakes 08232022Document7 pagesAbacusShortTakes 08232022ignaciomannyNo ratings yet

- AbacusShortTakes 08312022Document7 pagesAbacusShortTakes 08312022ignaciomannyNo ratings yet

- REIT Plan - FinalDocument1,701 pagesREIT Plan - FinalChristian John RojoNo ratings yet

- AbacusShortTakes 10252022Document6 pagesAbacusShortTakes 10252022ignaciomannyNo ratings yet

- Top Gainer 02.18.2017Document3 pagesTop Gainer 02.18.2017ignaciomannyNo ratings yet

- AbacusShortTakes 10262022Document6 pagesAbacusShortTakes 10262022ignaciomannyNo ratings yet

- wk26 Jun2019mktwatchDocument3 pageswk26 Jun2019mktwatchignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument4 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument5 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument4 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- wk26 Jun2019mktwatchDocument3 pageswk26 Jun2019mktwatchignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument4 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- All Countries Flags of CountriesDocument6 pagesAll Countries Flags of CountriesWelkin Sky100% (1)

- Financial Management BookDocument199 pagesFinancial Management BookSourav BasuNo ratings yet

- Eli Lilly WACCDocument3 pagesEli Lilly WACCImran ZulfiqarNo ratings yet

- RBI Vs SEBIDocument5 pagesRBI Vs SEBIMANASI SHARMANo ratings yet

- W654515 ReceiptpdfDocument1 pageW654515 ReceiptpdfSurendra SapkotaNo ratings yet

- GENMATH - Simple and Compound InterestsDocument1 pageGENMATH - Simple and Compound InterestsBern Balingit-ArnaizNo ratings yet

- Itbark Exp19 Excel AppCapstone Intro CollectionDocument6 pagesItbark Exp19 Excel AppCapstone Intro CollectionMohit LukhiNo ratings yet

- Cash Flow and Financial Planning Cash Budgeting ScriptDocument2 pagesCash Flow and Financial Planning Cash Budgeting ScriptAouabdi HanineNo ratings yet

- 88migration To Ekuber (Encls)Document5 pages88migration To Ekuber (Encls)a upenderNo ratings yet

- Corporate - TreasuryDocument49 pagesCorporate - TreasuryArif AhmedNo ratings yet

- Cash Management 11012018Document41 pagesCash Management 11012018narunsankarNo ratings yet

- Financial Instruments - IPSAS Slides PresentationDocument40 pagesFinancial Instruments - IPSAS Slides PresentationJOHN TUMWEBAZENo ratings yet

- 1430020817057Document40 pages1430020817057kazukiNo ratings yet

- Chapter 3: Islamic Financial Services ACT 2013: Law of Islamic Banking and Takaful MDBM 3103Document20 pagesChapter 3: Islamic Financial Services ACT 2013: Law of Islamic Banking and Takaful MDBM 3103Arif SofiNo ratings yet

- Audit 2 - Topic4Document18 pagesAudit 2 - Topic4YUSUF0% (1)

- FMRP Study Guide (V 3.1)Document142 pagesFMRP Study Guide (V 3.1)MusicaDaze0% (1)

- Banking Finance Sectorial OverviewDocument15 pagesBanking Finance Sectorial OverviewOladipupo Mayowa PaulNo ratings yet

- CH 15Document15 pagesCH 15Yousef ShahwanNo ratings yet

- Akeel Hussain 11022720-130Document58 pagesAkeel Hussain 11022720-130Akeel ChoudharyNo ratings yet

- Working CapitalDocument3 pagesWorking CapitalSiidolohNo ratings yet

- Customers Perception On General Bamking Activities of Prime Bank Limited 3Document49 pagesCustomers Perception On General Bamking Activities of Prime Bank Limited 3Shuvo DeyNo ratings yet

- Income Taxation of IndividualsDocument26 pagesIncome Taxation of Individualsarkisha100% (1)

- Liu006 Dealing With MoneyDocument2 pagesLiu006 Dealing With MoneyGaik Heok TanNo ratings yet

- Fainace ManagementDocument30 pagesFainace ManagementSaudulla Jameel JameelNo ratings yet

- Wa0005.Document11 pagesWa0005.Ivan RushmerNo ratings yet

- BondsDocument12 pagesBondsSai Hari Haran100% (1)

- M&A Financial Modeling PDFDocument22 pagesM&A Financial Modeling PDFRoma BhatiaNo ratings yet

- Synovus Statement JulDocument2 pagesSynovus Statement JulВалентина Швечикова100% (1)

- Basel 3 PDFDocument6 pagesBasel 3 PDFNischal PatelNo ratings yet

- Assignment On Financial System Operative in BangladeshDocument24 pagesAssignment On Financial System Operative in BangladeshShamsul Arefin67% (6)